Types of Shares

The process of buying and selling share has one primary goal – growing your money over time. However, did you know that there are many different types of shares?

For example, you have shares from UK markets like the London Stock Exchange and the AIM, as well as exchanges in the US, Australia, New Zealand, and dozens more. You then have sector-specific shares like pharmaceutical, tech, and even cannabis stocks.

In this guide, we run you through the many different types of shares that you can now invest in from the comfort of your home.

What are the Types of Shares?

There’s a huge amount of variety when it comes to the different types of shares that you can invest in. From blue chip stocks to penny shares, and from cannabis stocks to oil shares, there are many different types, so its important to be able to identify the types of company shares that are best for your portfolio.

Let’s take a look at the many different types of shares available to invest in.

Dividend Stocks

As the name suggests, dividend stocks relate to companies that pay dividends. For those unaware, dividends are a way for publicly-listed firms to share some of their surplus profits with stockholders. While some companies are not in a position to pay dividends (or simply choose not too), most firms listed on the FTSE 100 do. This allows you to combine regular income payments with long-term capital gains.

Here’s a quick example of how dividend stocks work.

- You hold 1,000 shares in BP

- BP pays dividends once every three months

- In its upcoming distribution, BP decides to pay a yield of 10%

- This amounts to 29p per share

- As you hold 1,000 shares, you will receive a payment of £290

- The funds are sent to the stock broker account that you hold the shares

As you can see from the above example, by holding shares in BP you were entitled to dividend payments at an amount proportionate to the number of stocks you hold. Interestingly, BP is actually one of the best dividend stocks on the FTSE 100, as its most recent distribution amounted to a yield of just over 10%.

On average, FTSE 100 companies pay in the region of 3-4%. Although this might not sound like a huge amount, you also need to take into account the fruits of capital gains. This is where the value of your shares increase above and beyond the amount you initially paid. As such, dividend stocks allow you to make gains in two forms, which is why they’re one of the most popular types of shares.

Blue Chip Stocks

In other words, these are shares that are viewed as the ‘Cream of the Crop’, not least because they have proven time and time again that they are here to stay – regardless of how the economy is performing.

- In the UK, this includes companies like British American Tobacco, BP, GlaxoSmithKline, AstraZeneca, Vodafone, and Royal Dutch Shell.

- Over in the US, blue chip stocks includes Ford Motors, Disney, Nike, Amazon, and Apple.

With that being said, there is no one-size-fits-all rule as to what defines a blue chip stock. For example, many would argue that all FTSE 100 companies are blue chip stocks, as well as US companies like Facebook and Netflix, But, when you take a closer look, this isn’t always the case.

A prime example of this is GVC Holdings. Although the firm is a FTSE 100 constituent, it was only launched in 2004. Sure, it has 16 years worth of trading history under its belt. However, it has only experienced a single stock market recession (2008 financial crisis), so it is far too early to label the firm with a blue chip status.

Nevertheless, below you will find a list of key qualities that most blue chip stocks possess.

- Blue chip stocks typically have a track record of paying consistent dividends. In some cases, dividends are increased year-on-year.

- In most cases, the respective company has been operational for a number of decades. This means that they have gone through several stock market corrections, and always recovered.

- Looking at the financials, most blue chip stocks have super-strong balance sheets and healthy free cash flows. Once again, this prepares them fully for a market correction.

- Some blue chip stocks operate in ‘staple’ industries, meaning that their products and services are demanded irrespective of how the economy is performing.

FTSE 100 Shares

The FTSE 100 is the main stock market ‘index’ in the UK. For those unaware, an index is tasked with tracking the value of a wider stock market, like the London Stock Exchange, New York Stock Exchange, or NASDAQ. This allows you to gain exposure to the wider economy, as opposed to investing in individual shares.

In the case of the FTSE 100, this covers the 100 largest companies that are listed on the London Stock Exchange – in terms of market capitalization. The index is updated every three months. As such, companies listed towards the bottom of the index might be replaced by firms that have since increased their market capitalization.

To give you an idea of the largest and most liquid FTSE 100 shares, check out the list below (figures correct as of 13/07/2020)

| Symbol (link) | Name | Last Price | Market Cap (£) |

| AZN.L | ASTRAZENECA PLC ORD | 8,520.00 | 112.0 Billion |

| ULVR.L | UNILEVER PLC | 4,271.00 | 111.8 Billion |

| RDSA.L | ROYAL DUTCH SHELL PLC A | 1,272.08 | 96.9 Billion |

| BHP.L | BHP GROUP PLC ORD $0.50 | 1,704.00 | 86.0 Billion |

| GSK.L | GLAXOSMITHKLINE PLC | 1,589.00 | 79.8 Billion |

| RIO.L | RIO TINTO PLC | 4,730.11 | 78.9 Billion |

| HSBA.L | HSBC HOLDINGS PLC | 383.1 | 77.9 Billion |

| BATS.L | BRITISH AMERICAN TOBACCO PLC | 2,896.50 | 66.5 Billion |

| DGE.L | DIAGEO PLC | 2,818.50 | 65.8 Billion |

| BP.L | BP PLC | 296.75 | 60.0 Billion |

Now, as all FTSE 100 companies have a multi-billion pound market capitalization (apart from NMC Health PLC), these are typically large, stable, and highly established stocks. There are several exceptions, of course. But, as the FTSE contains the 100 largest PLCs in the UK, you are investing in high-grade shares. Furthermore, most FTSE 100 shares pay dividends, which is an added bonus.

As a side note, many investors in the UK actually choose to invest in an ETF or mutual fund that tracks the FTSE 100 index. In doing so, you get to buy shares in each and every FTSE 100 stock through a single investment. This means that you will not need to go through the cumbersome process of researching and analysing individual companies. Moreover, and perhaps most importantly, you will still be entitled to your share of dividends!

Some of the most popular FTSE 100 ETFs are listed below:

- iShares Core FTSE 100 UCITS ETF

- HSBC FTSE 100 UCITS ETF GBP

- Vanguard FTSE 100 UCITS ETF

- Xtrackers FTSE 100 UCITS ETF

- UBS ETF (LU) FTSE 100 UCITS

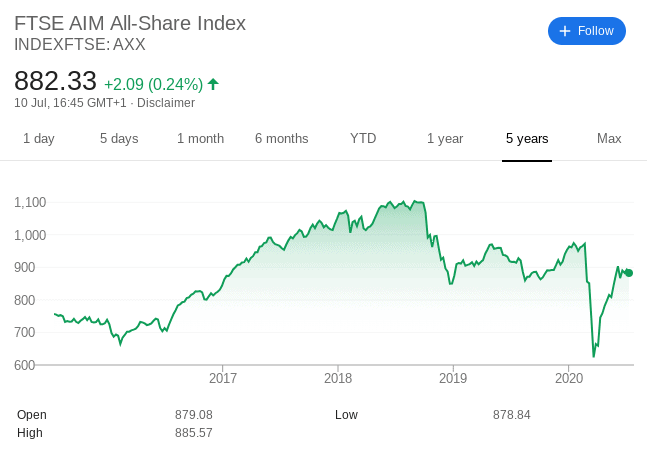

AIM Shares

The Alternative Investment Market – most commonly referred to as the AIM – is the UK’s secondary stock exchange. That is to say, the AIM is home to small companies that are not yet big enough to be listed on the London Stock Exchange. In most cases, AIM shares are linked firms that are still in their infancy, so they have a much smaller market capitalization.

While they are not as volatile and illiquid as penny shares, the risks involved are still higher than that of companies found on the London Stock Exchange. With that being said, AIM shares are popular with investors that are looking to catch a company while they are still young.

Let’s take online retailer ASOS as a prime example.

- Back in 2001 when it was listed on the AIM, the firm had a market capitalization of just £14 million.

- Fast forward to 2020 and not only is ASOS a fully-fledged company listed on the London Stock Exchange, but it carries a market capitalization of just over £3.3 billion.

If you want to add some AIM shares to your stock portfolio, there are a couple of important points to consider. Firstly, there are very few reliable brokers in the UK that give you access to the market.

As such, you need to spend some time researching a suitable share dealing accounts before taking the plunge. Secondly, it might be best to keep a very small proportion of your portfolio reserved for AIM shares, as the risk vs reward ratio is a lot higher in comparison to FTSE stocks.

Penny Shares

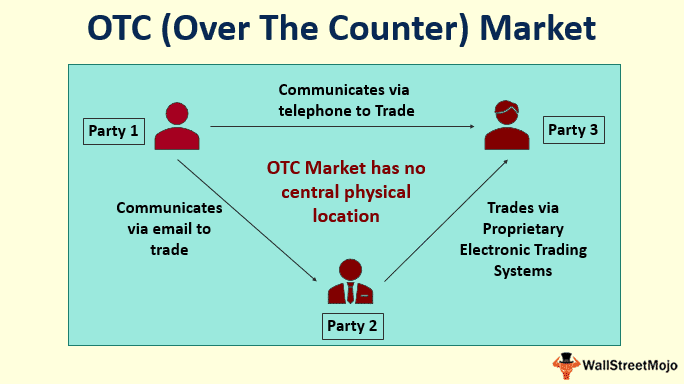

Penny shares are often sought-after by those that have a much higher tolerance for risk. This is because penny shares relate to small companies that typically have a micro-market capitalization. Most importantly, penny shares are not listed on traditional exchanges like the London Stock Exchange. Instead, you will often find them on OTC (Over-the-Counter) markets.

Put simply, this means that it is much more difficult to make an investment. For example, if you were to buy shares in Royal Mail, all you would need to do is use an online stockbroker, deposit some funds, and then decide how much you wish to invest. But, with penny shares, a broker would need to personally locate the shares for you from the OTC markets.

It is also important to note that penny shares have some high-risk qualities that need to be taken into account, such as:

- As penny shares suffer some low trading volumes, you will often find that stock prices are super-volatile.

- Liquidity levels are also low, which can be problematic when it comes to selling your penny shares.

- The rules governing penny shares are more relaxed in comparison to conventional stocks.

- There is often very little information available on individual penny stocks, which can make it difficult to perform independent research.

Although the risks associated with penny shares are much higher, as are the potential rewards. That is to say, it is not uncommon for a penny stock to increase in value by 1,000% or more.

However, just a small number of penny shares reach this feat. In fact, it is more likely that you will see your penny stock investment lose value. As such, if you do decide to proceed with a penny share investment, you should keep your stakes to a minimum.

Cannabis Stocks

The legal cannabis space is now a multi-billion pound industry that is growing at a rapid pace year-on-year. The overarching reason for this is that more and more governments around the world are slowly but surely beginning to relax cannabis-related laws. The legal industry can be split into two key sectors – medical cannabis and recreational cannabis.

In the case of the former, it is now possible for consumers to purchase cannabis on the back of obtaining a prescription from a doctor or accredited medical professional. Crucially, the medical cannabis scene is now active in dozens of countries, including much of the European Union.

- With that being said, the most significant opportunity for cannabis shares is that of the recreational space.

- Put simply, recreational cannabis is the process of buying the substance from a licensed dispenser without needing a medical prescription.

- As of mid-2020, the sale of recreational usage is legal in just two nations – Uruguay and Canada.

- It is also legal in several US states.

Ultimately, if you are looking to add some cannabis stocks to your portfolio, the value of your investment is almost entirely dependent on more countries and states relaxing their views of recreational cannabis. As such, you should once again ensure that your portfolio is well-diversified, as opposed to focusing exclusively on just cannabis stocks.

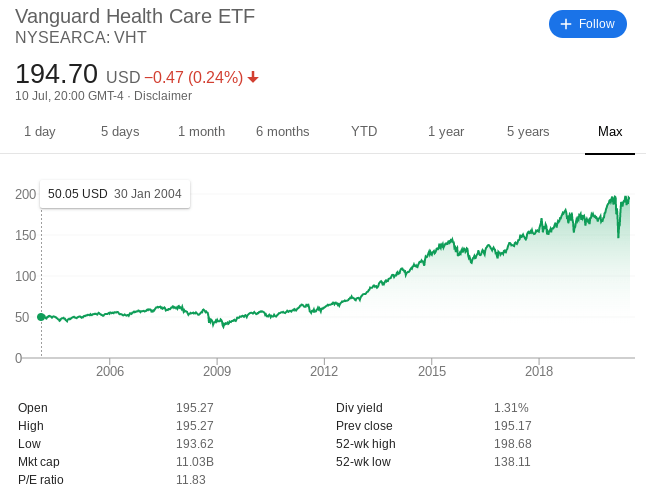

Pharmaceutical Stocks

An additional sector-specific type of stock that is popular with investors is that of pharmaceutical stocks. As the name implies, these are companies that operate in the pharmaceutical industry.

This could be anything from a large-scale drug manufacturer, a research and development firm that focuses on a specific disease, or even a company that produces x-ray machines for hospitals. In many cases, investors actually flock to pharmaceutical stocks as a means to protect their portfolio from market downturns.

This is because pharmaceutical stocks often fall within the remit of ‘defensive stocks’. Put simply, defensive stocks are not as suspectable to a stock market recession, as they are involved in products and services that are always demanded by consumers – regardless of how the economy is performing.

On top of pharmaceutical stocks, this would also cover companies that provide services in the food and beverage, tobacco, and household product sectors.

However, not all pharmaceutical stocks can be classed as defensive stocks. This might because the pharmaceutical company is relatively small, or is involved in a specific drug that is yet unproven. As such, it is often best to concentrate on large-scale pharmaceutical stocks that are strong and stable.

To give you an idea of which companies fall within this bracket, check out the list below.

- Johnson & Johnson

- Roche

- Novartis

- Pfizer

- AstraZeneca

- GlaxoSmithKline

- Abbott

We should also note that generally speaking, pharmaceutical stocks have a long and stable history of paying dividends. Once again, this will allow you to grow your money faster, not least because you can reinvest your dividend payments into other investment opportunities.

Oil Shares

As the name suggests, oil shares allow you to gain exposure to the global oil industry. You won’t be ‘investing in oil’ per-say, as this wouldn’t be feasible in the logistical sense. On the contrary, you will be buying shares in companies that are directly involved in the oil and gas scene. As such companies generate revenues in the production and sale of oil, it makes sense that there is a correlation between the value of the asset and that of their stock price.

Before we get to that, below you will find a list of some of the largest oil shares listed on the London Stock Exchange.

- BP

- Royal Dutch Shell

- Total S.A

- Tullow Oil

- PJSC Lukoil

So, before you take the plunge with an investment in oil stocks, it is crucial that you understand what can influence the value of your shares. After all, oil operates in a highly geopolitical environment, so current affairs have a major role on its value.

For example, if OPEC decides that it wants to decrease the value of oil to fend off market competitors, it will simply increase its production rates. In doing so, there is an over-supply of oil and thus – its market value goes down. Similarly, if major oil producers decide to decrease supply, the value of oil should go up.

Then, you have global issues like the coronavirus pandemic, which saw demand for oil ground to a halt. In fact, the Brent Crude Index hit lows of just under $16 per barrel earlier in 2020. At this price, the vast majority of oil companies were forced to sell their oil at below its break-even price. BP, for example, is rumoured to have a break-even price of $35 per barrel, which is why its stocks crumbled at the peak of the pandemic.

Undervalued Shares

Crucially, the most successful investors are skilled at selecting stocks that are undervalued. Namely, Warren Buffet himself will read through financial report after financial report with the view of finding undervalued stocks. In doing so, he is effectively investing in the firm at a discount.

In order to do this yourself, there are a number of exercises that you can put into place. A great starting point is to understand how the price-to-earnings (P/E) ratio works.

In a nutshell, the P/E ratio looks at the firm’s current stock price against its earnings per share. The subsequent ratio – in theory at least – has the potential to tell us whether a stock is over or undervalued.

A quick example of the P/E ratio is listed below.

- Let’s suppose that you are interested in buying shares in Tesco

- You want to see whether the shares are potentially undervalued, so you put the P/E ratio into place

- For simplicity, we’ll say that Tesco has a share price of £3

- We’ll also say that its earnings per share is £1

- This means that Tesco has a P/E ratio of 3 (£3 / £1)

Now, it’s all good and well being able to calculate the P/E ratio, but then what? After all, you need some sort of an average in order to determine whether the stocks are potentially under (or even over) valued!

Well, as of late 2019, FTSE 100 stocks had an average P/E ratio of 16. As such, anything less than this is a good indicator. However, it is crucial that you consider the specific sector that the stock in question is active in, as this can make all the difference.

Learn more: To find undervalued shares yourself, read our comprehensive guide on how to pick stocks and shares.

Non-Voting Shares

When you buy shares in the traditional sense, you will be afforded a number of key rights. After all, you are a stockholder, which means you own a segment of the company at an amount proportionate to what you invest. Such perks include the right to receive your share of dividends as and when they are paid.

Ordinary shares also permit the right to vote in shareholder meetings – such as an AGM (Annual General Meeting). However – and as the name suggests – non-voting shares do not give you the right to vote in such meetings. They do, however, still entitle you to dividends.

- In the vast majority of cases, non-voting shares are issued by companies as a means to reward its employees.

- It might utilize this route because it is a cost-effective and tax-efficient way of allowing staff members to benefit from surplus profits.

- At the same time, the firm might not want its employees to have the right to vote in shareholder meetings – especially when you consider that large organizations might have a 6-figure workforce!

With that being said, if you are buying shares with the view of growing your money over the course of time, you need to ask yourself whether you really want or need the capacity to vote.

Preference Shares

Much like in the case of non-voting shares, preference shares do not give you the right to vote. There are several different types of preference shares, and there are also some key characteristics that preference shares posses which you need to consider before making an investment. These include:

Fixed Dividends

Firstly, by holding preference shares, you will be entitled to a fixed dividend payment for the duration of your investment. In most cases, this will be be paid by the respective company on an indefinite basis. This is in stark contrast to ordinary shares, as the dividend can and will fluctuate on each distribution.

The exact yield will, in most cases, be determined by the financial performance of the firm in question. Ultimately, preference shares are great if you want to know exactly how much you are likely to make in dividends each year.

Retrospective Dividends

As an ordinary shareholder, there is never any guarantee that your chosen company will pay a dividend. In fact, this became highly evident during the coronavirus pandemic, as heaps of FTSE 100 companies made the decision to suspend their dividend policy until further notice.

The good news for you as a preference shareholder is that you might still be entitled to your fixed dividend payment – even if a suspension policy is in place. We say ‘might’, as you would need to be holding a specific type of stock – which is known as ‘cumulative preference shares’.

If you do, then you will still be entitled to your fixed dividend, albeit, this is usually paid retrospectively once the firm resumes its ordinary dividend policy.

Preferable Right to Assets

An additional – and equally as important, benefit of becoming a preference shareholder is that you will have a great right to a company’s assets if it files for bankruptcy. In the unfortunate event that it does, creditors and employees are typically first in line. After that is preference shareholders. Only then will ordinary stockholders get a share of any assets that are left.

Redeemable Shares

Redeemable shares are a sub-section of preference shares. As the name implies, this type of share allows the issuer (the company) to ‘redeem’ the shares at a later date. Although in some ways also beneficial to the stockholder, redeemable shares give companies much greater levels of flexibility in comparison to other types of shares. This is because the redeemable shares will come at a pre-determined value, which is the price that the company will pay when it comes to redemption.

Let’s look at a quick example in order to clear the mist.

- Let’s say that HSBC issues some redeemable shares at a nominal value £4 per stock

- At the time of the investment, HSBC is priced at £3 per stock

- As the stocks fall within the remit of preference shares, they come with a fixed dividend

- To keep things simple, we’ll say the yield amounts to 10%

- You decide to purchase 10,000 shares, which takes your total investment to £30,000 (based on current market price)

Now, for as long as you hold the redeemable shares, you will make an annual yield of 10%. On an investment of £30,000 – this amounts to fixed dividend payments of £3,000 per year. At a share price of £3, the company is not going to redeem its shares. After all, it would have to pay you £4 per stock, which is £1 higher than you originally paid. However, if and when HSBC shares are valued at £4 or more, the company might decide to purchase the shares back.

This means that:

- You are paid an attractive, fixed dividend yield for as long as you hold the shares

- You will likely get to enjoy this yield for as long as the stocks remain below the nominal share price – which in our example, was £4 per stock

Growth Shares

Put simply, growth shares are companies that have the potential to increase its stock price by a significant amount. In other words, the firms in question are ‘expected’ to outperform the wider markets, as well as those operating in the same sector or industry. While there isn’t a hard-and-fast rule as to what constitutes a growth share, there are some key qualities that remain constant.

For example:

- Most growth stocks are in the early years of their existence. A prime example of this is Tesla, which only went public in 2010.

- Leading on from the above point, the vast bulk of growth shares do not pay dividends.

- This is because they reinvest their profits into the growth of the company.

- Growth shares are typically higher risk than other stocks types (like blue chip shares), as their business model is arguably unproven.

Taking all of the above into account, growth shares are purchased by investors that wish to catch a company early. Once again using Tesla as a prime example, had you purchased its shares in 2010 you would have paid just $17 per stock. As such, had you bought 100 shares, you would have paid $1,700 in total. Fast forward to mid-July 2020 and the very same shares are worth $1,544 per stock. By holding 100 shares, your investment would be worth 154,400. Not bad for just 10 years!

With capital gains as high as this, investors are not so worried about the opportunity costs of not receiving dividends. On the flip side, there is no guarantee that your chosen growth shares will mirror the uncanny performance of Tesla, so do bear this in mind.

High Yield Shares

High yield shares fall within the remit of dividend stocks. However – and as the name implies – the dividend yield that such companies pay is higher than the average yield for that particular stock exchange or sector.

For example:

- If the London Stock Exchange pays an average yield of 3.9%, and you hold shares that yield 5% in dividends, these are high-yield shares.

- If you hold shares in a company that pays a dividend yield of 7%, and the sector average is 6%, this would also resemble a high-yield share.

Once again, there isn’t a one-size-fits-all character of why a particular company would pay higher-than-average dividend yields. For example, economic theory suggests that the better a company performs, the higher its dividend yield will be. However, you will often find that the complete opposite happens.

- For example, Apple – which is one of the most profitable companies in the world with excess cash reserves of near-on $200 billion, pays a trialing dividend yield of just 0.85%.

- However, BP – which saw its stock price drop by nearly 50% during the coronavirus pandemic, is still looking to pay a dividend yield of over 10%.

The reason for this is that companies which are struggling in the share price department – but still have strong cash flows, will often increase the size of their dividend to ensure that stockholders are still rewarded. Another example of this British American Tobacco, which is currently yielding over 7% – even though its share price is worth significantly less than 2017 levels.

Fractional Shares

Fractional shares aren’t technically a separate type of shares, but rather a different type of investment offered by many brokers. Investing in fractional shares essentially means you can buy portions of shares and invest smaller amounts than you would otherwise.

Company Shares

While there are many different types of shares out there, there are also thousands of different company shares from around the world that you can invest in. Different shares of companies come in all shapes and sizes, so its important to do your research and ensure you invest in the companies that best match your portfolio. Let’s take a look at some of the most popular companies to invest in in the UK. Ever wondered what the best vegan stocks to invest in are? Why not check out our in-depth guide to learn more.

| Name | Symbol | Last Price | Market Cap (£) |

| Amazon | AMZN | 3,084.00 | 1529.28 Billion |

| Apple | AAPLE | 329.95 | 1666.35 Billion |

| BP | BP.L | 307.42 | 61.21 Billion |

| FB | 239.73 | 638.55 Billion | |

| HSBC | HSBC | 23.95 | 97.55 Billion |

| Netflix | NFLX | 524.88 | 230.84 Billion |

| Royal Mail | RMG.L | 176.64 | 1.75 Billion |

| Tesco | TSCO.L | 213.91 | 20.87 Billion |

Here’s a list of other top shares that are popular among UK investors:

- Activision

- Airbnb

- Alibaba

- AMC Entertainment

- AMD

- American Airlines

- ASOS

- Aston Martin

- AstraZeneca

- Avacta

- Avast

- AVIVA

- Babcock

- Berkeley Group

- Beyond Meat

- BioNTech

- Biogen

- Blackberry

- Boeing

- Boohoo

- British Airways

- British American Tobacco

- BT

- Bumble

- Carnival

- CAT

- Cellular Goods

- Celtic

- Centrica

- Chewy

- Coinhbase

- Dart Group

- Deliveroo

- Diageo

- Disney

- DraftKings

- EasyJet

- Eaton Vance

- Etsy

- Experian

- Fastly

- FedEx

- Ferguson

- Ford

- Forterra

- Galliford Try

- Gamestop

- General Electric

- GlaxoSmithKline

- Greene King

- Harley-Davidson

- Heat Biologics

- Inovio

- Intel

- ITV

- Johnson & Johnson

- JPMorgan

- Kier

- Ladbrokes

- Legal and General

- Lloyds

- LSE

- Lyft

- Manchester United

- Meggitt

- Metro Bank

- Micron Technology

- Microsoft

- Mitie Group

- Moderna

- Morrisons

- National Grid

- Next

- Nike

- Nikola

- Nio

- Nvidia

- Ocado

- Oxford BioMedica

- Palantir

- Peloton

- Pennon

- PepsiCo

- Pfizer

- Pineapple Power

- Polypipe

- Provident

- Rangers

- Rightmove

- Riot Blockchain

- Rio Tinto

- Robinhood

- Roblox

- Rocket Companies

- Rolls Royce

- Sainsbury’s

- Samsung

- Santander

- Severn Trent

- Shell

- Shopify

- Snowflake

- Sportradar

- Spotify

- Square

- SSE

- Stagecoach

- Standard Chartered

- Standard Life Aberdeen

- Synairgen

- Syme

- Taboola

- TalkTalk

- Taylor Wimpey

- Teladoc

- Tesla

- Tilray

- Travis Perkins

- TUI

- Uber

- Unilever

- UPS

- Vectura

- Virgin Galactic

- Vodafone

- Walmart

- Wish

- Whitbread

- Zoom

Other Types of Shares

We’ve covered the main types of shares above, but there are also many other smaller categories that shares can be split into. Check out some other types of shares below:

- US stocks

- European stocks

- Asian stocks

- China stocks

- International stocks

- Cheap stocks

- FAANG stocks

- UK tech stocks

- Healthcare stocks

- Small Cap stocks

- Renewable energy stocks

- Hydrogen stocks

- Supermarket stocks

- AI stocks

- Airline stocks

- Cyclical stocks

- Oil stocks

- Oil tanker stocks

- Silver mining stocks

- Blockchain stocks

- Uranium stocks

- 5G Stocks

- Warren Buffett Stocks

- Bitcoin Stocks

- Biotech Stocks

- Casino Stocks

- Lithium Stocks

- Most Shorted Stocks

- Gold Mining Stocks

- Defensive Stocks

- Tokenised Shares

- Reddit Stocks

- Metaverse Stocks

Share Price Forecasts

Looking for the best shares to add to your portfolio? Just check out our share price forecasts below.

- AMC share price forecast

- Cineworld share price forecast

- Coca Cola share price forecast

- Pfizer share price forecast

- Sainsburys share price forecast

Where to Invest in Different Types of Shares?

So now that we have discussed the ins and outs of the many different types of shares, we need to conclude by outlining the importance of choosing a suitable stock broker. After all, you will need to use a third-party share dealing platform in order to buy shares – no matter which classification they fall under.

With the retail investment space getting more and more popular in the UK, there are literally hundreds of stock brokers now offering their services. Such a vast number of brokers on offer does make it difficult to know which platform to sign up with.

As such, below you will find some key metrics that you need to explore before choosing a broker.

- Is the stock broker regulated by the Financial Conduct Authorty (FCA)?

- Is your money protected by the Financial Services Compensation Scheme (FSCS)?

- Does the broker list your preferred type of shares?

- How much does the broker charge in fees, commissions, and annual maintenance?

- What UK payment methods can you use to deposit and withdraw funds?

- Is the broker suitable for first-time investors?

Conclusion

By reading our guide all of the way through, it is hoped that you now have a comprehensive understanding of the many different types of shares available to buy. Crucially, there are several sub-sections of each share type, so it’s important that you are to differentiate before taking the plunge.

For example, if you are looking for a high growth share, then you will need to focus on companies like Tesla, Upwork, Uber, and Netflix. At the other end of the spectrum, if you are more interested in strong and stable blue chip shares that pay dividends, you will be more suited for firms like GlaxoSmithKline and British American Tobacco.