Best UK Banks ETFs to Watch

Below we review 5 UK Banks ETFs for 2022. To give you a clearer picture of the their strengths, we have looked in particular at what sectors their portfolios focus on, their price performance during and after the pandemic.

UK Banks ETF for 2022

With many UK Banks ETFs to choose from, let’s take a look at five popular ETFs in this sector. You can scroll down or click on the link to review them in detail

- iShares Core FTSE 100 UCITS ETF

- iShares Core MSCI World UCITS ETF

- iShares Core MSCI Europe UCITS ETF

- iShares MSCI UK UCITS ETF

- MSCI United Kingdom IMI Socially Responsible UCITS ETF

Popular UK Bank ETFs Reviewed

Now let’s take a closer look at the popular ETFs that track UK bank stocks.

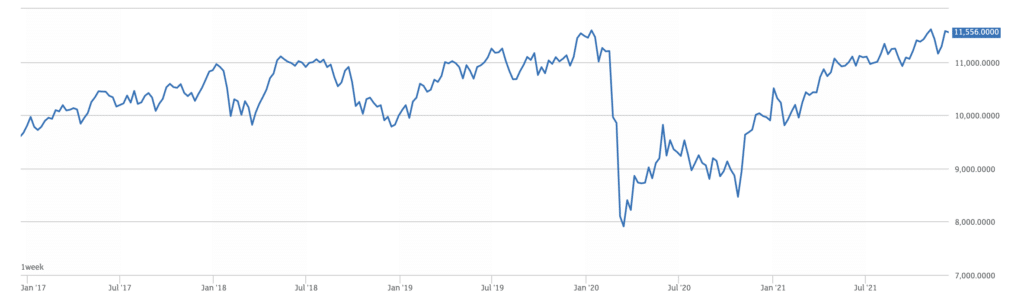

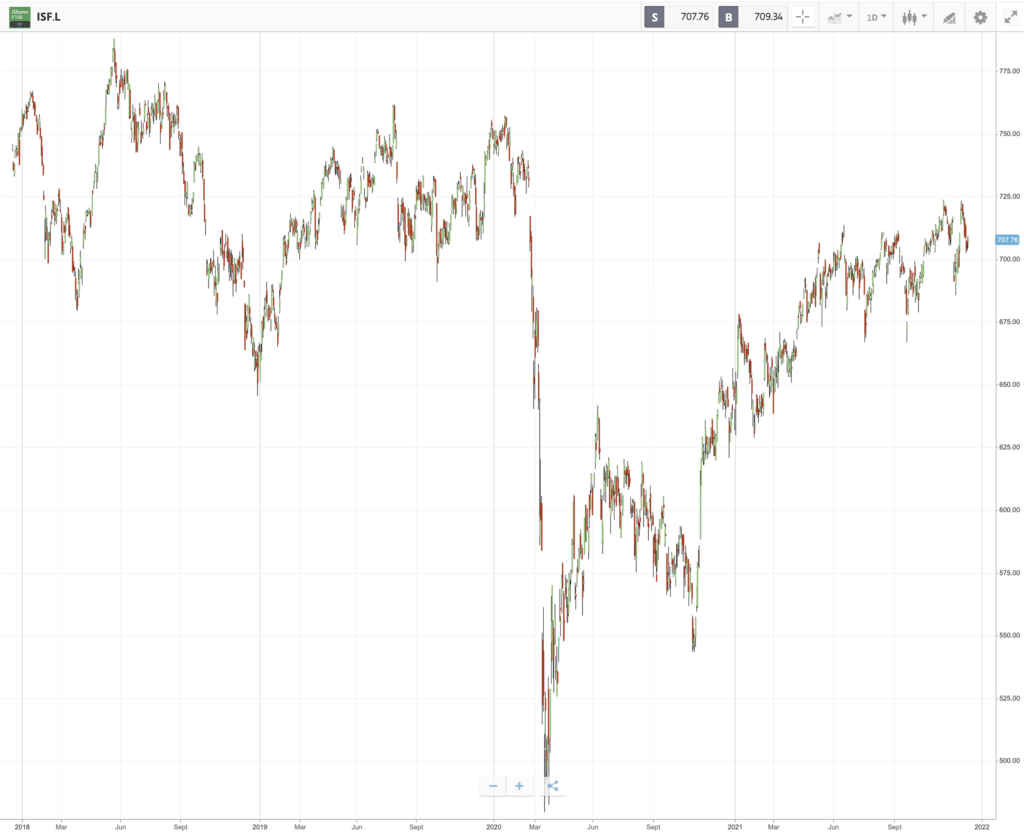

1. Core FTSE 100 UCITS ETF (ISF)

This UK Banks ETF gives you exposure to the Big Four UK banking stocks, as well as all other members of the UK’s FTSE 100 index. As a proportions of its £10bn portfolio, ISF holds:

- Barclays plc: 1.56%

- HSBC Holdings plc: 4.64%

- Lloyds Banking Group plc: 1.66%

- Natwest Group plc: 0.6%

In this ETF, along with key UK banking stock, you get the biggest, most robust stocks on the London Stock Exchange. The biggest 5 stocks held are British-Swedish pharma company AstraZeneca plc with 6.64% of total assets held, household staples giant Unilever plc (5.21%), Big Four UK bank HSBC Holdings plc (4.64%), drinks giant Diageo plc (4.6%) and consumer healthcare stalwart GlaxoSmithKline (4.05%).

Holdings in the financials sector make up 17.87% of the portfolio, with only consumer staples at 17.97% held in larger proportion.

As a tracker fund, ISF offers a super-low Total Expense Ratio (TER) of 0.07%. That means for every rise in value of assets held, just 0.07% will be withheld from investors to pay for running costs.

In terms of price performance, ISF – like many ETFs – got hammered during the pandemic, recording a -18% return for the financial year Sept. 2019 – Sept. 2020. The price recovered this year, however, bouncing back with a 25% return for 2020-2021.

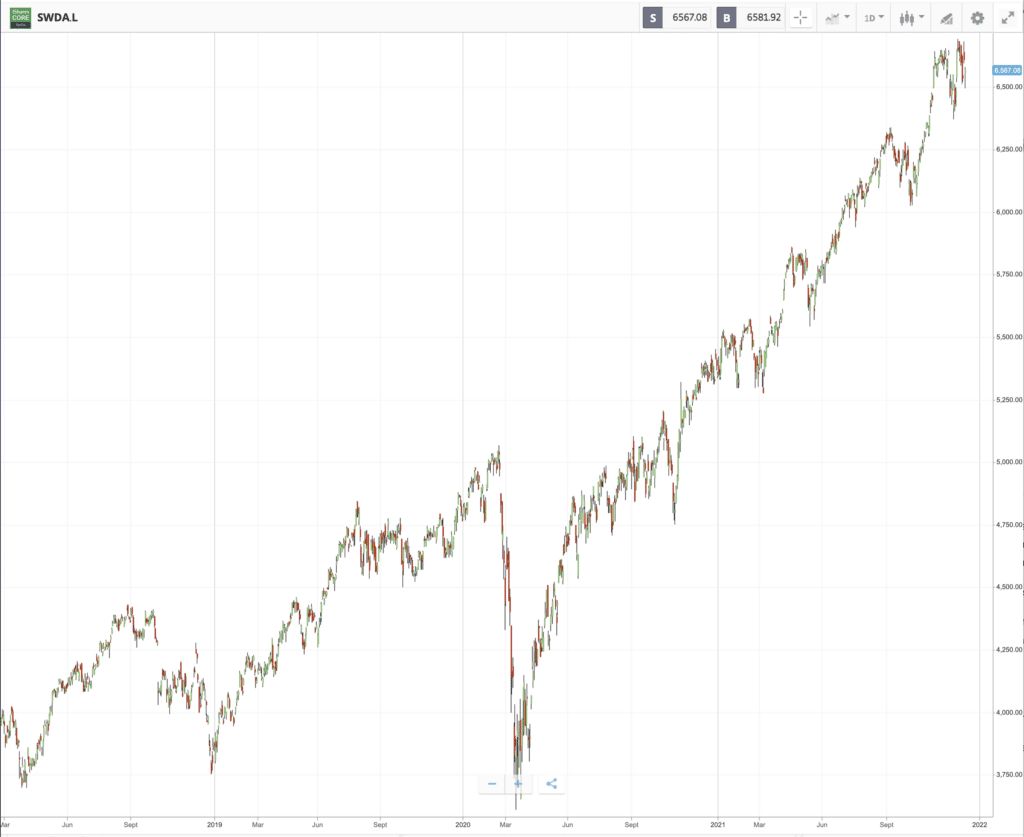

2. iShares Core MSCI World UCITS ETF (SWDA)

SWDA offers a small exposure to UK banking stocks as part of a $46bn portfolio of 1,582 global stocks.

- Barclays plc: 0.07%

- HSBC Holdings plc: 0.2%

- Lloyds Banking Group plc: 0.07%

- Natwest Group plc: 0.03%

Financial stocks make up 13% of this ETF. Stock in US banking giant JP Morgan Chase and Company is the biggest financial holding, with 0.78%.The biggest sector holding is in Information Technology (23%), which accounts for this ETF’s price performance during and after the pandemic. Financial year 2019-2020 saw a price gain of 10.4% for SWDA and this year saw a gain of almost 29%.

The largest 5 SWDA holdings are Apple Inc. (4.64%), Microsoft Corporation (3.78), Amazon Inc. (2.51%), Google A (1.42%) and Google C (1.36%). The sixth-biggest holding is Facebook/Meta (1.3%) – which completes this ETF’s holding in the tech giant ‘FAAMG’ group.

This ETF is listed on the London Stock Exchange, the SIX Swiss Exchange, Euronext in Amsterdam, the German Borse Xetra, the Borsa Italiana of Italy and the Bolsa Mexicana De Valores of Mexico.

SWDA offers a Total Expense Ratio of 0.20%. This ETF is ambitiously global in its scope, offering exposure to 85% of the listed equities in 23 countries.

Like ISF above, this ETF could act as a low-risk anchor for your portfolio. It has dealt with pandemic pressures well. It offers exposure to the UK banks as well as truly global diversification in large-cap companies.

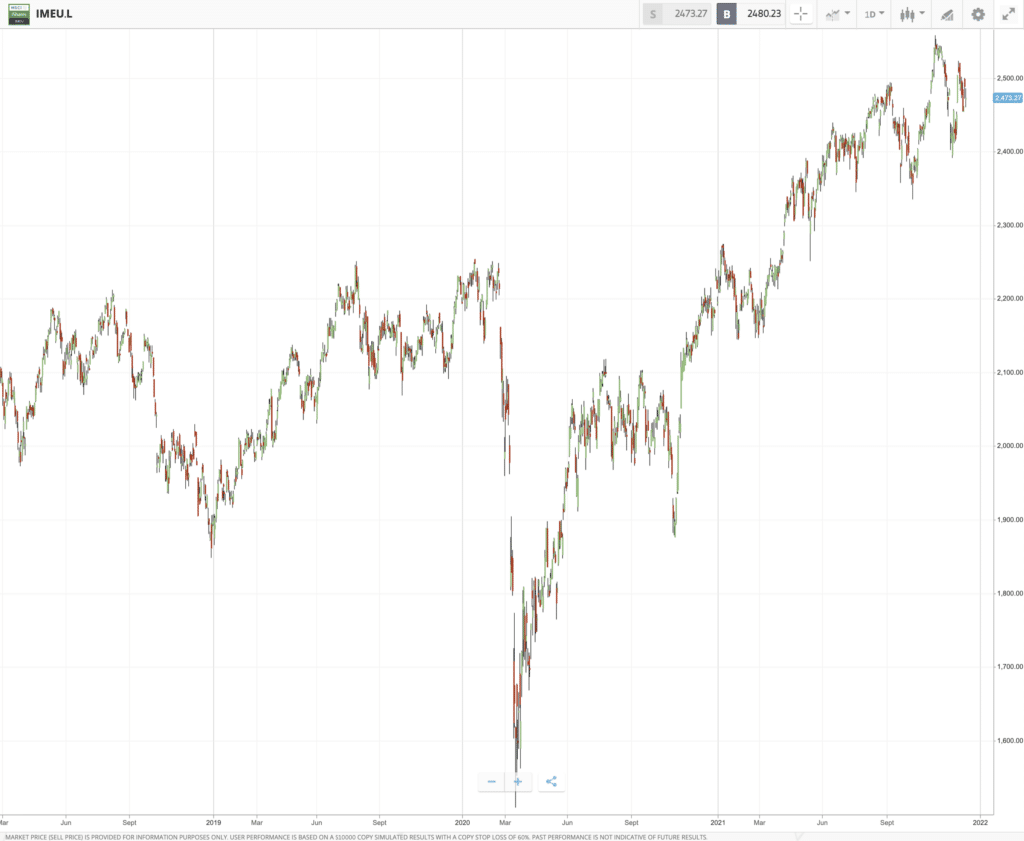

3. iShares Core MSCI Europe UCITS ETF (IMEU)

Launched in 2007 by BlackRockAsset Management, this ETF is domiciled in Ireland. It is valued at over €6.4bn and provides diversified access to a broad range of European companies. The portfolio numbers 433 stocks, with the finance sector being the largest sector invested in with 15.7% of assets. Industrials comes second with 15.0% and healthcare third with 14.7%.

Because of its European focus, IMEU has bigger holdings in the UK banks than the global SWDA ETF featured above:

- Barclays plc: 0.37%

- HSBC Holdings plc: 1.1%

- Lloyds Banking Group plc: 0.4%

- Natwest Group plc: 0.16%

This ETF, like the FTSE-based ISF, was hit badly by the pandemic. SWDA recorded a 7.6% drop in price in the financial year 2019-2020. But, like the European economies it tracks, SWDA rebounded this year with a 29% rise in price.

The biggest 5 stocks of this ETF read like a Who’s Who of European business. Consumer staples giant Nestle takes the biggest proportion of the portfolio (3.5%), followed by Dutch suppliers to the computer chip industry ASML Holdings (2.85%), Swiss healthcare veterans Roche Holdings (2.6%), Paris-based luxury goods firm LVMH (Moet Hennessy Louis Vuitton) (2.0%), and Danish pharma company Novo Nordisk (1.78%).

SWDA offers a Total Expense Ratio (TER) of 0.12%.

4. iShares MSCI UK UCITS ETF (CSUK)

Founded in 2010 by BlackRock Asset Management, this tracker ETF follows the MSCI United Kingdom Index which itself is similar to the FTSE 100 index. Large cap UK companies, offering strong yields and low price volatility are the focus.

Compared to the ETFs covered so far, this is a small fund with total net assets of £118m. But we are not off-piste here: CSUK, like ISF, SWDA and IMEU is a UCITS ETF, which means it is properly-regulated.

The largest five holdings are the same as for ISF, but in a slightly different order: AstraZeneca plc (7.1% of the portfolio), Unilever plc (5.59%), Diageo plc (5.0%), HSBC Holdings plc (4.96%) and GlaxoSmithkline plc (4.41%).

Consumer staples are the biggest sector covered, taking 19.5% of the fund. The financial sector takes the second-largest share of the portfolio, with 17.3%. The Big 4 UK banks are well-represented:

- Barclays plc: 1.67%

- HSBC Holdings plc: 4.96%

- Lloyds Banking Group plc: 1.78%

- Natwest Group plc: 0.69%

Thanks to the calamitous impact of the pandemic on the FTSE, a 20% reduction in share price was registered by this ETF for the financial year 2019-2020. This was followed this financial year by a price increase of 25%.

Although not strictly a FTSE 100 tracker, this ETF is very similar to the Core FTSE 100 UCITS ETF (ISF) covered above. CSUK offers 1% more exposure to UK banks.

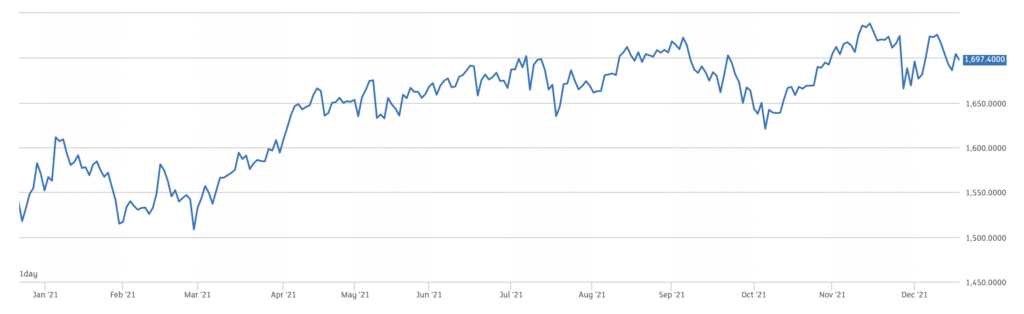

5. MSCI UK IMI Socially Responsible UCITS ETF (UKSR)

This index ETF – ticker label UKSR – is a UK Banks ETF with a focus on ethical investing. Of the Big Four UK banks, 3 are represented:

- Barclays plc: 3.46%

- Lloyds Banking Group plc: 3.70%

- Natwest Group plc: 1.41%

UKSR follows the MSCI UK IMI Extended SRI Low Carbon Select Index, which investment bank UBS describes as ‘a benchmark for investors seeking exposure to popular ESG United Kingdom companies while avoiding products whose social or environmental impact is considered to be negative by investors.’ (ESG means Environmental Social Governance, and is the metric used in the investment world to evaluate the ethical worth of companies).

With a Total Expense Ratio of 0.28%, UKSR is not an inefficient ETF.

UKSR’s largest 5 holdings are British-Dutch pharma company Astra Zeneca plc (5.27%), British-Dutch IT firm Relx plc (5.23%), producer of consumer healthcare products Reckitt Benckiser Group plc (5.06%) consumer healthcare giant GlaxoSmithkline plc (5.05%), and consumer goods multinational Unilever plc (4.82%).

UKSR has delivered a different price performance profile to the 4 other index funds reviewed above. Year-to-date, it has delivered a return of 13.63%. In 2020, the pandemic crisis had only taken 5.36% off its price by the end of the year. The year before that, 2019, had seen a price gain of 22.85%.

Just under a quarter of UKSR’s portfolio are financial companies, with industrials making up the second-largest holding with 18.26%.

What is a UK Banks ETF?

What is an ETF?

An ETF is an exchange-traded fund. ETFs evolved out of mutual funds, and thus invest in a basket of companies on behalf of a pool of investors.

Not only do ETFs feature they feature lower fees than mutual funds, but they can be traded like conventional stocks and shares.

UK Banks ETFs – Low-Cost, Low-Risk Exposure to the Big Four UK Banks

UK Banks ETFs are Exchange Traded Funds (ETFs) which feature UK banks that specialise in lending/borrowing rather than investing. Hence ETFs for UK banks include the Big Four UK banks: Barclays, HSBC, Lloyds, and Natwest.

No ETF focuses purely on these UK banks. But plenty of ETFs are available which feature them as part of a wider UK, European or even global focus on established large-cap stocks with low price volatility.

UK Banks ETF

You can purchase UK Banks ETFs with online ETF brokers.

Conclusion

UK Banking ETFs may be a way for users to diversify their asset holdings and add another asset class into their portfolio. After analysing our reviews on the popular ETFs available in this sector, make sure to conduct your own research and create your investment strategies before entering in any trades.