How to Buy Robinhood Shares UK – With 0% Commission

Robinhood’s upcoming IPO is one of the most exciting investment events of the year, with many investors looking to buy shares in the rapidly growing company. With revenues and customer acquisition both increasing at a meteoric rate, an investment in Robinhood looks set to be one of the most exciting additions to your portfolio for 2021. In this article, we explore How to Buy Robinhood Shares UK.

We will be covering everything you need to know about the company and its IPO and showing you how to invest in Robinhood with 0% commission.

Step 1: Choose a Stock Broker

The first thing you need to do before you buy shares in Robinhood is to find a reputable brokerage to facilitate your investment. There are numerous factors to consider, such as trading fees and minimum deposits, when choosing a suitable broker. Furthermore, with so many options to choose from, it may seem daunting to narrow down the possibilities.

Not to worry – the section below presents our recommendations for the best stock brokers to buy Robinhood shares in the UK.

Broker Price Comparison

As you can see from the section above, Fineco offers fantastic ways of investing in Robinhood shares. The table below presents a breakdown of these platforms compared to other ones in the industry, allowing you to compare factors such as commissions and fees when trading.

| Broker | Commission | Account Fee | Deposit Fee |

| Fineco | $3.95 per trade | None | None |

| Libertex | From 0.1% | None | None |

| Hargreaves Lansdown | £11.95 per trade | None | None |

Step 2: Research Robinhood Shares

One of the key things to do when equity trading is what’s known as ‘due diligence’. This refers to the process of researching a potential investment and considering whether it would be a good buy or not. Areas such as the company’s financials and business model should be considered to gain a comprehensive understanding of your potential investment.

To help you with this, the sections below break down everything you need to know about Robinhood, ensuring you’re able to make an informed investment decision.

What is Robinhood?

First thing’s first – what is Robinhood and what do they do? Robinhood is an American financial services company that offers commission-free trading of fractional shares and ETFs through its trading app. The company is heavily policed by numerous top tier regulators in the US, including the SEC and FINRA. Furthermore, Robinhood is a member of the Securities Investor Protection Corporation, ensuring users are afforded the highest levels of safety when using Robinhood’s services.

As Robinhood’s main selling point is the commission-free stock trading and ETFs trading, the company typically generates revenue through other avenues. Firstly, Robinhood earns interest on the balances in customers’ trading accounts; they also create revenue through margin lending. Another way that Robinhood generates income is through the sale of order flow information to high-frequency traders, with CNBC reporting that this business element is growing at a considerable pace.

At the time of writing, Robinhood has over 31 million users, which is exceptional considering the company was only founded in 2013. This user base has been grown through the cost-effective trading solutions offered and the various additional products that Robinhood has launched. One of the significant additions to Robinhood’s products and services in recent years is its cryptocurrency trading services. The timing of this addition has helped skyrocket Robinhood’s popularity with investors, as they still allow commission-free investing on crypto. Robinhood even offers banking services to US customers, providing an ‘all in one’ platform.

Robinhood has two ‘co-CEOs’ at present – Vladimir Tenev and Baiju Bhatt. The company is based in Menlo Park, California, and has over 1200 employees. Notably, Robinhood is about to undergo an Initial Public Offering (IPO) at the time of writing – this will be covered in-depth in the following section.

Robinhood Share Price

Now that you’ve got a solid overview of Robinhood’s business model, let’s dive into their financials. The first thing to note, and perhaps the most important, is that Robinhood intends to go public on 29th July 2021. The Robinhood IPO is set to be one of the most exciting IPOs this year, with many investors scrambling to get a piece of the action.

Before a company goes public in the US, it has to provide what’s called an S-1 filing which is presented to the SEC. This filing includes information on what the company intends to do with the funds, the company’s business model, and the methodology for calculating the share price.

According to Robinhood’s S-1 filing, the company intends to sell around 52.4 million IPO shares, with various significant shareholders in Robinhood also selling their shares. In terms of the Robinhood share price, the company anticipates the stock debuting between $38 and $42 per share. Putting all of these figures together, Robinhood aims to generate around $2.2 billion in funding, giving the company a valuation of $33 billion.

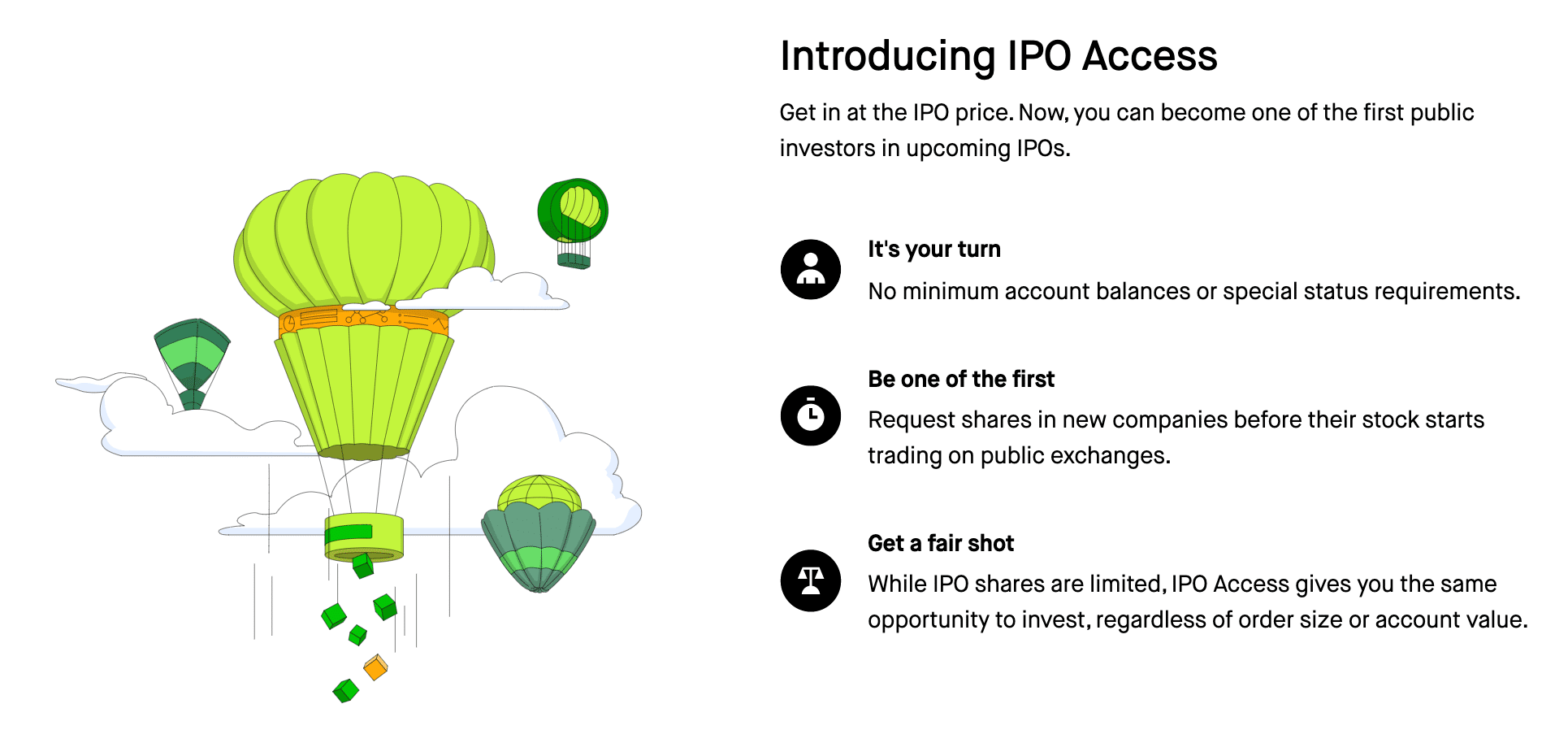

Interestingly, the Wall Street Journal noted that Robinhood will ‘reserve’ IPO access for between 20% and 35% of its shares for users of the Robinhood app. This will allow users to purchase at the IPO price. Ultimately, this process aims to be a sort of ‘reward’ to users since they will be able to get in at the debut price of the Robinhood stock.

Although we don’t know what the Robinhood share price will be until trading goes live, there’s great speculation about whether shares will be worth purchasing. We will dive into this more in the following sections, but an important thing to note is that Robinhood is growing rapidly. This growth, combined with increasing retail investors, makes Robinhood’s IPO an exciting prospect for investors worldwide.

Robinhood Shares Dividends

The upcoming Robinhood IPO has got everyone excited – and if you are interested in investing for income, you’ll probably be interested in knowing about dividends. At present, as Robinhood is not yet publicly listed, the company does not pay a dividend as it doesn’t have any tradeable shares. The vast majority of IPO companies do not offer a dividend when they go public, instead choosing to wait a few years until they’ve ‘found their feet’.

However, data presented by IPOhub noted that 84% of companies included in the S&P 500 do pay dividends. This adds validity to the idea that Robinhood may decide to offer a dividend to shareholders in the future. Ultimately this would come down to company performance and free cash flow – but if their financials continue heading in the direction they are currently, there’s every chance this could happen.

Robinhood ESG Breakdown

If you are interested in ethical investments, then it’s always wise to look at the impact that a company has on the environment and society. Typically this is completed through a company’s ‘ESG’ rating, which considers environmental, social, and governance elements. These elements combine to provide insight into how ethical and moral a company is.

As Robinhood are not currently public, the information of ESG elements is quite limited. This information will become more apparent as we go forward, but it is worth noting that its environmental impact is relatively low, thanks to the lack of physical locations used. However, in terms of the social implications, Robinhood did land itself in hot water during the early part of 2021, thanks to the ‘short squeeze’ brought about by Gamestop. This resulted in a considerable fine levied by FINRA, as reported by Which-50.

Are Robinhood Shares a Good Buy?

So, putting everything together, is it a good idea to buy shares in Robinhood in the UK? To provide further context into this, let’s look at two key factors to consider:

Rapid Growth

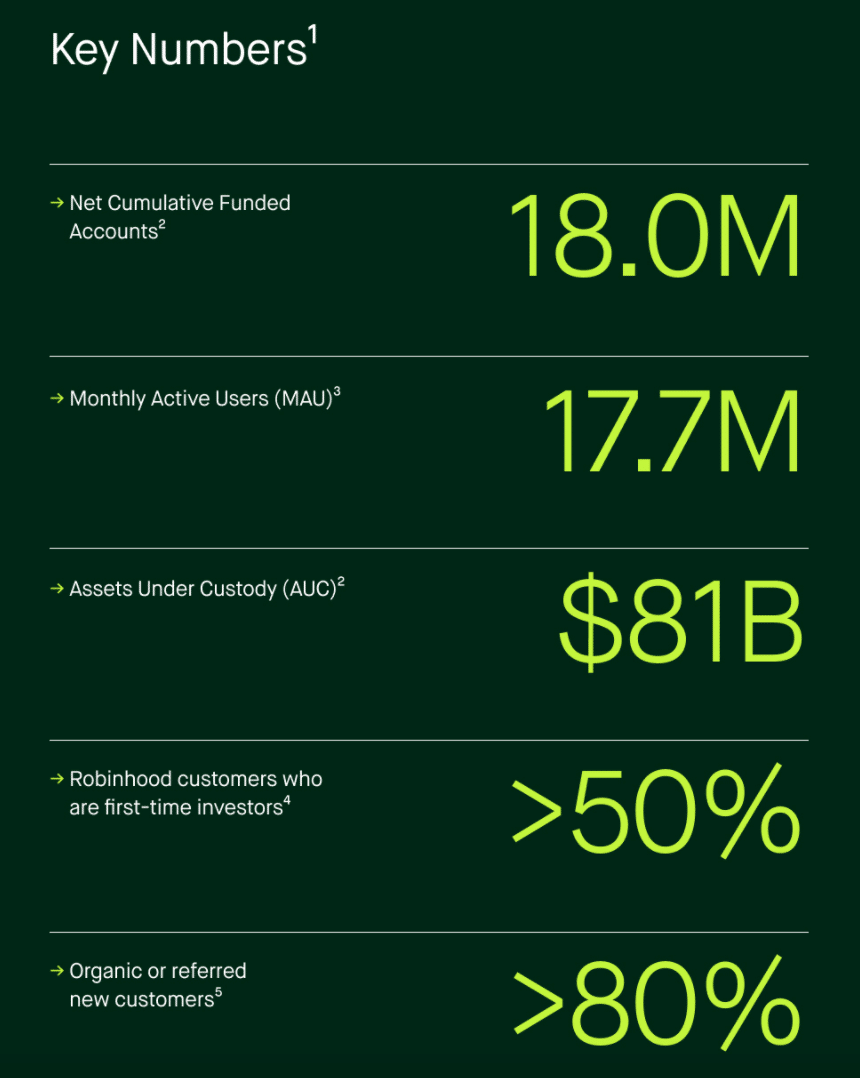

One of the main reasons to consider an investment in Robinhood is the company’s rapid growth. Q1 2021 customer figures were up 151% from the year previous, reaching 18 million users. Furthermore, sales growth in Q1 rose to 309%, which was primarily driven by the hype surrounding cryptocurrency at that time.

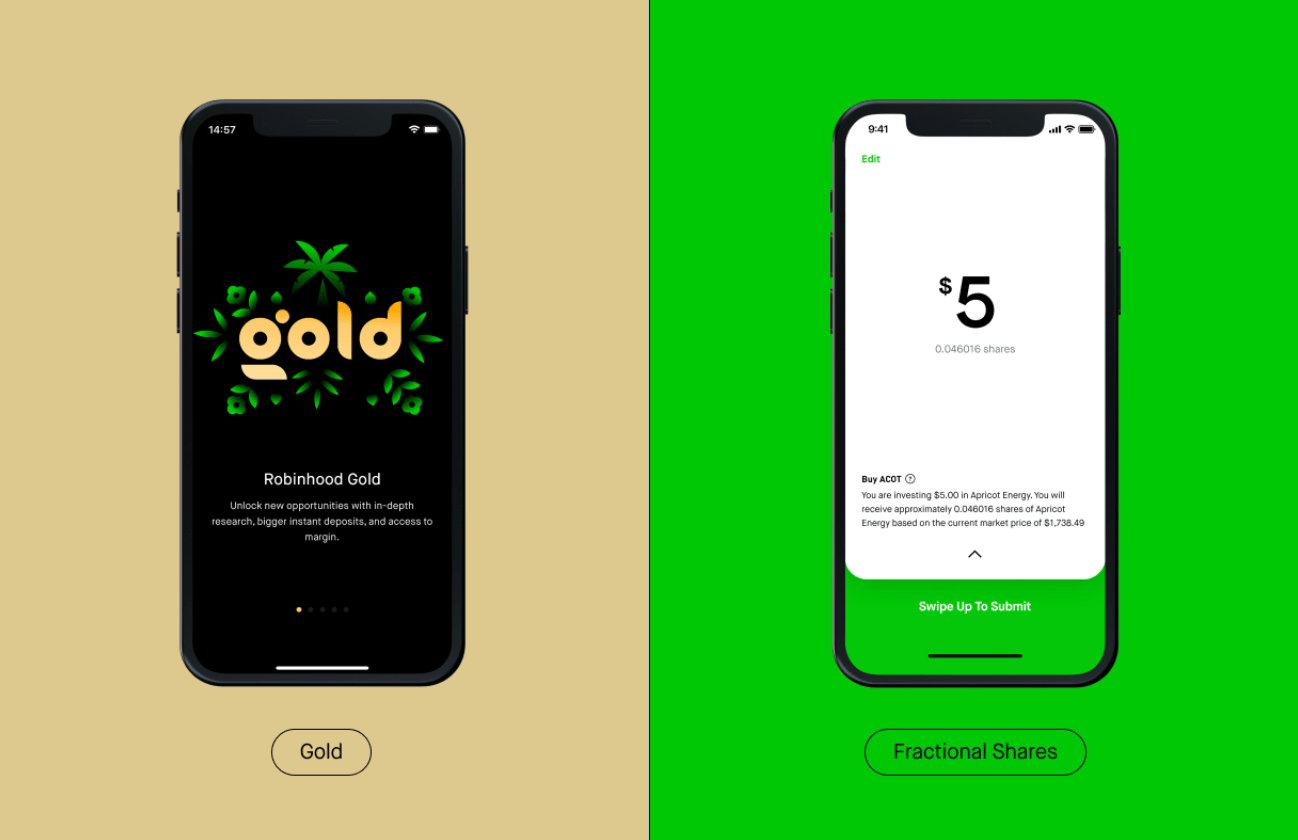

As noted earlier, Robinhood does make money through the sale of customer order information to 3rd parties. Some people do raise concerns over this practice, but the fact is that it generates substantial revenue for Robinhood. Other avenues that the company creates income are through interest on customers’ accounts and subscription revenue from Robinhood Gold.

Cryptocurrency Options

Q1 2021 data for Robinhood noted that cryptocurrency revenue was up nearly 2000%, which equated to a large percentage of the company’s transaction revenue. The commission-free trading options for crypto have made Robinhood the go-to platform for vast numbers of retail traders, which is excellent news for the company’s user base and overall revenues.

Although Robinhood does not currently offer any crypto wallets or additional features, there are rumours that the company may offer these in the future. With the growth of cryptocurrency trading showing no sign of stopping, this could be a crucial aspect of the business to focus on. This crypto craze has also benefitted Robinhood in a marketing sense, as many users sign up for Robinhood’s services through word of mouth marketing brought about via Reddit and other forums. This means that advertising spend is much lower for the company, leading to more significant margins.

Robinhood Shares Buy or Sell?

So, overall, are Robinhood shares a buy or a sell? We are inclined to stick with the former, although it’s hard to say at present. Taking a buy or a sell position in the pre-IPO phase is typically a risky bet, as nobody knows what the Robinhood share price will be until it goes live.

One of the main reasons to consider an investment in Robinhood is its brand appeal and well-established nature in the financial services sector. Furthermore, TechJury reported that the crypto market is expected to grow at a rate of 3.5% per annum between now and 2026. This highlights how popular these digital currencies are – especially with retail traders. With this popularity continuing to rise, it’ll mean companies such as Robinhood will continue to be in high demand going forward.

It is worth noting that Robinhood is still under threat of numerous class-action lawsuits related to its operations over the past year. When investing in the company, it is wise to be aware of this factor. However, if these can be sorted quickly and efficiently, it’ll clear the path for Robinhood to continue growing post-IPO.

Overall, Robinhood looks set to be one of the most exciting investment opportunities of the year. Although we won’t know the Robinhood share price until it goes public, the fact remains that investors worldwide will be keeping an eye out for potential opportunities to add Robinhood to their portfolio. If the company can continue growing at the rate it is and also add additional features to grow its user base even more, then there’s certainly scope for Robinhood to establish itself as one of the major players in the industry.

Buy Robinhood Shares with 0% Commission

In summary, Robinhood looks set to be one of the most exciting IPOs this year, with many investors looking to get involved when shares go live. With sales and revenue increasing at a rapid rate and the ever-growing popularity of cryptocurrency showing no signs of stopping, an investment in Robinhood could mean great things for your equity portfolio.