10 Popular Renewable Energy Stocks Among UK Investors

Savvy investors always need to be on the lookout for themes and industries which are likely to lead the next bull markets and which will give rise to the next big true market leaders capable of producing outsized gains.

In this article, we will present you with some renewable energy stocks UK in 2024, and explain in detail what are the driving forces behind each of the companies and the reasons why they could potentially be a great addition to your investment portfolio.

10 Popular Renewable Energy Stocks UK List

That is why we have narrowed down the list of renewable energy stocks UK from several different sectors within the renewable energy space:

- Daqo New Energy (DQ)

- First Solar (FSLR)

- Enphase (ENPH)

- SolarEdge Technologies (SEDG)

- Tesla (TSLA)

- Nio (NIO)

- BYD Co. Ltd. (BYDDF)

- Plug Power (PLUG)

- Shoals Technologies Group (SHLS)

- Nextera Energy Partners (NEP)

Renewable Energy Stocks UK Reviewed

Although the renewable energy sector stands out as one of the hottest investing themes to be involved in, investors should take into consideration the recent surge in the stock price of the abovementioned companies.

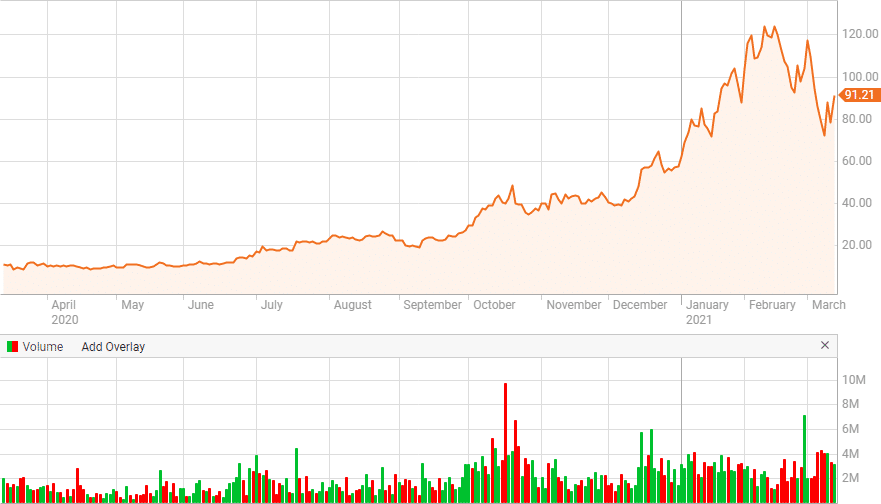

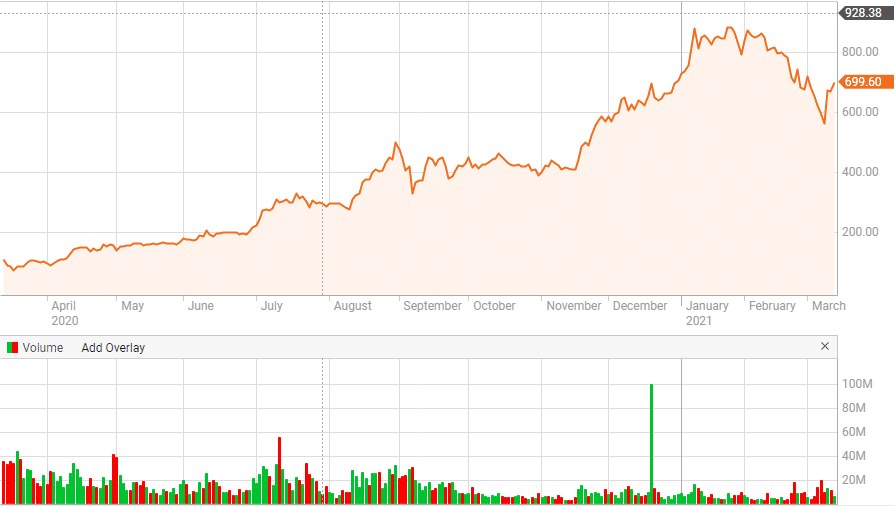

1. Daqo New Energy (DQ)

The China-based polysilicon manufacturer has been the star of 2020 with more than 1000% gain on the back of surging sales volume of more than 200% increase for several quarters coupled with an increase in production efficiency shown in expanding pre-tax profit margin of 16% and annual return on equity of 22%.

The healthy correction that is taking place at the time of this writing could provide investors with the chance to participate in the next leg up, especially as the easing of restrictions to Chinese companies that occurred with the new U.S. President should in the longer term reduce the price of products and thereby increase demand for them.

Sponsored ad.Your capital is at risk.

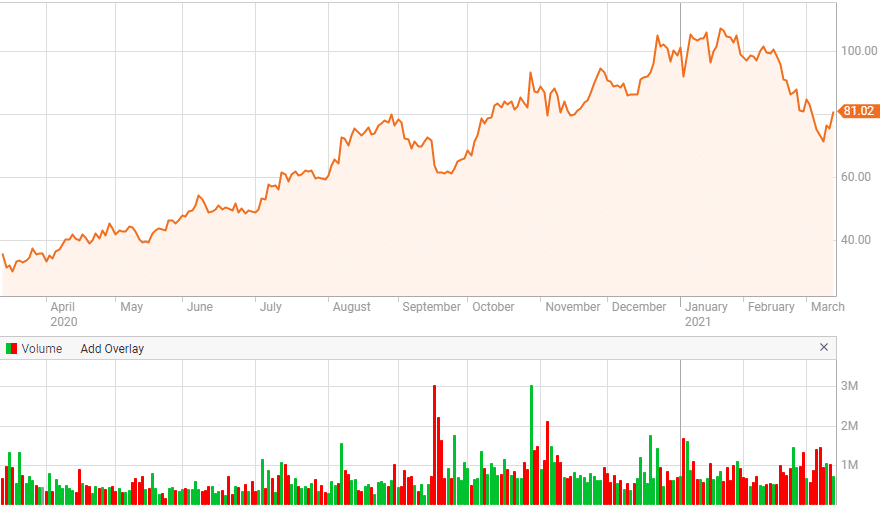

2. First Solar (FSLR)

Even though the fundamental ratios of FSLR stock don’t appear as convincing as the other stocks in this group, that might soon change as the U.S. company, in its recent February quarterly report, provided a first-quarter outlook above analyst estimates as the earnings trend continues to improve and point to a clear shift from previous 5 years of a generally negative trend.

The information that the number of renewable energy investment funds that own shares of FSLR increased by 22% in the last reported quarter from the previous one, shows that institutions took notice of that.

With some looming concerns from third-party market analysts about forced-labor programs in China, First Solar could be in a position with its strong cash war chest to benefit from possible restrictions that could be placed on Chinese solar content, as its production and factories are located in the U.S. and Southeast Asia.

Sponsored ad.Your capital is at risk.

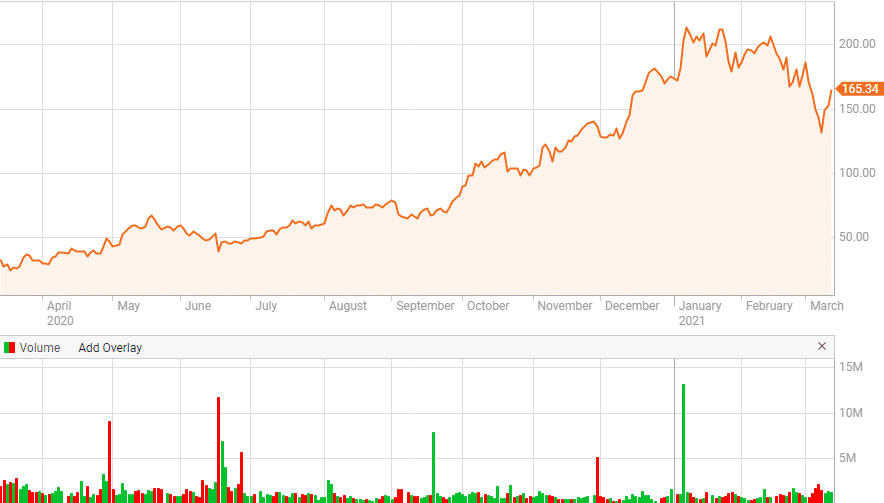

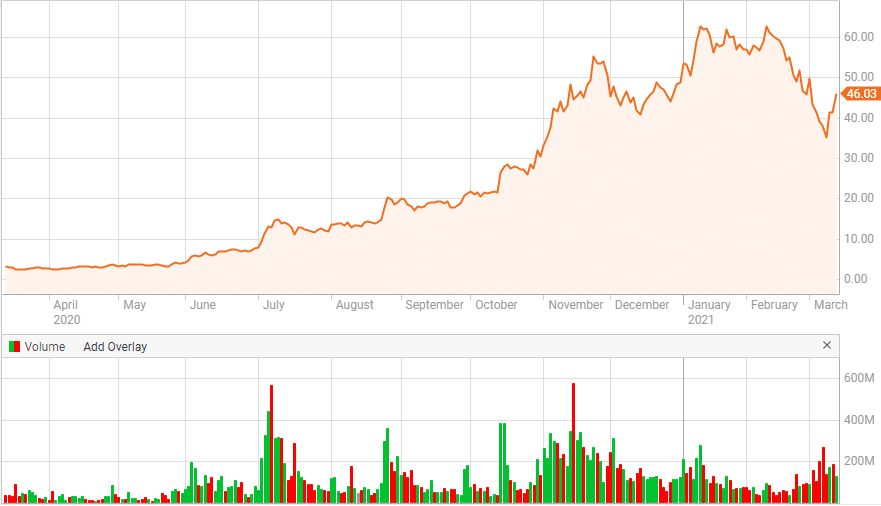

3. Enphase (ENPH)

The maker of home energy solutions for the microinverter-based solar-plus-storage systems continued with a strong demand for its product in the 4th quarter of 2020. Riding high on the solar energy wave and boosted by the $679.4 million in cash, the company also successfully completed the acquisition of Sofdesk, which is a leading provider of design software for residential solar installers and roofing companies and has expanded its production capacities with a new factory located in India.

With the continuously strong trend of earnings-per-share and sales growth, along with the amazing 50% of annual return on equity and 25% pre-tax margin.

Sponsored ad.Your capital is at risk.

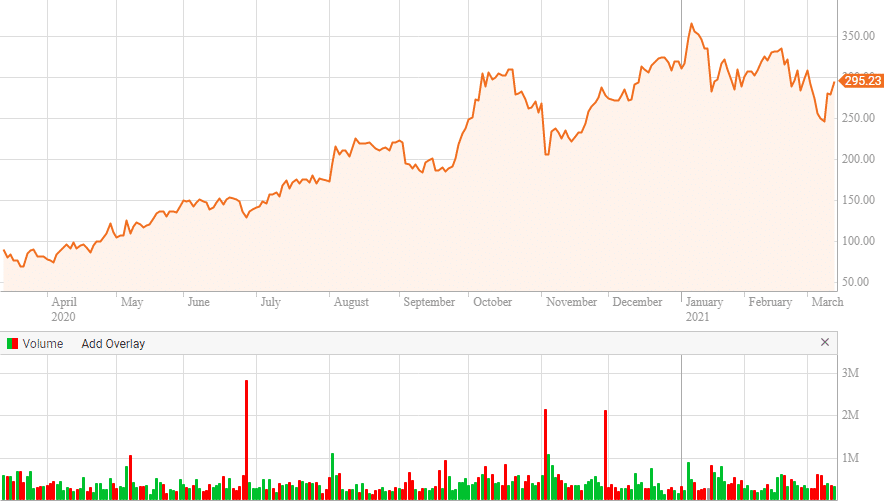

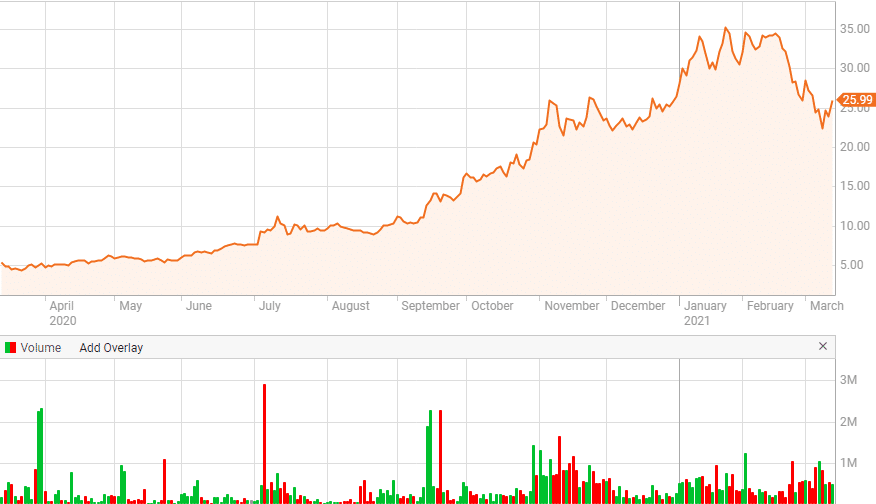

4. SolarEdge Technologies (SEDG)

Founded in 2006, SolarEdge is one of the longest-lasting names in the solar energy industry that continues to shine to date. Even as the global pandemic impacted demand for its products, shares of the company have certainly not budged as they have appreciated close to 400% in 2020. With an expected first-quarter revenue drop of -8%, and lower margin and sales projections, the company is somewhat less appealing than Enphase at this moment.

However, as SolarEdge looks to expand its business line to the European EV market as the supplier of powertrain units and batteries for Fiat e-Ducato van model, an additional $100 – $120 million in revenue is expected by some market analysts to be added to the company’s balance sheet in 2021.

Sponsored ad.Your capital is at risk.

5. Tesla (TSLA)

The potential for so-called “combustion engine killer” is still huge. Tesla is by and large a leader in the EV sector. The company is leaps and bounds over its both traditional car-manufacturing, as well as software competitors (Google, Apple, Baidu are all trying to get in the EV space) when it comes to high-quality data collection of real-world miles driven which is crucial for the future of autonomous driving and ride-sharing aspects of transportation which the future holds.

From the financial standpoint, the company has been increasing its sales (46% sales increase in the last quarter vs the 36% 3-Year sales growth), increasing its earnings per share (EPS) growth by close to triple-digit percent, raising its estimate revisions for future periods, while at the same time Tesla remains strongly favored by the world’s leading innovation-oriented fund ARK Invest and Cathie Wood (they already predicted, and bet big, that Tesla would go on an amazing run in 2017, while most of Wall Street was bearish on the company at the time) due to its unique place among the electric vehicle market.

With the 20% rise of Funds that own Tesla shares (compared to the previous quarter) and 6 quarters of increasing fund ownership, it certainly points to what the “smart” money is looking at.

Sponsored ad.Your capital is at risk.

6. Nio (NIO)

What separates NIO as a brand is its intention to build a whole “lifestyle” ecosystem around its name. The company appears greatly to the younger and tech-savvy Chinese generation and has pushed even deeper with NIO hubs and coffee shops, aimed at creating a community, evidenced by a more than 100% increase in year-over-year units sold.

The push into the subscription-based model and “battery as a service”, in a country that still does not have fixed parking charging stations and advance public charging infrastructure is a revolutionary move for the company that is trying to position itself as a viable competitor of Tesla in China, the world’s largest market for electric vehicles. With China’s aim to spread out battery swapping and charging networks throughout the country and go mostly green by 2035.

Institutional investors are already using the market correction to accumulate company shares again, as evidenced by 8 quarters of rising fund ownership.

Sponsored ad.Your capital is at risk.

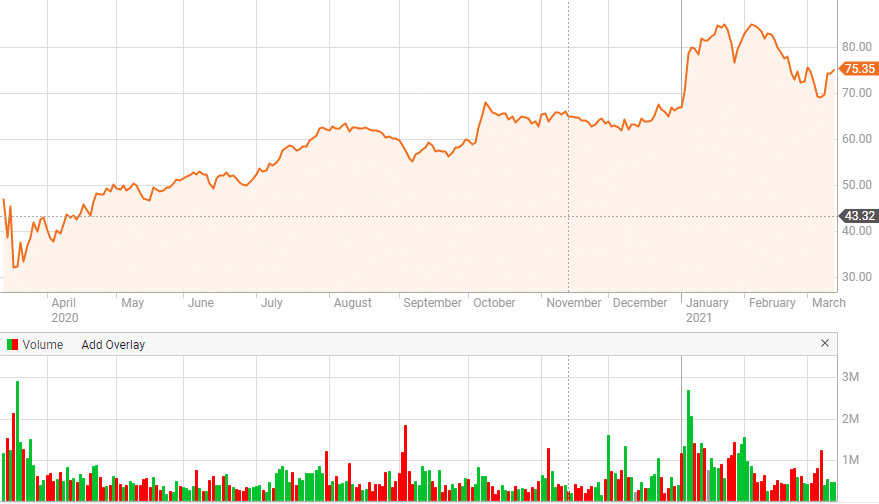

7. BYD Co. Ltd. (BYDDF)

It definitely means something when an investing guru like Warren Buffet decides to make his BYD position more than twice larger than a General Motors one. Berkshire Hathaway owns roughly 25% of all BYD outstanding flow and doesn’t show any signs of trimming it down.

With a 500% rise in price in 2020 and a powerful comeback after the market staged a comeback, BYD has rewarded its investors generously.

Sponsored ad.Your capital is at risk.

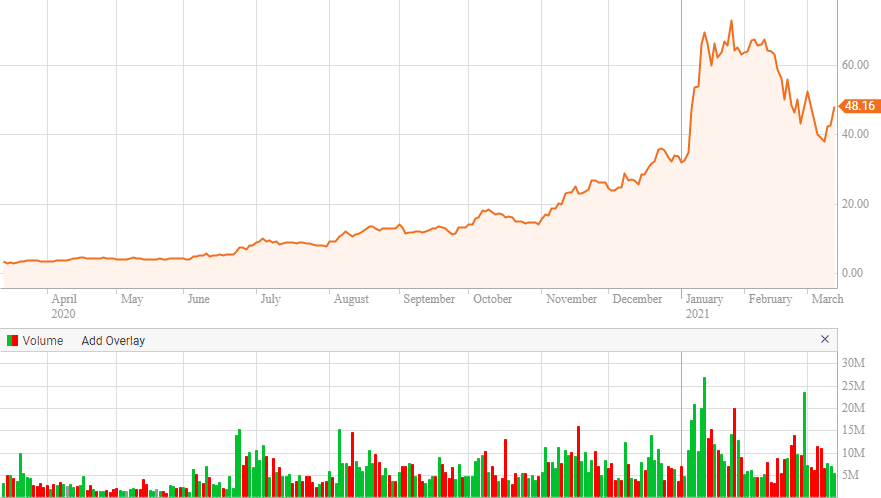

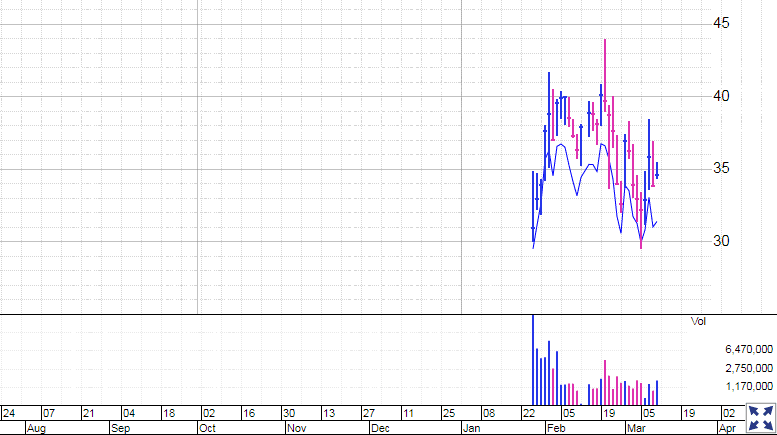

8. Plug Power (PLUG)

The provider of hydrogen fuel cell systems used in electric mobility and stationary power markets definitely has a huge potential. After being present mostly on U.S and European markets, in January 2021, the deal was announced with South Korean company SK Group, which would expand the reach of Plug’s products and services to Asian markets.

In the same month, a memorandum of understanding regarding the launch of the joint venture was signed with French automobile maker Renault. In the last report, management raised its outlook for 2021 from $450 million to $475 million as well as its 2024 gross billings target for as much as 40% from its prior outlook.

As the hydrogen stock corrected by close to 50% in the last month, investors should put it on their radar as a high-quality candidate for this year.

Sponsored ad.Your capital is at risk.

9. Shoals Technologies Group (SHLS)

It takes something really good to get the attention of the market that was running red hot such as this one at the beginning of 2021.

The company that produces solar power components and equipment used in the electric power transition from solar panels all the way to the power grid at the end, was priced above its initial public offering range due to big investor demand ($25 vs the expected $22-$23), and is the biggest ever solar IPO is just that type of company. Several major Wall Street firms already issued the coverage of the stock with buy/outperform ratings.

Shoals has close to 54% market position within its niche, and in the recent note to clients, Goldman Sachs estimates 40% compound annual growth of revenues in the next 3 years. What also stands out is that the company is profitable, and has been raising its sales by 30% both in the last quarter as well as in the 1 and a 3 year time period. Earnings per share and revenue also grew at an impressive double-digit rate, while at the same time its debt to equity ratio remains in the low teens, pointing towards a capable and quality management at the helm.

Sponsored ad.Your capital is at risk.

10. Nextera Energy Partners (NEP)

A part of the elite Fortune 500 list, NextEra Energy is the world’s largest private generator of wind and solar renewable energy through a wide array of activities like development, construction, and operation of projects, as well as energy storage services. Its subsidiary Nextera energy Partners focuses on running a portfolio of wind and solar projects, along with natural gas pipelines in the U.S. and Canada.

With the rise in both revenue from -5% to 3% and earnings-per-share from 0% to 70%, followed by the upward estimates revisions and 7 quarters of rising fund ownership of its shares.

Sponsored ad.Your capital is at risk.

Facts about Renewable Energy Stocks

As the global pandemic has accelerated the shift toward sustainability and as a consequence, shares of all of these companies benefited immensely. Despite their recent sell-off, which was to be expected after their huge run in 2020, longer-term prospects remain positive as these are industry disruptors, and it could be argued that the future belongs to these types of high-growth companies within the favorable thematic environment.

As the high beta stocks tend to correct more than the overall market, for investors who are confident about these names and their business prospects, the correction could provide the chance to initiate new positions within these candidates or to add on to already existing ones, and they have the potential to represent crown jewels in investor’s portfolios in years to come as they are strongly positioned within the trend in sustainable development and “green” all, which is here to stay and will only accelerate in the following period globally.

Stock Brokers That Offer Renewable Energy Stocks

Now we’ve reviewed some renewable energy stocks UK, let’s take a look at some stock brokers where you can invest in these companies with zero fees.

1. eToro

With an abundance of various renewable energy company stocks that you can invest in via CFDs, not only on the UK markets but also both the NYSE and the NASDAQ, as well as most popular ETFs used to gain exposure to space, this FCA-regulated broker is a perfect choice.

Whether you opt for individual company stocks on a DIY basis or the industry-oriented ETF, eToro does not charge any dealing charges, and you won’t pay an annual fee, leaving more money on the table for you.

Another strong selling point for eToro’s is its standout features like social and copy trading tools. Known as a pioneer of social trading among brokers, eToro allows more than 20 million of its users to engage in various investing topics. Having a quality peer group is a valuable tool for beginning investors as it represents another way to learn the tools of the job.

The broker allows for the fractional shares investing, with the minimum investment per stock trade of $10 which enables you to get involved in renewable companies without having to go above your financial comfort zone and invest heavily in the beginning. Other than the bid-ask spread and a $5 withdrawal fee, the only other charge that you need to factor in is a 0.5% conversion fee, as your GBP deposit would have to be converted into USD for trading purposes.

| Stock Broker | Minimum Deposit | Fractional Shares? | Pricing System | Fees & Charges |

| eToro | $10 | Yes – $10 minimum | 0% commission on ALL real stocks, spreads for CFDs | No Deposit fees, $5 withdrawal fee, $10 inactivity fee, no account management fees. |

Sponsored ad. 68% of retail investor accounts lose money when trading CFDs with this provider.

Renewable Energy Stocks – Conclusion

In summary, the February rotation from high-flying growth stocks to “economy opening” types can provide investors a chance to buy shares of renewable energy stocks at a more sensible valuation than at the start of the year. Whether you choose to invest in individual names on this list or opt for encompassing ETF allocation, make sure that you perform your own due diligence as well and build your conviction in the investment.