Best STP Broker in the UK to Research

The forex market moves incredibly quickly. This global market processes nearly £4 trillion in currency every single day. In such cases, many users opt to trade with STP brokers- who allow users to stay ahead of the market by executing trades on behalf of clients by providing the straight to liquidity providers.

In this guide, we’ll review some of the popular STP brokers in the UK.

-

-

Popular STP Brokers UK 2022

Many STP brokers charge a premium for their services and don’t offer all of the tools investors need to trade effectively in return.

Therefore, we focused our reviews on STP forex brokers that offer low spreads, powerful trading tools, and a wide selection of trading pairs. Here are some of the popular 5 STP brokers in the UK for 2022:

- Fineco

- Plus500

- IG

Popular STP Brokers UK Reviewed

1. Fineco Bank

One of the best broker for trading forex is Fineco Bank- which charges the tightest spreads and lowest fees in the industry. With Fineco, traders can access 50+ currencies pairs and trade forex CFDs with a leverage of up to 125x. Furthermore, users can practice trading for free by using the Fineco demo account.

Fineco Bank was launched in 1999 and has been successfully providing financial services around the globe ever since. The bank is listed in Europe and provides access to 26 different financial markets and over 20,000 assets.

As well as forex CFDs, users can trade stocks, ETFs, commodities, funds and invest into ISAs. Fineco also provides an automated investment service from £50 per month that will invest into fuds on your behalf.

Regarding forex trading, Fineco is one of the best platforms in the market with a variety of excellent research and analysis tools at your disposal. Traders can use the advanced Power Desk platform to view price charts, apply technical indicators and make informed decisions around their trading.

Forex trading on Fineco is uninterrupted- meaning you can place trades whenever you want during market open hours. It is also possible to manage risk by setting StopLoss and TakeProfit targets for each trade. Fineco also provides users with a variety of educational resources and access to a team of professional traders who can assist you in placing trades.

Fineco is a great broker to choose if you are looking for fast transaction speeds, the ability to diversify your trading and tight spreads.

Your capital is at risk.

2. Plus500

Plus500

is one of the cheapest STP brokers in the UK. This platform charges an average spread of 0.7 pips for the EUR/USD trading pair. There are no account fees for most traders, and users do not have to pay an inactivity fee simply by logging into your account once every 3 months.

The broker carries CFDs for 70 currency pairs, which is more than enough of a selection for most traders. Using this feature, users may apply leverage up to 30:1. In addition, Plus500 is slowly increasing the number of cryptocurrencies it offers and is now up to 14 digital currency CFDs.

On Plus500, the charting software is available for web and mobile and includes nearly 120 technical indicators. However, users are not able to create their own indicators or set up forex signals.

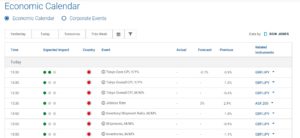

Plus500 also gives users access to a detailed economic calendar and market sentiment gauge, which may be helpful in trading around short-term trends. The trading platform does have a market news feed, but it’s not very focused on forex and doesn’t offer a lot of breaking headlines.

Furthermore, Plus500 offers 24/7 customer service by email and live chat. The brokerage is regulated by the UK’s FCA.

3. IG

IG has been operating in the UK since 1974 and is one of the biggest forex brokers in the world.

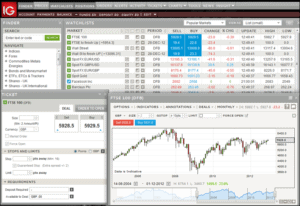

IG offers several powerful trading tools. IG’s proprietary trading platform is easy to use and highly customisable. At the same time, it supports complex trade alerts and comes with a set of ready-to-run forex signals. IG also gives you access to ProRealTime, a comprehensive trading platform that supports algorithmic trading, forex signals, and custom technical indicators. If you’re used to using MetaTrader 4, you have the option to also connect that platform to your IG account.

IG is also strong when it comes to analysis. The broker offers daily trade ideas based on its own signals and research. You may also access a detailed market news feed that’s based on Reuters headlines as well as an economic calendar. IG also frequently issues internal analyst reports, although these typically focus on stock trading rather than forex trading.

The main drawback to IG is its pricing structure. On its face, IG looks relatively affordable. The broker doesn’t charge commissions and the average spread for the EUR/USD trading pair is just 0.6 pips. However, IG has very high swap fees, exchange fees, and other fees that quickly increase the cost of trading. A $20,000 EUR/USD position with 30:1 leverage costs over $17.

Your capital is at risk.

What is an STP Broker?

An STP (straight through processing) broker is a forex broker that passes your trades directly through to liquidity pools for execution. This is different from market maker brokers, which send your trade to a trading desk where it can be matched with other incoming orders.

In essence, STP brokers automate the process of foreign exchange trading. Instead of holding up your trade at the brokerage to be looked over by the trading desk, it’s passed ‘straight through’ to a bank or another liquidity pool where it can be fulfilled. Typically, there are several liquidity pools available, so STP brokers automatically choose the one that’s offering the most beneficial price quote for your trade.

STP Broker features

There are many features that STP brokers provide, let’s analyse a few of these factors.

First, it’s fast. Your trade doesn’t need to sit at a trading desk and be manually fulfilled. Everything is electronic, and there’s no delay in matching your order with a liquidity pool that will fulfill your trade. The biggest holdup when placing trades with an STP broker is the speed of your Internet connection, not the trade execution process itself.

That’s a big deal in the forex markets, which move incredibly quickly. If you’re scalping based on small price movements or trying to trade around a breaking news announcement, millisecond delays may also have a big impact on your trading performance. Using an STP forex broker ensures there’s never a delay.

In addition, since there’s no delay, there are no requotes. The price you see when you hit execute is the price you get.

Another feature of an STP broker is that these brokers don’t bet against their traders. With a market maker broker, your broker acts as the counterparty to your trade – so it’s incentivized for your trade to lose. With an STP brokerage, the broker isn’t the counterparty to your trade. So, the broker is incentivized to execute well and collect its commission or spread.

STP Brokers Fees Comparison

Before using an STP broker, users should see how much fees they would be paying per trade. STP forex brokers typically charge two different types of trading fees: commissions and spreads. Commissions are flat, per-trade fees. You’ll pay a commission both when you enter a trade and when you exit it.

Spreads are variable fees that rise when liquidity for a forex pair is low and fall when liquidity is high. The spread is the difference between the bid and ask price for a forex pair, so you won’t notice it as a fee when you place the trade.

Most forex brokers charge spreads, and they may vary widely between brokers for the same currency pairs or throughout the trading day.

If you’re holding forex CFD positions overnight or using leverage, you could also be charged swap fees that can add up quickly. Be sure to compare these fees between brokers if you are not strictly day trading forex.

FAQs

What does STP mean in forex trading?

STP stands for ‘straight through processing.’ It means your order is sent straight on to a liquidity pool for execution instead of being sent to a broker’s trading desk.

Are STP brokers more expensive?”

STP brokers often aren’t any more expensive for forex trading than a standard broker. Many offer 0% commission trading and low or fixed spreads.

Is slippage an issue with STP brokers?

One of the reasons to use an STP broker is that they eliminate slippage and requotes for most trades. So, the price you see when you hit trade is the price you get.

What is a liquidity pool in forex trading?

A liquidity pool is an automated system that matches buy and sell orders for forex trades. Typically, liquidity pools for forex are run by large banks or investment firms that have enough currency on hand to fulfill any incoming trade.

Do STP brokers only offer forex trading?

STP brokering is most essential in forex trading, which is a fast-moving, global market. However, many STP brokers also offer other assets to trade, such as stocks, cryptocurrencies, and commodities.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Scroll Up

is one of the cheapest STP brokers in the UK. This platform charges an average spread of 0.7 pips for the EUR/USD trading pair. There are no account fees for most traders, and users do not have to pay an inactivity fee simply by logging into your account once every 3 months.

is one of the cheapest STP brokers in the UK. This platform charges an average spread of 0.7 pips for the EUR/USD trading pair. There are no account fees for most traders, and users do not have to pay an inactivity fee simply by logging into your account once every 3 months.

IG

IG