Best Gold ETFs UK to Watch

You don’t need to physically buy gold coins or bars to invest in the industry. Gold ETFs offer exposure to the market without buying any physical assets. In choosing an ETF, metrics to consider include annual fees, the minimum investment, and whether or not the instrument is actually backed by gold.

5 Popular Gold ETFs in the UK Based on Trading Volumes

If you’re strapped for time and looking to research some gold ETFs in the UK right now – here are some potential options. You can scroll down to read our full analysis of each ETF in more detail.

Key Metrics of Gold ETFs

In order to cover all bases, we looked at a variety of factors – such as:

- The type of gold ETF

- Whether the ETF is backed by physical gold

- The reputation and financial standing of the ETF provider

- What stock exchange the gold ETF is listed on

- How much the gold ETF UK charges in annual fees

- The minimum amount required to invest in the gold ETF

Taking all of the above into account, we found that the following providers offer ETFs that allow you to invest in gold companies.

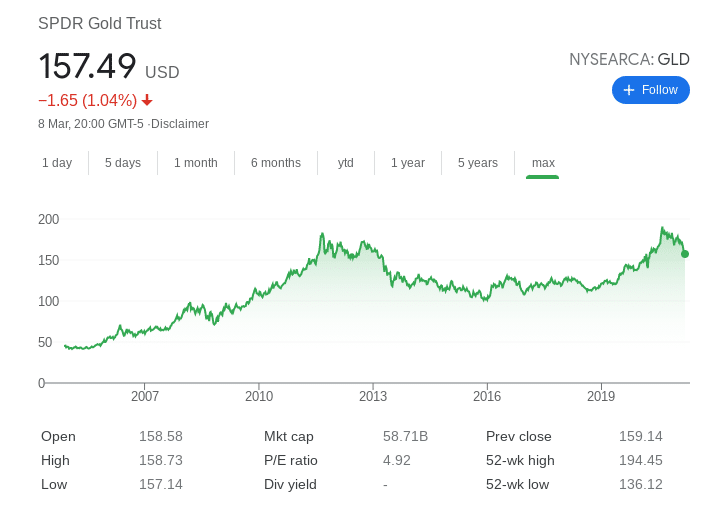

1. SPDR Gold ETF

The SPDR Gold ETF is the largest gold ETF in the industry. Most importantly, the ETF is backed by physical gold.

The way this gold ETF works is actually very straightforward. Firstly, the ETF is listed on the NYSE Arca and it is represented in shares. As such, the value of the SPDR Gold ETF will move up and down throughout the trading day. And as you likely guessed – this rise and gall in value will correlate directly to the current market price of gold.

ETF holders can enter and exit the market at any given time – during standard hours. As such, your money is never tied up. Plus, unlike a traditional gold investment in form of physical coins or bars – you don’t need to cash out the full amount.

For example, let’s suppose that you invested £1,000 in the SPDR Gold ETF. A few months into the investment, you might want to reduce your exposure by 20%. All you would need to do is sell £200 worth of your gold ETF investment at your chosen broker and leave the remaining £800 in play.

2. VanEck Vectors Gold Miners ETF

Another option that you might consider in your search for gold ETF UK is that of mining companies. These are firms are directly involved in gold mining – of which there are hundreds. Many are actually very small operations with no guarantee of success – as this is determined by the amount of gold the firm is able to find and extract.

The VanEck Vectors Gold Miners ETF is a diverse ETF option. By investing into this fund, you will be investing in 51 different gold mining stocks and companies. This includes some of the biggest mining operations globally – covering the likes of Newmont, Barrick Gold, Franco-Nevada, Kirkland Lake, Gold Fields, and Royal Gold.

Crucially, the ETF portfolio not only contains companies from various regions of the world – but it is weighted. This means that greater exposure is giving to less risky gold mining companies with a proven track record in this space. Much like the previously discussed SPDR Gold ETF, the VanEck Vectors Gold Miners ETF is listed on the NYSE Arca.

Once again, this means that your investment is liquid because you can cash it out any time the market is open. In terms of past performance, The VanEck Vectors Gold Miners ETF was priced at just under $20 per share in the five years prior to writing this guide.

Fast forward to early 2021 and the same ETF is valued at just over $31 per share. This represents gains of 55% in just five years of trading. During the same 5-year period, the spot price of gold increased by 33%. As such, the VanEck Vectors Gold Miners ETF has outperformed the wider market.

3. The iShares Gold Trust ETF

The iShares Gold Trust ETF will look to track the spot price of gold as closely as possible. Much like the SPDR Gold ETF, the iShares Gold Trust is backed by physical gold. This is stored in vaults in several safe haven locations around the world to hedge against currency fluctuations.

The underlying framework of this ETF is very simple – insofar that the rise or fall of your investment will closely mirror that of gold’s spot price. For example, in the 12 months prior to writing this guide, the benchmark price of gold increased by 24.17%. In the case of the iShares Gold Trust ETF, returns of 23.83% were realized.

Regarding the latter, the iShares Gold Trust ETF charges a sponsor fee of just 0.25%. This means that a £10,000 investment would amount to an annual charge of just £25.

4. Sprott Physical Gold Trust

In many ways, the Sprott Physical Gold Trust is very similar to the previously discussed SPDR and iShares ETF. This is because the ETF provider invests in physical gold bullion. As such, the value of your ETF investment will correlate very closely to the rise and fall of gold’s spot price.

With that said, the Sprott Physical Gold Trust gives you the opportunity to actually redeem your investment in physical gold bars. In order to be eligible, you would need to own the equivalent of 400 oz of gold via the ETF. For example, at the time of writing, 400 oz of gold is worth approximately $720,000.

When you invest in the Sprott Physical Gold Trust – legally, you have the remit to receive your holdings.

5. Gold and Energy CopyPortfolio

Most of the gold ETFs that we have discussed today largely concentrate on physical backed funds. That is to say, the ETF provider in question will buy and store the asset – and your share will be reflected in the stock price of the gold exchange-traded fund.

Other Gold ETFs to Consider

Although we have discussed five gold ETFs UK available today – there are many others in the market.

- SPDR Gold MiniShares Trust

- Aberdeen Standard Physical Gold Shares ETF

- GraniteShares Gold Trust

- Perth Mint Physical Gold ETF

- Invesco DB Precious Metals Fund

Important Features of Gold ETFs

With so many gold ETFs available to UK investors – knowing which one to choose can be a time-consuming task. To help clear the mist, below we discuss what to consider in your search for gold ETFs UK.

Type of Gold ETF

First and foremost, you need to assess the type of gold ETF that interests you. If you are simply looking to invest in the long-term value of gold, then you will want to opt for an ETF that is physically backed by precious metal.

This is because virtually the entire ETF portfolio is invested in physical gold bars. Naturally, this means that the ETF will rise and fall in value depending on the current spot price of gold. As such, this allows you to gain direct exposure to gold without needing to worry about storage or delivery.

On the other hand, there are also gold ETFs that are not physically backed. Instead, the ETF will look to gain exposure to gold in a different way. For example, the VanEck Vectors Gold Miners ETF consists of 51 gold mining companies that are publicly listed.

If you are interest, you should consider the output of each mining company. For example, the firm might invest vast resources into a new gold mining plot – only to find that the precious metal is inaccessible.

Past Performance

You might be under the impression that all physically-backed gold ETFs are the same – at least in terms of financial returns. After all, if these ETFs have allocated virtually all client funds into gold, you would expect the rise and fall of its stock price to mirror the market value of gold.

However, this isn’t the case at all, not least because there are other underlying factors in play. For example, in the first two months of 2021, the Shares Gold Strategy ETF made gains of 21.41%. During the same period, the Invesco DB Gold Fund made returns of 17.75%.

This is actually a huge difference when you consider the figures are based on just two months of trading. Largely, this difference in growth might be because of currency exchange risk, where the gold is being stored, and what market rates the ETF obtained at the time of the purchase.

Exchange Listing

As we previously discussed, all gold ETFs are listed on a public stock exchange. In most cases, this is on the NYSE Acra, albeit there are also ETFs on other marketplaces.

Expense Ratio and Fees

Like all investments that you make – you always need to pay a fee of some sort. When you buy shares, for example, you will pay your chosen broker a dealing fee or commission. Other than that, you won’t pay anything else until you decide to cash out – unless you are using a broker that charges a monthly/annual platform fee.

Nevertheless, things are slightly different in the world of gold ETFs, as you need to consider fees from two different angles. Firstly, most brokers and stock apps in the UK charge an ETF dealing fee – which is usually fixed.

For example:

- You might pay £10 to invest in the gold ETF another £10 when you get around to cashing out.

- With that said, there is a second charge at play – the ETF provider’s expense ratio.

- This covers a variety of costs – such as the process of buying, transporting, and storing gold on your behalf.

- You then have administrative fees linked to accounting maintenance, processing deposits and withdrawals, and customer support.

The expense ratio charged by gold ETFs UK is a variable fee – meaning it is multiplied by the size of your investment. In most cases, this will amount to less than 0.5%. For example, the SPDR Gold ETF has an expense ratio of 0.40%. This means that a £1,000 investment would cost you just £4 per year.

Minimum Investment

You also need to consider what the minimum investment is on your chosen gold ETF. This can and will vary depending on the provider. However, it can also vary depending on whether you invest directly with the ETF provider or through a traditional stock broker.

For example, the gold ETF UK that we came across – the SPDR Gold Trust, requires a minimum investment of 1 share when going direct. At the time of writing, that amounts to just over $157. However, if you completed the investment with ETF, the minimum is just $50.

Gold ETF UK Investment Platforms

There are many things that you need to look out for when choosing a commodity trading broker – such as whether or not it supports your preferred gold ETF and what fees you will need to pay.

Additionally, you also need to assess what payments are supported and whether the provider is regulated by the FCA. To save you countless hours of research, below we review gold ETF UK platforms currently in the market.

Conclusion

In summary, if you want to gain exposure to gold – a possible option on the table is to go with an ETF. Not only can you invest without worrying about ownership and storage – but the gold ETFs UK are priced competitively.

For example, the market that we came across – the SPDR Gold ETF – carries an annual expense ratio of just 0.40%. Most of the gold ETFs we have discussed today, allow you to hedge against the FTSE 100 and rising inflation driven by central banks.

Irrespective of which ETF you go with, just make sure that you choose a FCA-regulated broker.

FAQs

What is a popular gold ETF for UK investors?

What is the gold ETF fund for mining companies?

What is the minimum gold ETF investment in the UK?

Where to buy the gold ETF funds UK?

How much do gold ETFs cost in the UK?