Best Day Trading Platform UK 2025 to Research

If you are an active trader, you probably have a list of to-dos drawn up when selecting the most popular UK day trading platform. This process could include, among many other things, low fees, average spreads, premium research tools, speed, and everyday payment methods.

This guide explores some of the popular day trading platforms UK for investors to use. Keep reading as we’ll also cover all the key metrics from fees and payments, to regulations and customer support.

Key points on Day Trading Platforms

- Successful day trading relies on the correct use of a range of technical and fundamental analysis tools.

- Some UK brokers are relatively limited in this regard, so you need to choose carefully when it comes to picking a day trading platform.

- As well as the available day trading tools, you may want to review the trading fees, platforms, the range of assets and more when comparing day trading platforms.

Popular Day Trading Platforms List 2022

Day trading may seem easy on the outside, but active traders know that choosing some of the more reputable day trading platform UK goes a long way in determining success. In light of this, we have itemized some of the popular day trading brokers UK.

Each UK day trading platform has been chosen based on low fees, speed, reliability, and regulation.

- Avatrade

- Pepperstone

- Plus500

- Fineco

- IG

- Interactive brokers

Popular Day Trading Platforms Reviewed

As a savvy investor, finding a broker for day trading UK will help users in choosing a broker that will cater to their investing needs, Here’s a review on some of the popular day trading platforms available in the UK.

1. AvaTrade

AvaTrade is another popular day trading platform UK to use. Founded in 2006, AvaTrade is a reputable online CFD broker in the UK. It is a key part of the AVA Group of Companies. Aside from the AvaTrade web trader, AvaTrade offers trading platforms with MT4&5, MetaTrader for Mac, and MetaTrader for mobile.

The broker has offices in four key locations spanning Japan, Australia, Ireland, and the British Virgin Islands. Tradable assets span 50 FX currency pairs, nine crypto assets, several indices, stocks, bonds, ETFs, commodities, and options trading.

AvaTrade comes embedded with a social trading feature through the AvaSocial platform. This way, users can replicate trades of other investors, mitigating against capital loss. AvaTrade is regulated in all regions it operates and has licenses from ASIC, the Japanese Financial Services Authority (JFSA), and the Investment Industry Regulatory Organization of Canada (IIROC).

In the aspect of fees, AvaTrade offers tight spreads, most especially for professional traders. For instance, AvaTrade charges 0.9 pips for the EUR/USD trading pair but will drop this figure to as low as 0.6 pips for advanced traders. AvaTrade has a minimum deposit of £74.71 and supports multiple everyday payment solutions, including bank wire transfer, credit/debit cards, and e-wallet solutions. AvaTrade charges an inactivity fee of £37 after three months.

- Offers social trading

- Tight spreads especially for professional traders

- Reputable broker

- Healthy library of tradable assets

- Charges an inactivity fee

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Popular UK Day Trading Platform Comparison

| Platform | Tradable assets | Stock trading fees | FX Trading fees | Crypto trading fees | Overnight fees |

| Avatrade | FX currency pairs, crypto, indices, stocks, bonds, ETFs, and commodities, and options trading | Popular stocks like Apple, Amazon attract 0.13% in spread | 0.9 pips for EUR/USD, 1.6 pips for GBP/USD | Variable 0.25% over-market for BTCUSD, 0.28% over-market for ETH, 1% for XRP | Not stated but applicable |

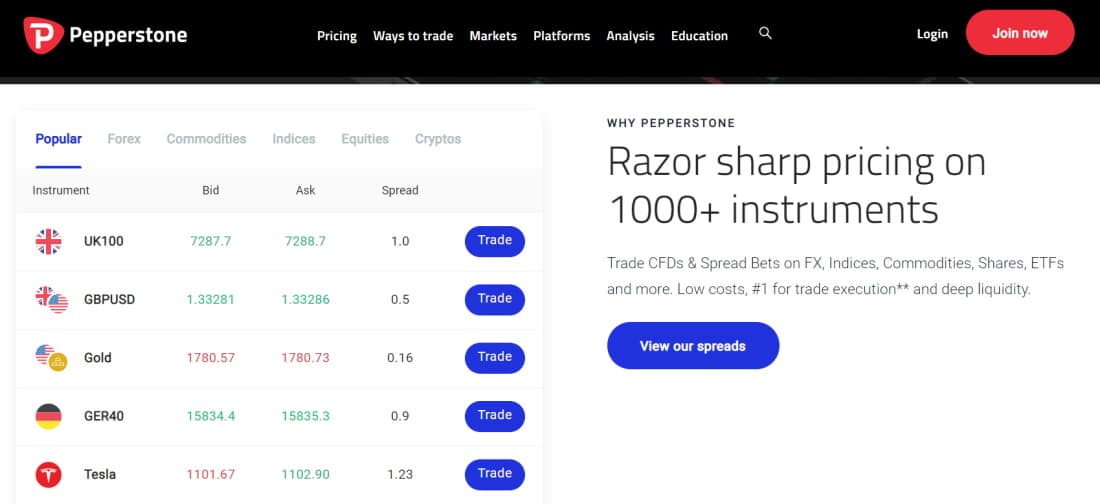

| Pepperstone | FX currency pairs, Index CFDs, Commodity CFDs, ETF CFDs, shares CFDs, Currency Index CFDs | 0.07% | 0.09 pips for EUR/USD | Nil | Not stated but comes with admin fee of 2.5% |

Day Trading Platform Features

Fees

Fees is important for most investors. Users may want to look for brokers that offer low fees or no commission on trades. Other trading fees surrounding deposits, withdrawals, and low spreads should also be chalked up on your list when selecting a day trading platform.

Tradable assets

Although most offer major financial instruments, including CFDs, stocks, bonds, commodities, cryptocurrencies, each broker has minor differences that may be preferable for each individual user. A large library of tradable assets ensures traders get the hottest assets from one broker instead of visiting several platforms to do this.

Platforms

Most proprietary platforms are usually beginner-focused and are always watered down in a way. If you are looking for more powerful charting and research tools, you should look out for one with multiple trading platforms comprising popular MetaTrader 4 and 5. These come with more sophisticated indicators which can help in giving better market insight.

Tools

Unique broker features and tools may be the requirement of users looking for multiple ways to invest their money. While some users offer leveraging options, other may provide multiple assets to invest from or trading bundles that can help to diversify your trades.

Mobile app

Mobile app support gives you more flexibility in your trading. Most brokers still use the web-based platform format while a few offer a mobile trading app. This lets you trade while on the move allowing you to access similar market data and open and close trades as you would on the web platform.

User experience

While day traders may not count this as important, it is still necessary. Exceptional user trading experience means users may easily and rapidly place trades without requiring any outside help in doing so. A complex trading platform can make it more complicated for users to open new positions, making the investment process much more difficult, especially for new investors.

Payments

Last but not least on the metrics to look out for is the kind of payment methods the broker supports. FCA regulated brokers support several everyday payment solutions with popular options like bank wire transfer, credit/debit cards, PayPal, Skrill, Neteller, and other e-wallet solutions. More payment methods mean more flexibility in how easily users may fund accounts with little to no fees.

How to Get Started on a Day Trading Brokerage

Now that you have learnt all about how day trading brokers UK work and what to look out for, we will show you step-by-step how to open a day trading account using a brokerage that matches your needs.

Step 1. Create an account

Most day trading brokers offer free accounts which can be accessed on their websites or apps. Users may be required to provide personal details such as your full name, email address, mobile number, username, and password to complete this step.

Step 2. Upload ID

After completing the registration, the next step is to verify your identity. All you need to do is upload a clear snapshot of your driver’s license or government-issued ID card. You will also be required to upload a copy of your recent utility bill or bank statement for proof of address.

Step 3. Make Deposit

Most day trading brokerages offer payment solutions like bank wire transfer, credit/debit cards and e-wallets. Deposit cash on your brokerage by selecting your preferred payment method.

Step 4. Purchase Your Asset

Now that you have completed the previous steps, investors can choose which assets they wish to purchase. After selecting on your preferred asset class, enter the amount you wish to enter in the trade and confirm your transaction.

UK Day Trading Platform – Conclusion

Day trading is a potentially profitable yet risky endeavour and you need all the right tools in place to ensure you limit your potential loss on any given day. Day trading platforms go a long way in determining your success, which is why you should choose a broker which provides low fees, multiple asset classes and multiple tools & features.