Best Private Equity Funds UK to Watch

In this guide, we will examine the Popular private equity funds UK, providing you with guidance on what to look for and showing you how to invest with popular stock brokers in the UK.

Private Equity Funds UK List

The list below showcases ten UK private equity funds for 2021. If you’d like to learn more about each of these funds, the section below will examine each of these funds in detail, highlighting crucial information you need to know in order to make an effective investment decision.

- HarbourVest Global Private Equity Ltd

- Main Street Capital Corporation

- KKR & Co LP

- Pantheon International

- 3i Group PLC

- Apax Global Alpha Limited

- HG Capital Trust PLC

- Standard Life Private Equity Trust PLC

- BMO Private Equity Trust PLC

- NB Private Equity Partners Ltd

Popular Private Equity Funds Reviewed

As private equity funds tend to provide capital directly to businesses, they are in a unique position that allows them to impact the business and boost cash flows – in turn, generating higher returns for investors.

In the section below, we will discuss ten private equity funds UK for 2021.

1. HarbourVest Global Private Equity Ltd

The first fund we’ll discuss in this guide is the HarbourVest Global Private Equity fund. Based in the UK, this fund aims to provide returns that are superior to what you can expect to receive from indices such as the FTSE 100. It does this by investing directly into companies to facilitate capital growth but also by investing in other funds too.

HarbourVest Global Private Equity has displayed some solid performance over recent times, returning 120.99% to investors in the last five years. Much like other funds, you cannot directly invest in it unless you are an accredited investor or high net worth individual.

2. Main Street Capital Corporation

Main Street Capital is located in Houston, Texas, and has provided hundreds of US companies with equity capital over the years. This company works with many middle-market clients from various sectors, using their experience and expertise to optimise business processes and fuel growth.

Listed on the New York Stock Exchange, this company even provides investors with a consistently high monthly dividend which is quite rare for private equity investing, as funds tend to reinvest profits back into other companies. This dividend yield is significant, clocking in at 6.28% annually.

3. KKR & Co LP

With a market capitalisation of nearly $30 billion, KKR and Co LP are among the largest investment funds on our list. This fund specialises in direct investments into many sectors, particularly real estate. It also invests in various other funds in an attempt to generate returns for investors. Through direct investments, KKR & Co can place themselves into their partner companies, transforming business operations from the inside in order to generate more cash flows for investors.

Looking at performance, KKR & Co’s stock was trading at $24.36 a year ago; it is now as high as $51.16, representing an increase of over 100%.

Pantheon International is a private equity investment fund UK and was initially launched back in the 1980s. Through their decades of experience and network of relationships, Pantheon aims to outperform market indices through their private equity investing activities. With a current market cap of $1.42 billion, this fund has produced annualised growth of 11.6% since inception (assuming all dividends were reinvested).

Looking at performance over the past year, Pantheon has returned an impressive 55.40% to investors over the past year alone, meaning if you’d invested £5000 a year ago, you would currently have £7770 (minus fees). Also, the company has performed very well since the downturn caused by the Coronavirus lockdown and has exceeded the previous highs it set before the pandemic.

5. 3i Group PLC

Huge companies such as Snapchat and Uber were beneficiaries of venture capital in their early days, showing the growth that can be achieved. 3i Group PLC is a fund that provides this sort of capital to small companies in the hope that incredible levels of development can be achieved.

With a market cap of $11.56 billion, 3i Group is headquartered in Connecticut and has returned an impressive 64.45% to investors over the past year. Furthermore, the company even offers a dividend with an annual yield of 2.95%.

6. Apax Global Alpha Limited

This company operates a private equity fund that invests in four sectors – technology, services, healthcare, and consumer. By investing in many industries, the fund can cover themselves if one sector experiences a downturn, as there is a chance one of the other sectors would experience an upturn at the same time.

Apax Global Alpha Limited aims to provide investors with both capital growth and an attractive yield. Looking at the former, the company has produced 56.56% returns for investors in the past year alone, easily outperforming indices such as the S&P 500. This fund also offers a dividend yield of 5.29% every year, distributed every December.

7. HG Capital Trust PLC

HG Capital Trust operates a private equity fund that invests in unlisted companies, aiming to add value to them through operational improvements and margin expansion. Furthermore, the fund invests in companies across various sectors and locations to optimise its risk/return profile.

In terms of performance, HG Capital Trust PLC has provided high returns to investors recently – in the past five years alone, it has generated returns of 181.65% for investors. This fund also provides a semi-annual dividend, with a yield of 1.51%.

8. Standard Life Private Equity Trust PLC

This fund invests directly into companies located throughout Europe but also into other private equity funds too.

Looking at Standard Life Private Equity Trust’s performance, you can immediately see the benefits it offers in terms of returns. The fund has generated positive returns in four of the last five years, even returning more than 25% in 2016 and 2017. Furthermore, this fund did generate a small negative return of 4.6% in 2020; however, this was much less than its benchmark index (FTSE Allshare), which produced a negative return of 16.6%.

9. BMO Private Equity Trust PLC

As mentioned previously, many private equity funds choose to reinvest profits entirely and not offer a dividend to investors. However, one fund that does provide a healthy dividend is BMO Private Equity Trust. Supplying investors with an annual yield of 4.17%.

BMO Private Equity Trust fund these dividend payments through profits generated from capital growth through their investment activities. In addition to dividend payments, this fund has also showcased some impressive performance in recent times, producing growth of 25.68% for investors over the past year. Furthermore, with investments into countries such as the US, UK, France, and Germany, the BMO Private Equity

10. NB Private Equity Partners Ltd

The last fund we will discuss is the fund offered by NB Private Equity Partners Ltd. This fund is listed on the London Stock Exchange and invests in direct private equity investments alongside other private equity firms – also known as a co-investment. Through these investments, the fund aims to supply healthy capital appreciation whilst keeping risk to a minimum.

Although private equity investing is inherently risky, this fund tries to minimise the risk through large-scale diversification. In terms of returns, the fund has performed very consistently over recent years, returning an incredible 62.57% in the last year alone.

What are Private Equity Funds?

Private equity funds are a type of closed-ended fund that invest directly into companies to improve them and therefore generate capital growth. This type of investing makes them very different from other fund types such as hedge funds and bond funds, as they provide capital directly to companies and then actively try to optimise their operations to increase cash flow. Private equity funds create income for themselves by a combination of cash flows generated from companies they invest in and also through management and performance fees they collect from investors.

Private equity funds are invariably managed by some of the world’s top experts, meaning you get exposure to an asset that is actively managed by the best in the business.

Private equity funds are provided by a private equity company itself. For example, Main Street Capital Corporation is a private equity company, and they operate their own fund whereby they conduct private equity investing. This distinction is essential, as investing directly into the fund is often reserved for high net worth individuals, accredited investors, and other entities such as pension funds and investment trusts.

Private Equity Fund Brokers

Now that you’ve got an idea of what private equity funds can offer as an investment, it’s time to discuss another crucial aspect of the investment process – choosing a reliable stock broker.

With so many options out there, it can be overwhelming when deciding which broker to go with. Not to worry – in this section, we will examine two stock brokers that allow users to invest in private Equity Funds.

1. Fineco

Fineco bank is listed on the Italian stock exchange and is regulated in the UK by the FCA.

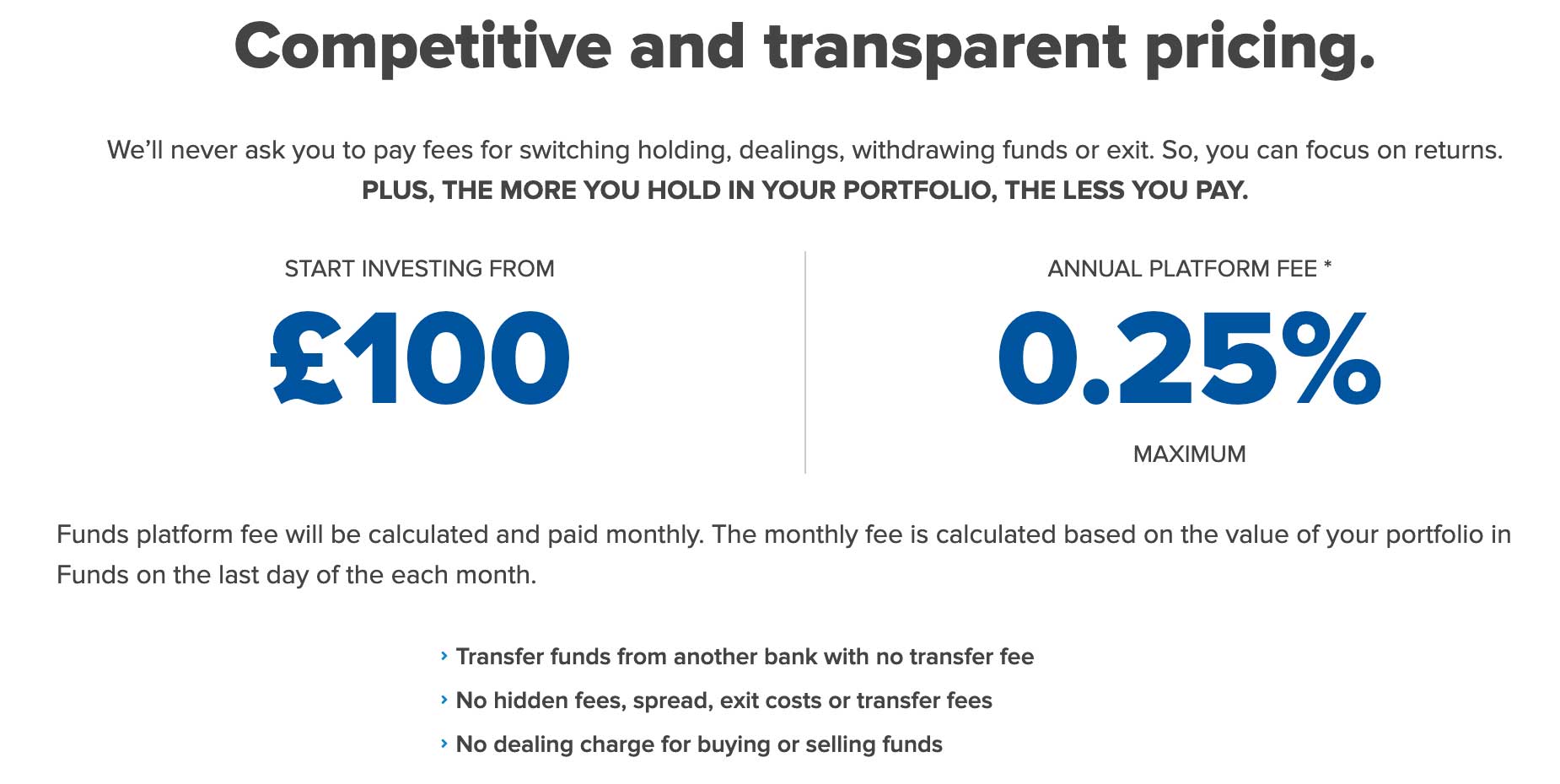

One of the beneficial things about using Fineco for your investing is their low fees when trading. If you are looking to invest in private equity companies to obtain exposure to their funds, you can do so with Fineco for a set commission – $3.50 per investment in US-based stocks and £2.95 per investment in UK-based stocks. This commission level does not change, even when using large investment amounts.

You can deposit for free into your Fineco account via bank transfer, with funds usually taking 2-3 days to arrive. Furthermore, if you make a profit on your private equity fund investing, you can withdraw this for free via bank transfer or credit/debit card. The withdrawal process at Fineco is swift, usually arriving in your account within one business day.

Finally, you can also trade a wide range of asset classes with Fineco, you can purchase shares, stocks, bonds, the popular ETFs, and FX. With 13 stock markets to choose from, and over 5000 ETFs available, Fineco ensures there’s an option for everyone.

Sponsored ad. Your capital is at risk.

Conclusion

Throughout this guide, we have examined some of the popular private equity funds available in the marketplace, highlighting their main features and factors for investing. .

You should make sure to only invest after conducting your own due-diligence. If you choose to invest in this asset class, you should do so with a stock broker that caters to your investing needs.