How to Buy Cellular Goods Shares – Beginner’s Guide

This year, cannabis-related businesses have been gaining increasing net profits, and Cellular Goods PLC is not left out. The firm was listed on the London Stock Exchange earlier this year, highlighting its impressive growth. In this guide, we’ll discuss How to Buy Cellular Goods Shares UK with an FCA-regulated broker.

How to Buy Cellular Goods Shares UK – Step by Step Guide 2022

If you intend to buy shares in Cellular Goods in the UK, this guide should come in handy. We recommend partnering with an FCA-regulated broker so that you can trade as safely as possible. The following steps will show you how to invest in Cellular Goods shares UK in a few minutes.

- Step 1: Open an account with a regulated broker – Head to your broker’s homepage and create an account. You will then need to provide a valid email address, username, and password to sign up.

- Step 2: Upload ID – You” then need to upload your government-issued documents, such as your passport or driver’s license.

- Step 3: Deposit – Fund your account through a popular method, such as credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy Cellular Goods Shares UK – Type the company’s name or ticker symbol in the search bar and click on it. Input the amount you’d like to invest and confirm the trade.

Choose a Stock Broker

The first thing you should do to get started is to choose a broker. Several brokers offer exposure to UK shares, and they all have various features and fee structures. This can become a minor headache as you may not know which one is the best to trade with. In this section, we will be covering some popular stock brokers you can buy Cellular Goods Shares with.

1. Fineco Bank

If you are looking for another popular broker, Fineco Bank fits the bill. Fineco Bank is regulated by the Italian Market regulatory authority CONSOB and the FCA.

If you are looking for another popular broker, Fineco Bank fits the bill. Fineco Bank is regulated by the Italian Market regulatory authority CONSOB and the FCA.

It also has a wide selection as it offers more than 10,000 shares to choose from. You can also pick from nearly 1,000 ETFs, thousands of bonds, and stock options. Fineco Bank also offers commission-free CFD trading, although this is only available for a limited selection of around 850 stocks.

Fineco Bank delivers on leverage and short-selling facilities when trading. Fineco bank offers maximum leverage of 1:30 on major forex pairs, followed by 1:20 on gold, major indices, and minor/exotic forex pairs when trading CFDs. For stocks, Fineco offers leverage of up to 1:5. Additionally, Fineco Bank allows you to short-sell assets. Notably, Fineco also doesn’t charge any non-trading fees, including no fees for inactivity, deposit, or withdrawal.

| Stock Trading Fees | 0% commission on CFDs; £2.95 per trade on UK shares; $3.95 per trade on US shares |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | No |

| Monthly Account Fees | No |

68% of retail investor accounts lose money when trading CFDs with this provider.

Research Cellular Goods Shares

Cellular Goods has generated much buzz around it, due to the company’s rapid growth. However, it is essential that you understand a little about its value proposition and see if its share price can rise in value. This step is crucial, especially in stock trading, as it will help you know if a company is a good investment or not.

Given the importance this step entails, we have taken some time to dive deep into Cellular Goods’ track record and to provide you with information on what the company does and the current state of its financials.

What is Cellular Goods?

Despite its name, which puts it more in the telecoms line, Cellular Goods is a UK-based premium biosynthetic consumer brand hoping to serve the skincare and sports recovery markets. Hoping because it has not launched any of its products in any of the highlighted market segments. The company is listed on the London Stock Exchange (LSE)’s main market. It is the only first “pureplay” cannabinoid company that has gone public, eschewing several competitors in the cannabis business.

Cellular Goods claims that its forthcoming products are laboratory-made, approved, and high-quality cannabinoids as it does not source its materials from the cannabis plants. This enables them to produce products that are free of pesticides, contaminants, and impurities.

Also, they are legal, not tested on animals, and are more sustainable than those derived from cannabis plants. These are expected to promote general body wellness and a sharper mind with cannabinoid (CBD) products to improve sleep, pain relief, appetite, memory, mood, inflammation, and immunity.

Cellular Goods is backed by footballer-turned-global celebrity David Beckham who reportedly has a 5% stake in the company through his DB Ventures firm.

Cellular Goods’ initial public offering (IPO) was one of the most talked-about in the UK, and the company went public on February 26, 2021, under the ticker ‘CBX.’ It raised £13 million and grew 400% on its debut, increasing from 5p to 20p and drawing the curtain on its first day of trading with resounding success. However, CBX has since lost its bullish momentum and whimpered to a low of 8p per share three months later.

This has largely been attributed to its recent financial crises, which saw them lose up to £2.1 million (about $3 million) for the last six months compared to a reported £140,000 loss during a similar period last year. Cellular Goods has earmarked its IPO, and its one-off payments to employees as share allocations are contributing factors to its financial woes.

This autumn, it will launch with three synthetic CBD products, including a face mask, a daily skin serum, and a topical sports recovery gel that can be applied through a touch-free roll-on applicator.

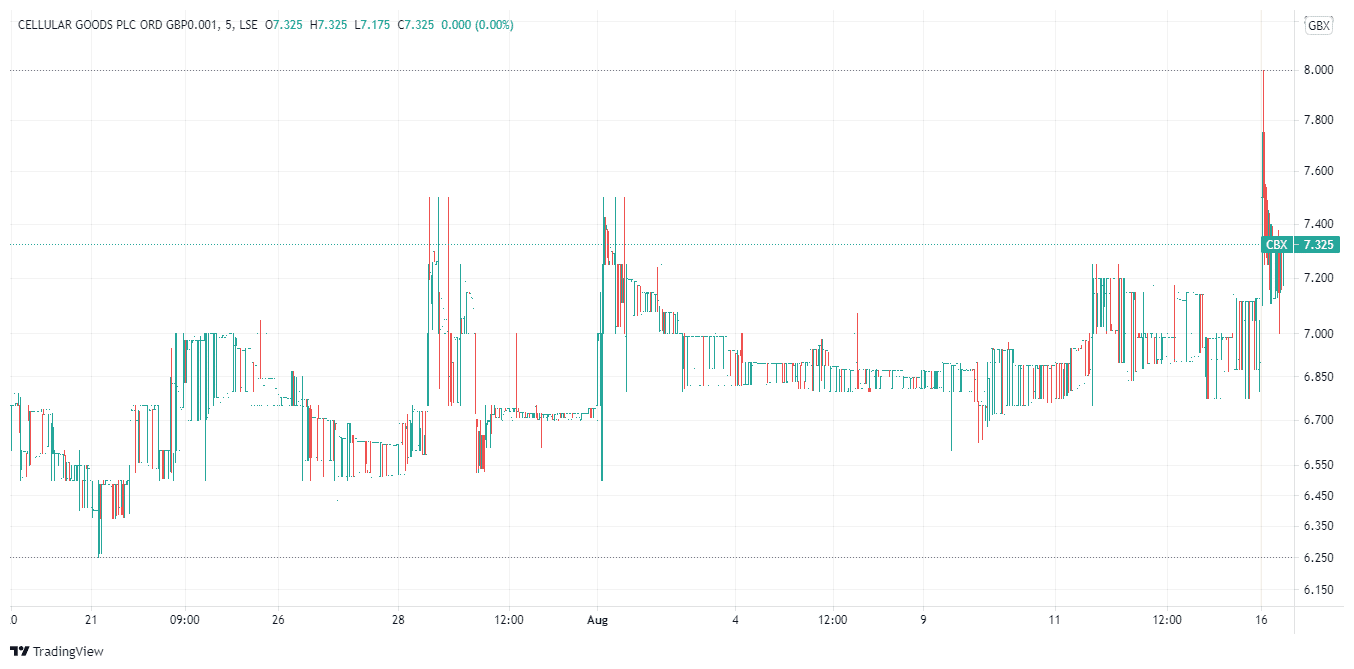

Cellular Goods Share Price

Cellular Goods was founded in August 2018 by Alexis Abraham and only came into the public sphere in February this year. This means that there is little to note on its share price. However, at press time, Cellular Goods’ share price currently trades at £7 a share. This represents a 0.10% increase from its open day trade of £5. Meanwhile, this is still a poor run of results following its 400% rally to £20 on the said day.

Given that its products are still untested out in the wild, Cellular Goods’ share price is showing resilience given the more dire figures that could have following its 75.2% drop a couple of months earlier. The company’s trading chart has been quite busy but has mostly been on a downward spiral.

The company’s poor run of form could mostly be attributed to a growing list of questions investors have if its products would be a hit or miss. One of such is THC, a psychoactive compound that is found in cannabis that makes people high. Investors are concerned if a poor user review could harm the company’s growth.

Cellular Goods Share Dividends

If you are a dividend-driven share investor, you may be interested in Cellular Goods’ dividend history. However, since Cellular Goods just listed on the stock market and has not posted any profits, it does not currently pay a dividend. Also, we could not find out if the company plans to pay investors dividends in the future.

Cellular Goods ESG Breakdown

Environmental, social, and governance (ESG) factors have driven investments in the last year. Dubbed ethical investment, investors are keen on supporting companies that are morally and socially responsible. This section covers this growing trend and lets you know if Cellular Goods is environmentally sustainable in its operations. We reviewed the company’s ESG rating on the popular ESG-centric website CSR Hub. However, Cellular Goods has not been listed yet, which can only mean that there are not enough data on the company to generate any data on its impact on the environment.

Is It a Good Idea to Invest in Cellular Goods Shares?

So, would it be a smart investment decision to buy Cellular shares in the UK? As with all investment decisions, you will need to make them yourself. However, nothing is guaranteed as all company shares are essentially a ‘bet’ on its long-term value.

However, the market need is there, and Cellular Goods could still pull this off. The competition would likely boost the company to make the right moves, pivoting it to launch a great product. If it can pull it off, Cellular Goods could become one of the most recognizable brands in the cannabis business. In turn, this should help drive revenues and profits over the longer term.

Open an Account & Buy Shares

If you want to buy Cellular Goods Shares in the UK, you need to have an account with a broker. It’s wise to partner with an FCA-regulated broker, since they offer the highest level of investor protection within the UK. Therefore, the steps below will show you how to set up a trading account and invest in Cellular Goods shares:

Create a Trading Account

Navigate to your broker’s homepage and opt to sign up. On the signup page that follows, simply enter your email address and choose a username and password.

Verify your Identify

FCA-regulated brokers will ask you to verify your identity. This process can be completed online in a matter of minutes. To do this, you’ll usually need to upload proof of ID (a copy of your driver’s license or official passport) and proof of address (a copy of a bank statement or utility bill). The broker will then verify these documents and contact you when complete.

Make a Deposit

You will usually need to make a minimum deposit as a new user. This will vary depending on the broker, with popular deposit methods usually including:

- Credit card

- Debit card

- Bank transfer

- PayPal

- Neteller

- Skrill

- Klarna

- Trustly

How to Buy Shares

Once you have made the deposit, you can now invest in shares. To do this, type the name or ticker symbol of the company you want to invest into the search bar and click on it.

You will be redirected to an order box where you can enter the amount you wish to invest. Your broker may also enable leverage to increase your returns. You can also add a take profit (TP) and stop loss (SL), if you wish. Once this is done, click on ‘Open Trade’ to complete your purchase.

Conclusion

In conclusion, this guide has covered the basics of buying Cellular Goods shares in the UK. If you want exposure to Cellular Goods shares, we recommend partnering with an FCA-regulated broker. These brokers offers a high degree of investor protection within the UK and allow you to trade as safely as possible.