Best Platinum ETF UK To Watch

If you’re scouting for a precious metal investment; platinum is one such commodity which may provide investors with a diversification opportunity in the market.

This guide looks to review some of the popular Platinum ETFs available in the market and also analyse a few popular UK-based brokers that allow you to trade in this sector.

Popular Platinum ETF UK 2021 List

Here’s a list of popular Platinum ETF UK that you can invest in. You can scroll down to read the full analysis of each ETF.

- Aberdeen Standard Physical Platinum Shares (PPLT)

- GraniteShares Platinum Trust (PLTM)

- iPath Series B Bloomberg Platinum Subindex Total Return ETN (PGM)

- Sprott Physical Platinum and Palladium Trust (SPPP)

- WisdomTree Physical Platinum

- iShares Physical Platinum ETC

- Nornickel

- Anglo American Platinum

- Impala Platinum

- Northam Platinum Ltd.

Platinum ETFs UK Reviewed

In compiling this list, we spent a considerable amount of time researching the popular platinum ETFs UK investors may want to look at. Here is a detailed review of each of the 10 Plaatinum ETFs.

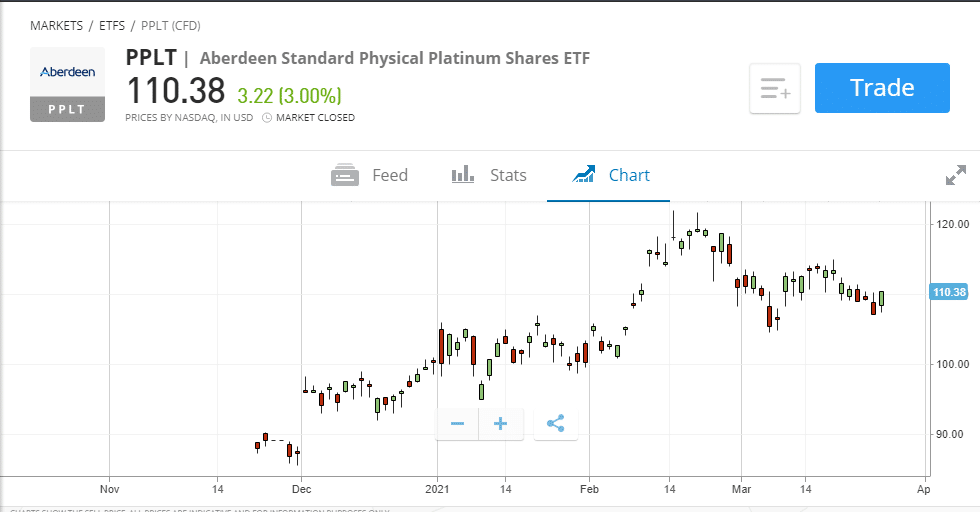

1. Aberdeen Standard Physical Platinum Shares (PPLT)

The Aberdeen Standard Platinum ETF Trust solely manages the Aberdeen Standard Physical Platinum Shares with ticker symbol PPLT. The precious metal investment company provides exposure to investors by letting them own shares that reflect the price of platinum.

PPLT is structured as a grantor trust and is listed on the London Platinum and Palladium Market. Its 1-year trailing total return stood at 29.7%, and its expense ratio was at a minimal 0.60%. PPLT holds $1.5 billion assets under management (AUM). The fund is backed by physical platinum held in a vault in London.

Like traditional investments like Ford Shares UK, you can enter and exit the market at any time you want during standard trading hours. This makes it easy for you to reposition your investments at any given time.

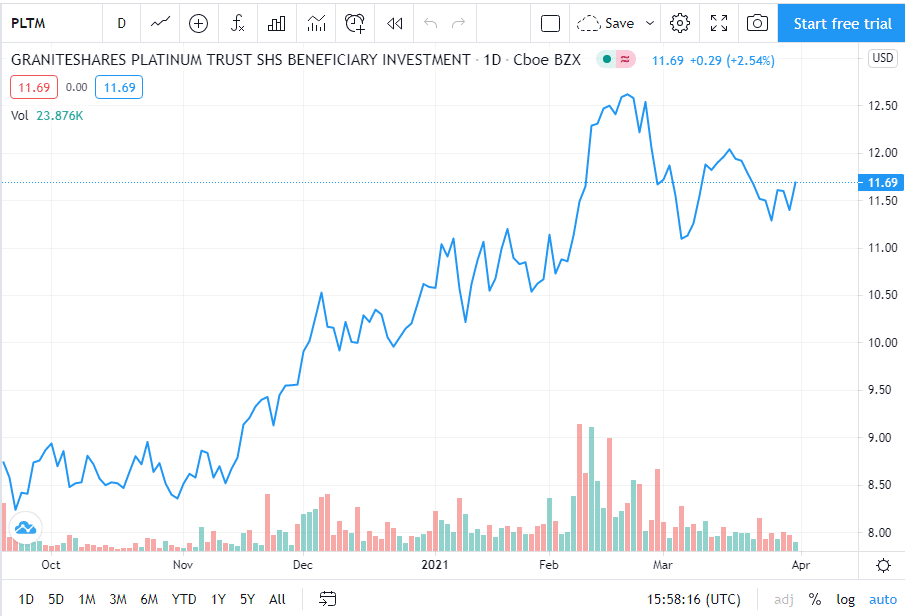

2. GraniteShares Platinum Shares ETF (PLTM)

PLTM makes returns based on the performance of the ISE Global Platinum Index. PLTM provides a cost-effective means for investors to own platinum by tracking public companies’ prices in the platinum mining business. It allows investors to own physical platinum bars and coins and owns a vault in London.

PLTM has $42 million worth of assets under management (AUM) and a 1-year trailing total return of 29.7%. The ETF’s expense ratio sits at 0.50% and it has a 3-month average trading volume of 105,323. It currently trades at $11.73 up 0.33% in the last 24hrs.

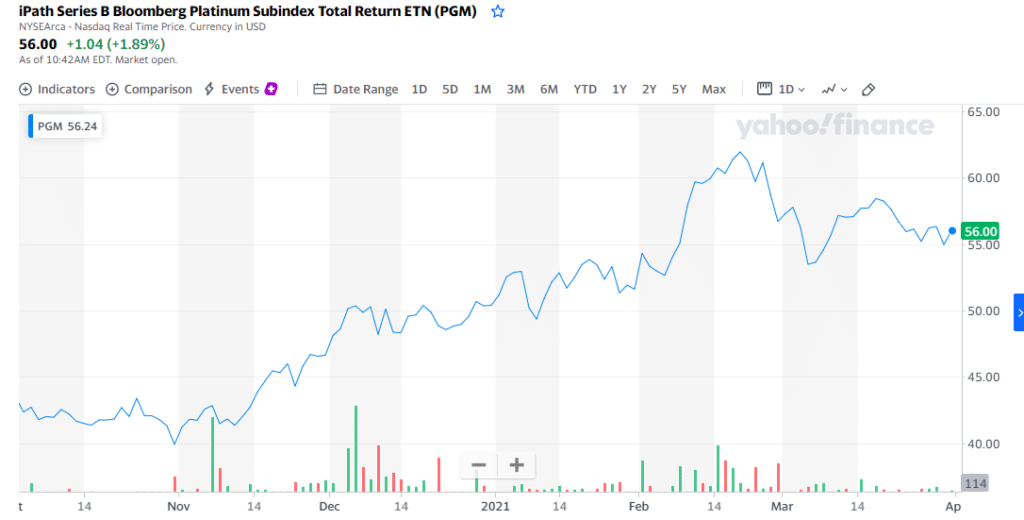

3. iPath Series B Bloomberg Platinum Subindex Total Return ETN (PGM)

PGM gives investors exposure to the Bloomberg Platinum Subindex Total Return. Structured as an exchange-traded note (ETN), the fund invests in futures contracts on platinum. Aside from this, the ETF also monitors the spot price of platinum after deducting expenses.

The subindex fund currently has $6.1 million worth of assets under management (AUM). It also made 26.8% in its one-year trailing total return and an expense ratio of just 0.45%. Its three months trading volume stands at 831 and the issuer is British financial firm Barclays Capital.

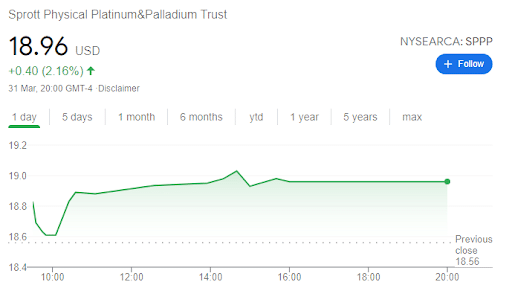

4. Sprott Physical Platinum and Palladium Trust (SPPP)

SPPP holds physical bullion instead of derivatives securities. In March 2020, the exchange-traded fund had more than 24,000 ounces of platinum and 44,000 ounces of palladium, the highest in the said period.

The ETF has rallied significantly making returns of 6% annually since being founded in 2012. The ETF also has an expense ratio of 1.29%. The trust’s holders can redeem their units for physical platinum and palladium monthly as long as they satisfy the stipulated requirements.

5. WisdomTree Physical Platinum (PHPT)

PHPT offers platinum investors a simple and cost-effective means to access the platinum market. The ETF offers insight by monitoring prevalent platinum spot price and bills investors a management fee.

PHPT holds physical platinum held by the HSBC Bank plc who serves as the custodian. Each platinum issued meets the basic Good Delivery requirements of the London

Platinum and Palladium Association. Each platinum bar is separated, individually labeled, and allocated.

PHPT has around $735 million worth of assets under management (AUM).

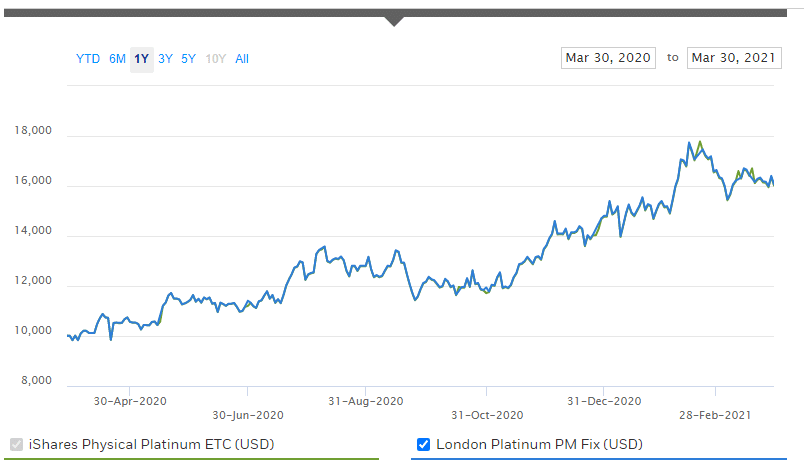

6. iShares Physical Platinum ETC (SPLT)

SPLT has over $151 million worth of assets under management (AUM) and a net expense ratio of 0.20%. The ETC aims to track the returns of the platinum spot price. It holds physical platinum and offers investors a single commodity exposure. In the last year, its trailing total return was 10.36% and its benchmark was 10.71%.

7. Nornickel (NILSY)

NILSY offers direct exposure to physical platinum. It has a trading volume of 249,674 as of March 2021. NILSY has over $7.8 million assets under management (AUM), and its one-year trailing total return stands at 26.15%.

It also permits investors to hold other precious metals like palladium, copper, and nickel.

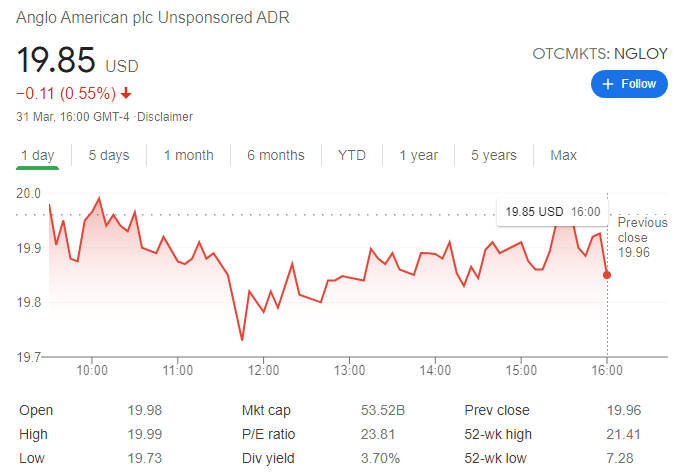

8. Anglo American Platinum (NGLOY)

NGLOY is a UK-based mining company exploring and mining precious metals, base metals, and ferrous metals. The company produces ore, manganese, copper, platinum, diamonds, and nickel.

NGLOY has a net revenue of $27.6 billion and a market cap of $34.1 billion. It is tradable on over-the-counter (OTC) secondary markets and has a 1-year trailing total return of 7.3%.

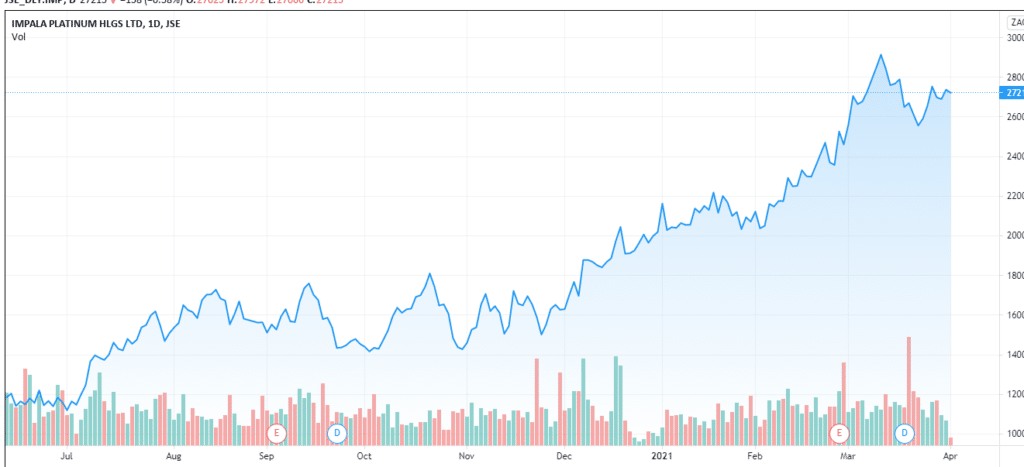

9. Impala Platinum (IMP)

IMP has an average trading volume of 212,046 and a market cap of $14.56 billion. It engages in the exploration and mining of precious metals and is headquartered in Johannesburg, South Africa.

The company also mines for platinum group metals (PGM) and a P/E ratio of 6.27%. Its forward dividend and yield is 4.98%.

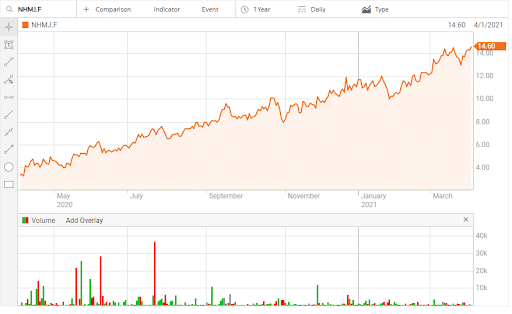

10 Northam Platinum Ltd. (NHMJ.F)

NHJM.F is an independent platinum group metal (PGM) producer. NHJM.F offers three major metals from its two mining sites. It offers exposure to physical platinum, palladium, and rhodium. It has a market cap of $130 million and a forward P/E ratio of 9.91%.

It has a trading volume of 110,069 and offers a volume of 615.

Are Platinum ETFs a Valuable Investment?

Platinum exchange-traded funds (ETFs) have surged over the years, with demand outstripping supply for the past eight years. ETFs, give investors exposure to some investments through an entity. When you purchase shares of an ETF, you are buying a fraction of that entity and, in turn, the assets it owns.

And as such, ETFs are created to meet different investment goals. ETFs are known to offer a wide range of investments, including stocks, bonds, and volatile assets like gold. Platinum also has an ETF dedicated to monitoring its price changes.

Even as industrial use cases consume more than 50% of all produced platinum, investors are already looking into the rare commodity market to make a fortune.

Notable results from the sector have seen the Aberdeen Standard Platinum Shares ETF (PPLT) increase 43.1% in the past year. GraniteShares Platinum Trust (PLTM) rallied as well, posting a rise of 44.5%, rounding up a remarkable year for the precious metal.

Just like gold, many investors and fund managers see physical platinum as a good store of value in an economically uncertain year.

An ounce of gold went for $1,818.9, while platinum’s spot price was $1 251.5 per ounce in Q1 2019. According to data released by the US Commodity Futures Trading Commission (CFTC), platinum owned 3.9 million troy ounces of metal against 3.4 million troy ounces in the past year.

However, make sure to research all the options before investing in any Platinum ETFs.

Platinum ETFs UK Investment Platforms 2021

Now that we have covered the popular platinum ETFs extensively for UK investors, we will set our sights on the popular platinum ETF investment platforms

In the sections below, we review two popular brokerages that allow users to invest in Platinum ETFs.

1. Fineco Bank

Fineco

The platform has a minimum deposit aggregate of 250 Euros. Fineco Bank will not penalize you for inactivity, and it doesn’t charge fees for deposits or withdrawals. Concerning payments, it gets clunky from there on out. Fineco customers in the UK can only make deposits through UK bank wire transfers. This severely limits your payments and withdrawal options.

The platform also offers a mobile trading app which is straightforward to use. It allows investors to pick their positions, set alerts and watchlists on the move.

Sponsored Ad. 67% of retail investors lose money trading CFDs at this site

How To Purchase Platinum ETFs UK

If users are looking to invest in Platinfum ETFs in the UK, you may want to look to choose a suitable broker that can provide you with low fees, multiple stock options and additional tools & features.

After choosing your suitable broker, here is how you can begin the investment process.

Step 1: Open Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verification

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Platinum ETFs

Once your account has been funded, proceed to search for any ETFs you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

This guide details the popular platinum ETFs investors can use to gain exposure to precious metals. Platinum itself is a metal with many practical uses, so users can look to research and analyse stocks in this sector to make an investment decision.

Should you choose to invest in this sector, users may want to review some of the popular brokerages to pick one that can cater to their investment needs.