How to Buy Polypipe Shares UK – with 0% Commission

Polypipe Group plc (PLP) is a UK-based producer and distributor of plastic piping systems. Its products can be found in both the commercial and residential sectors, and assist with water management, heating, cable installation, and more.

If you want to buy Polypipe shares, you will need to find a broker that gives you access to FTSE 250 companies.

In this guide, we explain the easiest and most cost-effective way to buy Polypipe shares online in the UK. Not only does this cover a discussion on the best brokers to buy the Polypipe shares today, but we’ll also give you a step-by-step walkthrough.

toc]

Step 1: Find a UK Stock Broker to Buy Polypipe Shares

Polypipe is a FTSE 250 member, meaning that it isn’t quite large enough to make the primary FTSE 100 index. With this in mind, the number of brokers allowing you to buy Polypipe shares is somewhat limited.

Nevertheless, we have located two leading stock brokers that allow you to invest in Polypipe at competitive fees, a low minimum deposit amount, and with FCA/FSCS protections.

1. Fineco Bank – Buy Polypipe Shares from £2.95

Fineco Bank is very competitive. For example, you can buy Polypipe shares at a commission of just £2.95. You will need to pay this at both ends of the trade, and all share portfolios at Fineco carry a 0.25% annual fee.

In the UK alone the platform offers over 1,200 stocks – including those located on the AIM. In addition to this, it offers heaps of markets in Europe, North America, and more. Fineco Bank also offers a significant number of ETFs and index funds, alongside financial derivatives like futures and options.

In addition to this, Fineco Bank also offers managed portfolios. This covers 78 different strategies that ensure your chosen portfolio mirrors your financial goals and appetite for risk. An additional stand-out feature at Fineco Bank is that the platform allows you to get started at just £100. The main drawback with this brokerage site is that you can only deposit funds through bank transfer, which can take a couple of days to arrive.

Pros:

Cons:

Your capital is at risk

Step 2: Research Polypipe Shares

With this in mind, its shares are going to be a lot more volatile – meaning more risk and higher potential. upside.

As such, we would strongly suggest that you perform lots of research on Polypipe shares before making a financial commitment.

What is Polypipe plc?

Polypipe is a British manufacturer of plastic pipes. The company – which was first launched in 1980 – operates a simple business model. That is to say, its piping systems are used both at a residential and commercial level – providing solutions for several requirements.

This includes heating and ventilation, water supply, plumbing, and cable management. Polypipe now has 18 locations throughout the UK and it employs just over 3,000 people. Revenues in 2019 stood at just over £447 million, translating into an operating income of £78.1 million.

Polypipe Share Price History & Market Capitalisation

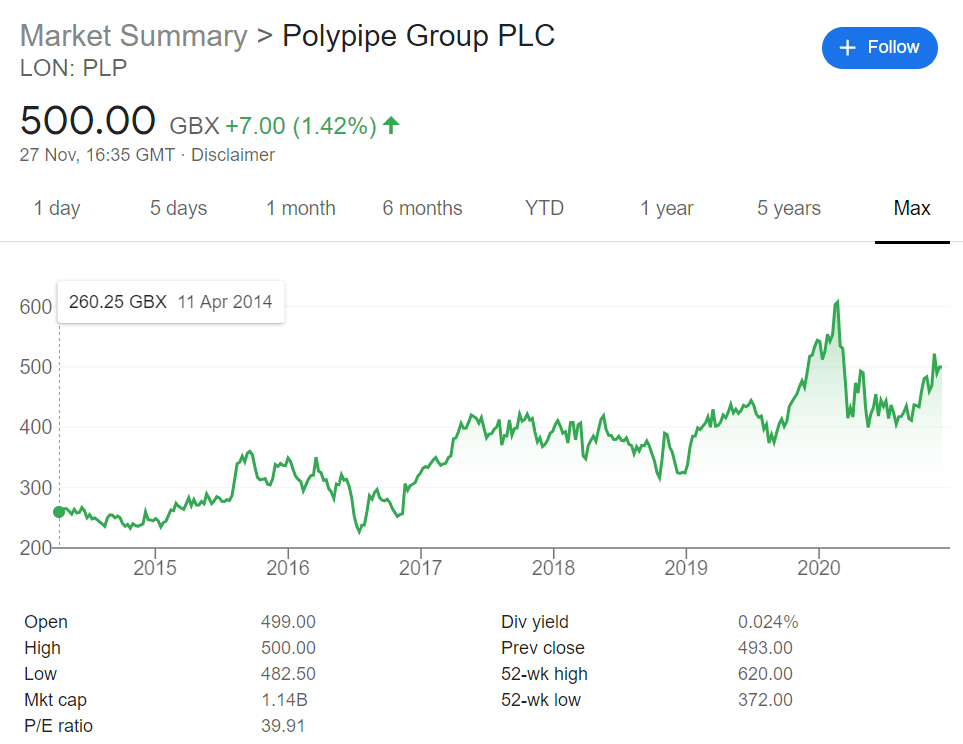

Although Polypipe was first launched in 1980, it wasn’t until 2014 that the firm went public. Back then, the shares were listed on the London Stock Exchange at just over 260p each. Since then, the stocks have enjoyed relative success. In fact, Polypipe shares hit all-time highs of 600p in February 2020.

This translates into a growth of 130% in comparison to the firm’s initial listing price. However, and much like the rest of the UK share arena, Polypipe stocks took a beating in the midst of the coronavirus pandemic. This was justified when you consider the impact that the UK lockdown had on its ability to operate.

In turn, Polypipe hits lows of 372p in March – meaning a sharp decline of 38% from just a month prior. The good news for backers of Polypipe is that the shares have since recovered to 500p. In effect, this means that those who caught the 52-week low are now looking at gains of 34%.

The key question now moving forward is whether or not the firm can regain its pre-COV19 pricing level of 600p. If it can, this would require a further increase of 20% based on current prices. Finally, its market capitalization of £1.1 billion means that Polypipe shares are listed on the FTSE 250 index.

Polypipe EPS and P/E Ratio

Based on its most recent full year financial results, Polypipe carries an EPS (Earnings Per Share) of 29.60p. This is slightly higher than the prior year of 28.40p. It is all but certain that this figure will take a hit in the next set of full-year results, owing to the wider impact of the pandemic.

In terms of its P/E (Price to Earnings) ratio, this currently stands at 39.91. This is up from its 2019 level of 18.20, and the 11.50 it held in 2018.

On the one hand, this would indicate that Polypipe shares are heavily overvalued – especially in comparison to the average FTSE’s average P/E ratio. However, the fact that the ratio is so high is largely because of its weak Q2/3 performance. Once again, this was out of the hands of Polypipe – as per the lockdown restrictions.

Pipestock Shares Dividend Information

Pipestock was actually a very good dividend payer until management canceled its planned payment in March. Once again, this was blamed on the wider impact of COVID-19.

| Year ending: | 31/05/2020 | 31/05/2019 | 31/05/2018 | 31/05/2017 | 31/05/2016 |

|---|---|---|---|---|---|

| Dividend payments | |||||

| Final: | 4.50p | 4.50p | 4.50p | 4.50p | 0.60p |

| Interim: | – | 2.70p | 2.70p | 2.70p | 1.70p |

| Total dividend for the year: | 4.50p | 7.20p | 7.20p | 7.20p | 2.30p |

There is no knowing when Polypipe shares will again start yielding dividends. As such, your main financial goal at present will be to see a return to its all-time high region of 600p per share.

Should I Buy Polypipe Shares?

So now that we have looked at the past performance of Polypipe shares, we now need to ascertain what the short-term future potentially holds.

Below you will find several metrics that should help you decide whether or not you should buy Polypipe shares.

Residential Sales are Strong

In a profitability trading update released by management just a week before writing this guide, Polypipe residentials sales are up 11.5% over the past 10 months.

This is great news for stockholders when you consider the restrictions Polypipe faced during the lockdown. We should also note that the firm’s commercial building department saw a growth of 8.6% during the same period.

Weaker Demand in RMI Market

The RMI Repair, Maintenance, and Improvement division at Polypipe is showing weak results this year. This does make sense when you consider that homeowners are tightening their belts on non-essential repairs.

This trend is likely to remain in play until the UK is back to some form of normality.

Although Down YTD, Polypipe Outperforming the FTSE 250

A great way to assess the strength of a stock is to look at the wider index it represents. In the case of Polypipe shares, that’s the FTSE 250.

Year-to-date, the FTSE 250 is down 11.5%. Polypipe, however, is just about outperforming the index, with a year-to-date loss of 8.2%.

Step 3: Open an Account and Deposit Funds

Now that you have performed some homework on the company, it is now time to buy Polypipe shares at your chosen stock broker.

To get the purchase underway, visit the website and open an account. You will need to provide the following information:

- Full name

- Home address

- Date of birth

- National insurance number

- Email address

- UK mobile number

- Username and password

The broker will also ask you a few questions regarding your historical trading experience. To ensure the platform remains compliant with the FCA, the broker will ask you to upload some documents. These are usually validated instantly and the documents needed are a passport/driver’s license and proof of address.

Note: You can upload these documents later if you are depositing less than $2,250 (£1,800-ish).

You will now need to make a deposit of at least $200. Some brokers support the following payment methods – all of which are instant apart from a bank transfer.

- Debit/credit cards

- Bank transfer (2-3 working days)

- Paypal

- Skrill

- Neteller

Step 4: Buy Polypipe Shares

As soon as your deposit has been credited, you can then buy Polypipe shares. As you can see from the image below, you simply need to enter ‘POLYPIPE’ into the search box. Click on the result that pops up.

Then, you’ll need to click on the ‘Trade’ button.

Now you need to enter the amount that you wish to invest in Polypipe shares. This is the total investment amount in US dollars and not the number of individual shares. In our example, we are buying the minimum amount – which is $50.

To complete your Polypipe share purchase, click on the ‘Open Trade’ button.

Polypipe Shares Buy or Sell?

Although Polypipe has been impacted by the COV-19 pandemic like the rest of the industry, year-to-date results have largely been positive. The firm has only been public for six years and arguably – it was a long way to go.

With a market capitalization of just £1.1 billion, Polypipe as an organization could be worth considerably more.

This will be amplified once it begins to diversify into other markets. At current prices, you still buy Polypipe shares at a discount.

The Verdict?

Buying Polypipe shares online in the UK can be achieved in minutes. By using our top-rated broker Fineco Bank, you’ll avoid share dealing fees, monthly/annual maintenance fees, and even stamp duty tax. Best of all, you only need to invest $50 – so you can diversify into other stocks simultaneously.

FAQs

Are Polypipe shares a good buy?

There is no reason to believe that Polypipe won't get back to pre-COVID levels. This means that at current prices, you can invest at a discount.

What stock exchanges are Polypipe shares listed on?

Polypipe is listed on the London Stock Exchange (LSE). It also forms part of the FTSE 250 index.

What is the Polypipe P/E ratio?

At the time of writing in late 2020, Polypipe shares carry a P/E ratio of 39.91.

Does Polypipe dividends?

Polypipe had been paying dividends since 2016 .However, management suspended their dividend policy in March 2020 as a result of the pandemic.

How much is Polypipe valued at?

As per the previous close of trading - Polypipe has a market capitalization of just over £1.1 billion.

Who is the Chief Executive Director of Polypipe?

The CEO of Polypipe is David Graham Hall, who has been at the helm since September 2005.

Can I invest in Polypipe via an ISA or SIPP?

As long as your chosen stock broker offers an ISA or SIPP, you can easily add Polypipe shares to the respective portfolio.