Best Cardano Staking Platform UK 2021 – Get Top ADA Rewards

Staking cryptocurrencies has grown to become a popular activity amid the rise of proof-of-stake (PoS) blockchains as miners can use the tokens of non-miners to increase their share of participation in the network. The rewards obtained from the process of staking can be quite attractive although they vary from one network to the other.

For buy-and-hold investors, staking is a great way to keep up with token inflation for variable supply tokens like ADA and, in this article, we explain how to stake Cardano by using some of our preferred Cardano staking platforms.

Best Cardano Staking Platforms 2021 List

Staking is now a common activity offered by most cryptocurrency exchanges. However, each exchange excels at certain aspects of staking.

To summarize what is it that they are good at, the following is a list of the five exchanges we consider the best for earning ADA staking rewards including a designation of what is it that makes them stand out from the rest.

- Kraken – Top Cardano Staking Platform for US Investors.

- Kucoin – Best Cardano Soft-Staking Platform.

- Binance – Top Centralized Cardano Staking Platform.

- CEX – Best Platform for Cardano Staking in the UK.

Best Cardano Staking Platforms Reviewed

Staking Cardano is very simple as most providers have facilitated the process of ADA staking by using their highly user-friendly platforms.

Of the five top Cardano staking platforms we mentioned above, we will be conducting a thorough review of three of them to provide you with all the details you need to know about how they work, how much you can earn, and how the process of staking ADA coins can be completed.

1. Kraken: Top Cardano Staking Platform for US Investors

Since May 2021, Kraken started supporting Cardano staking, offering an annual percentage yield (APY) ranging from 4% to 6%. To start staking Cardano with Kraken, users have to either buy ADA coins through their platform or deposit them from another wallet.

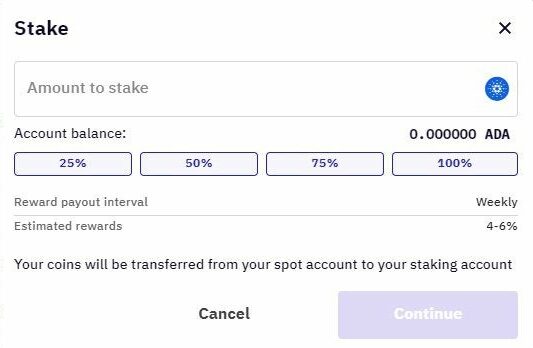

Once the ADA tokens have been received, the user will have to transfer these coins to the Kraken Staking Wallet by going to the Stake section. There is no waiting period to start earning rewards for staking Cardano with Kraken. Moreover, payouts are received more frequently – typically on a weekly basis.

Additionally, users can trade or transfer their ADA coins immediately by moving them from the Staking Wallet to the Spot Wallet.

- Well-reputed US-based cryptocurrency exchange.

- Weekly payouts.

- Competitive annual percentage yield.

- No waiting or lock-up period.

- Restrictions apply for users in certain countries.

2. Kucoin: Best Cardano Soft-Staking Platform

This exchange was one of the firsts to introduce soft-staking for ADA Coins. Soft-staking means that the user does not have to lock up his tokens during the staking period. They can be freely transferred or traded at any given point and users earn their rewards by just holding the ADA tokens on their wallets.

The annual percentage rate (APR) offered by Kucoin for ADA staking goes from 1.5% to 8% depending on market conditions and the only thing that users have to do to start earning these rewards is to move their ADA tokens to the Pool-X platform.

- Above-average average APR for staking ADA coins.

- No lock-up period.

- A hassle-free procedure that only requires holding the tokens in the Pool-X wallet.

- Does not require KYC.

- The company is not regulated by any top-tier financial watchdog.

- Not available for US residents, so they won’t be able to access Cardano staking services.

What is Cardano Staking?

For proof-of-stake (PoS) blockchains like Cardano, staking means to freeze a certain number of native tokens – in this case, ADA tokens that you can allocate in Cardano staking pools.

These stakes are used by miners (nodes) to participate as validators in the Cardano network. Miners are assigned with blocks that need to be recorded within the blockchain-based on the number of tokens they hold and they are rewarded accordingly.

When a user decides to “stake” his assets, it means that he lends his tokens to a miner who will be compensated for his participation in the network and the user will receive a reward for staking his tokens as a result.

How Does Cardano Staking Work?

The process of staking is very simple. The user just has to freeze his assets by using a platform that enables him to perform this transaction like the ones mentioned above. However, soft-staking permits that users earn rewards without having to lock up their assets.

On the other hand, during a hard Cardano staking period, the user will not be able to sell his tokens. In exchange, he/she will be compensated accordingly.

In some cases, staking rewards are accredited to the account every day while in other instances users will be entitled to receive these rewards once the staking period ends (fixed staking).

Is Staking Cardano Safe?

Yes. During the staking period, the owner of the token will remain in possession of his cryptocurrencies. However, he will not be able to transfer them in the case of hard staking.

It is important to perform the process of Cardano staking through a well-reputed centralized or decentralized exchange. Under no circumstances tokens will have to be transferred to a third party as part of the process of Cardano staking.

How Long Does It Take to Earn ADA Staking Rewards?

The Cardano network disburses staking rewards every 5 days, which is the equivalent of 1 epoch. However, rewards are paid around 10 days after this 5-day period ends which means that you’ll receive the proceeds from your staking operation 15 days after you initiate the procedure.

An epoch is a name given to one unit of time within the Cardano network.

Benefits of Staking Cardano

- The Cardano network is a well-reputed blockchain project that has been peer-reviewed by top researchers.

- Users can earn a fixed income for just holding their tokens.

- The rewards are quite attractive and paid every 15 days or weekly in some cases.

- Token holders are not required to hand over their cryptocurrencies to stake them.

- The price of the token can continue to appreciate during the staking period.

Pros & Cons of Staking ADA

- It is possible to generate a steady stream of fixed income by just holding ADA tokens.

- The Cardano network is a layer-1 network and its market capitalization is currently $110 billion. This makes it difficult for hackers to perform a 51% attack.

- Staking does not require handing over the possession of your tokens which means that the holder can still generate capital gains while his/her tokens are staked.

- The ADA token can decline in value during the process of staking and holders will be unable to sell it (hard staking).

- The process of staking is considered inflationary. This means that new tokens are created as a result of this activity and this higher supply will put downward pressure on the price of the token.

Conclusion

The process of staking Cardano has been made easier by the providers mentioned in this article and you can use it as a way to hedge your holdings against the impact of network inflation. Moreover, staking your cryptocurrencies will also help the network in performing better as more miners will be able to participate in the network. Cardano staking increases transaction execution speeds.

The risks are fairly limited and rewards are attractive if you are a buy-and-hold investor. Meanwhile, the introduction of soft-staking has eliminated the need to lock up your holdings, which allows you to transfer them or trade them as needed at any given point.