How to Buy Activision Shares UK – with 0% Commission

Activision Blizzard is a US-based holding company that owns a number of leading video game studios. Its subsidiaries are behind some of the biggest and best-known video games on the market – including but not limited to Guitar Hero, Call of Duty, Candy Crush Saga, and World of Warcraft.

If you’re looking to gain exposure to the video game industry via an investment – buying Activision shares in the UK is easy. All you need is an online share dealing account with a broker that provides access to the NASDAQ exchange.

In this guide, we’ll show you what you need to do to buy Activision shares online in the UK. On top of walking you through the investment process step-by-step, we’ll also discuss the best UK brokers to do this with.

How to buy Activision Shares in UK – Quick Step Tutorial

- ✅ Step 1: Open an account

Visit a broker’s official website and tap on ‘Join Now’. Enter your details and choose a username and password. - 🔎 Step 2: Verify your account

You’ll need to verify your account by uploading proof of ID and proof of address. - 💳 Step 3: Fund your account

Deposit a minimum of $10 (around £7) into your trading account via credit/debit card, bank wire transfer, or e-wallets such as PayPal or Skrill. - 🛒 Step 4: Buy Activision shares

Type “ATVI” into the search bar and click on ‘Trade’. With a minimum investment of $10 you can buy fractional shares of Activision with 0% commission.

Step 1: Find a UK Stock Broker to Buy Activision Shares

Activision is an American tech company – so naturally, you will find its shares on the NASDAQ.

Not only does this mean that you will need to find an online broker that offers US stocks – but also one that is simple to use, offers competitive dealing fees, and supports your preferred UK payment method.

To help clear the mist – we have selected two leading FCA regulated trading platforms that allow you to buy Activision shares online in the UK.

Step 2: Research Activision Shares

Whether you’re looking to buy Activision shares or invest in similar companies such as GameStop, you always need to do your research.

By this, we mean that it is important to first perform some research so you can assess whether or not Activision represents a viable investment. There are many things to look at in this respect – such as how the company is performing in terms of revenue and operating profit, and where the shares are likely to go in both the short and long run.

With this in mind, below we have outlined some important information to consider before you trade or buy Activision shares.

What is Activision?

Activision Blizzard Inc. – or simply Activision, is a US-based holding company that has a plethora of video game companies under its belt. The firm as it is known today was first founded in 2008 and has since produced and distributed some of the biggest gaming brands in the space. This was a result of Activision and Vivendi Games merging.

To name a few of its most well-regarded titles, this includes the Tony Hawk’s series, Call of Duty, Guitar Hero, Crash Bandicoot, World of Warcraft, Candy Crush, and Heroes of the Storm. All in all, much of the success of Activision as a parent company is fully aligned with the sales performance of its key titles.

Activision Share Price History

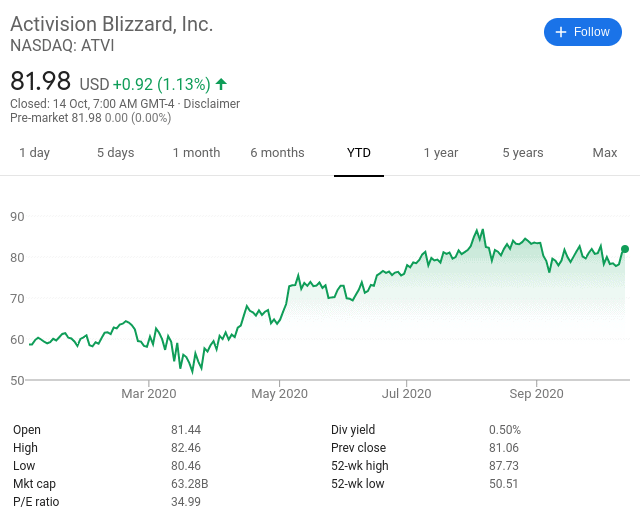

As noted above, Activision Blizzard was founded as a merger between Activision and Vivendi Games in 2008. As such, although the former was publicly-listed way back in 1993 – it’s best to focus on the parent company has formed since the merger. So, back in 2008, you would have paid in the region of $16 per stock.

It wasn’t the best of starts for newly formed partnership – with the shares plummeting to lows of $9. However, this was more to do with the downfall of the wider markets – as per the 2008 financial crisis. Nevertheless, it didn’t take long for the shares to rebound – with an upward trend that was to last until September 2018. This saw Activision shares reach highs of $83.

However, the shares then capitulated – losing more than half of their value in less than 6 months. Fortunately, the shares have since resurfaced to the $82-mark as of October 2020. It is important to note that unlike much of the stock markets – Activision shares have actually enjoyed a very fruitful 2020. Starting the year about just under $59 – this represents YTD gains of 38%.

Activision Shares Dividend Information

If you’re the type of investor that likes to blend capital gains with regular income payments – you’ll be pleased to know that Activision is a dividend-paying company.

This has been the case since 2010 – with no cuts or suspensions along the way. In fact, it is important to note that Activision has increased the size of its dividend payment each and every year since it started to make distributions.

This stood at $0.15 in 2010 and as per its most recent announcement – $0.41 for 2020. Interestingly, Activision pays a dividend once per year, as opposed to the standard process of making a distribution on a quarterly basis.

Should I Buy Activision Shares?

So now that you know how Activision shares have performed since 2008 – and the fact that it has increased the size of its dividend payment each and every year since 2010 – we now need to focus on what the future holds for the company. As such, be sure to review the following factors to help you determine which way the shares are likely to go.

Strong Q2 Earnings

Your first port of call when assessing the viability of a share investment is to look at the firm’s most recent earnings report. This gives you a snapshot overview of how the company in question has performed over in the prior three months. Crucially, Activision was behind some very strong results in its most recent earnings report of Q2 2020.

Firstly, sales saw an increase of 38% in comparison to 12 months prior – totalling $1.9 billion. Even more impressively, net income increased by a whopping 77% from the prior year – totalling $580 million. Taking a closer look at these figures – certain sub-divisions performed particularly well. At the forefront of this was hugely popular gaming series Call of Duty. This contributed over 50% of the firm’s total revenue for the quarter.

A Drop-Off in Q3 is Possible

While Q2 figures were nothing short of exceptional – there are two reasons to believe that Activision’s performance in Q3 might not be as impressive.

Secondly – and perhaps more concerning is that the fact that a single gaming series – Call of Duty, continued over 50% of total revenues. Unless Activision has similar success with its latest release of the aforementioned series in Q3 – revenues are all-but-certain to decline.

Step 3: Open an Account and Deposit Funds

Ready to trade or buy Activision online right now? If so, we are now going to guide you through the investment process with the broker. This is because the platform allows you to buy Activision shares instantly with a debit/credit card or e-wallet – all on a commission-free basis. But first, you’ll need to quickly open a share dealing account.

Here’s what you need to do.

Head over to the broker homepage on your desktop or mobile device and open an account. All you need to do is supply the broker with some personal information and contact details.

This includes:

- Full name

- Nationality

- Date of birth

- Home address

- National insurance number

- Contact details

- Username and password

You will now be asked to upload a copy of your passport or driver’s license. As per anti-money laundering regulations, this is to ensure that the broker is able to verify your identity.

You’ll also need to have your home address verified too. As such, upload a copy of a recently issued utility bill or bank account statement. Upon submitting the above documents, the broker should be able to verify them within a couple of minutes.

Note: You can upload the above documents at a later date if you do not plan on depositing more than $2,250 right now.

Next, it’s time to make a deposit. If you want to benefit from an instantly credited deposit – opt for a debit/credit card or e-wallet. Bank transfers are also supported by processing times can take several days. All deposit methods come with a $200 minimum and 0.5% FX charge,

Step 4: Trade or Buy Activision Shares

As soon as your deposit has been processed – you can buy Activision shares. This part of the process should take you less than a minute. Firstly, enter ‘Activision’ into the search box and click on the result that appears (like the below).

Then, click on the ‘Trade’ button.

Now you need to enter the amount that you wish to invest in Activision. This should be in US dollars and not the number of individual shares you want to buy. The minimum investment is $50 and you don’t need to purchase a full Activision share.

Finally, click on the ‘Open Trade’ button to complete the investment commission-free process.

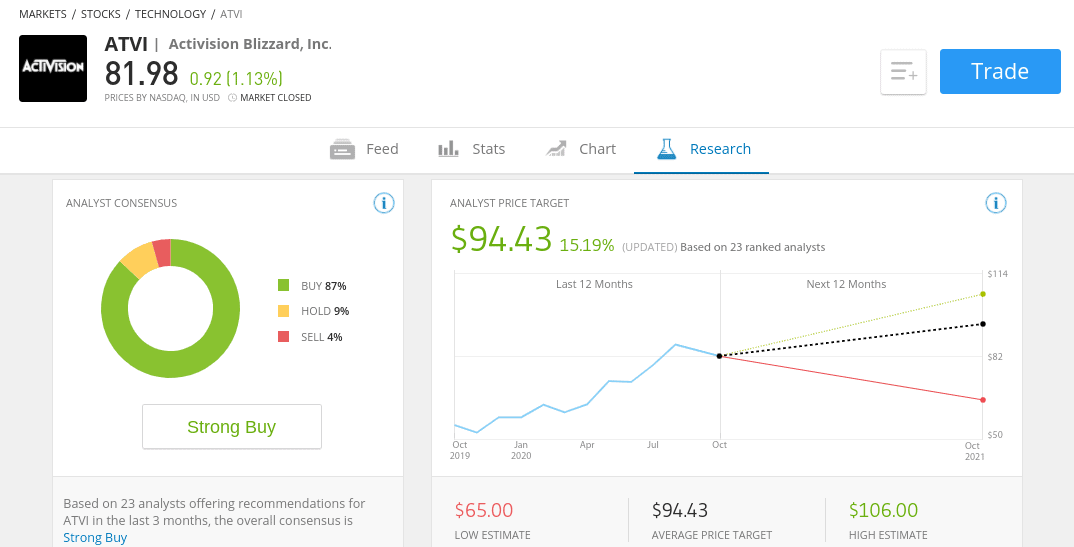

Activision Shares Buy or Sell?

The general market consensus is that Activision shares are a firm buy. Much like is based on the strong performance of the company to date – especially its Q2 earnings which smashed through market expectations. However, certain risks are present, too. At the forefront of this is a potential drop-off in Q3 now that global economies are slowly but surely beginning to open up. Additionally, more than 50% of the firms Q2 revenues were contributed by the Call of Duty series.

The Verdict?

Activision is one of the hottest stocks of this pandemic-stricken financial year – with YTD gains of 38%. If you are planning to jump on the bandwagon by making an investment today – you can buy Activision shares online in the UK at a brokerwithout paying any commission. There are no registration or monthly maintenance fees either – and the end-to-end investment process can be completed in less than 10 minutes when using a UK debit/credit card or e-wallet.

Simply click the link below to get started with this top-rated FCA broker!

Other Tech Shares

Looking to invest in other tech shares? Check out the companies below.

- Alibaba

- Alphabet

- Amazon

- Apple

- AMD

- Intel

- Lyft

- Micron Technology

- Microsoft

- Netflix

- Shopify

- Spotify

- Tesla

- Uber

FAQs

What does Activision do?

Activision Blizzard is the parent company of several leading video gaming developers. Some of its most popular titles include Call of Duty, Tony Hawk's, and World of Warcraft.

What stock exchange are Activision shares listed on?

Activision shares are listed on the NASDAQ exchange in the US.

Do Activision shares pay dividends?

Yes - Activision has an excellent track record when it comes to dividends. In fact, it has never missed a dividend payment since it started making distributions in 2010. Even more impressively, each and every dividend has increased in value. Activision dividends are distributed annually.

How much is Activision worth?

At the time of writing in October 2020 - Activision has a market capitalization of just over $63 billion.

How do you buy shares in Activision in the UK?

Activision shares are listed on the NASDAQ exchange in the US - meaning that you need to open a share dealing account with an FCA broker that gives you access to American stocks.