How to Buy Kier Shares Online in the UK

Kier is a UK-based construction company that builds everything from office blocks to commercial properties, and even rail networks. The firm was heavily impacted by the domestic lockdown that forced Kier to temporarily close many of its building sites.

On the flip side, this does mean that you stand the chance to buy its shares at a discounted price.

In this guide, we show you how to buy Kier shares online in the UK. We’ll discuss the best online brokers to buy the shares with, and walk you through the steps required to make a purchase today.

-

-

Step 1: Find a UK Stock Broker to Buy Kier Shares

As a UK-listed stock, Kier Group shares can be purchased from any online platform that gives you access to the London Stock Exchange. This means that you have hundreds of FCA-regulated brokers to choose from.

To save you hours upon hours of cumbersome research, below you will find the best UK stock brokers to buy Kier Shares from. Both of our picks are heavily regulated, offer commission-free trades, and allow you to instantly deposit funds with a debit card or e-wallet.

Step 2: Research Kier Group Shares

Whether you’re investing in Kier or other companies like Rolls Royce shares, you need to perform some in-depth research in order to determine whether or not the shares represent a viable investment. This should be the case regardless of what asset class you are thinking about investing in. As such, the following sections will explore the Kier share price history, dividend policy, and ultimately – what the future holds for Kier Group.

What is Kier Group?

Launched way back in 1928, Kier Group is one of the longest-standing construction companies in the UK. The firm provides building services for a range of sectors – including but not limited to education, military, health, and railway. Not only does Kier Group service the domestic market, but it has operations across several corners of the world. This includes Australia, the Middle East, and Hong Kong.

Kier Group Share Price History

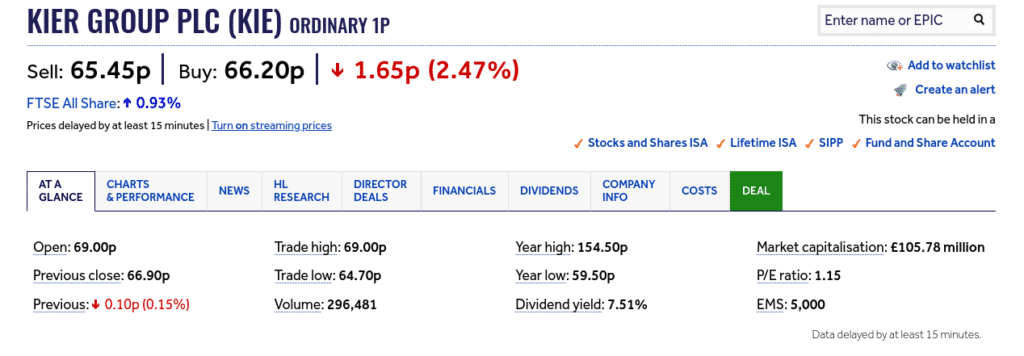

Although Kier group was first launched in 1928, it wasn’t until 1996 that the firm went public. Naturally, as a UK entity, Kier opted for the London Stock Exchange. At the time of writing, the firm has a minute market capitalization of just £105 million. This does mean that the shares have the potential to demonstrate volatile pricing swings, which might make for uncomfortable stock trading if you’re a newbie. Nevertheless, back in the mid-1990s, you would have paid in the region of 180p for each Kier share.

Since then, it’s been a tale of both good and bad times for the construction entity. For example, Kier shares went on a 10-year upward swing after its IPO, subsequently hitting peaks of just under 2,500p in April 2007. This represents a significant decade-long increase of over 1,200%. However, the firm has since been in dire straights – at least in terms of its stock price. For example, in the 12 months following its all-time highs, Kier shares hit lows of 693p.

This works out at a stock price decline of over 72% in a single year. The shares did show signs of recovery between 2009 and 2014 – managing to get back over the 1,800p-mark. However, the shares have been on a downward spiral since. At the time of writing in August 2020 – a single Kier share will cost you just 65p. This is highly significant for two key reasons. First and first, Kier shares are now worth substantially less than they were when the firm first went public.

In fact, had you bought the shares back in 1996, you would now be looking at a percentage loss of 63%. Secondly, and perhaps most pertinently, at 66p Kier Group shares have lost over 97% in value since their 2007 highs. In more recent times, Kier Group was heavily impacted by the COV-19 lockdown, not least because it was forced to close many of its building sites. As a result, the stocks are 29% down in 2020 as of August 12th.

Kier Shares Dividend Information

Historically, Kier Group has been been a strong dividend payer. That was until mid-2019 when the firm was forced to suspend its dividend policy. This was to protect the integrity of its balance sheet.

As per the COV-19 restrictions, it goes without saying that investors should not expect to see a dividend payment from the company until the foreseeable future. As a result, capital gains will be the only opportunity you have to make gains on your Kier share investment.

Should I Sell My Kier Shares?

If you’ve read through our section on the Kier share price history in full, then you will know that stockholders have been staring at unprecedented losses in recent years. This was further amplified by the 2020 mass-off sell that saw Kier shares hit all-time lows of just 59p. Crucially, the firm is no longer a billion-pound entity. On the contrary, it has a market capitalization of just over £100 million.

With that being said, this doesn’t mean that Kier shares necessarily represent a bad investment. As such, we are now going to take a closer look at what the future holds for the group.

Construction Sites Have Reopened

At the time of writing, Kier Group shares are down 29% for the year. The sharpest decline came in the 6 weeks that followed mid-February, with Kier stocks dropping by over 53%. However, it is important to remember that much of this downfall was due to the wider lockdown restrictions imposed by the UK government.

At the forefront of this was a requirement for Kier to close most of its building sites. On the flip side, Kier Group now has the capacity to resume operations in many of these locations, subsequently allowing the firm to get back to where it was pre-lockdown.

Upside Potential Offers Good Value

Before its February 2020 collapse, Kier shares were moving in the right direction. For example, the shares were priced at 94p at the turn of the year -hitting 52-week highs of 149p just a month and a half later. This means that the stocks were up by 58%. The government lockdown was of no fault of Kier, meaning that a short-to-medium term target of 149p is more than feasible.

Based on current prices of 66p per share, this offers significant upside potential at a great value. In fact, the shares would need to increase by 125% to reach this price target. Although this might sound somewhat unrealistic, it is important to remember that Kier Group has a minute capitalization of just over £100 million.

In simple terms, this means that the shares can move up or down a lot quicker in comparison to large-cap stocks with a multi-billion pounds valuation.

Extensive Order Book

It is crucial to note that Kier Group is currently not short of orders. On the contrary, the firm has secured a plethora of lucrative deals that will ensure it remains active in the coming years. At the forefront of this is the UK government’s plan to invest more than £100 billion in domestic infrastructure.

This is welcome news for Kier shareholders as to some extent – its future revenues are predictable. Additionally, with more than 60% of its orders secured with the government, this will ensure that the firm is paid in a timely manner. Once again, this will help with future cash flow levels and thus – help Kier Group improve the health of its balance sheet.

Kier Shares Buy or Sell?

Wondering whether Kier shares are a buy or sell? On the one hand, the construction firm has had a horrid time on the stock markets in recent years. Additionally, its balance sheet is looking somewhat vulnerable – especially when you factor in its rising debt levels.

On the other hand, some would argue that at current prices – Kier shares can be purchased at a major discount. In fact, a short-to-medium target could well be its pre-lockdown price of 149p. In the long run, it is also hoped that Kier Group will resume its dividend policy.

The Verdict?

In summary, the most important thing that Kier Group has going for itself at present is its ever-growing order book. More specifically, the firm has won a plethora of government contracts which should see Kier stay busy for several years to come.

FAQs

What does Kier Group do?

Kier Group is a UK-based construction company. It facilitates orders for both the private and public sectors. Although the UK is its main market, Kier Group also serves Australia, the Middle East, and Hong Kong.

What stock exchange are Kier shares listed on?

Kier is listed on the London Stock Exchange, which is somewhat surprising when you factor in its minute market capitalization of £105 million.

Do Kier shares pay dividends?

Although the firm has a historical track record of paying dividends, it was forced to suspend this in mid-2019. As such, you won't earn dividends when you buy Kier shares for the foreseeable future.

When did Kier go public?

Kier Group went public in 1996.

How do you buy shares in the Kier?

There are hundreds of UK brokers that offer Kier Group shares.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

As a UK-listed stock, Kier Group shares can be purchased from any online platform that gives you access to the London Stock Exchange. This means that you have hundreds of FCA-regulated brokers to choose from.

As a UK-listed stock, Kier Group shares can be purchased from any online platform that gives you access to the London Stock Exchange. This means that you have hundreds of FCA-regulated brokers to choose from.

If you’ve read through our section on the Kier share price history in full, then you will know that stockholders have been staring at unprecedented losses in recent years. This was further amplified by the 2020 mass-off sell that saw Kier shares hit all-time lows of just 59p. Crucially, the firm is no longer a billion-pound entity. On the contrary, it has a market capitalization of just over £100 million.

If you’ve read through our section on the Kier share price history in full, then you will know that stockholders have been staring at unprecedented losses in recent years. This was further amplified by the 2020 mass-off sell that saw Kier shares hit all-time lows of just 59p. Crucially, the firm is no longer a billion-pound entity. On the contrary, it has a market capitalization of just over £100 million.