Best High Yield Investments UK to Watch

High yield investments are financial assets that have historically paid an above-average rate of return. But of course, the risks that you take with this segment of the investment scene is going to be higher – especially when it comes to market volatility.

If this is a trade-off that you feel comfortable taking, here we discuss some popular high yield investments in the UK. We also discuss UK brokers to access high yield investments and how you can get started with a dealing account today.

-

-

5 Popular High Yield Investments 2022

Here’s a list of 5 popular high yield investments based on trading volumes. Scroll down to find out more about what each investment class offers.

- Tech Stocks

- Real Estate Investment Trusts

- Permanent Interest Bearing Shares

- ETF Bond Funds

- Nvidia

High Yield Investments in the UK

High yield investments are available in their drones. In order to meet our criteria, the investment in question must historically yield an above-average amount. We have set these criteria at a target annual yield of at least 10%. All of the high yield investments that we have opted for can all be accessed online from the United Kingdom by using an FCA-regulated broker.

1. Tech Stocks

While many sectors in the financial space suffered in 2020 – the tech stock scene has to date been unaffected by the coronavirus pandemic.

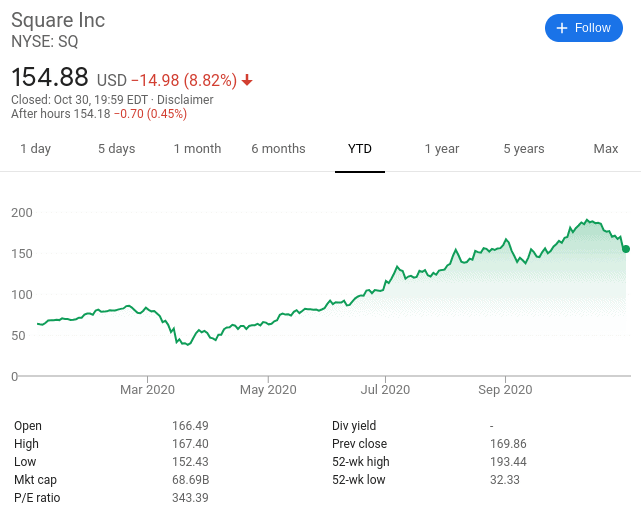

You then have growth tech stocks that have provided yields. For example, Etsy is up a whopping 174%, while Square stockholders are looking at returns of 144%.

On the flip side – and like a lot of high yield investments, the risks that you take with tech stocks are always much higher. This is because many companies active in the space are in possession of unproven business models.

2. Real Estate Investment Trusts (REITs)

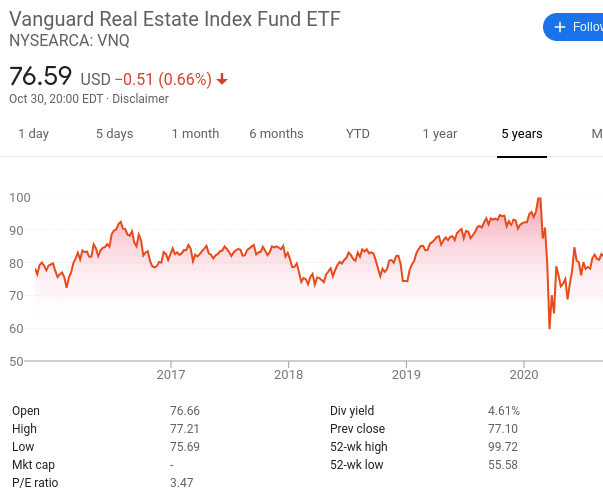

In a nutshell, REITs are backed by thousands of investors of all shapes and sizes. Run by large-scale financial institutions, REITs will pool investor funds together and then build a portfolio of properties. In some cases, the REIT will specialize in a particular area of the property scene – such as residential, commercial, office space, retail, or healthcare.

As an investor, you will be entitled to your share of rental income. After all, whether its a residential complex or a shopping mall – the REIT will charge tenants rent. Due to the sheer number of properties that the REIT is likely to have in its portfolio, you’ll typically receive a batch payment every three months – fewer fees.

Crucially, the specific value of the ETF is determined by the NAV (Net Asset Value) of all properties held. This means that you can cash out your investment whenever you see fit.

In terms of annual returns, there really isn’t a hard-and-fast average to speak of. This is because there are simply too many variables to take into account. For example, it will depend on the type of properties that the REIT targets, as well as the specific housing market that the real estate is located.

3. Permanent Interest Bearing Shares (PIBS)

For those unaware, PIBS are debt instruments issued by UK banks and building societies. In simple terms, they are corporate bonds in all but name.

This is because:

- PIBS are a way for banks and building societies to raise capital from outside investors

- PIBS come with fixed interest rates

- Issuers distribute coupon payments every 3 or 6 months

- The running yield of PIBS will change as per market conditions

- In all but a few cases, PIBS come with a fixed maturity date

- You will not receive your principal investment back until the PIBS mature

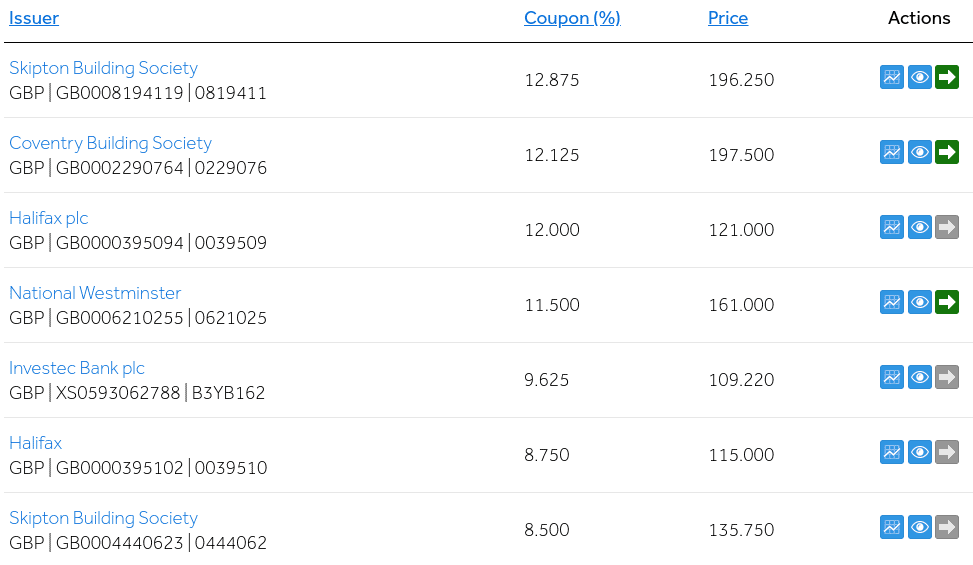

To give you an idea of what you can currently get – check out some examples below:

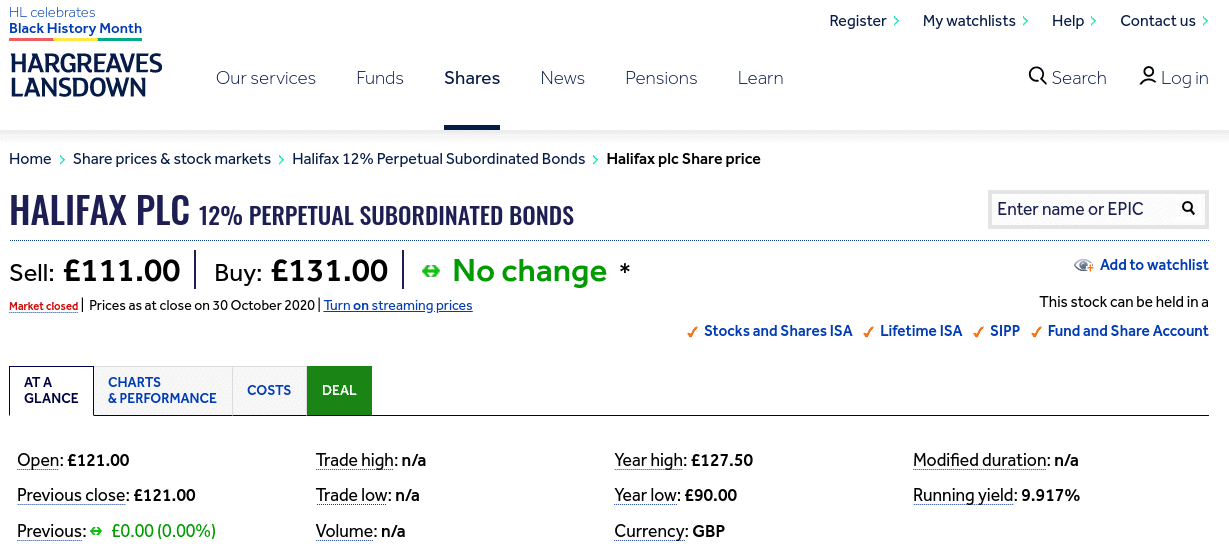

- Halifax PLC – 9.9%

- Investec Bank – 8.8%

- National Westminster – 7.1%

- Skipton Building Society – 6.5%

- Nationwide Building Society – 6.2%

However, as the PIBS are now in high demand (because of the high yield on offer), you need to pay a premium to buy them. As such, the effective yield that you will receive each year is slightly lower at 9.9%. Crucially, we must stress that although the above providers are partnered with the FSCS, your PIBS investment is not covered in the event of a default.

This is only the case if your money was stored at the bank or building society in the form of a cash deposit (current or savings account).

At the time of writing, the only platform that we are aware of that allows you to buy PIBS online is that of Hargreaves Lansdown.

Sponsored ad. Your capital is at risk.

4. ETF Bond Funds

In a nutshell, ETF bond funds will purchase a large basket of bond instruments. In fact, this often runs into the hundreds or even thousands of individual bonds. This will usually target a specific market. For example, low-risk bond funds will hold instruments issued by governments from strong economies – such as the US, UK, or Japan.

The Vanguard Total Bond Market ETF holds almost 10,000 different instruments from a variety of markets and economies.

Sponsored ad. Your capital is at risk.

5. NVIDIA

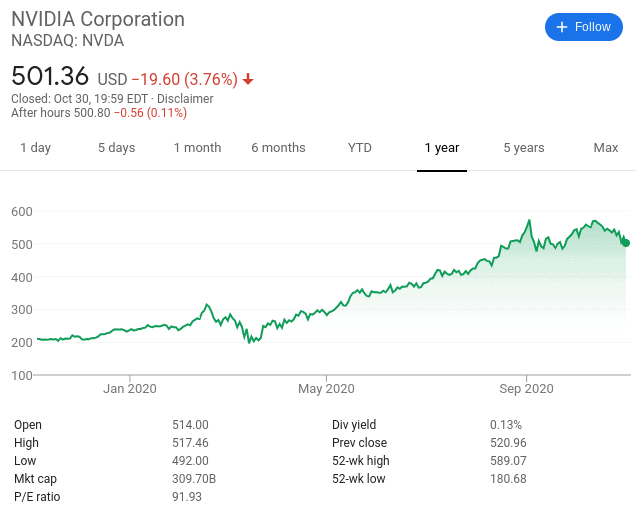

Although you might not have heard of NVIDA, it is actually one of the largest stocks in the United States in terms of market valuation. At the time of writing, this stands at more than $309 billion.

The firm is primarily involved in the production of graphics processing units. It is by far the largest supplier in the gaming space – albeit, NVIDIA is also involved in mobile and desktop computing chips, too. The company also a number of subsidiaries under its belt, including the recent $40 billion purchase of ARM.

As of early November 2020, the stocks are up over 109%. Returns of this magnitude are nothing short of uncanny when you consider the wider impact of the covid pandemic and thus – past performance does not provide any guarantees of future performance.

NVIDIA has shown little in the way of fluctuations and is as strong and stable as it gets in the stocks and shares space. For example, it arguably falls under the scope of a ‘staple stock’, meaning that its products will always be in demand irrespective of how the economy is performing. This is because it holds such a dominant position in the GPU and computing chip sectors.

Sponsored ad. Your capital is at risk.

Platforms Offering High Yield Investments UK

Not only do you need to perform in-depth research on a high yield investment before taking the financial plunge, but you then need to find a broker to buy the asset from. This in itself can be time-consuming, as there are many factors that need to be considered before you sign up. This includes everything from tradable markets and dealing fees, to supported payment methods and security.

1. IG

IG arguably has the largest range of asset classes. You will have access to over 12,000 markets – many of which fall within the remit of a high yield investment. This covers thousands of shares from a variety of the UK and international markets, alongside ETFs, investment trusts, and mutual funds. ISAs are also supported which is suitable for remaining tax-efficient.

Dealing fees start at £8 per trade, which is reduced to £3 when you place at least three orders per month. There are no fees to deposit and withdraw funds unless using a credit card (0.5%-1%). The minimum deposit stands at £250. This brokerage house is well respected in the UK as it has been operational since 1974. Alongside an FCA license and FSCS partnership, IG is listed on the London Stock Exchange with a multi-billion pound valuation.

Sponsored ad. Your capital is at risk.

What are High Yield Investments UK?

Put simply, high yield investments are financial assets that come with a much higher ‘risk vs return’ ratio. In other words, although your chosen high yield investment gives you the opportunity to grow your capital much faster, the underlying risk of losing money is greater.

With that said, being able to quantify the levels of returns offered by high yield investments is no simple feat. After all, you would need to compare it against the returns offered by lower-risk assets. One such example would be that of a traditional UK savings account.

Crucially, although your deposit is effectively risk-free up to the first £85,000 as per the FSCS, you’d be lucky to make more than 1-2% per year. Then you have the likes UK gilts (government bonds) that pay in the region of 1% – sometimes less depending on the maturity date.

With this in mind, such an amount of interest on offer is forcing UK investors to seek high yield investments that come with a greater element of risk.

Some examples of high yield investments are listed below:

- Growth stocks

- Tech stocks

- AIM shares

- Emerging market shares

- Emerging market bonds

- PIBS

- Cryptocurrencies

- Peer-to-peer lending

- Real estate crowdfunding

- Low-grade corporate bonds

Conclusion

In times of low interest rates being offered by UK banks, many investors are looking at alternative ways to grow their money. At the forefront of this are investments that pay a much higher yield. With that being said, you do need to have an understanding of the additional risks being undertaken.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up