How to Buy Sainsbury’s Shares UK – With 0% Commission

J Sainsbury plc, trading as Sainsbury’s, is a well-known supermarket chain in the UK and the second-largest food retailer in the nation with over 606 supermarkets and 820 convenience stores. With a market capitalization of £4.51bn, Sainsbury’s is also one of the most traded shares in the UK share market these days.

In this guide, we walk you through the process of how to buy Sainsbury’s shares online in the UK. We’ll also include an overview of the most trusted UK brokers to buy Sainsbury’s shares from, how the Covid-19 pandemic has affected the supermarket chain, its past performance and potential future profitability.

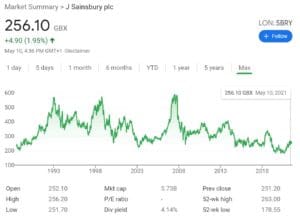

To help you find the right broker, below we suggest two of the most popular and well-known UK stockbrokers that offer you to buy Sainsbury’s shares. In the case of share CFDs, you can trade Sainsbury’s shares with a 5:1 leverage and a spread of 1.24. In terms of key features, Plus500 has an effective trader’s sentiment tool that collects traders’ opinions on any asset. Moreover, investors get real-time SMS, email, and push notification on a chosen asset based on price change, a change in asset percentage, or trader’s sentiment. Overall, Plus500 offers a user-friendly stock trading platform that can be accessed via any web browser or on your mobile phone via the Plus trading app. If opting for Plus500, you will have to meet minimum deposit requirement of £100 and complete a KYC verification process as the broker is FCA regulated. Pros: Cons: 72% of retail investor accounts lose money when trading CFDs with this provider. Whether you’re investing in Sainbury’s shares or shares in similar companies like Tesco, Morrisons, Argos or Walmart, you always need to research before you make an investment decision. Sainsbury’s shares have been under pressure for the past decade, or more accurately, since the 2008 economic global crisis. As a matter of fact, it is one of the most shorted stocks UK among hedge funds and big investment institutions. On the other hand, it is more than likely that Sainsbury’s stock currently trades at a discount, particularly when the company has seen strong demand during the Covid-19 pandemic crisis. In this section of our guide, we’ll analyze the Sainsbury share price performance, the company’s dividend policy, and the reasons why you should consider buying Sainsbury shares. Sainsbury was founded way back in 1869 by John James Sainsbury who had a small shop in London. In its early years of operation, Sainsbury has become very popular for offering basic and quality products at a low cost. By 1922, Sainsbury was the largest chain of grocery shops in the United Kingdom. The company, which was owned by the Sainsbury family at that time, went public in 1973 in one of the biggest-ever IPOs on the London Stock Exchange. Moving forward, since the 2008 economic crisis, Sainsbury’s share price has been on a long steady downward trend, falling from 587p at the peak to 179p per share in September 2020. The shares have since moved upward to 256p per share, above the level they traded at prior to the pandemic. Check out our Sainsburys share price forecast to see what are expert analysts see in the stock’s future. Sainsbury’s has a market cap of £4.51bn, which normally makes it a favorable company for hedge funds and large institutions. Its price-per-earnings (p/e) ratio stands at 35.03, which is relatively high and indicates that investors are concerned but at the same time are willing to pay a higher price with the anticipation of future growth. Sainsbury’s reported earnings per share (EPS) of 0.058c, which represents a decrease of 23% from the previous year. The company has also reported that grocery sales were by 10.5% and online digital sales more than doubled in the first half-year of 2020. For investors, Sainsbury is clearly a favored dividend stock as the supermarket chain typically pays an interim and an annual dividend yield for shareholders. In normal circumstances, Sainsbury pays a fixed rate of dividend each year at a yield of between 4%-5%. However, as more companies have suspended or canceled dividend payments so far this year amid the coronavirus uncertainty, Sainsbury’s has also deferred its final dividend for 2019. Looking at Sainsbury’s share price performance, investors might be confused about where the share is headed next. On the one hand, Sainsbury’s shares have been trading near the historically lowest levels and though the retailer is somewhat immune to the Covid-19 economic crisis, implications of the pandemic are not yet known. On the other hand, Sainsbury’s is a strong business and it will be surprising to see the stock drifting much lower. With that in mind, let’s take a look at some of the main factors to consider before buying shares of Sainsbury’s. The Covid-19 pandemic has had a huge impact on most businesses and the global economy in general. Luckily for Sainsbury’s, supermarket sales were strong during the Covid-19, including the periods of lockdowns. On the June 2020 earnings result, Sainsbury’s reported that its online digital sales more than doubled, and total retail sales grew by 8.5%. Further, Sainsbury’s is expected to report a net profit of £445m by the end of the year, which is almost the same net profit of £471 (after tax) in 2016 and above 2017’s net profit of £371 in 2017. The data suggest that Sainsbury’s is currently trading at a fairly cheap price. But although Sainsbury’s has benefited from the Covid-19 situation, it is still facing £500m of extra costs as a result of the pandemic crisis. As such, Sainsbury had to put its final dividend on hold until the Covid-19 crisis will ease down. Due to the Covid-19 pandemic, Sainsbury had to make a shift in its strategy to become a functional digital business. As such, digital sales have become a growing portion of overall sales, and Sainsbury’s SmartShop app is used in 37% of the total transactions on average. To manage the operation, Sainsbury’s said it plans to double capacity and it will then be able to deliver 700,000 online grocery orders every week. Sainsbury’s executive chief said: “Our business has fundamentally changed, customers are shopping very differently. The business has changed the way it works,” This makes Sainsbury’s a digital-first business. To improve its service, Sainsbury’s is also using big data and analytics to drive its digital strategy. In terms of market share, Sainsbury’s has always been a leading player in the UK grocery market. According to Kantar, Sainsbury’s market share has dropped to 14.9% from 16% in 2019, and at some point, Sainsbury’s lost the second spot to ASDA. However, very soon Sainsbury’s has returned to its position as the second-largest supermarket chain in the UK, behind Tesco at 26.8% and slightly ahead of Asda at 14.5% Sainsbury’s shares have been on a wild ride over the past year. The company’s shares were down through last summer even though Sainsbury’s stores remained open, but the share price has jumped to 256p in the last 6 months. That’s higher than the share price before the pandemic. In the short-term, we think Sainsbury’s is a buy. The company has a 15% share of the UK grocery market and has been competitive in the fight to attract customers over the past year. Easing restrictions should also help Sainsbury’s profit margins, which will boost the stock price. Over the long term, however, we’re more skeptical of Sainsbury’s ability to compete. The chain faces stiff competition from traditional grocers like Tesco as well as newcomers like Ocado that are bringing automation into the grocery market. Sainsbury’s has also been in a long-term decline that shows few signs of wearing off, despite the recent share price recovery. We still recommend Sainsbury’s as a buy. However, investors should carefully watch the company to see how its market share and profit margins change over time. If Sainsbury’s proves unable to stay ahead of emerging trends in curbside pickup and online groceries, then you should reevaluate whether this stock is worthwhile. Sainsbury’s is the second largest chain of supermarkets in the UK and one of the oldest and most resilient companies traded on the London Stock Exchange. Over the past decade, however, the company has struggled and its share is currently trading at its lowest level since 1995. While there’s uncertainty around when and how Sainsbury’s share will rise again, most analysts believe that Sainsbury’s is an attractive long-term investment opportunity right now. If you ready to buy Sainsbury’s shares, simply click the link below to get started!

Since June 2020, Simon John Roberts is the chief executive officer of Sainsbury's.

Sainsbury plc trades on the London Stock Exchange under the symbol SBRY.

Sainsbury's typically pays an interim dividend in January and an annual dividend for the previous calendar year in July. However, the company has announced in April that dividends are on hold amid the Covid-19 crisis.

As Sainsbury's is one of the most popular stocks in the UK, the majority of UK stockbrokers will allow you to buy shares of the company. Yet, most brokers will charge expensive fixed entry and exit fees and yearly management fees.

The largest holder of Sainsbury plc, which is the parent company of Sainsbury Supermarkets LTD, is the Qatari royal family that holds 26.14% of the company's shares as of October 2020.

Yes, you can buy Sainsbury's shares on ISA or SIPP account. You will have to find, however, a stockbroker that enables you to purchase Sainsbury's shares on ISA or SIPP account. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Sainsbury’s Shares

1. Plus500 – Trade Sainsbury’s Share CFDs with Tight Spreads

Step 2: Research Sainsbury’s Shares

How Much Are Sainsbury’s Shares Worth? Sainsbury’s Share Price History

Sainsbury’s Market Capitalisation, EPS and P/E Ration

Sainsbury’s Shares Dividend Information

Should I Buy Sainsbury’s Shares?

The Coronavirus Pandemic Impact on Sainsbury’s Share

Sainsbury’s is a Digital-First Business

A Large Market Share in the UK

Sainsbury’s Shares Buy or Sell

The Verdict

FAQs

Who is the chief executive of Sainsbury?

What stock exchange is Sainsbury listed on?

Does Sainsbury's pay dividends?

How do I buy shares in Sainsbury's?

Who owns Sainsbury's?

Can I invest in Sainsbury's via an ISA or SIPP?

Tom Chen