Best Stocks to Buy Now in Ireland – Invest with Zero Fees

eToro: 0% Commission on 700+ Shares

What are the best stocks to buy now in Ireland? The market isn’t very cheap right now, but that doesn’t mean there aren’t any bargains out there. On a price-to-free-cash-flow (FCF) basis, these ten stocks appear to be the best shares to buy now.

By the end of this guide, we’ll have covered the best stocks to buy right now as well as the cheapest stock broker that allows you to trade stocks with 0% commission.

-

- 1. Goodyear Tire & Rubber Co (NASDAQ: GT) – Best Auto Parts Stock to Buy Right Now

- What do Wall Street analysts expect will happen to this stock?

- 2. Hubbell (NYSE: HUBB) – Best Stocks to Invest in 2021 for the Electrification of the Economy

- 3. Accenture Plc (NYSE: ACN) – Based in Dublin, Accenture Wrapped up over $44B in Revenues last year

- 4. Ryanair Holdings plc (NASDAQ: RYAAY) – One of the best stocks to invest in right now in Ireland

- 5. Trinity Biotech plc (NASDAQ: TRIB) – Best shares to buy now for exposure to the POC (point-of-care) market

- 6. Johnson Controls International plc (NYSE: JCI) – Best Stocks to buy in Ireland today for exposure to developing energy solutions

- 7. Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 22.21%

- 8. Meta Platforms Inc (NASDAQ: FB) – Best shares to buy now with YTD gains of 26.72%

- 9. AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.13%

- 10. Snap Inc. (NYSE: SNAP) – SNAP stock is up by 52.55% in year-to-date gains

-

- 1. Goodyear Tire & Rubber Co (NASDAQ: GT) – Best Auto Parts Stock to Buy Right Now

- What do Wall Street analysts expect will happen to this stock?

- 2. Hubbell (NYSE: HUBB) – Best Stocks to Invest in 2021 for the Electrification of the Economy

- 3. Accenture Plc (NYSE: ACN) – Based in Dublin, Accenture Wrapped up over $44B in Revenues last year

- 4. Ryanair Holdings plc (NASDAQ: RYAAY) – One of the best stocks to invest in right now in Ireland

- 5. Trinity Biotech plc (NASDAQ: TRIB) – Best shares to buy now for exposure to the POC (point-of-care) market

- 6. Johnson Controls International plc (NYSE: JCI) – Best Stocks to buy in Ireland today for exposure to developing energy solutions

- 7. Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 22.21%

- 8. Meta Platforms Inc (NASDAQ: FB) – Best shares to buy now with YTD gains of 26.72%

- 9. AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.13%

- 10. Snap Inc. (NYSE: SNAP) – SNAP stock is up by 52.55% in year-to-date gains

Best Stocks to Buy Right Now in Ireland

If you’re looking to add the hottest shares to your portfolio here are our top ten picks of the best stocks to buy now in Ireland:

- Goodyear Tire & Rubber Co (NASDAQ: GT) – Best Auto Parts Stock to Buy Right Now

- Hubbell (NYSE: HUBB) – Best Stocks to Invest in 2021 for the Electrification of the Economy

- Accenture Plc (NYSE: ACN) – Based in Dublin, Accenture Wrapped up over $44B in Revenues last year

- Ryanair Holdings plc (NASDAQ: RYAAY) – One of the best stocks to invest in right now in Ireland

- Trinity Biotech plc (NASDAQ: TRIB) – Best shares to buy now for exposure to the POC (point-of-care) market

- Johnson Controls International plc (NYSE: JCI) – Best Stocks to buy in Ireland today

- Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 22.21%

- Meta Platforms Inc (NASDAQ: FB) – Best shares to buy now with YTD gains of 26.72%

- AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.13%

- Snap Inc. (NYSE: SNAP) – SNAP stock is up by 52.55% in year-to-date gains

Best Stocks to Buy in Ireland Reviewed

1. Goodyear Tire & Rubber Co (NASDAQ: GT) – Best Auto Parts Stock to Buy Right Now

- Industry: Manufacturing

- Current price: $19.05

- Market cap: $5.36B

- Dividend yield: N/A

- YTD return: +87.32%

In recent years, vehicle parts stocks have lagged the market. The declining demand for vehicle production is the most likely explanation. The majority of automotive suppliers are a mix of aftermarket parts and original equipment (OEM). The aftermarket and the OEM market have relatively low growth rates.

When it comes to expected free cash flow, though, there’s a compelling case to be made that Goodyear’s stock (NASDAQ: GT) is undervalued. The acquisition of Cooper Tires earlier this year is a significant factor that has many analysts keeping a close eye on this stock. The merger boosts Goodyear’s position in the U.S. car parts market as well as the China OEM market, where Cooper has a stronger presence.

What do Wall Street analysts expect will happen to this stock?

Furthermore, by 2023 management expects to create $165 million in annual cost savings. These cost savings will be passed on to Goodyear in the form of higher earnings and free cash flow. According to 2019 statistics, the new Goodyear would have returned $690 million in free cash flow.

What’s more, Wall Street expects Goodyear to generate just over $700 million in free cash flow by the end of 2022. In 2022, the stock would trade at only 7.5 times FCF, based on its present market valuation of $5.36B. That price appears to be excessively cheap, especially when you consider that 80 percent of Goodyear’s sales are for replacement car parts.

2. Hubbell (NYSE: HUBB) – Best Stocks to Invest in 2021 for the Electrification of the Economy

- Industry: Electrical and Electronic products Lighting Power Systems Oil and Gas

- Current price: $189.80

- Market cap: $10.32B

- Dividend yield: 2.07%

- YTD return: +21.62%

We’ve picked this company as it’s a key player in the electrification of the economy. The global economy is turning to electricity as a new source of renewable energy. From electric automobiles, industrial automation, and smart buildings, to data and networking, and renewable energy, the world is headed to net-zero carbon emissions by the end of the century.

Hubbell (NYSE: HUBB) produces electrical goods, lighting, and power components for a variety of applications, including commercial, industrial, residential real estate, and data centers, as well as electric grids. As a result, many investors are looking to buy into Hubbell as a way of gaining exposure to spending on electrical transmission and distribution.

Moreover, the need to replace outdated infrastructure and build networks for renewable energy projects is driving this market. Hubbell is therefore a good deal for investors, trading at less than $190.

3. Accenture Plc (NYSE: ACN) – Based in Dublin, Accenture Wrapped up over $44B in Revenues last year

- Industry: Software & Tech Services

- Current price: $349.74

- Market cap: $233.08B

- Dividend yield: 1.11%

- YTD return: +36.37%

Accenture Plc, based in Dublin, is a Fortune Global 500 business with revenues exceeding $44 billion. This professional services firm has been on a spending spree since 2019 with 500,000+ employees covering three continents.

According to Bloomberg, Accenture has bought at least 65 companies since 2019, including three that were revealed on March 1 — an Australian supply chain consultant, a Brazilian robotics startup, and a U.K. leadership development firm.

Accenture’s NYSE shares skyrocketed by 51.80% over the past year, leading to a market capitalization of $233.08 billion, a P/E ratio of 38.20, and a dividend yield of 1.11%.

4. Ryanair Holdings plc (NASDAQ: RYAAY) – One of the best stocks to invest in right now in Ireland

- Industry: Air Freight/Delivery Services

- Current price: $111.82

- Market cap: $21.50B

- Dividend yield: N/A

- YTD return: +6.16%

With an 83 percent year-over-year drop in passenger numbers, Ireland’s low-cost airline joined its competitors in suffering a difficult pandemic-burdened 12 months. However, in concert with its airline sector rivals, Ryanair is hoping for a strong post-pandemic recovery.

According to the aviation trade journal Simple Flying, Ryanair forecasts ‘1,809 routes this summer across 221 airports and 37 countries,’ representing a 112 percent year-over-year increase from last year and a very conservative 29 percent drop from the pre-pandemic summer of 2019.

Ryanair’s NASDAQ shares jumped up by 31.49% over the past year, resulting in a market cap of $21.50 billion.

5. Trinity Biotech plc (NASDAQ: TRIB) – Best shares to buy now for exposure to the POC (point-of-care) market

- Industry: International diagnostics

- Current price: $2.03

- Market cap: $42.43M

- Dividend yield: N/A

- YTD return: -43.77%

Trinity Biotech develops, acquires, and produces diagnostic systems for the point-of-care (POC) and clinical laboratory sectors of the international diagnostics industry, including both reagents and instruments. Diagnostic tests and apparatus for detecting infectious diseases, as well as solutions for diagnosing and monitoring diabetic patients, are all part of the company’s portfolio.

The medical sector’s move to try and manage the COVID-19 pandemic has had an influence on POC market sales over the last year, with Trinity also noting a reduction in sales of diabetes-related equipment as well as HIV testing kits. However, the company’s COVID-focused products helped yield $32 million in revenue in Q3 2020, up 30% year over year.

According to Bloomberg, Ronan O’Caoimh, Trinity CEO said “Revenues were very strong this quarter, particularly our Clinical Laboratory revenues which grew by 45%. This was driven by strong demand for our Covid-19 related products which includes our Viral Transport Media product, ELISA antibody test, monoclonal antibodies sold by Fitzgerald as well as our rapid respiratory products, demand for which have increased during the pandemic.”

Trinity Biotech’s NASDAQ shares have fallen by -22.81% over the past year, leading to a market capitalization of $42.43M.

6. Johnson Controls International plc (NYSE: JCI) – Best Stocks to buy in Ireland today for exposure to developing energy solutions

- Industry: Industrial Products

- Current price: $72.55

- Market cap: $51.67B

- Dividend yield: 1.49%

- YTD return: +57.10%

Johnson Controls International plc is a multinational conglomerate based in Cork that focuses on creating energy solutions, integrated infrastructure, and transportation systems. It was formed after the merger of the US company Johnson Controls with the Irish company Tyco International.

Power solutions and energy storage are just some of the technology and service capabilities it offers to a variety of end markets, including big institutions, and all types of real estate from commercial to industrial.

Since 2016, the company has increased its total sales by more than $10 billion, and it is now a member of both the Fortune Global 500 and the Fortune 500. It employs 105,000 employees in about 2,000 sites across six continents.

Johnson Control International’s stock has risen by 68.33% in the last 12 months, and with estimates showing that the firm’s earnings will continue to grow, JCI is a stock worth keeping an eye on.

7. Netflix Inc. (NASDAQ: NFLX) – One of the best stocks to buy now in Ireland with YTD gains of 22.21%

- Industry: Entertainment

- Current price: $635.75

- Market cap: $281.37B

- Dividend yield: N/A

- YTD return: +21.59%

Another one of the best stocks to buy in Ireland is Netflix. Chiefly, the tech giant’s main aim is to provide cutting-edge video streaming services. Throughout the pandemic, this has been one of the lead drivers of the company’s growth. Of course, you could say that the pandemic has and will continue to fuel demand for streaming services as a whole.

But, Netflix stands out as the leading go-to name with its plethora of popular shows and films. So much so that investors are adding Netflix stock to their watchlists and portfolios. At the time of writing, NFLX shares are trading at $636.17 with YTD gains of 21.59%.

To give you an example, the most recent news concerning Netflix today is about its pop-culture blockbuster, Squid Game. The South Korean series is worth about $900 million to Netflix, according to Bloomberg sources.

Squid Game was the company’s greatest series debut to date, with over 111 million global viewers on the first day.

All in all, Netflix continues to have enormous success in worldwide markets, thanks to a continually expanding library of diversified content. In light of all this, will you be investing in NFLX stock?

8. Meta Platforms Inc (NASDAQ: FB) – Best shares to buy now with YTD gains of 26.72%

- Industry: Media

- Current price: $327.74

- Market cap: $960.89B

- Dividend yield: N/A

- YTD return: +26.72%

Making up one of the FAANG stocks, Meta Platforms Inc (formerly Facebook) is a big tech company that’s become one of the leading social media networks worldwide. As of 2021, it has just under 3 billion monthly users across its social network platform. Facebook is also the parent company of other popular social media platforms such as WhatsApp, Instagram, and Oculus.

Companies across the world use Facebook Ads to expand their business and reach a wider consumer pool. FB stock currently trades at $327.74 and has year to date gains of +26.72%. Earlier this week, Facebook reported that it’s set to open 10,000 vacancies in the EU by 2026 as it works towards developing a metaverse.

This announcement comes after the social media giant has been investing in virtual reality and augmented reality projects. As such, the tech company plans to connect its billions of users via many devices and applications.

Furthermore, Meta Platforms Inc has set aside $50 million for research and development purposes related to its metaverse project. It’s also working on a new remote work app that allows users of its Oculus Quest 2 headsets to conduct virtual meetings as avatars.

With more announcements of innovative apps and devices, are investors right to add FB shares to their investment portfolios today?

9. AT&T Inc. (NYSE: T) – One of the best dividend stocks with a dividend yield of 8.13%

- Industry: Telecommunications, Media and Technology

- Current price: $25.97

- Market cap: $185.43B

- Dividend yield: 8.01%

- YTD return: -11.79%

Next on the list is AT&T. According to the company’s about page AT&T is ‘the first truly modern media company that has been changing the way people live, work and play for more than 140 years. It started with Alexander Graham Bell’s telephone. Since then, our legacy of innovation has included the invention of the transistor – the building block of today’s digital world – as well as the solar cell, the communications satellite and machine learning.’

AT&T Communications, a division of AT&T, delivers communications and entertainment services to more than 100 million Americans via mobile and broadband. It also provides high-speed, secure internet connectivity and smart solutions to roughly 3 million customers, including most of the Fortune 1000 constituents. At the time of writing, T stock is trading at $25.97.

The company said earlier this month that it will collaborate with Frontier Communications to deliver fiber-optic connectivity to large corporations outside of AT&T’s current client base.

Essentially, the two companies will enter a multi-year strategic partnership to support the development of AT&T’s 5G mobile network. To accommodate this demand, AT&T will require reliable fibre-optic networks that will allow it to reach a wider audience. Through this partnership, AT&T will be able to broaden its reach and expand its business in the long term. With that said, will you invest in AT&T shares?

10. Snap Inc. (NYSE: SNAP) – SNAP stock is up by 52.55% in year-to-date gains

- Industry: Media

- Current price: $75.65

- Market cap: $119.61B

- Dividend yield: N/A

- YTD return: +52.55%

Lastly, Snap is a camera and social media company that was launched in 2011. It’s trying to revolutionize the camera as a tool for improving people’s lives and the way we communicate with one another.

Millions of clients all use Snapchat and Spectacles daily. The company is set to release its Q3 financial results after the market closes on October 21, 2021. At the time of writing, SNAP shares are trading at $75.65, up by 107.26% in the past 12 months.

What has the company’s financial performance been like in the months leading up to its earnings report? In July Snap revealed in its second-quarter financials that its daily active users had climbed by 23% year-over-year to 293 million.

In addition, revenue increased by more than 50% to $982 million. According to Snap, the quarter illustrates the broad-based success of its business, as revenue and daily active users climbed at the fastest rates in the last four years. It’s also making huge strides with its augmented reality platform, and it’s committed to growing its global presence.

Therefore, will SNAP stock be on your trading radar today?

Best Stocks to Watch in Ireland

Seeing as we covered the best stocks to buy now in Ireland, let’s take a look at some stocks that many investors and Wall Street analysts are monitoring closely.

According to some market analysts, October is full of tricks and treats when it comes to the best stocks to watch in Ireland. Tesla and Walt Disney are two trending stocks to keep a close eye on right now.

Why areTesla and Walt Disney top stocks to watch this month?

The electric vehicle manufacturer has already had a strong start to the month. It stated over the weekend that it delivered a total of 241,300 vehicles in Q3, a 73 percent increase year-over-year at a time when other car manufacturers were seeing a drop in sales. Only 221,000 new Tesla cars were expected to hit the market, according to analysts.

Walt Disney, on the other hand, continues to excel on the streaming end, despite slowing down after a strong fiscal third quarter. Following a rebound from the pandemic, Disney’s stock is still trading marginally down in 2021. A good performance in October could help the iconic media stock reverse its year-to-date decline.

How to Buy the Best Shares Now in Ireland

If you’re looking for the best stocks to buy in Ireland today, you’ll need to pick a trusted online stock broker.

Step 1: Open an Account

To begin, go to the broker website and click on ‘Join Now’ to register for a new account. You’ll be required to enter some personal information, including your name, home address, date of birth, and phone number. You’ll need to pick a username and a secure password as well.

Step 2: Upload ID

Look for a broker that is regulated by the UK’s Financial Conduct Authority (FCA), as well as ASIC and CySEC. As a result, every user that creates an account must be verified. Simply attach a copy of your UK passport or driver’s licence, along with a utility bill or bank account statement.

Step 3: Deposit Funds

Funding your brokerage account is simple and easy. You’ll find several payment options available at your disposal. These include credit cards, debit cards, bank wire transfers, and e-wallets such as PayPal and Neteller.

The minimum deposit is just $50 and the only available account base currency is the USD. This means that if you deposit in GBP you’ll incur a small conversion fee of 0.5%.

Step 4: Buy Shares

After you’ve deposited funds, you’ll be able to purchase the best stocks of your choice. If you already know which of the aforementioned stocks you want to invest in, just type it into the search box at the top of the screen and hit the ‘TRADE’ button. In this example, we’re trying to purchase Netflix stock.

From here you’ll be able to enter your investment amount, as well as set stop-loss and take-profit orders.

Last but not least, to complete the purchase simply click on the button marked ‘Open Trade’.

How We Decide Which Shares are Best to Buy

Deciding which shares are best to buy requires heaps of fundamental and technical analysis. Our dedicated team of researchers and analysts scans the markets to find the best trading opportunities for our readers.

With that said, here are some of the key metrics used to pinpoint the best stocks to buy in Ireland.

Fundamental analysis

The first step to identifying a stock that’s a good fit for buying now is focusing on fundamental analysis. This consists of examining a company’s revenue, financial performance, earnings growth, past performance, free cash flow, sales figures, dividend yields, and E/P ratios.

When a stock’s fair value is higher than its current share price, it’s a good indicator that investors are undervaluing the shares.

Technical Analysis

Technical analysis is another important metric we use to find short-term opportunities. This type of chart analysis means looking at a company’s price movements to try and forecast future fluctuations. Some of the most popular technical indicators include RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

The RSI momentum indicator is used to measure the size of recent price movements as a way of analyzing overbought and oversold instances in the price of a stock.

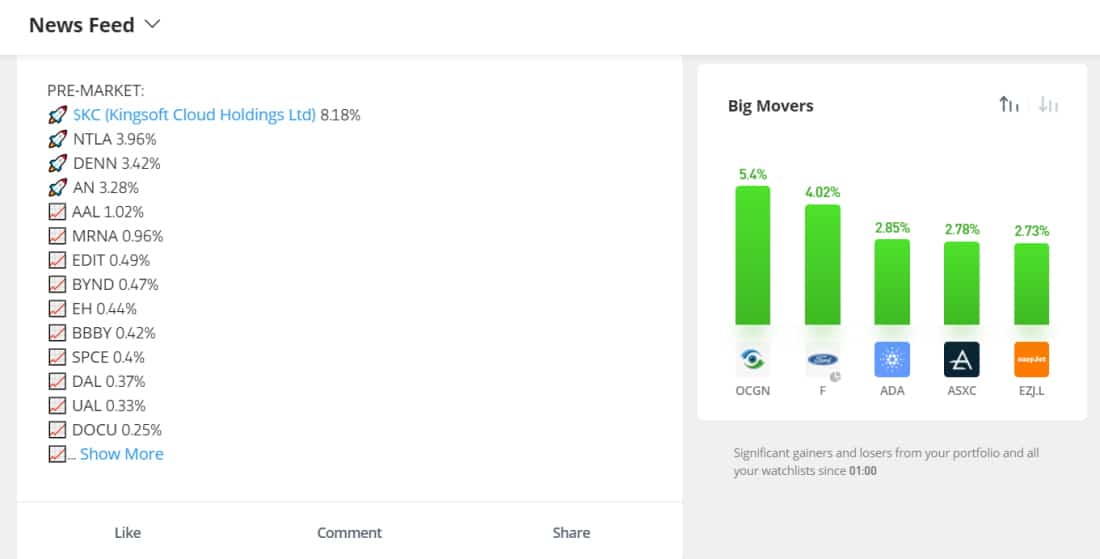

Market News

Stock prices undulate regularly throughout the day as the balance between supply and demand is always moving. If more investors try to purchase a stock, its market price will rise, and vice versa. Supply and demand are very sensitive to market news and trends.

Nevertheless, being at the mercy of real-time news is not an effective stock-choosing strategy for most investors. Typically, experienced investors react in advance to an event, not when the event is making headlines.

Conclusion

The stock markets and the Irish economy have been unsettled because of the Covid-19 pandemic and Brexit. But with many market analysts expecting a swift global economic recovery, now could be the best time to buy stocks in Ireland.

In this article, we’ve covered everything you need to know about the best stocks to buy now in Ireland, as well as the best trading platform to use in 2021. If you want to add the best stocks to your investment portfolio and gain exposure to global stock exchanges, open an account with a broker today and trade stocks with 0% commission.

Frequently Asked Questions on the Best Stocks to Buy in Ireland

What are good shares to buy now in Ireland?

We believe Netflix, Tesla, Facebook, Amazon, Apple, CRH Plc, Kerry Group Plc, Kingspan Group (ISEQ: KRX), Smurfit Kappa, and Ryanair shares offer good opportunities to buy now in Ireland. With the effective rollout of the Covid-19 vaccination program, the global economy is on a path to resume its pre-pandemic levels of performance. With that said, these stocks are committed to further growth in the face of challenging market conditions.

Which shares pay the best dividends in Ireland?

We found AT&T shares pay the best dividends in Ireland. At the time of writing AT&T stock has a dividend yield of 8.03%.

Where can I buy the best stocks in Ireland?

You can buy the best stocks including big tech stocks, dividend stocks, and growth stocks, at eToro. This fully regulated, copy trading platform offers stock and ETF trading with 0% commissions. Furthermore, you can buy fractional shares starting from just $50. eToro also gives you access to the London Stock Exchange (LSE) and the Irish Stock Exchange.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael Graw

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.