Best AI Stocks UK To Watch

Artificial intelligence is one of the most important technologies shaping the future of how we live and work. Automation and other AI-related processes have already begun to transform businesses and open up new technologies. Take, for example, voice assistants.

Given how important AI is expected to become, many investors are wondering how they can invest in this technology today. In this guide, we’ll review 10 popular AI stocks in the UK in 2021 and show you how to invest in these stocks as well.

-

-

10 AI Stocks 2021

Every company likes to say that it’s working with artificial intelligence. The phrase brings with it more investor attention and industry clout. But not every company is approaching AI in the same way or using it to the same degree.

With that in mind, here are 10 companies that are using AI to power growth:

- Amazon

- Kainos Group

- DocuSign

- Palo Alto Networks

- Ocado Group

- Adobe

- Nvidia

- Fortinet

- Sensyne Health PLC

- IBM

Popular AI Stocks UK Reviewed

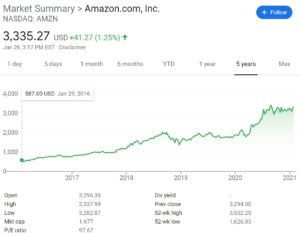

1. Amazon

Amazon is known for a lot of things, but AI isn’t typically one of them. To be fair, Amazon isn’t spending its massive amounts of cash on developing new or better artificial intelligence algorithms. But what the company is doing is investing heavily in Amazon Web Services, which provides the computing power for a vast number of the biggest AI companies.

Amazon Web Services is in fact crucial to the spread of AI because it allows these algorithms to be accessed from any business, anywhere in the world. Amazon currently dominates the cloud computing market, with a 32% market share (Microsoft Azure is in second place, with a 19% market share that pales in comparison). Amazon has also been testing out more advanced computing systems, such as quantum computers, that could open the doors to ever more powerful AI platforms.

Of course, AWS isn’t the only thing driving Amazon’s share price. This company’s value will rise and fall more based on the future of eCommerce than the future of AI.

2. Kainos Group

Northern Ireland-based Kainos Group offers consulting, software, and IT services to businesses. It has a broad portfolio that spans from cybersecurity to data analytics, and the company leverages AI to make all of its products better. Kainos Group’s range also insulates the company somewhat from a drop in any specific niche.

The company’s share price has gained more than 500% in the past 5 years. The company continually beats analysts’ forecasts and it saw a 16% increase in digital revenue over its past half-year reporting period. It’s also seen strong growth in its Workday software, which is a widely used HR platform for businesses of all stripes.

The stock is currently trading with a P/E of 55. It pays a dividend, but the yield is a paltry 0.005%.

3. DocuSign

DocuSign shares exploded last year thanks to the COVID-19 pandemic. As everything moved online, the company’s virtual contract signing service became vital to the continuing functioning of the legal system in the US and abroad. Shares started 2020 at just $75 apiece, but nearly tripled in value to over $220 apiece by July.

The company’s numbers justify its rapid jump in valuation. DocuSign added 166,000 new customers in the first half of the year and has grown its total customer base by 75% in the past two years. On top of that, the company has been steadily increasing revenue at 35-45% year-over-year.

Despite the company’s sensational growth, DocuSign isn’t yet profitable and doesn’t have an estimate on when it will be.

4. Palo Alto Networks

Palo Alto Networks is one of those tech stocks that hasn’t been able to catch a break in recent years. The share price bobbed up and down for years on end, with investors unclear on whether the company was making headway in the cybersecurity niche.

That is, until recently. Palo Alto Networks stock surged over 50% at the end of 2020 as the company’s investments finally started to pay off. One of the biggest investments it has made has been in AI, which it’s leveraging to help keep intruders out of enterprise-scale networks.

The company is planning for a major acceleration in sales in 2021, which bodes well for the stock. At the same time, the SolarWinds hack in the US is a loud signal to companies that they need to invest more in cybersecurity.

5. Ocado Group

Ocado Group has been one of the more popular UK tech stocks this last year. The company’s shares more than doubled in response to the coronavirus pandemic, as consumers switched from buying groceries in-store to relying on curbside pickup and delivery.

While Ocado is known in the UK for its delivery partnership with Marks & Spencer, the company also has a presence in the US. It’s partnered with grocery chain Kroger to build 20 automated warehouses.

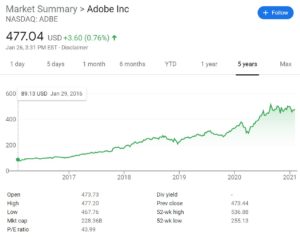

6. Adobe

Adobe is, simply put, one of the biggest stocks on the NASDAQ exchange. This company produces a professional creative suite that no other company even attempts to compete with. As a result, Adobe brings in a gross margin of over 90% on its primary product line.

It has used cash from that business to invest heavily in AI and to fuel its enterprise marketing war with Salesforce, another giant player in the software space. Adobe isn’t yet winning this war, but the company is seeing significant growth in its enterprise market products. T

Despite growing its share price by 440% in the past five years, Adobe shares still only carry a P/E ratio of 44. Adobe stock doesn’t pay a dividend as of yet.

7. Nvidia

Nvidia’s graphics processing units (GPUs) are the physical engines that drive AI. While there are other chipmakers, almost none have the same clout as Nvidia when it comes to the kind of high-end performance and multi-process threading that AI applications demand. Nvidia also acquired competitor ARM in September, giving them more control over the design of chips that companies like Apple use.

It’s worth noting that Nvidia currently gets nearly half of its revenue from chips made for video gaming.

Currently Nvidia has a pricey 87.5 P/E ratio or meager 0.12% dividend yield. Nvidia shares grew 120% last year.

8. Fortinet

Fortinet is a cybersecurity stock that is growing fast and strong financially. It had a 34% free cash flow margin at the start of the year and has grown its revenue by 10-20% every quarter for the last several years.

This financial stability is important because Fortinet is going to need to spend money if it wants to incorporate AI into its products. The company has a huge tailwind behind it thanks to the shift to remote work and events like the SolarWinds hack in the US.

Fortinet isn’t cheap, with a P/E ratio of over 56 at the time of writing. It also doesn’t pay a dividend.

9. Sensyne Health PLC

AIM-listed Sensyne Health PLC works with the NIH to improve patient outcomes. The company has access to a trove of anonymized patient data, which it’s used to train its algorithm and which can suggest ways to make healthcare work better for patients.

The company’s approach is gaining traction. It recently entered into an analytical partnership with biotech company Roche. Shares have been climbing since the Conservative election victory last year, which removed a lot of uncertainty for Sensyne Health PLC. Still, the share price is just 147p, and investment firm Peel Hunt has a price target of 195p – a gain of 33%.

Sensyne Health isn’t currently profitable as of yet.

10. IBM

IBM was one of the biggest US tech companies for decades, but it’s largely been left out of the tech boom in recent years. That all seems set to change now, as the company recently announced a major shift towards cloud computing and AI. Cloud computing has been one of the few bright spots for IBM in recent years, and the new CEO comes from the cloud and AI divisions of the company.

It also doesn’t hurt that the company is trading with a P/E of just 19.4, or that it sports a dividend yield of 5.4%.

Are AI Stocks a Valuable Investment?

AI impacts everything from cybersecurity to pharmaceutical development to daily office tasks. The basic concept is that an algorithm is able to learn from data over time, and then make decisions automatically going forward. So, it’s possible for an AI system to find new drugs, spot suspicious activity inside a business network, or automate a company’s HR or accounting departments.

AI is forecast to be one of the most disruptive technologies in human history, however, this does not mean that the success of AI is definitive.

Depending on your research, you should be able to decide whether or not you wish to invest in the future of AI stocks.

AI Stock Features to Look At

While picking AI stocks, users may want to focus on a variety of features while analysing the stocks and companies. Here are a few of them:

AI Pure-play vs. AI-adjacent Stocks

One thing you’ll notice about our AI stock picks is that very few of them are pure AI companies – that is, companies whose business models revolve solely around building or deploying an AI algorithm.

While such companies do exist, most in that category are private startups. AI technology still has a long way to go. That said, the share prices of these AI-adjacent companies depends on a lot more than AI development. In the case of Amazon, for example, eCommerce and non-AI-related cloud computing drives the bottom line more than the company’s AI efforts.

Valuation

Tech stocks in general, and AI stocks in particular, can have soaring valuations. To some extent, this is justified – AI services are expected to change the way the world does business and open up new product lines.

Before you invest in a pricey stock, however, be sure to think carefully about how the company is using AI and what it can do with it. If it’s using AI simply to make an existing product better, then a massive valuation might not be fully worthwhile. On the other hand, if the company is developing an entirely new category of products or services with its AI technology, then a huge valuation makes more sense.

Growth Stocks vs. Blue Chip Stocks

Within the world of AI stocks, there are two types of players: growth stocks and blue chip stocks.

Growth stocks, such as Ocado Group and DocuSign, are relatively new companies with a tiny market share.

Blue chip stocks, such as IBM and Amazon, are more mature companies that already have a dominant market position.

Growth stocks and blue chips stocks offer very different risk profiles for investing in AI. With growth stocks, there’s much more risk that the company doesn’t realize its potential, but more reward to be collected in case the investment works out.

You may want to go through these multiple factors to assess your investment decisions properly. Only invest in the sector after properly analysing and coming to a well-thought out investment strategy for the future.

Popular Stock Brokers in the UK

In order to purchase AI stocks in the UK, you’ll need to find a stock broker with a wide selection of shares. Since the tech sector has been so big in recent years, many UK brokers offer trading on top AI shares. So, you can look at other factors when choosing the right broker to purchase AI stocks.

In the sections below, we have reviewed a few of the popular brokers that allow users to trade AI stocks in the UK.

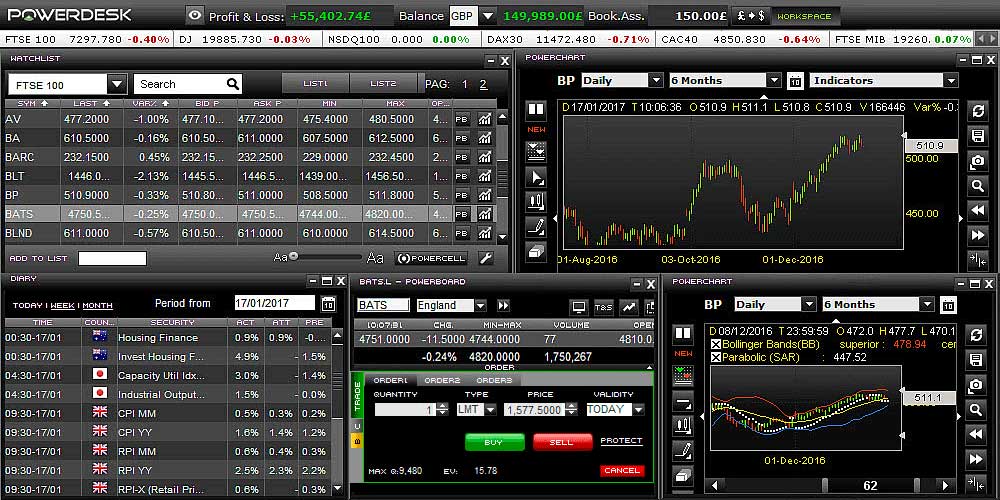

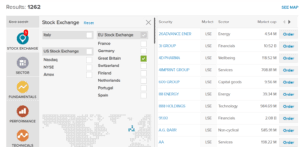

1. Fineco Bank

Fineco Bank

is an Italian bank with a large presence in the UK. This CFD broker and share dealing platform offers access to thousands of shares from the UK, US, and Europe. You may also trade a wide range of ETFs or access options for popular AI stocks. CFD trading is 100% commission-free, and the commission on share deals is just £2.95 per trade for UK stocks or $3.95 for US stocks.

In addition to offering a wide selection of shares, Fineco Bank gives you a suite of tools to help you find trading opportunities. The PowerDesk trading platform includes a news feed, economic calendar, and dozens of technical indicators. The only shortcoming is that the platform doesn’t include much in the way of analyst research.

Fineco Bank also offers an intuitive global stock screener. Share can be filtered from all of the markets that Fineco Bank offers by variables like market cap, market sector, and recent performance. This makes it straightforward to discover high-performing AI stocks, which you can then dive into in more detail in PowerDesk.

Fineco Bank is regulated by the UK’s Financial Conduct Authority and the Bank of Italy. It’s also publicly traded on the Milan Stock Exchange, which means the broker is relatively transparent about its financial well-being.

Sponsored Ad. Your capital is at risk.

How to Purchase AI Stocks in the UK

If you are keen on investing in AI stocks, you should do so with a reputable stock broker that can provide a range of features – such as low fees on trading, multiple stock options and low deposits.

After choosing your broker, here is how users can begin trading in 4 steps:

Step 1: Open a Brokerage Account

Head over to the homepage of your chosen broker and begin the account set-up process. You may be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verification

Users may need to verify their accounts if they are trading with regulated brokers. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in AI Stocks

Once your account has been funded, you can search for your preferred AI stocks on the platform’s search bar. Enter the amount of money you wish to deposit into the stock and confirm your transaction.

Conclusion

AI and related technologies can be an exciting area for investors, with this new industry expected to take-off in the coming years. While there are tons of companies providing services in this sector, users should analyse and invest in their preferred stocks after conducting their own market research and analysis of the company.

FAQs

Can I invest in AI stocks through an ETF?

Yes, you can invest in AI through ETFs. Most US and UK technology ETFs are invested in some or all the companies we highlighted. You also have the option to find smaller ETFs focused specifically on AI.

Are there any pharmaceutical companies using AI?

Yes, many pharma companies are leveraging AI for drug development and for personalized medicine. Pfizer and Moderna used AI to help with the design of their COVID-19 vaccines.

Is Apple an AI company?

Apple uses AI in many of its products, including the Siri voice assistant, the Apple Watch, and the iPhone.

How is cloud computing related to AI?

Cloud computing provided by companies like Amazon, Microsoft, and IBM gives companies everywhere the computing power needed to run AI algorithms. Cloud computing has enabled AI to be used in a wide range of products, rather than only by companies with huge server networks.

Do AI stocks pay dividends?

Some AI stocks like IBM pay dividends, but many do not. AI requires a huge amount of ongoing investment, so many tech companies choose to reinvest profits instead of making payments to shareholders.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up