Best Pharmaceutical Stocks UK to Watch

Pharmaceutical stocks are public companies that operate in the healthcare sector. This can be anything from research and development, manufacturing, licensing, or the distribution of drugs and treatments.

In this guide, we explore some pharmaceutical stocks to research in 2024. We also discuss some UK brokers that allow traders to access pharmaceutical stocks online.

[toc]What are Pharmaceutical Stocks?

Put simply, pharmaceutical stocks are companies that operate in the healthcare sector. Some – like GlaxoSmithKline and AstraZeneca, have huge multi-billion pound market capitalizations that have a global presence.

Put simply, pharmaceutical stocks are companies that operate in the healthcare sector. Some – like GlaxoSmithKline and AstraZeneca, have huge multi-billion pound market capitalizations that have a global presence.

Such pharmaceutical companies are involved in the entire end-to-end process of research and developing new treatments, manufacturing drugs, and then distributing the final product.

In other cases, some pharmaceutical stocks are up and coming, with much smaller market capitalizations. These are known as rising pharmaceutical shares and might specialize in a certain niche of the healthcare space, and offer much higher growth potential.

Why Do Some People Invest in Pharmaceutical Stocks?

Pharmaceutical stocks are often sought-after by some investors for a number of reasons, which we expand on below.

Defensive Stocks

Pharmaceutical stocks possess ‘defensive’ qualities. In Layman’s terms, a defensive stock is often immune, or less impacted, to a wider stock market downfall. This is because it offers products and services that are always in demand. As you can imagine, pharmaceutical shares are in the business of developing, producing and distributing products associated with health and medicine.

As a result, there will always be a need for such products – irrespective of how the economy is performing. For example, while the vast majority of companies making up the S&P 500 went down in value in 2008, the likes of Vertex Phamaceuticals Inc. increased its stock price by over 30.8%.

Then you have Edwards Lifesciences Corp – a manufacturer of medical devices, which saw its stocks increase by just under 20% during the same period.

Strong and Stable

Some of the largest stocks on the FTSE 100 and NYSE operate in the pharmaceutical arena. In fact, the largest constituent of the FTSE 100 Index is that of AstraZeneca, which carries a market capitalization of over £111 billion.

These strong and stable characteristics are why pharmaceutical stocks are often referred to as ‘high-grade’.

Consistent Dividends

Leading on from the above section, strong and stable pharmaceutical shares often have a long-standing track record of paying consistent dividends.

To give you an idea of which pharmaceutical stocks pay dividends, below you will find a selection of the most prominent.

- Amgen: 3.0%

- Gilead Sciences: 3.6%

- GlaxoSmithKline: 4.5%

- Novartis: 3.5%

- PetMed Express: 4%

- Sanofi: 3.5%

Portfolio diversification

When we talk about diversification in the stock markets, this generally means holding a basket of shares from multiple sectors. With that being said, it is also possible to diversify within specific large-scale industries such as the pharmaceutical space.

This includes:

- End-to-End Providers: In the case of multi-billion-pound pharmaceutical stocks like GlaxoSmithKline and Novartis, these companies are involved in the entire end-to-end supply chain. That is to say, these companies spend billions each year researching new drugs and treatments. They also manufacturer existing drugs, license them to third parties, and of course – distribute the final product.

- Research and Development: Some pharmaceutical stocks are involved purely in research and development. Such companies will focus on specific niches within the healthcare space, with the view of discovering new treatments. If and when they are successful, they will typically license the drug to major manufacturers.

- Manufacturers: In other cases, some pharmaceutical stocks are focus exclusively on production. In other words, those behind the rights to the treatment will get the firm to mass-produce the respective drug. These companies have expertise in manufacturing goods in medical-grade factory conditions.

- Distributors: Distributors are responsible for selling drugs and treatments to the end market. This could be anything from the health sector of a certain country or state or direct to private hospitals and pharmacies.

What are Pharmaceutical ETFs?

If you think that creating a diversified portfolio of pharmaceutical stocks is challenging, you will be pleased to learn that you can now access the market through an ETF (exchange-traded fund). For those unaware, ETFs allow you to invest in dozens (sometimes hundreds) of stocks through a single trade. Moreover, the ETF provider will buy and sell stocks on your behalf and even distribute your share of dividends.

For example, the SPDR S&P Pharmaceuticals ETF contains some of the most popular pharmaceutical stocks in the industry. To give you an idea of just how diverse this particular ETF is, below you will find a list of the shares it holds.

| Horizon Therapeutics Public Limited Company | 218,028 | $11,210.14 | 5.37% |

| Axsome Therapeutics Inc. | 138,986 | $3,182.60 | 5.00% |

| Eli Lilly and Company | 69,973 | $161,863.92 | 4.96% |

| Catalent Inc | 144,380 | $12,494.91 | 4.61% |

| Perrigo Co. Plc | 195,077 | $7,486.96 | 4.49% |

| Bristol-Myers Squibb Company | 178,824 | $134,765.81 | 4.46% |

| Zoetis Inc. Class A | 74,920 | $65,926.53 | 4.36% |

| Jazz Pharmaceuticals Plc | 95,955 | $5,952.00 | 4.32% |

| Merck & Co. Inc. | 131,645 | $196,677.97 | 4.30% |

| Mylan N.V. | 630,139 | $8,369.38 | 4.27% |

List of Popular Pharmaceutical Stocks in 2024

We are now going to discuss some popular pharmaceutical. As always, just make sure you perform your own research prior to taking the plunge.

1. GlaxoSmithKline – Strong and Stable With Healthy Dividends

As noted earlier, this particular pharmaceutical stock is a major player in the industry, with a market capitalization of over £80 billion. It’s also listed on the London Stock Exchange.

Although the firm is involved in most sectors within the wider pharmaceutical industry, it particularly excels in treatments related to cardiovascular, neurological, and respiratory issues.

At the time of writing in Q2 2020, this stands at a trailing yield of 4.5%. It is also important to note that GlaxoSmithKline (alongside Sanofi) is in the process of signing a deal with the UK government with respect to the supply of a COV-19-related treatment. The deal is reported to be worth in the region £500 billion.

2. AstraZeneca – Stocks up 30% Year-on-Year in Q2 2020

While there is no denying that GlaxoSmithKline is a giant in the pharmaceutical arena, AstraZeneca is even bigger and is a popular pharmaceutical stock. In fact – and as noted above, of all the FTSE 100 companies the firm is situated in number one for the largest market capitalization – which at the time of writing stands at £111 billion.

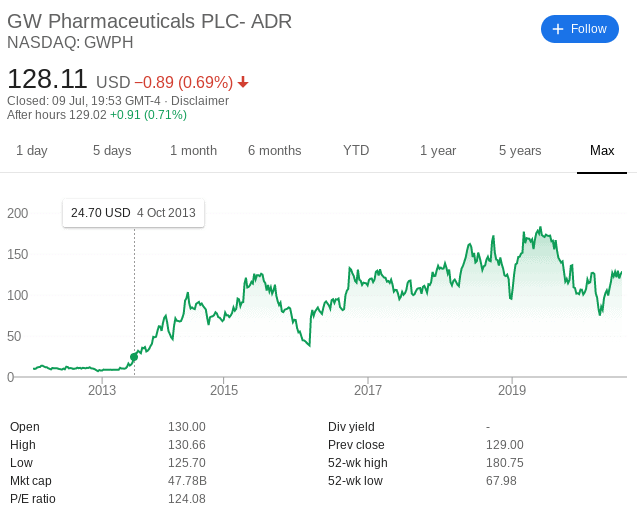

3. GW Pharmaceuticals

GW Pharmaceuticals is a UK-based pharmaceutical company that was founded in 1998. The company is involved specifically in cannabinoid-based medicines – and develops treatments for multiple sclerosis. It also focused on developing treatments for childhood-onset epilepsy.

This particular share also falls within the remit of a cannabis stock.

This is because its stocks were priced at just $10 back in 2012. The same shares are now priced at $128 as of July 2020. The firm is listed on the US-based NASDAQ exchange.

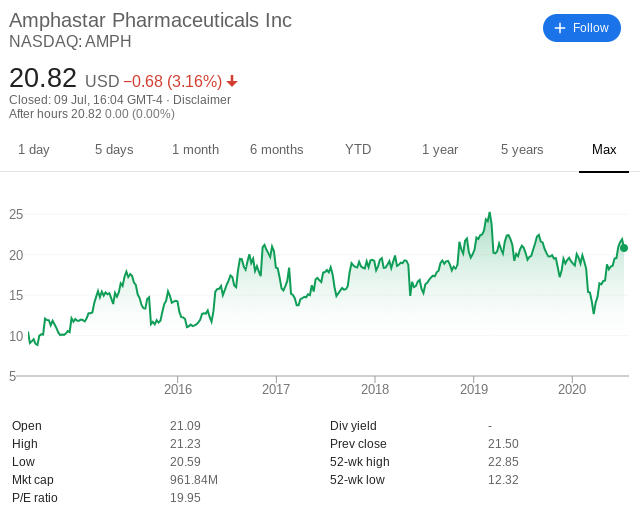

4. Amphastar Pharmaceuticals

Although the firm was launched back in 1996, it only went public in 2014. Opting for the NASDAQ exchange, this particular pharmaceutical stock has a market capitalization of just under $1 billion.

In the grand scheme of things, this actually makes Amphastar Pharmaceuticals ‘small fry’ in comparison to the other stocks. In terms of its performance, Amphastar Pharmaceuticals was valued at just over $10 per share in 2014.

It last hit all-time highs in early 2019 at a price of $24. At the time of writing in July 2020, its shares are valued at just over $20. This represents a 6-year increase of just over 100%. Much like in the case of GW Pharmaceuticals, Amphastar Pharmaceuticals is yet to pay any dividends.

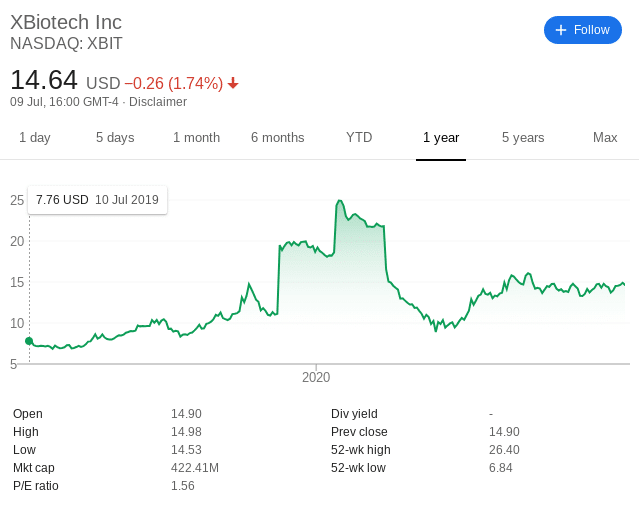

5. XBiotech Inc

XBiotech is a biotechnology company that is involved in several clinical-stage treatments. As of Q2 2020, the firm is involved in an antibody therapy trial for COV-19-related issues. Although this particular pharmaceutical stock is listed on the NASDAQ exchange, it has a micro-market capitalization of just $422 million.

In fact, with the shares moving from $7.76 to $14.90 in just 12 months, this represents a 1-year increase of 92%. We should also note that the firm is currently trading at a P/E ratio of just 1.56 times. This potentially indicates that the stocks can be purchased at a major discount.

Important Features of Pharmaceutical Stock

So now that we have discussed five pharmaceutical stocks we now need to explain some of the things that you need to research when selecting your own picks. After all, there are hundreds of pharmaceutical stocks active in the space.

Look at the Financials

As is the case with any investment, you need to spend some time exploring the financials. That is to say, look at some key accounting ratios that seasoned investors utilize to determine the viability of an investment.

For example, the P/E ratio tells us whether or no the stock is trading at a premium or discount. Then, you have the likes of the debt-to-equity ratio, which gives us a closer look at how healthy the firm’s balance sheet is.

Is the Pharmaceutical Stock Overexposed?

Large-scale pharmaceutical stocks will be highly diversified into dozens of medical and drug areas. In other words, they never put all of their eggs into one basket. Instead, they will collectively work on several treatments at any given time. However, some of the smaller rising pharmaceutical stocks active in the space concentrate on a single treatment.

Let’s take GW Pharmaceuticals as a prime example, not least because its treatments and drugs are centred on cannabis plants. On the one hand, as more and more governments around the world begin to relax laws on medical cannabis usage.

On the other hand, the industry is highly susceptible to legislative changes. That is to say, if a major market like the US or Canada decided to pull the regulatory plug on cannabis, GW Pharmaceuticals. could be in trouble. As a result, it’s always common practice to have a well-balanced portfolio of pharmaceutical stocks.

Learn More: Read our in-depth guide on how to pick stocks and shares to avoid relying on third-party opinions!

What Are the Risks of Investing in Pharmaceutical Stocks?

The risks of investing in pharmaceutical stocks are much the same as any other investment. In other words, there is never any guarantee that you will make money. In fact, there are plenty of pharmaceutical shares that are yet to reach their full potential and many others that are staring at a stagnant share price.

One of the overarching reasons for this is that much of the industry is based on research and development. That is to say, pharmaceutical companies spend billions of pounds attempting to discover new treatments.

Of course, there is no certainty that they will be successful, meaning that cash resources are being drained at the rate of knots. Even if a treatment does come to fruition, it then needs to go through the long and drawn-out process of clinical trials. After that, the firm in question is required to get regulatory approval, which again, offers no guarantees.

Which Brokers offer Pharmaceutical Stocks?

Put simply, if you want to buy pharmaceutical stocks you will need to find an online stock broker. Not only do you need to ensure that the broker offers your chosen shares, but you also need to look at metrics surrounding fees, commissions, safety, and supported payment methods.

To help point you in the right direction, below you will find a selection of UK stock brokers that allow you to buy pharmaceutical stocks with ease.

1. FXCM

While many of you will be looking to buy pharmaceutical stocks in the traditional sense, meaning that you will hold on to the shares for many years. Put simply, you will be speculating on the short-term price movement of pharmaceutical stocks via CFDs.

This means that you will have the option of going long (buy order) or short (sell order), as well as apply leverage. A provider of pharmaceutical stock CFDs is that of FXCM. The trading platform allows you to trade stock CFDs without paying any commissions, and spreads are very competitive.

You will also be able to apply leverage of up to 1:5 as a UK retail trader, and more if you are a professional client. FXCM allows you to open an account and start trading with a minimum deposit of just £50. This is ideal if you want to learn the ins and outs of stock trading without risking too much money.

This CFD broker is also popular because it offers the industry-leading trading platform MT4. This is a third-party platform utilized by most seasoned traders, as it comes packed with technical indicators, charts, drawing tools, and the ability to deploy trading robots. When it comes to safety, not only was FXCM launched way back in 1999, but it is regulated by the FCA.

Sponsored ad. 73.05% of retail investors lose money when trading CFDs at this site

2. IG

Another broker that offers some pharmaceutical stocks is IG. This UK-based broker was launched all the way back in the early 1970s, and it is licensed by the FCA, as well as ASIC. The platform is particularly popular because it permits access to a huge range of over 10,000 companies.

This means that you will be able to buy pharmaceutical stocks that are listed overseas. IG charges a flat commission of £8 per trade, which you pay when you both buy and sell pharmaceutical stocks.

IG offers users a choice of several different trading platforms. Alternatively, this broker also supports MetaTrader 4 and ProRealTime, which provide access to a variety of advanced tools.

When it comes to deposits, IG supports a range of methods, including PayPal, and accounts take just minutes to set up. The only real drawback to IG is that it charges a 0.5% and 1% transaction fee when using a MasterCard or Visa.

Sponsored ad. There is no guarantee you will make money with this provider.

Conclusion

Pharmaceutical stocks are plentiful in the global investment scene. Although they are often referred to as ‘strong and stable’, there are actually pharmaceutical companies of all shapes and sizes. In other words, while some have multi-billion pound market caps, others are just starting out and thus – offer a much higher risk vs reward ratio.