Best Chinese ETFs UK to Watch

China, Asia’s largest economy, has only just started opening up its mainland stock market to the rest of the world and the opportunities for investors are numerous. Chinese ETFs offer investors a way to access the rapidly developing market.

In this guide, we examine 5 Chinese ETFs you can research today. We’ll also take a look at some other Chinese ETFs, explain how they work, and show you how to invest without paying any commission.

Key points on Chinese ETFs

- Chinese ETFs provide exposure to one of the world’s most rapidly developing financial markets and offers a wide range of investment opportunities.

- Some of the popular Chinese ETFs are the KraneShares MSCI China Clean Technology Index ETF, the HSBC MSCI China UCITS ETF, and the Xtrackers Harvest CSI 300 China A-Shares ETF.

- Although the growth of Chinese is appealing, you should bear in mind that there are also risks, such as trade tensions with the US.

Popular Chinese ETF UK 2022 List

You’d be wrong to think that China is dominated exclusively by state-owned enterprises. Tencent Holdings and China Yangtze Power Co are just a few examples of companies whose shares are publicly traded. While exposure to international markets, especially to the world’s second-largest economy, gives investors the benefit of diversification, it may be too time-consuming to sift through dozens of different Chinese ETFs.

We’ve done exactly that.

- 1. KraneShares MSCI China Clean Technology Index ETF

- 2. HSBC MSCI China UCITS ETF

- 3. Xtrackers Harvest CSI 300 China A-Shares ETF

- 4. iShares MSCI China ETF

- 5. Invesco China Technology ETF

Chinese ETFs UK Reviewed

Now for a closer look at the ETFs that cover Chinese companies and markets.

1. KraneShares MSCI China Clean Technology Index ETF (KGRN)

Ranked as a Chinese ETF, KGRN has gained 71% in the last 12-months, dwarfing the S&P 500 ETF which is up close to 34% in this period.

The KGRN stock price fell by -1.90% on 9 November 2021 from $49.54 to $48.60. The price has risen in 6 of the last 10 days and is up by 0.48% over the past 2 weeks. The year-to-date total return of the Chinese ETF is 4.65%.

It’s worth nothing that China generates 31% of the world’s total renewable energy capacity and has allocated $360 billion to invest in this sector between 2017 and 2020. The country expects renewable energy to account for 35% of total electricity consumption by 2030.

2. HSBC MSCI China UCITS ETF

The HMCH stock price has fallen -0.997% in the last 52 weeks, while the year-to-date total return of the Chinese ETF is -15.58%.

A-Shares have outshone H-Shares over the past year and this is highlighted in the 66.5% returns of HMCT versus just 11% for the Amundi MSCI China UCITS ETF which solely offers exposure to the H-Shares market.

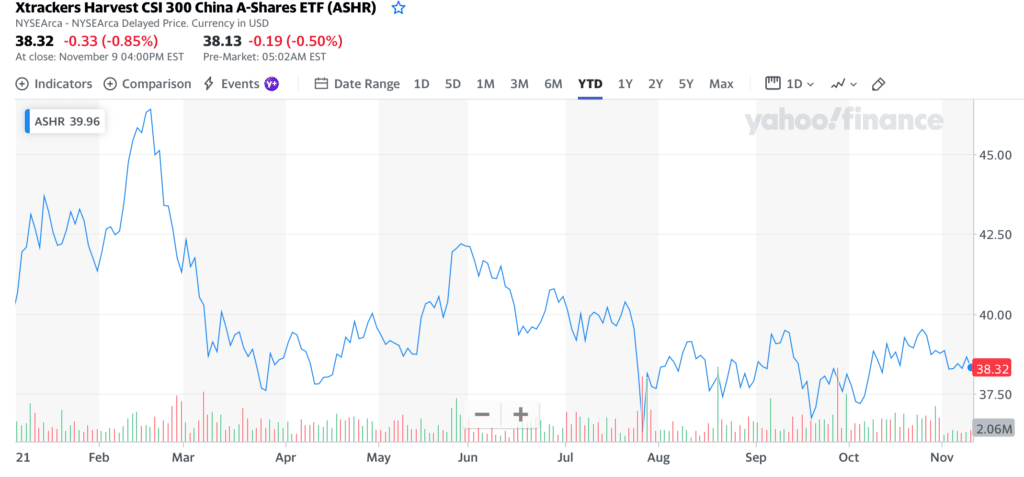

3. Xtrackers Harvest CSI 300 China A-Shares ETF

The ASHR stock price fell by -0.85% on 9 November 2021 from $38.65 to $38.32. The price has been fluctuating heavily recently and there has been a -2.54% loss for the last 2 weeks. The year-to-date total return of the Chinese ETF is -5.76%.

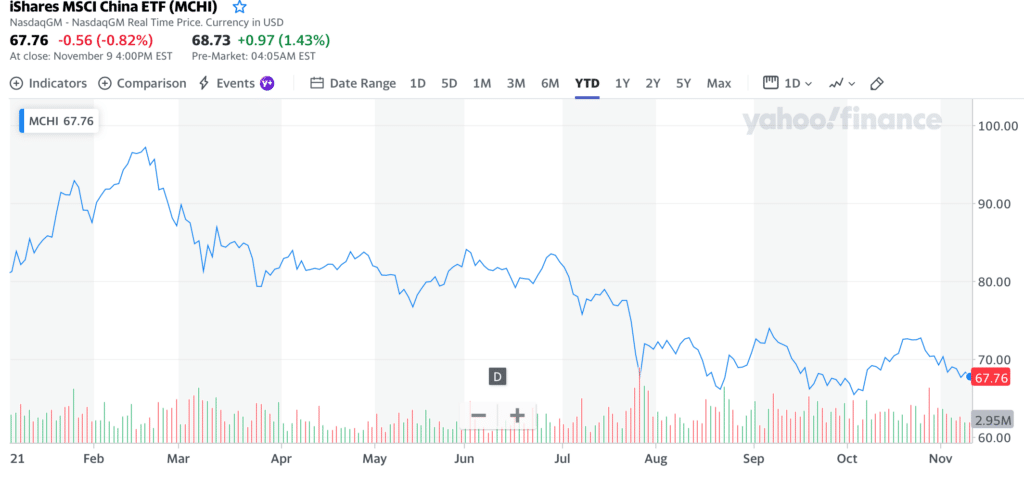

4. iShares MSCI China ETF

The MSCI stock price fell by -0.15% on 9 November 2021 from from $653.81 to $652.82. The price has fallen in 6 of the last 10 days, but is still up by 1.51% over the past 2 weeks. The iShares ETF is up 20% year-to-date, outdistancing the returns of both the Vanguard China ETF (iShares MSCI Emerging Markets ETF) which has been up about 12%, and the SPDR S&P 500 ETF, which has gained 5%.

5. Invesco China Technology ETF

The CQQQ stock price fell by -0.20 on 9 November 2021 from from $68.88 to $68.74. The price has fallen in 6 of the last 10 days and is down by -1.53% for this period. Since 20 October 2021, the Chinese ETF has fallen by -4.96%. The year-to-date total return of the Chinese ETF is -17.28%.

What is a Chinese ETF?

The use of ETFs became widespread during the 2000s and has recently accelerated. ETFs combine the structure of a traditional savings vehicle – the mutual fund – with real-time pricing on stock exchanges, offering many different kinds of investors a powerful tool. They have a wide range of uses, from acting as core holdings in long-term savings plans, serving as a useful tool for making tactical asset allocation changes and permitting investors to take short-term views on market movements.

Just as there are European ETFs and Russia ETFs that cover those markets, there are also ETFs that specifically allow you to gain exposure to Chinese markets.

China’s stock market has three main components: the mainland, Hong Kong and U.S-listed Chinese companies. Using exchange-traded funds (ETFs) is a convenient way to get exposure to Chinese markets as they allow one to invest in baskets of Chinese companies without having to buy stocks directly. Instead, the issuing company purchases the underlying asset (such as stocks, bonds or currency), and fund investors purchase shares in the fund. As the underlying assets rise and fall, so does the value of your fund investment.

As tradable funds, Chinese ETFs enable investors and traders to enter and exit positions at dealing prices set freely by the interaction of other market participants. There are a multitude of Chinese companies listed on Shanghai, Shenzhen, Hong Kong, London and the US stock markets and investing in a Chinese ETF gives you instant exposure to hundreds of Chinese companies.

It may come as a surprise that some of the Chinese ETFs are not eligible to hold all investable shares. For example, the $6.1 billion iShares FTSE China 25 Index Fund, which holds 25 of the largest and most liquid Hong Kong-listed Chinese shares, is only eligible to hold H-shares and red chips.

The key to knowing which share class a fund is eligible to hold lies in knowing which index the fund tracks.

Fundamentals of Chinese ETFs

Chinese equities, as measured by the MSCI China Index, have significantly underperformed the U.S stock market over the past 12 months, posting a total return of 2.4% compared to the S&P 500’s total return of 35.5%, as of 11 August 2021.

Investing in Chinese ETFs carries risks, such as trade tensions with the U.S. For example, certain Chinese stocks were delisted by the New York Stock Exchange (NYSE) after an executive order signed by the former U.S President Donald Trump in November 2020 banned U.S investors from investing in Chinese companies with alleged ties to the Chinese military. Ongoing trade tensions between the U.S. and China continue to pose risks.

Also, despite its size and economic prowess, China’s share of global equity indices is surprisingly low. China only makes up 52% of MSCI’s All Country Equity index known as MSCI ACWI, while the US takes 58.21%. Overall, Chinese equities are widely under-represented in global indices and investment portfolios.

More importantly, the bottom has fallen out for China since the government decided to target many of the country’s biggest businesses with a regulatory crackdown. For context, Alibaba, Tencent and JD.com were early recipient’s of the Chinese government’s attention and their stock prices have been plummeting ever since.

With every investment you make, there is a risk that its value may fall. Investors should be aware of the risks and uncertainty surrounding China, including US-China tensions and environmental, social and governance concerns.

Brokers Offering Chinese ETFs

You don’t have to search far and wide to invest in Chinese ETFs, as there are dozens of brokers that can enable you to do this.

ETFs trade like individual stocks, so many of the features sought by investors in a share dealing account are also relevant to ETF investors. Fortunately, some brokers offer ETFs commission-free. Besides commissions, it’s also important to consider other criteria including a broker’s fund selection and tools for creating a well-diversified portfolio.

Here are online ETF brokers for every kind of Chinese ETF investor, whether you’re looking for a broker with free commissions, the broadest range of ETFs or a trading platform to help you build and manage a portfolio.

Frequently Asked Questions on Chinese ETFs

What is a Chinese ETF?

What is the largest Chinese ETF?

How do I invest in a Chinese ETF?