How to Buy UPS Shares UK – with 0% Commission

United Parcel Service Inc, also known as UPS, is among the most well-known global companies in the world with more than 500k employees across 220 countries worldwide. This American company is the largest global courier delivery service as of 2020 with a market capitalisation of nearly $145bn and annual revenues of 46.5 billion in 2019. In 2020, the UPS stock has performed incredibly well and is up around 40% since the beginning of the year.

So, if you want to buy UPS shares online in the UK today, this guide will show you everything you need to know. We’ll suggest the best UK stockbrokers to buy UPS shares from, explore the UPS stock price performance, and conduct market research to help you decide whether it’s the right investment for you right now.

-

-

Step 1: Find a UK Stock Broker That Offers UPS Shares

UPS is an American company that has a primary listing on the New York Stock Exchange since the company went public in 1999. This means that buying shares of UPS in the UK should not be a huge problem as it is one of the most traded stocks in the US and worldwide. With that in mind, you want to make sure you find the best UK stockbroker for your needs, and check carefully the broker’s regulatory framework, fees and commissions, and trading features.

UPS is an American company that has a primary listing on the New York Stock Exchange since the company went public in 1999. This means that buying shares of UPS in the UK should not be a huge problem as it is one of the most traded stocks in the US and worldwide. With that in mind, you want to make sure you find the best UK stockbroker for your needs, and check carefully the broker’s regulatory framework, fees and commissions, and trading features.To help you get started, below you will find two of the best UK stockbrokers to trade or buy UPS shares in the UK.

1. Fineco Bank – Trusted UK Share Dealing Platform With Low Fees

Fineco Bank is an Italian institution with trading and investing solutions in many countries and regions including the United Kingdom. This broker is considered one of the safest and well-regulated brokers in the industry with a huge variety of services, and financial products. When trading with Fineco Bank, you’ll get access to UK and international stocks directly from the exchange or global CFD trading. You can also trade futures, currency pairs, indices, options, and even bonds.

Fineco Bank is an Italian institution with trading and investing solutions in many countries and regions including the United Kingdom. This broker is considered one of the safest and well-regulated brokers in the industry with a huge variety of services, and financial products. When trading with Fineco Bank, you’ll get access to UK and international stocks directly from the exchange or global CFD trading. You can also trade futures, currency pairs, indices, options, and even bonds.This is considered below the average in the industry, which normally ranges between $5-$7. The broker also offers a decent range of trading platforms for all levels of traders and investors. As such, users can choose between the PowerDesk, which is a professional trading platform, and the web platform which gives investors an easy-to-use interface. Crucially, both platforms are available on any mobile device.

To get started with this broker, you will have to meet a minimum deposit requirement of £100, and complete a short registration process. Fineco Bank is also a regulated broker by several agencies including the Financial Conduct Authority in the UK.

Pros:

- Charges a fixed rate of £2.95 per trade when buying and selling shares

- Access to thousands of UK and international shares, including UPS

- Deposit funds with a UK bank account

- Heavily regulated, including an FCA license

- Suitable for both newbies and experienced investors

- Great research and educational department

- Established way back in 1999

Cons:

- Does not offer commission free trading

- Still relatively unheard of in the UK investment scene

Step 2: Research UPS Shares

So far this year, UPS shares have dropped dramatically in March and then rallied since the eCommerce boom emerged amid the Covid-19 pandemic. As a matter of fact, shares of UPS trade at all-time highs levels since the largest express carrier in the world has seen a significant increase in online orders. Indeed, UPS has a YTD return of around 40 % as of November, and an increase of 13.4% in revenues in the Q2 from the previous year. But the question is whether the UPS stock can climb any higher than where it is right now.

With that in mind, let’s take a close look at UPS’s share price history, future outlook, and Wall Street analysts’ opinions.

How Much Are UPS Shares Worth? UPS Share Price History

UPS foundation story is quite an interesting one. This company was founded in 1907 in Seattle Washington by two teenagers who had borrowed $100 from a friend and started a small delivery business called American Messenger Company. In the first years of operation, the company was mostly delivering messages to and from businesses on foot and bicycle, but in 1910, the company has made its first investment when it acquired the Model T Ford. Just a few years later, UPS founders James Casey and Claude Ryan merged with one of its competitors and formed a new company called Merchants Parcel Delivery.

UPS’s expansion during the previous century was very impressive and steady despite several challenges such as the great depression in 1929 and the decreasing demand for third party commercial parcel service due to growing personal car ownership in the early 40s and 50s. Even so, by 1962, UPS had grown to operate in 31 US states, and in 48 US states by 1975.

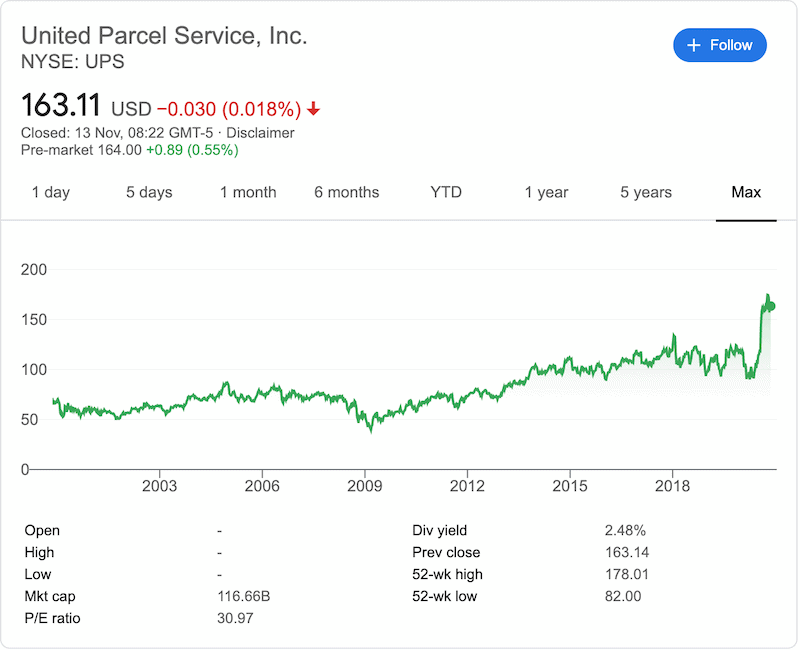

In 1999, the company finally went public at a price of $50 per share in the biggest ever Initial Public Offering at the time. UPS shares were trading in a relatively narrow until the 2008 economic crisis when it reached the bottom price of $39.38 in 2009. But since then, UPS shares have been on a long steady upward trajectory. So far this year, UPS shares fell drastically in March when the Covid-19 pandemic disrupted business and the global economy. The UPS share price reached a yearly bottom of around $86 per share in March, but once it was clear that the Covid-19 is positively affecting many e-commerce businesses, UPS shares have had an incredible run of nearly 100% growth in just seven months. Eventually, UPS reached an all-time high of $176.54 on October 12, 2020, and is currently trading near the all-time high territory.

UPS Share Fundamentals – Market Cap, P/E Ratio and EPS

As of November 2020, Universal Parcel Service Inc has a market capitalisation of almost $118bn. The company’s Price-Per-Earnings (PE) ratio stands at 30.94, which is relatively high and generally means that investors have a higher opinion of the business’s prospects.

In the third quarter of 2020, UPS has reported in its earnings call reports an Earnings Per Share (EPS) of $2.24, an increase of 11% from the previous year. The annual EPS for the twelve months ending on September 30, 2020, was $5.26, a decline of 8.52% from the same time in 2019.

UPS Shares Dividend Information

UPS is considered as one of the best dividend-paying stocks in the industrial sector. The company’s dividend yield has increased by more than 500% over the last 20 years, and the dividend yield stands at around 4% at the time of writing. Moreover, it has a policy of paying quarterly dividends, which makes it another reason why it’s a favorite dividend stock for investors. In the last report, the UPS (NYSE: UPS) Board of Directors declared a regular quarterly dividend of $1.01 per share on all outstanding Class A and Class B shares.

Should I Buy UPS Shares?

Even though UPS shares are trading at all-time high levels, and the bullish momentum remains strong, it is still important that you make your own research and take into the account all the factors why investors and analysts believe UPS has more room to grow. With that in mind, here are the main reasons why we think UPS is still a great long-term investment opportunity.

The Coronavirus eCommerce Boom

The eCommerce boom caused by the Covid-19 pandemic has lead to significant growth in sales and revenues of online retailers companies like Amazon, Chewy, and the world’s largest package delivery company Universal Parcel Service. In the last quarter, UPS reported the strongest sales growth in the past decade and a significant increase in order volumes.

Recently, UBS upgraded UPS shares to buy and set a price target increase of 30% from current levels. The Swiss investment banking company said that UPS’s ability to raise prices while cuttings costs should be a strong catalyst for a further increase in the share price. All in all, as the e-commerce boom is expected to continue in the near future, UPS revenues can follow the trend.

Steady Dividend Policy

Those who invest in dividend-paying stocks like UPS can be rewarded with a dividend yield of around 4%, which is considered very high in the current monetary economic status of near-zero interest rates. The UPS dividend yield is almost double the average yield of the S&P 500 stocks. Moreover, the fact that the package delivery and supply chain company has not scrapped the dividend payment during the Covid-19 pandemic and has presented a steady growth of dividend yield over the past 20 years make it one of the best dividend growth companies in the market right now.

The Most Dominant Package Delivery Service in the World

At the time of writing, UPS is the largest package delivery and supply chain management company in the world in terms of both market capitalisation and revenues. The company’s main competitors are FedEx and the United States Postal Service (USPS). While many people think that UPS and FedEx offer the same service, the big difference between the two is that the first specializes in domestic ground package delivery, while FedEx has the strength of global air express freight.

Technology is a key strength of UPS compared to any other package delivery service in the world. The Atlanta-based company is a leader in developing technology for supply chain and freight management. Additionally, UPS uses some of the most advanced technologies including Barcode Scanner, DIAD, Wireless Communication, ERP, Web service, and GPS tracking device.

UPS Shares: Buy or Sell?

UPS is a blue-chip S&P 500 company with strong cash flow and a huge operation in more than 220 countries worldwide. The company is somewhat resilient in all economic storms as it has been in the case of the coronavirus pandemic.

Ultimately, if you are a low-risk investor looking for security and passive income in the form of dividends, UPS might be the ideal long term share to buy. Further, the market is expecting that more stimulus will come from the Joe Biden administration. This could be a huge factor for another growth in UPS shares as this company is the perfect integration of a tech eCommerce platform and industrial company. For instance, UPS is widely known as one of the most tech-driven companies that use Artificial Intelligence, Machine Learning, and Big Data solutions to improve its service.

The only risk for UPS investors would be a pullback in the stock market if a Covid-19 vaccine will be available soon and if a new coronavirus stimulus package will be delayed under the Joe Biden administration.

The Verdict

The bottom line, UPS shares have been silently reaching all-time highs amid the Covid-19 pandemic that contributed to the company’s growth. But even when the Covid-19 ends, UPS will remain one of the largest companies in the world with steady cash flow, revenue stream, and a stable dividend policy that may constantly attract new investors.

Although UPS stock is trading near its all-time highs, we still think it has more room to grow. As such, any dip in the price is a great opportunity for long-term investors. If you are ready to buy UPS shares, simply click the link below to get started!

FAQs

Who is the chief executive of UPS?

Carol Tome is the Chief Executive Officer of United Parcel Service since June 2020.

What stock exchange is UPS listed on?

Although many people think UPS is listed on the Nasdaq stock exchange, United Parcel Service Inc is listed on the New York Stock Exchange (NYSE) under the ticker symbol UPS.

Does UPS pay dividends?

Yes, UPS pays dividends to shareholders of common stocks. In fact, it is among the best dividend stocks in the market right now.

How do I buy shares in UPS?

To buy UPS shares, you need to find a UK stockbroker that offers you to trade US shares. But while there are plenty of brokers offering you direct access to the US stock market, you might want to consider buying UP shares via a CFD platform that does not charge any trading commission and allow you to leverage your positions with a ratio of 5:1.

Can I invest in UPS via an ISA or SIPP?

Ye. In order to do that, you need to find a brokerage firm in the UK that enables you to buy individual US shares on an ISA or SIPP account.

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom is an expert in the areas of day trading and technical analysis as it applies to futures, cryptocurrencies, forex, and stocks. Tom’s primary interests include economics, trading, social-economic systems, technology, and politics. He has a B.A. in Economics and Management, a Journalism Feature Writing certificate from the London School of Journalism. Tom has written for various websites, such as FX Empire, The Motley Fool, InsideBitcoins, Yahoo Finance, and Learnbonds.View all posts by Tom ChenWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Even though UPS shares are trading at all-time high levels, and the bullish momentum remains strong, it is still important that you make your own research and take into the account all the factors why investors and analysts believe UPS has more room to grow. With that in mind, here are the main reasons why we think UPS is still a great long-term investment opportunity.

Even though UPS shares are trading at all-time high levels, and the bullish momentum remains strong, it is still important that you make your own research and take into the account all the factors why investors and analysts believe UPS has more room to grow. With that in mind, here are the main reasons why we think UPS is still a great long-term investment opportunity.