Lloyds is one of the largest financial institutions in the world. In addition to offering banking, lending, insurance, and much more, Lloyds also offers retail brokerage accounts for everyday trading and investing.

With Lloyds, you get access to the entire UK stock market along with markets in the US and across Europe. Even better, this broker has more than 2,000 mutual funds available for trading and ready-made portfolios to make investing simple.

The downside to Lloyds Bank share dealing is that a brokerage account comes with quite a few fees. Although trading commissions are low, these charges can add up over time and may not be worthwhile for those who only place a few trades each year. In addition, Lloyds’ trading platform leaves plenty to be desired, as the broker doesn’t even offer a mobile app.

Our Lloyds share dealing review will explain everything you need to know about this huge UK broker to help you decide if it’s the right choice for your investments.

What is Lloyds?

Lloyds is a retail and commercial bank headquartered in London, but it has branches all across the UK. Lloyds was founded in 1765 and has since grown into one of the largest financial institutions in the world. In fact, it is considered one of the four main clearinghouse banks in the UK.

In part because of that status, Lloyds was bailed out by the UK government during the 2008 financial crisis. The government took a more than 43% stake in the company at the time of the crisis. Since 2017, though, the UK government has not held any shares of the bank. Lloyds trades on the London Stock Exchange as part of the FTSE 100.

Lloyds has more than 16 million banking and investing customers in total. The bank owns two other major UK brokerage firms, Halifax and iWeb, and the three brokers share much of their platform and tools in common. However, the pricing structure for these three brokerages is very different even though they are all part of Lloyds.

What Can You Buy on Lloyds Share Dealing Account?

Since Lloyds is one of the largest financial institutions in the world, it should come as little surprise that its stock brokerage arm gives investors access to a wide range of markets and investment products, including many of the most popular shares.

Shares

Lloyds currently offers stock trading on virtually all major shares on the London Stock Exchange, and all shares in the FTSE 250. That includes trading for Lloyds itself, as well as for popular shares like Tesco and Royal Mail.

In addition, the Lloyds share dealing account enables retail investors to buy shares on the New York Stock Exchange and NASDAQ exchange in the US and the Euronext exchange in Brussels, Milan, Amsterdam, Frankfurt, and Paris.

Notably, although Lloyds itself reaches to markets in Asia and Africa, individual shares from exchanges in these regions are not available to retail traders through the share dealing account. You cannot buy and sell individual shares on the well-established Hong Kong or Tokyo exchanges. Nor can you speculate on emerging markets through riskier shares for companies in Southeast Asia or Africa. To access these markets, you will need to invest through funds.

Mutual Funds, ETFs, and Investment Trusts

Investors also get access to a very wide variety of funds from providers in the UK, US, and Europe through the Lloyds Bank share dealing account. The brokerage offers more than 2,000 mutual funds, many of which enable you to focus your investments on market sectors that you cannot access through share trading – for example, real estate, commodities, or emerging markets.

Lloyds online share dealing currently offers around 575 exchange-traded funds (ETFs), although this number seems surprisingly small given the stature of the financial institution. The ETFs on offer are diverse and cover both the UK and US, but you won’t find the same diversity of investments as you will for mutual funds.

The number of investment trusts is also somewhat small, at just under 300. However, this represents a much larger proportion of popular UK trusts. Given the managed nature of these investments, there are more than enough investment trusts for the average investor to choose among at Lloyds TSB share dealing.

Ready-made Portfolios

While you could create a diversified portfolio using mutual funds or investment trusts, Lloyds also offers three managed portfolios of its own. These are kept in balance on your behalf so that they continually meet a target such as price appreciation or dividend yield.

The three funds are divided according to risk, although all are relatively conservative. Don’t expect a significant return on these funds – they’ve averaged annual returns of 2.1% or less over the past five years, while the FTSE 100 has gained 7% per year during that same timeframe.

Lloyds Share Dealing Charges, Fees and Commission

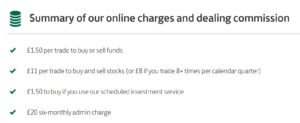

Lloyds has a somewhat unique pricing structure that places an emphasis on account fees while keeping commission for fund trades low. Every Lloyds share dealing account charges a £40 annual fee, although you can open an individual savings account (ISA) without paying an additional fee. On top of that annual fee, you will pay £11 per share trade, which is quite pricey.

Where investors get a break is with fund investing and regular investing. Fund trades cost just £1.50 each, which is one of the lowest fees from any major UK broker. Regular investing, which requires that you invest a set amount of money in a share or fund each month, also costs just £1.50 per trade. This is a way to avoid the £11 per share trade commission, although you have significantly less flexibility in your investing.

Notably, Lloyds’ ready-made funds come with their own fee structure. For these portfolios, you will pay 0.50% of your invested capital per year as a management fee. You’ll also be responsible for transaction and fund costs, as you would be with any other fund purchases, but Lloyds guarantees these will add up to less than 0.17% of your investment per year.

It’s worth pointing out that Lloyds does not offer self-invested personal pension (SIPP) plans at this time. This is unusual among UK brokers.

Lloyds Share Dealing Platform and Trading Tools

Lloyds shares its trading platform with Halifax and iWeb. We’re not overly impressed by the platform and the user experience feels far from seamless.

Worse, our Lloyds share dealing review revealed that the broker does not offer a mobile investment app, which is a significant drawback for many investors. You can access the trading platform from your mobile device’s web browser, but it is not easy to navigate on a small screen.

The Lloyds share dealing service web platform is centred around the Shares Centre and Funds Centre. While these sound appealing, there’s not much too them. The Shares Centre is essentially a dashboard where you can monitor the day’s performance of the major UK and global stock indices. But you won’t find your watchlist in the dashboard and there are no trading alerts or recommendations from Lloyds analysts. For the most part, this dashboard is just a page you need to navigate through in order to search for individual shares.

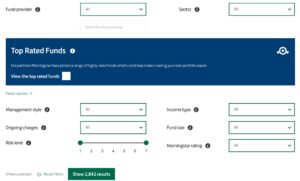

The Funds Centre is more useful, although it’s not even a dashboard. Rather, this is a fund screener tool that you can use to search for mutual funds, ETFs, and investment trusts. Lloyds did a nice job with the screener, as you can search not just by provider or market sector but also by Morningstar risk and performance ratings. The range of parameters is enough to enable you to narrow down the thousands of choices, although you still won’t find any recommendations from Lloyds about what funds are best.

One tool that is noticeably missing within Lloyds is a portfolio analyser. Given the broker’s focus on long-term investing in funds, this would be extremely useful for identifying overlap and gaps between the mutual funds you currently hold. Unfortunately, if you want to analyze your portfolio, you’ll need to export the list of your holdings to another software.

Lloyds online share dealing does provide a news feed with trading accounts, but it’s not a particularly useful feed compared to what other brokers offer. You can see top headlines for the UK and global markets, but you cannot customize the stories that appear based on your watchlists or portfolio.

Research and Analysis at Lloyds

Despite the fact that it is a global powerhouse when it comes to investment research, the Lloyds share dealing account provides very little access to research and analysis. There are no analyst reports for shares or funds available and no recommendations from Lloyds analysts.The primary tool that traders get access to is a technical charting interface, which is somewhat clunky. But it does come with more than 90 built-in technical studies that can be slightly modified to customize your analysis. The charting interface is far from the best we’ve seen, and you cannot plot multiple share prices in the same window.

Lloyds does also provide some fundamental data for shares, although the data you get is surprisingly limited. For the most part, you’re stuck with basic metrics rather than given full balance and cash flow tables. This makes it difficult for investors to truly analyze the fair value of a company without turning to an external data source.

Payments at Lloyds

Lloyds online share dealing only accepts payments to fund your share dealing account by bank transfer – direct deposit or wire – or by debit card. You cannot fund your account with a credit card or online payment system. Helpfully, there are no fees associated with depositing or withdrawing money from your Lloyds share dealing account and there is no minimum deposit required when you open a new account.

Lloyds Share Dealing Login

If you are already a Lloyds customer and hold their share dealing account, you can click here to login. You will find all your share dealing account details once you login. However if you are unable to login, below are their customer support details for further needs.

Lloyds Share Dealing Customer Service

Lloyds offers 24/7 customer service, which is a significant point in favor of this brokerage. You can get in touch at any time by phone or live chat, or reach out to the bank on social media. You can also visit a Lloyds bank branch anywhere in the UK for in-person help with your Lloyds Bank share dealing account. Most branches are open from 9 am to 3:30 pm, Monday to Friday.

Lloyds contact number: 0345 300 0000

Lloyds address: 25 Gresham Street, London EC2V 7HN

Is Lloyds Safe?

As the experience of 2008 demonstrated, the UK government is likely to step in and bail out the bank rather than allow it to default in a crisis. If Lloyds ever were to fail, all investment accounts held at this brokerage are backed by the Financial Services Compensation Scheme and insured for up to £85,000.

It’s also worth remembering that Lloyds is highly regulated and under quite a bit of public scrutiny. All investments are regulated by the UK’s Financial Conduct Authority. Plus, since Lloyds is publicly traded as part of the FTSE 100, its finances are made public every quarter and closely looked at by analysts.

The Verdict

Although it is one of the largest and most renowned investment firms in the UK, the Lloyds share dealing account leaves a lot to be desired. The fees and commissions are quite high, especially compared to other UK brokers and even Lloyds subsidiaries Halifax and iWeb. In addition, while Lloyds gives traders access to markets in the UK, US, and Europe, it completely leaves out individual share trading in Asia.

The number one reason to choose Lloyds is that it offers more than 2,000 mutual funds. However, you can get a comparable range of funds from a number of other stock brokers. The trading platform that Lloyds provides is very underwhelming, and the lack of a mobile app really hurts this broker in terms of ease of use.

Halifax and iWeb both offer lower fees and a wider range of account options, while giving you the same trading platform and market options.