10 Popular Gold Funds Among UK Investors

Gold is respected worldwide as one of the most attractive assets you can own due to its inherent value and diversification benefits.

In this guide, we will analyse the Most Popular Gold Funds UK, discussing each fund’s features and why you may consider implementing them in your investment strategy. We will also provide a guide on how you can invest in a gold fund with an FCA-regulated broker.

Popular Gold Funds UK List

The list below highlights ten of the most popular gold funds UK in 2022. In the following section, we will discuss these funds one by one, analysing their performance and providing insight into how they work:

- SPDR Gold

- VanEck Vectors Gold Miners ETF

- SPDR Gold MiniShares Trust

- BlackRock Gold and General Fund

- Jupiter Gold and Silver Fund

- LF Ruffer Gold Fund

- Ninety One Global Gold I

- Invesco DB Precious Metals Fund

- Aberdeen Standard Gold ETF Trust

- ProShares Ultra Gold

Popular Gold Funds to Watch

Whether you are wondering how to invest £500 or you are looking to invest a lot more, it’s always a good idea to weigh up all of your options to make an informed decision. There are numerous to choose from when it comes to gold funds, so deciding which one is suitable for you can seem daunting.

However, this guide will make the process easier for you by discussing ten of the most popular gold funds. Each fund will be discussed in detail, touching on past performance and highlighting key features.

1. SPDR Gold

One of the most popular gold funds in the world is the SPDR Gold ETF. Currently the largest physically-backed gold ETF globally, the SPDR Gold is a favourite of both retail and professional investors across the globe. This exchange-traded fund tracks the performance of gold bullion, giving investors exposure to the price of gold and all of the benefits that accompany this, including hedging and diversification benefits.

With a low-cost expense ratio of only 0.4%, the SPDR Gold is also popular due to its cost-effectiveness. Furthermore, performance-wise it is also an attractive investment; in 2020, the fund returned 23.68% to investors and returned 18.36% to investors in 2019. So, if you are someone who is looking for an inexpensive gold fund that displays excellent performance, this one is a popular option.

2. VanEck Vectors Gold Miners ETF

Another way to gain exposure to gold is through investing in gold mining companies. As these companies are inextricably linked to the gold price, investing in them provides indirect exposure to the gold market. The VanEck Vectors Gold Miners ETF is a great way to do this, as it tracks the performance of the NYSE Arca Gold Miners Index, which in turn tracks gold mining companies.

This method of gaining exposure has been great for the fund, as it has made positive returns for investors in both 2019 and 2020, returning 40.1% and 23.3%, respectively. Another factor regarding this fund is that it also pays an annual dividend to investors every December. If you are looking to gain exposure to gold mining stocks or firms and gain some passive income in the process, this is a popular option.

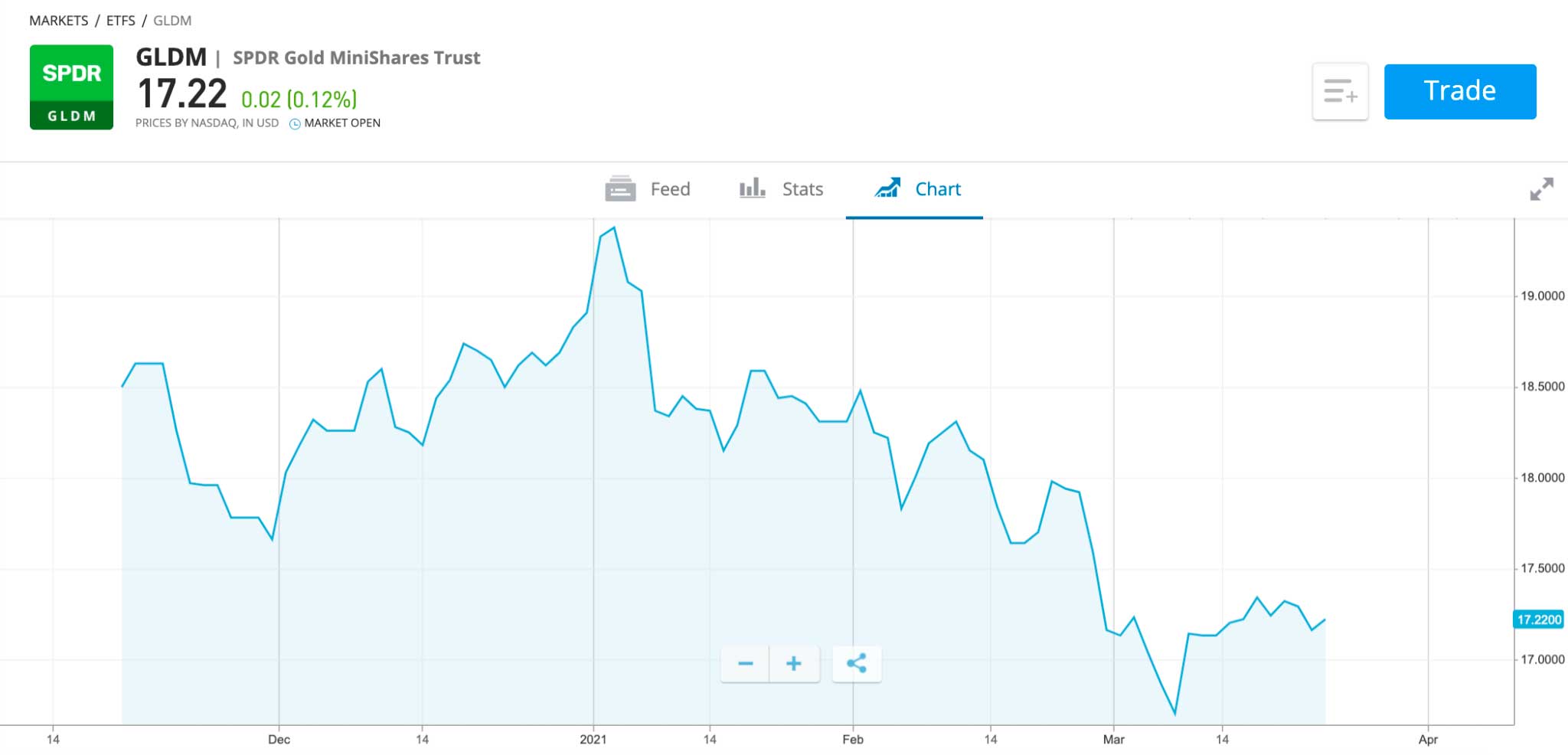

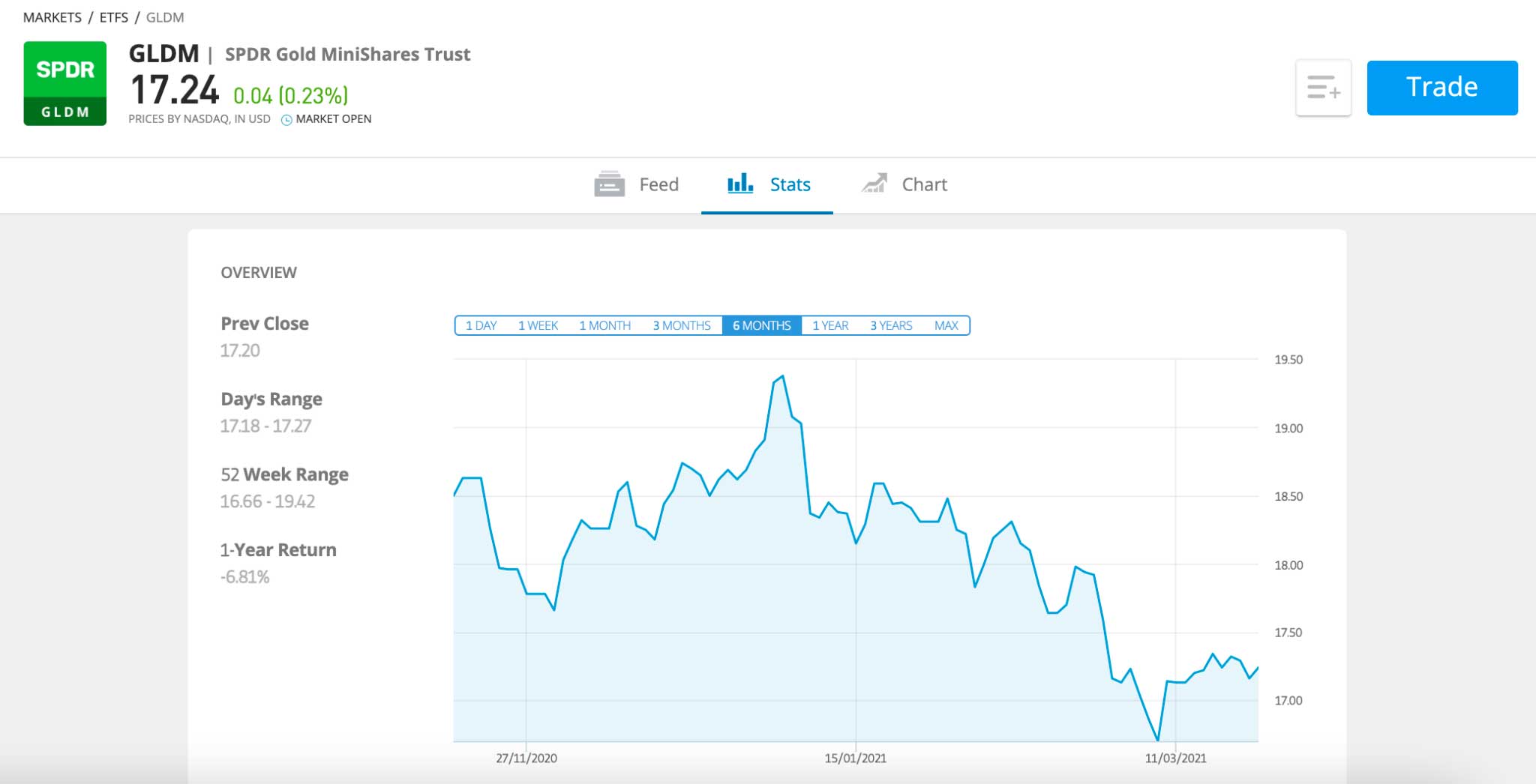

3. SPDR Gold MiniShares Trust

This fund is very similar to its parent fund mentioned earlier, the SPDR Gold ETF. However, a critical difference between that fund and this one is the accessibility factor. The SPDR Gold MiniShares Trust is designed and targeted more towards retail investors who wish to place their capital in a fund over the long term. Thus, the SPDR Gold MiniShares Trust is one of the cheapest gold funds.

With an expense ratio of 0.18%, this fund is cost-effective. If you invested $1000 into this fund, you would only pay $1.80 in fees for the full year; this equates to only £1.30. What’s more, you still get all the benefits of investing in a gold fund with interests in gold bullion, such as hedging against market shocks and diversification benefits. Much like the previous two funds, if you are interested in getting involved, you can do so using an FCA-regulated broker.

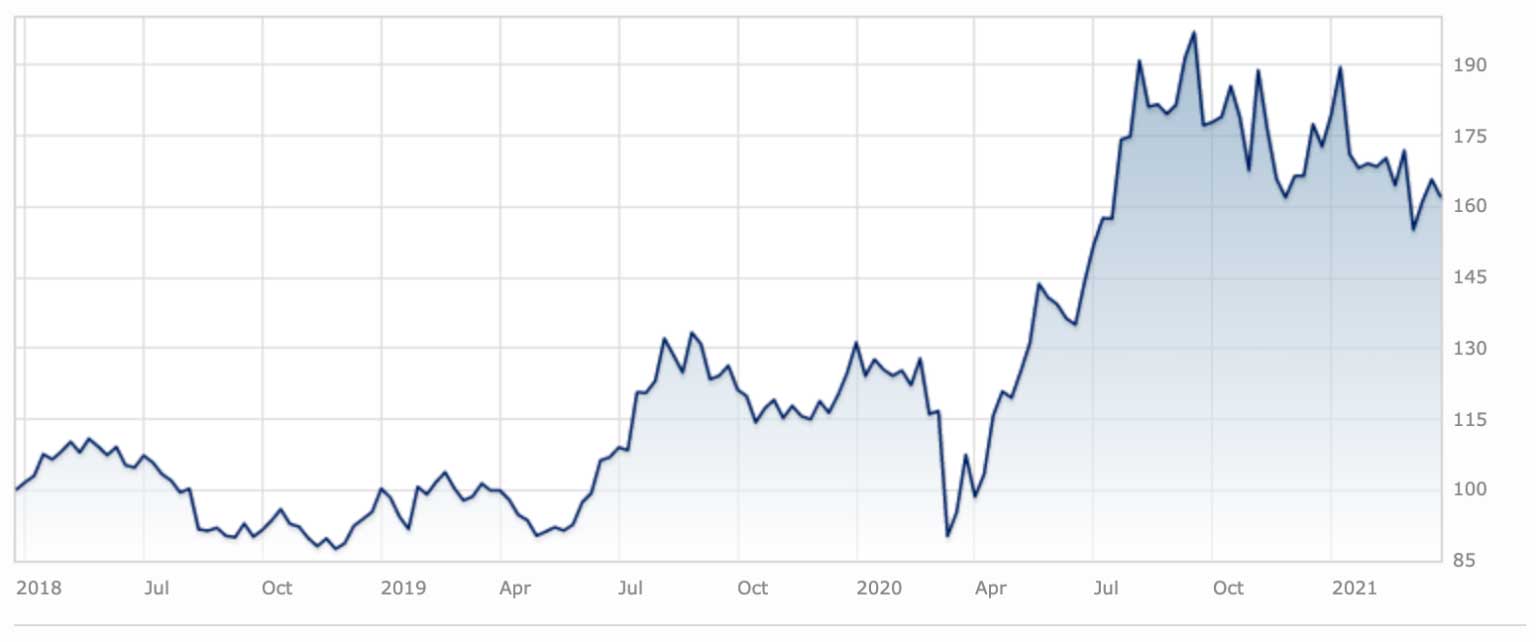

4. BlackRock Gold and General Fund

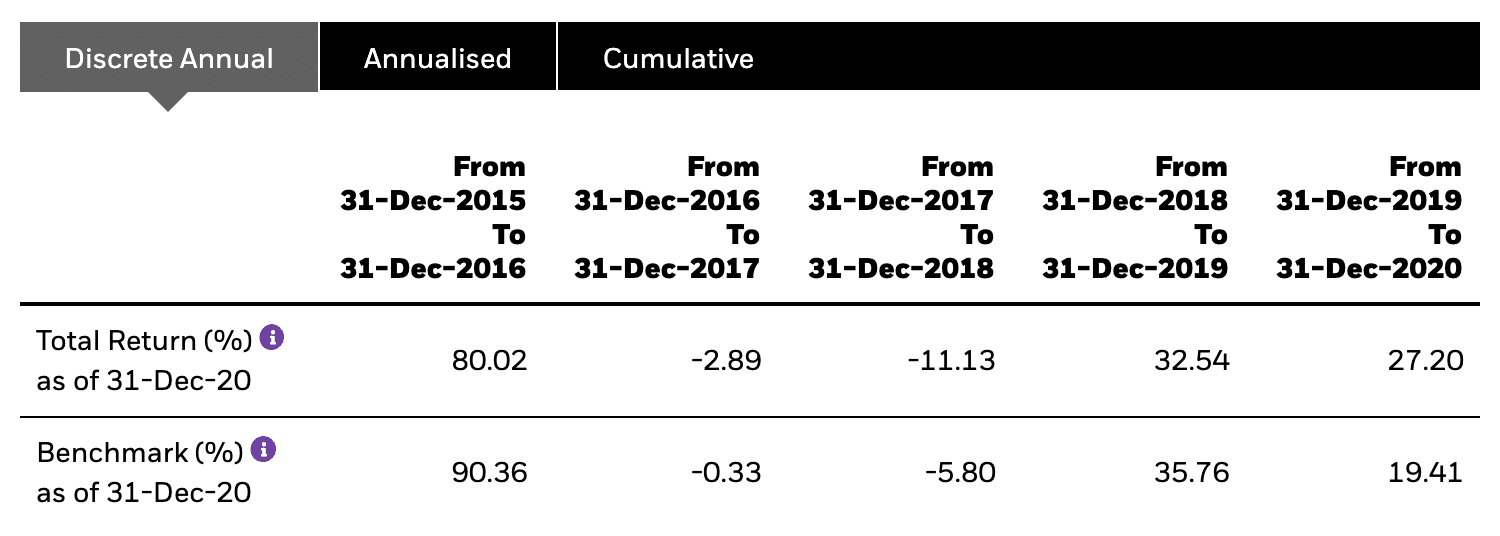

This fund is one of BlackRock’s premier gold funds and seeks to invest in equities of firms that derive their income from operations that are related to gold. With smart investments from the fund manager, the BlackRock Gold and General Fund has managed to beat the market by quite a large amount in 2019 and 2020, returning 32.54% and 27.20%, respectively.

Although this fund is riskier than others due to the nature of the equities it invests in, it does offer the additional annual dividend yield of 0.42%. This is popular with investors who are placing large amounts of capital into the fund, providing another stream of income. With exposure to companies located in Canada and the US, this fund is a potential option for investors who are happy to take on a little more risk in exchange for more returns.

5. Jupiter Gold and Silver Fund

The Jupiter Gold and Silver fund is another option, as it invests in both physical gold bars and silver bullion, providing exposure to both commodities. It also invests in gold and silver mining companies; therefore, the fund offers a popular investment opportunity to people who are interested in investing in gold but also wish to gain exposure to the silver investment market too.

Due to this Jupiter fund UK’s considerable investment in the silver market, it displays a negative correlation with a large majority of other assets, meaning it could be a useful addition to your portfolio thanks to its diversification benefits. Also, the fund steers clear of investing in mining companies that are deemed ‘dangerous’, lessening any geopolitical risk it may be exposed to. Finally, this fund reinvests dividends automatically, making it an accumulation fund.

6. LF Ruffer Gold Fund

If you are looking for capital growth and don’t place too much emphasis on current income, then the LF Ruffer Gold Fund could be worth considering. This fund acts as an accumulation fund, meaning that any dividend/interest income is automatically reinvested into the fund, thereby increasing your overall position. So, if you had a $1000 investment and the fund paid out $10 in income, you would then have your position increased to a total of $1010.

With an expense ratio of 1.03%, this fund is slightly higher in terms of fees. However, the fund invests inequities related to the gold mining industry, which can be potentially lucrative. The average yearly return over the past five years has totalled 18.07% each year. With exposure to the Canadian and Australasian mining industries, this firm could be used to diversify your portfolio in a geographic sense.

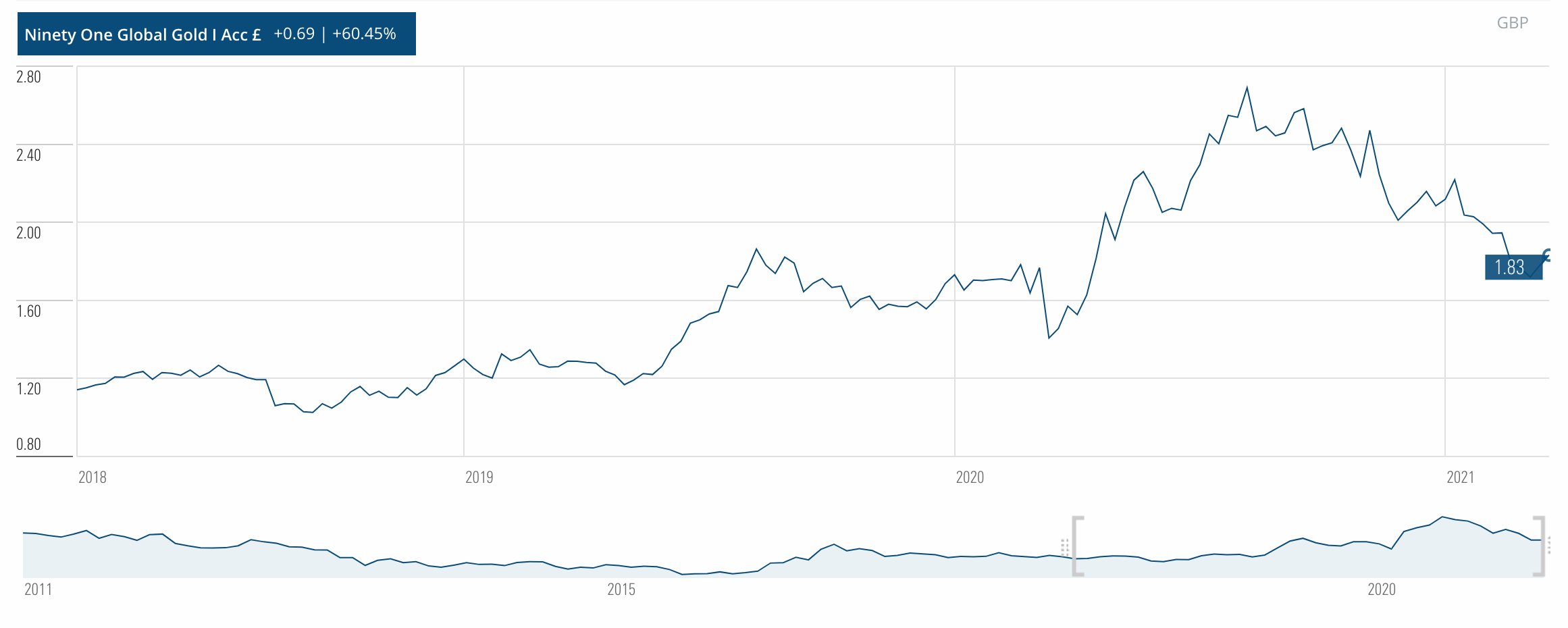

7. Ninety One Global Gold I

This fund invests in gold-related equities and derivatives, aiming to provide investors with gradual growth over the long term. Unlike other funds, this fund tends to display less volatility in terms of returns, meaning it is an alternative investment fund for investors with lower risk tolerance.

In addition, a dividend is paid each year to investors with a historic price yield of 0.11%, providing an additional income stream. Furthermore, the fund has displayed consistent positive returns, only experiencing a negative return in one of the previous five years.

8. Invesco DB Precious Metals Fund

If gold-mining equities don’t take your fancy, another option could be investing in the Invesco DB Precious Metals Fund, which focuses on the futures industry. Futures trading is a way to speculate on the ‘future price’ of a commodity (in this instance, gold and silver), so they are suitable if you have an idea of where the price might go down the line.

However, futures are inherently volatile, so this fund is designed more for people with higher risk tolerance. The Invesco DB Precious Metals Fund tracks the DBIQ Opt Yield Precious Metals Index’s performance, which is composed of futures contracts based on gold and silver. However, over the past five years, the fund has returned investors an average of 6.24% each year, highlighting its consistency in volatile situations. Although it is currently down 7.25% in the year-to-date, this fund is a potential option for risk-seeking investors and looking to gain exposure to the futures market.

9. Aberdeen Standard Gold ETF Trust

The benefits of exposure to the gold market are numerous, and one of the most prominent is its hedging benefits. When market shocks occur (such as the financial crisis in 2008 or the Coronavirus pandemic), it is always wise to have a hedging asset in your portfolio that can offset potential negative returns. Gold is thought of as one of the most popular ways to hedge these shocks.

With the Aberdeen Standard Gold ETF Trust, you can invest in a fund that offers a low expense ratio and is physically backed with actual gold. This means that, unlike other ETFs, this fund has tangible gold assets, which boosts its hedging properties. If a market shock should occur, there is every chance that this fund would weather the storm.

10. ProShares Ultra Gold

The last fund we will discuss is the ProShares Ultra Gold. This fund focuses on daily investment results rather than long-term gains. The ProShares Ultra Gold aims to double the return made by its benchmark index, the Bloomberg Gold Subindex.

This fund utilises both leverage and compounding to generate significant returns for investors. Although it has experienced some negative returns over the last quarter, the ProShares Ultra Gold has returned over 30% to investors in 2019 and 2020 and has made returns as large as 57% in 2010.

What are Gold Funds?

The logistical difficulties of investing in physical gold bars and gold coins have necessitated new and innovative methods to get exposure to the gold market. One of these methods is gold funds, which are open-ended funds that aim to generate returns through exposure to the gold market. This exposure can come in various ways, such as investing in gold mining companies, investing in gold bullion, or even investing in gold futures contracts.

In terms of performance, gold ETFs typically generate their returns based on the relative value of gold at the time. If gold is particularly valuable at a given point (perhaps during a market shock), then gold funds will, in turn, see their performance levels increase. So, even though you are investing in a gold fund, you are indirectly investing in the price of gold at the same time.

Gold funds work in a similar way to other funds, in that you can invest in them through your broker of choice and then earn a return based on the price you opened your position at and the price they increase to.

Different gold funds have different objectives, so you must do your due diligence and evaluate which is suitable for you. Some funds target professional investors interested in dividends, whilst other funds (such as the SDPR Gold MiniShares Trust) target retail investors who want to gain exposure to the gold market in a cost-effective way. The previous section of this guide highlighted some of the most popular gold funds UK, which contained some important information on how these funds operate.

Why do People Invest in Gold Funds?

Now that we have examined the most popular gold funds to invest in, you might be wondering why investors choose to invest in them. There are various reasons for this, which we will discuss in this section.

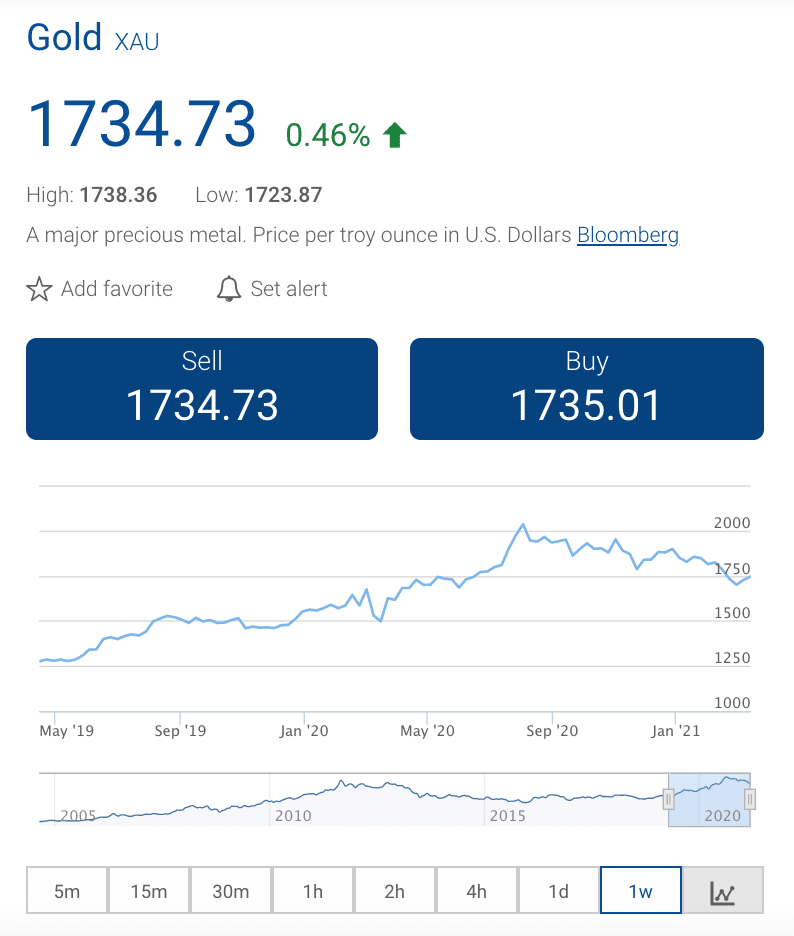

Firstly, the most popular gold investment funds offer hedging benefits, which are essential in the modern financial climate. Gold tends to negatively correlate with other assets, such as equities and bonds, meaning that people will flock to gold in times of turmoil as it is a ‘safe haven’. Gold even negatively correlates with interest rates; if interest rates fall, sentiment towards gold usually turns bullish. This demand for gold will, in turn, push up its price, leading to positive returns for investors in gold funds.

Another reason why people invest in the most popular gold funds is their accessibility and liquidity benefits. As mentioned, investing in physical gold doesn’t make sense as you would have to store it and transport it around, which would be very challenging. Gold funds allow you to gain exposure to the price of gold without having to hold the physical asset. What’s more, they are highly liquid, so if you decide to exit your investment, it is straightforward due to the market’s inherent liquidity.

Also, gold funds typically have provided above-average returns to investors. From 2005 to 2020, the price of gold has increased by roughly 330%; this is far higher than the 153% increase in the Dow Jones Industrial Average index over the same period. In addition, the Blackrock Gold and General Fund has showcased market-beating performance multiple times over the past decade; the image above highlights just how well this fund can perform. However, gold is not always a winner; in times of economic booms and rising stock markets, investors tend to move away from gold investments, making the price decrease.

Popular Gold Funds Brokers

It’s now time to discuss the most popular gold funds brokers that you can use to make your gold funds investments. In this section of the guide, we will analyse two widely-used stock brokers, helping you decide which is suitable for you.

1. Plus500

Another broker to consider when trading gold funds is Plus500. The firm is a popular UK broker, offering CFDs on a variety of different assets.

CFD trading works a little differently from investing in the actual asset; instead of owning the asset, you’ll instead own a contract based on the price of the underlying asset. So, with Plus500, you would own a CFD on your chosen gold fund rather than investing in the fund itself.

This is a popular way to speculate on an asset’s price, such as a gold fund, without having to actually own it. Another feature of Plus500 is that you can use leverage to boost your position – they offer up to 1:5 leverage on ETFs. So, if you invested $200 into a gold fund with Plus500 and applied 5x leverage, your position would equate to $1000.

What’s more, Plus500 allows users to trade CFDs without having to pay any commission. Furthermore, they are considered a trustworthy broker in the UK, being regulated by the FCA. Finally, Plus500 even offers a demo account to practice with; so if you want to get a feel for their platform before trading for real, you can do this.

| Stock Trading Fees | 0% commission + spread |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | $10 (£7.60) per month after three months |

| Monthly Account Fees | No |

How to Invest in Gold Funds

To wrap up this guide, we will now explain the exact process you need to follow to trade the most popular gold investment funds.

Open your account

The first step is to open an account with an FCA-regulated broker. You can do this easily through their website or investment app.

To sign up, all your need to provide is a few personal details, an email address, and your National Insurance number.

Verify your identity and address

As mentioned earlier, FCA-regulated brokers must follow the strictest security guidelines to protect their users. Due to this, you must verify your identity and address before you can trade.

Simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill), and then you’re good to go.

Make a Deposit

The next step involves funding your account to make your investment in the most popular gold fund UK. Most brokers allow you to make deposits completely free of charge, and you can do this via credit card, debit card, bank transfer, and even various e-wallets.

Search for your chosen Gold Fund

Click into the search bar and type in the name of your chosen fund. Then, click on it to be taken to an order box.

Invest in Gold Fund

The final step involves completing your investment. You will be presented with a box similar to the one below; simply enter the amount you wish to invest, double-check everything is correct, and confirm the trade.

Conclusion

In summary, gold funds are a popular investment for many reasons, not just their potential returns. Their ability to hedge against inflation and deflation, combined with their exceptional diversification benefits, means that gold funds are a favourite of both retail and professional investors worldwide.

If you have decided to take the plunge and invest in a gold fund, you can do so using an FCA-regulated broker. As always, never invest more than you can afford to lose and always employ proper risk management.