5 Popular Property Funds Among UK Investors

Property funds allow you to invest in the real estate market without needing to have a large amount of capital at your disposal. In additionl, you can earn money in two ways – through rental payments and appreciation.

In this guide, we review the Most Popular Property Funds UK and how you can invest at an FCA-regulated UK broker.

5 Popular Property Funds UK List

Below you will find the most popular property funds UK for 2022. We review each property fund in great depth further down.

- iShares UK Property UCITS ETF

- Real Estate Select Sector SPDR Fund

- iShares Global REIT ETF

- Simon Property Group

- Sabra Health Care REIT

Property Funds UK Reviewed

When searching for a property fund to invest in – there are many factors that you need to take into account.

For example, does the fund invest in commercial real estate and rental apartments? You do, of course, also need to research the fund’s past performance and what annual expense ratio applies.

We have done the hard work for you by discussing the most popular property funds UK in the market right now.

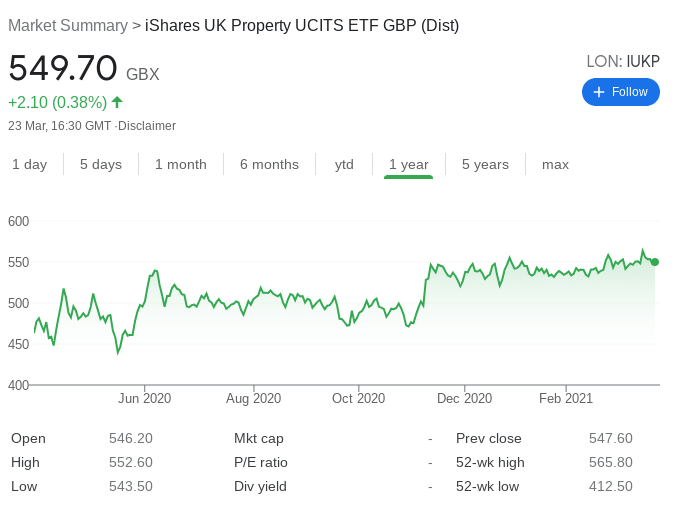

1. iShares UK Property UCITS ETF

If you are looking to gain exposure to the UK property scene – then you might want to consider the iShares UK Property UCITS ETF. In total, this ETF gives you access to 40 companies that are heavily involved in UK real estate is a fully diversified manner. The largest holding in the ETF’s portfolio is the Segro REIT.

Other top holdings of the iShares UK Property UCITS ETF include LandSecurities Group, British Land REIT, Unite Group, Derwent London, and Tritax Big BOX. Each of these entities is invested in a specific sector of the UK real estates scene – such as retail, office space, and commercial lettings.

In terms of how you make money – this is split between two revenue streams. Firstly, the ETF property fund will make a dividend distribution every three months. This consists of your share of rental payments – after management fees. You also stand to increase the valuation of your investment through capital gains.

This will happen if the properties held within each individual ETF holding collectively increase. When it comes to financial performance, the iShares UK Property UCITS ETF is up more than 72% over the past 10 years. The expense ratio – which how much the fund charges each year – stands at just 0.40%.

2. Real Estate Select Sector SPDR Fund

Established in 2015 – the Real Estate Select Sector SPDR Fund is a great option if you wish to gain access to the US real estate industry. As this property fund is represented via an ETF – you can enter and exit your investment at any given time. This means that your capital is never tied up.

In particular, this fund will look to track the performance of firms involved in property development and management. This means that you are indirectly investing in newly built properties. This might be anything from a multi-family residential property to a new shopping mall. Either way, you will be entitled to your share of any rental payments and capital gains.

Breaking the portfolio of this fund down further – you will be investing in 29 different entities. This includes Crown Castle International Corp, Digital Realty Trust Inc., American Tower Corporation, Prologis Inc., and Public Storage. When it comes to fees, this is actually one of the most competitive-priced property funds in the market.

At an expense ratio of just 0.12%, this means that you will pay an annual fee of just £1.20 for every £1,000 invested. Crucially, this property fund has generated steady returns since its inception. Over the past five years, the fund has returned 8.73% in capital gains via an increased NAV. And of course, the fund has also generated rental payment dividends – which are paid quarterly.

3. iShares Global REIT ETF

While most property funds focus on a specific housing market – some of you might want to build a global portfolio of real estate. If so, iShares Global REIT ETF could be a suitable option. This ETF will indirectly invest in properties from all over the world.

It does so by holding securities in companies that are involved in the real estate industry. In fact, this property fund will get you access to 312 different entities from a variety of markets. For example, although there are holdings that focus on the UK and US real estate sectors – there are also development firms from the emerging markets.

This means that both the risks and potential rewards on this property fund are somewhat higher. With that said, financial returns generated by the iShares Global REIT ETF have been relatively stable since its inception in 2014. This stands at an average annualized return of 3.82% per year – equating to total gains of 27% since inception.

As the iShares Global REIT ETF holds many stocks that are involved in real estate development, the fund is still recovering from the impact of lockdown restrictions. Finally, the fees of this property fund amount to just 0.14% per year.

4. Simon Property Group

Simon Property Group is a US-based investment fund that focuses exclusively on real estate. More specifically, this property fund is one of the largest shopping mall developers globally. This includes over 100 malls and shopping center facilities scattered across the US and overseas. In the UK, for example, Simon Property Group is behind the West Midlands Designer Outlet.

This property fund also has exposure in Japan, South Korea, Malaysia, Spain, Italy, France, Puerto Rico, and more. Crucially, this allows you to invest in a global portfolio of retail real estate that is continuously expanding. Now, it should be noted that Simon Property Group took a major hit in the midst of the pandemic last year.

However, it appears that investors are now becoming more interested in this fund. This is because in the 12 months prior to writing this page, Simon Property Group has increased in value by over 100%.

A few years ago, the fund was priced at $142 per share. At the time of writing in late March 2021 – you can invest in this fund at a share price of just $110. This means that the medium-term upside stands at almost 30%. As Simon Property is listed as a stock on the NYSE, there is no concern about cashing out your investment. In fact, you can do this any time during standard market hours.

5. Sabra Health Care REIT

If you are looking to invest in the most popular property funds UK because you seek solid income through dividends – the Sabra Health Care REIT is likely to be of interest. As the name suggests, this property fund invests exclusively in healthcare facilities across the US. This includes over 300 skilled nursing facilities, as well as senior care homes and housing communities.

The fund is also invested in 24 large-scale hospitals. The most appealing thing about Sabra Health Care is that in many ways – it is somewhat immune to wider economic conditions. After all, health care is something demanded irrespective of how the economy is performing.

Furthermore, and perhaps most importantly, most of the healthcare facilities controlled by Sabra Health Care are based on long-term tenant agreements. This means that there is a predictable flow of incoming revenues. When it comes to returns, this property fund has increased in value by over 57% in the 12 months prior to writing this page.

Alternative Property Investment Funds UK

There are hundreds of property funds available to UK investors – both domestically and internationally. Although we have discussed some popular picks – below you will find some other property investment funds that appear to be popular in the UK.

- M&G Property Fund

- Kames Property Income Fund

- Aviva Property Fund

- Aberdeen Property Fund

- Royal London Property Fund

To find out whether a property fund meets your financial goals – be sure to perform lots of research prior to making an investment.

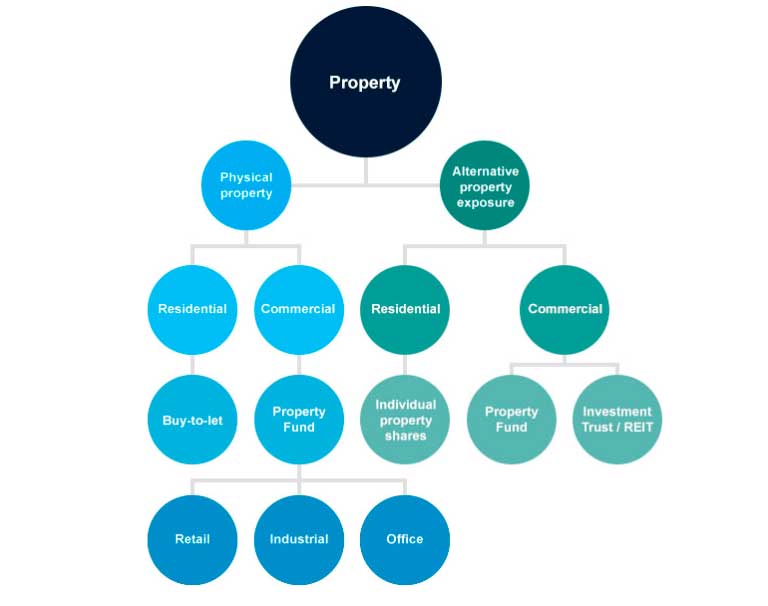

What are Property Funds?

Property funds allow you to invest in the real estate industry without needing to buy a house or take out a long-term buy-to-let mortgage. Instead, you will be investing your money into a property fund provider that buys, sells, and manages real estate on behalf of its stakeholders.

In other words, the fund will collect money from thousands of individual investors and in turn – will purchase a basket of properties. In many cases, the property fund will focus on a specific housing market – such as the UK or the US.

Either way, by investing in property funds UK – you will be able to grow your money in two ways. This is through dividends that are funded by monthly rental payments and appreciation of the properties themselves.

Let’s explore how you make money from property investment funds UK in a little more detail.

Property Rental Payments

When you invest in a home or apartment in the traditional way – one of the main benefits is that you will have a regular source of income via monthly rental payments. The good news is that the most popular UK property funds allow you to indirectly earn your share. This typically comes in the form of a dividend distribution that the property fund makes every three months.

This will, of course, be at an amount proportionate to what you invested into the property fund and less management fees.

Here’s a quick example of how your property fund dividends might work in practice:

- You invest £3,000 into a UK property fund that invests in commercial office space

- Over the course of the first three months – the property fund collects rental payments from tenants

- After management fees, this amounts to an annualized yield of 6%

- This means that at the end of the first quarter – you will receive a payment equivalent to 1.5% of your investment

- You invested £3,000 – so you will receive a dividend payment of £45 from the property fund

Like any property investment, there might come a time where the property fund is unable to collect rent from its tenants. If and when this does happen – it will impact the amount of dividends that you receive. This is why dividend distributions fluctuate on each respective quarter.

Property Fund NAV

In a similar nature to mutual funds, investment trusts, and ETFs, you can also make money from a property fund when it increases its NAV (Net Asset Value). For those unaware, the NAV refers to the current market value of all assets held by the property fund.

Here’s an overly simplistic example of how the NAV works when investing in the most popular UK property funds:

- Let’s suppose you invest in a property fund that focuses on UK shopping malls and retail parks

- You invest £5,000 into the UK property fund

- At the time of the investment, the total market value of all property holdings amounts to £1.5 billion

- Three years later, the respective shopping malls and retail parks are now collectively worth £2 billion

- This means that the NAV has increased by 33%

Now, as you invested £5,000 into the property fund and the NAV has grown by 33% – your capital is now worth £6,650. However, unlike dividends, you will only have access to your capital when you exit your property fund investment. Until then, the value of your investment will rise and fall in the same way as when you buy shares.

Why do People Invest in Property Funds?

There are many reasons why property funds are becoming so popular with UK investors – which we discuss in more detail in the sections below.

Low Minimum Investment

Many UK property funds allow you to gain exposure to the real estate industry without needing to have access to a large amount of money. This is crucial – as the traditional method of entering the property scene is to buy a house outright through a long-term mortgage. Not only is this out of reach for many UK residents – but you are over-exposed to a single property.

By investing in a property fund – you often only need to have access to a few hundred pounds. This means that these assets are more accessible to retail investors.

Instant Liquidity

If you were to buy a property outright in the UK – your money is essentially locked up. That is to say, the only way that you can turn your property investment back into pounds and pence is to go through the long and cumbersome process of putting the house up for sale.

This process can take many months to complete and is fraught with fees and agent commissions. But, by investing in the most popular property funds UK – you can enter and exit the market whenever you wish. This is because many property funds are actually represented by ETFs.

In turn, ETFs are listed on public stock markets just like shares – so you can sell your investment at the click of a button during standard market hours. When you do, the funds will be reflected in your brokerage cash balance – which you can then withdraw to your UK bank account.

Competitive Fees

When you think about what goes on behind the scenes when investing in a property fund – you would expect management fees to be sky-high.

- For example, the fund needs to perform in-depth research and due diligence to find the most popular property investments and then formulate the required legal agreements with tenants.

- It then needs to collect monthly rental payments and distribute the funds every three months to your and your fellow investors.

However, by investing in the most popular property funds UK – you will often pay an annual fee of less than 0.4%. In fact, one of the most popular funds – the Real Estate Select Sector SPDR Fund, charges an annual expense ratio of just 0.12%. This offers solid value – as you will be investing in a 100% passive manner.

Income and Growth

Although we discussed the ins and outs of how you make money from a property fund – it is important to clarify that you can generate returns from both income and growth. This works in a similar nature to dividend stocks.

That is to say, by investing in the most popular property funds UK – you will receive a dividend payment every three months – which you can then reinvest back into the respective provider.

Plus, when you eventually get around to cashing your investment – you will make capital gains if the value of the NAV has increased. This will happen if the properties held by the fund have appreciated.

Passive Investing

Many UK real estate investors enjoy the journey of selecting properties to buy and the management process that goes hand-in-hand with renting the home out to tenants. However, it must be noted that this is a highly time-consuming process that in many cases – is a full-time job in itself.

But, when investing in the most popular property funds UK – you can sit back and let your money work for you. This is because the property fund manager makes all investment decisions for you and your fellow investors.

It will also manage the respective properties in terms of finding tenants and collecting rental payments. As such, property funds are suitable if you are looking to invest in a truly passive manner.

Property Funds UK Brokers

Once you have chosen a property fund investment that you like the look of – you then need to carefully select a suitable online broker.

There are many stock brokers and investment apps in the UK that allow you to invest property funds – so you need to spend some time exploring applicable dealing fees and minimum account requirements. You also need to assess the regulatory standing of the broker and what payment methods it supports.

To fast-track the brokerage selection process – below you will find some of the most popular trading platforms to invest in property funds.

2. Fineco Bank

Another online broker that allows you to buy the most popular property funds UK is that of Fineco Bank. The provider – which is backed by an Italian financial institution, offers a low-cost way to invest in funds and other asset classes.

In fact, Fineco does not charge any dealing fees when you invest in a fund, albeit, a 0.25% annual management fee applies. This is in addition to the expense ratio charged by your chosen UK property fund. In terms of support markets, Fineco covers property funds in the UK and broader real estate ETFs from overseas.

The minimum investment at this platform is just £100 – so you can spread your capital out across several funds. Fineco Bank also gives you access to self-directed stocks and shares. On top of companies listed on the London Stock Exchange and AIM, Fineco supports dozens of international markets.

The fee on individual stock purchases amounts to £2.50 on UK shares. You’ll pay $3.50 on US-listed stocks and a variable rate on other exchanges. Fineco Bank is authorized and regulated by the FCA and your capital is protected by the FSCS. You won’t be able to deposit funds with a debit/credit card at this broker – so you’ll need to perform a UK bank transfer to get started.

| Trading Fees | 0% commission on CFDs; £2.95 per trade on UK shares; $3.95 per trade on US shares |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | No |

| Monthly Account Fees | No |

Sponsored ad. Your money is at risk.

How to Invest in Property Funds

If you’ve got your finger on the pulse and are ready to invest in the most popular property funds UK right now – this section will walk you through the process with an FCA-regulated broker.

Open an Account and Upload ID

First, visit your broker’s website and sign up. Then, you will need to enter your personal information – such as your name, address, date of birth, mobile number, and email.

After confirming your email address and mobile number – you will need to upload some verification documents. This is required by all FCA-regulated brokers and ensures that financial crime is kept away from the platform.

All you need to do is upload a copy of your passport/driver’s license and proof of address. The latter can be a bank account statement or utility bill – as long as it was issued within the prior three months. Digital copies are fine.

Add Funds to Your Investment Account

Your broker will now give you the opportunity to deposit funds into your newly created investment account. If you want to invest in your chosen property fund right now – opt for an instant payment method. This includes debit cards, credit cards, and e-wallets like Paypal and Skrill.

Search for a UK Property Fund

Once your account has been funded you can process to invest in your chosen property fund. If you already know which fund you wish to invest in – enter it into the search box.

How to Invest in a Property Fund UK

After you opt to trade, you will see an order box pop-up like in the image below. This tells your broker how much you wish to invest in the property fund.

Enter your investment size and confirm the transaction to place your investment fund trade.

Property Funds UK – Conclusion

No longer do you need to buy a property outright to invest in the real estate industry. Instead, by investing in a property fund UK – you often only need a couple of hundred pounds to get started.

In doing so, you will still be entitled to your share of rental payments via dividends, as well as appreciation when the fund NAV increases.

If you’re looking to invest in property funds UK, it’s wise to partner with an FCA-regulated broker who can complete your trades safely and securely.

FAQs

What is a property fund?

How do property funds work?

How can I invest in property funds?

How much do property funds cost in the UK?