How to Buy PepsiCo Shares UK – With 0% Commission

PepsiCo, the owner of well-known brands such as Pepsi, Gatorade, and Frito-Lay, has had a fantastic few weeks, reaching all-time highs of $157. With the company’s financials looking solid and plenty of room for demand growth, there’s every chance the PepsiCo stock could continue to rise in the months to come – and beyond.In this article, we discuss How to Buy PepsiCo Shares in the UK .

We will be covering everything you need to know about the company and showing you how to invest in PepsiCo without paying a penny in commissions.

Broker Price Comparison

Found below is a breakdown of the cost of buying PepsiCo shares with a selection of the best stock brokers in the UK:

| Broker | Commission | Account Fee | Deposit Fee |

| Fineco | $3.95 per trade | None | None |

| Libertex | From 0.1% | None | None |

| Hargreaves Lansdown | £11.95 per trade | None | None |

Step 2: Research PepsiCo Shares

It’s essential to have a solid overview of a company and its financials before you begin equity trading. With this in mind, the sections below present all of the critical information you need to know before investing in PepsiCo.

What is PepsiCo?

PepsiCo, Inc. is a food and beverage corporation known for owning various popular brands such as Pepsi, Gatorade, Quaker Oats, and Tropicana. PepsiCo oversees the entire business process concerning its brands, including the production, distribution, and marketing elements. At present, the company is headquartered in New York and owns 23 brands, with distribution occurring in more than 200 countries.

PepsiCo, Inc. is a food and beverage corporation known for owning various popular brands such as Pepsi, Gatorade, Quaker Oats, and Tropicana. PepsiCo oversees the entire business process concerning its brands, including the production, distribution, and marketing elements. At present, the company is headquartered in New York and owns 23 brands, with distribution occurring in more than 200 countries.

PepsiCo is the second-largest food and beverage company in the world, just behind the Swiss firm Nestle. The company has a fantastic range of brands that include carbonated drinks, snacks, teas, cereals, and more. According to data gathered from FoodBev.com, PepsiCo generated a remarkable $70.37 billion in 2020 – which is even more impressive considering the lowered demand brought about by the COVID-19 pandemic.

At present, PepsiCo has a market cap of $217.01 billion. The company’s CEO is Ramon Laguarta, who also acts as Chairman of PepsiCo. In terms of PepsiCo’s shares, the company has a primary listing on the NASDAQ under the ticker symbol ‘PEP’. Notably, PepsiCo is a member of the S&P 500 and S&P 100 indices.

PepsiCo Share Price

Before investing in a company, one of the best share tips is to review the company’s share price. In terms of the PepsiCo share price, the company is currently trading at $157.07 per share. This is essentially the company’s all-time high, which was reached just days ago. The PepsiCo share price has had an up and down year so far, currently up by 7% since the turn of the year. The early part of the year saw shares drop quite drastically; however, since then, the PepsiCo share price has recovered to reach the heights we see today.

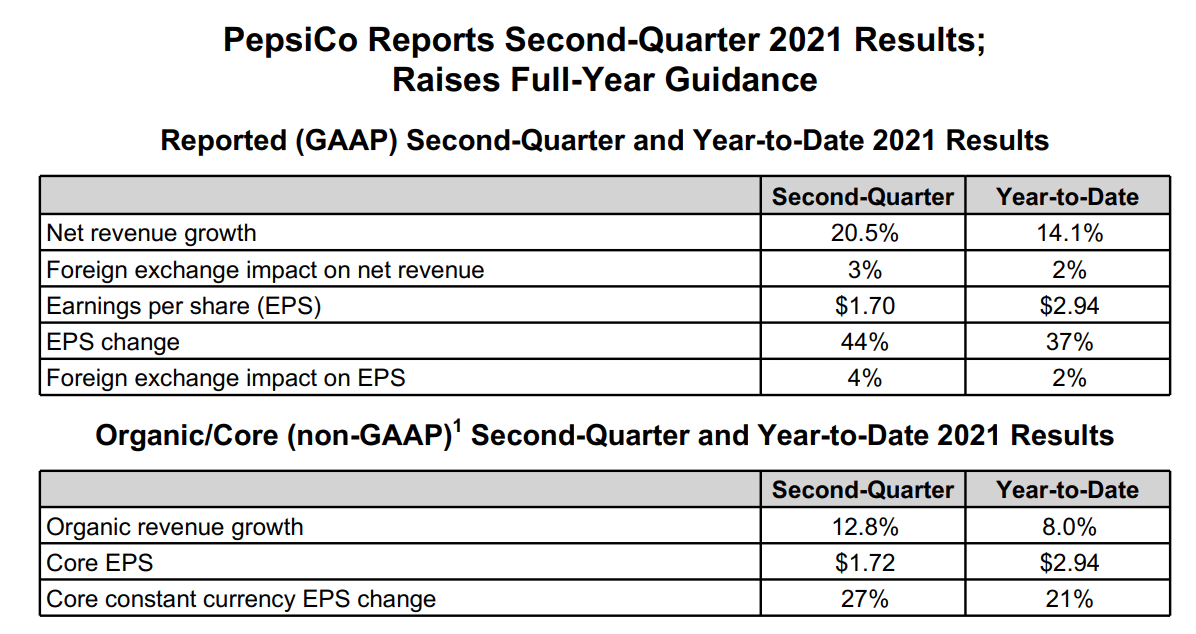

According to Q2 earnings data from MacroTrends, PepsiCo’s earnings per share (EPS) figure is currently sitting at $1.70. This represents a 44.07% increase from this time last year – a remarkable show of growth from the company. Furthermore, according to the most up-to-date data, PepsiCo’s P/E ratio is stated as 25.94. This is the highest it has been since late 2018, showcasing just how well the company has performed financially.

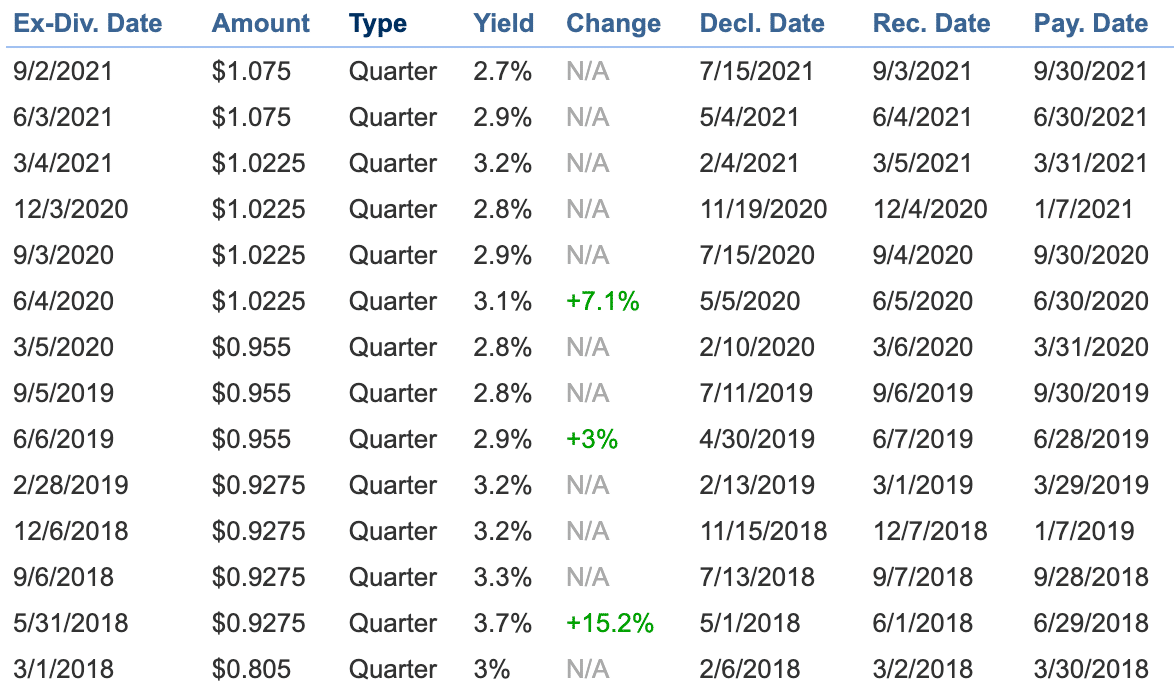

PepsiCo Shares Dividends

If you are interested in investing for income, then PepsiCo is undoubtedly worth considering. The company currently pays a quarterly dividend to shareholders, occurring in January, March, June, and September. The dividend payment for September has already been declared – so if you were to invest in PepsiCo shares today, the following payment you’d be eligible for is in January.

PepsiCo’s annual dividend yield is currently 2.7%, a solid amount for a food and beverage company. One of the best things about PepsiCo is that the company seems to increase dividend payouts every single year. The yearly dividend for 2020 was 402.25c per share – an increase of 6.1% from the previous year. This dividend growth, combined with the consistent payments, makes PepsiCo one of the best dividend stocks this year.

PepsiCo ESG Breakdown

Traders interested in ethical investments will be interested in knowing how well PepsiCo does in terms of environmental, social, and governmental factors. We’ve researched the company and its operations in-depth to determine where PepsiCo sits on the ESG scale. Found below is a breakdown of PepsiCo’s ESG rating for 2021:

- Environmental – 5.1/100

- Social – 7.8/100

- Governance – 4.8/100

As you can see, PepsiCo ranks very low on the elements of the ESG breakdown. The company’s total ESG score puts them in the 15th percentile, meaning they are categorised as having a ‘Low’ ESG risk score. Essentially, this means that PepsiCo is performing admirably in terms of its impact on the environment and society as a whole – which is excellent news for people looking to add ethical companies to their portfolios.

Are PepsiCo Shares a Good Buy?

So, putting everything together, are PepsiCo a good buy? We believe so. To back up our arguments, the two points below showcase why we feel PepsiCo is an excellent addition to your portfolio for the months (and years) to come:

Strong Financials

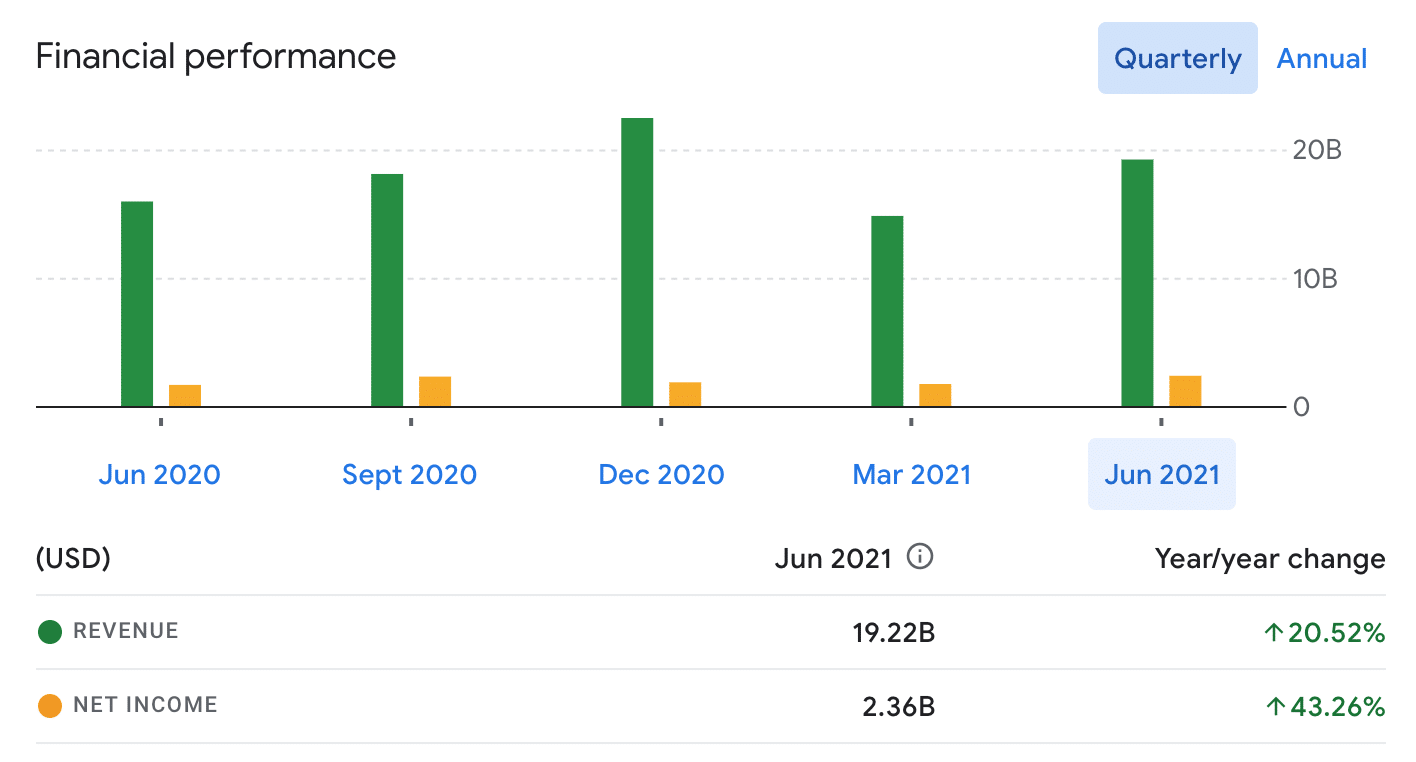

As you can see from the chart below, PepsiCo’s financials are solid. The company’s core earnings increased by an impressive 27% in Q2, thanks to supply chain efficiencies and cost-cutting measures. PepsiCo also saw increases in sales from business segments such as their snack segment – snack sales rose by 6%, adding a further boost to its revenues.

In the future, the company looks set to continue growing at a rapid pace. The recent earnings report noted that PepsiCo expects sales to increase by 6% in 2021, which would be remarkable for a company of its size. Furthermore, when you add PepsiCo’s impressive dividend into the mix, it makes for an attractive investment opportunity.

Brand Awareness

Aside from the increasing PepsiCo share price and the company’s strong financials, there are other intangible reasons to invest in PepsiCo. One of these reasons is the company’s brand awareness, which puts them in a great place to continue growth. Brands such as Pepsi and Gatorade will always be popular – which allows PepsiCo to generate huge revenues whilst still innovating in other areas.

By investing in a well-established company, you’ll be able to benefit from lower volatility over the longer term. PepsiCo certainly fit the bill in this regard, making them one of the best long term investments in the current climate.

PepsiCo Shares Buy or Sell?

Putting everything together, is it a good idea to buy PepsiCo shares in the UK? We believe so. If you look at the growth rate that the company is experiencing in sales and earnings, it’s clear to see why the PepsiCo share price is currently at all-time highs. Furthermore, if you add the company’s impressive dividend yield into the mix, it makes for an exciting investment proposition.

Earnings per share (EPS) estimates rose by a remarkable 27% in Q2, showing just how well PepsiCo has performed as lockdowns have begun to ease. The sheer diversity of PepsiCo’s brand portfolio means that the company is well-placed to navigate any market shocks or demand decreases, which makes them ideal for people investing over the long term.

Overall, we see no signs of PepsiCo’s growth halting any time soon. Analyst expectations for the company are incredibly positive, with earnings projected to grow rapidly over the next five years. If PepsiCo can continue this growth and dividends keep rising, then the company’s stock can undoubtedly be classed as one of the best investments this year.

Buy PepsiCo Shares With 0% Commission

As this article has highlighted, PepsiCo is one of the best growth stocks to buy right now, thanks to increasing sales and rising profits. If PepsiCo can continue on this trajectory, there’s no question the stock price will benefit greatly – leading to fantastic returns for shareholders.