Best Cyber Security ETF UK to Watch

There has been a recent increase in demand for cyber security services causing stock and ETF prices covering this sector to surge recently.

In this guide, we review some popular Cyber Security ETFs and go through some popular stock brokers that allow users to invest in this sector.

Popular Cyber Security ETF UK 2022 List

If you’re looking for popular cyber security ETFs in the UK, below is a list of the popular ETFs that focus on this sector.

- First Trust Nasdaq Cybersecurity ETF

- Global X Cybersecurity ETF

- L&G Cyber Security ETF

- PureFunds ISE Cyber Security ETF

- ETFS ISE Cyber Security GO UCITS ETF

- iShares Cybersecurity & Tech ETF

- WisdomeTree Cybersecurity Fund

- Rize Cybersecurity & Data Privacy ETF

- ProShares Ultra Nasdaq Cybersecurity Fund

- Simplify Volt Cloud & Cybersecurity Disruption ETF

These ETFs cover a wide range of ETF cyber security providers. Each of them will have a specific focus on the sector such as investing in cybersecurity companies, cloud computing stocks or data privacy stocks.

Popular Cyber Security ETFs UK Reviewed

Let’s take a look an in-depth look at 10 popular Cyber Security ETFs in the UK.

1. First Trust Nasdaq Cybersecurity ETF

The First Trust Nasdaq Cybersecurity ETF (ticker CIBR) is the world’s largest exchange-traded fund that focuses on the cybersecurity sector. The aim of the fund is to seek returns that correspond to the price of the equity index Nasdaq CTA Cybersecurity Index.

As such the fund investors into companies that are engaged in the creation, implementation and management of security protocols focused on public and private networks, mobiles and computers.

For the fund to invest, the cybersecurity company must have a global market cap of $250 million and a three-month average daily trading volume of $1 million to ensure enough liquidity.

The recent price action of the First Trust Nasdaq Cybersecurity ETF shown above was fairly range based at the beginning of the year before breaking out into a long-term uptrend.

The ransomware attack on the United State’s largest oil pipeline system called the Colonial Pipeline earlier in the year, has led to investors pouring into cybersecurity ETFs like this one. The stock is currently trading at all-time high price levels.

2. Global X Cybersecurity ETF

The Global X Cybersecurity ETF (BUG) is the world’s second-largest cybersecurity fund. It has net assets of around $990 million and a low total expense ratio of 0.5%.

Overall, the fund has 31 holdings which include popular cybersecurity companies such as Zscaler, Fortinet, Crowdstrike Holdings Inc, Palo Alto Networks and others.

According to the fund’s factsheet, the aim of the fund is to invest in companies that are likely to benefit from the increased adoption of cybersecurity technology. This is mainly companies that focus on the development and management of security protocols that prevent attacks and intrusion into different systems.

The Global X Cybersecurity ETF is up more than 100% since inception.

3. L&G Cyber Security ETF

The L&G Cyber Security UCITS ETF (HURNTR) is available to invest indirectly from the LGIM Cyber Security ETF product which is on the L&G Investment Management portal.

Essentially, the L&G Cyber Security ETF is a tracker fund of the ISE Cyber Security UCITS Index which is part of the Nasdaq ISE Indexes range. The L&G Cyber Security ETF has 63 securities in the fund which includes companies such as Darktrace and Palo Alto Networks.

According to the L& Cyber Security UCITS ETF factsheet, the aim of the fund is to track the results of companies who are actively involved in providing cyber security services and technology. More than 85% of the fund is weighted towards the technology industry.

Currently, the L&G Cyber Security UCITS ETF share price is trading at record highs.

There is the L&G Cyber Security UCITS ETF (ISPY) which is denominated in the British pound (GBP), rather than US dollars (USD) like most cyber security ETFs.

4. PureFunds ISE Cyber Security ETF

The PureFunds ISE Cyber Security ETF was a very popular cyber security ETF. In 2017, the name changed to the ETFMG Prime Cyber Security ETF (HACK). The fund invests in companies that provide cyber security solutions over hardware and software services.

The fund trades on NYSE Arca venue and has a low expense ratio of 0.60%. The fund aims to track the performance of the Prime Cyber Defense Index and currently has 63 holdings within it which are rebalanced quarterly.

According to the fund’s factsheet, the three largest holdings include Cloudflare (NET), Cisco Systems (CSCO) and Palo Alto Networks (PANW).

5. ETFS ISE Cyber Security GO UCITS ETF

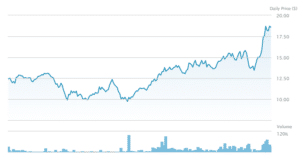

The ETFS ISE Cyber Cyber Security Go UCITS ETF is an Ireland-based cyber security fund that aims to track the performance of the ISE Cyber Security Index. The fund has units that are priced in US dollars (USD), euros (EUR) and British pounds (GBP).

According to the fund’s fact sheet, the ETFS ISE Cyber Security ETF holds 57 stocks. Some of the largest holdings include Palo Alto Networks, Fortinet, Cyberark and Avast.

The share price of the ETF has performed well since its inception and over the last five years as the chart above shows. The total expense ratio of the fund is 0.75% and is invested in stocks across a wide range of currencies but is unhedged.

6. iShares Cybersecurity & Tech ETF

iShares is one of the largest ETF providers in the world and was formed by the largest asset manager in the world BlackRock. The iShares Cybersecurity and Tech ETF’s (IHAK) aim is to invest in companies that are at the forefront of cybersecurity innovation.

The fund aims to track the benchmark index fund NYSE FactSet Global Cyber Security Index. According to the fund’s factsheet, it holds 41 different cybersecurity stocks and has a very low expense ratio of just 0.47%.

The biggest holdings in its fund include Zscaler (ZS), Fortinet (FTNT), CrowdStrike Holdings Inc (CRWD) and others.

7. WisdomeTree Cybersecurity Fund

The WisdomTree Cybersecurity Fund (WCBR.NV) is run by a team of financial professionals and specialists in cybersecurity called Team8. The aim of the fund is to target exposure to companies that are driving innovation in cybersecurity technologies.

The fund has a low expense ratio of 0.45% and was only created at the beginning of 2021. According to the fund’s factsheet, the largest holdings are Cloudflare (NET), Datadog (DDOG), Rapid7 (RPD) and CrowdStrike Holdings Inc (CRWD).

While the fund may be new, it has performed relatively well over the past year. According to the WisdomeTree Cybersecurity Fund prospectus a $10,000 initial investment at the time of inception (28 January 2021), would currently be worth $12,105.

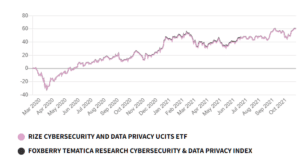

8. Rize Cybersecurity & Data Privacy ETF

Rize ETF is Europe’s first specialist thematic ETF issuer. The investment team at Rize ETF have created Europe’s first cybersecurity and data privacy ETF.

The Rize Cybersecurity & Data Privacy ETF (CYBR) aims to track the performance of the Foxberry Tematica Research Cybersecurity & Data Privacy Index. The NAV per share is currently USD 7.9149 and the amount of the net assets total USD 130,534, 474.

According to the fund’s factsheet, the fund has 56 holdings. Some of the biggest holdings include Cloudflare, Zscaler, Rapid7, Fortinet and Okta Inc.

When the ETF first launched it sank nearly 50% lower. However, the ETF price is currently 60% higher than its initial public offering price.

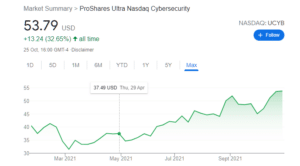

9. ProShares Ultra Nasdaq Cybersecurity Fund

The ProShares Ultra Nasdaq Cybersecurity Fund (UCYB) has unique properties. It is a leveraged index ETF. The aim of the fund is to provide returns that correspond to two times (2x) the daily performance of the Nasdaq CTA Cybersecurity Index.

Known as ‘geared investing’ leveraged ETFs amplify both gains and losses so investing in this fund does provide high risk and volatility than others. The Nasdaq CTA Cybersecurity Index tracks the performance of 36 companies with the biggest holdings including Accenture, Cisco Systems, Okta and Pal Alto Networks.

The ProShares Ultra Nasdaq Cybersecurity ETF only launched at the beginning of 2021. However, the fund is already up more than 30%. The expense ratio is higher than some of the other funds at 1.12%.

10. Simplify Volt Cloud & Cybersecurity Disruption ETF

The Simplify Volt Cloud & Cybersecurity Disruption ETF (VCLO) holds a narrow portfolio of companies that focus on global cloud computing and cybersecurity. The type of companies the fund invests in include streaming media, cloud storage, payment methodologies, big data, data management and cybersecurity.

One difference with this fund is that they will use put and call options to leverage the future performance of the underlying stock. At the time of writing the fund is holding class A stock in Cloudflare, CrowdStrike Holdings Inc, Datadog and Palantir. There are also options positions on Zscaler, Snowflake and others.

While the fund is relatively new its year to date performance is beyond 53%. The expense ratio is 0.95% owning to the fact this is a more actively traded fund due to the options positions it participates in.

Cyber Security ETFs

If you are looking to invest in Cyber Security ETFs, then it is important to do so with a broker that can provide low fees, multiple investment options and other features that will help you in the investment process.

In the sections below, we will review two stock brokers that allow users to purchase Cyber Security ETFs.

Conclusion

It’s quite clear that the cyber security sector is going through a boom period in the last few years. Uncertainty in the market may bring-forth more risk according to some market analysts. This is why users should conduct their own research before investing in any ETF from the sector.

Should you choose to invest in Cyber Security ETFs, you may want to do so with a reputable broker that caters to your investing requirements.