The Next Bitcoin UK

Over the past decade, Bitcoin has dominated the cryptocurrency market due to its size and first-mover advantage. However, recently we have seen more and more coins launch that aim to rival Bitcoin, offering investors additional opportunities within the crypto ecosystem.

In this guide, we’ll discuss the next Bitcoin UK in detail, exploring the various options available in the market and highlighting how you can invest in these coins today – with low fees!

Key points on the Next Bitcoin

- Although Bitcoin still has the highest market cap of any cryptocurrency, there are now hundreds of alternatives to BTC for investors to consider.

- DeFi coins, ERC-20 tokens, and stablecoins are just a few contenders to be the next Bitcoin.

- When investing in cryptos such as this, it’s crucial that you research elements such as regulation, availability, and scalability over the long term.

- Our recommended broker to buy the next Bitcoin is Coinbase,as you can invest in many different cryptocurrencies with excellent security features.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

The Next Bitcoin List 2021

Are you interested in figuring out what the next Bitcoin is? If so, the list below presents our top 10 cryptos that could rival BTC soon.

- Ethereum (ETH) – Overall Top Pick to be the Next Bitcoin

- Litecoin (LTC) – Alternative to Bitcoin with Quicker Transactions

- Dogecoin (DOGE) – Meme Coin Which Could Be the Next Bitcoin

- Monero (XMR) – Innovative Crypto with Better Privacy than Bitcoin

- Algorand (ALGO) – Speedy Blockchain Platform Offering Bitcoin Alternative

- Tether (USDT) – Stablecoin with the Potential to be the Next Bitcoin

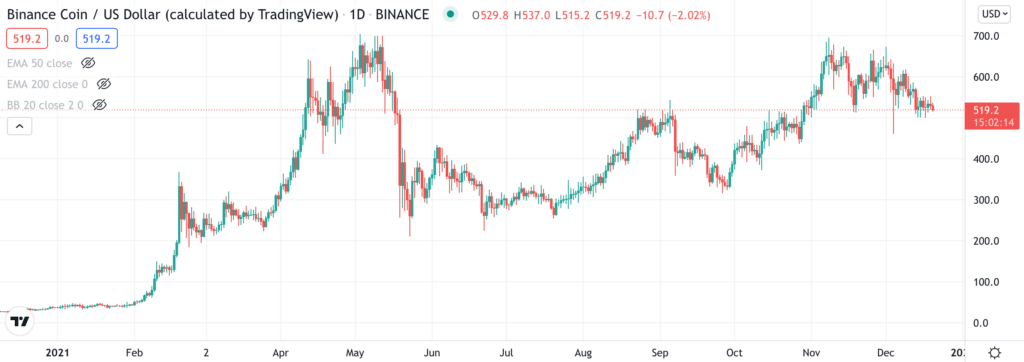

- Binance Coin (BNB) – Exchange Token Which May Be the Next Bitcoin

- TRON (TRX) – Decentralised Blockchain for Content Creators

- Stellar (XLM) – Low-Volatility Crypto with Potential to be the Next Bitcoin

- Polkadot (DOT) – Blockchain Protocol with High Scalability

Contenders for the Next Bitcoin – a Closer Look

If you’re looking to buy cryptocurrency, you may wish to invest in something that isn’t Bitcoin to gain exposure to exciting new opportunities. Let’s explore some of the top altcoins available right now, touching on their features and future potential.

1. Ethereum (ETH) – Overall Top Pick to be the Next Bitcoin

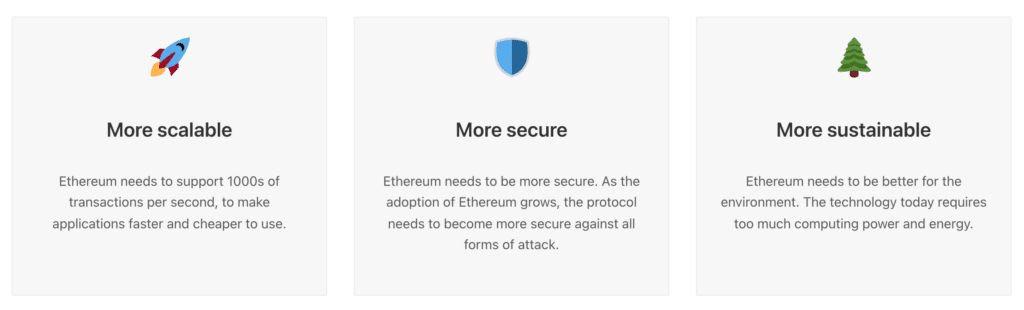

Understandably, our pick for the next Bitcoin is Ethereum. With a market cap of over $454bn, Ethereum is the second-largest cryptocurrency in the world behind BTC. Most people who buy Ethereum will understand its potential, as the Ethereum blockchain has complete functionality for smart contracts. Due to this, developers can build decentralised applications (dApps) on the Ethereum network, opening up incredible opportunities in the realms of DeFi and NFTs.

Although Ethereum’s scalability has been a concern for a while, the upcoming upgrade to ‘Ethereum 2.0’ is set to change all of that. The network will be transitioning to a Proof-of-Stake (PoS) mechanism, which will be greener, faster, and cheaper for users. Furthermore, as Ethereum has the first-mover advantage in this area, most developers will be inclined to build their projects on the Ethereum network. Overall, the future looks bright for Ether (ETH), making it our recommended pick for the next Bitcoin.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

2. Litecoin (LTC) – Alternative to Bitcoin with Quicker Transactions

If you’re looking for a Bitcoin alternative that offers similar functionality to BTC, then we’d recommend checking out Litecoin. Much like Bitcoin, Litecoin provides a way for people to send money to each other quickly and cost-effectively. It does this through the use of the Lightning Network, which shares many of the same features as the one developed by Bitcoin. Through this network, customers can pay for goods and services using cryptocurrency, avoiding the fees and transaction times experienced when using traditional banking methods.

Compared to Bitcoin, Litecoin has a much shorter block generation time, meaning that transactions can be confirmed much quicker. Litecoin also has a fixed supply of 84 million coins, with over 69 million already in circulation. Ultimately, Litecoin’s goal is to be used as a method of value transfer as we continue to see industries transition into the crypto ecosystem. So, although it is still behind BTC right now, there’s scope for LTC to grow more prominent in the years ahead and make up some ground on the price of Bitcoin.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

3. Dogecoin (DOGE) – Meme Coin Which Could Be the Next Bitcoin

If you’re familiar with cryptocurrency trading UK, you’ll undoubtedly have heard of Dogecoin. Dogecoin was famously started as a joke between two software engineers, yet has grown exponentially in the past year and is not consistently in the top 10 cryptos as measured by market cap. This crypto is based on the mechanics behind Litecoin and functions in much the same way, offering functionality to send and receive money quickly and with low fees. Furthermore, as DOGE has no fixed cap, this incentivises people to use it for payments, making it more widespread.

One of Dogecoin’s main draws is its community backing. Since it started as a joke and features the well-known Shiba Inu meme on its coin, Dogecoin has attracted a significant following on social media sites such as Reddit. Furthermore, Dogecoin has also been mentioned by numerous celebrities – including a notable mention by Elon Musk on SNL. Overall, although many still view Dogecoin as a caricature, the fact is that this crypto is now one of the main BTC alternatives, meaning it has a bright future ahead of it.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

4. Monero (XMR) – Innovative Crypto with Better Privacy than Bitcoin

If you’re wondering, “What’s the next Bitcoin?” then Monero may be the answer. Monero is known as a ‘privacy coin’, meaning that it builds on the functionality offered by BTC but makes it more private. When you send someone money on the Bitcoin network, other users can see the amount sent and the wallet addresses involved in the transaction. By using Monero, this information is hidden, making transactions completely anonymous and private.

Monero uses an open-source network, meaning that anyone can contribute or suggest ideas to improve the system. As Monero hides private information through the use of a ‘stealth address’, this makes the coin a go-to for people sending or receiving money for shady reasons. Due to this, privacy coins like Monero have been under regulatory scrutiny in recent times, as they are seen as a way to money launder or contribute to other illegitimate activities. However, aside from this, Monero offers a great alternative to BTC for those interested in maintaining privacy – meaning that it’s likely to continue growing in popularity in the years ahead.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

5. Algorand (ALGO) – Speedy Blockchain Platform Offering Bitcoin Alternative

If you’re looking for an excellent long term investment in the crypto space, then Algorand is worth considering. Algorand is a blockchain platform that offers developers to way to create and host decentralised applications (dApps). The platform was created in 2017 by Silvio Micali, a famous computer scientist at MIT who won the Turing Award in 2012. Along with Silvio, the development team behind Algorand is filled with experienced academics, adding a great deal of credibility to the platform.

Like Ethereum, Algorand has full support for smart contracts and is built using a Pure Proof of Stake (PPoS) consensus. Many see this as a better version than traditional PoS algorithms, as it allows anyone to participate in the network and earn rewards. Due to this, Algorand can support around 1000 transactions per second (TPS) with near-instant finality. Finally, Algorand’s creators claim the platform is carbon-neutral, making it appealing to environmentally-conscious investors. Overall, Algorand is a fascinating platform and looks set to continue growing in popularity in 2022 and beyond.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

6. Tether (USDT) – Stablecoin with the Potential to be the Next Bitcoin

Another of the best cryptocurrencies UK to consider is Tether. Tether is very different from other cryptocurrencies because its value is pegged to the US dollar (USD). This makes it a ‘stablecoin’, allowing it to be used as a payment method for many vendors. Tether is backed by USD, meaning that for every USDT, there is an equivalent in USD, held by Tether Limited in China. Due to this, Tether is a crucial part of the crypto ecosystem, as it allows merchants to get involved in the sector without overly worrying about volatility eroding the coin’s value.

Tether has many use cases, making this digital money a potential option for the next Bitcoin. Many cryptocurrency exchanges offer trading pairs that contain USDT, meaning Tether can be used as a ‘bridge’ between traditional capital markets and the crypto market. Furthermore, users can also exchange their crypto to USDT in bear markets, which may preserve value faster than cashing out. Finally, more and more merchants are accepting USDT as a payment method, making it a viable alternative to BTC for the years ahead.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

7. Binance Coin (BNB) – Exchange Token Which May Be the Next Bitcoin

If you are familiar with Binance, you’ll likely have heard of Binance Coin. Put simply, Binance Coin (BNB) is the native token of the Binance crypto exchange, which is the world’s largest exchange as measured by trading volume. Initially, BNB was solely used as a medium of exchange, acting as a ‘bridge’ between FIAT currencies and the overall market. However, as Binance has grown larger, more and more use cases have developed for BNB, making it an exciting crypto to consider.

Binance clients can use BNB to reduce the transaction fees they pay, providing a clear incentive to hold this coin. Furthermore, BNB holders can also stake their coins, with interest rates over 27% per annum offered on specific lock-in durations. Finally, BNB is even used as a payment method for some online merchants, adding another reason to hold it. Ultimately, as Binance continues to grow in stature, the popularity of BNB will naturally follow – meaning it’s certainly worth considering if you’re looking for the next Bitcoin.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

8. TRON (TRX) – Decentralised Blockchain for Content Creators

TRON is an exciting blockchain platform that seeks to truly decentralise content creation. The platform has a very similar architecture to Ethereum, although it uses a ‘delegated proof of stake’ mechanism to achieve consensus. Ultimately, the TRON ecosystem aims to allow users to own and monetise the content they create, offering an alternative to the likes of YouTube, owned by Alphabet. Furthermore, as TRON has smart contract functionality, the platform also offers scope to create blockchain games and other dApps.

The native token of the TRON platform is TRX, which is used to pay content creators for the material they produce. Holders can also lock up their TRX holdings to gain ‘Tron Power’, which provides them with voting rights and can influence decisions made on the TRON network. Finally, there are no fees for TRX-based transactions, with a capacity for 2000 transactions per second to be completed. As we see society become more decentralised, platforms such as TRON’s will likely become even more popular – making TRX an excellent alternative to Bitcoin as we progress into next year.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

9. Stellar (XLM) – Low-Volatility Crypto with Potential to be the Next Bitcoin

If you’re wondering how to invest £500 in crypto, then Stellar is worth considering. Stellar is a digital asset created by Jed McCaleb, who was also the founder of Ripple (XRP). Essentially, Stellar is a protocol that allows low-cost transfers between people worldwide and provides functionality to exchange any pair of currencies possible. Due to this, Stellar provides a viable alternative to traditional financial services, as cross-border transactions using XLM can be completed in seconds and much more cost-effectively than using the SWIFT network.

The Stellar network handles all of the conversions, with fees pretty much non-existent when making payments. Furthermore, Stellar is designed in such a way to aid people in developing nations who do not have access to a bank account. This is crucial as it enables a whole new demographic to gain access to the crypto ecosystem and work towards financial stability. Overall, although Stellar may not be the most exciting cryptocurrency out there, its relative lack of volatility compared to others will be appealing to investors who are at the ‘risk-averse’ end of the spectrum.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

10. Polkadot (DOT) – Blockchain Protocol with High Scalability

The final cryptocurrency that we’ll discuss today is Polkadot. After recently hitting a record high in November 2021, Polkadot has been on a bit of a downward trend yet still has exceptional prospects for the years ahead. Put simply, Polkadot is an open-source protocol that aims to connect different blockchain networks together, allowing developers to create dApps that work across various platforms. As this will mean more people can use them, cross-chain applications will grow in stature – shaking up entire industries.

Polkadot enables parallel processing through the protocol’s ‘parachain’ system, allowing platforms and applications to boost their scalability significantly. Furthermore, as projects and apps will be able to share information, this will improve the efficiency of these applications and attract more users. The native token of the platform, DOT, can be used for governance and can also be staked by holders to earn rewards. Ultimately, Polkadot looks likely to be the ‘glue’ that bonds various blockchains together in the years ahead – making it a vital component in the crypto market’s success.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

How to Judge the Cryptos Most Likely to be the Next Bitcoin

Much like when you buy Bitcoin, it’s crucial to do your research before placing an investment in your chosen cryptocurrency. Found below are five critical things to consider, ensuring you have the requisite fundamentals to trade optimally.

Price Action

Technical analysis isn’t just used in forex trading UK – it’s also crucial in the crypto market. It’s essential to study the price chart of the coin you’re interested in, as this can provide insight into the coin’s prospects. Keep an eye out for support and resistance areas, along with using technical indicators such as EMAs and Bollinger Bands to look for entry points.

Potential Uses

As new platforms are being created all the time, it’s wise to ensure your chosen coin’s use case is future-proof. A platform such as Ethereum will likely have great staying power, as they already have hundreds of apps built on them. However, newer platforms like Algorand may have better technology, which puts them in a solid position for the future.

Community Backing

A strong community’s impact cannot be understated, as this can help push the price higher than it would without it. During the Coronavirus pandemic, coins like Dogecoin significantly benefitted from social media backing, so it’s wise to consider the community’s strength before investing.

Max Supply

If a coin has a maximum supply and burns tokens regularly, this effectively makes the coin scarce. Due to the laws of supply and demand, the price will rise as supply decreases (assuming demand remains constant). So, by investing in a coin with a max supply, you’ll have a deflationary asset that is more likely to produce solid returns.

Underlying Technology

Finally, the technology underpinning your crypto should be considered. Platforms that use Proof of Work (PoW) are now seen as outdated, with PoS systems considered greener and more scalable. By opting for a coin with advanced tech, you’ll ensure your investment doesn’t become obsolete in the short term – paving the way for more significant long-term gains.

How to Buy the Next Bitcoin

Before we round off this guide, let’s discuss the process of investing in the next Bitcoin. As you may be aware, to invest in crypto, you’ll have to create an account with a licensed broker or exchange. By following the steps presented below, you’ll be able to invest in the next Bitcoin with our recommended broker, Coinbase – all in the space of a few minutes!

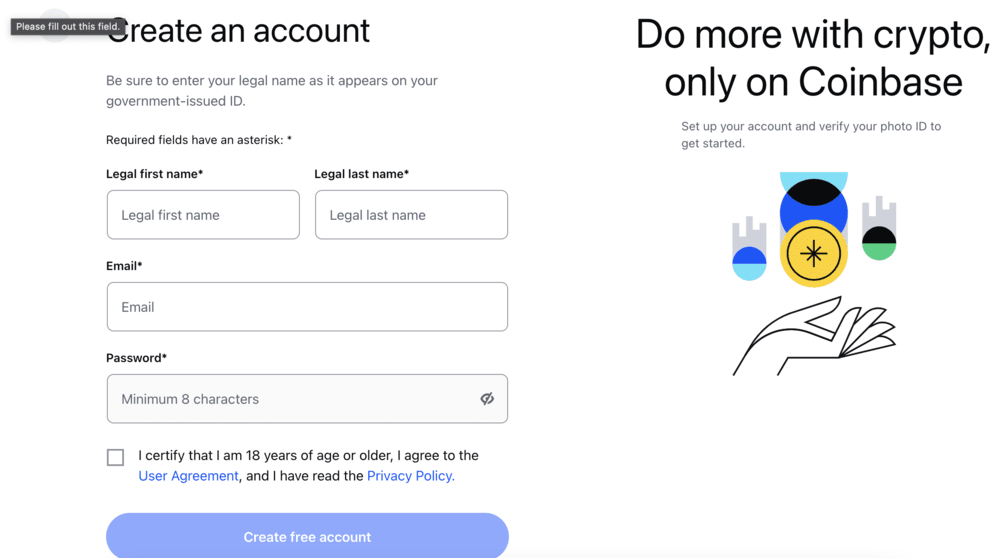

Step 1 – Open a Coinbase Trading Account

The first step is to open an account with Coinbase.

The onboarding process is straightforward and requires some personal information, such as name and email.

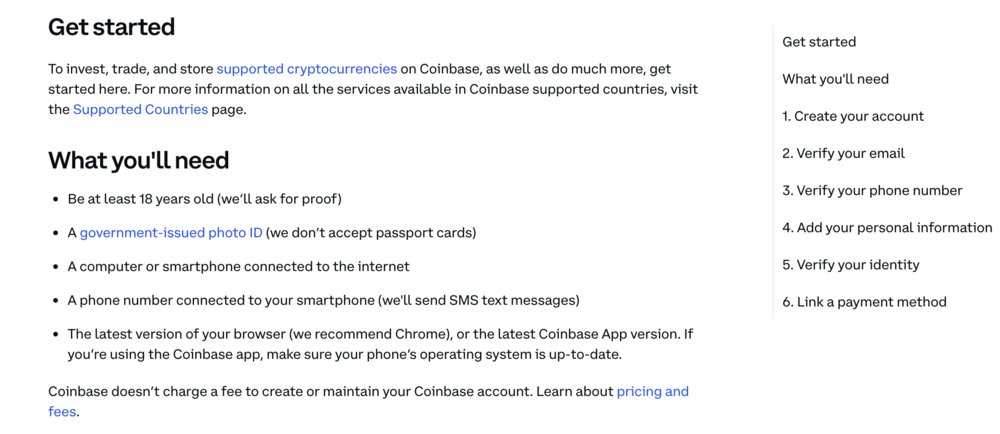

Step 2 – Verification

As part of the standard KYC (know your customer) regulations, you’ll need to upload copies of your passport and a recent bank statement as proof of ID and address.

You will also need a phone number.

This is to help prevent money laundering and identity theft.

Step 3 – Deposit Funds

The next step involves funding your Coinbase brokerage account. As we’ve already discussed you can deposit funds using a variety of payment methods.

There are no deposit fees to pay and e-wallet transfers are processed instantly.

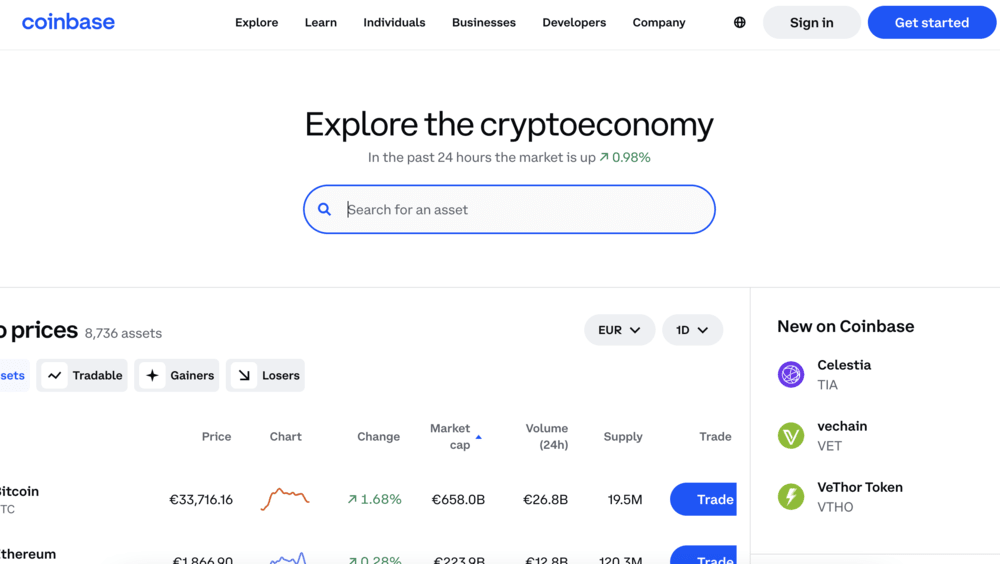

Step 4 – Search For And Purchase Crypto

The final step is to buy your crypto of choice. The easiest way is to type it into the search bar.

You will be taken to an order page to input how much crypto you want to buy, then click on ‘Open Trade’ to have it sent to your wallet.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

The Next Bitcoin UK – Conclusion

In summary, this guide has explored various coins that have the potential to be the next Bitcoin, highlighting their features and discussing their future prospects. Although BTC is still the dominant force in the market, many alternatives are springing up which aims to change the financial system – meaning now is a great time to consider adding them to your portfolio.

If you’d like to buy the next Bitcoin today, we’d recommend opening an account with Coinbase, which has tight spreads and excellent security features.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.