10 Popular Undervalued Stocks Amongst UK Investors

Buying undervalued stocks is the objective of most seasoned investors. After all, you are buying the shares at a price lower than their perceived intrinsic value. In other words, in relation to the company’s true value, you believe that you are making an investment at a discount.

In this guide, we explore some examples of undervalued stocks in the UK in 2025. We also give you some background information on what to look out for when finding undervalued stocks yourself.

-

-

How to Buy Undervalued Stocks

- Choose a low commission stock broker that’s regulated by the FCA.

- Fund your account with a debit card, PayPal, or instant bank transfer.

- Select a company stock and open a position by clicking ‘Buy’.

- To buy and own physical shares, select 1x (zero leverage).

- To trade the share as a CFD, specify your Stop Loss, Leverage (2x or more), Take Profit, and open your trading position.

To learn more, continue reading this guide.

List of Popular Undervalued Stocks

Here’s a quick list of 5 popular undervalued stocks in the UK

- Cineworld

- Boohoo

- BP

- British American Tobacco

- Tesla

5 Undervalued Stocks 2025

Although classifying a share as undervalued is subjective, it’s worth us outlining some possible examples to show you what seasoned investors typically look for.

As such, below you will find 5 undervalued stocks in the UK. You must, however, perform your own market research prior to taking the plunge.

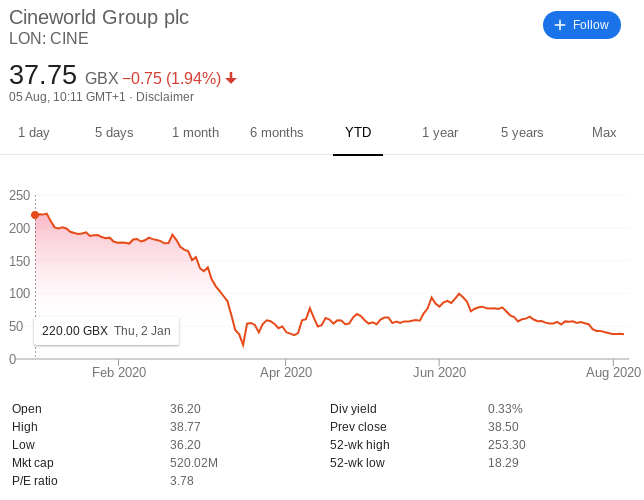

1. Cineworld Group PLC (LSE)

Make no mistake it – were you in possession of Cineworld Group shares at the turn of 2020 and they are still sitting in your portfolio – you would have been looking at significant losses. At the start of the year, for example, the shares were priced at 220p. Fast forward to August 2020 and the very same shares are worth just 37p. This represents a decline of over 83% in just 6 months of trading. It doesn’t take a genius to figure out why the shares have been hit hard.

After all, UK cinemas have spent the vast bulk of 2020 with their doors shut. Put simply, this means that Cineworld has had virtually no incoming revenues for months on end. At the same time, it is burning through cash to meet its overheads and debt obligations. Its share price was further impacted when Universal Pictures and AMC Entertainment formed a partnership to bring new cinema releases to TV screens from 75 days post-screening to just 17 days.

The movies will end up on platforms like Netflix and Amazon Prime Video. While this isn’t ideal for the cinema chain, it should be noted that audience figures won’t necessarily be hit hard by this. For example, as per the UK Cinema Association, admissions grew from 157.50 million in 2014 to 176.10 million in 2019. This represents growth of over 11% during a period that has seen unprecedented demand for TV streaming.

With that being said, it could be argued by some analysts that Cinema Group’s decline is a substantial overreaction from the markets.

2. Boohoo (AIM)

Boohoo is an online retailer that specializes in fashion for the 16-30 demographic. The firm has enjoyed an exceptional ride on the AIM exchange since its listing in 2014. Back then, you would have paid just 70p per share. Boohoo continued its sharp upward trajectory through to July 2020, where the shares breached 433p This translates into a growth of 518% in the course of just 6 years. However, the online retailer was stopped in its tracks not long after its all-time high stock price.

This was because of a news scandal that accused Boohoo of facilitating slave-like working conditions in its factories. Additionally, it was also reported that a factory in Leicester – which is believed to have been sending up to 80% of its garments to Boohoo, was behind a COV-19 breakout in the city. Before the scandal broke, Boohoo was enjoying a remarkable market capitalization of over £6 billion. This would have put it firmly within the reach of the primary LSE and even the FTSE 100.

However, the shares have since tumbled, hitting lows of 224p. This translates into a mass sell-off that resulted in a share price reduction of 48%. Once again, some within the industry argue that the sell-off was a major overaction. After all, it must be noted that the financial markets have a very short memory when it comes to scandals such as this. Since hitting 224p, Boohoo shares have actually recovered to 267p – amounting to gains of 19%.

3. BP (LSE)

Some analysts believe that BP shares are still heavily undervalued. Before we get to that, we need to look at what impact the coronavirus pandemic had on the firm’s stock price. At the start of 2020, you would have paid just over 500p per BP stock.

Then, as global travel came to a standstill in March, BP stocks crashed. In fact, the shares hit 52-week lows of 222p. This means that BP lost just over 55% in share value in less than one month. Fully in line with this downfall was the sharp decline of global oil prices.

The Brent Crude Index – which is the most commonly used oil price benchmark outside of the US, hit lows of $19 per barrel in April. This was highly detrimental for BP, which is reported to have a break-even price of around $35 per barrel. At the time of writing in August, this stands at over $45 per barrel – gains of 189% since its 2020 lows.

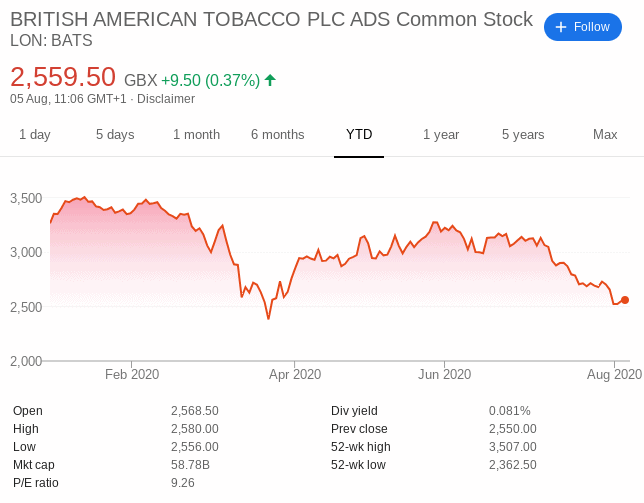

4. British American Tobacco (LSE)

British American Tobacco is one of the largest tobacco producers in the world. It is listed on the London Stock Exchange and it is a major constituent of the FTSE 100. With a huge market capitalization of over £58 billion as of August 2020, you might be surprised to see BAT in our list of 5 popular undervalued stocks. However, there are two key factors that make British American Tobacco stand out from the crowd.

First and foremost, its current share price of 2,562p is far shy of its prior all-time highs. It last reached this feat in 2017 – where the stocks hit 5,578p. Since then, the shares have been moving in the wrong direction. In fact, British American Tobacco shares are worth just under 60% less than their 2017 highs. But, this once again could be unwarranted. For example, the firm has an exceptionally strong balance sheet – which includes free cash flow levels that are more than healthy.

The tobacco giant is also involved in an industry that typically falls within the remit of ‘staple’ products. In simple terms, this means that tobacco is demanded by consumers no matter how good or bad the wider economy is. Moreover, and perhaps most importantly, British American Tobacco is a dividend payer on the FTSE. At the time of writing, this now stands at trailing dividend yield of just over 8%.

5. Tesla (NASDAQ)

For those unaware, Tesla is a US-based electric car maker that is also involved in other sectors such as renewable energy solutions. The firm was only launched in 2003, and it held its respective IPO as recently as 2010. Speculative investors were able to purchase Tesla shares at just $17.

Fast forward to 2020 and the stocks have hit 52-week highs of $1,794. This works out at gains of over 10,000% in just 10 years. This rapid growth was further amplified in July, whereby it was announced that Tesla became the most valuable carmaker in the world. The firm subsequently overtook Toyota – the Japanese car manufacturer that was founded way back in 1937.

Well, first and foremost, we need to look at the very short-term. With the shares priced at $1,487 as of August 2020, there is a bit of upside available if and when Tesla regains its 52-week high of $1,794. In doing so, it would represent a growth of 20%.

What are Undervalued Stocks?

If something in life is undervalued, then it means you stand the chance of buying it at a lower cost price in relation to its ‘true value’. You could just as easily refer to this is as a discounted purchase.

This is no different from the world of stocks and shares. That is to say, by getting your hands on the most undervalued stocks, you are buying the stocks at a price lower than their intrinsic value.

For example:

- Let’s say that you buy BP shares at 250p per stock

- But, based on future cash flows and its predicted revenues, you feel the shares are worth 400p

- As such, you’ve just bought some undervalued stocks

However, the key point here is that the term ‘value’ is a subjective metric. In other words, just because you ‘believe’ that BP shares have an intrinsic value of 400p, this isn’t necessarily the case. On the contrary, the markets might have it spot on at a value of 250p per stock.

As a result, finding and buying undervalued stocks is a skill-set that very few investors can master. Legendary stock market guru Warren Buffet most definitely falls within this bracket. Buffet himself has said on many occasions that the Secret Sauce of choosing which companies to invest in is to look for the most undervalued stocks.

Buffet will do this by reading through financial report after financial report – with the view of finding a hidden gem. If you are successful in buying an undervalued share, then, in theory, you should make money when it returns to its intrinsic value.

How to Find Undervalued Stocks

So now that we have discussed some UK undervalued stocks of 2021, we now need to explain how you can find discounted stocks yourself. After all, you should never buy shares just because a third party believes they are undervalued. On the contrary, you need to perform in-depth research and ultimately – make your own investment decisions.

Nevertheless, to help point you in the right direction, below we list some crucial steps that you need to take in your search for the most undervalued stocks.

Tip 1: Learn why a Company Might be Deemed to be Undervalued

First and foremost, it is somewhat difficult to find an undervalued share if you don’t quite understand why the stocks represent a good deal. After all, for a stock to be undervalued, it needs to be trading at a price lower than its perceived intrinsic value.

This will typically be for one of the following reasons:

Wider Market Crash

When the uncertainties of the COV-19 pandemic came to light, the financial markets reacted with outright fear. That is to say, virtually every stock market in the world lost value during the collapse of March 2020. This was at no fault to individual companies per-say, as the crash brought the entire markets down with it.

With this in mind, stock market crashes could be a prime time to buy undervalued stocks. For example, the S&P 500 – which tracks 500 large companies in the US, went from lows of 2,237 points in March to a current price of 3,306 points. This works out at gains of over 47%. But keep in mind that this is purely for educational purposes and in no way should this be construed as investment advice.

Negative Fundamental News

Shares can react to negative news stories very quickly. For example, if a firm announces that it is planning to make a series of job cuts, this would be a cause of concern for shareholders. As such, there could be a short-lived overaction to the news, with shareholders offloading their stocks.

In turn, this would force the price of the shares down. However, if you can see beyond the news story (like in the case of Boohoo), then this could be a good opportunity to buy the shares at a discount.

Earnings Report

Most companies will release earnings reports every three months. This gives the public a breakdown of how the company has performed in the most recent quarter – and will include metrics like revenues, operating margins, cash flow levels, and more.

If it turns out that the earnings report yields worse-than-expected results, then naturally, the market will respond negatively. Once again, this provides an opportunity for shrewd investors to buy the shares at a discount. This is because the sell-off is often just a short-term reaction.

Tip 2: Focus on Sectors you Understand

On top of exploring why a company might be undervalued, you should also make sure you only focus on sectors that you actually understand. In other words, how can you be sure if a stock is undervalued if you do not know how its business model functions?

For example, do you know how Tesla generates its main source of income, or why British American Tobacco pays such an attractive dividend yield? If you don’t know the answer to these questions, then this illustrates that you need to perform additional research.

In fact, it’s common practice to focus on a particular sector like retail, tech, or banking – as opposed to trying to be a Jack of All Trades.

Tip 3: Learn Key Financial Ratios

While the fundamentals are always a good place to start, there are several financial ratios that can help you find undervalued stocks.

This includes:

- Price-to-Earnings Ratio: This is a ratio that looks specifically at whether a company is potentially over or undervalued. You need to take the current share price and divide it by the firm’s annual earnings. While there are other metrics to take into account, a low P/E ratio could indicate that the shares are trading at below market value.

- Debt-to-Equity Ratio: The debt-to-equity ratio looks at the size of the firm’s debt levels to that of its shareholder equity. The larger the ratio, the more debt it has on its books. This could illustrate that the stock is overvalued, so do bear this in mind.

- Price-to-Earnings to Growth: As the name suggests, this ratio is used in conjunction with the price-to-earnings. You will be left with a ratio once you divide the P/E into the firm’s projected earnings growth. In particular, if the stock has a high P/E and high PEG, it could be undervalued.

There are many other accounting ratios that you can use to determine the true value of a stock. As such, it’s well worth doing some independent research.

Tip 4: Look at the Bigger Picture

There are some metrics in the stocks and shares space that cannot be found on the balance sheet. Instead, you sometimes need to look beyond the numbers. Amazon is a prime example of this. Due to the fact that its online retail business has virtually no competition, Amazon is in full control of its pricing model.

That is to say, during times of economic uncertainties, Amazon has the capacity to reduce its prices in order to attract even more customers. Other online retails operating in the space would not be able to do this, as they don’t have a balance sheet or market share anywhere near as strong as Amazon.

This relates to the process of finding the most undervalued stocks, not least because you sometimes need to think outside the box.

Important Features of Undervalued Stocks

If you were able to get your hands on a £50 note for just £30, would you view this as good value? Well, this is exactly how you should view the most undervalued stocks of 2021. As we discussed in great detail earlier on, you are essentially buying shares at a discount. This is because the price you pay is lower than the stock’s true intrinsic value. If your perception of the stock’s value is correct, then you stand to make money if and when the shares eventually reach their projected value.

For example:

- Let’s say that HSBC shares are priced at 330p

- As per your research, you believe that the intrinsic value of HSBC shares is 500p

- As such, you decide to buy 1,000 shares

- This takes your total investment to £3,300

- Although it takes 18 months, HSBC finally hits your projected share price of 500p

- You sell 1,000 shares at 500p, which amounts to £5,000

- On an initial stake of £3,300, you made a profit of £1,700

Although the above example is arbitrary, it illustrates just how lucrative buying undervalued share can be when your projection is correct.

How to Calculate Undervalued Stocks 2021

The only way that you can calculate undervalued stocks is to use one of the accounting ratios that we discussed earlier. This won’t necessarily give you a sure-fire way of knowing whether or not a share is undervalued, but it will point you in the right direction.

To illustrate this, below we give you an example of how the ratios can help us find an undervalued share.

Example of P/E Calculation

- Let’s say that Facebook has a stock price of $250

- We’ll say the firm made annual profits of $25 billion

- We’ll also say that 2 billion shares are in circulation

- The Earnings Per Share (EPS) would, therefore, amount to 12.5 ($25 billion / 2 billion)

- To get the P/E ratio, we would need to divide 12.5 into Facebook’s share price of $250

- This leaves us with a P/E ratio of 20x

So now that you know that the P/E ratio of Facebook shares is 20x, then what? After all, you would need to be able to compare this to another metric in order to assess the value of the stock. Well, as Facebook is listed on the NASDAQ, it would be wise to see what the average P/E ratio is for that particular exchange.

- If the average P/E ratio on the NASDAQ was 35x, the Facebook shares could be undervalued

- If the average P/E ratio on the NASDAQ was 10x, the Facebook shares could be overvalued

You could go even deeper by looking at the average P/E ratio for firms operating in the same sector as Facebook, such as Twitter.

Example of Price-to-Book Ratio

- The price-to-book (P/B) ratio looks at the firm’s book value against that of its current share price

- The book value looks at the firm’s value in terms of its balance sheet

- If the ratio is below 1, then this could mean that the shares are undervalued

- Let’s say that Company XYZ has a share price of $30

- It also has a book value of $50

- This means that its P/B ratio is 0.6x ($30/$50)

As you can see from the above, as Company XYZ has a P/B ratio of less than 1, it could be undervalued.

Shares Brokers Offering Undervalued Stocks in the UK

If and when you find undervalued stocks, you will then need to locate a suitable stock broker. There are heaps of platforms active in the online space, so you need to find one that meets your needs.

For example, you don’t want to use a broker that charges high fees, as this will eat into your share dealing profits. Similarly, you’ll want to ensure the platform is heavily regulated, and that it accepts your preferred payment method.

With this in mind, below you will find a selection of stock brokers that allow you to buy undervalued stocks in the UK.

1. Plus500

Plus500 does not offer traditional share dealing services. On the contrary, the platform is a specialist CFD (contracts-for-differences) provider. This means that you will be speculating on the future value of a stock without you taking ownership.

Although somewhat different to traditional investing, this does come with a number of benefits. For example, you can choose from both a buy (long) and sell (short) order. This means that you can speculate on whether you think the stock CFDs will increase or decrease in value. All trades at Plus500 are commission-free, too.

Plus500 is also favoured by UK traders because it offers leverage facilities. On stock CFDs, this stands at 1:5 if you are a retail client. This goes up to 1:30 when you trade major currency pairs. Outside of stock CFDs, the platform hosts a range of other financial instruments. This covers CFDs in the form of indices, commodities, cryptocurrencies, forex, and interest rates.

If you like the sound of trading stock CFDs on a commission-free basis, Plus500 allows you to open an account in minutes. It requires a minimum deposit of just £100. You can choose from a debit card, credit card, Paypal, or a bank account transfer. There are no fees to deposit or withdraw funds. Plus500UK Ltd is authorized & regulated by the FCA (#509909).

Broker Number of Shares CFDs or Real Shares? Pricing Structure Price for Trading Amazon Shares Account Fee Plus500 1,000+ stocks CFDs Spreads Spread of 24.16 pips or 0.75% None 3. IG

IG is a very well-established broker that provides access to over 10,000 shares. On top of hundreds of UK-based companies, this also covers shares listed in the UK, South Africa, Australia, Canada, and more.

On the one hand, IG does not offer free share dealing purchases. But, you can still get your hands on stocks for a relatively good price. This starts at £8 per order, which you will pay when you buy shares and again when you sell them. This is especially useful if you trade larger volumes, as a percentage-based commission can hit you hard.

You can actually get your share dealing fee down to £3 if you traded three or more equities in the previous 30 days. IG offers two stock trading platforms to choose from. This covers MT4 and its own proprietary platform. Both are packed with advanced trading tools and technical indicators, which is ideal if you are looking to perform chart analysis. You can also trade via the IG mobile application. This is useful if you want to have access to your portfolio while on the move.

IG allows you to open an account online or via your mobile phone in minutes. You will need to deposit at least £250. Supported payment methods include a UK debit/credit card or bank account. The former is instantly processed, while the latter can take a few days. IG is heavily regulated – including that all-important FCA license.

Broker Number of Shares CFDs or Real Shares? Pricing Structure Price for Trading Amazon Shares Account Fee IG 16,000+ stock CFDs plus UK-traders can trade real stocks from 8 markets Both Trading commission for share CFDs, real shares, and options. Spreads for forex, stock index CFDs, commodity CFDs, and bond CFDs Minimum spread of 0.10% None Sponsored ad. Your capital is at risk

Conclusion

To summarize, undervalued stocks typically allow you to invest in companies at a discount price. This is because traders are potentially buying the shares at a lower price in comparison to their intrinsic value. The difficult part is knowing how to find undervalued stocks.

FAQs

What are undervalued stocks?

If you buy shares at a lower price than their intrinsic value, then you are technically buying undervalued stocks.

Which stock market is popular for finding undervalued stocks?

Undervalued stocks can be found on all stock markets. This includes everything from the LSE, AIM, NASDAQ, and NYSE.

What is the ratio to find undervalued stocks?

There are several ratios that seasoned investors use to find undervalued stocks. This includes the likes of the P/E ratio and P/B ratio.

Which shares are undervalued?

The term ‘undervalued stocks’ is a subjective one. After all, what is undervalued to one investor might appear overvalued to the next! As such, you need to do some research in order to find undervalued stocks.

How do I buy undervalued stocks in the UK?

You can buy undervalued stocks from a regulated stock broker that offers a range of stocks without paying any dealing fees.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

If something in life is undervalued, then it means you stand the chance of buying it at a lower cost price in relation to its ‘true value’. You could just as easily refer to this is as a discounted purchase.

If something in life is undervalued, then it means you stand the chance of buying it at a lower cost price in relation to its ‘true value’. You could just as easily refer to this is as a discounted purchase.