Best High Risk Investments UK to Watch

In this guide, we explore high risk investments in the UK. We also discuss UK brokers to buy high risk investments and how you can get started with an account today.

-

-

5 Popular High Risk Investments

Here’s a list of five popular high risk investments in 2022 to watch.

- Bitcoin

- EasyJet

- Rolls Royce

- Vanguard Emerging Markets Stock ETF

- Cineworld

High Risk Investments in the UK

Each asset class comes with a different level of risk and potential yield, so spend some time thinking about what your financial goals are before taking the plunge.

1. Bitcoin

Bitcoin is the world’s first cryptocurrency and still leads the way in terms is mass awareness, valuation, and real-world usage. To give you some perspective of how rapidly this digital currency has grown, Bitcoin was worth less than a fraction of $0.01 when it was first launched in 2009. Just 9 years later in 2017 – the very same Bitcoin would have cost you $20,000.

The cryptocurrency has since tailed-off in terms of pricing – even hitting lows of $3,000 along the way. With that said, as of November 2020 Bitcoin is valued at around $13,500. Comparing this to its price back in 2009, this represents an unprecedented increase of almost 135 million percent.

It is also important for us to note that a lot of UK investors avoid Bitcoin because they are worried about the safety of their investment.

2. EasyJet

While there are several industries that have been hit particularly hard by the pandemic – none have been quite as disastrous as the airline arena. First, passenger numbers were dropping off anyway as the fears of the virus began to grow in early 2020. Then, as more and more governments around the world implemented entry restrictions, airlines were forced to ground their planes for months on end.

Secondly, you need to assess whether or not your chosen airline has the financial means to see itself through the current economic climate. After all, although planes are once again back in the air, passenger numbers are still at record lows.

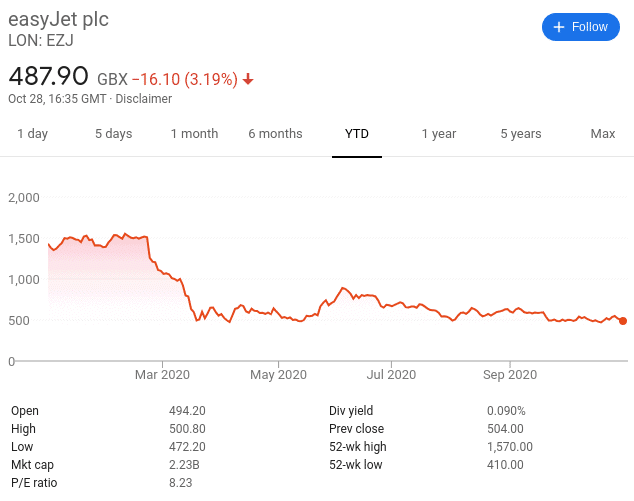

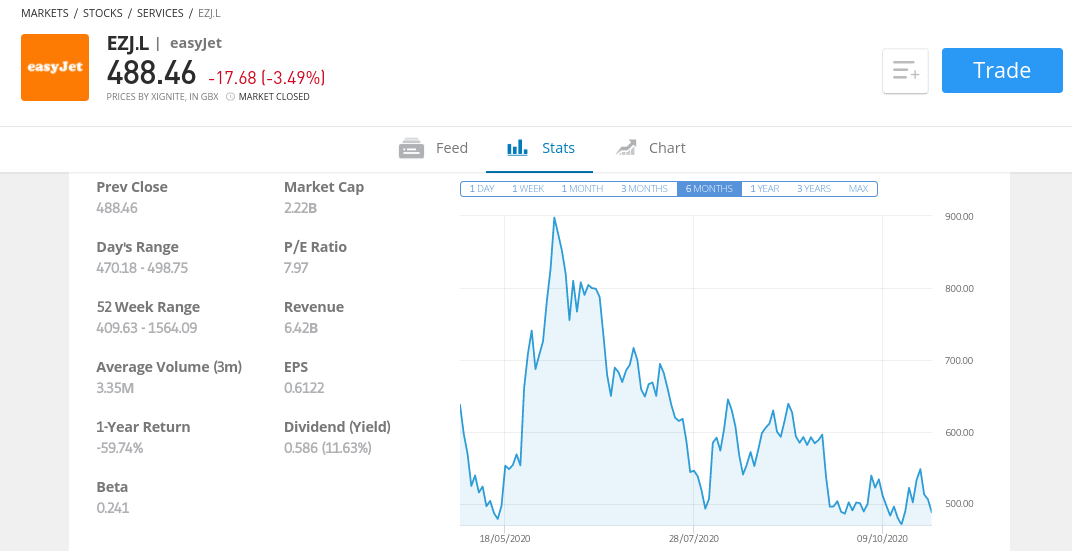

This is why airline stocks sit well within the scope of a high risk investment. In terms of choosing which airline stock to invest in, there are many options are on the table. With that said, we are inclined to stock with budget airline EasyJet. Before we get to the specifics, let’s have a look at the firm’s stock price action. At the start of the year, EasyJet shares were priced at 1,430p.

Fast forward to November 2020 and the same shares are worth just 487p. This represents a 10-month decline of 65%. But, before the pandemic came to fruition, EasyJet shares were actually on a run. For example, back in August 2019, the stocks were priced at 887p.

Sponsored ad. Your capital is at risk.

3. Rolls Royce

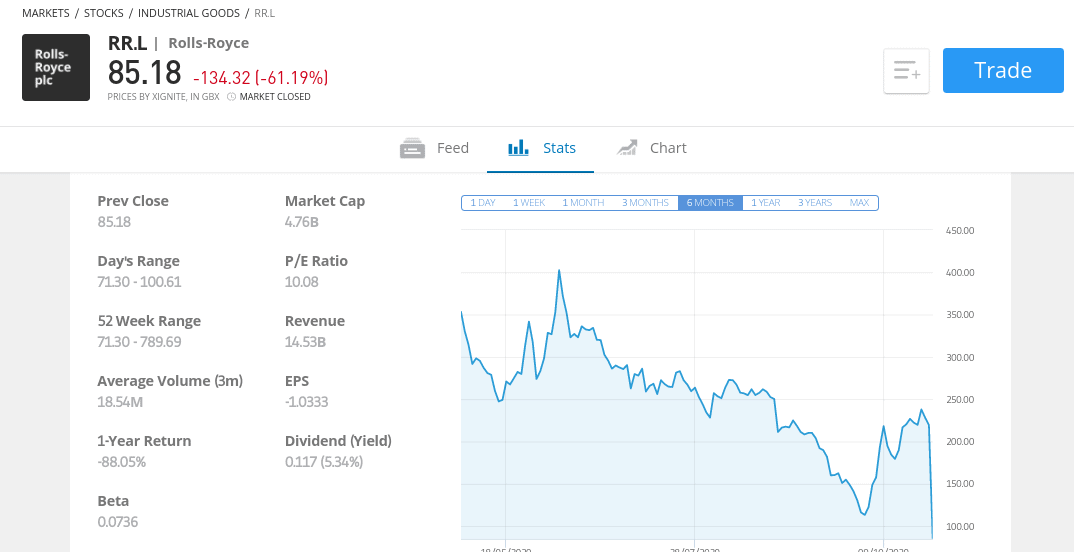

In the 24 hours prior to writing this article, Rolls Royce shares increased by almost 220%. In the 24 hours prior to that, the shares crashed by over 60%. Regarding the 60% drop, this was large because management at Rolls Royce initiated a £6 billion share issue. As such, those currently in possession of stocks were heavily diluted.

At the time of writing, the same shares will cost you just 82p. This translates into a 12-month decline of 95%. To put that into perspective, had you invested £10,00 into Rolls Royce shares 1-year ago, your investment would be worth just £500.

Contrarians, on the other hand, will look at this and question whether Rolls Royce is still a growing concern. As such, we need to look at the fundamentals. We should note that much of Rolls Royce’s business model centres on its high-grade engines. It supplies many of these engines to the airline industry.

This is once again a prime example of how the pandemic has resulted in a ‘dominos’ effect. In other words, as demand for air travel has plummeted, as have the engines that Rolls Royce is so famous for manufacturing. So, taking this lack of demand into account and the pressures it has had on free cash flows, this forced Rolls Royce to issue £2 billion worth of equity.

Sponsored ad. Your capital is at risk.

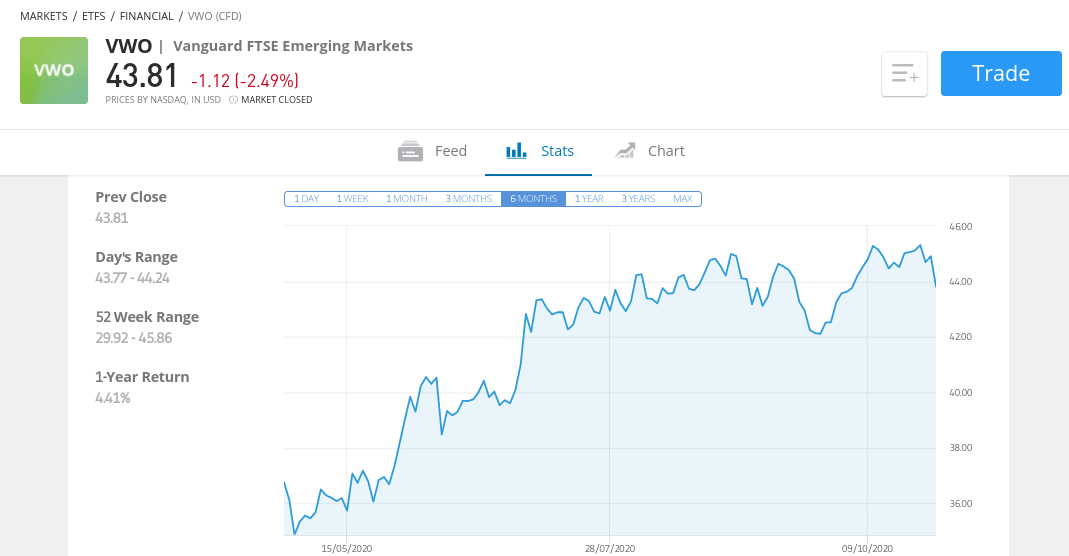

4. Vanguard Emerging Markets Stock ETF

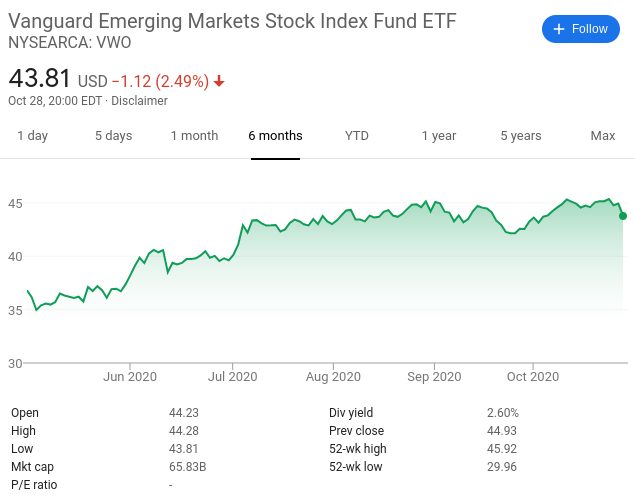

The Vanguard Emerging Markets Stock ETF will buy and sell shares on your behalf. As such, you will benefit from a high risk investment stream that is 100% passive.

This ETF will give you instant access to over 5,000 stocks. 44% of your portfolio will be directed to Chinese stocks, 16% to Taiwan, and 10% to India. Other countries include Russia, Mexico, the Philippines, Malaysia, South Africa, Brazil, and Indonesia.

To give you an idea of some of the stocks that you will be investing in with the Vanguard Emerging Markets Stock ETF, check out the list below:

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Meituan Dianping

- Reliance Industries Ltd.

- Naspers Ltd.

- JD.com Inc.

- Ping An Insurance Group Co. of China Ltd.

- China Construction Bank Corp.

- Infosys Ltd.

As you might have guessed, being able to access companies such as those listed above is not a simple process for UK retail clients. In terms of performance, this high risk investment has yielded almost 10% over the past 12 months.

Sponsored ad. Your capital is at risk.

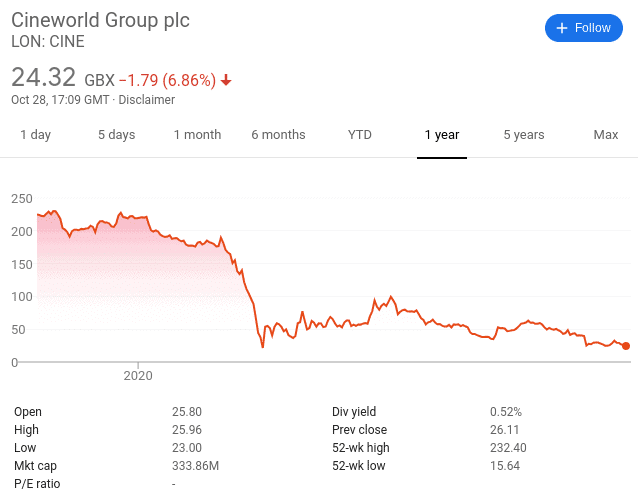

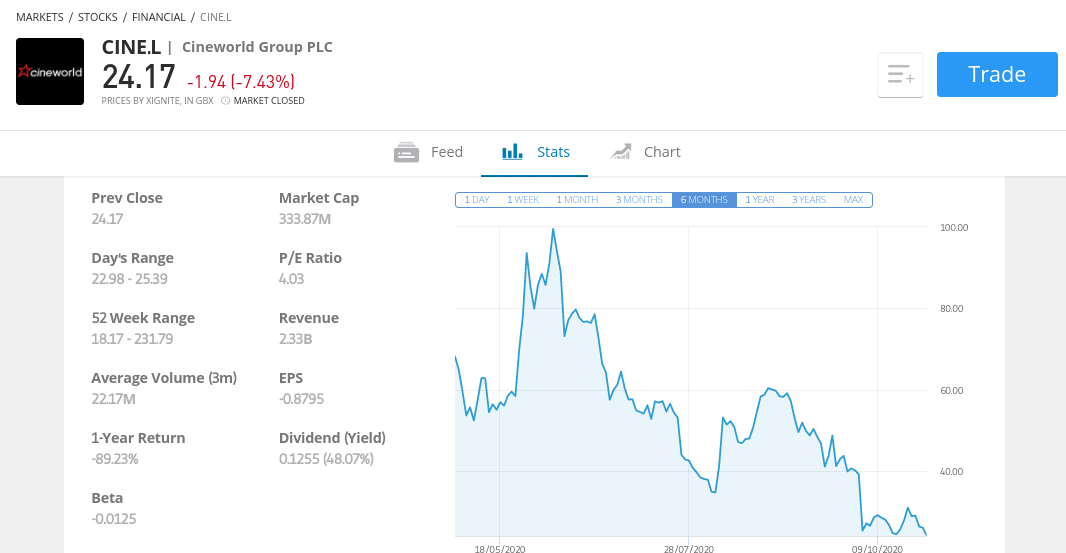

5. Cineworld

In a similar nature to pubs, hotels, restaurants, and gyms – cinemas in the UK were put under severe financial pressures during the lockdown. At the forefront of this is Cineworld – the UK’s largest cinema chain with over 120 sites. All in all, Cineworld stockholders have had a torrid time in 2020 – more so than many shares listed on the London Stock Exchange.

For example, the stocks started the year at 220p each. In November, the same shares are worth just 24p – giving Cineworld a market capitalization of just £333 million. As such, the shares have lost 89% in valuation in just over 10 months of trading. The main concern here is not whether UK cinemas will one day return to pre-covid levels.

This may be more of a probability than a possibility. The key problem is when. Like all sectors trying to battle their way through the wider impact of the virus, Cineworld can’t survive forever. After all, it still has liabilities that it needs to service. With incoming cash flows at record lows, this is becoming more and more challenging.

This is especially the case when you consider that the firm has net debt of over $8 billion. In its recently published half-year results, Cineworld noted that it had enough cash to see it through the next year. In addition to this, its creditors have agreed to work alongside the cinema group, albeit, it remains to be seen for how long.

Sponsored ad. Your capital is at risk.

Platforms Offering High Risk Investments

Not only do you need to spend ample time researching high risk investments for your personal financial goals, but you also need to find a brokerage site.

Check the below list of UK stock brokers to buy high risk investments.

1. IG

The broker – which was launched in 1974, is a public company listed on the London Stock Exchange. With a full host of regulatory licenses under its belt – including that of the FCA and a partnership with the FSCS, you can invest at IG without needing to worry about the security of your funds. Nevertheless, you will have access to over 12,000 assets here.

This includes a huge selection of the UK and international stocks, ETFs, mutual funds, and even investment trusts. With so many assets available, it goes without saying that you have heaps of high risk investments to choose from. For example, you can buy AIM shares, foreign-listed equities, and even trade CFDs. You can also access the cryptocurrency markets, apply leverage, and engage in short-selling.

If opting for the traditional share dealing side of IG, you will be charged a fee of £8 per trade. If you trade regularly at IG, the £8 fee is reduced to just £3. Additionally, you also have the option of placing your high risk investments into a Stocks and Shares ISA.

Sponsored ad. Your capital is at risk.

What are High Risk Investments?

Puts simply, a high risk investment is one that carries an above-average chance of loss. In other words, the ‘risk vs reward’ spectrum is much higher than traditional assets and low risk investments. This means that while you stand the chance of making higher returns, you also face a chance of losing money.

To give you an idea of some high risk investments available in the UK, check out the list below.

- Emerging market stocks

- Emerging market bonds

- Low-grade corporate bonds

- Cryptocurrencies

- Peer-to-peer lending

- Mortgage-backed securities

- Derivatives and leveraged assets

- Commodities

- Penny stocks

- IPOs

- Stocks with weak balance sheets

- Exotic forex pairs

- Venture capital funds

- And many more

Fundamentals of High Risk Investments

With so many high risk types of investments available to UK traders, knowing which assets to add to your portfolio can be challenging. After all, you’re not investing in blue-chip stocks like Apple, Amazon, or IBM.

On the contrary, you are investing in an asset that has a much higher chance of losing your money. This is why the research process is absolutely crucial when it comes to making investment decisions.

Here’s what you need to know before taking the plunge with your chosen UK high risk investments.

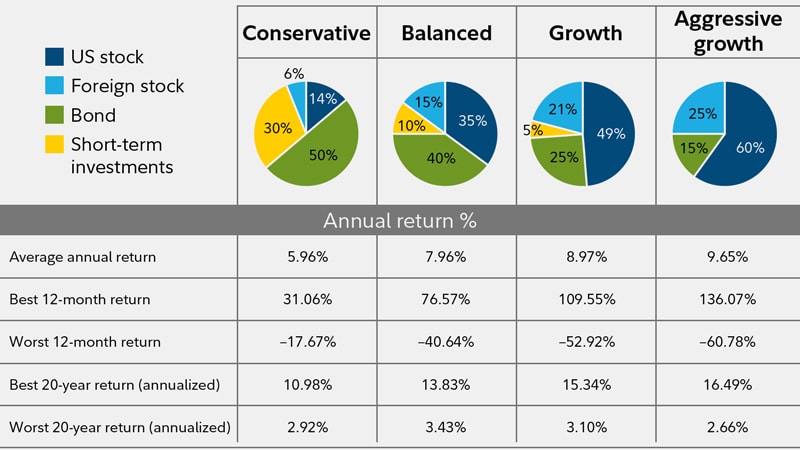

Diversification

Creating a diversified portfolio is one way to limit your risks by some distance.

For example, let’s suppose that you have £10,000 to invest in the financial markets. Of this figure, you want to allocate 5% to high risk investments – which amounts to £500 of your available capital. An inexperienced investor might decide to use the entire £500 into one high risk asset class like Bitcoin or EasyJet shares.

On the other hand, a seasoned investor with a firm understanding of diversification will look to split that £500 across as many high risk investments as possible.

COV-19 Consequences

As have discussed throughout this guide on UK high risk investments, the coronavirus pandemic has had a major impact on the value of many assets.

You need to evaluate is whether or not the company in question has the financial means to get through the pandemic until some sort of normality resumes. This doesn’t necessarily need to be in the form of its cash reserves per se – as some companies have been able to raise sufficient levels of credit.

How Liquid is the Investment?

If a high risk investment is ‘liquid’, this means that you can sell it for cash. For example, the likes of stocks and ETFs have high liquidity levels, as you can exit your position at any given time during normal market hours. This is also the case of cryptocurrencies.

On the other hand, the likes of bonds are not so liquid, are you typically need to wait until they mature to receive your original investment back. All of the high risk investments discussed on this page are liquid.

Conclusion

In summary, while high risk investments do give you the chance to chase returns, you do need to ensure that you have a firm understanding of the additional risk that this represents.

FAQs

What is a high risk investment?

As the name suggests, a high risk investment is a financial instrument that carries an above-average risk of loss.

What are examples of high risk investments?

There are many examples of high risk investments. This includes everything from emerging market bonds and stocks, cryptocurrencies, hedge funds, crowdfunding, peer-to-peer lending, and commodities.

What is the riskiest type of investment?

The riskiest of all asset classes would have to be a cryptocurrency like Bitcoin. With that said, this speculative asset class is a high performing financial instrument over the past decade. Exotic forex pairs are another high risk investment which is prone to volatility due to things like political events and interest rate differentials.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up