Best Absolute Return Funds UK to Watch

Absolute return funds aim to deliver a positive return regardless of whether the market in which they invest rises or falls. In this guide, we are going to cover everything you need to know about absolute return funds. We list and review some Absolute return funds and some brokerages that allow users to invest in them.

10 Popular Absolute Return Funds UK List

Below we review in detail 10 Absolute funds that users can research in the UK.

- The PIMCO Active Bond Exchange-Traded Fund

- Premier Multi-Asset Absolute Return Fund

- LF Ruffer Absolute Return Fund

- Janus Henderson UK Absolute Return Fund

- Jupiter European Opportunities Trust

- Standard Life Global Absolute Return Strategies Fund

- M&G Absolute Return Bond Fund

- BlackRock UK Equity Absolute Return Fund

- FP Argonaut Absolute Return Fund

-

Aegon UK Equity Absolute Return Fund GBP

Popular Absolute Return Fund Reviewed

1. The PIMCO Active Bond Exchange-Traded Fund

PIMCO is one of the largest and most well-known investment managers in the world with around $2.21 trillion in assets under management as of December 2020. Founded by the American superstar bond fund manager Bill Gross, Pimco has 93 funds in various regions including the United Kingdom including the Pimco Active Bond ETF that is one of the most liquid and stable funds offered by the global investment firm. This fund holds a huge number of 1149 assets and has an estimated yield to maturity rate of 2.48%.

In general, the fund seeks fixed income and long-term capital appreciation, regardless of the market conditions – making it among the most popular absolute return funds in the world. Crucially, since inception, the fund has outperformed the benchmark markets with a consistent and stable price movement. If you have any concerns about high volatility, then this fund has an annualized volatility of just 3.73%.

Furthermore, the fund has a net asset value of nearly $4.2 billion and an expense ratio of just 0.57%. Finally, it has a distribution yield of 2.71% and NAV total return (after fees) of 4.49% since its foundation.

2. Premier Multi-Asset Absolute Return fund

With 92 positive months over the last 10 years, this is one popular multi-asset absolute return funds in the UK and globally. The fund invests in a range of assets including bonds, company shares, property funds, and alternative assets (over 60% of its portfolio is invested in alternative securities). Premier was the a popular alternative investment fund in terms of performance over the last year with a return of 13.28%, despite the coronavirus pandemic crisis. And, from the start of the year, the fund has a return of nearly 2%.

Premier Milton has recently reduced the asset management fees on eight of the funds in its multi-asset arm including the Multi-Asset Absolute Return Fund. As such, the new ongoing cost to the fund (OCF) has been reduced to 0.99% from 1.21%.

3. LF Ruffer Absolute Return Fund

If you are looking for low volatility and consistent returns, then you might want to analyse the LF Ruffer Absolute Return Fund. Established in 2006, the fund has a simple goal – to generate positive returns regardless of how the markets perform. This fund invests in Non-UK index-linked, illiquid strategies and options, cash, long-dated index-linked gilts, gold and gold equities, index-linked gilts, etc.

In terms of shares, the 10 largest equity holdings of the fund include iShares Physical Gold, Lloyds Banking Group, Barclays, BP Group, NatWest Group, Countryside Properties, Centene, Yara International, Cigna, and Royal Dutch Shell. The Fund’s net assets under management totaled approximately £4.5 billion, and it offers a dividend yield of 0.76% as of March 2020. The expense ratio – which shows the amount that an investment company charges investors to manage the fund – stands at 1.23%.

In terms of market performance, the fund has generated 4.5% since the start of the year. The 1-Year return stands at 19.7% and more than 58% over the past 10 years.

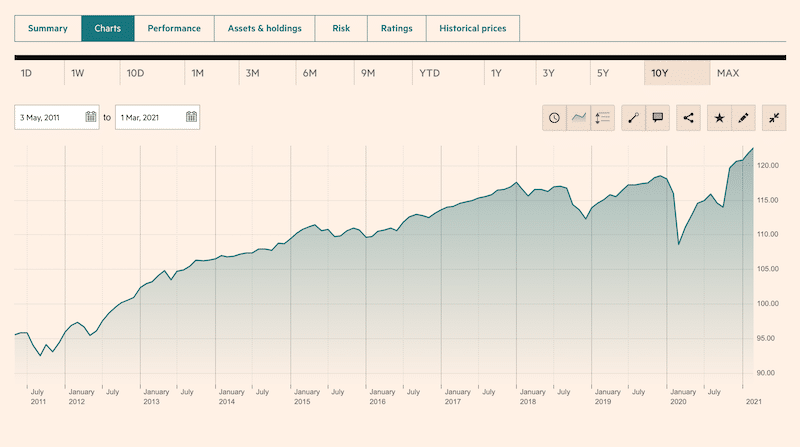

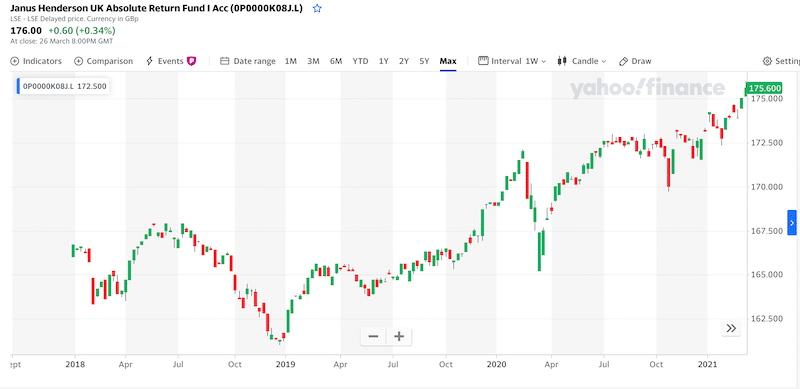

4. Janus Henderson UK Absolute Return Fund

Another defensive absolute return fund that aims to beat inflation and generate a steady yearly return is the Janus Henderson fund. In the past four years, this fund has generated an annual return of 3.4%, -2.3%, 4.8%, and 2.5%. And, so far in 2021, the fund’s return stands at 1.91%.

Ultimately, this fund has one target – To outperform the Bank of England base rate (after the deduction of charges) over a period of 3 years. It is, therefore, invests in shares and derivatives to take both long and short positions in companies in the UK, meaning it aims to provide positive return regardless of the future direction of the market. The overall portfolio composition includes 68.7% in cash and 30 .77% in stocks, meaning the exposure to the stock is relatively low when compared to other absolute return funds.

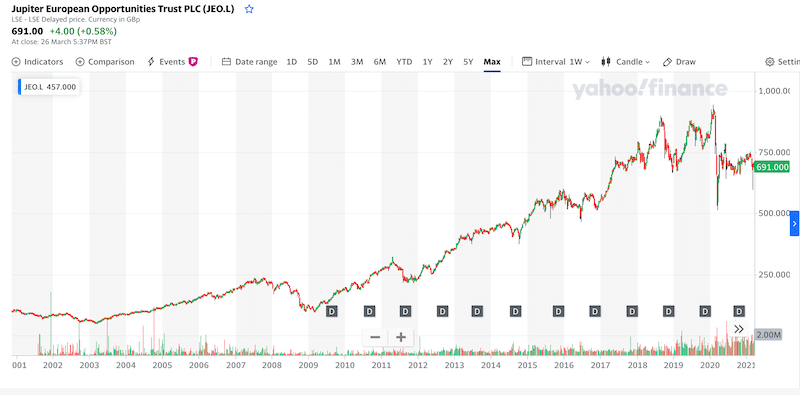

5. Jupiter European Opportunities Trust

Unlike all the other funds on our list, the Jupiter European Opportunities Trust is not a pure absolute return fund. This fund basically invests in securities of European companies, with a focus on companies that have a sustainable competitive advantage.

As such, the fund is exposed to the risk of a stock market crash or a correction in stock prices, so it’s a fairly high risk investment. Nonetheless, the fund has a certain nature that is not similar to other ETFs that take positions against the entire market or a specific sector.

Since 2001, the fund is listed and trades on the London Stock Exchange (LSE) under the ticker symbol JEO.L. Its largest holdings include SAP, Uniliver, Nordo Nordisk, Procus, Worldline SA, ASML, Essity, Elec De Portugal, Linde, and Deutsche Borse. The fund’s market cap stands at nearly $1 billion with a 1-year return of slightly above 10%.

6. Standard Life Global Absolute Return Strategies Fund

This fund is primarily composed of government bonds – this includes 21.56% in Future On Five Year Treasury Note, 14.63% in 10 Year Australian Treasury Bond Future Dec 20, 4.44% in iShares China Cny Bond Etf Usd Dis, 4.43% in Topix Core30 Future Dec 20, and 3.54% in Aberdeen Standard Liqdty (Lux) Euro Z3.

Crucially, the GARS differs from most other absolute return funds by using a broader range of investment strategies. Thus, this fund forms as a multi-asset fund, meaning it invests in a mix of different assets. Thus, the Standard Life Global Absolute Return Strategies fund has the potential to make money in falling markets as well as in rising or neutral markets.

Looking at the fund’s specifics – The current fund size stands at €724.7 million with a YTD return of 0.3% as of February 2021. However, the fund has generated a return of 4.1% over the period of 1 year.

7. M&G Absolute Return Bond Fund

This fund simply aims to achieve a total return of at least 2.5% a year, before any management charges are taken, and, in any market conditions over any three-year period.

As implied by the name, this fund focuses on fixed income assets such as the United States, Netherlands, Germany, the United Kingdom, Australia, and Japan, All in all, the fund is composed of bonds (47%), and cash assets (38%).

Further, the expense ratio stands at just 0.68% with an annual dividend yield of 1.87%. In terms of market performance, the fund has returned an annualized 6.35% between March 2019 to February 2020, and 1.8% between February 2020 to February 2021.

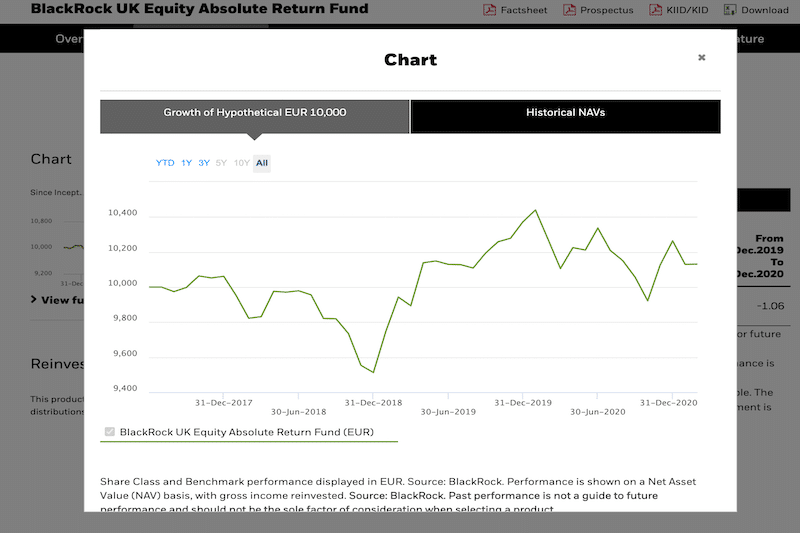

8. BlackRock UK Equity Absolute Return Fund

The BlackRock UK equity absolute return fund aims to deliver positive absolute returns through a combination of capital appreciation and fixed income on investors’ investment regardless of market conditions. The BlackRock equity absolute return fund is an ideal option for those who are looking to increase their risk by getting exposure to equity securities and the equity market. The fund invests at least 70% in shares of companies domiciled in or have their primary listing in the United Kingdom.

All in all, the fund holds stocks of 69 companies including RELX plc, Rio Tinto plc, Reckitt Benckiser Group plc, Tesco, and more. In terms of market performance, the BlackRock UK equity absolute return fund is up 1.02% since the beginning of the year after having a negative return in 2020. In 2019, however, the fund has generated a return of nearly 10%.

9. FP Argonaut Absolute Return Fund

While most absolute return funds focus on a combination of shares appreciation and fixed income assets, the FP Argonaut Absolute Return Fund aims to deliver positive returns by combining long and short market stock positions.

Since its launch, the fund has generated over 118%. In 2020 only, the annual return stands at 16.6% and 12.8% in the year before. This year, however, the fund, so far, has a negative return of -1.4%.

This absolute return fund also has exposure in the United States, United Kingdom, Germany, Russia, Spain, Switzerland, Netherlands, Sweden, France, and Mexico. The FP Argonaut fund has three different classifications – A, R, and I – The fund’s management teams charges an annual ongoing fee of 1.65%, 0.9%, and 0.9% respectively.

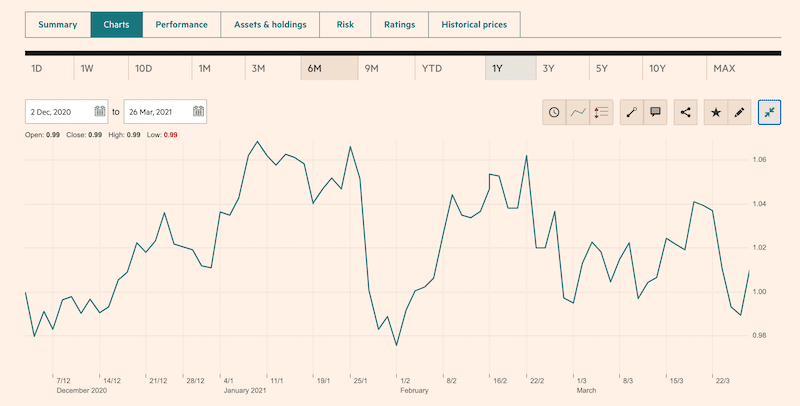

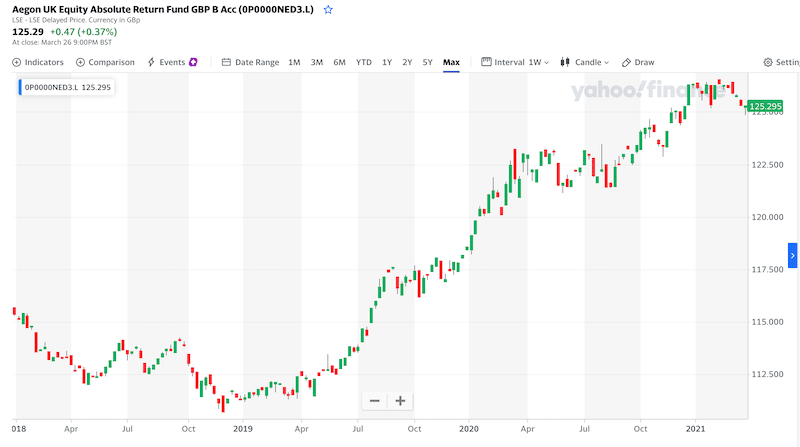

10. Aegon UK Equity Absolute Return Fund GBP

Like most absolute return funds in our list, the Aegon UK Equity Absolute Return Fund GBP has a market-neutral approach. With that in mind, the fund is more aggressive and heavily invested in leveraged and risky assets like the FTSE 100 Index (New Style) Future June 15, Ftse 250 CFDs, Gs Ka Energy Custom Gskaoeap CFD, GlaxoSmithKline PLC CFD, Unilever PLC CFD, etc.

Nonetheless, the fund’s return steadily outperforms its benchmark, the Sterling OverNight Index Average (SONIA). Since its inception in 2010, the Aegon UK Equity Absolute Return Fund has generated a return of 26.12%, and, in the last two years, and overall return of 12.49%.

What are Absolute Return Funds?

Absolute return funds have been in existence for decades though this type of funds has rapidly gained popularity in recent years. As a matter of fact, the first-ever absolute return fund was created in 1949 by Alfred Winslow Jones, who is known as “the father of the hedge fund industry.” In simple terms, an absolute return fund, as the name implies, is a form of fund that aims to generate positive returns regardless of the markets’ direction in which the fund is invested in.

But unlike traditional funds that purchase shares in companies they predict will rise in value, absolute return funds seek to buy or short sell assets without taking a side or direction in the market. In that aspect, the condition of the market – falling, rising, or neutral, is irrelevant to the success of the fund.

Popular Absolute Return Funds Brokers

If you are looking to purchase Absolute funds, you should do so using a reputable stock broker that can cater to all your investing needs.

1. Fineco Bank

The broker charges an annual platform fee of 0.25% on the first £250K, 0.15% for any value between £250,000 and £1m, and 0.05% for a portfolio value between £1m and £2m. If you have a portfolio with a value of above 2m, Fineco Bank does not charge any annual fees. Additionally, Fineco Bank offers a wide range of investment trusts from top fund managers such as Invesco, Jupiter, M&G Investments, Aberdeen Standard Investments, Igebris Investment, and more.

Besides the platform annual fee, however, the broker does not charge any additional fees – no hidden fees, spread, exit costs, or transfer fees and no dealing charge for buying or selling funds. To start investing in absolute return funds at Fineco Bank’s platform you need to invest a minimum of just £100.

Your money is at risk.

Conclusion

If you have ever experienced the tension of investing in financial assets, then you probably know how stressful it might be, particularly when you are betting on a direction of a certain market.

However, you should always research and analyse the possible asset classes you choose to invest in, prior to opening a trade.