Forex Spread Betting UK

Most forex traders trade CFDs online, but if you do forex spread betting, all of your profits will be exempt from capital gains tax.

In this guide, we explore how Forex Spread Betting UK works, what benefits it offers, and the available brokerages that allow you to trade Forex spreads in the UK.

How to Start Forex Spread Betting UK

The end-to-end process of forex spread betting UK is very simple. By following the guidelines below, you could be placing your first forex spread betting position in less than 10 minutes.

- Step 1: Register an account with a popular-rated spread betting broker.

- Step 2: Once registered, make a deposit with your UK debit/credit card, e-wallet, or bank account transfer

- Step 3: Head over to the forex trading section of the site and select the currency pair that you wish to trade (e.g. GBP/USD).

- Step 4: Select from a long or short position, enter your stake, and if applicable – the amount of leverage you wish to deploy.

- Step 5: Place your order to complete your forex trade,

Forex Spread Betting Explained

If you are an experienced forex trader then you’ll be pleased to know that spread betting is very similar to CFD trading. However, there are a number of differences too – so it’s best to read through the sections below before you embark on your forex spread betting UK journey.

What is Forex Spread Betting?

Financial spread betting is a form of online trading where you are required to predict whether an asset will rise or fall. In the case of forex spread betting UK – this will be a currency pair like EUR/USD or GBP/TRY. Much like you would at a traditional forex trading site, the overarching objective is to determine whether the exchange rate of your chosen pair will increase or decrease in value.

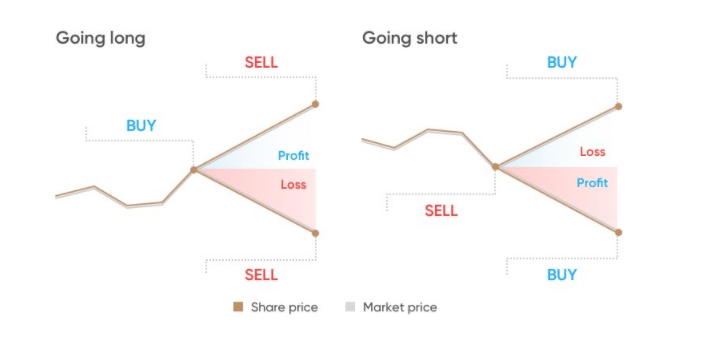

Much like a conventional CFD broker, you get to choose from a long (buy) or short (sell) position. This means you can attempt to make a profit from both rising and falling markets. Additionally, most forex spread betting UK platforms allow you to apply leverage.

We discuss this in a bit more detail later – but when spread betting major forex pairs you’ll be offered leverage of 1:30, and 1:20 on minors and exotics. Crucially, when using a forex spread betting UK site, any profits that you make will be exempt from capital gains tax.

This is in stark contrast to traditional forex trading – which is fully liable for exemption – much like any other investment arena in the UK. As such, opting for a forex spread betting platform is a no-brainer – as long as you understand the ins and outs of how the phenomenon works.

How Does Forex Spread Betting Work?

In this section of our guide – we are going to break down each aspect of how forex spread betting UK works so that you can assess whether this form of currency trading is right for you.

Forex Pairs and Ownership

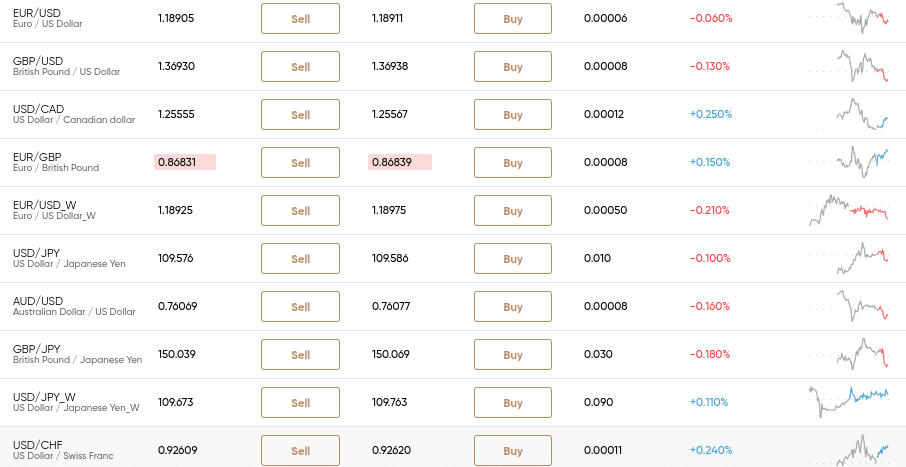

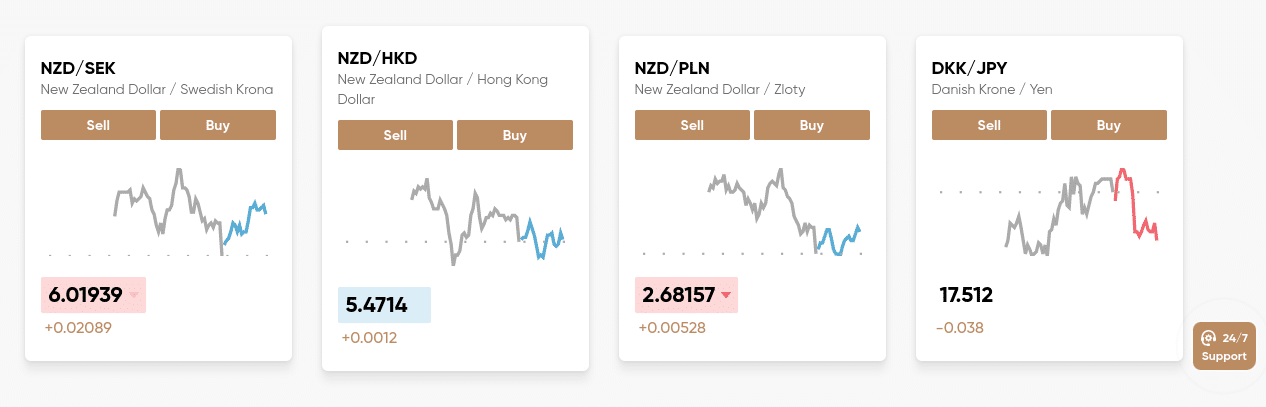

When you use a forex spread betting UK broker – you will first need to find a currency pair to trade. Like any other trading platform in this space, you’ll likely have access to a selection of major, minor, and exotic pairs. Once again, the objective is to predict whether the exchange rate of the pair will rise or fall.

As spread betting instruments are financial derivatives – you do not own any of the currencies in the pair that you are trading. Instead, the spread betting market simply tracks the actual wholesale spot price on a second-by-second basis.

Long or Short

In order to tell your chosen spread betting broker whether you think the exchange rate of the pair will rise or fall – you need to place an order. If you think the pair will rise, you’ll place a long order. If you think the pair will drop in value, opt for a short order.

Point Movements

At traditional forex trading sites, you are likely used to identifying price movements in ‘pips’ (percentage in point). For example, if GBP/CAD moves from 0.8683 to 0.8687 – that’s a price increase of 4 pips.

However, in the world of forex spread betting UK – price movements are calculated in ‘points’. This isn’t anything to worry about – as the process of identifying profits and losses is much the same as doing so in pips.

- For example, if GBP/CAD moves from 0.8650 to 0.8645, that’s a decrease of 5 points.

- Or, if EUR/USD goes from 1.1890 to 1.1899 – that’s an increase of 9 points.

The reason it is important for us to mention this is that you place an order – you won’t risk a fixed amount like £200 or £500. On the contrary – you’ll be risking a monetary amount per point – which we explain in more detail below.

Stake Per Point

This is perhaps the first major difference between trading forex spread betting instruments and CFDs. In a nutshell, you need to determine how much you wish to stake per point when spread betting.

For example:

- Let’s say that you are looking to trade AUD/USD

- The price on this pair is 0.7606 – which you think will rise in the next few hours

- You decide to go long at a stake of £2 per point

- Your speculation was correct – as AUD/USD is now trading at 0.7640

- This translates into an increase of 34 points

- You staked £2 per point – so that’s a profit of £68

As you can see, your profit was simply the number of points that your speculation was correct by, multiplied by your stake per point. Naturally, if you speculated incorrectly – the same calculation would determine your losses.

Because of this, inexperienced traders are advised to start off with a small stake size. There are a number of brokers in this space that allow you to trade from 10p per point – which is very conservative.

Leverage and Margin

When it comes to leverage, there is no difference between forex spread betting and CFDs. As we briefly noted earlier, forex spread betting platforms will offer you leverage of 1:30 when trading major currency pairs. This means that a £500 account balance would effectively permit a maximum trade size of £15,000. Minor and exotic pairs will get you slightly less – at 1:20.

When comparison spread betting vs CFD trading – margin requirements are also the same. That is to say, to access leverage you will be required to put up a margin balance. For example, if you trade with leverage of 1:10 – the margin amounts to 10%. If your position falls by 10% – your trade will be closed automatically and the spread betting platform will keep your margin deposit.

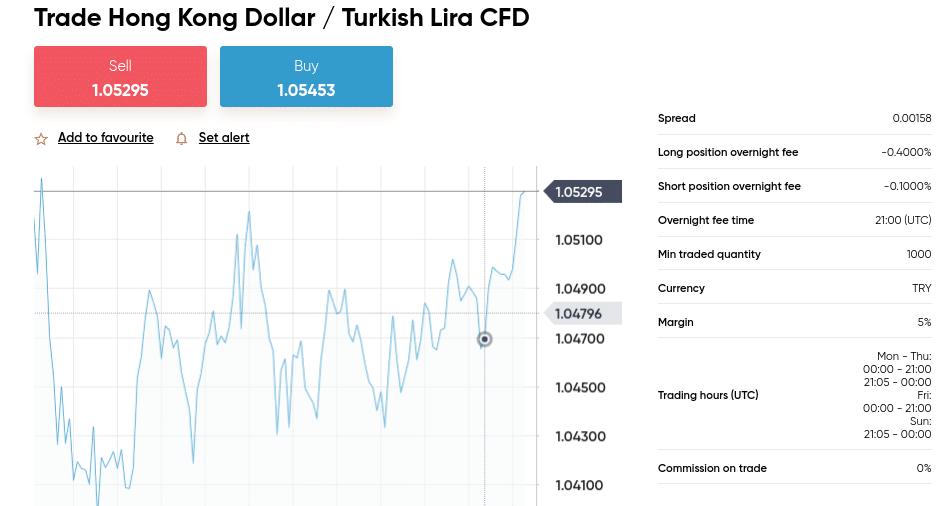

Expiry Date

On top of the ‘point’ system (as well as tax which we cover later) – the other major difference between forex spread betting and CFD trading is the duration of each market. For example, when you trade CFDs – they never expire, so you may keep your position open for as long as you wish.

This wouldn’t be advisable because you will pay overnight funding fees for each day the position is live. But, it’s possible nonetheless. However, spread betting forex markets always come with an expiry date – similar to options or futures. This will either be a ‘daily funded’ bet or a ‘quarterly funded bet’.

78% of account lose money money when trading CFDs with this broker.

As the name implies, the former expires within 24 hours and the latter will expire within three months. All this means is that your position will be automatically closed by the spread betting forex broker on expiry.

Spread Betting vs Forex Trading

If you read through the above sections – you should now know the difference between spread betting and forex trading. To clear the mist further, below you will find the most notable differences for your consideration.

- Global Markets: Both spread betting and forex trading give you access to an abundance of currency pairs – covering majors, minors, and exotics.

- Fees: You will usually find that both spread betting and forex trading sites are commission-free – so all fees are built into the spread.

- Leverage: There is no difference between spread betting and forex trading when it comes to leverage. All brokers must abide by FCA regulations – meaning majors are capped at 1:30 and minors/exotics at 1:20.

- Duration: The traditional forex markets never expire – even outside of standard trading hours. Spread betting forex markets will always have an expiry date – which is either on a daily or quarterly basis.

- Price Movement: Forex trading markets are usually calculated in pips. Price movements in the spread betting forex scene are based on points.

- Stakes: When you enter a stake at a traditional forex broker – you will enter the total amount you wish to risk (e.g. £50). When spread betting, you need to enter your stake per point movement (e.g. £1 per point).

- Tax: You will be liable for capital gains tax on your forex trading endeavors when you end the financial year in profit. All profits are, however, exempt from tax when you trade via a forex spread betting UK broker.

As you can see from the above, there are many similarities between forex trading and spread betting. The key differences center on tax, price movements, stakes, and the trade duration.

Key Features of Forex Spread Betting

The features discussed below are some of the main factors that may affect your decision to conduct forex spread betting.

Forex Spread Betting Tax

Make no mistake about it – if you are a successful forex trader that makes consistent gains – your profits will be liable for capital gains tax. This is no different from purchasing shares and selling them at a profit later down the line. However, profits from forex spread betting UK falls under the remit of gambling.

That is to say, much like gambling winnings, spread betting profits are 100% tax-free. This is a major game-changer for seasoned forex traders that year-on-year have historically had to hand over a percentage of their profits to HMRC.

Low Trading Fees and Tight Spreads

Forex spread betting UK sites are able to offer you financial markets at extremely competitive fees. This is because the underlying asset does not exist.

Instead, spread betting instruments track the real-time price movements of the pair in question. In turn, this is why a lot of spread betting sites in the UK allow you to trade commission-free. Spreads – which refer to the gap between the bid and ask price of the currency pair, as also typically very tight when spread betting.

Small Stakes

Professional forex trading is usually done in ‘lots’. In most cases, 1 forex lot will refer to 100,000 units of the base currency. For example, if you’re trading GBP/USD – that’s a lot size of £100,000.

This is, of course, out of reach for the average Joe Blogs that wishes to speculate on the forex markets with a small amount of money.

But, when using a forex spread betting UK broker – you can trade with an inconsequential amount. As we mentioned earlier, this is often at a stake of just 10p per point movement. And of course – you’ll also have access to leverage, which will allow you to enter positions worth much more than you have available in your spread betting account.

Other Markets

Spread betting isn’t reserved just for the forex trading markets. On the contrary, the popular spread betting brokers in this space cover heaps of other asset classes.

No Stamp Duty

You won’t be required to pay any stamp duty tax when you use a forex spread betting UK site. Once again, this is because you are not purchasing or selling the actual asset that you are trading.

Risk Management

Although spread betting is fraught with risk – especially when applying high levels of leverage, there are many tools on offer that allow you to reduce your exposure to financial loss.

- At the forefront of this is stop-loss orders.

- Much like you would at a conventional stock trading site, this allows you to specify the most you are willing to risk on your trade before it is closed automatically.

- For example, if you set your stop-loss at 3% and your position declines in value by 3% – the forex spread betting broker will exit the position on your behalf.

Although losing money is never ideal, this is just the nature of online trading. Ultimately, by installing stop-loss orders on all of your spread betting positions – you can keep these losses in check.

Popular Forex Spread Betting Platform

So now that we have covered everything there is to know about forex spread betting in the UK – you’ll need to start thinking about which broker you wish to use. Important considerations to make should center on regulation, supported spread betting markets and trading commissions.

In the sections below, we have reviewed two brokers that let you begin forex spread betting in the UK.

1. Pepperstone

Pepperstone also offers a Razar Account – which gets you access to industry-leading spreads. This is because you will be trading directly with other market participants. To give you an idea, you won’t pay any spreads on major pairs like EUR/USD, AUD/USD, and GBP/USD. Instead, you will pay a flat commission rate – which averaged $3.50 (or base currency equivalent). On top of forex, Pepperstone also offers spread betting markets on indices, commodities and spread betting shares.

You will have access to leverage at this forex spread betting broker. This is once again capped at 1:30 if you’re a retail client. If, however, you meet the criteria to open a professional trading account – you will get leverage of up to 1:50 on forex. Finally, when it comes to safety – Pepperstone is regulated by the FCA and you are protected by the FSCS scheme.

| Broker | Commission | Inactivity Fee | Deposit Fee | Withdrawal Fees |

| Pepperstone | £0.02 per 0.01 lot or 0.0035% | None | FREE | $5 (about £4) |

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

How to Start Forex Spread Betting

If you are looking to get started with forex spreading, it is advisable to choose a suitable broker that can cater to your investing needs. In the steps below, we show you how to begin the investing process.

Create Account

Getting started takes a matter of minutes. Simply make your way to your brokerage’s website and begin the sign-up process. This will open a sign-up form and you’ll be required to enter your name, email address, as well as choose a username and password for your new trading account.

Verification

Users may be required to complete a simple KYC process, if they invest with a regulated broker. Upload a copy of your passport or driving license as proof of identity, and a copy of a recent utility bill or bank statement as proof of address.

Deposit Funds

With a fully verified account, you’re one step closer to start trading a range of assets with the click of a button. Depending on the broker you choose, you can transfer funds using a debit card, credit card, bank wire transfer, as well as e-wallets such as PayPal, Neteller and Skrill.

Choose your preferred payment method and deposit your funds into the account.

Search for Spread Betting Market

Now that your account is funded, you can search for the forex pair that you want to spread bet.

Place Spread Betting Order

Now you need to set up an order. After searching the forex spread betting pair, confirm your deposit amount and confirm the transaction.

Conclusion

With Spread betting, you have access to buy/sell positions and the ability to apply leverage. However, by opting for a spread betting broker – you won’t pay any tax on your profits. However, these options will be better utilised by experienced and senior traders, who are willing to access more advanced trading options in the market.