Best Bond Funds UK to Watch

Bond funds are a potential way to invest your money in a lower-risk fashion than traditional equity investments. .

In this guide, we will review some of the Popular bond funds UK and review the popular brokerages that offer these assets to investors in the UK.

Popular Bond Funds UK List

If you’re looking for a quick rundown of some of the bond funds UK for 2021, look no further. In the section that follows, we will review each of these funds in-depth, allowing you to make an informed investment decision.

- Vanguard Total Bond Market ETF (BND)

- iShares TIPS Bond ETF (TIP)

- 20+ Year Try Bond iShares (TLT)

- Iboxx $ High Yield Corporate Bd Ishares (HYG)

- SPDR Bloomberg Barclays High Y (JNK)

- iShares Emerging Markets Local Government Bond UCITS ETF (IEML.L)

- Vanguard Short-Term Bond ETF (BSV)

- Vanguard Long-Term Bond ETF (BLV)

- BlackRock Charities UK Bond Fund

- PIMCO Active Bond Exchange-Traded Fund (BOND)

Popular Bond Funds Reviewed

Deciding on a bond fund for you can be a daunting prospect. With various elements to factor in, ranging from fund yields to expense ratios, it can be overwhelming to choose where to place your money.

Not to worry – in this section, we will review 10 popular bond funds for your to analyse in-depth separately.

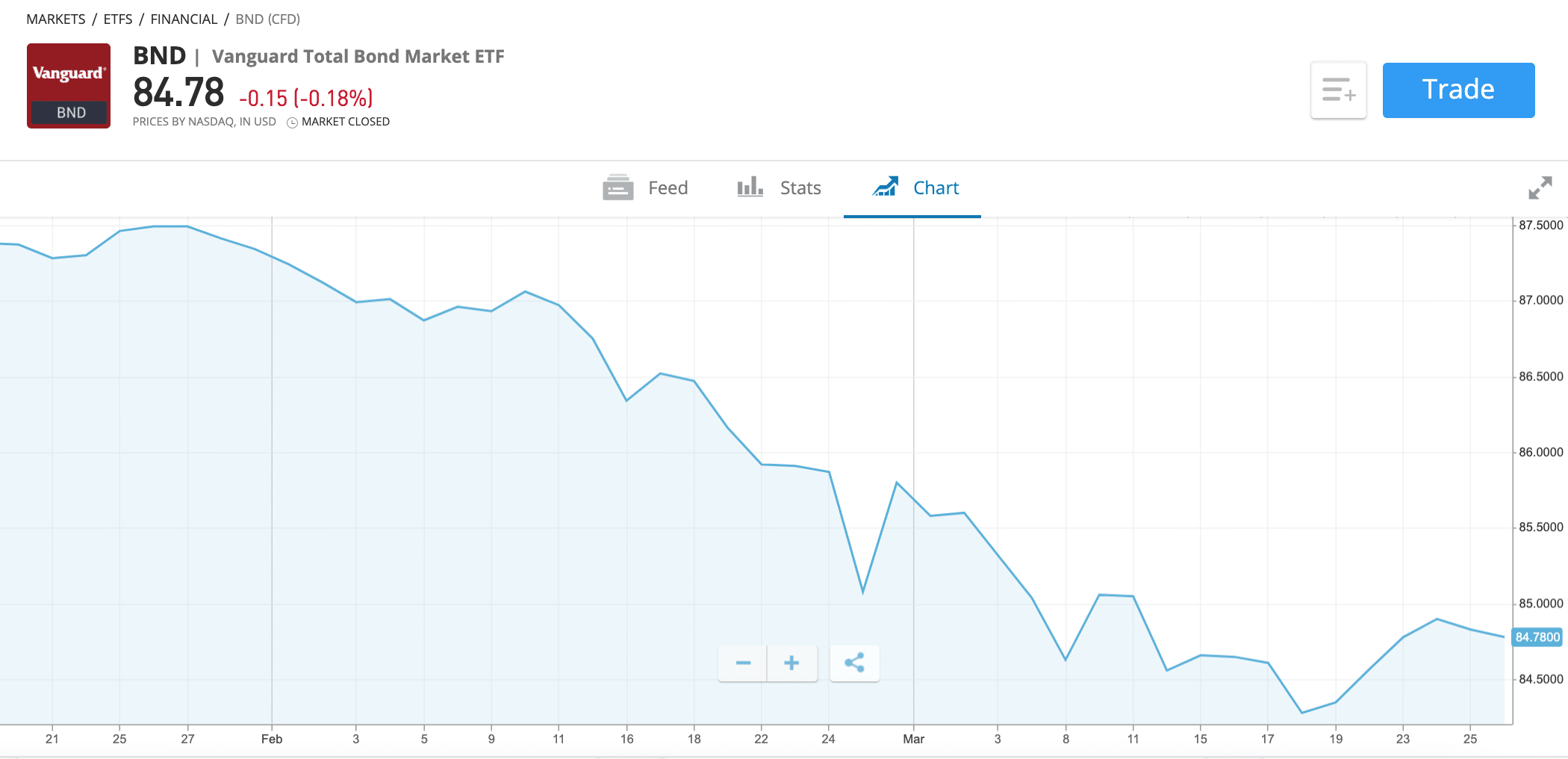

1. Vanguard Total Bond Market ETF (BND)

The Vanguard Total Bond Market ETF offers exposure to investment-grade government bonds. These types of bonds are considered some of the safest you can research, as they are essentially backed by the power of the US government and have a very high credit rating. The only way they would default is if the US government suddenly decided to stop paying.

The fund itself is made up of over 10,000 bonds, mainly with intermediate-term durations. In terms of performance, the Vanguard Total Bond Market ETF has only experienced a negative return in two of the past 13 years, even returning a healthy total return of 7.71% in 2020. Furthermore, with an expense ratio of only 0.03%, the fees associated with this bond are minuscule.

Sponsored ad. Your capital is at risk

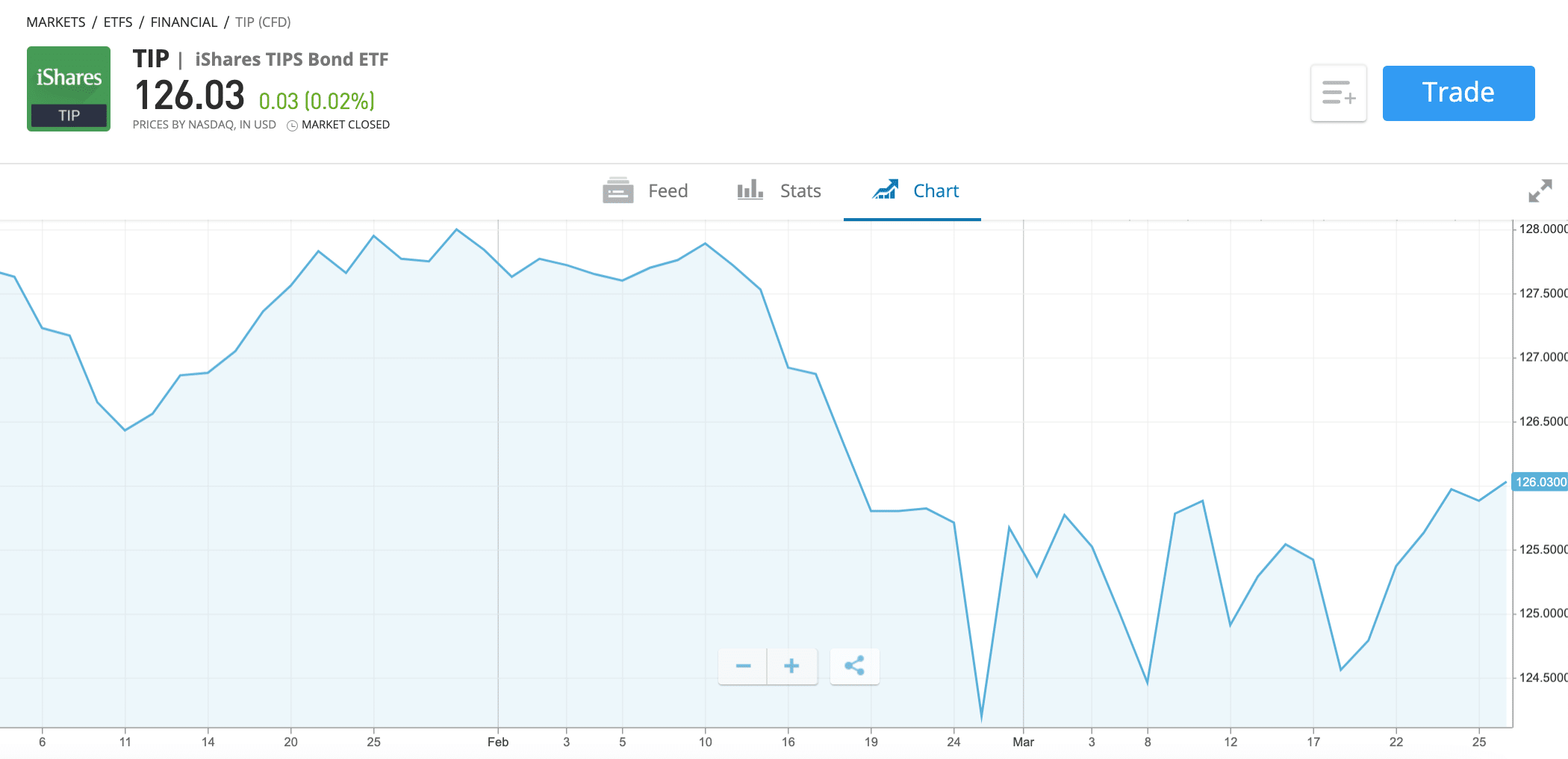

2. iShares TIPS Bond ETF (TIP)

Common financial knowledge highlights that inflation and bond prices tend to be negatively correlated; as inflation rates rise, bond prices fall, due to inflation eroding the gains made through capital growth.

This fund invests in 53 of the most popular US TIPS, a specific type of bond that is protected against inflation. Through this investment, the iShares TIPS Bond ETF aims to protect investors’ capital from inflation effects whilst providing a solid yield in the process. The fund returned 10.91% in 2020. Furthermore, it also provides a small monthly cash payment to investors, based on an annual yield of 1.08%.

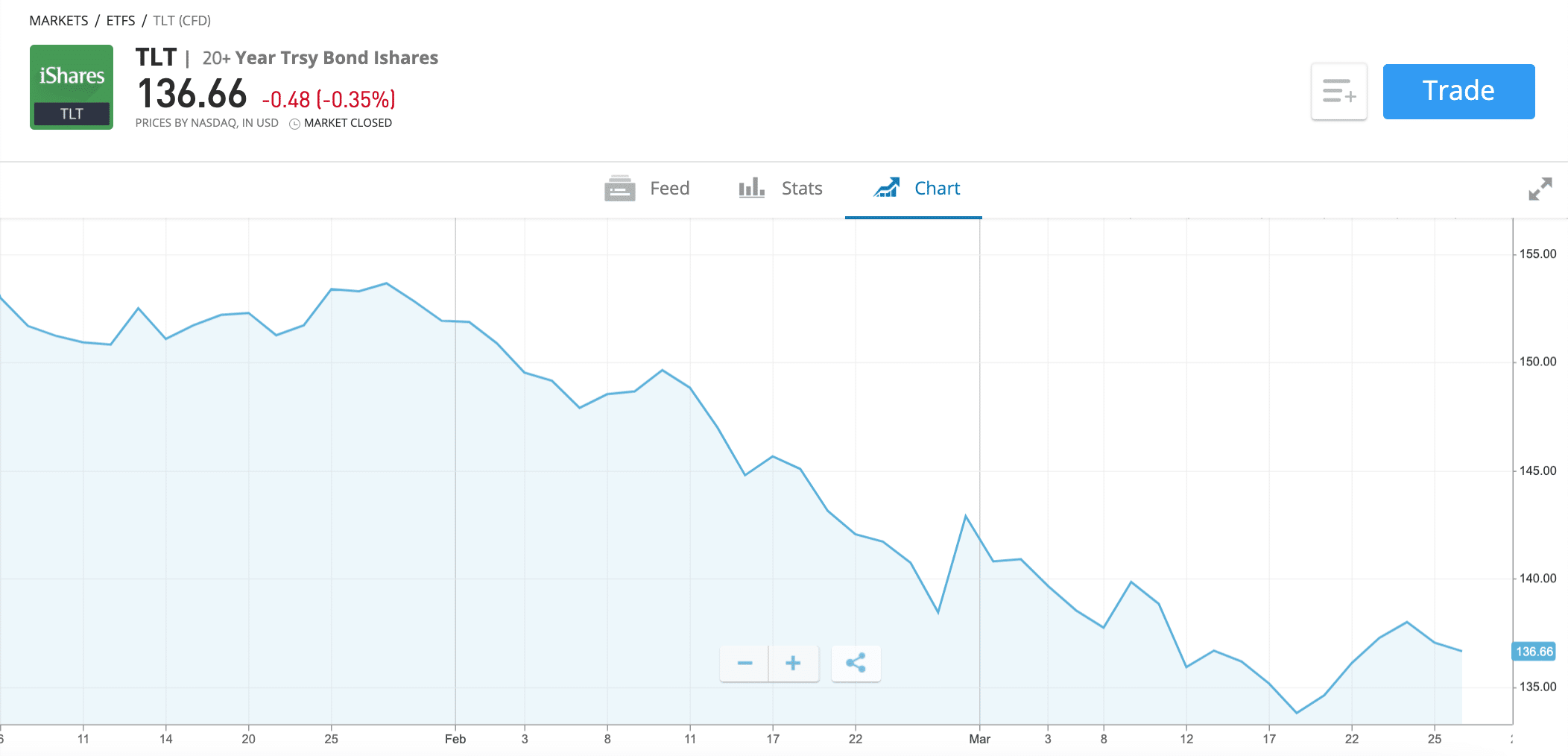

3. 20+ Year Try Bond iShares (TLT)

One of the notbale things about long-term bond funds such as the 20+ Year Try Bond iShares is that the interest rate on the fund’s assets is essentially ‘fixed’ and usually higher than short-term bonds. This is because, due to the more prolonged nature of the duration, there is a more significant chance of default from these bonds than, say, a 1-year bond.

This can be showcased through the 20+ Year Try Bond iShares performance in 2020 – it returned 17.92%, outperforming both the FTSE 100 and the S&P 500. What’s more, it also produced a healthy 14.93% in 2019, which makes this fund one of the more popular ones for higher returns.

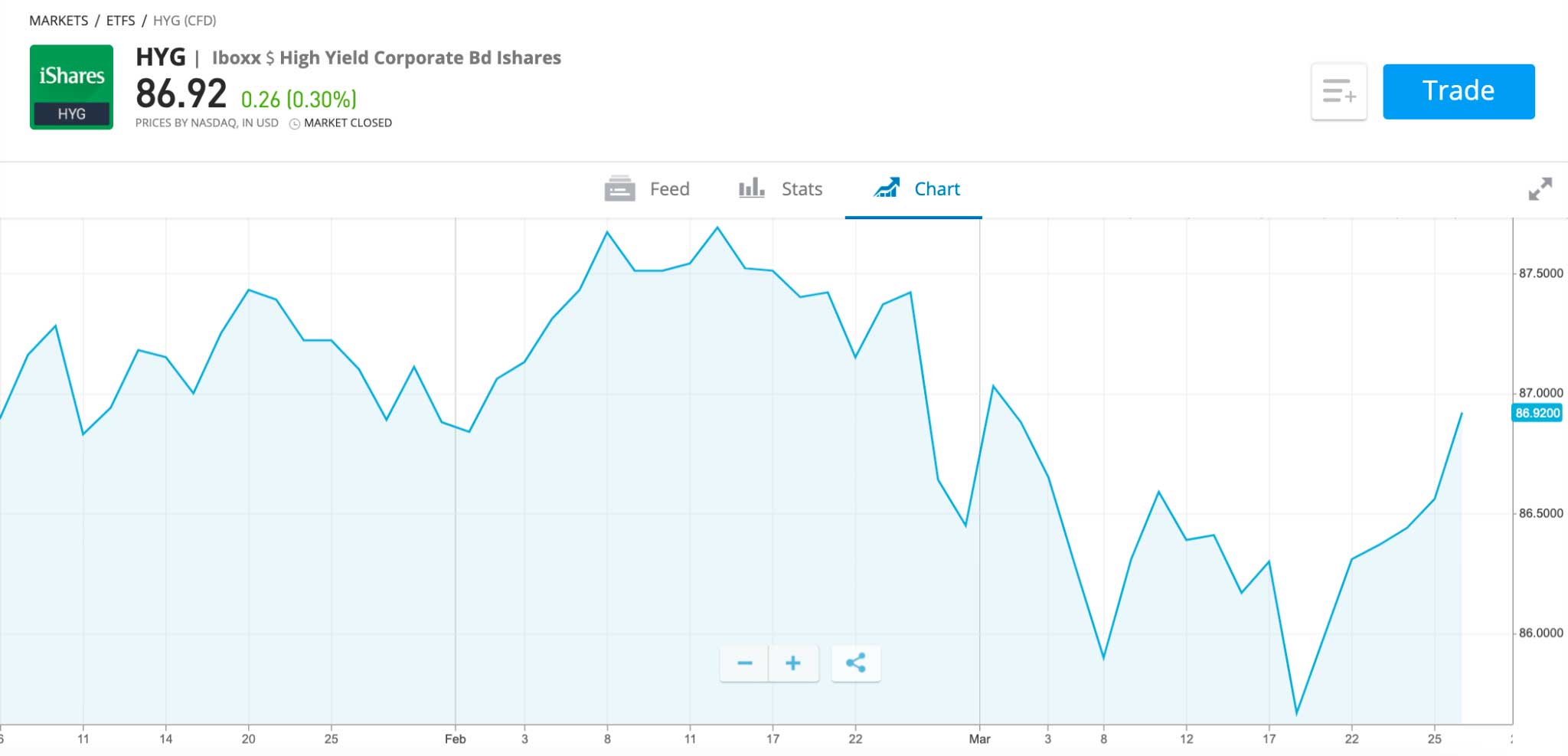

4. Iboxx $ High Yield Corporate Bd Ishares (HYG)

If you are looking to gain exposure to the US bond market whilst earning a passive income stream, the Iboxx $ High Yield Corporate Bd Ishares is an option. Holding 1,313 of the popular corporate bonds from various durations, this fund seeks to provide both a similar yield to high yield ETFs and also a solid annual return to investors. The fund has a solid price yield of 4.86%.

Looking at performance, the fund has returned an average of 7.11% to investors each year over the past five years. What’s more, the fund has only produced a negative return in two of the past twelve years.

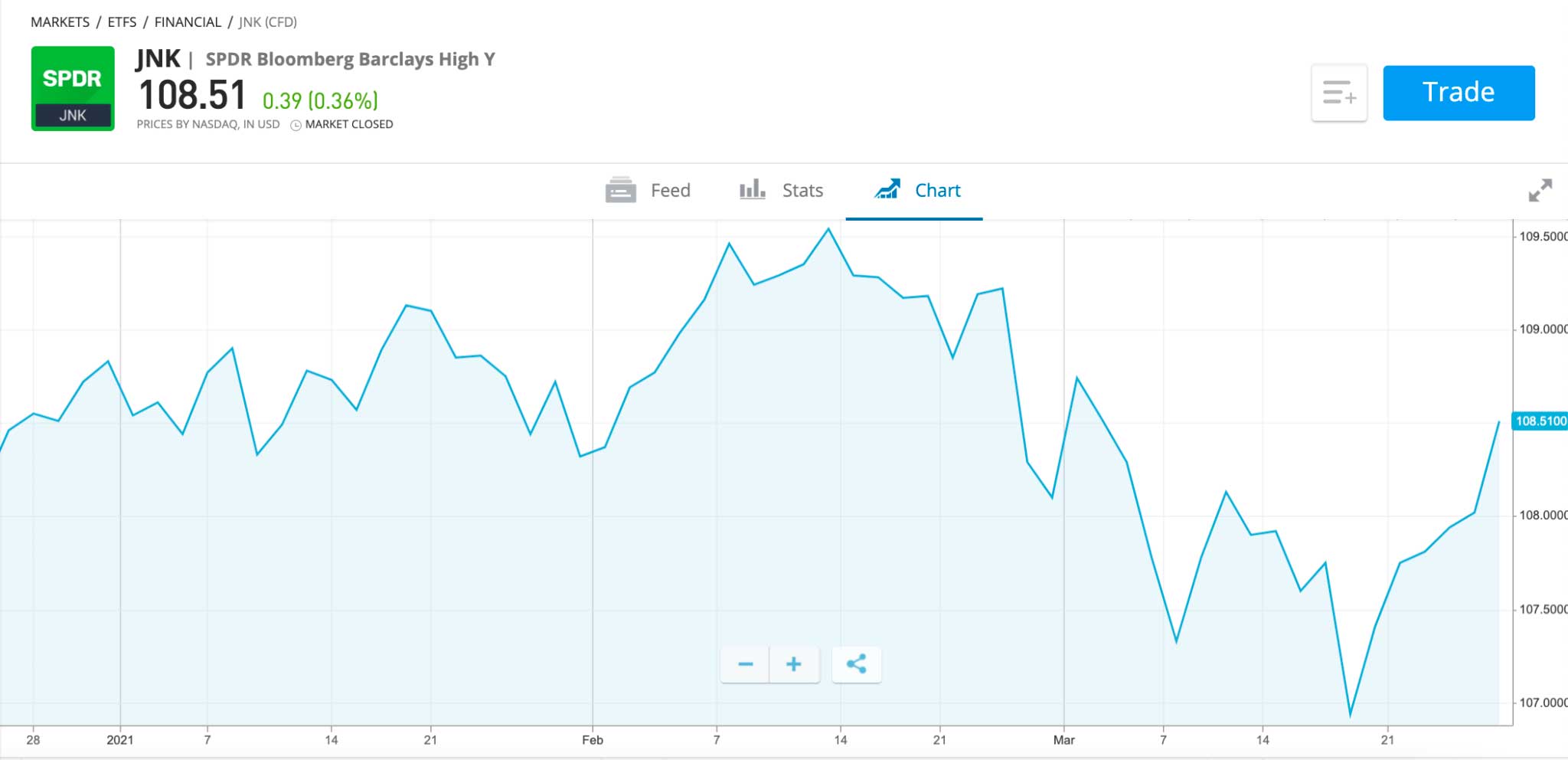

5. SPDR Bloomberg Barclays High Y (JNK)

If you are happy to take on more risk to receive a higher yield, this fund might be a suitable option for you. The SPDR Bloomberg Barclays High Y is composed of a variety of ‘junk bonds’. These bonds are below investment grade. Relating this to the SPDR Bloomberg Barclays High Y, this fund provides an impressive yield of 5.67% to investors.

Investing in 1163 USD-denominated junk bonds, this fund also provides access to an actively managed investment. The fund manager in charge will rebalance the asset allocation at the end of each month, ensuring an optimum risk/return profile. In addition, this fund also has a modest expense ratio of 0.40%, meaning if you invested £1000, you would only have to pay £4 in fees for the whole year.

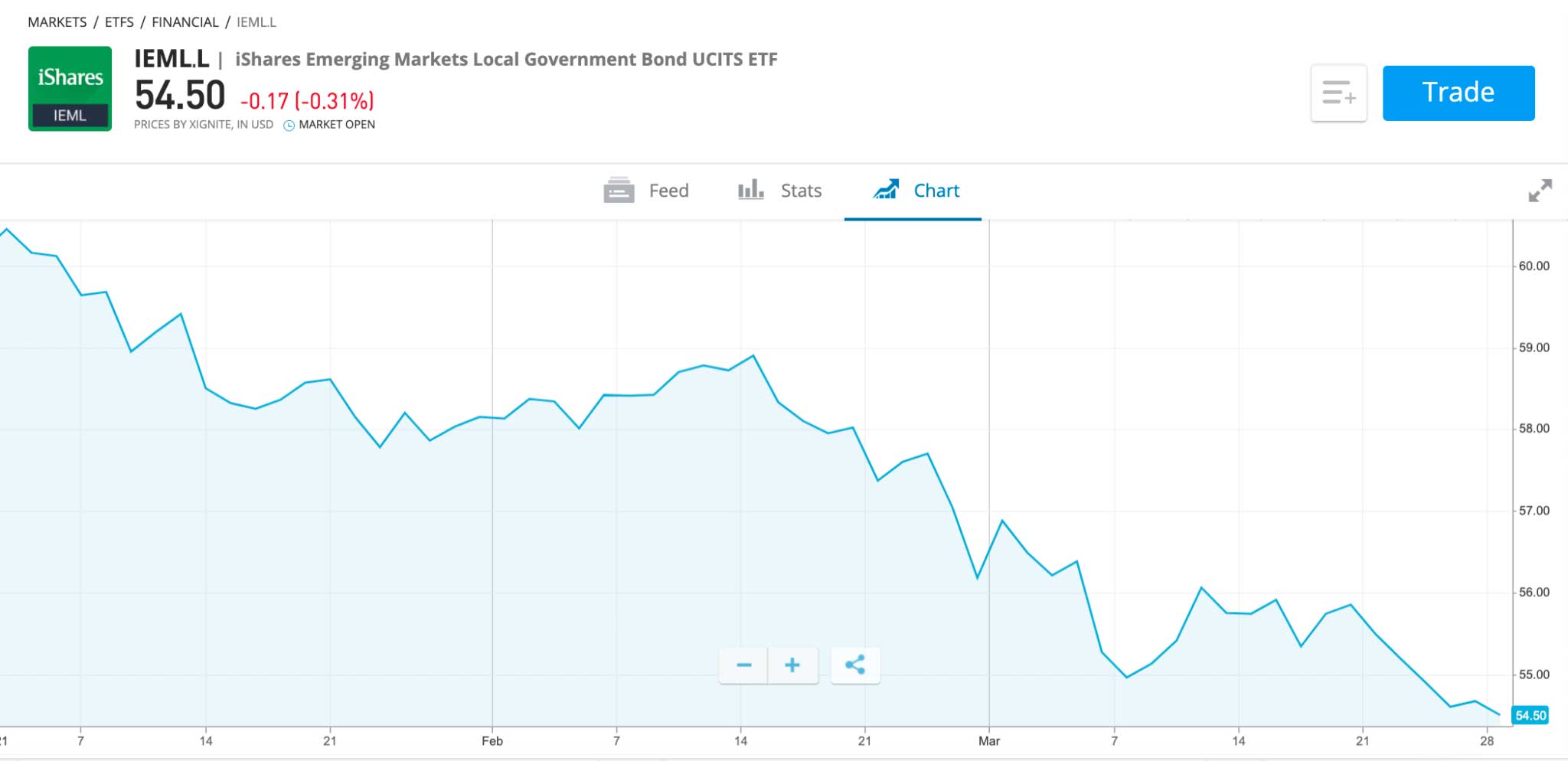

6. iShares Emerging Markets Local Government Bond UCITS ETF (IEML.L)

The exposure this fund provides to emerging markets such as China and Brazil is an attractive prospect for several reasons. By investing in a combination of high yield and investment-grade treasury bonds, from a selection of countries in emerging markets, the iShares Emerging Markets Local Government Bond UCITS ETF provides investors with both diversification benefits and potentially high returns.

Investing in emerging markets tend not to be as ‘consistent’ when it comes to returns due to the markets’ growing nature and the various geopolitical risks associated with them. This can be evidenced by the returns produced by this fund; negative returns of -7.15% were experienced in 2018, which then turned into a healthy positive return of 11.56% in 2019. This fund also provides a semi-annual distribution to investors, with a yield of 4.59%.

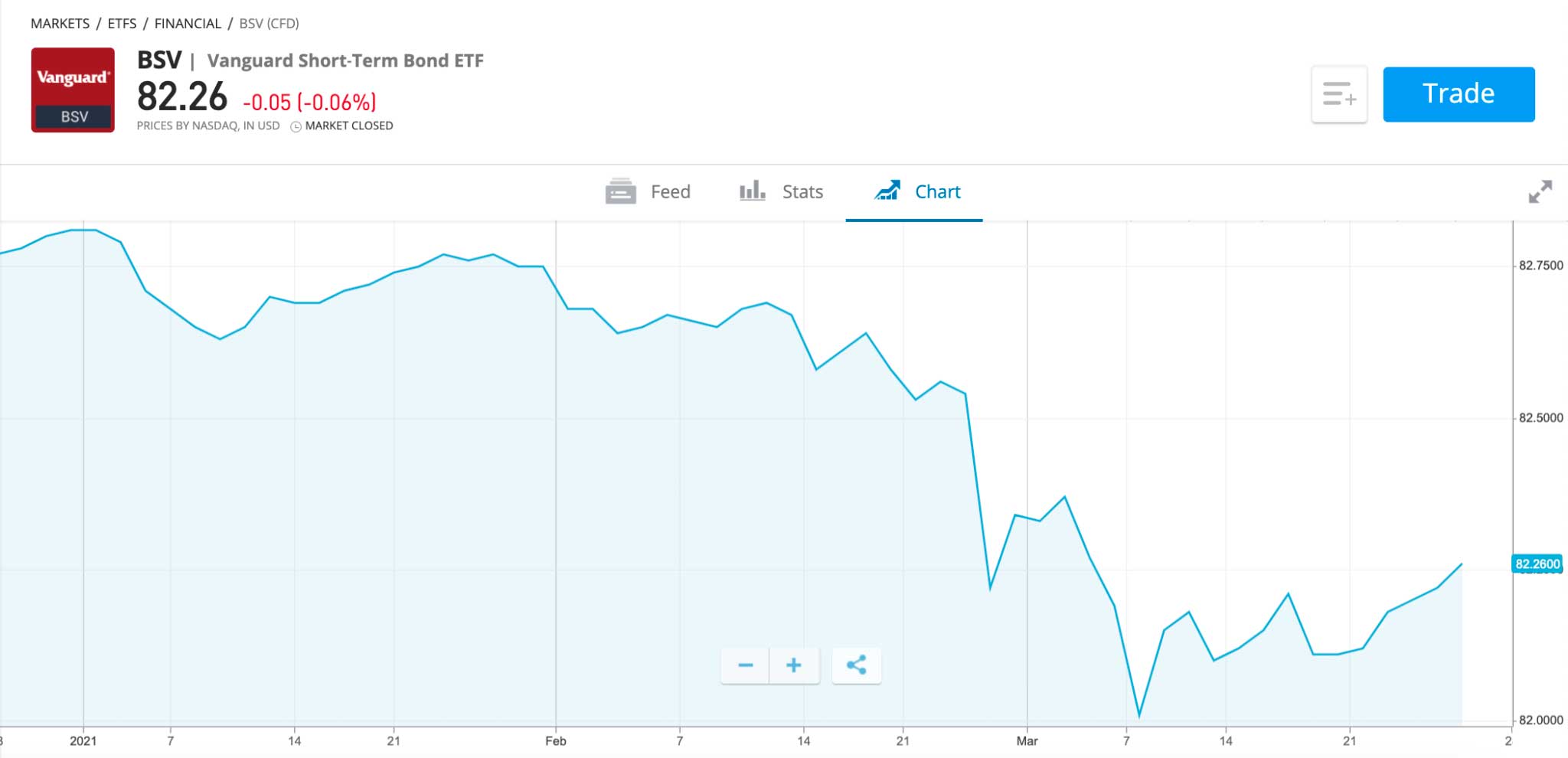

7. Vanguard Short-Term Bond ETF (BSV)

Short-term bonds are termed a safer investment than long term bonds. Due to this, short term bonds are amongst the safest assets available and are even used as the ‘risk-free’ rate in financial models. However, because they are so low risk, they often have quite low annual returns.

The Vanguard Short-Term Bond ETF provides investors exposure to the short-term bond market by investing in 2638 investment-grade bonds with a duration between 1-5 years. This fund has incredibly consistent past performance, making a positive return each year since 2008. However, in only one year have annual returns reached over 5%. Also, this fund has an incredibly low expense ratio of 0.05%, making it a cost-effective option.

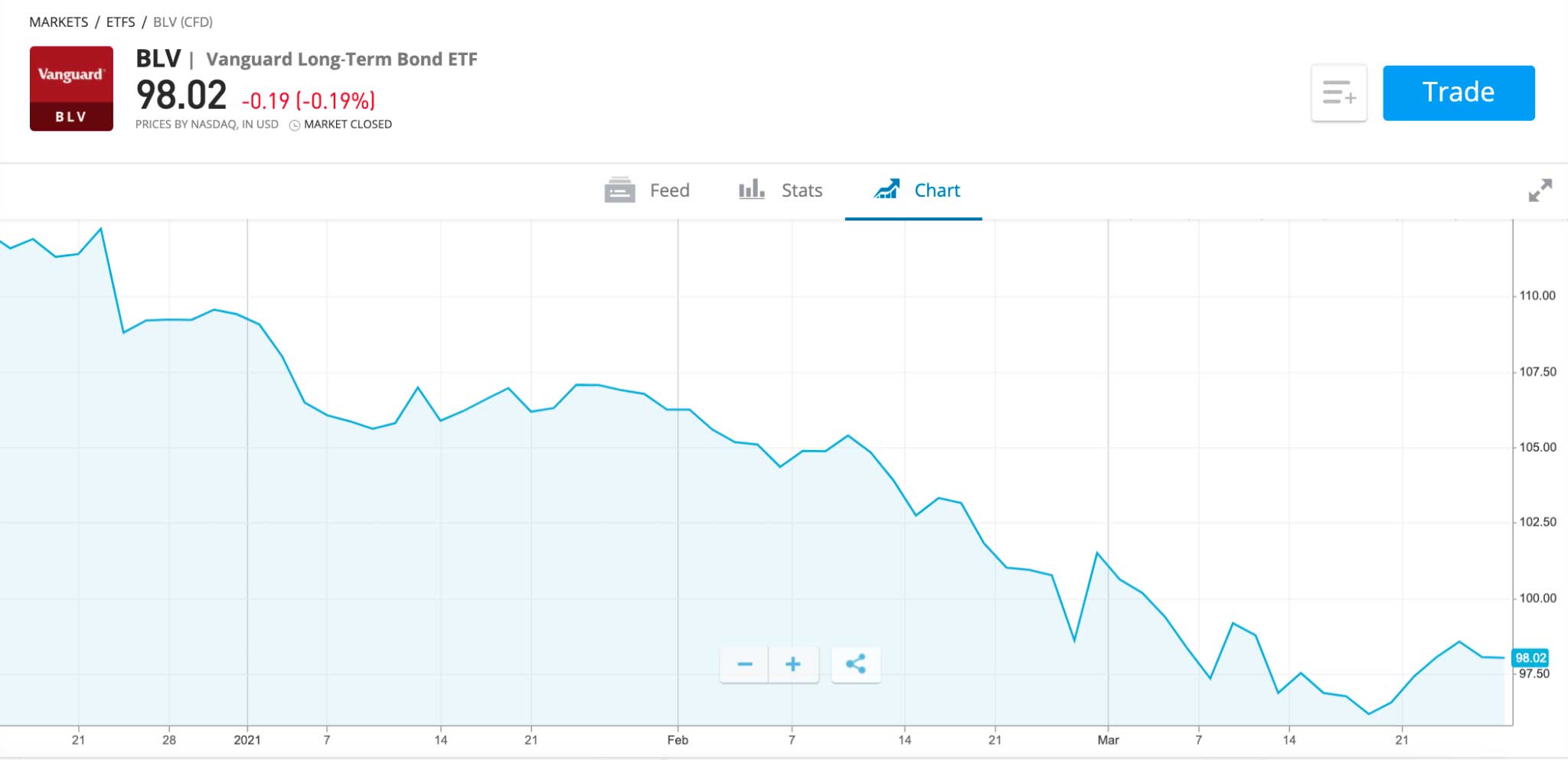

8. Vanguard Long-Term Bond ETF (BLV)

In contrast to the previous fund, the Vanguard Long-Term Bond ETF focuses on the long-term bond market. These types of the bond have longer durations, so are therefore deemed riskier due to the more significant potential for default across their duration. However, this risk is compensated by a greater return. This fund invests in a range of USD-denominated investment-grade bonds with maturities of 10 years or more, providing investors exposure to this section of the bond market.

Looking at performance over the last few years, we can see that this fund does display larger volatility than the other funds in this list, having experienced negative returns in three of the previous ten years. However, in the years it has made a positive return, these have been quite large; the fund returned 19.09% and 16.24% in 2019 and 2020, respectively. Furthermore, this fund also has an annual yield of 3.07%, spread across monthly payments.

9. BlackRock Charities UK Bond Fund

If you are looking for exposure to the UK bond market specifically, this fund may allow users to do so. The BlackRock Charities UK Bond Fund invests in a selection of 135 UK GILTs, which is short for ‘Gilt-Edged Security’. These GILTs are essentially the UK-equivalent of US treasury bonds and showcase a very low risk of default and a low rate of return.

This fund has displayed solid consistency over the past five years, only making a small negative return of -0.43% in 2018, whilst the other years have seen the fund return more than 6% on three occasions. It also has a price yield of 3.73%.

10. PIMCO Active Bond Exchange-Traded Fund (BOND)

The final fund we will discuss is the PIMCO Active Bond Exchange-Traded Fund. Through intelligent management, this fund aims to provide long-term capital growth for investors by investing in 1149 bonds, ranging from investment grade to mortgage-backed securities. Tthis fund is actively managed, which means that the fund manager will rebalance the investments periodically to optimise its risk/return portfolio.

Looking at performance, this fund returned a solid 7.63% in 2020 and also returned 8.69% the year previous. Furthermore, it also provides investors with a decent yield of 2.65%, distributed each month. Finally, it does have a higher expense ratio of 0.57%.

What are Bond Funds?

Put simply, bond funds are a specific type of mutual fund that invests exclusively in bonds. Much like other types of funds, bond funds pool money together from a range of investors, both retail and professional. They then invest this money on their behalf to produce capital growth and generate income for investors through periodic interest payments, expressed as the fund’s yield.

As bond funds invest solely in bonds, they are termed a much safer option than investing in other, riskier funds such as equity funds. Due to them being safer, the returns produced by bond funds are typically lower than their peers.

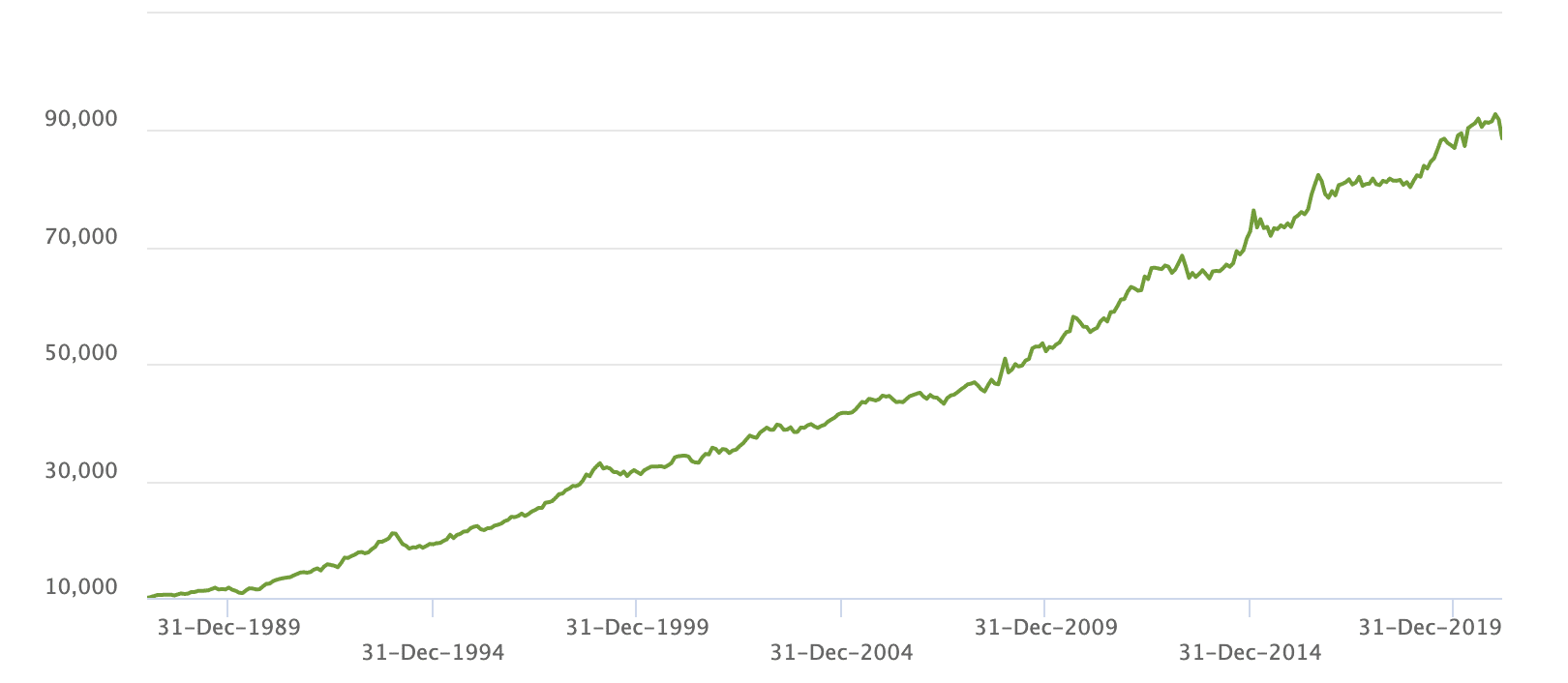

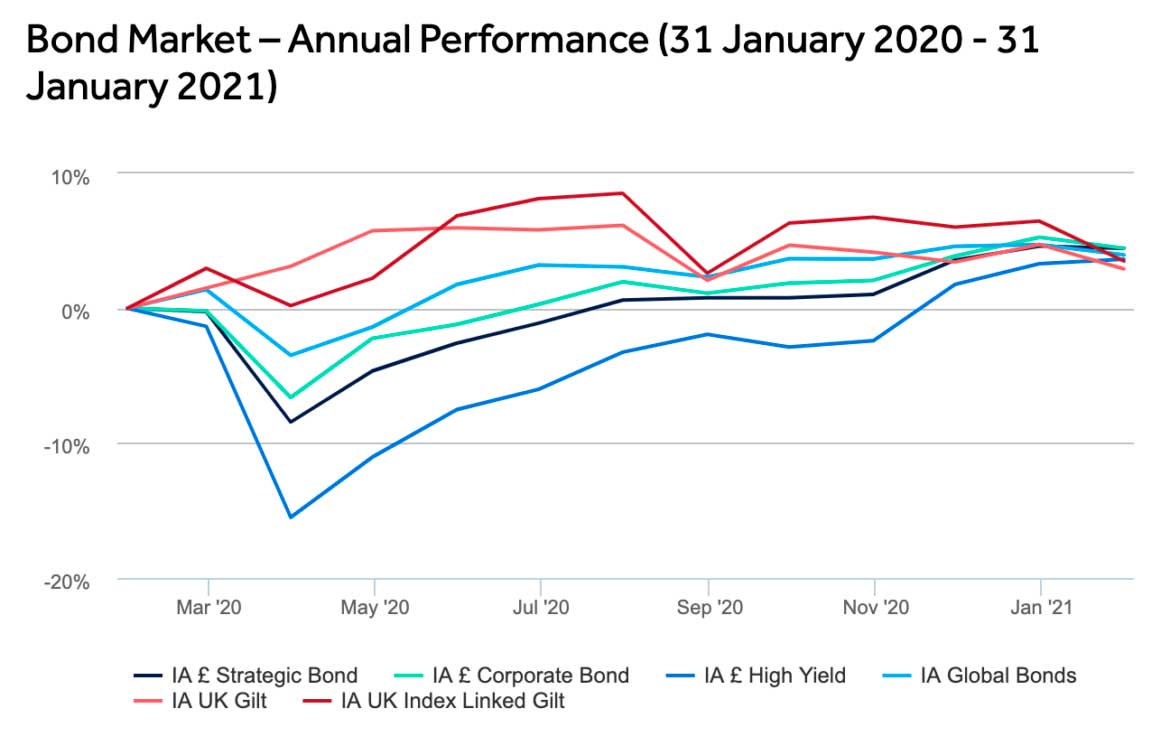

An example of bond fund returns is highlighted in the image below. It showcases the returns produced by various UK-based bond funds in 2020 and pinpoints how they suffered a minor setback at the onset of the pandemic in March but then recovered and produced consistent returns for the remainder of the year.

Popular Bond Funds Brokers

One of the most important aspects to consider when investing is which broker to use to facilitate your investment. In this section, we discuss two popular Uk trading platforms.

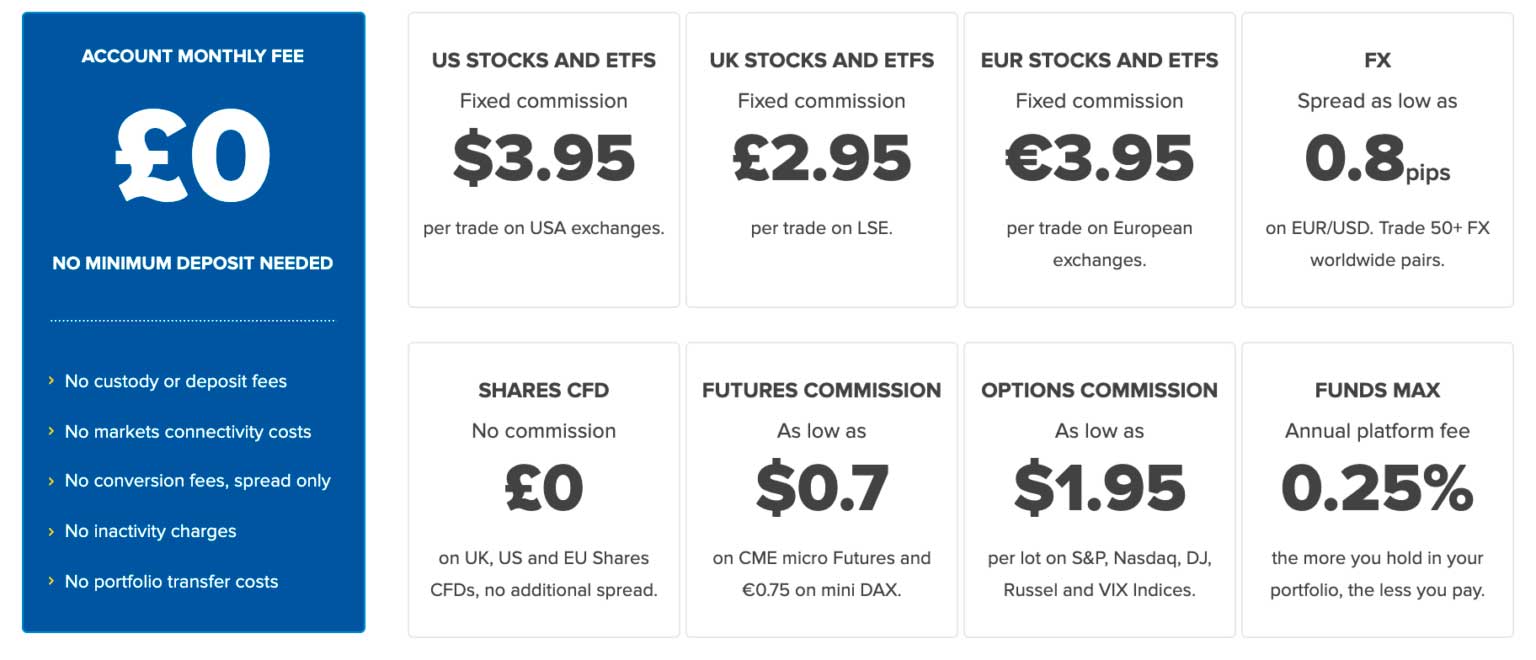

Fineco

Fineco is a popular investment platform to use to facilitate your bond fund investing, as they are low-cost and one of the well-known FCA-regulated brokers. Furthermore, they have a solid reputation in both the UK and Italy and are even listed on the Italian stock exchange.

Fineco does not charge a fee to open a position in their fund selection; however, they charge a minimal fee for holding the fund, equating to 0.25% of your investment up to £250k. So, if you invested £1000 in a fund with Fineco, you’d have to pay £2.50 to the broker each year. In addition, you would also have to pay the expense ratio that the fund provider charges.

Besides their holding fee, Fineco does not charge anything else to use their brokerage services – no account fees, inactivity fees, withdrawal fees, or deposit fees. Account opening is also straightforward and can be completed digitally. Also, Fineco does not have a minimum deposit amount to open your account, which is affordable for beginner traders who wish to test the waters first.

Sponsored ad. Your capital is at risk.

Conclusion

In this guide, we have examined some of the popular bond funds UK, discussing the various elements you need to be aware of to make an informed investment decision.

However, you should properly analyse and examine each possible investment before opening a trade.