How to Buy JPMorgan Shares UK – With 0% Commission

JPMorgan is the largest bank in the United States, providing investment banking and financial services to hundreds of thousands of customers worldwide. As consumer spending begins to rise thanks to lockdowns easing, JPMorgan’s financials look set to benefit – meaning great things for the company’s share price.

In this guide, we discuss How to Buy JPMorgan Shares in the UK – exploring the company in detail and highlighting how you can buy JPMorgan shares without paying any commissions whatsoever!

Step 1: Choose a Stock Broker

One of the most important things to do before you buy JPMorgan shares in the UK is to create an account with a secure and low-cost stock broker. These brokers help facilitate your investment in JPMorgan, pairing buy orders with sell orders. Choosing a suitable broker can make all the difference in the long run, as it’ll save you money and enable you to trade safely.

With this in mind, we’ve done the research and found our two recommended brokers when it comes to investing in JPMorgan, which are presented below.

Broker Price Comparison

When it comes to the best share dealing accounts. To provide further context, the table below presents a fee comparison between these brokers and other brokers in the industry, allowing you to compare all of the options.

| Broker | Commission | Account Fee | Deposit Fee |

| Fineco | $3.95 per trade | None | None |

| Libertex | From 0.1% | None | None |

| Hargreaves Lansdown | £11.95 per trade | None | None |

Step 2: Research JPMorgan Shares

Before you begin stock trading, it’s a good idea to thoroughly research the company you intend to invest in to ensure the investment has a good chance of generating a return. This is known as doing your ‘due diligence’ and involves looking at elements such as the company’s business model and financials.

To help streamline this research process, we’ve done all the hard work for you. The sections below present all of the information you need to know about JPMorgan, allowing you to make an informed investment.

What is JPMorgan?

So, what is JPMorgan? JPMorgan (full name JPMorgan Chase & Co) is an investment banking and financial services company based in New York City. At the time of writing, JPMorgan is the largest bank in the United States and the fourth-largest bank in the world. According to Statista, the company had total assets of $3.38 trillion in 2020.

JPMorgan provides a myriad of services to customers across the globe, including investment banking, commercial banking, asset management, private banking, private wealth management, treasury services, and more. In fact, JPMorgan’s services are so crucial to the economy that the Financial Stability Board (FSB) has deemed the company to be a ‘systemically important financial institution’. This means that if JPMorgan were ever to fail, it might trigger a financial crisis – which is where the term ‘too big to fail’ comes from.

JPMorgan is traded on the New York Stock Exchange (NYSE) under the ticker symbol JPM and is a member of the S&P 500. Jamie Dimon is the current CEO, where he has held the position since 2005. According to Macrotrends, the company has over 250,000 employees worldwide and generated revenue of $129.50 billion in 2020. In terms of market cap, JPMorgan is currently valued at $453.54 billion.

JPMorgan Share Price

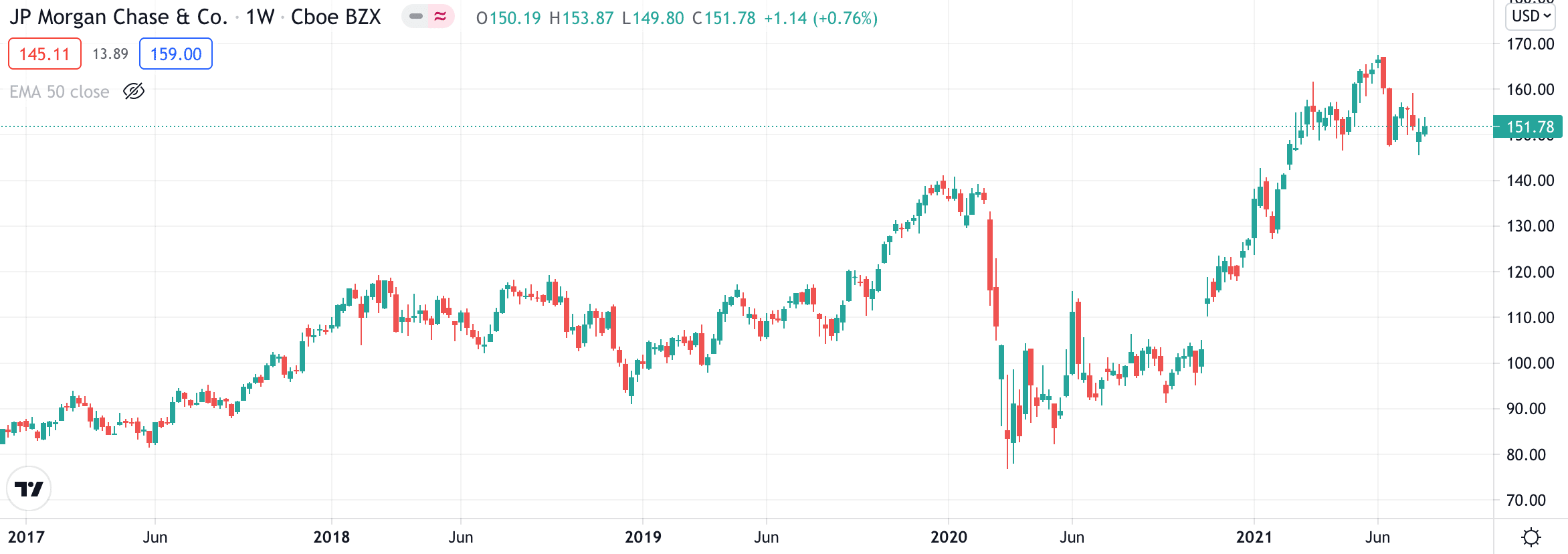

At the time of writing, the JPMorgan share price is currently sitting at $151.78. This represents an increase of 19.24% in the YTD and a rise of 56.57% since this day last year. In fact, JPMorgan even hit an all-time high of $167.21 in June 2021, highlighting the fantastic year the company has had.

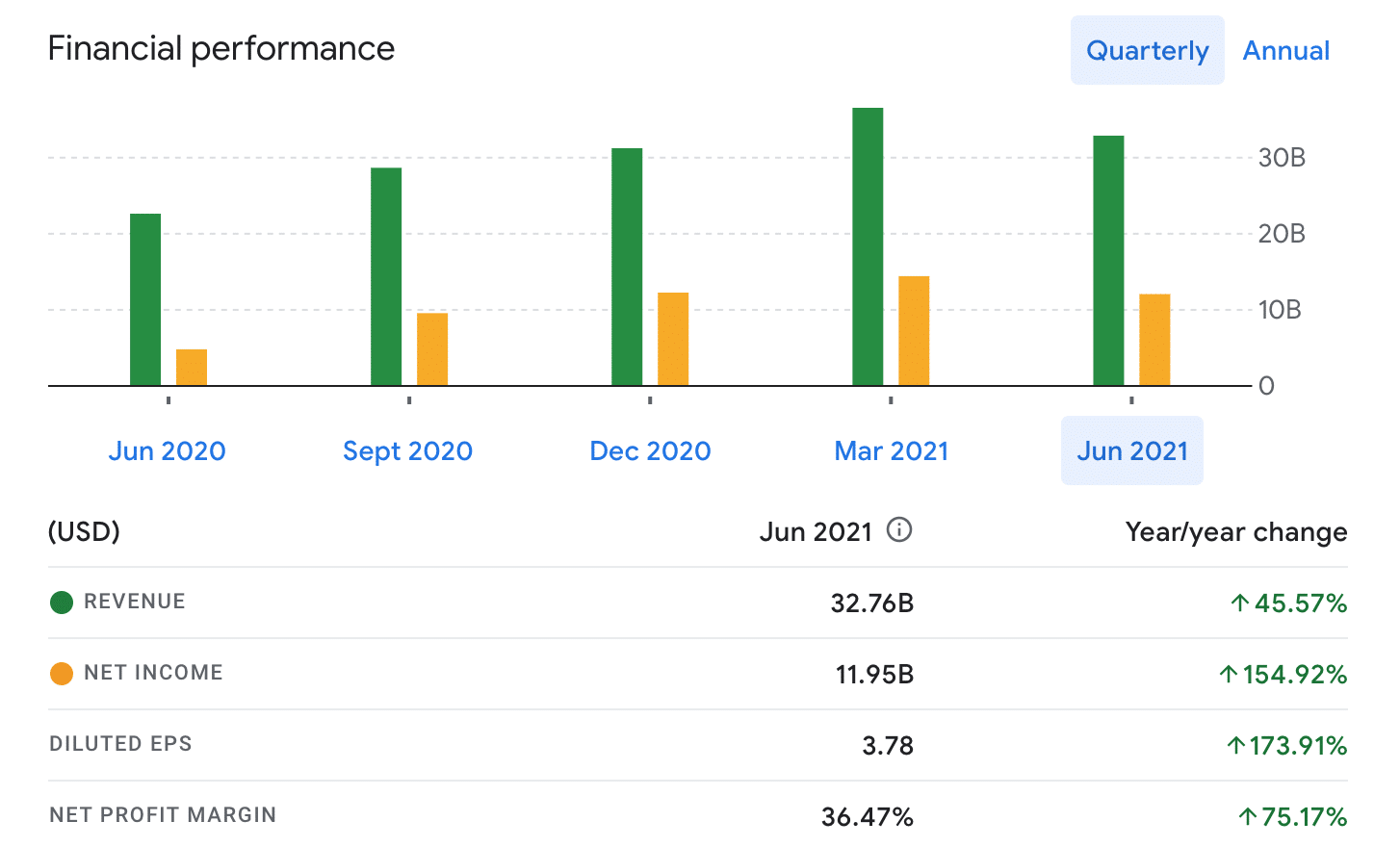

As you can see from the price chart, the JPMorgan share price has had a rough couple of weeks – but this can be considered more of a pullback than anything long term. The company’s foundations are still rock-solid, as evidenced by JPMorgan’s EPS. Macrotrends data notes the company’s EPS for Q2 2021 as $3.78, highlighting how profitable JPMorgan is as a whole. This is a significant increase from the EPS of $1.38 experienced in the same period last year.

In terms of the P/E ratio, data from YCharts notes this as 10.13 at the time of writing. The P/E ratio is a good indicator of a company’s value relative to other companies in the industry. From this data, we can state that JPMorgan is trading at 10.13 its earnings, which is a relatively solid level. Sometimes when a company is trading at 20x or 30x its profits, it can be considered ‘overvalued’ – so this isn’t the case with JPMorgan stock.

JPMorgan Shares Dividends

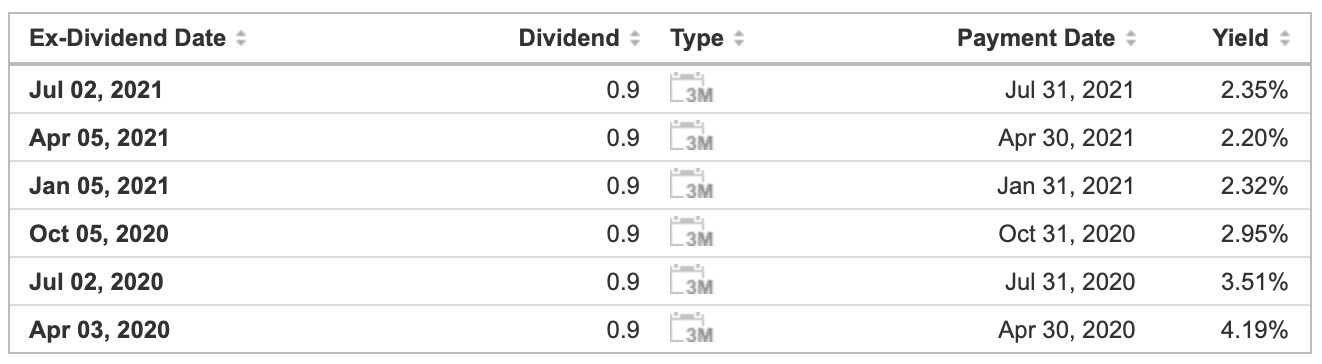

For those interested in the best ways to invest money to generate a passive income stream, dividend-paying stocks are a good option. JPMorgan is one of these stocks, providing a dividend yield of 2.5% based on today’s share price data. This dividend is paid quarterly, with payments arriving in January, April, July, and October.

According to Dividend.com, the average yield for financial companies in the S&P 500 equates to 2.5% – so this puts JPMorgan right in the middle. However, the great thing about JPMorgan is that the company tends to increase dividends every year. The company were paying a lowly $0.40 per share back in 2014, yet are now paying $0.90 per share.

The ex-dividend date for the next payment is on 5th October 2021, which means that if you buy JPMorgan shares before this date, you’ll be eligible to receive that dividend payment. So, if you are looking for a company that consistently increases dividends and pays out regularly, then JPMorgan certainly fit the bill.

JPMorgan ESG Breakdown

Ethical investments are becoming more and more popular these days, prompting more emphasis on a company’s ESG rating. The ESG rating relates to a company’s environmental, social, and governance impacts, which help determine how ethically run the company is.

Relating this to JPMorgan, found below is a breakdown of the company’s ESG rating for 2021:

- Environmental – 1.1/100

- Social – 16.1/100

- Governance – 10.8/100

A lower score represents a ‘better run’ company in relation to each metric – so as you can see, JPMorgan do pretty well across the board. Environmentally they do exceptionally well, being nearly inside the top 1% of companies. Social and governance factors are also reasonably solid, making JPMorgan a well-run company overall.

Combining these scores gives JPMorgan a ‘Medium’ rating in terms of ESG, according to Yahoo Finance. This means that the company does well overall, although it still has some areas to improve on. JPMorgan sits in the 50th percentile of companies in terms of ESG, making them firmly ‘middle of the pack’ regarding ethical companies.

Are JPMorgan Shares a Good Buy?

So, putting everything together, is it a good idea to buy JPMorgan shares in the UK? We believe so. To provide further context to this, found below are two of the main reasons that explain why JPMorgan would be an excellent addition to your equity portfolio this year:

Firmly Established In The Sector

As noted earlier, JPMorgan is the largest investment bank in America and the fourth-largest bank in the world. Due to its well-established nature, JPMorgan still managed to perform admirably in 2020 during the pandemic, with net income in Q4 up 29% from the year previous. This is even more impressive considering consumer spending was way down, representing a large portion of the company’s revenue via credit card spending.

More recently, second quarter 2021 results also beat expectations. The investment banking division performed exceptionally well, with revenue up 20% from Q1. Furthermore, credit card and debit card spending also increased by 45% from the same quarter last year. These metrics highlight that JPMorgan is in a solid financial position – and improving all the time.

Strategy for Future Growth

JPMorgan’s CEO, Jamie Dimon, has been in the role for 16 years – and it’s easy to see why. The CEO has led JPMorgan to exceptionally high levels and has put a plan in place for further growth going forward. JPMorgan is well on its way to completing its goal of opening 400 new branches, which will give them an incredible presence across America.

In addition, JPMorgan is investing heavily in fintech, which has helped grow the bank’s mobile users by 10% from the previous year. Also, Coindesk reported recently that JPMorgan will release an actively managed Bitcoin fund later this year. Although this seems like a minor announcement, the fact is that this step could pave the way for further crypto-related advances in the years to come.

JPMorgan Shares Buy or Sell?

In summary, are JPMorgan shares a buy or a sell? Through our research and analysis, we feel it is the former. An investment in JPMorgan is an excellent way to diversify your portfolio into the banking sector, as the company is well-established and has rock-solid fundamentals. With the JPMorgan share price recently hitting all-time highs, there’s never been a better time to invest.

Going forward, the CEOs leadership looks set to allow JPMorgan to keep up with the trends shaping the banking sector. Areas such as fintech and cryptocurrency will be crucial in years to come, which is why JPMorgan is deploying lots of capital to ensure they don’t get left behind.

Finally, the company is famous for increasing dividends every year, which is excellent news for people investing for income. Overall, the combination of a solid passive income stream and great prospects make JPMorgan a great addition to your portfolio for the months and years to come.

Buy JPMorgan Shares with 0% Commission

As you can see, JPMorgan looks like an excellent investment if you are looking to gain exposure to the banking sector. The company has established itself as the top dog within the industry in the US, thanks to outstanding leadership and strategy from the CEO. In the future, if JPMorgan can continue investing in areas such as fintech, it’ll allow them to keep up with current trends and continue reaching new heights in the stock market.