How to Buy Tilray Shares Online in the UK

Tilray is a US-listed stock that in its own words – is “pioneering the future of cannabis globally”. The firm is involved in several segments of the ever-growing legal cannabis industry – including research, cultivation, processing, and distribution.

If you’re based in the UK and wish to buy Tilray shares yourself – the process can be completed in minutes when using the right brokerage site.

In this guide, we’ll show you how to buy Tilray shares online in the UK. We’ll walk you through the process of choosing a suitable broker, opening an account, and then completing your Tilray share purchase.

-

-

Step 1: Find a UK Stock Broker to Buy Tilray Shares

Tilray is a Canadian company that is listed on the NASDAQ exchange. Crucially, this means that in order to buy some shares of your own you will need to use a broker that gives you access to the US markets.

There are many brokers that offer just this, albeit, you need to be extra careful when it comes to fees. This is because some brokerage in the space charge high fees to invest in non-UK stocks.

With this in mind, we have hand-picked a small selection of UK stock brokers that not only allow you to buy Tilray stock – but in a cost-effective manner.

1. XTB

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

76% of retail CFD accounts lose money.

2. AvaTrade

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options – but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

Your capital is at risk.

3. FP Markets

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

4. Pepperstone

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading – US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

Your capital is at risk.

5. PrimeXBT

PrimeXBT is an innovative stock broker that caters to a diverse range of traders, from beginners to seasoned professionals. Known for its versatility and user-friendly interface, the platform offers an array of features designed to enhance the trading experience across multiple asset classes.

One of the standout aspects of PrimeXBT is its wide range of available markets. Users can trade in cryptocurrencies, forex, commodities, and indices all from a single account. This flexibility allows traders to diversify their portfolios and take advantage of different market opportunities without needing to switch between platforms.

PrimeXBT offers a suite of trading tools and advanced charting options to help traders make informed decisions. The platform integrates customizable indicators, drawing tools, and multiple timeframes, enabling users to tailor their charts to suit their individual trading strategies. Additionally, PrimeXBT provides leverage trading options, which can amplify potential profits for experienced traders.

The platform’s trading interface is sleek and intuitive, designed to make navigating the markets straightforward. Opening, managing, and closing trades can be done with ease, while the performance of live trades can be tracked in real-time. PrimeXBT also offers an innovative feature known as Covesting, which allows users to follow and replicate the trades of successful strategy managers, providing an educational and potentially profitable experience.

PrimeXBT also prioritizes the security and privacy of its users. The platform employs industry-standard security measures to safeguard user accounts and data, such as two-factor authentication and encryption. Customer support is available to assist traders with any queries they may have, ensuring a smooth and reliable trading experience.

In summary, PrimeXBT stands out as a comprehensive trading platform offering a variety of markets, robust tools, and an easy-to-use interface. Its emphasis on security, diverse asset offerings, and innovative features like Covesting make it an excellent choice for traders looking to explore and capitalize on global market opportunities.

Your capital is at risk.

6. Admiral Markets

Admiral Markets is a globally recognized online trading broker known for its comprehensive range of financial instruments and user-friendly platforms. With a presence in over 40 countries, the company has built a strong reputation for providing a reliable and secure trading environment for both beginner and experienced traders.

One of the standout features of Admiral Markets is its extensive selection of trading instruments, including Forex, stocks, commodities, indices, and more. This variety allows traders to diversify their portfolios and explore different markets with ease. The broker offers competitive spreads and flexible leverage options, catering to various trading styles and strategies.

Admiral Markets is also praised for its robust platforms, particularly MetaTrader 4 and MetaTrader 5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available on both desktop and mobile devices, ensuring seamless trading experiences across all devices.

The broker places a strong emphasis on education, providing a wealth of resources such as webinars, tutorials, and market analysis to help traders make informed decisions. Additionally, Admiral Markets is regulated by several reputable financial authorities, ensuring a high level of trust and transparency.

Overall, Admiral Markets stands out as a top-tier broker, offering a comprehensive trading experience supported by excellent customer service and innovative tools.

Your capital is at risk

7. Trade Nation

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

75% of retail investor accounts lose money when trading CFDs with this provider.

8. Plus500 – Commission-Free Stock CFD Trading Platform

Plus500 is home to a huge UK stock trading community. This trusted platform specialises exclusively in CFD instruments – meaning that you will be trading assets as opposed to buying them. The Plus500 asset library covers thousands of financial instruments across stocks, indices, interest rates, commodities, cryptocurrencies, and forex.

Crucially, this includes Tilray stock CFDs. Some of the many benefits of choosing Plus500 to trade Tilray shares is that you can apply leverage of up to 1:5. In simple terms, this means that a £100 account balance would allow you to enter a position worth £500. If you’re a professional trader then you will get even higher limits. Unlike traditional stock brokers, the Plus500 CFD platform allows you to profit from rising and falling markets.

In other words, you get to choose from a sell or buy order – meaning that you can attempt to make a profit irrespective of which way Tilray stocks are moving in the market. Each and every financial instrument – including Tilray stock CFDs – can be traded commission-free at Plus500. At the time of writing, you will benefit from a very tight spread of just $0.21, too. Plus500 allows you to trade online or via your mobile phone. The latter includes a native mobile stock trading app on iOS/Android devices.

If you like the sound of Plus500, you can easily open an account. You simply need to provide some basic personal information and contact details. Then, you’ll need to meet a minimum deposit of £100 or more. You can do this instantly with a debit/credit card or Paypal. Or, bank transfers are also supported – but processing times can take a couple of days. Plus500UK Ltd is authorised & regulated by the FCA (#509909).

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Retail clients can trade stock CFDs with leverage of up to 1:5

- You can short-sell a stock CFD if you think its value will go down

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- More suitable for experienced traders

72% of retail investors lose money trading CFDs at this site

9. IUX.com

IUX.com is a forex broker designed to empower traders of all experience levels. They offer a comprehensive suite of trading tools, including a wide range of instruments, flexible account types, and the industry-standard MT5 platform. This combination allows you to tailor your trading experience and pursue opportunities across the forex market.

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk

10. Fineco Bank

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license.

Commission Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. Deposit fee Free Withdrawal fee $0 Inactivity fee None Account fee None Minimum deposit £0 Stocks markets Access to 13 stock markets Tradable assets CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, Available Trading Platforms Web-based trading platform, mobile trading app, desktop trading platform Your capital is at risk.

Step 2: Research Tilray Shares UK

Whether you’re investing in Tilray or other pharmaceutical companies like AstraZeneca, Vectura or Pfizer, it’s always important to do your research.

this is especially important in the case of Tilray. After all, the company is operating in an unproven, high-risk industry. Moreover, Tilray was only launched in 2013 and went public in 2018.

As a result, the next sections of this guide will cover some background information on the stock and what you should consider before taking the plunge.

Tilray Share Price History

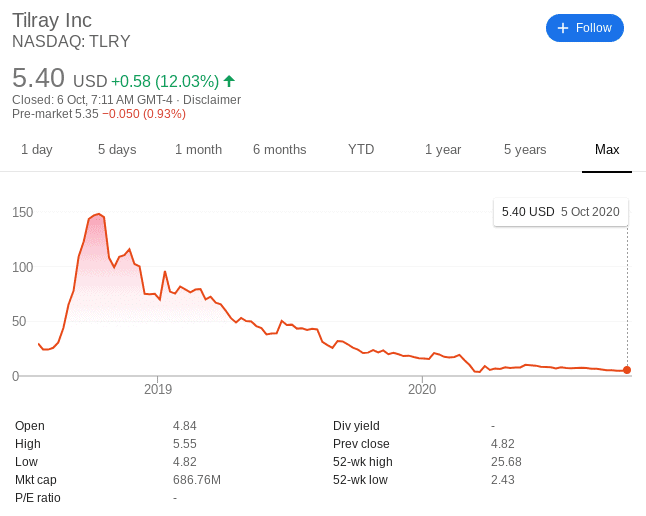

As noted above, Tilray went public in 2018. The firm opted for the NASDAQ exchange and initially priced its shares at $17 per stock. Just four months later, the very same stocks were valued at $148 – representing a rapid increase of 770%. On the one hand, those that backed the firm during the IPO and managed to cash out near its October 2018 peak are looking at unprecedented gains.

On the other hand, the stocks have since been moving in the wrong direction. In fact, at the time of writing the Tilray share price is just $5.40 on the NASDAQ. This is very concerning for two key reasons. First and foremost, $5.40 translates into a stock price capitalisation of over 96% from its prior all-time highs.

This has resulted in the vast bulk of Tilray’s market capitalisation being wiped out. At the time of writing, this stands at just under $700 million – which is small-fry. Secondly, a stock valuation of $5.40 is 68% lower than its initial IPO price. In more recent months, much of this downfall occurred in the response to the coronavirus pandemic. Starting the year at $16.40 -Tilray shares hit 2020 lows of just $2.43. At the very least, the shares have recovered by over 122% since this 52-week lows.

Tilray Shares Dividend Information

It goes without saying that a company as young and as unprofitable as Tilray does not pay dividends. Instead, all operating profits are being reinjected into the long-term growth of the stock. If dividend stocks are what you are after, you’ll want to focus on large-cap companies that have a long-standing track record of making distributions.

Should I Buy Tilray Stock Today?

So that begs the question – should you buy shares in Tilray? Unfortunately – the answer to that question can only be realised upon performing in-depth research. To help you along the way, below we cover some of the most important factors that you need to take into account before buying Tilray shares.

The Legal Cannabis Industry is Huge

Although figures vary wildly depending on the metrics used to perform the study – BusinessInsider notes that the legal cannabis industry was worth between $20-$23 billion in 2017 in the US alone. The same publication states that this figure is estimated to increase to $77 billion by the end of 2027. With that said – the numbers are significantly higher when you look outside of the US.

Relaxation of Laws is Crucial

By investing in a cannabis stock like Tilray, you are somewhat reliant on government legislation. In other words, the long-term goal is for more and more countries around the world to relax the laws not only on medical usage – but recreational. Regarding the former, there are dozens of nations around that permit the medical-usage of cannabis.

This must, however, be provided by licensed dispensers. On the other hand, the recreational side of the industry is substantially larger. At the time of writing, just Canada, Uruguay, and several US states permit the recreational sale of cannabis. But, if more governments follow suit – this would be extremely welcome for Tilray shareholders.

Discounted Share Price

As we covered in earlier, Tilray shares have capitulated not only since their all-time highs – but the initial IPO price. While this is, of course, very concerning for stockholders – this does mean that you can buy the shares at a huge discount.

For example, at $5.40 per stock – a return to an IPO price of $17 would represent upside of 214%. On the flip side, there is no guarantee that this will be the case. As such, you should keep your stakes to a minimum.

Expect Volatility

With a current market capitalisation of $686 million – Tilray shares are going to move in much more volatile cycles in comparison to large-cap blue chip stocks. This means that they might not be overly suitable if you are an inexperienced investor. After all, you are likely to see the value of your Tilray stock goes up and down in sharp movements. For example, between September 8th and 23rd – Tilray shares lost just over 16% in value. But, in the proceeding 11 days – the shares increased by 14%.

Tilray Shares Buy or Sell?

Most analysts on Wall Street have Tilray as a ‘hold’ at the time of writing. This means that the general consensus does not favour a buy or sell. Crucially, Tilray is likely to appeal to those of you that have a firm belief in the future of the legal cannabis industry.

With that said, even if the industry does continue to thrive as expected – there is no guarantee that Tilray stock will follow suit. As such, the only way that you can make an informed investment decision is to perform heaps of independent research.

The Verdict?

Buying shares in Tilray from the UK is a process that can be completed in minutes. The most important part of the process is finding a suitable share dealing platform. After all, many UK brokerage firms will charge a premium to invest in US stocks.

FAQs

When was Tilray launched?

Canadian company Tilray was launched as recently as 2013.

What stock exchange are Tilray shares listed on?

Tilray is listed on the NASDAQ exchange.

What price were Tilray shares went it went public?

Going public in 2018 - The Tilray share price was initially $17. Although it went on a parabolic upward trajectory in the proceeding months - the shares are now worth just $5.40 (as of October 2020).

What is the minimum number of Tilray shares you can buy?

This depends on the stock broker that you use. For example, some UK brokerage firms require a minimum investment of £500 or more.

What is the highest price Tilray shares have hit?

Tilray stock last hit all-time highs in October 2018 - reaching $148 per share. This amounts to 770% more than its IPO price of just a few months prior.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Tilray is a Canadian company that is listed on the NASDAQ exchange. Crucially, this means that in order to buy some shares of your own you will need to use a broker that gives you access to the US markets.

Tilray is a Canadian company that is listed on the NASDAQ exchange. Crucially, this means that in order to buy some shares of your own you will need to use a broker that gives you access to the US markets.

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.