How to Invest in iShares FTSE 100 UCITS ETF

Investing in an ETF is a one way to gain access to a diversified portfolio, and one of the most popular ETFs among investors is the iShares FTSE 100 UCITS ETF.

In this article, we take a closer look at how to invest in iShares FTSE 100 UCITS ETF. We will also cover a choice of brokers that you can trade iShares FTSE 100 UCITS ETF with. Read on for a detailed look at the price history, dividend history, and exposures and sectors.

How to Invest in iShares FTSE 100 UCITS ETF

- Step 1: Open an account with your preferred broker.

- Step 2: Verify identity by uploading passport or driver’s license and recent utility bill.

- Step 3: Fund your account by making a minimum deposit.

- Step 4: Search for iShares FTSE 100 UCITS ETF and open your position.

Popular ETF Brokers

When looking at how to invest in iShares FTSE 100 UCITS ETF, it’s important to choose the right broker to suit your investment needs. Some important broker considerations should include commission, minimum deposit, and regulations. To save you the time of researching the right broker, we have compiled a list of some of our stock brokers. Read on for a closer look at each.

iShares FTSE 100 UCITS ETF Research

Now we have looked at brokers to trade iShares FTSE 100 UCITS ETF with, let’s dig a little deeper into the ETF itself.

What is iShares FTSE 100 UCITS ETF?

The iShares FTSE 100 UCITS ETF tracks the performance of the FTSE 100 Index Fund and so is a good way in if you’re looking at how to invest in FTSE 100. This is comprised of the largest 100 UK listed companies in the world, giving investors massive diversification. iShares is an ETF-specific provider parented by BlackRock, the global investment management firm. BlackRock is one of the largest and most profitable investment management firms in the world, and iShares ETFs benefit directly from this.

In terms of how the ETF works, It tracks the FTSE 100 like for like. This means its portfolio is comprised and weighted just like the FTSE 100. Investing in the ETF will give you indirect ownership of all 100 companies.

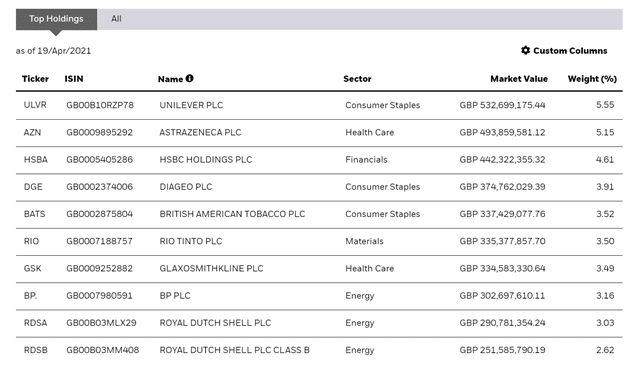

For example, if you invested £1000 you would indirectly own £56.10 worth of Unilever shares- the largest company in the FTSE. This is because Unilever makes up 5.61% of the FTSE 100 and therefore the same amount is invested into the iShares ETF. The second-largest holding is healthcare giant AstraZeneca (5.15%) and the third is multinational bank HSBC (4.55%).

The ETF gives investors portfolios exposure to the 100 largest listed UK companies. iShares suggests using this investment at the core of a portfolio to seek long-term, steady returns on investment. The ETF offers globally diversified growth through sector-leading companies. This diversity is great as it means you don’t have to try and construct your own portfolio of a few UK companies. It also means if one sector is declining, it will likely be offset by growth in another sector.

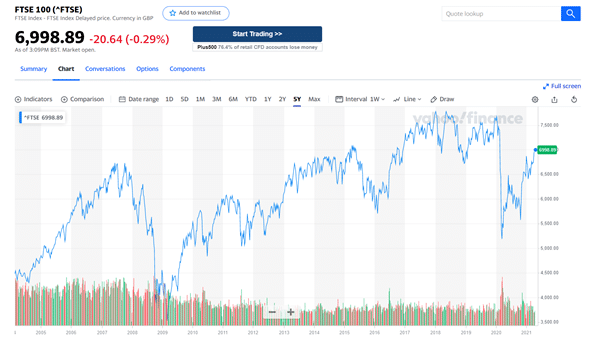

iShares FTSE 100 UCITS ETF Price

As we mentioned above, the price of the iShares FTSE 100 ETF fluctuates in line with the FTSE 100 share price. For example at the time of writing the FTSE has jumped above £7000 for the first time since March last year. As a result, the iShares FTSE 100 ETF risen to a share price of £6.90, also its highest value since the pandemic struck.

Looking at the price history, the FTSE 100 has delivered a return of 103.98%. This represents an annualized figure of 5.19% and the benchmark for the ETFs growth. The iShares FTSE 100 ETF has grown at an annualized rate of 5%, showing the like-for-like returns that the iShares ETF offers.

Looking at more recent price movements, the 1-year annualized return of the FTSE 100 is 21.88%. This is largely in line with the coronavirus pandemic recovery, as at the end of the FY2020 Q4, the UK was in full lockdown. The iShares 1-year return is also exactly 21.88%, making it a hugely profitable investment in the last year.

The pandemic sent share prices of most publicly traded companies downhill. This was represented by the market crash of March last year, where the FTSE stooped to a 10 year low of £4500. This downtrend was reminiscent of the 2008 financial crisis, which sent prices crashing to as low as £4000.

However, as many stocks have recovered in share price since this crash, the FTSE has seen huge growth. It has risen over 20% in the past 6 months, proving a great recovery index. Since the iShares FTSE 100 ETF directly tracks the index its share price has also increased over 20% in the past 6 months.

Is iShares FTSE 100 UCITS ETF a Good Investment?

The FTSE 100 is renowned for being stable and for it’s growth. The re-opening of the UK economy is underway, which is largely why the index has been creeping up in recent weeks. The vaccine roll out is good news for the FTSE as it is moving the world back to normality. Though the index has risen a huge 21.88% this financial year, this is largely due to unprecedented market conditions provided by the pandemic.

iShares FTSE 100 UCITS ETF Dividend History

The iShares FTSE 100 ETF pays dividends as many of the FTSE 100 firms pay a dividend. This is a great incentive for investors as it provides extra returns for their portfolios. These dividends will be paid every 3 months to investors. Its current dividend yield is 2.88%. The last dividend paid was on 11 March 2021 and was 0.0562p per share.

This was lower than both the 2020 and 2019 dividend amounts, however, this is largely due to FTSE 100 companies freezing dividend payments during the pandemic, as they simply didn’t have the spare capital to pay them. The dividend price is usually in line with the FTSE 100’s value – as it increases in value when its constituent companies perform well. When these companies perform well, they turn over more revenue and can pay a higher dividend.

iShares FTSE 100 UCITS ETF Exposures and Sectors

The iShares FTSE 100 ETF is made up predominately of financials and consumer staples. These make up 18.95% and 17.78% of the ETF respectively. Other predominant sectors include materials (14.11%) and industrials (10.42%), giving broad exposure to different sectors.

At the time of writing, the two largest holdings are Unilever which makes up 5.61% of the portfolio, and AstraZeneca, which makes up 5.15%. However, 3 of the 10 holdings are in the energy sector, namely BP PLC, Royal Dutch Shell, and Royal Dutch Shell Class B. A detailed list of all holding can be found on the iShares website.

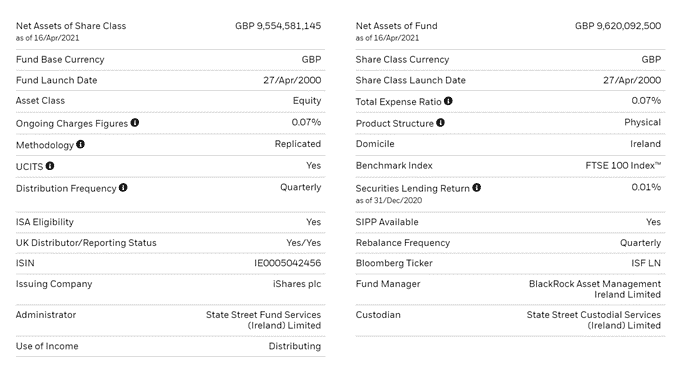

In terms of currency exposure, over 99% of the ETF is held in British Pounds. This is because the FTSE 100 deals in UK firms listed on the London Stock Exchange, and a large amount of them are UK companies. The US dollar and Euro also represent some holdings of 0.68% and 0.17% respectively. Although this seems like a tiny amount, the net assets of the fund are £9.6bn, meaning only 1% is equal to £96m! The FTSE 100 company makeup accounts for about 80% of the London Stock Exchange’s market cap. This highlights the exposure that the iShares FTSE 100 ETF has to the UK market.

iShares FTSE 100 UCITS ETF Key Facts

Below you can find a fact sheet from the iShares website that lists some of the fundamental information on the ETF. These key facts offer a good insight into some of the more advanced metrics that investors consider before buying securities.

Conclusion

In conclusion, the iShares FTSE 100 UCITS ETF is a choice to consider when looking for ETFs. Tracking the FTSE 100 index the ETF has provided historically near-identical annualized returns. Compromised of the UK’s largest 100 countries, it offers investors a chance to massively diversify their portfolio, provided a solid core of stability to build around.

The ETF has exposure to some of the biggest industries in the world including Energy, Financials, Consumer Staples, Materials, and much more. This gives traders a chance to own an indirect slice of huge company shares such as AstraZeneca, BP, and Unilever, which are some of the ETF’s largest holdings. The ETF also pays a dividend that is in line with FTSE 100 firms’ total dividends. This adds another great incentive to owning this ETF.

That being said, in the past 6 months, the iShares FTSE 100 ETF has risen a whopping 21.88% in line with the strong FTSE 100 pandemic recovery.

FAQs

What is the FTSE 100 forecast?

What’s the difference between an ETF and index fund?

Does the iShares FTSE 100 UCITS ETF pay dividends?

How much does the iShares FTSE 100 UCITS ETF cost?

How do Index tracking ETFs work?