Best Russia ETF UK To Watch

In today’s world, Russia is more familiar with its geopolitics rather than a thriving and vibrant economy. However, the country has vast resources at its disposal and a population of around 145 million people, so it’s one of the biggest emerging markets for investors to explore.

In this article, we’ll review some of the Russian ETFs UK for 2022.

-

-

Popular Russia ETF UK 2022 List

Here are 5 Russia ETFs in the UK for 2022:

1. VanEck Vectors Russia ETF

2. iShares MSCI Russia ETF

3. Direxion Daily Russia Bull 2x Shares ETF

4. Lyxor MSCI Russia UCITS ETF

5. VanEck Vectors Russia Small-Cap ETFPopular Russia ETFs UK Reviewed

We’ve reviewed some of the popular Russia ETFs in the UK by looking at important factors like how well the fund encompasses the Russian market, the reputation of the company issuing the fund, and the fund’s annual fees. Scroll down to look at our analysis for 5 available Russian ETFs in the UK markets.

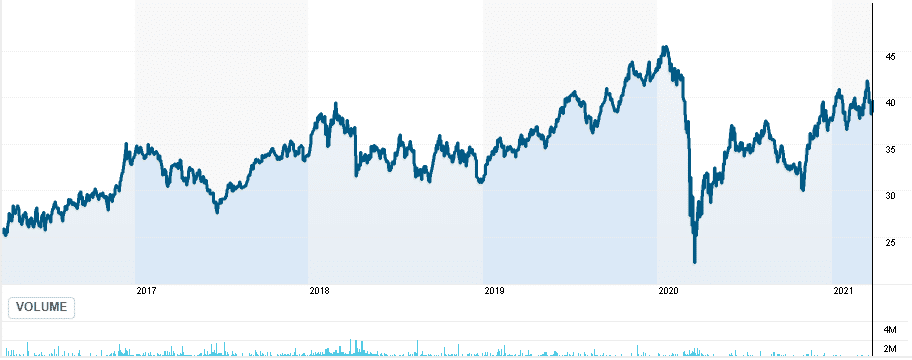

1. VanEck Vectors Russia ETF

This ETF is one option for investors in the UK to enter into the Russian market. It currently has around $1.67 billion in assets.

Under the ticker symbol RSX, this fund seeks to replicate the price and performance of the MVIS® Russia Index. This includes not only publicly traded companies incorporated in Russia, but also foreign companies that generate at least 50% of their revenues in Russia. Since the fund holds companies incorporated outside of Russian borders, it offers a broader reach than other ETFs from this list.

There are 29 positions in the portfolio in total, and 60% of the fund’s assets are in the largest 10 holdings.

Oil and gas names dominate the list, with companies like Gazprom, Lukoil, Novatek, Rosneft and Tatneft at close to 40% of the overall holdings. Mining companies make up an additional 26% of the fund’s assets. Sberbank and TCS Group Holding PLC, both banks, also feature significantly in the portfolio weighting.

The VanEck Vectors Russia ETF carries an expense ratio of 0.67%. It has a one-year return of 55.93% and a 5-year average annual return of 13.24%.

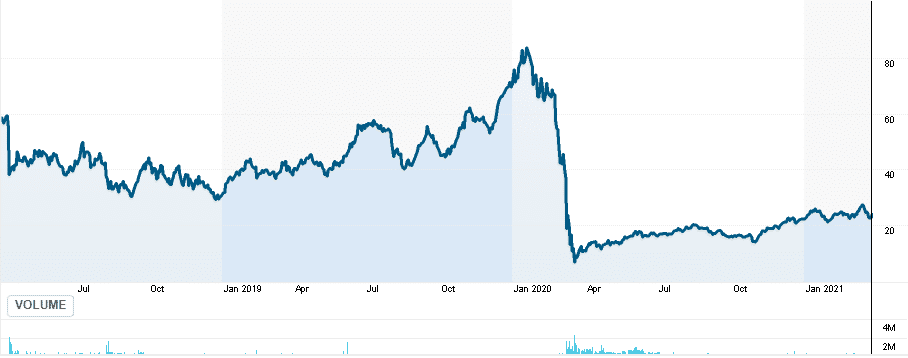

2. iShares MSCI Russia ETF

The second-largest Russia ETF, by assets under management, is the iShares MSCI Russia ETF. It has $470 million in assets.

Unlike the VanEck RSX fund, this ETF doesn’t include companies listed outside Russian territory. As a result, there are only 27 holdings in the fund.

Close to 70% of assets are invested in the top 10 positions, including Sberbank, Gazprom, Lukoil, Tatneft, Novatek, Norilsk Nickel, and Rosneft. The iShares ETF has a large position in the Russian tech company Yandex but doesn’t currently hold a position in the promising e-commerce company Ozon.

iShares charges a 0.59% expense ratio, which is cheaper than the VanEck ETF, but its performance has lagged as well. It produced a 45.11% return last year and a 5-year annual return of 13.07%.

3. Direxion Daily Russia Bull 2x Shares ETF

The Direxion Daily Russia Bull 2X Shares ETF seeks to double (2X) daily movements in the underlying Market Vectors Russia Index (the same index that the RSX ETF tracks).

Holding RUSL for longer periods may expose you to compounding losses due to daily rebalancing. Until March 31st, 2020, Direxion offered a 3X leveraged version of this fund, but it is no longer available.

This fund has a relatively small pool of assets under management due to its risky nature (it holds close to $57 million in AUM). The expense ratio is a pricey 1.23%.

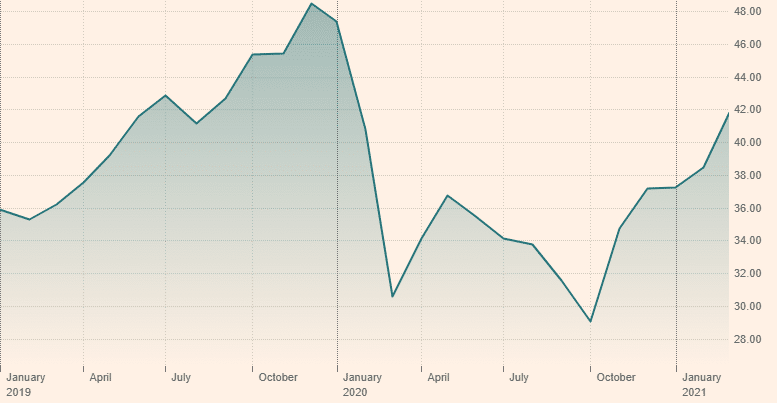

4. Lyxor MSCI Russia UCITS ETF

The Lyxor MSCI Russia UCITS ETF is denominated in EUR rather than USD and is listed in Luxembourg, with around 234 million EUR in assets under management. The fund’s aim is to track both the upward and the downward movement of the MSCI Russia IMI Select GDR Net Total Return index, which combines Russia’s large-cap, mid-cap and small-cap stocks listed on the London Stock Exchange through depository receipts.

The fund has a one-year return of 33.96% and a 3-year annualized return of 8.40%. The fund charges 0.65% in annual management fees.

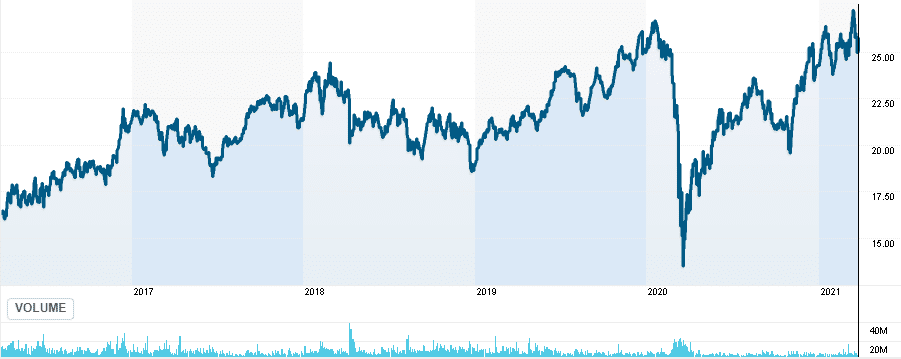

5. VanEck Vectors Russia Small-Cap ETF

As the name suggests, this $32 million VanEck ETF seeks to replicate the performance of small-cap stocks in Russia by tracking the MVIS® Russia Small-Cap Index. As for VanEck’s more popular RSX fund, this ETF includes companies incorporated outside of Russian borders that generate at least 50% of their revenues from Russia.

The fund carries an expense ratio of 0.77% and holds positions in 29 companies. It has a broad industry allocation, with utilities, consumer cyclicals and telecommunications sectors each making up between 9% and 15% of portfolio. Industrials and financials lead the way. Notably, energy stocks make up less than 3% of the portfolio.

The fund has a one-year return of 57.61% and a 5-year annualized return of 14.79%.

Are Russia ETFs a Valuable Investment?

Russia is a member of the so-called ‘BRIC’ group of emerging market countries – which includes Brazil, Russia, India, and China. The country is a global commodity powerhouse and accounts for a significant portion of the world’s supply of oil, gas, and metals.

Despite Russia’s size and large population, the country has always struggled economically. Russia is in the midst of rolling out its own vaccine.

Russia’s economy and stock market are heavily dependent on the energy and mining industries. Some of the biggest companies in the country are state-run enterprises like Gazprom and Lukoil. When oil prices drop, as they did in the first half of 2020, Russia’s economy quickly drops as well.

Another thing to factor in is the impact that frequent geopolitical clashes with the West have on the normal and stable functioning of the market. Sanctions by the US and Europe, in particular, have held Russia’s economy back in recent years.

On the other hand, investing in Russia doesn’t have to be only about the energy sector. The VanEck Vectors Russia Small-Cap ETF focuses on utilities, telecom, and financial companies, while broader Russia index funds now include tech companies like Yandex.

How to Invest in Russia ETF UK

If you choose to invest in any Russian ETFs, you have the option to do so with a popular stock broker that provides low fees, multiple assets to choose from and multiple features & tools to support your trades.

After picking your preferred broker, here is how you can begin trading in 4 steps.

Step 1: Open An Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue with the trading process.

Step 2: Verify Your Identity

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Russian ETFs

Once your account has been funded, proceed to search for any Russian ETFs available or any other asset classes on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Many Russia ETFs are energy and materials heavy. However, there is a lot of uncertainty in the markets, which is why users should properly research all ETFs prior their investments.

FAQs

Should I hold ETF for long-term or short-term horizon?

The answer depends on individual preferences and investing style, but ETFs can be used both as a longer-term position as well as a shorter-term tactical play. It is important to conduct your own research and analysis, so you can make a well-informed decision on your investment strategies

Ilija Rajakovic

Ilija Rajakovic

Ilija Rajakovic is a Serbian-based investor and writer. His main focus areas include finance, trading, and macroeconomy. Ilija holds a Master’s Degree in Investment Banking and is pursuing his Ph.D. with a focus on sustainable finance and development. He is actively managing personal investment portfolios and advising private clients. And has run a website which generated actionable stock market ideas and provided insights into global economic landscape in the past. His economic articles have been publshed in highly respected magazines like NIN and Magazin Biznis.View all posts by Ilija Rajakovic

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up