Best High Yield ETFs UK to Watch

This guide will discuss some high yield ETFs. We’ll also show you the step-by-step process of how to invest in a high yield ETF.

Key Points on High Yield ETFs in UK

- As the name suggests, dividend ETFs are financial instruments that invest in a portfolio of dividend stocks.

- Fund managers pick a basket of stocks, using a dividend index, that pay dividends to shareholders.

- Dividend ETFs in UK are managed passively. This means the fund manager tracks an index such as the FTSE 100 .

- High yield ETFs are possible options for investors with low risk tolerances, using income-investing strategies.

10 Popular High Yield ETFs in the UK

Below you will find a list of ten high yield ETFs in the UK. In the following section, we will delve into each of these exchange-traded investment funds in detail, providing a comprehensive overview of their features and performance.

- Iboxx $ High Yield Corporate Bd iShares (HYG)

- iShares Core High Dividend ETF (HDV)

- Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

- SPDR Bloomberg Barclays High Y (JNK)

- Alerian MLP ETF (AMLP)

- iShares Preferred & Income Sec (PFF)

- Vanguard FTSE Emerging Markets (VWO)

- InfraCap MLP ETF (AMZA)

- JPMorgan Ultra-Short Income ETF (JPST)

- Global SuperDividend US ETF (DIV)

Cryptocurrency is now one of the most popular financial assets and offers the potential for huge growth and big returns in a quicker time than traditional stocks. Investing in crypto to diversify is also an effective way to hedge a portfolio over the long term. However, the volatility of crypto means there are some risks, so make sure you do your research before investing.

- Read more and start investing in crypto now.

High Yield ETFs UK Reviewed

Researching what high yield ETFs UK are can be a tricky proposition. You have to consider various factors, ranging from the annual yield they pay to the type of returns they have experienced in recent years.

This guide will ease the burden of doing all of this research yourself by discussing the ten ETFs for high yield returns for UK investors. This section will provide an overview of each fund, touching on past performance and discussing the assets they invest in and what kind of yield you can expect. Wondering what the UK dividend ETF 2021 is? Keep reading to find out.

1. Iboxx $ High Yield Corporate Bd iShares (HYG)

One of the high yield ETFs for UK investors to research is the Iboxx $ High Yield Corporate Bd iShares. This high yield dividend ETF UK aims to track an index composed of high yield corporate bonds from US firms. These bonds are considered riskier than Treasury bonds; however, they provide a higher interest rate which translates into an increased level of current income.

Looking at its performance, this bond ETF fund has returned an average of 7.11% to investors over the past five years alone, highlighting incredible consistency. Not only that, but it also pays a monthly dividend, equating to an annual dividend yield of 4.86%. This ETF provides consistent capital growth. So, the Iboxx $ High Yield Corporate Bd iShares is a strong option for a monthly dividend ETF.

2. iShares Core High Dividend ETF (HDV)

If you are looking for a solid high dividend yield ETF, look no further. The iShares Core High Dividend ETF provides exposure to 75 of the dividend stocks based in the US. In turn, this provides investors with a steady stream of income whilst also remaining at an acceptable level of volatility.

With similar performance levels to the fund above (an average of 7.48% over the past five years), the iShares Core High Dividend ETF can be considered one of the high yield ETF funds out there. Furthermore, it also pays a quarterly dividend to investors, with a yield of 3.98%. So if you invested $1000 into the fund, you’d likely receive $39.80 in dividend payments; however, this is before fees, so double-check what your net income would be.

3. Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

There are many types of investors out there; some are more risk-seeking, whilst others are more risk-averse. For the investors in the latter camp, the Invesco S&P 500 High Dividend Low Volatility ETF may be one of the high yield, low risk ETF funds for you. Tracking the performance of the S&P 500 Low Volatility High Dividend Index, this S&P 500 ETF is made up of 52 of the highest dividend stocks that are also low volatility.

With a very low expense ratio of 0.30%, this fund is one of the list’s cheaper options. What’s more, this ETF also provides a yield of 4.19% to investors, spread out through monthly payments. Finally, over the past year, it has made a return of 9.44%, which is remarkable considering the impact of the Coronavirus pandemic.

4. SPDR Bloomberg Barclays High Y (JNK)

The SPDR Bloomberg Barclays High Y ETF is a high yield bond ETF that offers exposure to the US bond market. UK. This fund aims to provide diversified exposure to high yield corporate bonds that are denominated in USD. The fund manager in charge of this high yield ETF will also actively rebalance the portfolio’s allocations on the last day of each month, ensuring the highest levels of performance possible.

Although the securities within this UK high dividend ETF are not investment grade, this fund is still an excellent option for investors who are happy to take on a little extra risk to make a higher return. Even though the bonds the fund invests in are considered ‘junk bonds’, it still has a fantastic track record over the past decade, only displaying a negative return in two of the last ten years.

5. Alerian MLP ETF (AMLP)

The Alerian MLP ETF operates in an alternative field of investments. This UK dividend ETF tracks the return of a benchmark index composed of firms that generate cash flow from operations within the energy sector. These firms tend to be mid-cap and are all located in the US. With total net assets of $4.57billion, the Alerian MLP ETF is a favourite of both retail and professional investors worldwide.

It is worth noting that this fund had a rough 2020, ending the year down 32.39%. Again, the disclaimer that the fund was affected by the COVID-19 pandemic still applies. However, since January, the Alerian MLP ETF is up approximately 13.68%. Most notably, this fund provides one of the highest percentages of income to investors, sporting an annual yield of 10.16% that spread across quarterly cash payments.

6. iShares Preferred & Income Sec (PFF)

Preferred stocks are a specific type of stock with superiority over common stock – this means that they receive dividend payments before any other type of stock does. If a company were to go bankrupt, preferred stockholders would be the first to be paid before anyone else. As they pay a dividend and also act as an equity, these stocks are often referred to as hybrid securities.

The iShares Preferred & Income Sec is one of the high yield investments for getting exposure to preferred stocks. Through this exposure, investors into the fund can expect to receive a solid return whilst also acquiring an attractive passive income stream. This fund pays an annual yield of 4.57% and is distributed to investors via monthly cash payments.

7. Vanguard FTSE Emerging Markets (VWO)

More and more investors are looking to gain exposure to emerging markets. The Vanguard FTSE Emerging Markets ETF provides this exposure through investing in mid-cap and large-cap firms that operate in various emerging markets. Some of the countries the fund invest in are China, Taiwan, India, and Brazil.

Through these investments, this Vanguard ETF aims to provide a high yield to investors in the fund. It has returned 19.66% and 14.66% in 2019 and 2020, respectively, making it a better performer than the FTSE 100 over the same period. This fund also pays a small dividend to investors every quarter, with a current yield of 1.74%.

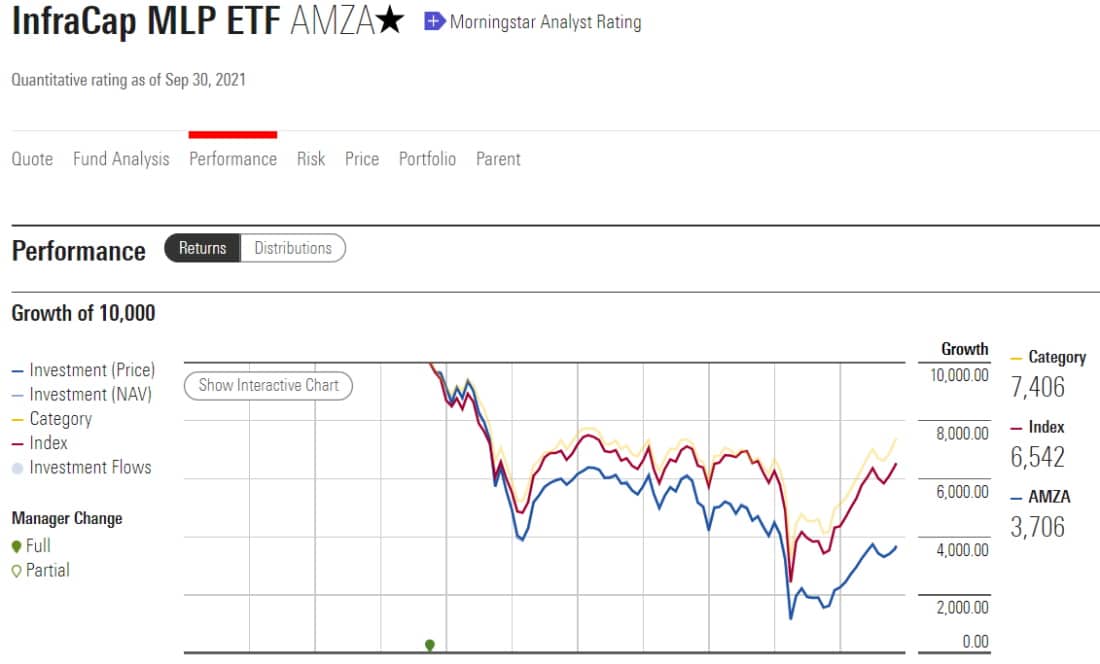

8. InfraCap MLP ETF (AMZA)

If you are looking for income ETFs UK that provide a steady income stream each month, then this may be the one for you. The InfraCap MLP ETF provides an excellent yield of 12.95% annually and is spread across 12 monthly payments. However, this fund does have one of the higher expense ratios on the list, clocking in at 2.01% annually.

Looking at returns in isolation, the InfraCap MLP ETF does fall short of other funds on this list, generating a negative return in three of the last five years. However, this can be put down to the energy sector’s performance, in which this fund invests heavily. Overall though, even though this fund is more volatile relative to others on the list, it does have one of the highest annual yields.

9. JPMorgan Ultra-Short Income ETF (JPST)

The JPMorgan Ultra-Short Income is one of our favourite high yield ETFs due to its consideration for ethical investments. These investments lean towards assets that have are attractive in terms of environmental, social, and corporate governance elements. As such, the fund aims to deliver an appropriate yield to investors whilst also providing a morally correct investment vehicle.

With a low expense ratio of 0.18%, this fund is an attractive prospect to retail investors worldwide. Furthermore, the fund has only been in operation for under five years and has displayed a positive return in each year of its existence thus far. Finally, due to holding a mix of US and non-US bonds, the JPMorgan Ultra-Short Income fund provides a yield of 1.15% to investors. Although not as high as other yields in this list, it’s one of the income funds as it offers a solid return for people who wish to create another source of income and want to invest in a morally responsible way.

10. Global SuperDividend US ETF (DIV)

The final ETF we will discuss is the Global SuperDividend US ETF, which invests in 50 of the highest dividend-paying equities in the US market. Furthermore, this fund makes income distributions monthly and utilises equities with low betas – meaning you get a fund that provides a passive equity income stream in a low-volatility manner.

This fund focuses on many areas, with the three being consumer staples, energy, and real estate. Through investments into these sectors, this ETF provides exposure to the US market. Furthermore, it offers an incredibly attractive yield of 6.64%. With a year-to-date total return of 14.40%, the Global SuperDividend US is one of the high yield ETF for UK investors.

Fundamentals of High Yield Funds UK

Now that we’ve touched on a variety of dividend ETFs UK, you might be wondering whether they would be an appropriate investment decision for you. Well, depending on your investment goals, these funds may be precisely what you are looking for.

Provide a Passive Income Stream

Everyone wants more money – that’s a given. A high yield ETF (such as the Iboxx $ High Yield Corporate Bd Ishares) is a type of financial instrument focused on current income, derived from either dividend payments from stocks or interest payments from bonds. Due to this focus, investors can expect to receive a consistent passive income stream paid monthly, quarterly, or annually, depending on the specific fund. The fund’s yield determines this income stream – so make sure to research the historic yield that your chosen fund pays to determine how much income you can expect to receive.

Diversification for your portfolio

This refers to their ability to spread your portfolio risk across various asset classes, thereby reducing your investment pool’s overall risk. To provide an example of this, if you were predominantly invested in equities, you could invest in an asset such as a gold fund to diversify, as gold funds tend to be negatively correlated with equities.

Relating this to high yield ETFs, these funds would offer a similar level of risk-reducing benefits. Holding a portfolio of different asset classes, and ensuring an appropriate weighting of each, is an effective methodology to optimise your risk/return profile. So, if you had a portfolio made up of equities, bonds, REITs, or any other asset class, you could add a high yield ETF investment into the mix to add to the diversification level.

Low-fees

When you invest in a high yield ETF, the fund provider will always charge what is known as an expense ratio. The thing is that these expense ratios are often very low relative to other assets and are expressed as a percentage charged annually on your position size. So, if you invested £1000 into a high yield ETF with an expense ratio of 0.25%, you would only pay £2.50 per year in fees! This highlights how cost-effective these ETFs are, especially when you consider the returns they can make – check out the image below for a snapshot of the InfraCap MLP ETFs performance in recent years as an example.

However, depending on who you invest with, you may also have to pay a commission to open a position in a high yield ETF.

Dividend ETF UK Conclusion

To wrap up, this guide has highlighted just how attractive high yield ETF funds can be to a variety of investors. Whether you are looking for low volatility or you are more risk-seeking, the multitude of high yields ETFs you can choose from ensures there is always an option that suits your investment goals.