Best Lithium Stocks UK – Invest with 0% Commission

Lithium is fast becoming a hot commodity, largely due to it’s use in electric cars and a surge in global demand. Don’t want to miss out on this investment opportunity? Read on for our full guide on the Best Lithium Stocks UK!

In this comprehensive guide, we take a closer look at some of the Best Lithium Stocks UK to buy in 2021 and the best brokers to invest in!

Best Lithium Stocks UK List

Need help to find the best lithium stocks UK? Here are our top 10 picks to buy this year. Scroll down for an in-depth look at each.

- Tesla– The global electric vehicle powerhouse- Invest Now

- Albermarle– Largest lithium provider for electric vehicles in 2020- Invest Now

- Livent– Industry-leading material science expertise- Invest Now

- Sociedad Quimina y Minera (SQM)– The world’s biggest lithium producer.

- Lithium Americas- Hosts the third-largest lithium depository in the world.

- FMC- Forging the future of agriculture.

- NIO- Chinese electric car manufacturer.

- EnerSys- Battery manufacturer and distributor.

- Piedmont Lithium Limited (PLL)- Emerging lithium company.

- Mineral Resources Limited (MRL)- Diversified mining services.

Best Lithium Stocks UK Reviewed

Lithium stocks are set to surge in the coming years, as the electric vehicle industry grows. However, after the pandemic market crash, it is important to analyse company fundamentals in order to make sure they have a solid foundation for recovery. Below, we take an in-depth look at the top lithium stocks in the market.

1. Tesla- The global electric vehicle powerhouse

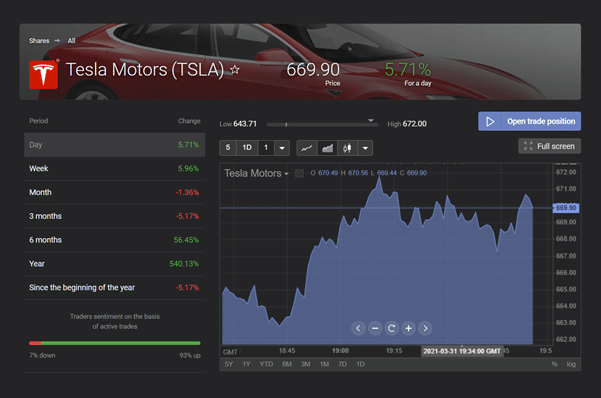

Global electric vehicle manufacturer Tesla (NASDAQ: TSLA) is heavily reliant on lithium and so is a clever way to invest in Lithium UK. Tesla is credited as one of the best-performing stocks this decade, soaring over 3200% since its IPO. Run by innovative CEO Elon Musk, the company has grown to become the world’s largest producer of electric vehicles, producing nearly half a million throughout 2020.

Though the pandemic hurt many shares’ stock price, Tesla shares actually saw a huge increase in share price, increasing from just $85 per share in March to just over $700 at the end of 2020. This was largely due to the huge increases in US tech sector share prices, due to people spending more time at home and online.

Recent share prices have dipped. This is largely due to the US tech sell-off, closely linked to rising bond yields and inflation worries. Though this may seem alarming, Tesla actually earned its first-ever profit in 2020 of $721m. These numbers are only likely to increase in the coming years.

What’s more, the company recently invested $1.5bn of its capital into Bitcoin. With investment in Bitcoin on such a rally, this is likely to raise even more cash for the company. What’s more, Musk announced earlier this week that Bitcoin is now an accepted payment method. This seems like a smart move from the firm, considering the moves towards a crypto dominant world.

2. Albermarle- Largest lithium provider for electric vehicles in 2020

Albermarle (NYSE: ALB) is a leading global producer of lithium. The firm also produces Bromine and Catalyst solutions, to pursue what they describe as a “more sustainable future“. Albermarle’s share price has risen over 76% over the last 12 months making it one of the best lithium stocks UK to buy for 2021. At the time of writing the stock trades at $148.

The pandemic saw a decrease in lithium prices worldwide. This was reflected by Albemarle’s decrease in net sales by 11%, down to $879m. Although they expect lower lithium prices, this is likely to be offset by an increased volume of sales. However, the company expects in 2021 performance to be largely improved in line with the economic recovery from the pandemic. The firm also offers an attractive dividend of 0.96%, which is nothing to complain about.

3. Livent- Industry-leading material science expertise

Livent (NYSE: LTHM) formed in 2018 as a spin-off from FMC, with its sole focus on lithium. The company sunk to a pandemic low of $4 per share in March but peaked at $22 in February 2021. Though the share price has recently dipped to $16, analysts expect earnings-per-share to rise to $0.17 contrasting the $-0.02 earnings-per-share in 2020. With Livent being a pure-play lithium producer, it is likely to capitalize on future growing market demand, making it a lithium stock that could explode.

During the fourth quarter of 2020, the firm reported profits of $82.2m, a 13% improvement from the third quarter. More excitingly, Livent announced in the report that it had signed a multi-year deal with automotive company BMW Group. The deal includes the supply of lithium hydroxide and lithium carbonate for BMW’s electric vehicle fleet.

Livent has a great forecast for 2021. The company expects revenues to be in the range of $335m to $365m, largely due to an expected increase in post-pandemic lithium demand. Lower costs are also expected in 2021, largely due to reduced third part carbonate usage. This could free up more cash strengthening the balance sheet.

4. Sociedad Quimina y Minera (SQM)- The world’s biggest lithium producer

SQM (NYSE: SQM) is a Chilean lithium powerhouse, with a market capitalisation of $13.8bn. Share value has rallied 98% in the last twelve months, proving a top pandemic performer. Rising from a low in March 2020 of $16 the share price peaked at $57 earlier this month. The pandemic hurt most of SQM’s financial metrics. The firm saw decreases in revenue, net income, and earnings-per-share of 7%, 41%, and 41% respectively.

SQM announced that it has pledged $1.1bn to lithium capacity expansions for 2021-2024, which poises it to capitalise on growing lithium demand. In addition to this, the firm announced it has signed a deal to supply LG Energy Solutions with lithium. This deal is expected to run between 2021 and 2029 and supply over 55,000 metric tonnes of lithium. SQM was chosen for this deal due to its stability, which it has proved since its founding in 1968. SQM also offers a small dividend yield of 0.54%.

Profit is set to double over the next few years. With electric vehicle production increasingly daily, the demand for lithium is spiking. This is good news for SQM, the world’s second-largest lithium producer. Therefore this stock is also one of the best lithium stocks UK to buy now.

5. Lithium Americas- Hosts the third-largest lithium depository in the world

Lithium Americas (NYSE: LAC) owns large-scale lithium mining facilities in Argentina and Nevada. Its share price soared throughout 2020 gaining 296% in value. In addition to this, the share value jumped 57% in January 2021 alone! The current share price is $14, down from the high of $23 in January. The stock saw a great pandemic recovery, with a large upswing in the second half of 2020.

Shares jumped 30% on January 19th alone. This was a day after the announcement that its Thacker Pass project was one step closer to commercialisation. Thacker Pass is the world’s largest known lithium resource, and this project involves converting it into a mining facility.

The Thacker Pass project really puts this stock on the map for future growth. The share price has also performed excellently during the pandemic, making it an attractive stock to investors.

6. FMC- Forging the future of agriculture

FMC (NYSE: FMC) is an agricultural sciences company. It is another lithium stock that had a nice upswing in share price throughout the tail end of 2020. At the time of writing, the share price sits around $110 marking a 70% increase year-to-date. Since 2016 the stock had risen pretty nicely, for example from December 2016 to December 2019 share value rose over 100%. This shows the companies stability.

However, digging into the fourth quarter financials from 2020 we can see some small pandemic losses. Revenues were down 4% to $1.15bn compared to 2019’s Q4. In addition to this earnings-per-share were down 19%.

Although these metrics aren’t great, FMC actually managed to remain pretty unscathed by the pandemic. Overall revenue actually grew 1% to $4.64bn and free cash flow rose a staggering 80% to $544m. This is great for FMC as it places them in a much better place moving forward than many of its competitors. Most of the stocks discussed in this article suffered big revenue losses in 2020 but FMC actually grew!

The future outlook also looks promising. With revenues and cash flow for 2021 expected to be around 5-6% greater than 2020, the company is expecting to grow at a healthy rate. The dividend yield is also 1.74% which offers a nice income on top of any share price increases.

7. NIO- Chinese electric car manufacturer

NIO (NYSE: NIO) is a Chinese electric car manufacturer. This means its success and stability are heavily linked to the lithium market. NIO was one of the hottest stocks of 2020, soaring over 1100%. It also saw a 113% increase in manufacturing bringing its total for 2020 to 43,728. In the first month of 2021, 7225 vehicles were issued which is a 352% year-on-year increase. It is safe to say this stock is definitely carrying some momentum!

This stock also trades at a fraction of industry giant Tesla’s share price. Founder and Chairman William Li has also announced plans to expand into the European markets later this year, which would massively broaden market reach, likely increasing sales.

Like Tesla, NIO has recently seen a harsh drop in share price. This is due to the previously mentioned rise in bond yields, which is indicative of rising inflation and interest rates. This tends to harm growth stock’s value such as NIO. The firm also offers a series of power solutions to charge consumer vehicles at home. This again is reliant on lithium stock price and performance.

Though the company currently operates in loss (many growth stocks do) the 2020 Q4 51.5% year-on-year decrease in losses is encouraging. The 133% increase in revenues over the same period has helped reduce losses no doubt. However, this lithium stock could be considered risky as it’s still in its early stages of growth, unlike FMC, Lithium Americas, and SQM who have had years in the industry.

8. EnerSys- Battery manufacturer and distributor

EnerSys (NYSE: ENS) produces and distributes batteries that use lithium as an essential metal ingredient. The share price has performed historically well, with plenty of upswings since its original listing. It has profited from recent lithium stock booms, reaching a share price high of over $100 at the start of March 2021. This represents a huge pandemic recovery of 150%!

EnerSys currently has the number one market share of 21%. This means it has market dominance and can capitalize on the growing lithium battery industry. The firm is also a major battery supplier to 5G antenna sites. This is another growing industry in which EnerSys already has its foot in the door. The companies third-quarter results for 2020 are also encouraging. Net sales hit $751m, up 6% sequentially.

However, this was actually a 2% decrease comparative with 2019’s Q3. The pandemic was responsible for this as sales dropped throughout mid-2020 due to the economic standstill. However, with economies looking to reopen soon, this lithium stock could be set to explode. The pre-pandemic performance is very encouraging in this respect.

9. Piedmont Lithium Limited (PLL)- Emerging lithium company

Piedmont (ASX: PLL) is an emerging lithium company based in the US. It mines lithium from its 100% owned Piedmont lithium project in North Carolina. Although the share value was affected, it wasn’t nearly as bad as some of the other stocks we have looked at. Share prices fell from just under $10 to around $5 as a result of the pandemic.

As seen in the graph above, it was around September that things started to go crazy for PLL. A huge initial spike occurred, followed by another shortly after. Peaking at $78 dollars per share, this stock’s price soared over 1400%! This is massively encouraging for the company however it does still pose some risks.

PLL is still a relatively new company, with the goal of capitalizing on the growing electric vehicle market. It wants to become a large-scale domestic supplier of lithium hydroxide to fuel this market. Due to it being such a new company, it will have to fend off competition from more reputable companies such as SQM and FMC, who have years of industry experience. This is a potential risk to be aware of.

Net cash flow rose from $4m in 2019 to over $18m for 2020, representing good cash management during the pandemic.

10. Mineral Resources Limited (MRL)- Diversified mining services

Mineral Resources Limited (ASX: MIN) is an Australian-based lithium and iron mining company, founded in 1993. It also offers a lithium hydroxide processing service. The share price fell from $19 to $13 when the pandemic struck but it has since rallied over 205%! Peaking at $40 per share the price has only fallen slightly to $37.

The first-half results for 2021 are also very encouraging. MRL has seen record production of spodumene (the primary source of lithium), up 36% from the previous half-year. In addition to this, it announced that its new Kemerton hydroxide plant construction is going as planned. This will scale up lithium production and processing.

The firm turned over revenues of $1.5bn, up 55% from the previous six months too. Overall mining was also up by 23%, along with cashflow up a whopping $303m. A final positive from this company is that the next dividend payment has been raised to $1 per share.

The company has good past performance too, with lots of upswings. MRL is therefore included on our best lithium stocks UK list.

Are Lithium Stocks a Good Investment?

When deciding which best lithium stock UK to add to your portfolio, there are a lot of considerations as there are different types of shares. The lithium market as a whole has performed extremely well in the second half of 2020. This is largely in line with tech stocks performing extremely well with electric vehicle stocks such as Tesla and NIO included. These are directly reliant on lithium production, so a mirror in market upswing trends can be seen.

The electric car industry is estimated to be worth $803bn by 2027. Household automotive brands such as Ford and General Motors have set aside $11bn and $27bn respectively for electric car research and manufacturing. Many countries across the world are ushering in new regulations to encourage electric vehicle travel and reduce their carbon footprint.

By 2030, electric vehicles could need up to 2700GWh of lithium-ion batteries, thirteen times more power than we use today. Lithium is the key metal used in rechargeable battery technology and an increasingly wireless world is leading to its steep demand. This demand is likely to outgrow supply, which is great news for all the lithium producers we have looked at. Prices are shooting up, and are likely to continue on a bullish trend as electric vehicle manufacturing increases.

What risks should I be aware of?

Investing in any stock always carries risk, but when researching a company there are certain things to consider to minimise this risk. Three main areas should be looked at:

- Balance sheet- This summarises the company’s financial balance highlighting company liabilities and assets. Many companies carry liabilities like debt and often operate in losses. However, whilst losses are accepted when scaling up the business, they should always remain finite. Debt should also be considered and shouldn’t outweigh free cashflow.

- Cash flow– A company needs a solid cash flow to keep business up and pay investor dividends. It provides a good metric for the company’s health, and how easily/quickly cash can be raised gives a good idea of financial management quality.

- Annual report– Analysing a companies annual report will show investors a number of key metrics for the past year’s performance. An annual report includes both a balance sheet and a cash flow statement for the year. It will also show investors the all-important profits and revenues, as well as future forecasts.

If investors are keen to grab shares, but can’t decide on one from our top 10 best lithium stocks UK list, then an ETF may be a better option. ETF’s like the Global X Lithium & Battery Tech ETF or the ETFS Battery Tech and Lithium ETF allow investors access to a broad range of top lithium stocks all under one investment. Both of these lithium ETFs have recently rocketed due to their holdings in many of the lithium stocks we have looked at.

A final area to consider before buying lithium stocks is the stock’s pre-pandemic performance. This is a good indicator of how stable or volatile the stock would be under normal circumstances. Though the pandemic has likely helped the electric vehicle and tech industry (and consequently the lithium industry) it has still created unprecedented market environments.

Best Brokers to Buy Lithium Stocks

Now that we have analysed the best lithium stocks UK, we must pick a broker to buy shares with. The majority of our best lithium stocks UK list are listed on either the NYSE or the NASDAQ exchanges. Therefore it is important to find the right best UK stock brokers to connect you with the US exchanges. To help you find the right broker, we have listed the top 2 platforms that offer a great selection of lithium stocks.

1. Libertex – Trade lithium stocks with zero spread

This allows investors to short sell lithium stocks they think will decline in share value. Libertex also offers leverage trading of 1:5, meaning you can trade up to five times your account value. The platform also offers zero spreads, making it one of the most competitive CFD brokers on the UK market.

Traders receive free market signals from Trading Central experts, allowing them to identify new market trends and opportunities. Free risk management tools are also available to minimize risk. These vary from stop loss to custom push notifications.

To open an account with Libertex, you must deposit a minimum of just £100. The platform will then allow you to trade lithium CFDs as you please. You can deposit funds using credit, debit, and e-wallet. Libertex, which has been running since 1997, protects your funds with industry-leading security protocols such as CySEC.

Pros:

- Trade CFDs spread free

- CySEC Regulated

- Fixed commission structure

Cons:

- Only trades CFD’s

- Limited number of UK stocks

83% of retail investors lose money trading CFDs at this site.

How to Invest in Lithium Stocks in the UK

Now we have run you through our best lithium stocks UK list, you should have enough information to decide if you want to invest. We will now show you how to set up an account and open a position using a top pick broker.

Step 1: Opening an account

The first step is to open an account. You can visit the homepage using an online browser or via the app. Once on the homepage, select the ‘join now’ button and follow the onscreen instructions. You will then have to upload some personal information and complete a short financial questionnaire to assess your trading knowledge. In addition to this, you will need to enter your mobile number for authentication purposes.

Step 2: Verify identity by uploading documents

For security purposes, users will have to upload documents to prove their identity and start trading. These documents are either a passport or driver’s license and a recent utility bill. In most cases, the broker will verify these documents and have your account ready within minutes

Step 3: Make your deposit

Now your account is verified you must deposit a minimum of $200, which is around £145 at current conversion rates. The broker allows for a variety of payment methods including debit or credit card, PayPal, bank transfer, and Skrill. All payment methods are listed by the broker meaning they will receive the funds instantly (excluding bank transfer).

Step 4: Trade lithium stocks

You can now choose your lithium stock by using the onscreen search bar. You can also browse the platform for other stocks, selecting relevant markets and stock exchanges. Once you have chosen your stock, click on the ‘Trade’ button to fill out an order form. Fill out this form and use your funds to set the amount you wish to purchase. Then click the ‘Set Order’ button to complete the investment.

Buy Lithium Stocks with 0% Commission

Lithium stocks have rallied in recent months, with much evidence to suggest they could climb further. The electric vehicle industry is set to boom in the next decade as the world moves towards cleaner alternatives to petroleum-fuelled travel. This expansion complements lithium demand, which has largely been reflected in the recent spike in lithium stocks.

However, whilst this sounds like good news, there are still risks that must be considered. With many up-and-coming firms in the market, lithium production is becoming competitive. In addition to this, there is no guarantee that share prices will continue to rise in the short term, as huge share growth is usually followed by market correction or a dip in share price. The most important factor will be to diversify your lithium stocks and keep your stakes sensible.

FAQs

What is the lithium markets forecast for 2021?

The lithium market will expand throughout 2021 and long after. With such a growing demand in lithium hydroxide and lithium carbonate for rechargeable battery technology, the markets will likely boom throughout this decade. As the world moves towards clean electric energy, lithium share prices will keep rising.

What is the best lithium stock to buy UK?

All of our best lithium stocks UK are great options to consider when looking at the lithium market. Each stock has its own strengths and weaknesses which will suit varying investment styles. For example, some of the larger reputable companies such as FMC may give investors slower more steady returns. Newer, growing stocks such as NIO, may offer larger short-term upside potential, but this comes at a higher risk.

Is there a lithium stock etf?

Yes. Some lithium stock ETFs include the Global X Lithium & Battery Tech ETF and the ETFS Battery Tech and Lithium ETF. These provide a great way for investors to access a broad range of lithium stocks, all under one investment.

Why are lithium stocks rising?

Lithium stocks are rising due to growing market demand and expansion of the electric car industry. They also rose during the last half of 2020 due to the increased spotlight on tech stocks, of which many use lithium as a key ingredient for battery production.

What other lithium stocks are there?

Other popular lithium stocks include Galaxy Resources, Tianqi Lithium, Jianxi Ganfeng Lithium, and Orocobre.