How to Buy Legal and General Shares Online in the UK

Legal and General is a UK-based financial services company that has an international presence. This includes exposure in the Far East, Mainland Europe, and the US.

The firm currently has a market capitalization in excess of £13 billion, and so it forms part of the FTSE 100 index. This means that you can invest in Legal and General with ease.

In this guide, we show you how to buy Legal and General shares online in the UK. On top of exploring the best UK share dealing platform to do this with, we also consider what the future holds for Legal and General.

-

-

Step 1: Find a UK Stock Broker to Buy Legal and General Shares

Buying Legal and General shares in the UK couldn’t be easier. After all, there are hundreds of online brokers that give you access to the London Stock Exchange. However, this can make it somewhat difficult to know which platform is right for your needs.

Below we list a small selection of the best UK stock brokers to buy Legal and General from.

1. Plus500 – Commission-Free Stock CFD Trading Platform

Plus500 is an online trading platform that specializes in CFDs. This includes everything from shares, indices, cryptocurrencies, forex, bonds, and commodities. When it comes to Legal and General shares, you will be speculating on the firm’s future price via CFDs. In simple terms, this means that you will not own the underlying stock.

Crucially, this means that you can speculate on the shares going up and down. Plus500 is also useful for trading Legal and General shares as you can apply leverage. As a UK retail client, this means that you only need to put down a margin of 20%. As such, your profits and losses will be amplified by 5x. Regardless of whether you go long or short on Legal and General, Plus500 does not charge any commissions.

You will also benefit from tight spreads when trading during standard market hours. You can access the Plus500 trading suite via the platform’s main website or through your phone. If opting for the latter and you have an iOS or Android device, you can trade via the Plus500 mobile app. In terms of getting started, the platform allows you to open an account in minutes. You will be asked to meet a minimum deposit of £100.

You can get money into your Plus500 account with a debit/credit card, e-wallet, or bank account. There are no fees to make a deposit or withdrawal at the platform. Plus500UK Ltd is authorized & regulated by the FCA (#509909). Its parent company – Plus500 Ltd, is listed on the London Stock Exchange. As a result, you should have no issues regarding the safety of your funds.

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Retail clients can trade stock CFDs with leverage of up to 1:5

- You can short-sell a stock CFD if you think its value will go down

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- More suitable for experienced traders

72% of retail investors lose money trading CFDs at this site

Step 2: Research Legal and General Shares

You need to perform in-depth research before parting with your money, whether you’re investing in Legal and General or other companies like Lloyds or LSE. With this in mind, below we discuss the firm’s historical share price action, whether it pays dividends, and where the stocks are likely to go in the near future.

Legal and General Share Price History

Legal and General is a financial services company based in the UK. On top of serving the domestic market, the firm also has exposure in the US, Asia, and Mainland Europe. With a market valuation of over £13 billion as of August 2020, Legal and General is one of the largest firms on the London Stock Exchange. As a result, it is a constituent of the FTSE 100 index. As of its 2019 end of year results, Legal and General had just under £1.2 trillion in assets under management.

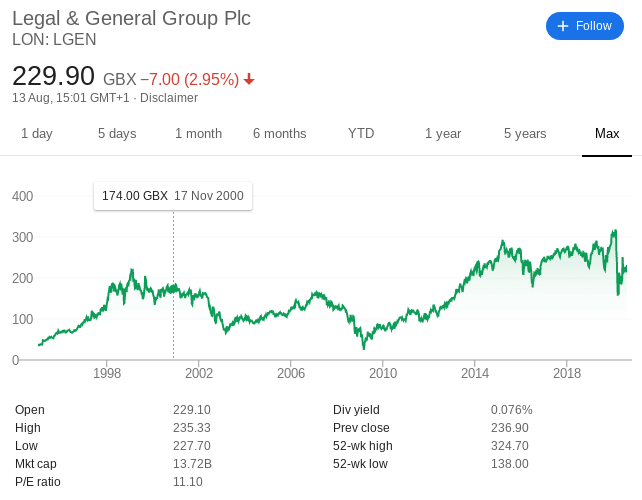

In terms of its shares, Legal and General have been active on the stock exchange since the mid-1990s. Since then, the financial services firm has executed a stock split. Taking this into account, the shares were worth just over 35p each in 1995. The stocks have had somewhat of a rollercoaster ride since, with various ups and downs along the way.

With that being said, the shares were in all-time high territory in February 2020 – peaking at 324p. But, and much like the rest of the UK financial services scene, Legal and General shares fell off of a cliff in response to the COV-19 market sell-off. In fact, the shares went as low as 138p the following month, amounting to a capitulation of over 54%. There has, however, been a rather speedy recovery for the shares, with the stocks now priced at 230p.

This represents an increase of 66% in just 5 months. This once again highlights that timing the market right is crucial when investing in the stocks and shares space. At this price, Legal and General shares have a further 40% to go to get to pre-COV-19 levels.

Legal and General Shares Dividend Information

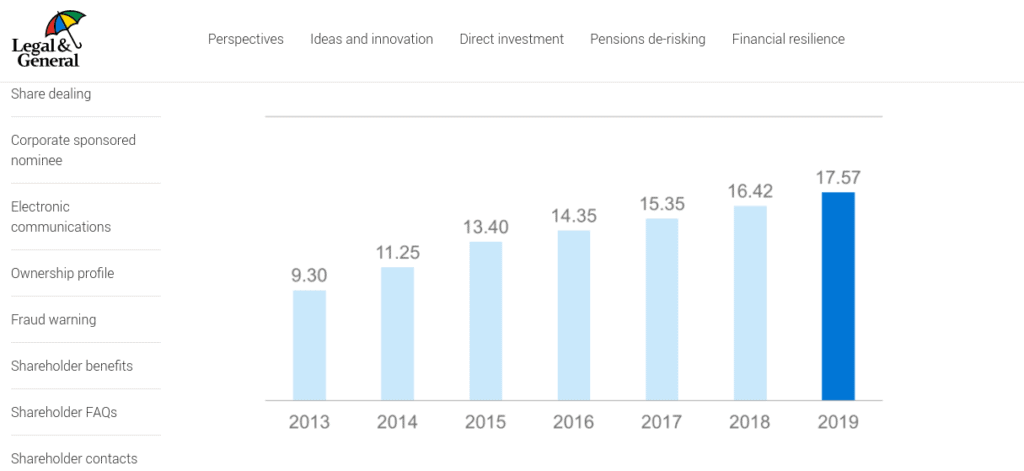

Legal and General has a good track record of paying dividends. In fact, the firm has increased the size of its dividend annually for the past seven years in a row. Back in 2013, it paid a yearly dividend of 9.30p. In 2019, this stood at 17.57p. This represents a 7-year increase of 88%.

Now, the good news for stockholders is that Legal and General is one of the few UK-based financial services companies to resist suspending its 2020 dividend payment – as per COV-19. However, it recently announced that it would be cutting its first-half payment to 4.93p per share. Before the pandemic came to fruition, it had initially planned to increase its dividend by 7%.

Should I Buy Legal and General Shares?

Once you have had a chance to digest the historical Legal and General share price action, you then need to assess what the future holds for the company. This is especially crucial during a time where much uncertainty lies ahead for the UK financial services arena.

With this in mind, below we discuss some of the most important factors surrounding an investment in Legal and General.

Invest at a Discounted Price

As noted just a moment ago, Legal and General shareholders saw the value of their holdings drop by over 54% between February and March 2020. On the flip side, those that entered the market when the stocks hit 52-week lows of 138p are now looking at gains of 66%.

But, the shares are still 40% shy of their pre-COV-19 levels, meaning that you stand the chance of buying the stocks at a discounted price.

6-Month Earnings Report 2020

Looking at its most recent earnings report, Legal and General reported a 10% rise in operating profits. Its key annuities division also saw a rapid rise year-on-year, growing by 12% to £585 million. Over in its asset management division, the firm saw an increase of 9.3%. This takes its total assets under management figure to just under £1.2 trillion.

In less favourable news, profits in the capital investment division dropped by £123 million. Moreover, operating profits in its insurance division declined by 34.4% to £88 million.

Solvency II Coverage Ratio

As insurance plays a major role in the wider business model of Legal and General, it is crucial that you have a brief understanding of how the Solvency II coverage ratio works. For those unaware, this is an EU directive that was created in 2009 to ensure that large-scale insurance providers have sufficient levels of capital.

The ratio ultimately ensures that there is a 99.5% probability that the insurance company in question will not run into financial ruin within the next year. While the minimum Solvency II coverage ratio stands at 85%, Legal and General amounts to 173%.

This is a 171% increase from its prior earnings report. In Layman’s terms, this means that Legal and General has an exceptionally strong balance sheet. This also means that it is well prepared for the uncertainties of a potential COV-19-inspired bear market.

Stable Dividend Payments

In the seven years prior to the COV-19 pandemic, Legal and General increased the size of its dividend payment annually. This is highly conducive if you are looking to build a portfolio of dividend stocks. In fact, the firm had planned to increase its dividend once again this year – with an initial hike of 7% announced.

However – and as we covered earlier, Legal and General was forced to cut its dividend as a result of weaker market conditions. The key point here is that unlike the vast majority of the UK financial services scene, Legal and General at the very least is still paying a dividend.

As and when more stable market conditions return, it is hoped that the firm will continue with its ever-growing dividend policy.

Legal General Shares Buy or Sell?

There is generally a good vibe surrounding Legal and General at present. Although the financial services company lost a substantial chunk of its valuation in Q1 – this was ultimately down to the fear and uncertainties of the pandemic. But, not only have the shares recovered 66% since their 2020 lows, but the firm is well-positioned to weather a bearish market cycle.

Crucially, its balance sheet is in tremendous shape, especially when you look at the size of its Solvency II coverage ratio. As such, the market is bullish on Legal General shares moving into Q3.

The Verdict?

In reading our guide from start to finish, you should now have a firm understanding of whether or not you think Legal and General represents a good investment.

If you do, we have illustrated just how straight forward the process is. You simply need to open an account with your chosen broker, deposit some funds, and then determine how many Legal and General shares you want to buy.

FAQs

What does Legal and General do?

Legal and General is a UK-based financial services firm that is also present overseas. It is behind a number of key divisions, including mortgages, investment management, and insurance.

What stock exchange are Legal and General shares listed on?

Legal and General shares are listed on the London Stock Exchange. It also forms part of the FTSE 100.

Do Legal and General shares pay dividends?

Legal and General not only has a good track of paying dividends, but consistently increasing the size of its payment, too. With that said, although the firm did not suspend its dividend policy in response to COV-19, it did need to reverse its plans to increase its payment by 7%.

What is the minimum number of Legal and General shares you can buy?

Minimum loit sizes will vary from broker to broker.

Can you short Legal and General shares?

You can, but you will need to use an online broker that allows you to trade CFDs.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up