Moneyfarm Review UK – Features & Fees Revealed

Moneyfarm is an online investment platform that allows you to invest via robo advisor technology. This means that investments will be made on your behalf – based on the amount of risk that you feel comfortable taking. In this Moneyfarm app review, that’s what we plan to find out.

We cover the ins and outs of what this robo advisor platform offers, where your money will be invested, whether it has low fees, what account minimums you need to meet, and what historical returns the Moneyfarm app has yielded.

-

-

What is Moneyfarm?

Moneyfarm is an online robo advisor investment platform and wealth management service that was first launched in Italy in 2011. The overarching concept is that you can invest in the financial markets without needing to do any of the legwork. This is because all investment decisions will be made by the underlying technology – otherwise referred to as a ‘robo advisor’.

This means that you won’t be required to spend countless hours researching stocks, nor do you need to be kept abreast of key market developments. Instead, you simply need to meet a minimum investment threshold and allow the Moneyfarm robo advisor to do the rest. Once you are set with a Moneyfarm account, new investors will then be asked to complete a questionnaire. This will centre around your financial goals and ultimately – what kind of level of risk you feel comfortable taking.

In total, there are 7 different portfolios that you might be assigned. At the lower end, low-risk portfolios will chase modest returns to minimize risk. At the other end of the spectrum, higher risk appetite portfolios will prioritize investor returns, taking higher risks along the way to achieve this goal.

Although we will cover fees in more detail later on, all Moneyfarm investors are required to meet an annual maintenance charge. Unless you are looking to inject more than £100,000, this will cost you 0.75% per year. In addition to this, there are also ETF fees that you need to pay – which will vary depending on the provider.

Moneyfarm Account Types

The Moneyfarm app offers several account types, which we have listed below.

General Investment Account

Most investors at Moneyfarm will open a general investment account. This is the account that you will need to open to take advantage of the robo advisior investment service.

Stocks & Shares ISA

If you’re looking to invest in the stock market through a Stocks & Shares ISA, this is something offered at Moneyfarm. You won’t be able to choose your own shares though, as you will have a pre-made, diversified portfolio built for you. The main benefit of this account type is, of course, that the tax-free ISA allowance of the first 20,000 invested in 2020/21 will be shielded from HMRC. Moneyfarm doesn’t offer a cash ISA savings account.

Pension Account

Moneyfarm also offers a SIPP pension account that might be suitable if you are looking to save for your golden years. The Moneyfarm pension account is tax-efficient and much like the Stocks and Shares ISA – your portfolio will be built for you.

Moneyfarm Available Investments

In a similar nature to other UK robo advisor platforms – Moneyfarm specializes exclusively in exchange-traded funds (ETFs). This is because ETF trading allows you to diversify into hundreds of assets via a single trade – subsequently offering a risk-averse way to access the markets. For example, an ETF backing the Dow Jones 30 Index would effectively mean that you own all 30 shares that make up the index.

We think that’s it really important that you understand where your money is going when you join a robo advisor investment platform, which is why we have decided to break down the intricacies of Moneyfarm portfolios in more detail.

Risk Rating

To ensure that the Moneyfarm app caters to all financial goals and investor profiles – it offers a risk rating system. In other words, it offers 7 portfolios – each of which has been assigned a risk rating.

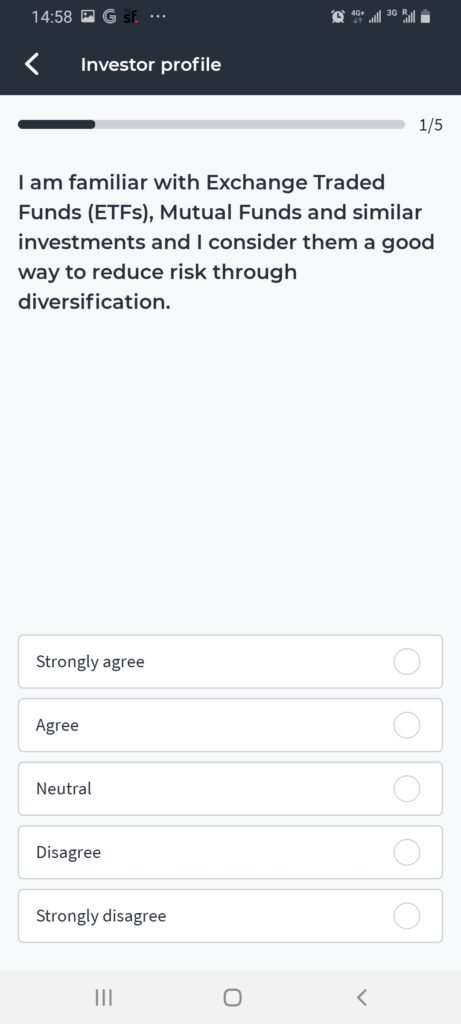

Before we get to that, it is important to note that a risk profile will be suggested to you when you go through the initial setup process. As noted, this is via a series of questions to assess what type of investor you are and how much risk you feel comfortable taking.

Nevertheless, the Moneyfarm risk matrix runs from 1 (lowest risk) to 7 (higher risk). It goes without saying that the less risk you take, the less you should expect in annual returns (as visa-versa).

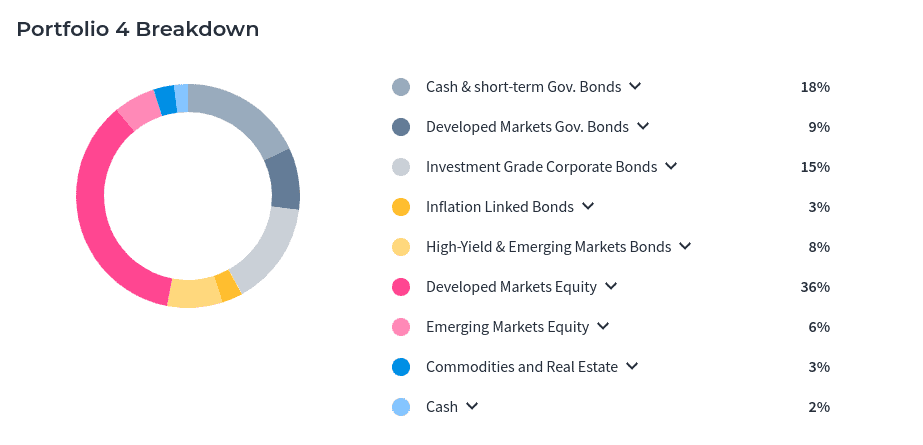

Asset Allocation

As noted above, all Moneyfarm investments are allocated to ETFs. With that said, there are heaps of different ETF instruments that could end up in your portfolio. The specific ETF will ultimately depend on your risk rating. Some ETFs might appear across several or even all Moneyfarm portfolios, albeit, with a different weighting.

Below we have listed some of the different ETF asset classes that you might come across when using the Moneyfarm app.

- Cash & short-term Gov. Bonds

- Developed Markets Gov. Bonds

- Investment Grade Corporate Bonds

- Inflation-Linked Bonds

- High-Yield & Emerging Markets Bonds

- Developed Markets Equity

- Emerging Markets Equity

- Commodities and Real Estate

- Cash

Weighting

As you might have guessed, the ETF asset classes listed above cover a variety of risk levels. For example, while low-risk portfolios at Moneyfarm will stick with developed market equities and government bonds, higher-risk portfolios will likely include emerging market bonds and shares, alongside commodities.

However, each portfolio will contain a variety of the above ETF asset classes, albeit, at different ‘weighting’ levels. Let’s take portfolio 2 and 6 as a prime example. While portfolio 2 has a whopping 38% in cash and short-term government bonds, portfolio 6 has just 2%. Similarly, while portfolio 6 has 57% in developed market equities, portfolio 2 has just 17%.

Ultimately, this is why robo advisor and wealth management platforms are really useful, insofar that your portfolio will be weighted to mirror your personal appetite for risk and volatility.

Moneyfarm Services

Moneyfarm focuses on passive investment portfolios via robo advisor technology. With that said, you can also elect to receive personalized, one-on-one financial advice through the provider. This will cost you a fee, albeit, Moneyfarm doesn’t actually publish what this is on its website. ,

By taking investment advice, you will get a completely bespoke portfolio built for you based on your personal circumstances. Moneyfarm will also help you consolidate your investments to ensure you are as tax-efficient as possible.

Moneyfarm Portfolio Management

Moneyfarm portfolios are 100% automated, meaning that you will never need to manage your investments manually. With that said, it is important to note that Moneyfarm does a lot more than just build your portfolio. On the contrary, the robo advisor will continuously rebalance and readjust your portfolio according to a predetermined investment strategy to ensure it stays on-par with your financial goals.

For example, if you have a low-risk portfolio and the markets are looking bearish, expect more exposure to cash and government bonds and less on equities.

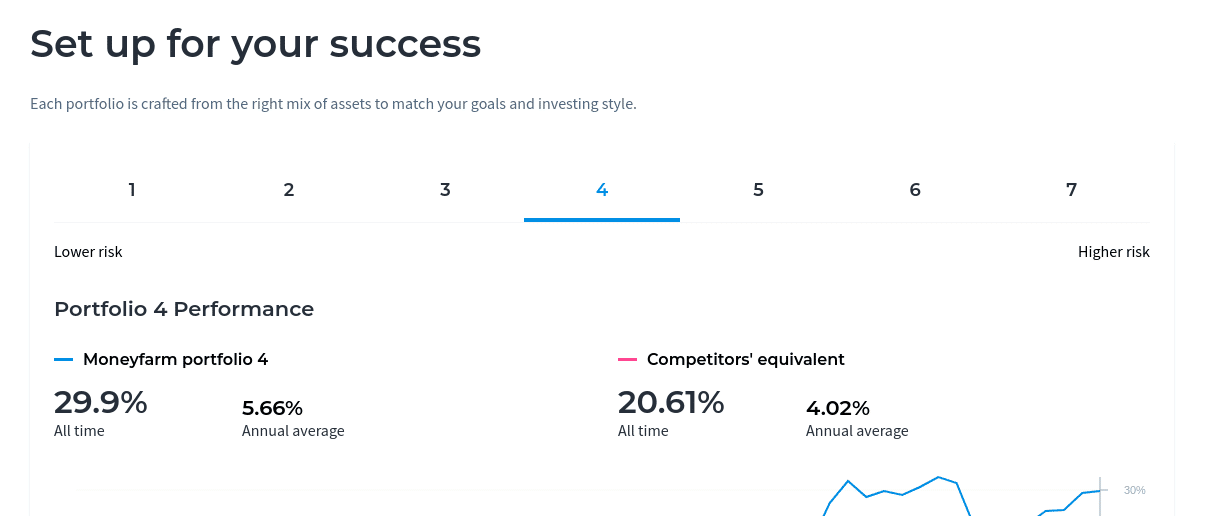

Moneyfarm Portfolio Performance

To give you an idea of how much you would have made by previously investing with Moneyfarm, check out some of the examples listed below.

Note: The figures below are all-time returns since Moneyfarm was launched. .

- Risk Rating 2: 16.59%

- Risk Rating 5: 34.86%

- Risk Rating 7: 50.12%

Moneyfarm Fees

Moneyfarm has a tiered fee structure in place, meaning that the more you invest, the less you pay.

- On the first £10,000, you will pay a fee of 0.75% per year

- Anything between £10,000 and £50,000 will cost 0.60%

- Anything between £50,000 and £100,0000 will cost 0.50%

- Anything above £100,000 is charged at 0.35%

To clarify, the above percentage rates are multiplied against the amount you invest at Moneyfarm. For example, if you were to invest £9,000 into your chosen Moneyfarm portfolio, you would pay £67.50 annually (£9,000 x 0.75%).

However, it is important to note that two other fees will come into play when using the Moneyfarm app.

Firstly, you will need to cover the cost of the ETF itself. This will average 0.20% at Moneyfarm but can be more or less. In addition to this, there is also a market spread fee that you need to pay.

This is the difference between the buy and sell price of the ETF in question which is an indirect fee passed on from Moneyfarm to you. As such, the average cost for investing £10,000 or less at Moneyfarm is 1.04%.

Apart from the above, there are no fees to deposit or withdraw funds, nor will you be charged an account set up fee of any sort.

Moneyfarm Minimum Investment

When it comes to account minimums, Moneyfarm might be out of reach for those of you looking to start off small. This is because you will need to meet a lump sum investment of £5,000 or more. The only way around this is to invest at least £1,500 upfront, followed by a monthly direct debit of £100 or more.

As we discuss in more detail shortly, not only are there other options available to UK investors that come with a lower account minimum, but also at a much lower cost, too.

Moneyfarm App User Experience

All in all, the Moneyfarm app offers a seamless experience. The app ranks very high when it comes to ease of use, and it’s very well designed so you shouldn’t have any problems navigating it.

When you first load the app up you need to go through a simple setup process. Not only does this include providing your personal information, but this is where you’ll need to answer some questions about your investing goals. Everything is based on multiple-choice so that the robo advisor algorithm can determine what type of investor you are.

Moneyfarm Features, Education & Resources

Moneyfarm is a bit thin on the ground when it comes to additional resources. There is a personal finance blog available to users of the app, which includes market insights and general all-round guidance. However, content is published once in a blue moon, so this won’t be enough to facilitate your research needs.

Ensuring that complete newbies are provided for, our Moneyfarm review found that the app offers several eBooks. Other than a pension calculator and glossary of key financial terms, there isn’t much else offered in the way of enhanced resources.

Moneyfarm Contact and Customer Service

Moneyfarm offers a variety of ways to contact the support team. First and foremost, assistance is available Monday – Thursday: 9 am – 7 pm and Friday: 9 am – 6 pm. Any inquiries over the weekend will need to wait until Monday morning.

You can access this via the app at any time during the above opening hours.

There is also a freephone telephone number, which you’ll find at 0800 433 4574. Alternatively, emails can be sent to [email protected]. We also like the fact that Moneyfarm has a social media presence on Twitter and Facebook.

Is the Moneyfarm App Safe?

The safety of your funds should always be the first thing that you assess before joining a new investment app provider. In the case of Moneyfarm, you should have no concerns at all.

Firstly, the firm is licensed by the Financial Conduct Authority (FCA), which is the UK’s financial watchdog. You are also covered by the Financial Services Compensation Scheme (FSCS).

This means that the first £85,000 that you have held at Moneyfarm would be covered by the government if the worst happened and the platform went bust. Crucially, Moneyfarm stores funds in segregated bank accounts. This ensures that it does not use your money for its own capital expenses.

Moneyfarm Review: Conclusion

While Moneyfarm is a useful app for newbies – as well as those that seek a passive income, the platform comes with several key flaws. At the forefront of this is the huge minimum investment required.

This stands at a lump sum of at least £5,000 or £1,500 plus a monthly commitment of £100 via direct debit. It is also regrettable that you have no control over your portfolio and that you will only be exposed to ETFs. Regarding the former, this means that there is no option to buy shares that you like the look of.

FAQs

What is Moneyfarm’s Assets Under Management?

It was reported in June 2020 that Moneyfarm has now surpassed the £1 billion in assets under management.

Is Moneyfarm protected by FSCS?

By investing your money at Moneyfarm, you are protected by the FSCS. This covers you up to the first £85,000 int he event of a platform collapse.

How does a Moneyfarm investment work?

Once you join the Moneyfarm platform, you will need to answer some questions about your financial goals. Based on your answers, Moneyfarm will suggest a risk rating (1-7). This risk rating will determine how your portfolio is built, and how it is rebalanced moving forward.

What is the Moneyfarm minimum deposit?

You have options in this respect. Firstly, Moneyfarm requires a minimum lump sum of £5,000. But, if you can’t meet this you can deposit from £1,500, alongside a monthly direct debit of at least £100.

What payment methods does Moneyfarm support?

In order to deposit funds at Moneyfarm, you will need to transfer money from your UK bank account. For recurring payments, you can sign a direct debit agreement.

What are some alternatives to Moneyfarm?

We think eToro is a possible alternative to Moneyfarm. Other popular robo advisor investment apps include Nutmeg, Moneybox and Wealthsimple.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Moneyfarm is an online

Moneyfarm is an online