Best Bitcoin Trading Platform UK – Cheapest Platform Revealed

Bitcoin trading platforms are a way to buy and sell Bitcoin. These trading platforms are usually an online marketplace where you can buy and sell Bitcoins using different currencies and they charge transaction fees for each completed trade and offer advanced tools such as price charts, volume graphs, order history etc – so you can get the best price possible when you trade Bitcoins. So If you want to invest in Bitcoin, you will need a trading platform that is safe and reliable. You also need to make sure that it offers the features you want, such as low fees or fast transfers.

If you’re based in the UK and looking for the best Bitcoin trading platform in UK – you have heaps of providers to choose from. While some focus on extremely low feeds and commissions, others are known for offering hundreds of Bitcoin-denominated pairs. To help clear the mist, this guide will review the best Bitcoin trading platforms.

We also explain what metrics you need to look out for when choosing a provider yourself and outline the steps required to join a UK Bitcoin trading platforms today.

Want to get started with the best Bitcoin trading platform right away? Here’s how in 4 quick steps:

- Step 1. Open an account with Coinbase: Head over to the Coinbase website and open an account.

- Step 2. Upload ID: Upload and verify your identity with a copy of your passport or driver’s license.

- Step 3. Deposit: Fund your trading account by making a deposit using credit or debit card, bank transfer, or e-wallet.

- Step 4. Trade Bitcoin: Search for BTC, click ‘Trade,’ and place your order. It’s as simple as that!

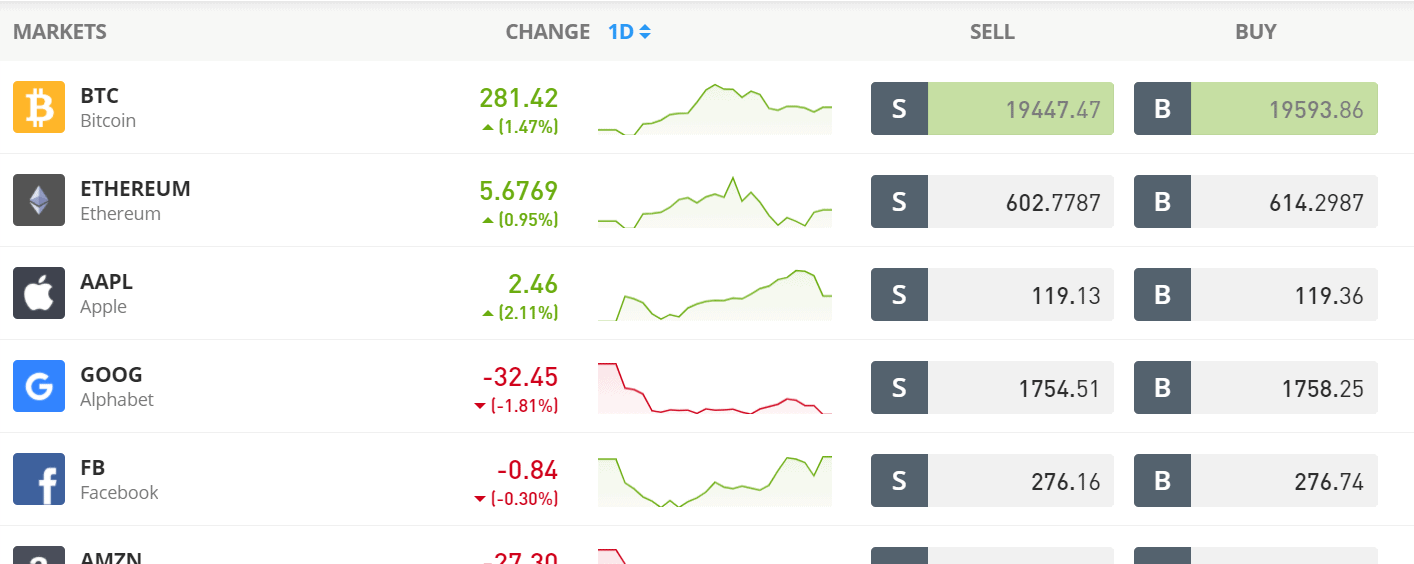

Best Bitcoin Trading Platforms UK with the Best Rates

Before we review the best bitcoin trading platforms in more detail here’s a quick look at the top trading platforms in the UK right now. You can compare the features and fees of the UK’s best bitcoin trading platforms, and you can even change the investment amount and cryptocurrency you’re investing in to see how much each platform charges. Did you know that you can buy Bitcoin, Ethereum, and XRP with the click of a button using a crypto app?

Best Bitcoin Trading Platforms UK Reviewed

By performing a quick Google search of ‘Best Bitcoin Trading Platform UK’ – you are going to be inundated with hundreds of potential results. This is because interest in the online cryptocurrency trading scene has sky-rocketed in recent years. As such, knowing which Bitcoin trading platform to join can be a daunting task.

To help you along the way, we have reviewed the best Bitcoin trading platforms in the UK market right now.

- Coinbase

- Crypto.com

- Huobi

- CoinCorner

- Binance

- Coinjar

- Luno

1. Coinbase – User-Friendly Bitcoin Trading Platform UK

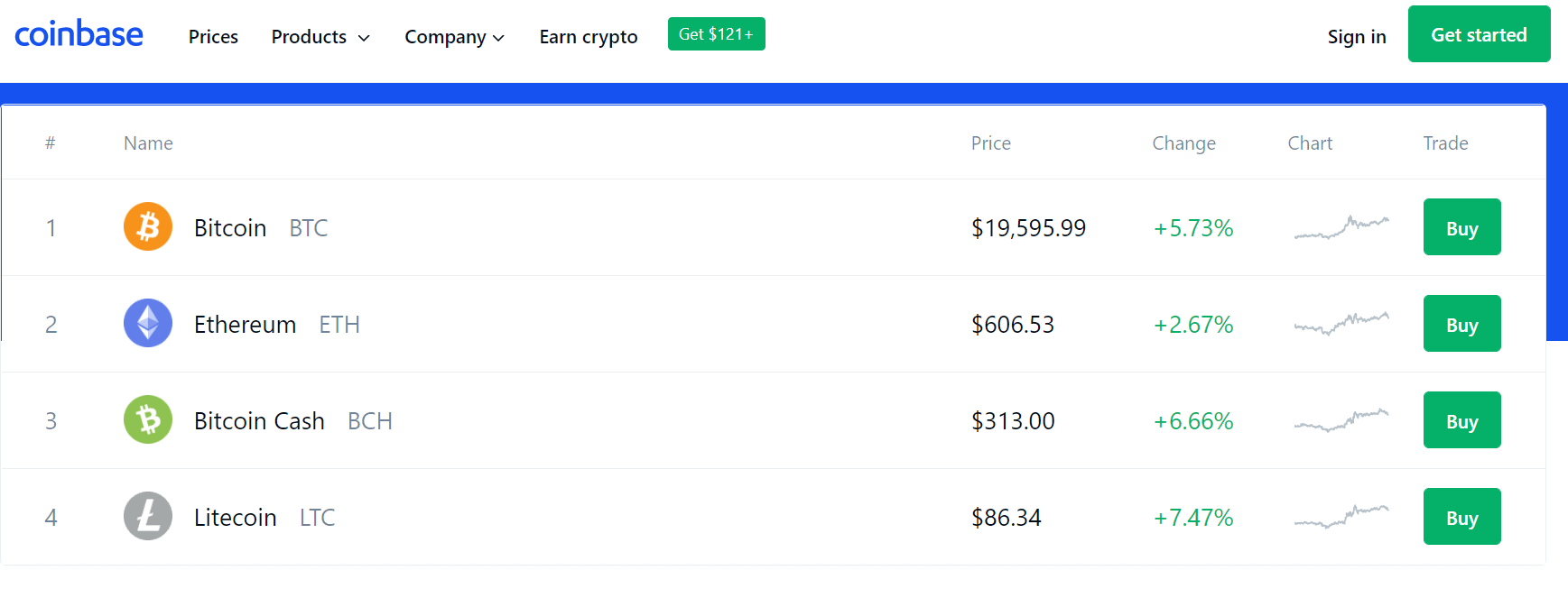

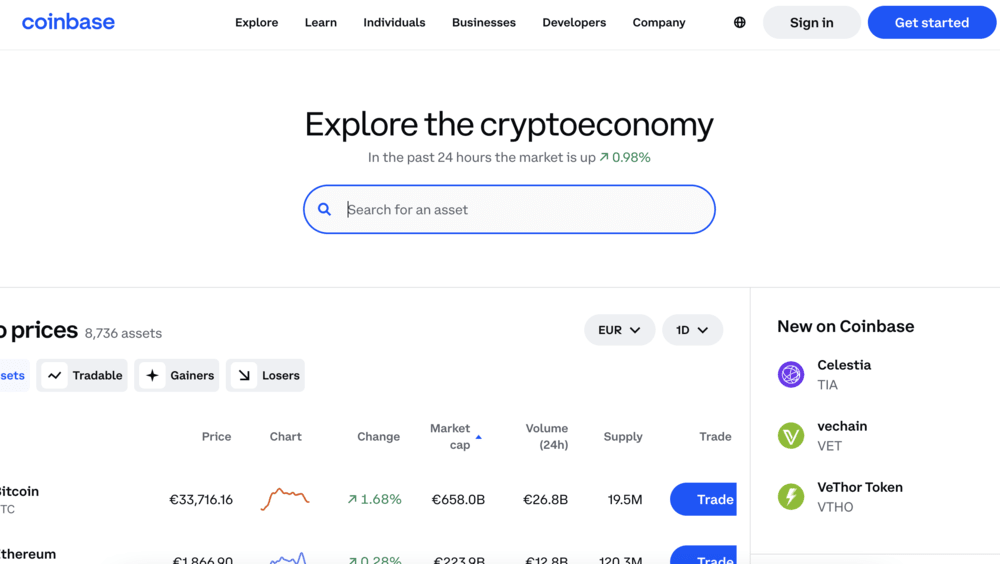

Coinbase is the largest cryptocurrency trading platform globally. Based in the US, the broker is home to over 35 million users across more than 100 nations. In the UK, this Bitcoin trading platform is licensed by the FCA.

As such, your money is safe when you trading cryptocurrencies at Coinbase. Now, Coinbase does come with both its pros and cons – like most platforms. Regarding the good points, Coinbase is a superuser-friendly way to trade Bitcoin. This is evident from the moment you visit its website – as everything is laid out so clearly and free from jargon.

Additionally, Coinbase is strong when it comes to security. It keeps 98% of client funds in cold storage – which makes it virtually immune to external hacks. It also offers security controls like two-factor authentication and the ability to lock your Bitcoin away for 48 hours after a withdrawal request is made.

In terms of tradable markets, Coinbase offers a good selection of cryptocurrencies that you can buy – including Bitcoin. It also offers a sister-platform that is dedicated to short-term trading. Coinbase Pro, as it is now branded, offers heaps of crypto pairs – many of which contain Bitcoin. Did you know you can invest in Polkadot on Coinbase easily with a couple of clicks?

Now for the negatives. The main drawback with Coinbase is that it charges huge fees. For example, you will need to pay 3.99% to deposit funds with your UK debit card. Bitcoin trading fees amount to 1.49% – which again, is expensive. You will pay even more if you trade with a small amount of money, as the variable fee turns into a flat rate. Ultimately, while Coinbase is great for newbies and top-notch security, this does come at a cost.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

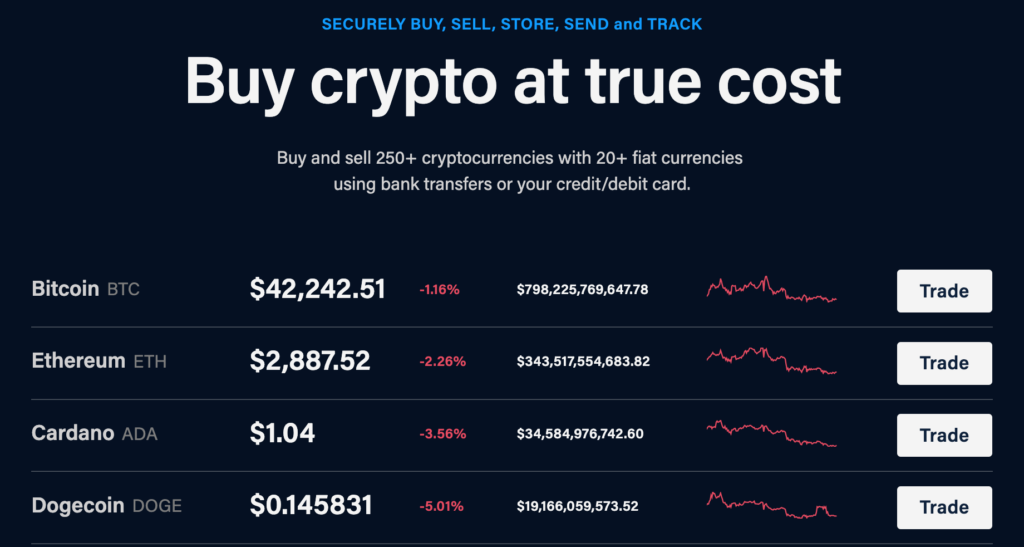

2. Crypto.com – Popular Bitcoin Trading Platform

Crypto.com is a renowned cryptocurrency exchange that provides a variety of services ranging from traditional trading and investing to crypto staking, NFTs, wallets, and much more. This mainstream cryptocurrency exchange offers access to over 250 cryptocurrencies, has low fees, and rewards crypto traders who hold Crypto.com coins (CRO).

Crypto.com uses a range of security protocols to protect account security, such as multi-factor authentication (MFA) and whitelisting. This popular crypto exchange also offers one of the best crypto savings accounts in 2022.

Crypto.com offers users up to 14.5 percent p.a. for stablecoins and 8.5 percent for BTC and ETH when it comes to crypto staking prizes. Furthermore, this prominent crypto staking exchange supports a large number of tokens and coins; 40+ to be exact. You may also download a crypto staking app to your mobile device to make your crypto work for you whenever and wherever you choose.

Crypto.com is more akin to a crypto bank than just a bitcoin exchange or broker. Indeed, the platform allows customers to buy cryptocurrency as well as sell it via P2P. You can also exchange them with other crypto enthusiasts via DeFi wallet-to-wallet payments. Moreover, you can use a prepaid Visa card to spend your cryptocurrency, making it an excellent alternative for crypto payments. You can be paid in crypto, put your money in an interest-earning account, and even acquire a crypto loan in certain nations.

For a complete breakdown of all the key features that this crypto exchange has to offer, read our exhaustive Crypto.com review now.

Crypto assets are highly volatile unregulated investment products. No UK or EU investor protection.

3. Huobi – Trusted Crypto Exchange with Wide Range of Supported Crypto Assets

Huobi Global provides an all-encompassing environment for cryptocurrency investors, allowing them to purchase, sell, stake, and borrow a wide range of cryptos. However, the exchange has yet to achieve regulatory compliance in large areas, and newcomers may find it hard to use the platform’s array of features.

Huobi is a popular cryptocurrency exchange that has established prominence in the Asian markets as offering some of the best Bitcoin alternatives. Launched in 2013, Huobi offers a wide range of crypto services from staking and loans to spot trading and more.

With a Huobi account you can access over 400 digital currencies with new cryptos being added all the time. As well as the web-based trading platform, you can download the Huobi mobile crypto app that’s compatible with Android and iOS mobile devices.

When it comes to fees, Huobi charges a fixed base fee of 0.2%. If you hold HT tokens (Huobi Tokens) you can also receive further discounts and rewards on trading fees.

In terms of account safety, Huobi keeps customer funds in multi-signature cold storage. Additionally, it has a 20,000 Bitcoin SRF (Security Reserve Fund) that was created to offer greater insurance for its clients.

Cryptoassets are highly volatile unregulated investment products. No UK or EU investor protection.

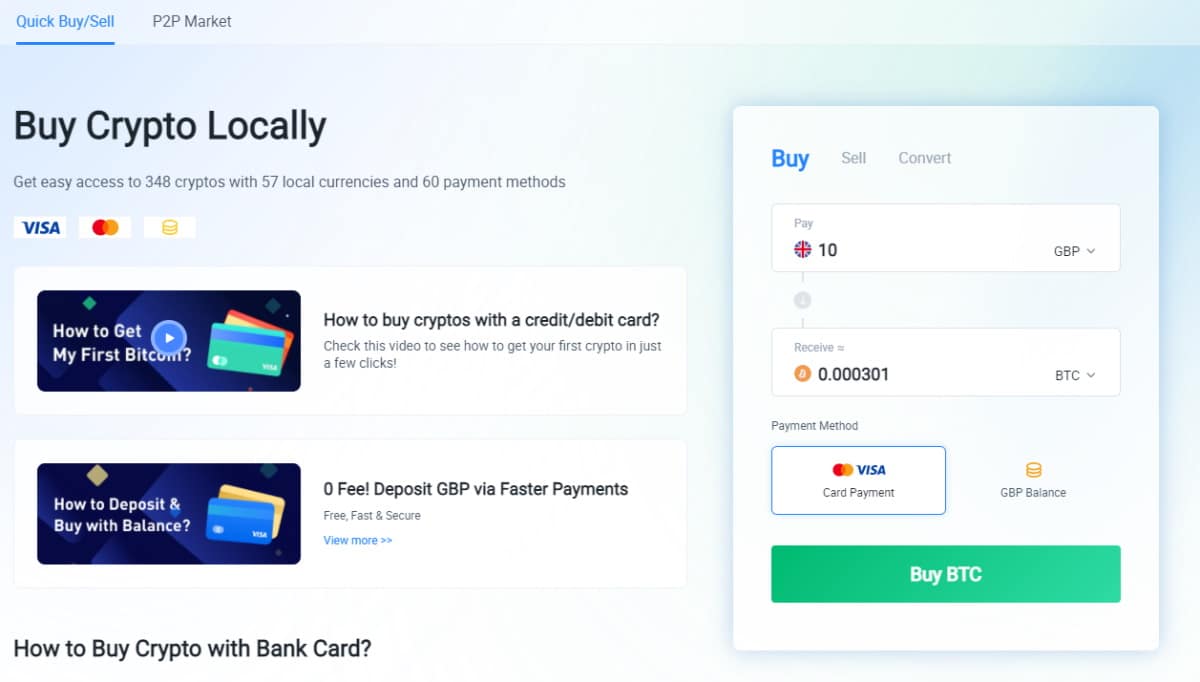

4. CoinCorner – Best Bitcoin Trading Platform UK for Fast Account Set-Up

CoinCorner is more of a Bitcoin broker than a conventional trading platform. That is to say, you will be using the website to purchase Bitcoin and employ a long-term ‘buy and hold’ strategy.

This means that you will be investing in the future value of Bitcoin, as opposed to trading it for short-term gains. This particular approach to Bitcoin trading is suitable for newbies – as you don’t need to have an understanding of technical or fundamental analysis.

On the contrary, you simply need to believe that Bitcoin will continue to grow in value over the course of time. So, CoinCorner makes the process easy by offering a fast sign up process that is accompanied by a range of instant payment methods.

This includes UK debit cards, credit cards, or popular e-wallet Neteller. Unfortunately, you can’t buy Bitcoin with Paypal or Skrill. Nevertheless, the fee structure at CoinCorner varies depending on the payment option. For example, a UK bank transfer costs £1, and the minimum funding amount is just £5. Debit/credit cards and Neteller, however, are expensive. This costs 2.5% and 3.2%, respectively.

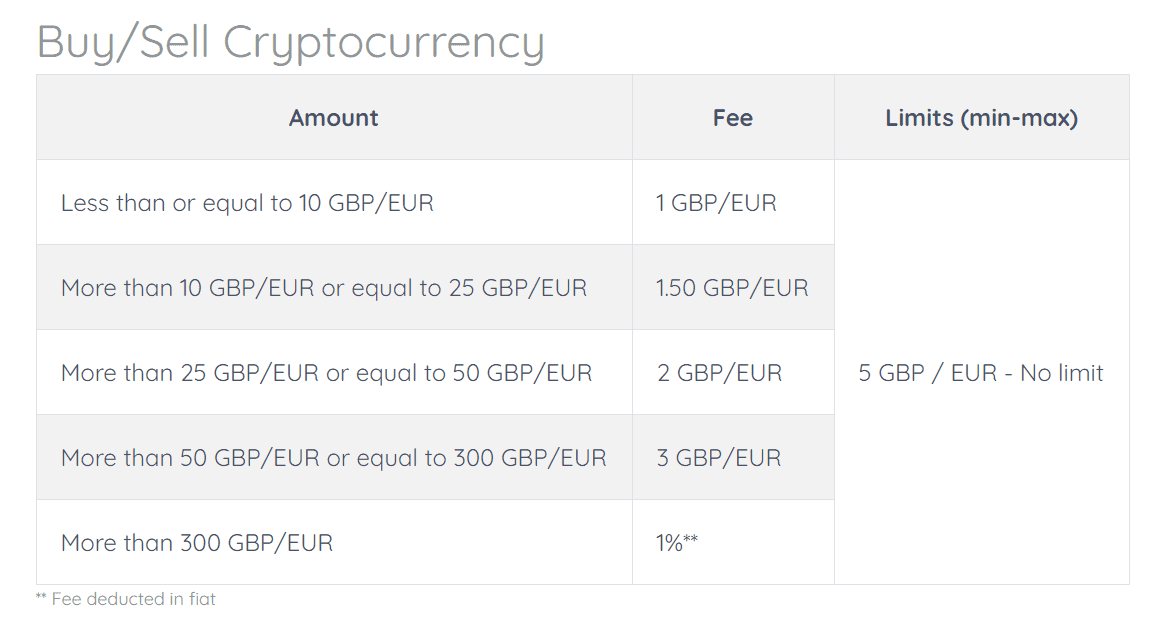

Withdrawals are competitive though, with debit/credit cards costing just £0.80. In terms of Bitcoin trading fees, this depends on the amount you buy. This starts at £1 from purchases of £10 or less. Anything above £300 will cost you 1%.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

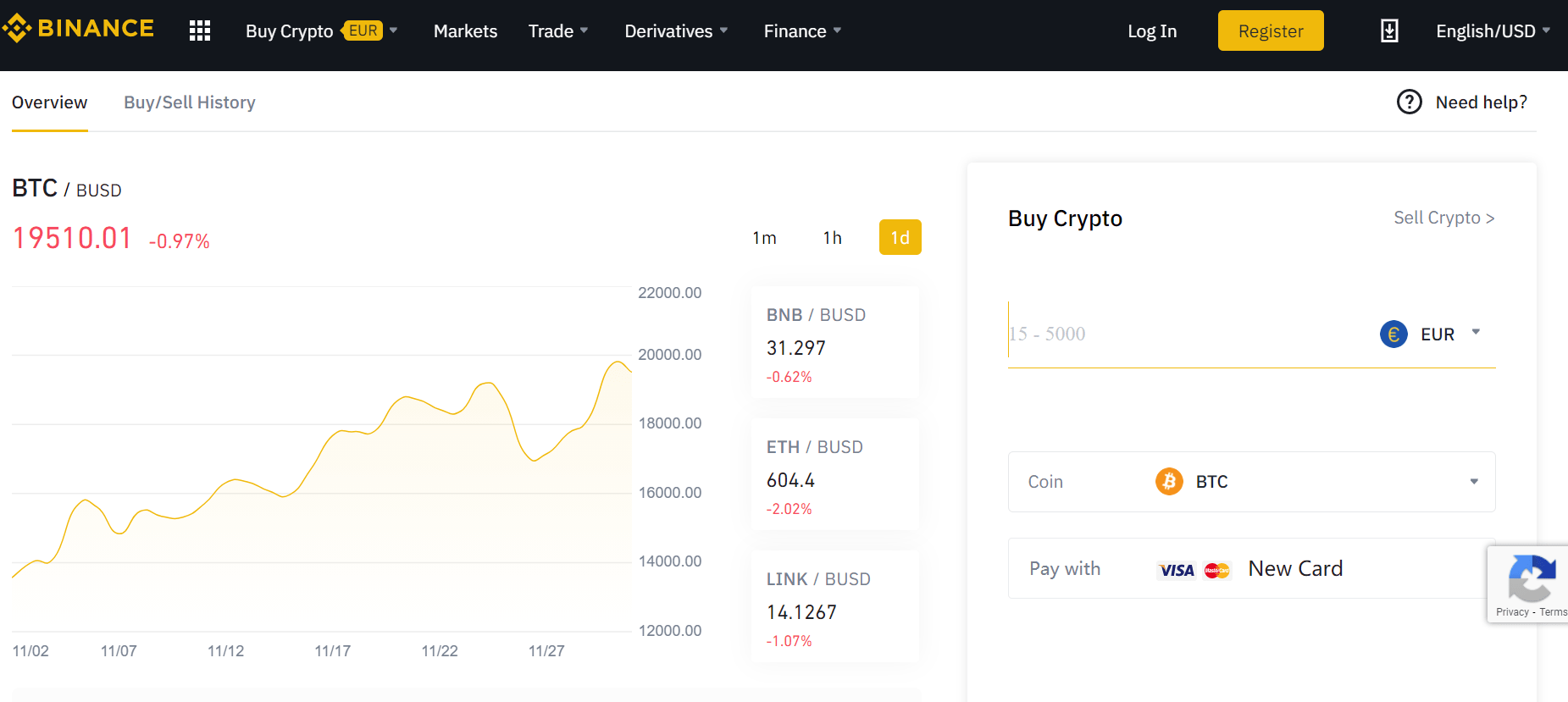

5. Binance – Bitcoin Trading Platform With Hundreds of Crypto Pairs

In terms of trading volume, Binance is by far the largest Bitcoin exchange platform. Although the provider was launched as recently as late 2017, it’s often facilitated over $2 billion worth of daily trading activity.

Binance is popular with Bitcoin traders in the UK for several reasons. First and foremost, you will pay a very small trading commission of just 0.1% on buy and sell orders. This means that a £1,000 trade would cost you just £1.

Even lower fees are on offer if you add some Binance Coins to your wallet. This is the native cryptocurrency backed by Binance, and it allows you to reduce your trading fees by a further 25%. Binance is also popular with UK traders because of the size of the trading platform.

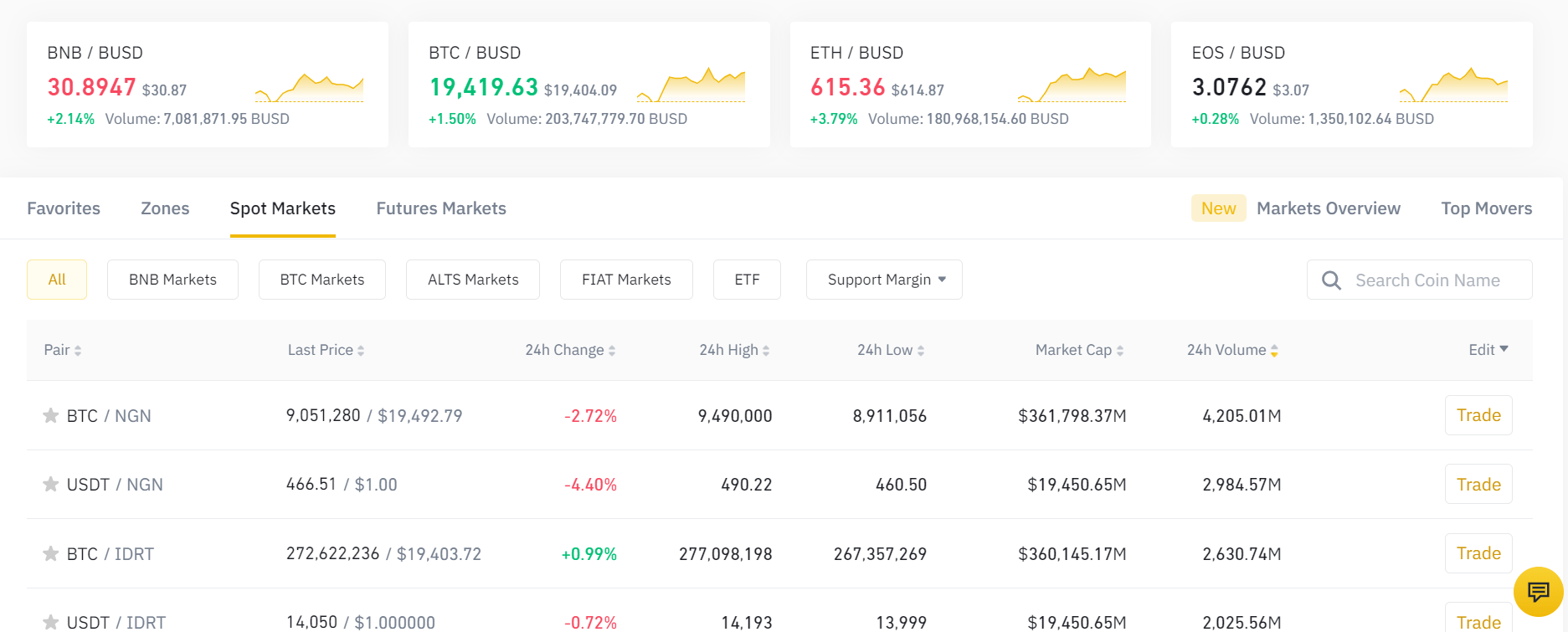

In fact, you will have access to hundreds of cryptocurrency pairs – most of which contain Bitcoin. Not only does this include major digital assets like Ethereum, LTC, EOS, and Bitcoin Cash – but heaps of ERC-20 tokens. These are small cryptocurrency projects that are a lot more volatile – which does appeal to some traders.

In terms of deposits, you have a couple of options. This top crypto exchange allows you to transfer your cryptocurrency from an external wallet and straight into your trading account. Or, if you don’t currently own any cryptocurrency, you can buy Bitcoin with a debit/credit card. This does, however, come with a 2% transaction fee.

When it comes to security, Binance is home to institutional-grade safeguards. This includes its SAFU offering, which is a reserve pot put in place to reimburse users in the event of an external hack. Finally, we should note that Binance is best suited for experienced traders – as you will have access to heaps of advanced analysis tools.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

6. Coinjar – Best Bitcoin Trading Platform UK for Long-Term Investing

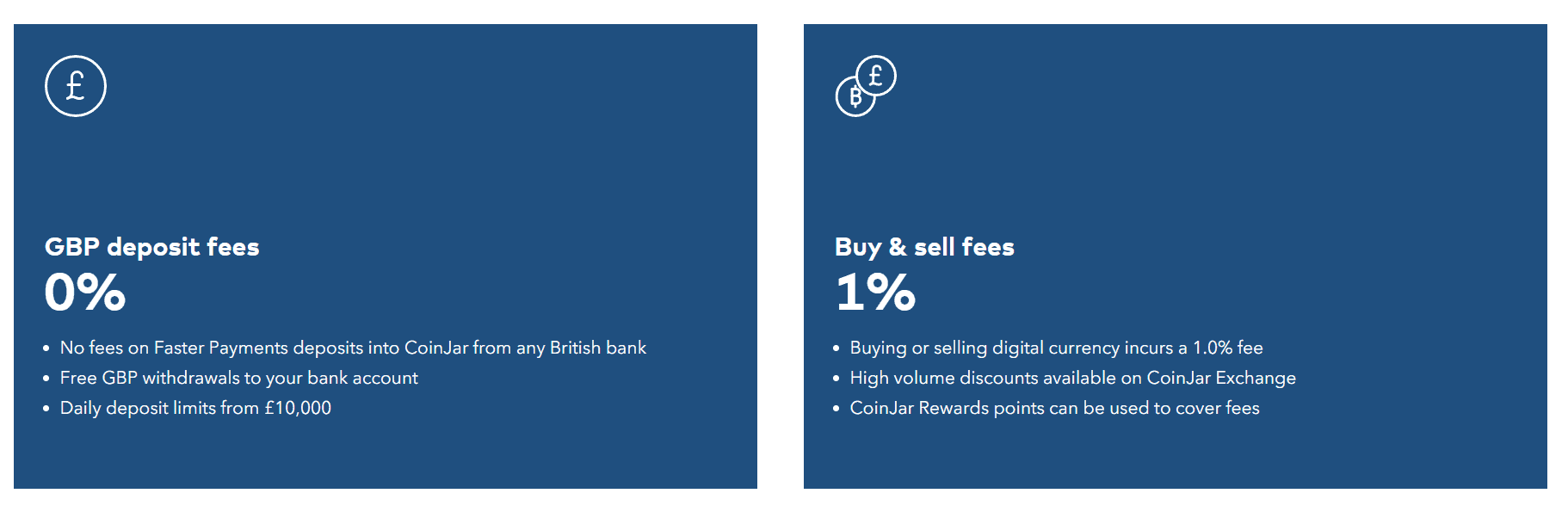

Coinjar is the largest Bitcoin trading platform in Australia. Its popularity Down Under has since seen the provider enter the UK market. As such, you can easily open an account in minutes and deposit funds with a UK bank account.

If opting for a Faster Payments bank transfer, there are no fees to deposit or withdraw funds. When it comes to transaction fees, buying and selling digital currencies at Coinjar will cost you 1%.

However, once you have obtained Bitcoin at the platform and you head over to the trading exchange, the fees are a lot more competitive. This starts at just 0.20% and goes down to 0.15% when you trade more than £6,000 in a 30-day period. The lowest fee possible is just 0.08%, albeit, you’ll need to trade over £6 million!

In terms of tradable markets, Coinjar offers over 49 digital currency pairs. On top of crypto-cross pairs, you can also trade Bitcoin against the British pound and Australian dollar. This is useful, as most Bitcoin trading platforms only offer a market against the US dollar.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

7. Luno – Best Bitcoin Trading App

Luno is an FCA-regulated cryptocurrency broker. The provider also offers trading services, with the platform coming jam-packed with technical indicators and other advanced tools. On the one hand, we really like the 0.1% commission fee charged by Luno.

This makes the platform one of the cheapest in the cryptocurrency trading scene. However, if you are planning to deposit funds with a UK debit card, you will need to pay a whopping 3.5%. When it comes to tradable cryptocurrencies, Luno only supports Bitcoin, Litecoin, Ethereum, and Ripple.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

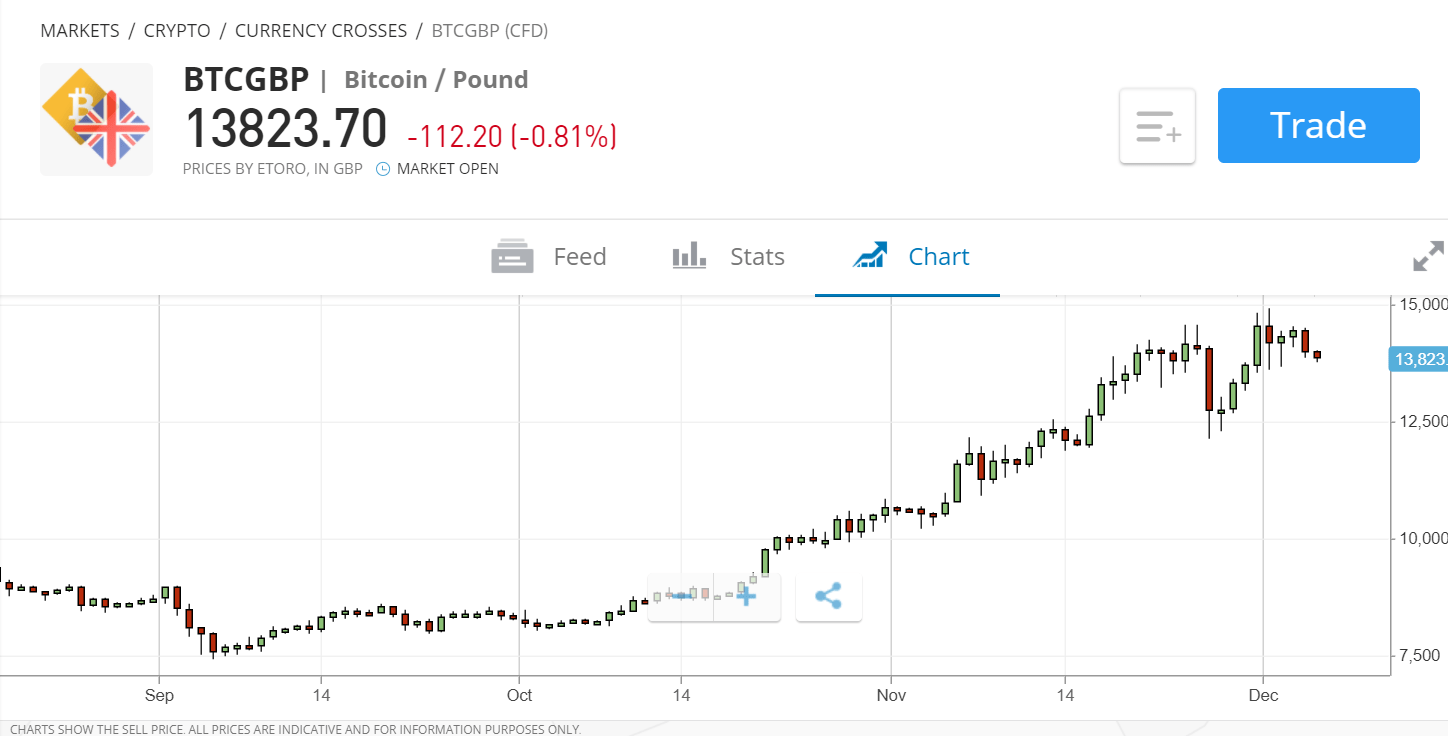

What is Bitcoin Trading UK?

The former simply means that you will be buying Bitcoin, keeping hold of the investment for several months or years, and then hopefully – cash out at a higher price.

This is no different from investing in traditional shares. However, Bitcoin trading is a completely different kettle of fish to investing in the long-term.

This is because you will be looking to actively buy and sell Bitcoin pairs – making small, but frequent profits from ever-changing prices.

Here’s a quick example of how Bitcoin trading works in practice:

- You deposit £500 into a Bitcoin trading platform

- You want to trade BTC/GBP – which is the exchange rate between Bitcoin and the British pound

- The pair is currently priced at £14,500

- You think that the exchange rate will rise, so you place a £500 buy order

- A few days later, BTC/GBP is worth £16,000 – representing an increase of 10.3%.

- You close your Bitocin trade – so on a stake of £500 you made £51.50

As you can see from the above, you kept your Bitcoin trading position open for just a few days. However, some traders will often keep a position open for a matter of hours or even minutes. This is known as day trading – and it involves placing several positions throughout the day.

It is also important for us to explain that there are two types of pairs that Bitcoin trading platforms UK offer. This covers crypto-to-fiat and crypto-cross pairs – which we explain in more detail below.

Alternatively, if you’re looking for the best crypto lending platform you might want to check out our Nexo review.

Crypto-to-Fiat Pairs

The term ‘fiat’ refers to a traditional currency like the British pound or US dollar. As such, by trading crypto-to-fiat pairs, you will be trading the exchange rate between Bitcoin and a mainstream currency. The vast majority of this space is dominated by Bitcoin and the US dollar – with the pair represented as BTC/USD.

This pair benefits from the largest amount of trading volume, tightest spreads, and huge amounts of liquidity. As such, this is the best Bitcoin trading pair to focus on. With that said, Bitcoin trading platforms like Coinbase offer several other crypto-to-fiat pairs that contain Bitcoin.

This includes the following:

- BTC/GBP – Bitcoin and the British pound

- BTC/JPY – Bitcoin and the Japanese yen

- BTC/AUD – Bitcoin and the Australian dollar

- BTC/EUR – Bitcoin and the Euro

As such, if you feel more comfortable trading Bitcoin against the pound, then Coinbase is going to be your best option.

Crypto-Cross Pairs

The best Bitcoin trading platforms UK also offer crypto-cross pairs. Put simply, this means that you will be trading Bitcoin against another cryptocurrency. Popular pairs include BTC/ETH (Ethereum), BTC/XRP (Ripple), and BTC/EOS (EOS).

Here’s an example of how a crypto-cross pair works at a Bitcoin trading platform UK.

- You want to trade BTC/ETH – which is the exchange rate between Bitcoin and Ethereum

- The pair is currently priced at 31.50

- You think that the exchange rate will rise, so you place a £200 buy order

- A few days later, BTC/ETH is worth 40.30 – representing an increase of 27.9%.

- You close your trade – so on a stake of £200 you made £55.80

As you can see from the above, there is no fiat currency involved in the pair. This can make it difficult to quantify your profits and losses. As a result, if you have little knowledge of how Bitcoin trading works, it’s best to stick with crypto-to-fiat pairs.

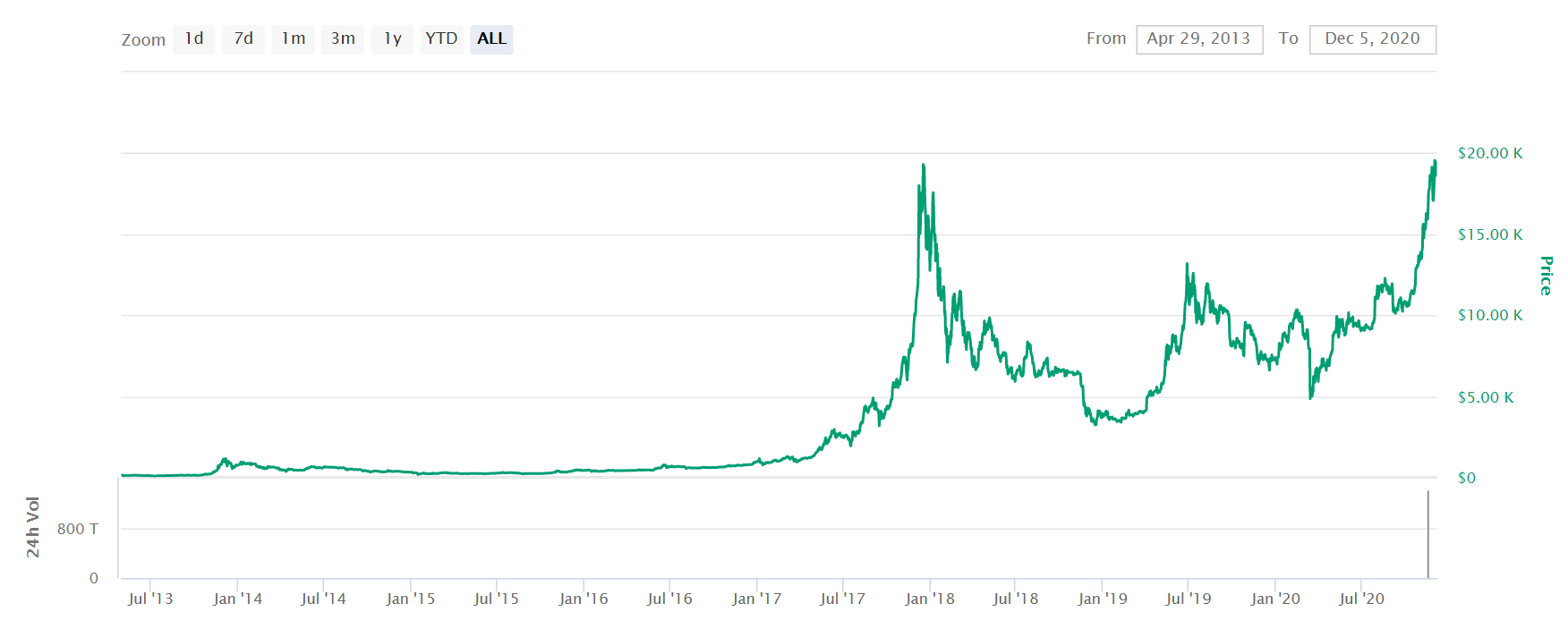

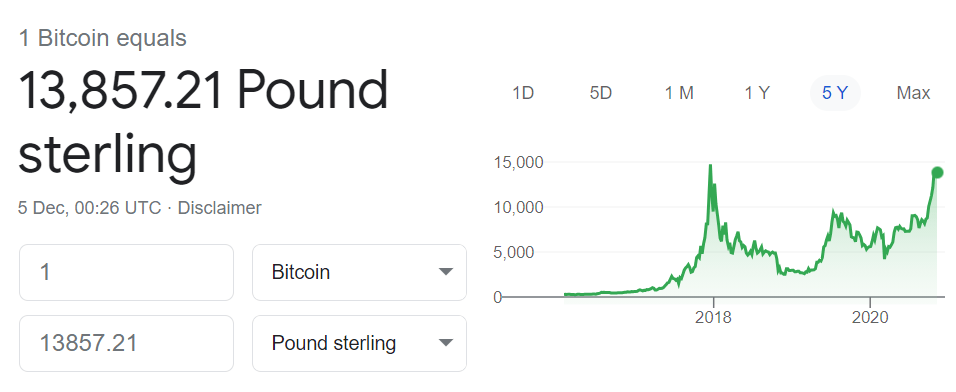

Bitcoin Trading Price

An additional learning curve that you need to get your head around is that of the Bitcoin trading price. After all, this digital currency does not exist in physical form, so a lot of newbie investors can’t quite comprehend how its value is derived.

The good news is that the value of Bitcoin works no different from any other asset class. That is to say, the Bitcoin trading price will go up and down on a second-by-second basis – fully dictated by market forces.

So, if the demand for Bitcoin is high, more people will buy it. In turn, the price of Bitcoin will naturally go up. And of course – the same is true when demand for Bitcoin is low – meaning its price will decline.

As you can now see, this is exactly the same as stock trading or forex trading. Crucially, Bitcoin is traded on public exchanges. This means that its value will rise and fall naturally – depending on where the money is.

Past performance is not an indication of future results

Automated Bitcoin Trading

Make no mistake about it – generating profits by buying and selling pairs at a Bitcoin trading platform UK is no easy feat. After all, you need to have a firm understanding of how technical analysis works – especially if you are trading in the short-term.

Learning how to read charts effectively will take months or even years to master. This shouldn’t dishearten you, however, as there are several ways you can bypass the need to perform in-depth chart analysis. This includes Bitcoin trading robots, third-party signals, and Copy Trading.

Let’s explore how each of these Bitcoin trading strategies works and whether or not they are suitable for your financial goals.

Bitcoin Trading Robots

Automated trading is big business in the traditional stock and forex trading scenes. In fact, the vast majority of hedge funds and financial institutions utilize advanced robots to buy and sell assets on their behalf. After all, automated robots have the capacity to perform at a significantly faster rate than the human brain.

This means the robot can operate 24/7 – subsequently scanning thousands of markets at any given time. Fortunately, these Bitcoin automated trading robots are not reserved just for large institutions. On the contrary, there are thousands of robot providers active in the space – some good, some bad, and some very ugly.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

As such, you need to perform lots of research on the robot provider before signing up. Nevertheless, in order to make use of a Bitcoin trading robot, you will need to use an online broker that compatible with MT4. This is a third-party trading platform that sits between you and your chosen Bitcoin trading platform.

The process is as follows:

- You perform research on an automated Bitcoin trading robot provider and decide to buy it

- You download the robot to your desktop computer via a software file

- You also also download third-party trading MT4 and log in with your brokerage credentials

- You install the previously downloaded Bitcoin trading robot software file into MT4

- You give the robot authority to trade on your behalf

Once you follow the above instructions, the automated Bitcoin trading robot will begin placing buy and sell for you. You will get to choose your preferred stakes and risk/reward targets – and you can switch off the robot at any given time.

If you’re looking for a simpler solution, you might consider a dedicated robo-trading platform like Bitcoin Trader. This service trades Bitcoin on your behalf, so you don’t need to know anything about the cryptocurrency market to turn a profit. If you want to lean more about Bitcoin Trader, check out our full Bitcoin Trader review UK.

Bitcoin Trading Signals

While Bitcoin robots do all of the bidding for you – some investors in the UK find the phenomenon somewhat uncomfortable.

This is because you will be allowing software to use your hard-earned trading capital. As such, if you’re interested in automated Bitcoin trading but want to retain control over your account balance – then you might want to consider signals.

Put simply, signals are trading suggestions sent out by a third-party. In most cases, this will be an experienced human trader that spots a profit-making opportunity. Then, the trader will tell you what orders to place to capitalize on their findings. This will usually come via Telegram, email, or SMS.

Below you will find an example of what a Bitcoin trading signal looks like:

- Pair: BTC/GBP

- Order: Buy

- Entry: £14,200

- Stop-Loss: £13,100

- Take-Profit: £15,900

As you can see from the above, the best Bitcoin trading signals will provide you with all the required orders need to not only access the trade – but to do so in a risk-averse manner. This is because you are provided with the required buy/sell entry price, as well as stop-loss and take-profit orders.

Margin Trading Bitcoin

Margin trading – otherwise referred to as leverage, allows you to trade with more money than you have in your account. In the UK, the amount of margin that you can trade with is dictated by ESMA. Although the UK has technically left the EU, these rules still remain in place.

This means that the most you can apply is 1:30 (major forex pairs), with other assets coming with lower limits. In order to access these markets, you need to use a CFD broker.

Now, up until January 2021, Bitcoin trading platforms UK could offer cryptocurrency CFDs with leverage of 1:2. This meant that a £100 stake would give you £200 in trading capital. However, the FCA has since announced that come the new year, crypto CFDs are no longer available to UK residents.

With that in mind, the only way that you will be able to engage with Bitcoin margin trading is to use an unregulated, offshore broker that offers crypto derivatives. It will come as no surprise to hear that we strongly suggest avoiding such platforms, as your capital is at risk. After all, if the broker collapses – it will likely take your funds with it.

Bitcoin Forex Trading

Bitcoin trading has a lot in common with forex trading – so much so that it’s sometimes referred to as Bitcoin forex trading. You can change pounds for Bitcoin with the best Bitcoin trading platform UK just like you would change pounds for dollars with a forex broker.

Bitcoin is typically traded in a currency pair with the US dollar. However, some Bitcoin trading platforms give you more flexibility. You can trade Bitcoin directly against the pound or the Euro, for example, or trade Bitcoin against another cryptocurrency like Ethereum.

Are Bitcoin Trading Platforms Legal in the UK?

Yes, Bitcoin trading platforms are legal in the UK as long as they adhere to regulatory guidelines. The best Bitcoin trading platforms in the UK are regulated by the Financial Conduct Authority (FCA) who monitor trading platforms to ensure that they operate safely.

One of the biggest reasons that people in the UK are wary about trading Bitcoin is the legal standing of cryptocurrencies in the UK. It is legal to use Bitcoin trading platforms including platforms that are not regulated by the FCA. However, if a Bitcoin trading platform causes harm to traders to financial markets, the FCA could take action and put a ban in place.

It is illegal to use a Bitcoin trading platform that has been banned in the UK. This is because platforms that are banned by the FCA could be harmful to consumers or markets. The best way to ensure that you are trading Bitcoin legally is to use a platform that is regulated by the Financial Conduct Authority

Benefits of Trading with the Best Bitcoin Trading Platform UK

There are many benefits – as well as risks, of using Bitcoin trading platforms to buy and sell crypto assets.

Let’s start with the benefits:

Innovative and Revolutionary Technology

The obvious starting point here is that Bitcoin – albeit, 12 years old, is still a new and exciting technology that is still well in its infancy. The underlying technology – the blockchain, can do things that we have never seen before.

For example:

- It allows people to send and receive Bitcoin without needing a third-party

- Transactions are not tied to the real identity of the sender or receiver

- It takes just 10 minutes for fund transfers to arrive – irrespective of location

- Transactions fees are super-low

In addition to the above, Bitcoin is decentralized. This means that the government or central bank can’t own or take control of it.

All in all, the above characteristics mean that by trading Bitcoin, you can enter the crypto market at a very early stage. This is no different from investing in top-rated internet stocks like Amazon back in the 1990s. But of course, there is no guarantee that you will make money by trading Bitcoin, so do bear this in mind.

Lots of Bitcoin Trading Markets

As we briefly covered earlier, the best UK Bitcoin trading platforms offer heaps of markets. This covers both crypto-to-fiat and crypto-cross pairs. This ensures that you can take full advantage of short-term price movements.

For example, you might think that Bitcoin is undervalued against the British pound – and place a trade accordingly.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

On another occasion, you might think that Bitcoin is underpriced against Ethereum. Whatever your prediction, Bitcoin trading platforms offer heaps of pairs and markets that you can access at the click of a button.

24/7 Trading

When you trade traditional assets like stocks and shares, you can only do so during standard market hours. For example, the London Stock Exchange operates between 8 am and 4 pm, Monday to Friday. As such, anything trades outside these hours must wait until the market reopens.

However, Bitcoin trading platforms UK operate 24 hours per day, 7 days per week. Sure, you might not have a requirement to buy and sell Bitcoin during the early hours of Sunday morning.

But, knowing that the markets never close is a handy safeguard to have. After all, you might want to cash out your position instantly and not want to wait until Monday morning to be able to do so.

Huge Trading Volumes

Back in the early days of Bitcoin trading, volume was minute. This went from a few hundred dollars a day, to thousands, and eventually millions.

However, fast forward to 2022, and Bitcoin trading platforms collectively see billions of pounds worth of activity each and every day.

In fact, in the 24 hours prior to writing this guide, there has been more than $31 billion worth of activity on BTC/USD alone. Across the entire cryptocurrency trading industry, this figure stands at over $138 billion in the past 24 hours.

Low Barrier to Entry

The best Bitcoin trading platforms UK allow you to get started with ease. It typically takes just minutes to open an account, and brokers like Coinbase allow you to instantly deposit funds with a UK debit/credit card or e-wallet. Best of all, you can trade Bitcoin with small amounts.

Go Long or Short

When you trade Bitcoin pairs like BTC/USD, this allows you to go long or short. This means that you can speculate on the price of Bitcoin rising, as well as falling. However, there is a slight caveat to this benefit.

As we noted earlier, the FCA introduced new regulations that mean that from January 2021, UK residents can no longer trade crypto CFD products. This was the go-to avenue to short-sell cryptocurrencies like Bitcoin.

The good news is that you can still short-sell Bitcoin if this is something you want to achieve. In order to do this, you will need to trade a crypto-to-crypto pair like BTC/USDT.

This means that you will be trading Bitcoin against Tether – which is pegged to the US dollar. As such, this works in the same way as trading BTC/USD via CFDs.

Bitcoin Trading Risks

Now that we have covered the benefits, we should discuss the risks of Bitcoin trading.

Risk of Loss

It goes without saying that any asset class can lose you money when trading it online. This is no different from trading Bitcoin. As such, you need to understand the financial risks involved. As we cover shortly, you can mitigate these risks by deploying a sensible risk management strategy.

High Volatility

Bitcoin is a new and often volatile digital currency – meaning that you stand the chance of losing more than you had hoped. This is because the cryptocurrency can move by more than 10% in a single day of trading. This is much more likely to happen than a blue-chip stock – so do bear this in mind.

Wider Spreads

When you trade established, stable stocks – you will find that the spreads on offer are super competitive. However, as Bitcoin trading platforms experience high levels of volatility throughout the day, this often results in wider spreads.

For those unaware, this is the difference between the buy and sell price of Bitcoin. The wider the spread, the more you indirectly pay in fees. For example, at Coinbase, while the spreads on major stocks average 0.2% to 0.25%, with Bitcoin it is usually 0.75%.

Understand Crypto Wallets

Depending on which Bitcoin trading platform you sign up with, you might need to have an understanding of how crypto wallets work.

This is because cryptocurrencies like Bitcoin are stored in a digital wallet on your desktop or mobile device. This means that you need to have an understanding of private keys, public addresses, and backup phrases.

Fortunately, if you use a regulated broker like Coinbase, you won’t need to worry about knowing the ins and outs of crypto wallets. This is because Coinbase will safeguard your digital coins in their own wallet.

Bitcoin Trading Strategies

Trading Bitcoin and expecting to make a profit from day one is wishful thinking. After all, you need to understand what drives the price of Bitcoin and thus – how to capitalize from this.

To help you along the way, below we have listed some of the most utilized Bitcoin trading strategies.

Buy and Hold

If you’re looking to trade Bitcoin as a complete novice, then it might be best to stick with a simple buy and hold strategy. This entails buying Bitcoin and then holding on to the investment long-term. This might be for several months or even years.

The reason that this strategy is useful for newbies is that you do not need to worry about short-term volatility. In turn, this also means that you don’t need to have a grasp of technical analysis – which is the art of reading charts.

Swing Trading

If you’re prepared to learn the ins and outs of technical and fundamental analysis, then you might want to consider swing trading. This is a short-term approach to Bitcoin trading, as you will be looking to stay with wider trends. For example, if Bitcoin is on a prolonged downward trend, then you will want to short-sell the digital currency.

Skilled swing traders will look to keep this sell position open for as long as the Bitcoin trend is bearish. When it appears the trend is coming to an end, the swing trader will exit the position. Then, if and when a new upward trend kicks in, the swing trader will once again capitalize. Only this time, with a buy order.

Day Trading

Day trading is the process of buying and selling Bitcoin pairs throughout the day. In fact, as most positions remain open for just minutes or hours, rarely do day trading keep an order open overnight.

As you can imagine, keeping hold of a position for such a small amount of time will result in minute profit margins. However, it is important to remember that day traders will usually place heaps of trades every day – so these small profits can quickly add up.

Take note, day traders rely almost exclusively on technical indicators. As such, if you like the sound of day trading Bitcoin, you will need to understand how to read charts and perform in-depth analysis.

Is Bitcoin Trading Safe?

With that being said, Bitcoin trading can be safe if you follow a crucial rule – only use regulated platforms

As such, by using regulated Bitcoin trading platforms UK, you can ensure that you are able to buy and sell cryptocurrencies safely. On the other hand, there are hundreds of cryptocurrency exchanges in the space that still operate without a license, so be extra careful when picking a platform that we haven’t discussed on this page.

Risk Management

Irrespective of which of the above Bitcoin trading strategies you decide to deploy, it is crucial that you have a risk management plan in place.

As the name suggests, this will ensure that you are able to trade Bitcoin in a risk-averse manner. In its most basic form, you can achieve this goal by ensuring that you always set up stop-loss and take-profit orders on each trade.

- Stop Loss Orders: This is an order that allows you to limit your potential losses. For example, you might decide that you do not want to risk more than 5% of your trading capital. As such, you simply need to place a stop-loss order 5% above or below your entry price – depending on whether you are long or short.

- Take Profit Orders: This order type allows you to set a clear profit target before you enter the trade. For example, if you place a take-profit order at 10%, the Bitcoin trading platform UK will close the position if this target is met. This also ensures that you don’t need to spend hours at your computer waiting to close the trade manually!

Crucially, these orders, although not compulsory, should always be added to your trade.

How to Get Started on the Best Bitcoin Trading Platform UK – Coinbase

If you’ve made it through our guide on the Best Vitcoin Trading Platform UK all of the way through, then you should now be ready to start buying and selling crypto pairs.

If so, we are now going to walk you through the process of getting set up with Coinbase.

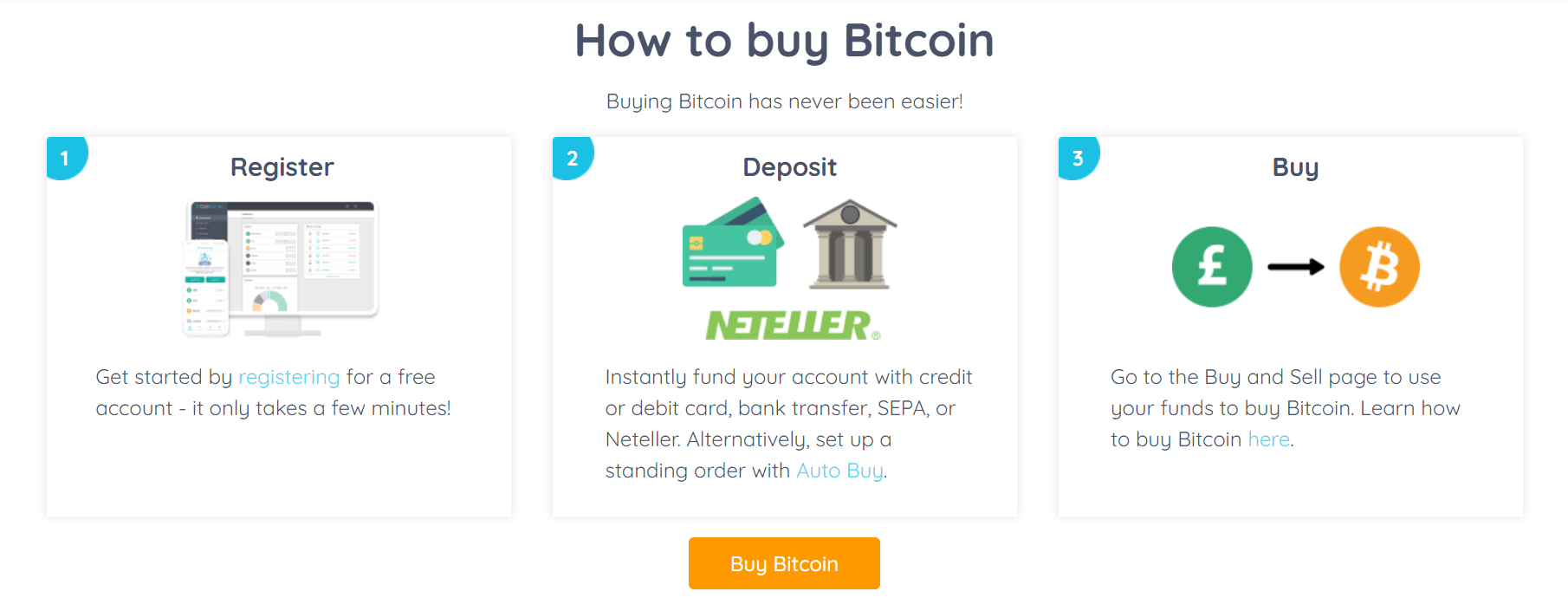

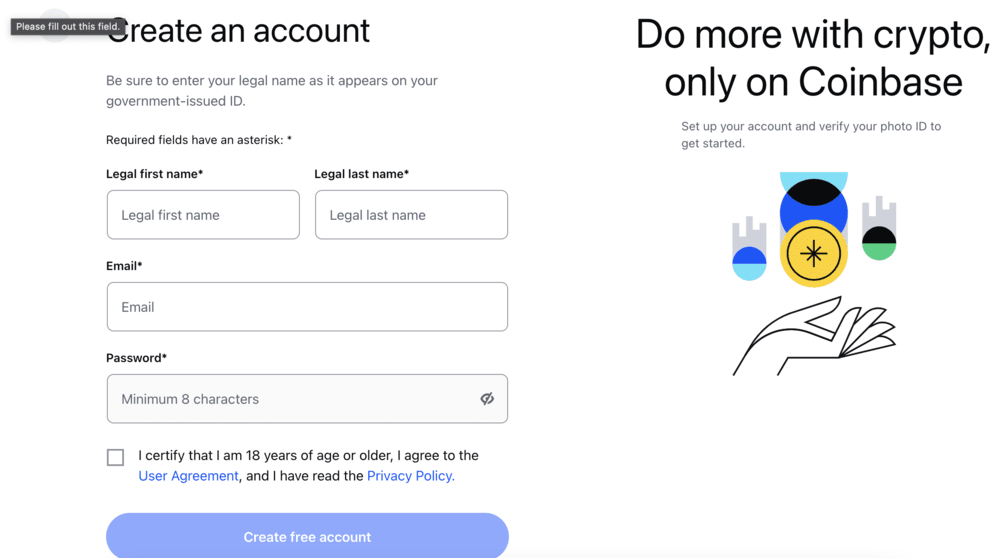

Step 1: Register With Coinbase

The first step is to open an account with Coinbase by submitting basic information.

This will require name and email for the initial setup.

Step 2: Verify KYC Data

As part of the standard KYC regulations, you’ll need to upload copies of your passport and a recent bank statement as proof of ID and address.

This is to help prevent identity theft.

Step 3: Deposit Funds Into Account

The next step involves funding your Coinbase account. You can deposit funds using a variety of payment methods.

There are no deposit fees to pay.

Step 4: Search And Buy BTC

The final step is to search for and buy the BTC coin. The easiest way is to type it into the search bar.

You will be taken to an order page to decide how much BTC you want to buy.

Click on ‘Open Trade’ to have it sent to your wallet.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Coinbase – Best Bitcoin Trading Platform UK

There are hundreds of Bitcoin trading platforms UK, so knowing which provider to trade with can be a time-consuming process. After all, you need to check that the platform is regulated, that it offers your preferred payment method, and that it allows you to trade in a cost-effective manner.

Taking all of this into account, our in-depth research process concluded that Coinbase is by far the best Bitcoin trading platform UK. It is very secure and provides a wide range of features.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.