Best Vanguard Funds UK to Watch

Index funds, ETFs, and mutual funds are hugely popular with UK investors that seek a passive form of income. After all, once you make an initial investment with your chosen provider, the fund manager will decide which assets to buy and sell.

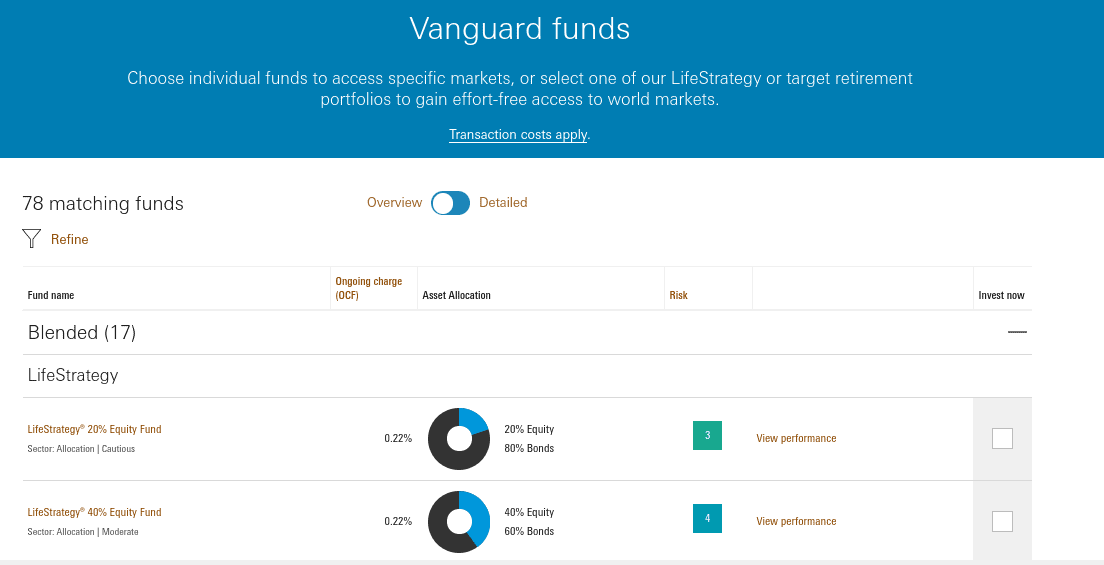

Vanguard is a market leader in this particular space, with more than 78 funds on offer on its UK website. You will have access to even more Vanguard funds when investing through an online broker.

In this guide, we’ll run you through some UK Vanguard funds of 2022. We cover a variety of options – including but not limited to retirement funds, index funds, bond funds, life strategy, and mutual funds.

Vanguard Funds at a glance

- Vanguard has made a reputation as a leading provider of index mutual funds and ETFs.

- Index funds are a popular passive investment model that mimics, as opposed to outperform, the performance of a benchmark index such as the FTSE 100.

- Vanguard typically adopts a sampling strategy to build its index funds helping to maintain low costs.

Popular Vanguard Funds UK List

- LifeStrategy 40% Equity Fund

- FTSE 100 UCITS ETF

- S&P 500 UCITS ETF

- Global Emerging Markets Fund

- Global Short-Term Bond Index

- Active UK Equity Fund

Although Vanguard funds allow you to invest in a passive manner, you still need to do some homework. This is because there are dozens of funds to choose from, each of which will appeal to a specific type of investor.

For example, while some funds offer a split between UK stocks and bonds, others will focus on international marketplaces. You then have long-term UK Vanguard funds that are to aimed to those that want to build a retirement pot.

Vanguard Index Funds

If you are looking to track a particular stock markets index – such as the FTSE 100 or NASDAQ 100, then Vanguard offers a variety of options. This covers indexes that track both large and small-cap companies, both domestically and internationally.

The most popular Vanguard index funds of the year are listed below:

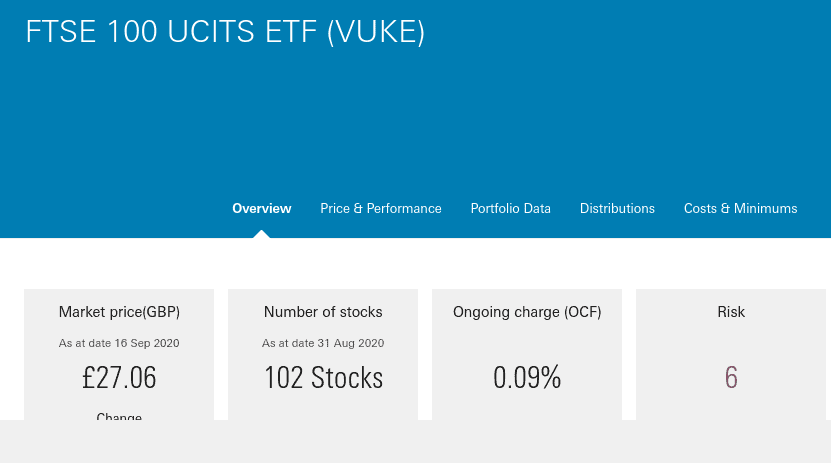

FTSE 100 UCITS ETF

If you want to invest in the wider UK stock markets, then you’ll want to focus on the FTSE 100. After all, the index in question tracks the 100 largest companies listed on the London Stock Exchange. This means that your portfolio will be well-diversified across dozens of sectors.

This Vanguard fund won’t, however, look to outperform the FTSE 100. Instead, it is tasked with tracking the movement of the index like-for-like.

Breaking the fund down further, Vanguard has a weighting ratio that is pretty much identical to that of the actual FTSE. For example, the fund has 7.17% in AstraZeneca, 3.39% in Rio Tinto, and 2.97% in Royal Dutch Shell. If and when a company moves out of the FTSE 100, Vanguard will proceed to offload its holding in the firm.

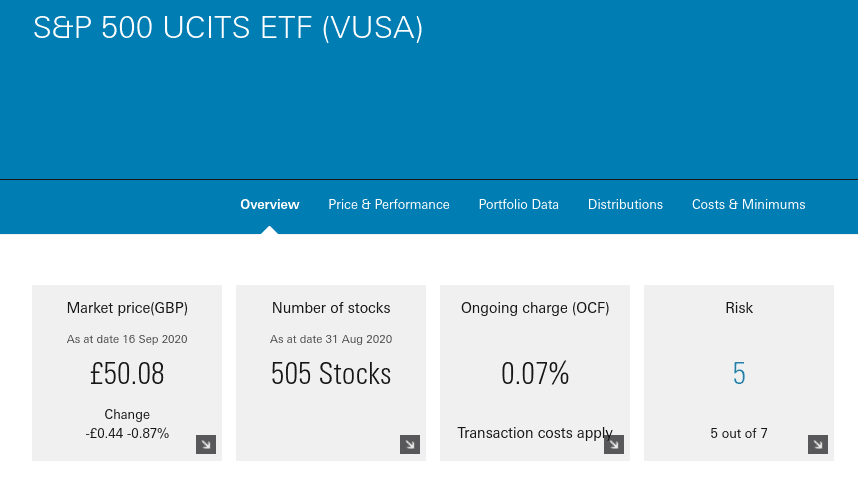

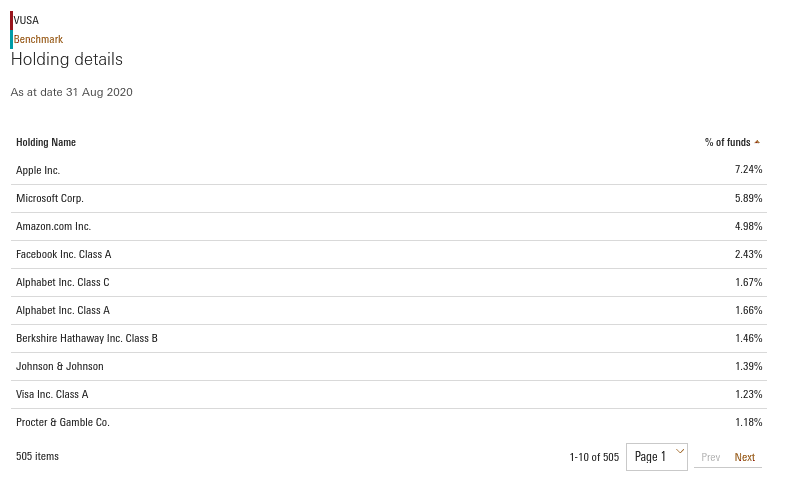

S&P 500 UCITS ETF

If you want to invest in US companies – then the index fund on offer is that of the S&P 500. This index contains 500 large-cap firms that are listed on either the New York Stock Exchange or NASDAQ. In the 9+ decades that the S&P 500 has been in operation, it has returned average annualized gains in excess of 10%.

Much like the FTSE 100, this Vanguard index fund weights its portfolio based on market capitalisation. That is to say, the more a constituent is worth on the markets, the more it will contribute to the index. For example, Apple and Microsoft each contribute 7.24% and 5.89%.

Then you have the likes of Amazon, Facebook, and Alphabet (Google), who each contribute 4.98%, 2.43%, and 1.67%. Outside of the major tech players, you’ll also find well-known firms like Starbucks, Boeing, Wells Fargo, and BlackRock. When it comes to fees, this Vanguard fund will cost you just 0.07% when going direct. The same account minimums of £500/£100 apply.

Vanguard Lifestrategy Funds

Vanguard offers a variety of Lifestrategy strategy funds to suit various risk appetites. Each fund will contain a mixture of bonds and/or equities. Vanguard will not personally select individual assets. Instead, each fund contains a variety of Vanguard indexes.

Your options include:

- 20% Equity, 80% Bonds

- 40% Equity, 60% Bonds

- 60% Bonds, 40% Equity

- 80% Equity, 20% Bonds

- 100% Equity

We find that the most appealing Vanguard Lifestrategy funds are as follows:

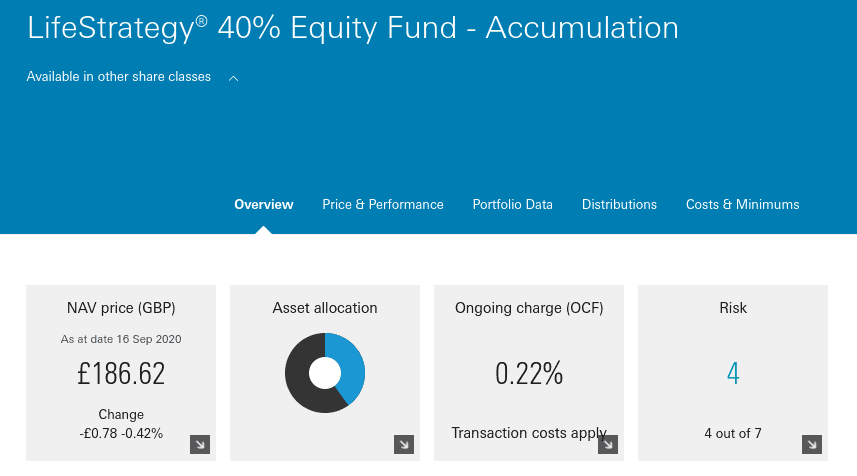

LifeStrategy 40% Equity Fund

This particular Vanguard Lifestrategy fund will allocate 40% of its capital on equities, and the balance on bonds. One of the most appealing aspects of this fund is that Vanguard does not pick and choose which equities and bonds to invest in. On the contrary, the portfolio is made up entirely of Vanguard funds.

Although the portfolio is reasonably well-diversified, two index funds, in particular, contribute almost 40%. This includes the Vanguard FTSE Developed World Equity Index and the Vanguard Global Bond Index Fund. Regarding the former, this is an equity-focused index that contains over 480 stocks.

The Lifestrategy 40% Equity Fund will also invest in indexes that track the FTSE All-Share, US Equity Index, and a range of Japanese, UK, and US government securities. Investing in this Vanguard fund via the provider’s website will require a minimum lump sum of £500. You can also invest at £100 per month via direct debit.

Vanguard Retirement Funds

At the time of writing, Vanguard offers 11 funds that are tailored towards your golden years. This is a option if you are looking to put a bit of money into your pot at the end of each month. The provider allows you to select a ‘target’ retirement year, which starts at 2025 and runs to 2065.

The split between bonds and equity will depend on which year you choose. For example, if you opt for a super long-term plan, then most of your portfolio will be placed in equities. At the other end of the spectrum, if you have less than 10 years before you are due to retire, then a emphasis will be on bonds.

To show you how Vanguard retirement funds are typically weighted, check out the example below:

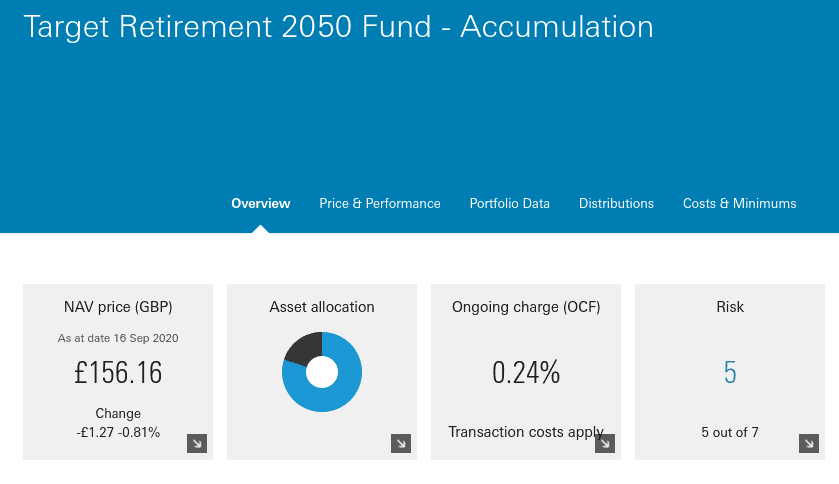

Target Retirement 2050 Fund

By opting for this fund, you are setting yourself a target retirement goal of 30 years. The fund will initially start with an 80/20 split in favour of equities. This is why the fund has an entry-level risk rating of 5/7. Much like the other retirement options on offer, the entire portfolio consists of individual Vanguard funds.

For example, there is 19% in the FTSE 100 Developed Index, and 18% in the US Equity Index. There are also Vanguard funds that track stocks listed on and AIM, as well as the emerging markets. In terms of its bond holdings, this is weighted in favour of government securities.

Vanguard Bond Funds

Some UK investors prefer bonds over stocks. This is because they provide a much clearer picture of potential earnings – as bonds come with fixed coupon payments. With that said, Vanguard bond funds will rarely hold onto bonds until they mature. Instead, the provider will look to profit from ever-changing yields.

Below you will find a selection of the Vanguard bond funds available to UK investors.

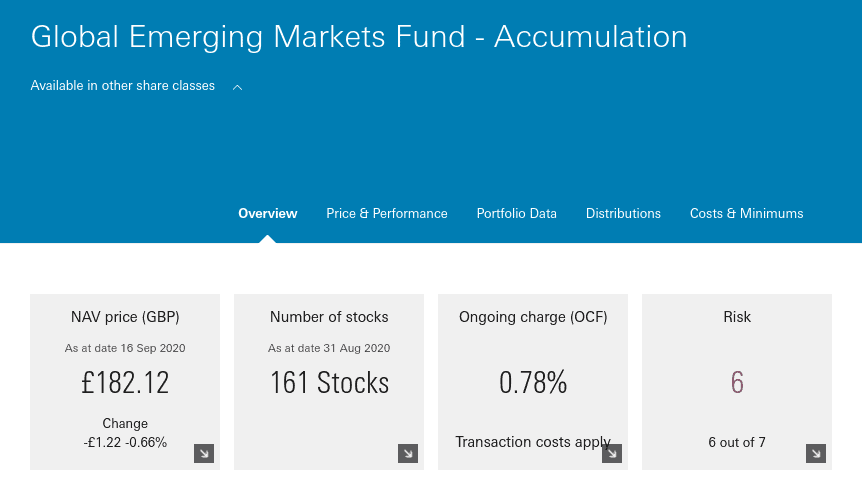

Global Emerging Markets Fund

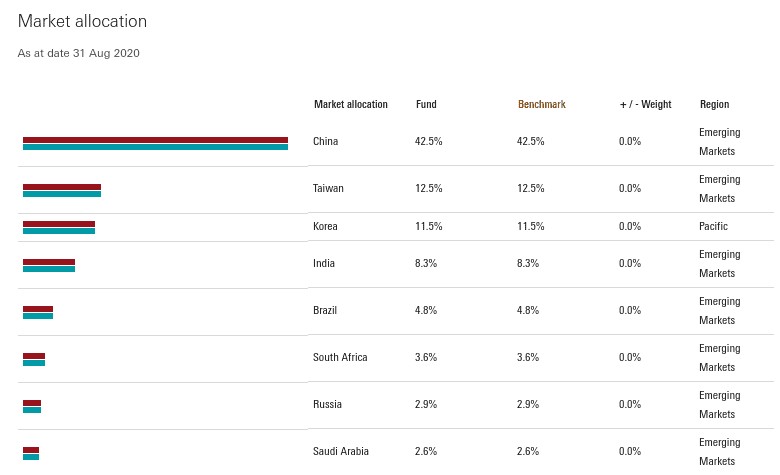

As the name suggests, this Vanguard fund focuses most of its efforts on emerging markets. This includes a huge weighting in favour of China at 31.4%, followed by Taiwan at 12.4%.

The fund also gives you exposure to bonds issued in Korea, India, Russia, Hong Kong, and Brazil. In total, the fund holds over 160 bond instruments from various sectors. This includes technology, oil and gas, consumer services, and financials. Gaining access to the emerging markets can be challenging – even for a large-scale firm like Vanguard.

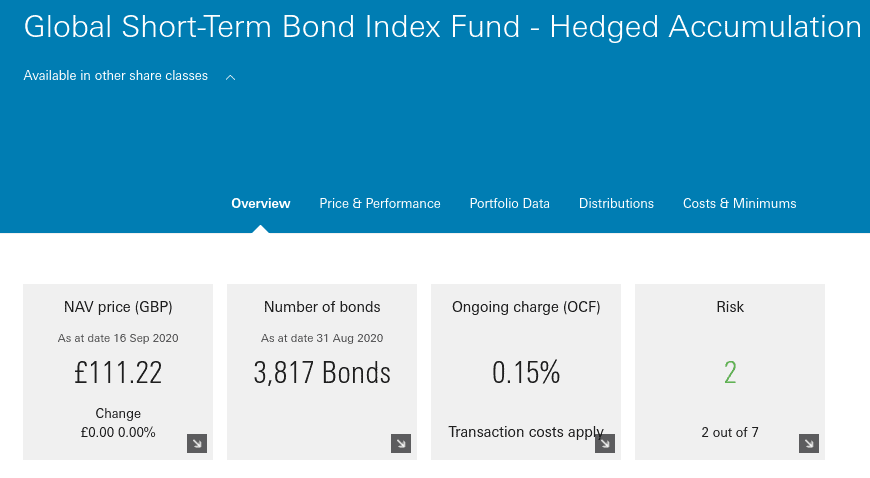

Global Short-Term Bond Index – Low-Risk Bond Fund With 3,800+ Instruments

First and foremost, the fund holds over 3,800 individual bonds – which is for diversification purposes. Most importantly, 42.5% of the portfolio contains bonds that are rated AAA. 15.2% and 21.9% are rated AA and A, respectively. Its low-risk rating can also be attributed to the 53.4% of holdings in US Treasuries.

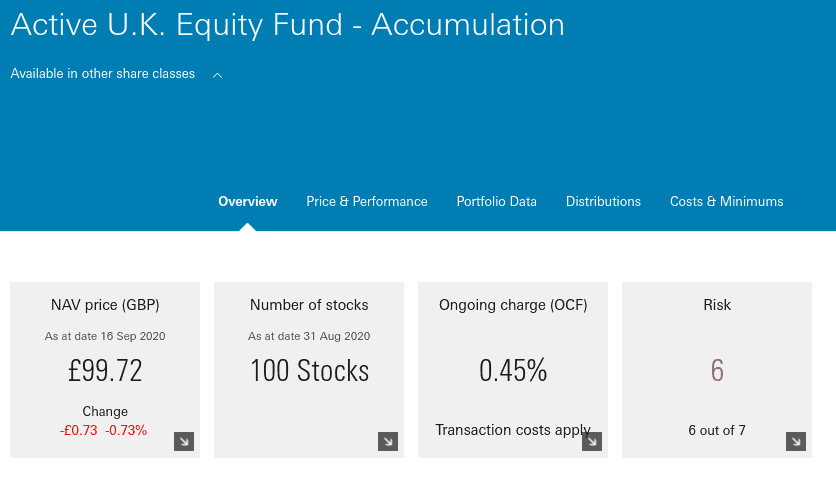

Active UK Equity Fund

Not to be confused with the FTSE 100 index, the Active U.K. Equity Fund will invest in 100 UK companies. Crucially, this is an actively managed mutual fund, meaning that Vanguard will choose which shares it thinks are worth investing in. It will also determine what weighting ratio it should give to each holding.

Its portfolio is well-diversified, albeit, 35.7% of stocks are from the consumer services sector. After that, industries and financials make up 20.9% and 13.7%, respectively. In terms of major holdings, Rightmove carries 5.50%, which HomeServe stands at 3.77%. Then you have the likes of Ocado Group, Auto Trader, Experian, Diageo, and Trainline.

Interestingly, this particular Vanguard fund was only launched in October 2019. Over the past six months alone, the fund has grown from just under £74 per share to £100 per share. This equates to gains of 35%. Vanguard charges a rather competitive 0.45% per year on this fund.

What are Vanguard Funds?

Launched in 1975, Vanguard is a global financial powerhouse that manages a range of funds. This includes everything from mutual funds and ETFs, to index funds. The provider has over $6 trillion in assets under management – and more than than 30 million investors worldwide.

In the UK market, Vanguard has opened its doors to everyday retail investors. This is because you can now invest in a fund directly from the provider’s website. You can do this at a minimum lump sum of £500 or a monthly direct debit of £100. You can also invest in Vanguards funds at various FCA-regulated stock brokers.

This will consist of stocks, bonds, or a blend of the two. In this sense, Vanguard funds allow you to access the financial markets in a passive manner. This is especially attractive if you have no experience in how to pick stocks. An additional benefit of investing in a Vanguard fund is that you can access difficult-to-reach asset classes. In particular, this includes bonds and stocks from emerging markets.

How do Vanguard Funds Work?

Investing in a Vanguard fund is super easy. You simply need to choose a fund that meets your needs, deposit some funds, and that’s it – there nothing more to do until you decide to exit your investment. There are, however, a number of things that you need to have a firm grasp of before injecting money into a Vanguard fund.

This includes:

The objective of the Fund

All Vanguard funds have an objective that is clearly defined. For example, an FTSE 100 index fund would simply look to track the FTSE 100 like-for-like. To achieve this, the fund will ensure that its portfolio not only matches the 100 companies that make up the index but also at the correct weight.

In the case of mutual funds, Vanguard will look to outperform a particular marketplace. For example, a fund that actively buys and sells UK stocks will look to outperform the FTSE 100. If it didn’t, then there would be no point in paying Vanguard to make investment-based decisions. Instead, you could just opt for a more traditional index fund.

Stocks and Bonds Are Weighted

Vanguard funds will implement a weighting mechanism that gives favour to specific stocks or bonds. In the case of an index fund like the NASDAQ 100, it makes sense that Apple, Amazon, and Facebook each contribute significantly more than most of their counterparts.

In the case of the FTSE 100, AstraZeneca and GlaxoSmithKline will have a much weighting than the likes of GVC Holdings and Royal Mail.

Here’s an example of how the weighting of a Vanguard fund can impact your returns.

- You invest £1,000 into a Vanguard fund that tracks UK equities

- British American Tobacco has a weighting of 3%

- This means that you have £30 worth of shares in British American Tobacco

- HSBC has a weighting of 4%

- This means that you have £40 worth of shares in HSBC

Vanguard will often rebalance its weighting system to ensure it reflects the wider markets.

Net Asset Value (NAV)

The net asset value is a useful term to understand when investing in the Vanguard funds in the UK. In its most basic form, this represents the current value of the fund. It obtains its valuation by taking the current market value of all assets held in the portfolio.

For example:

- Your chosen Vanguard fund has 50 million BT stocks at £1 per share (£50 million)

- The fund also has 100 million Shell stocks at £0.50 per share (£50 million)

- This means that the fund has a NAV of £100 million

We’ll then say that 12 months later, BT stocks are worth £1.50 and Shell at £0.75

- At £1.50, 50 million BT stocks amount to £75 million

- At £0.75, 100 million Shell stocks amount to £75 million

- The Vanguard fund now has a NAV of £150

Crucially, by increasing its NAV from £100 to £150, the fund is now worth 50% more. As such, if you had initially invested £10,000 into this particular fund, it would now be worth £15,000.

Dividends

When you invest in a Vanguard fund, you will be entitled to dividends. This is usually paid every three months. This will be a result of Vanguard receiving dividends on its stock investments or coupon payments on its bond holdings. As you indirectly own these assets, you will receive a share of the proceeds at an amount proportionate to what you have invested with Vanguard.

Here’s an example of how Vanguard dividends work:

- You invest £5,000 into a Vanguard bond fund

- The fund distributes dividends every 3 months

- Over the course of the quarter, the fund receives an annualized yield of 6%

- As this is a quarterly payment, we need to divide this by 4 – leaving us with an effective yield of 1.5%

- On an investment of £5,000 – your dividends will equal £75

Selling a Vanguard Fund

Unless you are investing in a mutual fund or moneymaker fund, most Vanguard funds can be sold at the click of a button. This is because the respective ETF will be listed on a public stock exchange. In turn, you can exit your position whenever you see fit.

Mutual funds and moneymaker funds are still fairly liquid, albeit, it might take a day or two for the sale to go through. This is because the aforementioned funds are not publicly listed.

Types of Vanguard Funds UK

Vanguard offers dozens of funds in the UK. The provider typically splits its funds into the following categories.

Product Type

This is the overarching fund type and includes:

- Lifestrategy – Long-term investment plan with various bond/stock splits

- Target Retirement – This allows you to set a target retirement year. Vanguard will weigh its portfolio accordingly.

- Mutual Fund – These are funds that are actively managed by Vanguard

- ETFs – These Vanguard funds are listed on public exchanges

Asset Class

You then get to select the type of asset that you wish to gain exposure to.

- Equities: This fund will allocate 100% of funds into stocks

- Income: This fund will allocate 100% of funds into income-generating bonds

- Blended – This fund will allocate some funds to bonds and some to equities

- Money Market – These are super low-risk funds, you’d choose to invest in money market funds for short-term growth. These investment products allocate funds to high-grade government securities and bank deposit notes

Risk Level

Vanguard provides a risk rating on all of its funds, which runs from 1 to 7. While 1 presents the lowest risk, 7 comes with the most. As is the case with any asset class, the more risk that you take on, the higher the expected returns.

An example of a low-risk Vanguard fund would be one that focuses on government bonds issued by the US, Europe, Japan, and the UK. A high-risk fund would target stocks and bonds from the emerging markets, or from small-cap exchanges like the AIM.

Fundamentals of UK Vanguard Funds

If you’re still unsure as to whether or not Vanguard UK funds are right for you, check out the investment benefits outlined below:

No Investment Experience Needed

The only decision that you need to make is which Vanguard fund to invest in. Other than that, there is nothing more for you to do. This is if you want to invest in stocks and/or bonds, but you don’t know where to start.

Passive Income

There is no requirement to waste countless hours researching potential investments, nor is there a need to read company reports or perform technical analysis. Instead, this is a role reserved exclusively for Vanguard. The firm will dictate which assets should be invested in, and when.

Low Fees

Vanguard funds are very well priced. There is no dealing charge when you go direct with the provider, and ongoing maintenance fees typically cost less than 0.4% per year. Vanguard does not charge any deposit or withdrawal fees either.

With that being said, investing in a Vanguard fund via a third-party broker is often an even more cost-effective option.

Access Difficult to Reach Markets

UK Vanguard funds are jam-packed with financial instruments that you as an everyday investor would find it difficult to reach. For example, while you can easily buy UK Gilts or US Treasuries, you likely won’t be able to get your hands on bonds issued by the government of Kenya, India, or Brazil.

Similarly, you might find it difficult to invest in certain small-cap stocks that are still at the very start of their corporate journey. This won’t, however, be an issue when investing in a Vanguard fund. After all, this multi-trillion dollar powerhouse has access to virtually every financial scene on offer.

Low Minimums

Across most of its 80+ UK funds, Vanguard has a fixed minimum investment amount of £500. You can also elect to set up a direct debit at just £100 per month. The latter is especially useful if you simply want to put a bit of money to one side at the end of each month.

Risks and Drawbacks of Vanguard Funds

Although Vanguard UK funds are attractive to most investor profiles, there are also some risks and drawbacks to consider.

This includes:

- Lack of Say in Investment Decisions: By investing in a Vanguard fund, you will not have any say in which assets the provider buys or sells. This might result in you missing out on a particular investment opportunity.

- Loss of Funds: There is every chance that your Vanguard fund will go down in value. This will be the case if the fund is tracking an index like the FTSE and the wider markets are bearish.

- Timing the Market: Although Vanguard funds are largely passive, there is still an element of ‘timing the market’ that needs to be considered. For example, when it comes to cashing your investment out, you need to determine the time to do this.

- Fees: On the one hand, Vanguard funds are typically well-priced. On the other, it is often possible to invest in a Vanguard fund at a more favourable price when using a third-party broker.

1. Hargreaves Lansdown

In terms of choice, Hargreaves Lansdown is home to dozens of Vanguard funds. In fact, the platform hosts a variety of international funds that the Vanguard website does not list on its UK website.

You will need to invest at least £100 at Hargreaves, although you can also elect to sign up for a monthly direct debit of £25. In terms of fees, this FCA broker charges 0.45% per year on Vanguard funds. It won’t cost you anything to withdraw your funds out, and FSCS protections apply.

Hargreaves Lansdown fees:

| Commission | 0.45% per year for investments less than £250k |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | N/A |

Sponsored ad. Your capital is at risk

3. Vanguard

Vanguard doesn’t charge any deposit or withdrawal fees, but ongoing charges will always apply. This is typically below 0.4% per year, albeit, mutual funds are slightly higher. If you do invest directly with Vanguard, you cash out your fund at any given time.

Hargreaves Lansdown fees:

| Commission | Typically less than 0.4% per year |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | N/A |

Sponsored ad. Your capital is at risk

Conclusion

Vanguard is often the go-to institution for funds. After all, you can access hundreds of assets through a single investment. There is no requirement to perform any research on the financial markets either, so Vanguard funds are for newbies. In fact, Vanguard funds are suited for any investor that wishes to earn a passive income. The only decision that you need to make is the type of Vanguard you opt for.