How to Buy Shares UK 2026 – Online Guide for Beginners

Based in the UK and looking for information on how to buy shares for the first time?

In this beginner’s guide, we’ll give you all the information you need on how to buy shares in the UK in 2026. We’ll discuss how to select an authorised and regulated stockbroker, the fees to expect, how to place your first share order, and provide tips on choosing the right shares.

Before you can buy shares, you need to choose a reputable stock broker. We’ve listed a number of FCA-regulated stock brokers below, with a full breakdown of their fees and features. You can even enter the amount you plan to invest and the number of trades to work out how much each broker will cost.

How to Buy Shares UK – Step by Step Guide 2026

Step 1. Open an Investment Account

Open an account with a UK stock broker, enter your name, your email, and a password for your account.

Step 2. Deposit Funds

Once your account is set up and you’ve completed KYC, you can make a deposit.

Step 3. Buy Shares

Once your account has been funded, you can then buy your very first share. In our example, we are looking to buy shares in BP. So, we’ll enter ‘BP’ into the search box at the top of the screen and then click on ‘TRADE’ to open a new order. Then we’ll enter the amount we want to trade and click ‘OPEN POSITION’ to place our first stock trade.

That’s it – you’ve now learned how to invest in stocks UK in just 3 simple steps!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Learn the Basics of Buying Shares in the UK

Due to the way UK share dealing works today, you can buy thousands of global shares at the click of a button. All you need is a reliable online stock broker account.

Best of all, as there are now hundreds of UK stockbrokers each competing for your business, fees, and commissions have never been so competitive. In fact, there are the even UK share dealing platforms that allow you to buy stocks without paying any dealing charges.

However, as well as learning how to buy shares in the UK, it’s also very important to learn the basics of how shares actually work, the investment journey, and any tax rules vs tax benefits. By getting comfortable with the fundamentals, you stand the best chance possible of avoiding costly mistakes. Top share tip: once you’ve bought shares in a company, they are required to send you a share certificate within two months.

What are Shares?

When a company decides to go ‘public’, this means that it will be listed on a stock exchange. In turn, this allows everyday investors to purchase ‘shares ‘in the firm. As the name suggests, you will own a ‘share’ of the company that you invest in – proportionate to the number of stocks that you hold.

The value of the shares are determined by market forces. In other words, if there are more buyers than sellers, the share price will increase. When it does, the value of your investment will follow suit.

If there are more sellers than buyers, this has the opposite effect – meaning that the value of your shares will go down. As a shareholder of a company, you will be entitled to a range of perks.

Selling Shares

At the forefront of this is an entitlement to dividends and the ability to vote at Annual General Meetings (AGMs). You can sell shares at any given time during standard market hours. The amount you receive back in cash will be based on the number of shares you hold against that of the current stock price of the company. We recommend you bookmark our shares terminology page whilst you purchase your first share.

Bullish and Bearish Markets

In order to invest successfully, you will need to understand different market conditions and what they mean. Knowing this can help to guide your trading decisions and improve your strategy.

There are two main market conditions that you may experience when trading. These are Bullish and Bearish conditions. Bullish is the term given to markets that are predicted to experience an increase in prices overtime. Bullish markets typically occur after a period of price decline. A commonly used definition of a bullish market is when prices rise by 20% after two falls of 20% each time.

On the other hand, a Bearish market is a market that is experiencing price decline. In a bearish market, stock prices fall by 20% or more over a period of time. This is typically met with negative investor attitude and pessimism. The prices of stocks fall as investor sell their shares.

During both bullish and bearish markets, prices will be volatile. If you choose to trade during these conditions, it is important to conduct thorough analysis and keep up to date with the latest news.

How Much Does It Cost To Buy Shares UK?

The cost of buying shares in the UK varies depending on the platform that you use and the size of your investment. Each platform offers a different fees structure and it is worth researching this before deciding where to buy shares from. Common fees that may be charged include account management fees, payment and withdrawal fees, trading fees, spreads, commission and inactivity fees. If you buy shares in the UK, you may also need to pay tax.

It is possible to buy shares in the UK for a low cost if you choose a platform that offers minimal fees. However, fees aren’t fixed and may change with market conditions. It is always best to familiarize yourself with a trading platform’s fee structure before depositing any funds and making any trades.

Do I Pay Tax On Shares?

In the UK, capital gains are added to your income which means that you do have to pay tax on shares. The amount of tax that you pay will depend on your total earnings- in the UK you are placed into a tax bracket which determines how much you will need to pay each year. You may also pay a 0.5% tax on each share trade that you make. This is automatically taken when you sell shares online.

To pay tax on the shares that you own, you will need to include them as part of your self-assessment tax return. This is an annual document that is used by HMRC to determine that tax that you pay. If you do not declare earnings from shares as part of the annual tax return, you could receive a fine from HMRC.

How Much Money Can You Make From Investing in Stocks & Shares?

If you want to work out how much you stand to potentially make learning how to invest in shares UK, try out our handy investment calculator. Remember, historically shares tend to yield a 6%-7% annual return.

How to Make Money from Buying Shares & Stocks in the UK:

This can be achieved in three ways – capital gains, dividends, and compound growth.

1. Capital Gains

If the value of your shares is higher than the price you originally paid, this is known as ‘capital gains’.

For example:

- Let’s suppose that you buy 1,000 shares in BP at 350p per stock

- This means that your total investment amounts to £3,500

- Five years later, BP shares are now priced at 450p per stock

- You are happy with your gains so you decide to sell the shares

- You made 100p per share (450p-350p), and at 1,000 shares, this amounts to a profit of £1,000

This £1,000 profit is what is known as capital gains. In the UK, you will need to declare your capital gains to HMRC. The specific tax rate will vary depending on your personal circumstances.

2. Dividends

You will also have the opportunity to earn money from shares in the form of dividends. In its most basic form, dividends allow large companies to share their profits with stockholders.

If and when they do, you will be entitled to your share of the proceeds. The specific dividend income that you get will vary depending on how well the company is performing. Not all shares pay dividends, but if they do they are typically distributed every 3 or 6 months.

Here’s how dividends stocks work:

- Let’s say that you hold 500 shares in HSBC

- The firm pays dividends every three months

- This time around, HSBC announces a dividend yield of 7%

- This amounts to £0.28 per share

- You hold 500 shares, so you will receive a total of £140 (£0.28 x 500 shares)

The best thing about dividends is that you will receive this in addition to your capital gains. In an ideal world, you will be investing in stocks that increase in value, while at the same time pay regular dividend payments!

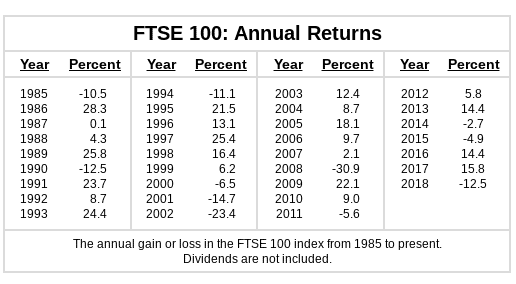

While past performance is never a sure-fire indicator of future results, below you will find the average annualized returns of the FTSE 100 over the past 25 years.

If you wanted to mirror these returns, you would need to invest in an ETF or mutual fund that tracks the FTSE 100.

3. Compound Growth

Rather than simply cash out capital gains or hold out for dividends income, many investors look to reinvest an asset’s earnings to generate more earnings over time. This is known as compounding. By holding a stock for a long time and constantly reinvesting capital gains, you can achieve a compounding effect which sees you earn gains on your gains.

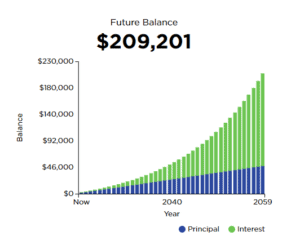

Let’s take a look at an example of how compound growth works:

- You invest in £100 per month in an asset that has a 6% return

- If you did this for 10 years, you’ll have invested £13,200 and have £18,915

- If you did this for 20 years, you’ll have invested £25,200 and have £50,640

- If you did this for 40 years, you’ll have invested £49,200 and have £209,201

The reason your investment grows in this way is because you earn on the gains you reinvest as well as your original investment. This means that each year you earn more interest on both your initial investment and your compounding gains.

Compound growth requires patience as the initial gains are small, but over the long run, it can be highly lucrative. Of course, investors have to take share fluctuations, inflation, and fees into account, but if done right, compound interest can be one way to grow wealth via shares.

What to Consider Before You Buy Shares in a Company

Although the stock markets have historically performed well – this isn’t the case with all companies. On the contrary, many firms – both in the UK and overseas, are now worth just a fraction of their prior all-time highs. This is especially the case with the UK high street banking space – with the like of HSBC and Natwest never truly recovering from the financial crisis of 2008.

With this in mind, below you will find some handy share tips that will allow you to mitigate your risks when learning how to invest in stocks UK for the first time.

💡 Tip 1: Diversify as much as you can

In a nutshell, diversification is simply the opposite of putting all of your eggs into one basket. That is to say, instead of investing in one or two companies, a well-diversified portfolio would see you hold dozens, if not hundreds of different stocks. Not only this, but you will be investing in firms from several sectors – subsequently ensuring that you are not overexposed to a single niche. For example, let’s suppose that you have £5,000 to invest into the stock markets.

- An inexperienced investor might use the entire £5,000 to invest in a single company

- A shrewd investor would likely buy shares in 100 different companies at £50 each. This would cover multiple sectors, too.

💡 Tip 2: Start off with low stakes

If you have never previously learned how to invest in shares UK, it might be worth starting off with low stakes. On the one hand, most regulated UK stockbrokers require you to meet a minimum investment amount that typically sits within the £100-200 range. On the other hand, you are not required to inject the entire balance into a single trade.

On the contrary, platforms like eToro permit a minimum stock investment of $50. As such, by starting off with small amounts, you will be able to build your confidence up without breaking the bank.

💡 Tip 3: Learn how to research before you buy stocks UK

Some examples of widely When you learn how to buy shares, it is also important for you to learn how to research stocks. By this, we are not talking about anything overly complicated like technical analysis or chart reading. On the contrary, just make sure that you are kept abreast of any key market developments that might impact the value of your investment.

- For example, let’s suppose that you have £3,000 invested in Royal Mail

- If Royal Mail announces that it is planning to cut hundreds of jobs, how do you think this will impact the share price?

- Without a doubt, negative news such as this would likely result in a mass sell-off from shareholders.

- In turn, the value of the shares will go down.

- With that said, if you sold the shares as soon as the news was announced, you would stand the best chance possible of minimizing your losses and getting back as much as possible.

As a side-tip, it might be worth signing up for news alerts with a third-party platform. For example, the Yahoo! Finance website allows you to add your invested companies into its portfolio, and then you can elect to receive real-time news when a relevant story breaks. For more information on stock tips and selling shares, check out our best shares to buy guide.

Some examples of widely-used stock analysis methods are listed below:

- Price-to-Earnings Ratio: The price-to-earnings (P/E) ratio looks at the correlation between a company’s earnings with that of its stock price. This allows investors to ascertain whether the shares are under or overvalued. You simply need to divide the current share price into the company’s earnings per share, and you will be left with a ratio. Although there are many other variables to consider, the major US stock markets average a price-to-earnings ratio of between 13-15.

- Debt-to-Equity Ratio: The debt-to-equity ratio looks at how much debt a company has in correlation to its equity. In simple terms, this lets you know whether or not the company has too much debt on its hands. The calculation will leave you with a ratio of between 0 and 1 – and so the higher the number, the more debt it has (in relation to the size of its equity). You do need to assess the type of industry that the company is operating in when utilizing the debt-to-equity ratio, as it is widely accepted that certain sectors need to carry more debt than others (such as construction firms).

There are many other fundamental analysis methods used by seasoned investors. You can read more on how to pick stocks and shares on a DIY basis here.

💡 Tip 4: Consider a copy trading portfolio

If you have little to no knowledge of how stocks and shares work, it might be worth considering the merits of a copy trading portfolio. Beginner-friendly platforms like eToro allow you to mirror the trades of experienced investors.

Not only does this include their current portfolio – but each and every investment thereon. The best thing about it is that you get to review the credentials of the trader before you invest in money. Copy trading essentially allows you to invest in shares without doing any of the work, so it’s very popular among new investors.

How to Select a UK Stockbroker to Invest in Shares 2026

You now know how to buy shares, but do you have a reliable stockbroker that matches your investment preferences? The are many brokers out there and they all differ in terms of tradable assets, fees, and features, so you need to spend some time researching different platforms before signing up.

Some of the most important factors that you need to look out for are:

Financial Conduct Authority Regulation

The first – and most important metric that you need to consider before joining a UK stock broker is whether or not it is regulated by the Financial Conduct Authority (FCA). This will ensure that you are able to buy, sell, and trade shares in a safe and secure environment.

For example:

- All FCA brokers are required to go through a long and drawn-out application process before they can legally accept UK traders.

- The platform will need to have its books audited by the FCA on a quarterly basis.

- All client funds must be held in segregated bank accounts. This is a crucial safeguard, as it means the broker cannot use your invested funds to cover its own working capital.

- Segregated bank accounts also mean that was the broker to run into financial problems, your money would be ringfenced.

All in all, never sign up with a UK share dealing platform if it doesn’t hold that all-important FCA license.

UK Payment Methods To Buy Stocks UK

Once you have assessed the broker’s regulatory standing, you then need to explore what payment methods it accepts. In the vast majority of cases, UK share dealing platforms will accept a debit card and bank account transfer. The latter is more suitable for larger deposits over £10,000. Depending on the broker, it may take 1 to 3 business for bank wire funds to land in your account, but if you conduct an instant bank transfer they can be credited in two hours.

| Stock Broker | Payment methods | Minimum deposit |

| eToro | Bank Transfer, Skrill, Neteller | $50 |

| Plus500 | VISA, MasterCard, Bank Transfer, PayPal, Skrill | $100 (£75) |

| AvaTrade | VISA, MasterCard, Bank Transfer, Skrill, WebMoney, Neteller | $100 (£75) |

| Fineco | Bank Transfer | No minimum deposit |

What Shares Can You Buy in the UK?

As we briefly noted earlier, there are tens of thousands of publicly listed companies across dozens of stock exchanges. Crucially, the specific markets that you will have access to will depend on the broker that you sign up with. For example, between eToro, Plus500, and IG you will be able to buy, sell, and trade over 10,000 different companies.

This includes firms listed on the:

- London Stock Exchange (UK)

- Alternative Investment Market (AIM – UK)

- NASDAQ (US)

- New York Stock Exchange (US)

- Tokyo Stock Exchange (Japan)

- Hong Kong Stock Exchange (Hong Kong)

- And many, many more!

It’s best to choose a stock broker that covers both UK and international markets, as this will give you the best chance possible of diversifying your risk. eToro, for instance, allows you to purchase shares from 17 different markets.

How To Sell Shares Online UK

If your investment has appreciated in value, you may want to sell before prices drop. Luckily, it is easy to sell shares online in the UK with a reputable broker.

To sell your shares, simply log into your online broker and navigate to your portfolio. Here, you should be able to see a full list of stocks and shares that you own. Select the share that you wish to sell and click ‘sell’ or ‘close’- each broker will use a different wording but they mean the same thing. You can either sell the entire share or choose to sell a fraction of the share that you own. For example, you may wish to only sell 50% of your shares and hold the remaining 50% incase the market continues to rise.

When you sell shares, the value of the share that you sold will appear in your account cash balance. You can cash out by withdrawing funds to your connected payment method or reinvest by buying different shares with the balance. It is important to note that some brokers may charge fees for withdrawing funds from your account. You will need to make sure that you can cover the fees involved before withdrawing any funds.

UK Broker Fees Comparison

There a number of fees and charges to consider when you’re looking for a stock broker, including dealing commissions, annual account fees, and withdrawal fees.

The good news is that some UK share dealing platforms allow you to buy stocks without paying any dealing charges or annual fees. Instead, they make their money from the ‘spread’, or a one-off conversion fee when you make your first deposit (eToro, for instance, charges 0.5%).

To give you an idea of what you are likely going to pay after you’ve learned how to invest in shares UK, check out our stock broker comparison table below.

| UK Stock Broker Fees | Charge Per Trade | Annual Fee | Conversion Fee |

| eToro | Free | N/A | 0.50% |

| Alvexo | Tight Spreads | N/A | N/A (GBP deposits accepted) |

| Plus500 | Free | N/A | Up to 0.3% |

| AvaTrade | Free | N/A | N/A (GBP deposits accepted) |

| Fineco | From £2.95 per trade | N/A | N/A |

Where to Buy UK Shares – FCA Regulated UK Share Dealing Platforms 2026

Finding the time to research the ins and outs of an online stockbroker can be challenging. Below you will find a selection of the best share dealing accounts that meet a number of minimum requirements that can act as investment managers for your shares. This includes that all-important Financial Conduct Authority license, support for bank accounts, and the ability to buy and sell shares in domestic and international companies.

1. eToro

eToro is a popular retail investment platform that allows customers to buy over 800 different shares with 0% commission.

eToro also absorbs the cost of stamp duty to keep costs even lower. Safety and security-wise, eToro is FCA regulated broker and very popular among millennials who are beginner investors.

At eToro, you can invest in British blue-chip stocks such as Tesco, BT, and Rolls Royce, as well as the best technology ETFs UK and trending tech shares such as Amazon, Apple and Tesla. One of the main reasons that eToro makes our list is that it allows you to buy and sell shares without paying any dealing charges. The platform also offers a wide variety of the most popular cryptocurrencies, you can buy bitcoin UK, Ethereum, Ripple and many more.

This is revolutionary in the UK investment scene and share trading, as the likes of Hargreaves Lansdown will charge you in excess of £11.95 per trade. Instead, it’s only the 0.5% conversion fee on your deposit that represents any type of charge.

If you wish to trade stock CFDs – where the leverage of up to 1:5 is available (your capital is at risk when trading with leverage) – then you will have to pay a small fee known as the spread. You can learn more on the difference between buying a physical stock and trading stock CFDs here. Remember that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail Investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Learn more

eToro has a fully-fledged license with the FCA. It’s also licensed in Australia (ASIC) and Cyprus (CySEC) – so you have regulatory protection on three fronts.

Once your deposit has been processed by the broker, it will be converted to US dollars at a small fee of 0.5%. This allows you to access international markets without needing to keep worrying about exchange rates. If you wish to deposit over $2,000, then eToro requires you to submit identification. The platform supports large investments – up to $40,000 per card transaction and no limit with bank wire transfers. These would qualify you for a VIP account manager and a chance for a face-to-face meeting at their London headquarters.

eToro also offers copy trading functionality, which gives you the chance to copy successful stock investors and build like-for-like portfolios. This feature does, however, come with additional charges. For a more detailed overview, check out our eToro review.

Note: eToro does not calculate any tax you may need to pay for you, for example, capital gains tax, so you must calculate this yourself based on your country of residence.

| Deposit fee | Free |

| Withdrawal fee | $5 |

| Inactivity fee | $10 per month after 12 months of no login activity |

| Account fee | None |

| Minimum deposit | $50 |

| Stocks markets | Access to 17 stock markets |

| Tradable assets | CFDs, Forex, Commodities, Cryptocurrencies, real Stocks and ETFs, indices |

| Available Trading Platforms | Web-based trading platform, mobile trading app |

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

2. XTB

XTB, a well-known stock broker in the UK, is a preferred choice for traders due to its extensive range of trading options. With over 2,100 shares and ETFs available, traders can benefit from commission-free trading, making it an affordable option. Notably, XTB stands out as one of the most cost-effective choices for UK traders, with spreads starting as low as 0.015% for US-listed stocks. What’s more, this broker does not require a minimum deposit and does not charge any fees for deposits or withdrawals.

One of the key features of XTB is its tailor-made stock trading platform, xStation 5, which can be accessed through web and mobile devices. The platform offers a comprehensive set of research tools to enhance trading strategies. It provides users with technical charts and a wide range of studies to analyze market trends. Moreover, the platform includes a market news feed that not only keeps traders informed but also provides actionable trade ideas, complete with annotated price charts. Additionally, XTB’s platform offers a market sentiment gauge, allowing users to easily gauge the opinions of fellow traders regarding the direction of a stock’s price.

Traders can benefit from XTB’s stock and ETF screener, a valuable tool for scanning the market and identifying stocks that are experiencing upward momentum or potential declines. This feature enables users to create watchlists and refine their search, facilitating the discovery of optimal trading opportunities.

To ensure the safety and security of its clients, XTB is regulated by both the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Furthermore, the broker provides negative balance protection for all traders, mitigating the risk of losses exceeding the trader’s account balance. Should any assistance be required, XTB offers customer support through multiple channels, including phone, email, and live chat, ensuring prompt assistance is available to traders 24 hours a day, 5 days a week.

75% of retail CFD accounts lose money.

3. AvaTrade

AvaTrade is one of the best investment platforms for users who wish to employ leverage, making it super popular in the trading industry. With over 200,000 registered users, AvaTrade has operations in over 150 countries and is a firm favourite with traders interested in various asset classes. What’s more, AvaTrade is licensed and regulated by numerous reputable governing bodies – including the Central Bank of Ireland.

In terms of fees, as AvaTrade is a CFD broker, all costs are built into the spread. Spreads vary depending on market conditions but tend to be very tight for liquid stocks such as Apple and Amazon. Notably, AvaTrade offers leverage of up to 1:5 for stock CFDs – although this does go up drastically for traders outside of the EU.

The minimum deposit at AvaTrade is £100, which is entirely free to make. Users can fund their accounts via credit/debit card, bank transfer, and various e-wallets – including Neteller, Skrill, and Klarna. Another great thing about AvaTrade is that withdrawals are free to make via credit/debit card, with funds taking around three days to reach your account. Finally, AvaTrade has a fantastic WebTrader platform available on your browser and mobile, featuring a user-friendly interface and various order types to utilise.

Your capital is at risk

4. PrimeXBT

The platform stands out for its advanced charting tools and trading indicators, which are customizable to suit individual strategies. Traders can leverage these tools to analyze market trends and make informed decisions. PrimeXBT also offers leverage trading options, providing the potential for greater profits for experienced traders.

The trading experience on PrimeXBT is seamless and efficient. Users can open, manage, and close trades with ease, and track their performance in real-time. A notable feature is Covesting, which allows traders to follow and replicate the strategies of successful managers, serving as both an educational and potentially profitable opportunity.

PrimeXBT places a strong emphasis on security and user privacy. The platform employs industry-standard measures such as two-factor authentication and data encryption to protect user accounts and information. Furthermore, the dedicated customer support team is available to assist users with any queries, ensuring a smooth trading experience.

In conclusion, PrimeXBT offers a robust trading platform with a variety of markets and sophisticated tools tailored for traders seeking a comprehensive approach to trading. Its focus on security, innovative features like Covesting, and user-friendly interface make it a preferred choice for those looking to capitalize on global market opportunities.

Your capital is at risk.

5. Trade Nation

Trade Nation is a multi-regulated broker with offices in South Africa, the United Kingdom, and Australia. Among the four jurisdictions where they are regulated are South Africa (FSCA), the United Kingdom (FCA), Australia (ASIC), and the Bahamas (SCB). Their goal is to offer their clients the highest quality products, leverage, and trading experiences globally.

The company was founded in 2020 but has been known as Core Spreads since 2014. As a result of their fixed spreads and low costs, they became one of the most popular brokers. There is a tendency for Trade Nation to carry this over.

In addition to their brand values, they place a lot of emphasis on the outlook of their business. Its mission and focus are taking a client-driven approach and bringing a fresh approach to trading.

Besides the app and trading platform, Trade Nation (T.N.) will offer MetaTrader 4 (MT4). With fixed spreads and guaranteed stops, their proprietary platform offers a large list of tradable assets. You’ll find the platform extremely user-friendly if you’re familiar with MetaTrader 4.

Your capital is at risk

6. Admiral Markets

Among the many services Admiral Markets offers are online trading services, forex trading, and contracts for difference (CFDs). Additionally, the stock market offers many other investment opportunities.

A commitment to serving clients well drives the platform and company and provides excellent trading software. You can enjoy the best and most transparent financial experience with confidence and without reservations.

Furthermore, Admiral Markets offers an extremely specialized blog section. Its website provides users with market news. Additionally, it provides useful information and strategies on various trade-related topics.

The company offers books and brochures that provide information in addition to training programs. These tools can help traders improve their skills and knowledge to make informed and intelligent decisions.

With Admiral Markets, traders can trade forex and CFDs online. This is accomplished using the NDD/ECN methodology.

Since NDD operates without a dealing desk, it means No Dealing Desk. In contrast, an ECN is an electronic communication network.

Your capital is at risk

7. Pepperstone

Since two Tier 1 jurisdictions regulate Pepperstone, it is a safe and low-risk option for trading forex and CFDs.

For algorithmic traders and copy traders, Pepperstone offers MetaTrader and cTrader platforms. Additionally, Pepperstone offers several premium add-ons that can be downloaded to enhance the functionality of the MetaTrader platform as well.

Even though Pepperstone performs better than the average company in the industry, it still lags behind eToro and XTB, some of the industry leaders. Pepperstone offers a limited array of products and focuses on them closely.

Retail traders will find Pepperstone’s Razor accounts in line with industry averages, but active traders will find them competitive.

Pepperstone will charge a commission on CFD positions in stocks and commodities overnight, including weekends. The commission for the product you are trading is 2.5% plus regional interest rates.

As far as Forex is concerned, Pepperstone’s Razor account has a spread minimum and average lower than its Standard account.

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

8. Plus500

An additional trading platform that has proven popular in recent years is Plus500. Unlike eToro, this provider specializes exclusively in CFDs. The main drawback of this is that you will not own the underlying stock. On the flip side, you will be able to trade more than 2,000 stock CFDs without paying a penny in commission.

Plus500 also allows you to apply leverage on your stock CFD trades the same way they allow you to apply leverage on other instruments. At an upper limit of 1:5 for retail clients (and more on other asset classes), a £200 deposit would permit a maximum trade size of £1,000. Using Plus500 to trade stock CFDs will also give you the capacity to choose from a buy or sell order. This means that you can speculate on the price going up and down. This is something that you won’t be able to do with a traditional stockbroker.

In terms of the fundamentals, not only is its parent company listed on the London Stock Exchange as a PLC, but Plus500UK Ltd is authorized & regulated by the FCA (#509909). You can open an account in minutes at Plus500, and deposit funds with a UK debit/credit card, bank account, or Paypal. You’ll need to meet a minimum deposit of £100.

Your capital is at risk

Stock Brokers Fees Compared

| UK Stock Broker | Fees | Min Deposit | Margin |

| eToro | 0% Commission | $50 | 20% |

| Alvexo | Tight Spreads | $250 | 30% |

| XTB | 0% Commission | Zero | 20% |

| Plus500 | 0% Commission | $100 (around £75) | 20% |

| AvaTrade | 0% Commission | $100 (around £75) | 50% |

| Fineco | From £2.95 per trade | No minimum deposit | 20% |

How To Buy Shares in The UK With eToro – Guide

Based on customer reviews, eToro is a popular FCA regulated share dealing platform that can be used to buy shares in the UK from $50. In this section of our article, we will walk you through the steps involved with buying shares from eToro in the UK.

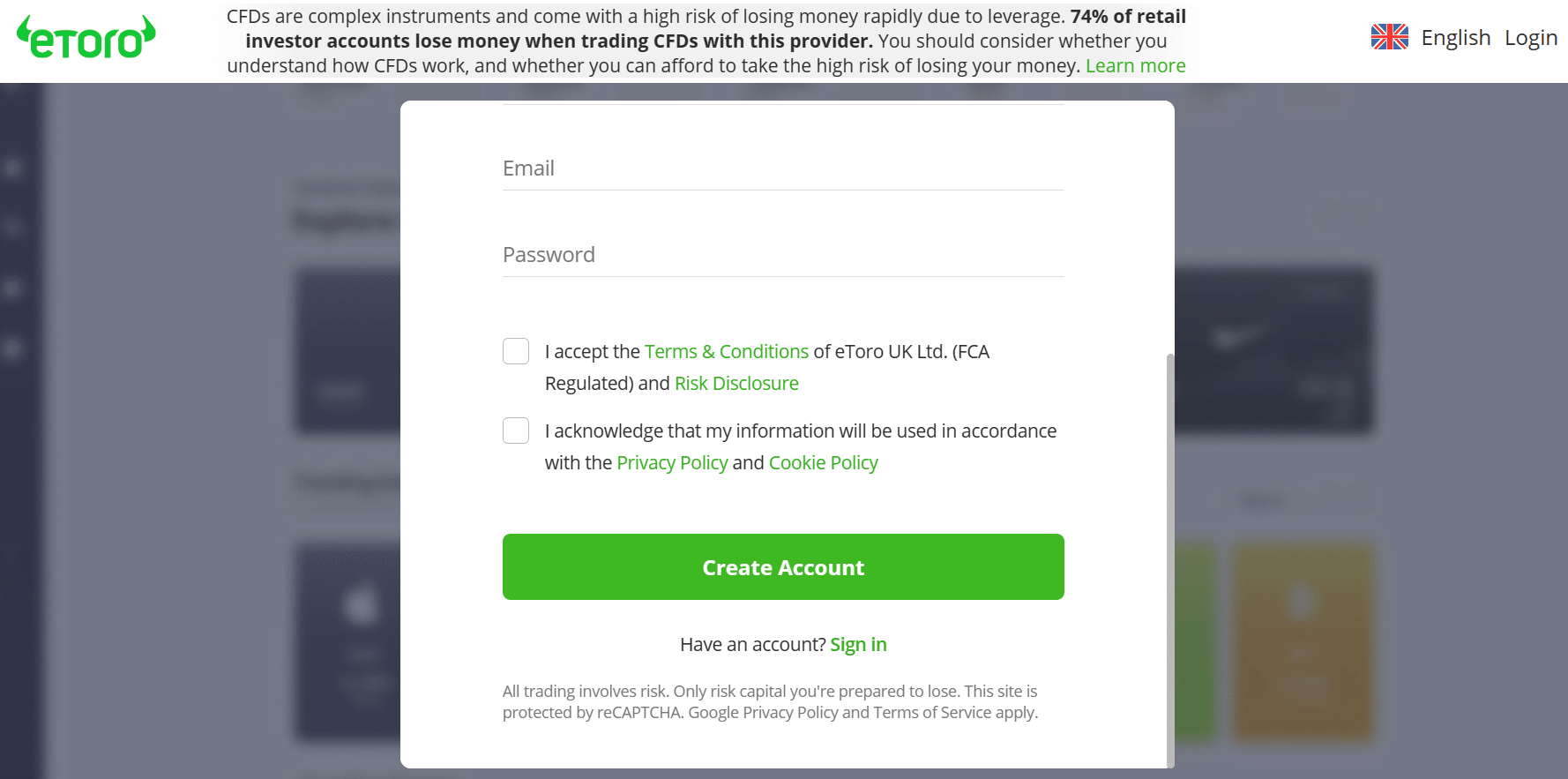

Step 1: Create an eToro account

As a regulated trading platform, eToro must comply with KYC requirements. As a result, all new customers must create an account with their email address and two valid forms of ID.

To speed up the process of creating an eToro trading account, make sure to have two forms of ID to hand. Then, navigate to the official eToro website and click ‘start investing’. You will then be redirected to the registration form.

You will be asked to fill in some personal information including your name, email address, residential address and mobile number. After filling in these details, you will be asked to upload your two forms of ID.

One form of ID must verify your address. Accepted documents include utility bills and bank statements. The second form of ID must verify your identity and can be either a passport, driver’s license or birth certificate. Take clear pictures and upload these to the platform. eToro will then verify your account. This can take anywhere between 10 minutes and 48 hours.

Step 2: Practice with the demo account

Before you start buying shares on eToro, you could practice trading with the eToro demo account for free. A demo account is a risk-free way of practicing your skills without using any real funds. eToro provides a demo account that can be funded with up to £100k in virtual funds.

Traders can use the demo account to test different strategies and try out the various features that are offered by eToro.

There is no limit to how long you can use the demo account for. It is a good idea to use demo trading until you are 100% confident with the share dealing platform.

It is possible to switch between demo and live trading on eToro. This means that you can use the demo account at any point in your trading journey to improve your abilities and practice new strategies.

Step 3: Fund your account

When you are comfortable with eToro, you can fund your trading account. The minimum deposit to buy shares with eToro is $50 in the UK. eToro accepts a variety of payment methods, including Skrill and Neteller.

Never invest more money than you can afford to lose. Buying shares is risky so it is important only to deposit funds if you are in a financially comfortable position. Unverified accounts are limited to a maximum deposit of $2,250. However, it is possible to deposit more than this once the account is verified.

It may take a few minutes for the funds to appear in your eToro account.

Step 4: Search for shares

The next step is to search for shares that you would like to buy. You can do this through the search bar tool or buy browsing through the explore page. eToro organizes shares in different categories which makes it possible to find options that meet your requirements.

At this stage, you could also experiment with social trading. Head to the discover section of the app and scroll down to find the news feed and copy trading sections. Here, it is possible to view what other traders are buying and selling.

Before buying any shares, conduct thorough research using a mixture of trading tools, financial news and sentiment analysis. Never invest blindly.

Step 5: Place an order

After conducting research and analysis, you can start buying shares on eToro.

Navigate to the share that you would like to purchase and click ‘invest’. Then, enter the amount of funds that you would like to buy the shares with. You can also set the rate at which you would like to execute the order. After entering the details, click ‘set order’.

The order will be executed when the price of the share hits the rate that you set in the order. When the order is executed, the shares will appear in your eToro portfolio.

What Is The Simplest Way To Buy Shares UK?

The simplest way to buy shares in the UK is to open an account with a regulated broker that provides a quick and easy registration process. For example, it is possible o create an account and start buying shares with eToro in minutes. It is also wide to choose a broker that is compatible with a fast payment method such as a debit card. Depositing funds through wire transfer can take a longer time which can slow down the process of buying shares in the UK.

Brokers should make the entire process of buying shares straight forward. This means offering an easy-to-use interface, clear platform navigation, good research and analysis tools and a simple order system. Our top brokers meet each of these requirements. We recommend taking a look through our full stock broker reviews before deciding which platform to choose.

Latest Shares News

Before rounding off this guide, let’s take a look at some of the biggest news stories in the stock market for the week beginning September 25th, 2023:

- It was a disappointing week in the stock market, with all major indices posting losses. The S&P 500 fell by 2.93%, while the FTSE 100 sank by 0.42%.

- The Federal Reserve opted to hold rates steady last week, which was widely predicted by analysts. However, the Fed revised its economic growth projections upwards, estimating a 2.1% rise in GDP this year.

- However, Fed Chair Jerome Powell did indicate that there will be one more interest rate hike before the end of 2023. Moreover, fewer rate cuts are to be expected in 2024 than investors had hoped for.

Conclusion

The process of buying shares in the UK has changed considerably over the past decade. No longer do you need to speak with a traditional stock broker over the phone to place your buy and sell orders. Instead, you simply need to choose a regulated online share dealing platform, deposit some money with your card – and then choose which stocks you want to buy.

Frequently Asked Questions about Buying Shares

Can you invest in foreign companies?

Who regulates UK share dealing sites?

What UK payment methods can I use to buy shares online?

What fees will I pay when I invest in stocks?

How do I buy shares listed on the AIM?

How do shares work?

What is a dividend per share?

How to buy IPO shares?

How to buy shares online without a broker?

Disclaimer: Investing in shares involves significant risk of loss and is not suitable for all investors. You should carefully consider your investment objectives, level of experience, and risk appetite before making a decision to buy shares. Most importantly, do not invest money you cannot afford to lose.