How To Buy Biogen Shares UK – With No Commission

Investing in healthcare stocks can be quite profitable due to their patent protection. In this how to buy Biogen shares UK guide, we dig into the company’s roots, explore their earnings, and how to buy the company’s shares without paying a penny in commission.

Step 1: Choose a Broker

Deciding on the broker, you want to invest in Biogen shares through is crucial as there are many of them in the market. Nonetheless, what should guide your decision is the fee structure and if the broker is regulated. To help you make this decision, this section presents an overview of two of our recommended stock brokers for the job.

1. Fineco – Affordable Share Dealing Platform to Buy Biogen Share

In terms of financial instruments, Fineco makes is a top platform to buy several assets. This includes UK shares such as HSBC, Tesco, and Royal Mail.

You also have access to an international share of companies such as Amazon and Tesla. Fineco also provides UK investors with access to the Toronto Stock Exchange to purchase cannabis stocks with ease. Besides stocks, investors can also engage in forex trading, commodity trading, indices, and derivatives trading. Fineco offers straightforward and competitive fees on share orders. For example, for the UK and European shares, you can expect to pay £2.95 and €3.95 respectively. The platform doesn’t charge a fee for deposits, but the funding option is limited to bank deposits. This means you can’t use options like credit cards or PayPal.

Pros

Cons

Your money is at risk.

Research Biogen Shares

It is only considered prudent that you know what you are putting your money into before investing. Understanding a company’s financial history and track record is vital in making an informed and logical decision.

Due diligence is very important when moving towards buying a company’s shares, and one means of verifying your data is to look at the past performance of the investment you are interested in.

To make this process easy for you, we have outlined some of the most significant milestones in the history of Biogen.

What is Biogen?

Founded in 1978 by the trio of Charles Weissmann, Heinz Schaller, Kenneth Murray alongside Nobel Prize recipients Walter Gilbert and Phillip Sharp, Biogen is an American multinational biotechnology company based in Cambridge, Massachusetts. The biotech company specializes in the discovery, development, and delivery of therapies to treat neurological diseases.

Biogen is a major player in the biotech field, focusing on finding solutions to degenerative diseases like multiple sclerosis, Alzheimer’s disease, Parkinson’s disease, and amyotrophic lateral sclerosis (ALS). It also focuses on less common conditions like spinal muscular atrophy (SMA) and supranuclear palsy (PSP). Biogen has grown exponentially in its 43-year history and is currently the world’s 280th most valuable company with a $62.43 billion market cap. Biogen has an operating revenue above $13 billion and currently employs 7,300 in over 37 countries.

Some of its well-known products are Avonex, Fampyra, Plegridy, Tecfidera, Tysabri, Spinraza, and also recently approved Alzheimer’s disease medication Aduhelm, also known as Aducanumab.

In regards to expansion, Biogen has over 75 subsidiaries spread across 37 countries. In its Q1 earnings call, Biogen CEO Michel Vounatsos noted that the company had realized total revenue of $2.7 billion and a non-GAAP EPS of $5.34.

Biogen forecasts that its total revenue would rise from $10.45 billion to $10.75 billion to provide full-year guidance for investors. Its non-GAAP diluted EPS would also experience a shift with it moving from $17 to $18.50 for the year 2021. However, capital expenditures would also surge by $50 million to $425 million for the set period. Vounatsos attributes this first-lap success to the company’s multiple sclerosis (MS), Spinraza (SZ), and biosimilars brands. Biogen is a publicly-traded biotech company, and you can find it in the NASDAQ stock exchange under the ticker BIIB.

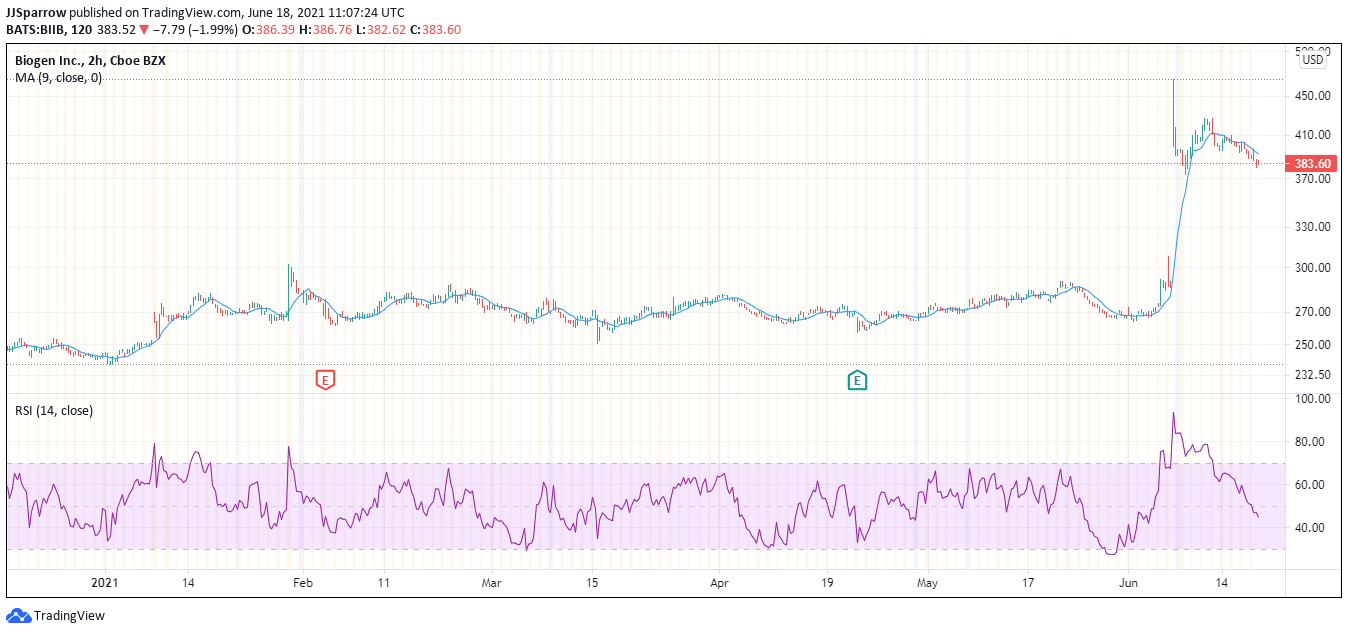

Biogen Share Price

One other metric you will need to make an informed decision is to look at the company’s share price and previous performance before buying Biogen shares. You will need to verify if investors are buying into the company and if there is a potential for the company.

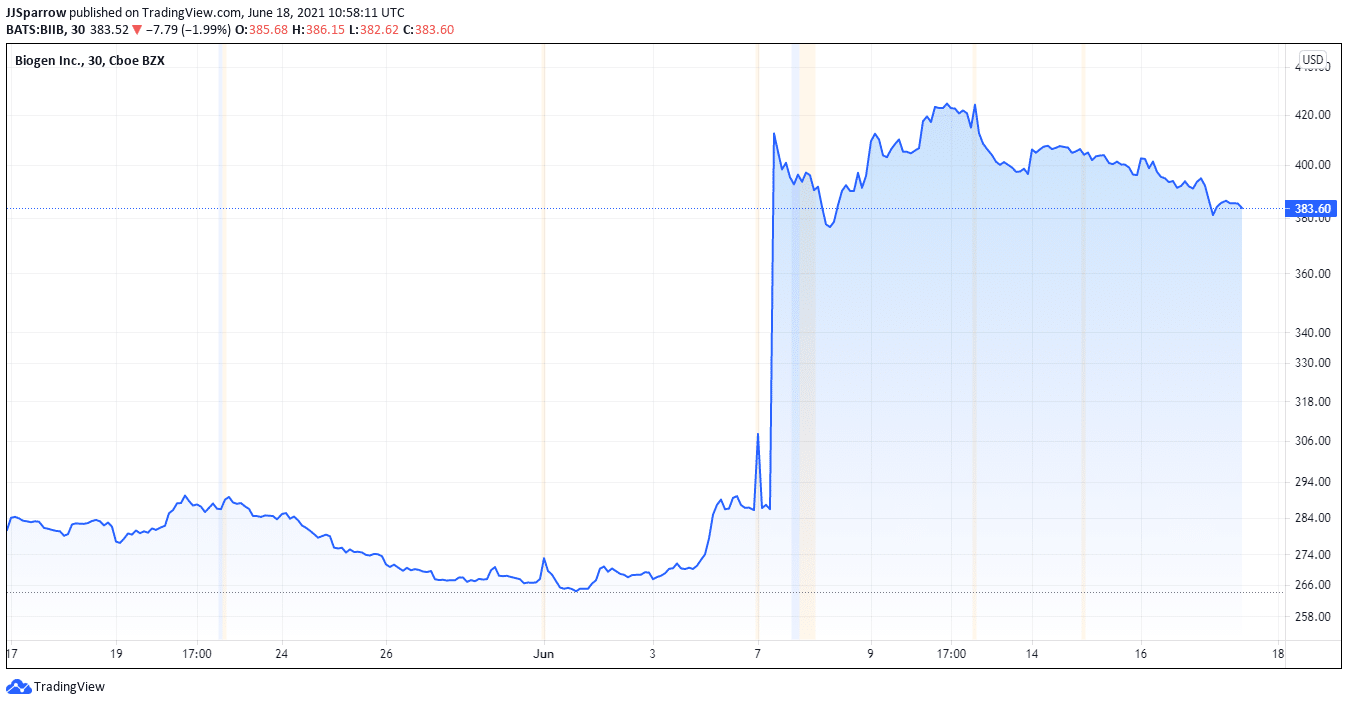

Regarding its share price, Biogen has performed phenomenally. Following the Food and Drug Administration (FDA) approval of its Alzheimer’s disease medication Aduhelm, also known as Aducanumab, Biogen has seen its fortune change overnight. A big reflector of its rise into the league of the best pharmaceutical stocks saw its value surge on the Nasdaq stock exchange. In the aftermath of the news, Biogen’s stock BIIB skyrocketed to an all-time high (ATH) of $395.85 from $109.71. This is its highest close since April 2015, surging 38.3%. It hasn’t stopped there but closed Thursday trade at $383.60. Following the resumption of the market, BIIB has seen volatility take some of the steam from it. This is following concerns about its recently approved memory-boosting drug.

Aduhelm has a checkered past and was once thrown into the trash after failing one of its phase 3 critical trials for patients in 2019. However, the FDA feels it is worth a trial and has included it in a temporary ‘accelerated approval’ phase as the government agency believes that Aduhelm can treat the underlying disease process of Alzheimer’s.

Following this approval, market analysts are forecasting that Biogen could make up to $17 billion in the sales of its amyloid clearing drug Aducanumab in the coming years. Biogen has put the annual expense for the drug at $56,000, further swelling speculation that it may make more from selling the drug.

More estimated earnings of $100 billion have been predicted, and this could see Biogen gaining a first-mover advantage. Going into the second quarter of the year, Biogen’s share price is only projected to surge even further on the back of this.

Looking at other financial metrics, we turn to Biogen’s price-to-earnings (P/E ratio), a performance metric that measures a company’s share price relative to the cost of its earnings per share (EPS). Known also as earnings multiple, the P/E ratio compares a company against its historical record or companies in the same industry. Data from analyst website Ycharts puts Biogen’s P/E ratio at $20.80 for June 11, 2021, which is a good indicator for the company’s stock.

Another metric we will be using to measure the viability of Biogen’s share price is earnings per share (EPS). EPS is a figure describing a company’s profit per outstanding share of stock, and according to official data, Biogen made $2.69 for the quarter just ended following a 66.71% decline year-over-year. However, its EPS for twelve months looks good, with a $19.41 valuation showing a 40% decline year-over-year while its one-year return stands at 41.95%. Trading at $390 at the close of the market, Biogen is definitely a good investment given the recent approval of its Alzheimer’s drug.

Biogen Share Dividends

Some investors buy shares for the price increase. Others engage in stock trading to earn high-yield dividend payments. If you’re part of the latter, it’s advisable you find out what you will be getting.

According to a company statement, Biogen does not pay dividends or a dividend reinvestment plan (DRIP).

Dividend payment has never been a part of Biogen’s business model, and investors have to look at the capital markets if they intend to make any gain from holding the shares of the biotech giant.

Are Biogen Shares A Good Buy?

Coming this far, you probably know enough about Biogen to make an informed decision on if it is a good buy. We’ve touched on fundamentals like the company’s historical records and possible future uptrend. All in all, an investor interested in Biogen should have no issue getting their hands on the company’s shares.

Biogen is publicly traded, making it a safe place for your investment, but you will need to do your own research (DYOR). You can start with this article and continue from here.

As regards its records, Biogen is pretty much open like every other public company, so you should not find it too hard to get the details.

However, Biogen’s recent spike may not hold for long given that it is buoyed on the accelerated approval of its Aduhelm drug. Accelerated approval basically lets the FDA release a drug for use in urgent cases for a seriously debilitating disease. It does not mean it has passed all the regulatory hurdles, but the FDA wants to use this to arrest the mortality rate for that illness. If the approved drug does not facilitate the expected results, the FDA can pull it out of the market at any time. Given this, even though Biogen is a good buy for your portfolio, things can change in a second, so make sure you are updated on patients’ responses to the Alzheimer’s drug.

Meanwhile, Biogen shares is one for the long term given the following reasons.

-

Aduhelm Use Is A Potential Gold Mine

Aduhelm is controversial for two things; first, it never scaled the phase 3 clinical trials in 2019. Biogen only recently discovered that it slowed the growth of amyloid plaques in the brain (protein-like accumulation) after going through its data and finding out that a tiny portion of patients who took large doses of the drug saw a statistical decline in the amyloid spread in their brain. Second, it works on only small or mild cases, with the drug having no effect on more severe cases.

The FDA is running with the statistical decline, claiming it uses the surrogate endpoint (as long as it attacks what causes the plaques). But Aduhelm is known to come with some serious side effects, with patients complaining of brain swelling, diarrhea, confusion, and some others. Biogen has recommended brain scans to monitor complications.

In the interim, Aduhelm’s temporary approval can be the company’s goldmine. With a $62.43 billion market cap, Biogen could rival Amgen when its Aducanumab drug rolls into US hospitals.

-

Aduhelm Heralds Biogen Into A Golden Era

Another likely outcome is Biogen riding on the tide of its Aducanumab success and moving into previously untested waters. With the company now facing stiff competition in its MS and SZ sections, Biogen can use the revenue from Aduhelm to move into new markets and further expanding its operations.

Buy Biogen Shares With 0% Commission

In this how to buy Biogen shares guide, we have found Fineco Bank to be the preferred broker to trade this stock. Fineco is a reputable broker known for its zero-commission trading, social trading features, access to hundreds of stocks, including Biogen. In addition, Fineco provides UK traders with access to forex trading, indices, bonds, cryptocurrencies, and commodities. The platform is also regulated by the Financial Conduct Authority (FCA) in the UK, which means signing up on Fineco comes with investor protection. This is important when trading stocks online. The Fineco platform is user-friendly, making it easy for users to place trades in minutes. You can fund your account in minutes using your debit or credit cards, bank transfers, Skrill, Neteller, and others. There’s a minimum deposit of $200 required to get started

FAQs

How much does it cost to buy Biogen Shares?

At the moment, one share of Biogen shares goes for $386.08, which is a lot for retail investors. In addition to this, some brokers charge a commission to open a position, which is calculated according to the position size of your investment.

Does Biogen pay dividends?

No. Biogen does not offer a dividend reinvestment plan (DRIP).

What is the minimum number of Biogen shares I can buy?

Traditional brokers will require you to buy at least a share of Biogen before you can open a position.

Is Biogen A Good Buy?

Degenerative diseases have been a major source of concern for health practitioners. Given the advancement in technology, companies in this line of business are constantly battling to provide a cure for these diseases. Biogen’s Aduhelm approval puts it at the forefront of the fight against Alzheimer's disease and dementia. If the drug can reduce the growth of amyloid in small or mild Alzheimer cases, Biogen may see its stock value rival the likes of Amgen in the next few years.

Where is the best place to buy Biogen shares in the UK?

We recommend using a standard broker, given its social trading platform and commission-free trades.