10 Popular Tech Stocks Amongst UK Investors

Although US stocks like Apple and Amazon get much of the attention lavished on the tech industry, the NASDAQ isn’t the only place to find tech stocks. In fact, the London Stock Exchange is home to more than 200 fast-growing UK tech companies.

Many of these technology companies don’t share the extreme valuations of their cousins across the pond. In this guide, we’ll take a closer look at 10 UK tech stocks that you can research in 2025.

-

-

List of Popular UK Tech Stocks Stocks 2025

- dotDigital – Fast-growing marketing platform

- Sage Group – Transitioning to SaaS accounting

- Keywords Studios – Powering the world’s video games

- GB Group – Building identity management solutions

- Moneysupermarket.com – Inexpensive UK fintech stock

- Blue Prism Group – Enabling back-end business automation

- Ocado – Leading online grocery tech

- FDM Holdings – Highly profitable tech consulting

- Team17 – Mid-cap video game maker

- RightMove – Dominant company in online home buying

UK Tech Stocks Reviewed

1. dotDigital

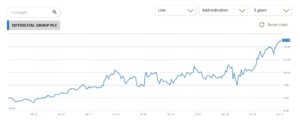

dotDigital (DOTD) specializes in email marketing and offers groundbreaking Engagement Cloud technology. This platform gives companies a huge suite of tools to make their marketing campaigns more effective, making dotDigital an essential partner for virtually every large company in the UK and beyond.

dotDigital (DOTD) specializes in email marketing and offers groundbreaking Engagement Cloud technology. This platform gives companies a huge suite of tools to make their marketing campaigns more effective, making dotDigital an essential partner for virtually every large company in the UK and beyond.In fact, more than 4,000 brands currently use dotDigital’s software.

dotDigital had a strong 2020, growing 56% to 162p by the end of the year. Despite that, the company’s price-to-earnings (PE) ratio is sitting at a very inexpensive 27.2. The company pays a modest dividend of 0.66%, and it has enough cash on hand to cover that payout more than 5 times over.

.

2. Sage Group

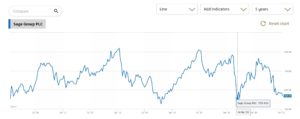

Sage Group (SGE), which produces online accounting software, had a much more difficult 2020 than the rest of the tech sector. As the company switched to subscription services, it reported a drop in operating profits of 3.7%. Although that doesn’t sound like much, most other tech companies, including US competitor Intuit, were extremely successful last year.

In response to the news, Sage Group’s share price dropped 17% in the month of December. However, we think that’s an overreaction by the market. Sage managed to increase its recurring subscription revenue by 20% in 2020 and is making a concerted effort to move its customers onto a high-revenue SaaS model.

The company has a PE ratio of 25.4 and a valuation of £6.24 billion. It also sports a dividend yield of 2.4%.

3. Keywords Studios

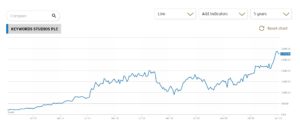

Keyword Studios (KWS) is a powerful company in one of the fastest-growing industries in the world: video gaming. This company provides art, development, audio, and quality control services for 23 of the game developers in the world, such as Nintendo, Activision Blizzard, and Electronic Arts.

The firm had a banner year in 2020 despite the COVID-19 pandemic. In fact, Keyword Studios announced that its work from home policy actually helped cut down operating costs and boosted its bottom line. Investors took note of the company’s gains, boosting the shares by nearly 95% last year and giving Keyword Studios a £2.1 billion market cap.

The video game industry is rapidly expanding, which means more business from all of the Keywords’ clients. In addition, the company just acquired a small competitor, g-Net Media, to build out its marketing capabilities.

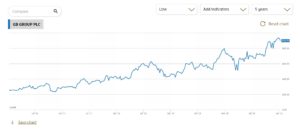

4. GB Group

GB Group (GBG) is another tech stock to watch in a burgeoning industry. This company builds identity management solutions for blue chip companies like Nike and IBM, as well as for banks like HSBC. The company has seen strong customer retention.

GB Group shares have more than doubled in the past 3 years and grew 30.5% in 2020. The company currently has a market cap of £1.8 billion and a PE ratio of 66.

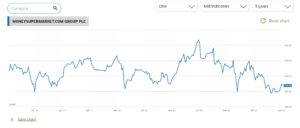

5. Moneysupermarket.com

Moneysupermarket.com (MONY) was one of the few tech stocks in the UK to end 2020 with a lower share price than it started with. In fact, the company is actually down around 15% over the past 5 years.

The company is trading with a PE of just 18.7, making it one of the least expensive UK tech stocks. In addition, the company pays out a dividend yield of over 3.5%.

The company lost revenue from its travel insurance and personal finance divisions thanks to the UK and European lockdowns and slow issuance of new loans by UK banks.

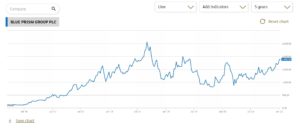

6. Blue Prism Group

Blue Prism Group (PRSM) could be a UK tech stock to watch in the years ahead. This software company uses artificial intelligence and basic coding to automate back-end office processes. That might not be the most exciting use of artificial intelligence, but it’s one of the most important applications from the perspective of cutting down on business costs.

In the short term, however, Blue Prism shares suffered due to the lockdowns since the company couldn’t bring on new business in the middle of a crisis.

The company isn’t yet profitable.

7. Ocado

Ocado (OCDO) was one of the hottest stocks in the FTSE 100 in 2020, in large part thanks to the COVID-19 pandemic. This UK tech company builds automated warehouses for online grocery fulfillment – something that didn’t seem like a huge deal until lockdowns came into effect around the world. It also has a joint venture with Marks & Spencer to deliver that grocer’s food around the UK.

Ocado shares jumped more than 90% in 2020, and the company recently raised earnings guidance following the December lockdown in the UK. Ocado doesn’t have the market share to challenge established supermarket stocks like Tesco, but the real value of this company lies in its ability to partner with existing supermarkets. For example, Ocado is helping Kroger build 20 new automated warehouses in the US.

For now, consider Ocado a high risk investment.

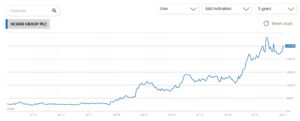

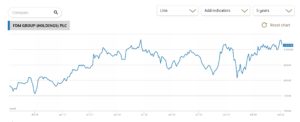

8. FDM Holdings

FDM Holdings (FDM) isn’t the most flashy tech company in the UK, but it is one of the strongest performings. This company trains businesses’ employees in IT and administrative practices, as well as deploys its own team of IT consultants that can work in-house in any business where they’re needed.

The demand for this type of consulting is bigger than many investors realize. FDM Holdings has nearly doubled its revenue over the past 5 years and has profits of over £40 million. It also pays out a generous 3.3% dividend yield and has a PE ratio of just 28.

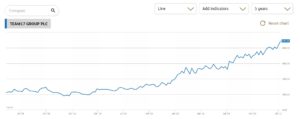

9. Team17

Team17 (TM17) shares nearly doubled in 2020 and this company’s momentum shows no signs of slowing. The video game maker has produced several wildly popular games for Xbox and Playstation 5, and there’s no shortage of demand for new games in this market.

Team17 is listed on the AIM and has a market cap of just over £1.1 billion, which may be too small for some investors. It has a PE ratio of 59.

10. RightMove

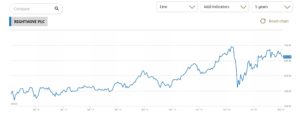

RightMove (RMV) is revolutionising the way that people buy and sell property in the UK. Through this FTSE 100 company’s online portal, owners can list their homes and buyers can browse through available properties.

RightMove dominates online home buying in the UK. The company controls more than 85% of the online home buying market share in the UK and has more than 50% as many online listings as any competitor.

The company has a very reasonable PE of 40 and the shares actually ended 2020 slightly down from where they started.

Why do Some Traders Invest in Tech Stocks?

Tech stocks were among the highest-flying investments in 2020 when the coronavirus pandemic accelerated trends towards eCommerce, remote work, and automation. Now, in 2021, many investors are wondering whether UK tech stocks can fly even higher.

Technologies like artificial intelligence, cloud computing, and Bitcoin are fundamentally changing the way the world does business. The potential market for UK tech is global and any company that doesn’t adopt new tech faces an uphill battle in the years ahead.

UK tech stocks haven’t received the same attention as US stocks like Apple, Amazon, Netflix, Tesla, Microsoft and others. They are often worth a few billion pounds as opposed to over $1 trillion dollars.

Important Features of Tech Stocks

The first is to look across the market and see which companies have a technology that is truly unique. Many tech companies are filling niches that until a few years ago didn’t exist.

Another thing to consider is valuation. Many tech stocks have lofty valuations with PE ratios that make them surprisingly expensive compared to other UK shares. These high PE ratios may be justified if a company has a lot of future growth potential – and it’s up to you to decide if that’s the case. You can also search for tech stocks with relatively low PE ratios, and then analyse these to determine if other investors are missing out on a potential winner.

However you conduct your analysis, it’s important to remember that UK tech companies aren’t operating in a bubble. Tech is, by its very nature, global. So, UK tech stocks are competing against companies from the US, mainland Europe, and Asia. Before investing in a tech company, make sure that you know who its competitors are and how their products or services compare.

UK Tech Stock Brokers in the UK

In order to buy UK tech stocks, you’ll need a stock broker that offers trading on the London Stock Exchange (LSE).

If you want to trade derivatives like options, make sure to pick a broker that offers these instruments. In addition, be sure to take a close look at the trading tools your brokerage gives you.

Popular UK Tech Stocks – Conclusion

UK tech shares are often much less expensive than their US counterparts. If you’re looking for UK tech companies to research in 2025, check out our list above.

FAQs

Can I buy UK tech stocks through an ETF?

Yes, many ETFs that cover the FTSE 100 or FTSE 250 include UK tech stocks. You can also find global tech stock ETFs that include UK tech companies alongside US, European, and Asian tech companies.

Do UK tech companies pay dividends?

Tech companies aren’t known for paying high dividends, but some tech stocks in the UK do make payments to shareholders. For example, Sage Group and Moneysupermarket.com both pay dividends.

What is a stock’s PE ratio?

The price to earnings (PE) ratio compares a company’s share price to its earnings per share. The average PE ratio for the FTSE 100 is around 13.7, although most tech stocks are more expensive than this.

Are tech stocks considered growth stocks?

Most tech stocks are considered growth stocks, especially in the UK where the tech market is still growing rapidly. However, some mature tech stocks may have less volatility than their small- and mid-cap peers.

Should I invest in UK or US tech stocks?

UK and US tech stocks tend to have very different valuations. Tech stocks in the US are among the most popular and expensive stocks in the world. Tech stocks in the UK are expensive, but they typically come with much less extreme PE ratios and some pay dividends.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Sage Group (SGE), which produces online accounting software, had a much more difficult 2020 than the rest of the tech sector. As the company switched to subscription services, it reported a drop in operating profits of 3.7%. Although that doesn’t sound like much, most other tech companies, including US competitor Intuit, were extremely successful last year.

Sage Group (SGE), which produces online accounting software, had a much more difficult 2020 than the rest of the tech sector. As the company switched to subscription services, it reported a drop in operating profits of 3.7%. Although that doesn’t sound like much, most other tech companies, including US competitor Intuit, were extremely successful last year.

Keyword Studios (KWS) is a powerful company in one of the fastest-growing industries in the world: video gaming. This company provides art, development, audio, and quality control services for 23 of the game developers in the world, such as Nintendo,

Keyword Studios (KWS) is a powerful company in one of the fastest-growing industries in the world: video gaming. This company provides art, development, audio, and quality control services for 23 of the game developers in the world, such as Nintendo,

GB Group (GBG) is another tech stock to watch in a burgeoning industry. This company builds identity management solutions for blue chip companies like

GB Group (GBG) is another tech stock to watch in a burgeoning industry. This company builds identity management solutions for blue chip companies like

Moneysupermarket.com (MONY) was one of the few tech stocks in the UK to end 2020 with a lower share price than it started with. In fact, the company is actually down around 15% over the past 5 years.

Moneysupermarket.com (MONY) was one of the few tech stocks in the UK to end 2020 with a lower share price than it started with. In fact, the company is actually down around 15% over the past 5 years.

Blue Prism Group (PRSM) could be a UK tech stock to watch in the years ahead. This software company uses artificial intelligence and basic coding to automate back-end office processes. That might not be the most exciting use of artificial intelligence, but it’s one of the most important applications from the perspective of cutting down on business costs.

Blue Prism Group (PRSM) could be a UK tech stock to watch in the years ahead. This software company uses artificial intelligence and basic coding to automate back-end office processes. That might not be the most exciting use of artificial intelligence, but it’s one of the most important applications from the perspective of cutting down on business costs.

Ocado

Ocado

FDM Holdings (FDM) isn’t the most flashy tech company in the UK, but it is one of the strongest performings. This company trains businesses’ employees in IT and administrative practices, as well as deploys its own team of IT consultants that can work in-house in any business where they’re needed.

FDM Holdings (FDM) isn’t the most flashy tech company in the UK, but it is one of the strongest performings. This company trains businesses’ employees in IT and administrative practices, as well as deploys its own team of IT consultants that can work in-house in any business where they’re needed.

Team17 (TM17) shares nearly doubled in 2020 and this company’s momentum shows no signs of slowing. The video game maker has produced several wildly popular games for Xbox and Playstation 5, and there’s no shortage of demand for new games in this market.

Team17 (TM17) shares nearly doubled in 2020 and this company’s momentum shows no signs of slowing. The video game maker has produced several wildly popular games for Xbox and Playstation 5, and there’s no shortage of demand for new games in this market.

RightMove (RMV) is revolutionising the way that people buy and sell property in the UK. Through this FTSE 100 company’s online portal, owners can list their homes and buyers can browse through available properties.

RightMove (RMV) is revolutionising the way that people buy and sell property in the UK. Through this FTSE 100 company’s online portal, owners can list their homes and buyers can browse through available properties.