Price Action Trading UK Guide 2025

Most styles of day trading rely heavily on technical indicators and highly tested strategies. But some traders will argue that there’s no need to look at indicators when you could go right to the source of market movements – price.

Price action trading is a type of trading that uses current price movements to predict what the price is going to do next. This fast-paced trading style is growing in popularity, especially as high market volatility presents challenges to traditional market indicators.

Want to jump into price action trading in the UK? We’ll explain what price action trading is and how it works. We’ll also cover price action trading strategies and review popular UK brokers you can start trading with today.

What is Price Action Trading?

Price action trading is an approach to trading that looks primarily at price movements to predict where an asset is going next. This is in contrast to other styles of day trading, which rely on technical indicators to make decisions about the future price of an asset.

Price action trading in the UK can involve looking at technical studies and indicators. However, price will always be the main driver of trading decisions. Generally, price, trading volume, and the speed of price changes are the main factors that price action traders consider when buying or selling.

One of the interesting things about price action trading is that it can be very subjective. Given a single setup, two price action traders may come to very different conclusions about where the price is heading.

The subjective nature of UK price action trading can be a good thing and a bad thing. On the one hand, it means that you can easily craft a custom price action trading strategy that won’t be overrun by other traders in the marketplace. On the other hand, it means that there can be a lot of emotion attached to price action trading that can lead to risky trading decisions.

What Assets are Popular for Price Action?

You can create a price action trading system for almost any type of asset. That said, UK price action trading is popular with volatile assets that see a lot of rapid, high-volume price changes. Price action forex trading and stock trading are particularly popular since these assets undergo big price swings throughout the trading day.

Price action trading can also be used to trade around news and market events. Commodity trading is often affected by market news and economic announcements, for example.

You can also build price action trading strategies around ETF trading or options trading. However, beware that these assets may trade with relatively low liquidity. As a result, it can be difficult to enter or exit positions quickly.

Price Action Trading Strategies

Since price action trading in the UK tends to be subjective, it’s up to you to find price action trading strategies that work for you. Generally, price action traders will look for several different setups throughout the day. Sticking to a single pattern or price setup can limit the number of trading opportunities you find.

While many price action trading systems don’t include technical indicators, candlestick patterns can often provide insight into what an asset’s price will do next. Candlestick charts are widely used because they clearly show buying and selling activity within a time interval, instead of only showing the opening and closing prices.

Let’s take a closer look at three price action trading strategies you can try.

Three Line Strike

The three-line strike is a candlestick pattern that typically indicates a powerful reversal. This pattern forms when three bearish candlesticks form in a row, each one extending the downtrend from the prior interval. The fourth candlestick is the reversal – this candlestick should open below the prior candlesticks, but then close above the top of the first candlestick.

Ideally, the reversal candlestick should be accompanied by a relatively strong trading volume. This indicates that the reversal is being supported by buying action across the market and the new bullish trend is likely to continue.

Evening Star

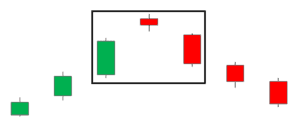

The evening star pattern is widely used for price action forex trading. This price action trading strategy predicts a reversal from a bullish trend to a bearish trend.

The pattern begins with a large bullish candlestick at the end of an uptrend. This candlestick is followed by an even higher candlestick that gaps up, but which closes slightly lower than its opening price on low trading volume. The evening star pattern finishes with a bearish candlestick that gaps down from the second candlestick.

Bull Flag Breakout

The bull flag breakout pattern is another popular price action trading strategy. It begins with a tall bullish candlestick, which becomes the flag pole in this pattern. The pole is followed by several candlesticks in which the price moves sideways or slightly down. These candlesticks serve as the flag.

At the end of the flag, look for another strong bullish candlestick to initiate the breakout. You can trade before the breakout to capture this upside, but beware that it does not always form.

Main Features of Price Action Trading UK

Just like scalping trading, price action trading can be difficult to master, but it comes with a variety of elements that make it popular among some traders.

Flexible Strategies

One of the most popular benefits of price action trading in the UK is that it is flexible. You can use many different trading strategies depending on what asset you’re trading or the market conditions. That’s a benefit because it means that you can find trading opportunities no matter what the market is doing.

In addition, unlike other types of trading, you’re not locked into trading on any specific setup. There is plenty of room in UK price action trading for interpretation as to whether a specific chart pattern fits your criteria buying or selling.

Real-time Data

Price action trading relies primarily on price, so you’re looking at the latest market data. This is in contrast to looking at technical indicators, which typically lag the market by at least a few minutes. Price is the main data point upon which all indicators are based, and with price action trading you go straight to the source.

Choose Your Own Risk

One more feature with UK price action trading is that you have plenty of flexibility to choose your own risk tolerance. If you’re not confident in a particular setup, you’re free to skip it. Alternatively, you can use price data to decide how to set stop losses for your price action trading strategy.

Price Action Trading Risks

Price action trading systems are inherently subjective, which brings some important risks. Any time there is emotion involved in your trading, there is the potential to make mistakes or to become invested in trades even as they go against you.

Setting stop losses with your trades can help mitigate this risk. Stop losses take real-time decision-making out of when to exit a losing trade. So, you can commit to a maximum allowable loss before entering into a price action trade in the first place.

Another thing to consider when price action trading is that it doesn’t lend itself well to automation. If you’re price action forex trading, for example, you may not be able to take advantage of forex signals or forex robots. This isn’t necessarily a major drawback, but it’s worth considering when deciding whether price action trading in the UK is right for you.

Popular Price Action Trading Platforms

Choosing the right price action trading platform is an important component of your success. Of course, a price action trading platform should have highly advanced price charts and drawing tools so you can analyze price movements in real-time. Some brokers even offer the ability to trade right from your charts, which can speed up the order entry process.

You’ll also want to think about what assets a UK price action trading broker offers, particularly if you want access to multiple markets.

With all that in mind, let’s review five of the most popular price action trading platforms in the UK:

1. FXCM

Another feature when price action trading with FXCM is that it comes with a variety of advanced trading platforms. You can use MetaTrader 4 for forex trading or NinjaTrader or Trading Station for charting stocks, commodities, and cryptocurrencies. FXCM also integrates with Trading View, which is a social network where price action traders post strategies and ideas.

If you want to dive into social price action trading, FXCM also integrates with ZuluTrade. With this platform, you can copy other price action traders without any work on your part. Or list your own trades and get paid every time someone else copies your trades.

| Stock Trading Fees | 0% commission + spread |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | No |

| Monthly Account Fees | No |

Sponsored ad. There is no guarantee you will make money with this provider.

2. IG

A popular reason to trade with IG is that you get access to some of the most advanced trading platforms on the market. Price action forex traders can use MetaTrader 4 for charting and analysis, while all other traders get access to ProRealTime. Both of these software platforms support backtesting strategies as well as offer the ability to place trades right from your charts.

MetaTrader 4 and ProRealTime each come with mobile apps to enable you to trade on the go. You can create price alerts or trading signals to stay on top of market movements. Plus, it’s possible to switch back and forth between your smartphone and desktop.

| Stock Trading Fees | £8 per trade (£3 for active accounts) |

| Deposit Fees | No (0.5% – 1% for credit cards) |

| Withdrawal Fees | No (£15 for international bank transfers) |

| Inactivity Fees | £12 per month after two years |

| Monthly Account Fees | No |

Sponsored ad. There is no guarantee you will make money with this provider.

3. Plus500

Plus500 also makes price charting simple. The web-based charting software is suitable for beginner traders to navigate. In addition, Plus500 offers a mobile trading app that gives you access to advanced candlestick charts on your smartphone. You can set price alerts on the desktop and have them pushed to your phone.

All CFD trading with Plus500 is commission-free. Finally, the platform is light on non-trading fees.

| Stock Trading Fees | 0% commission + spread |

| Deposit Fees | No |

| Withdrawal Fees | No |

| Inactivity Fees | $10 (£7.60) per month after three months |

| Monthly Account Fees | No |

Key Points when Price Action Trading UK

- Can be used for most types of assets

- Build your own personalized trading strategy

- Use multiple strategies to increase trading opportunities

- Set your own risk level for any trade

- Less reliance on confusing technical indicators

- Subjective interpretation of trade conditions

- Emotions can play a role in trading

- Not easily integrated with trading signals

How to Start Price Action Trading

Ready to start price action trading in the UK? The steps below will show you how to do so with an FCA-regulated broker:

Open a Price Action Trading Account

You’ll need a brokerage account in order to start price action trading in the UK. Head to your chosen broker’s homepage and create a new account. Enter a username and password, then fill in personal details like your name and email address.

To comply with government regulations, FCA-brokers require that you verify your identity. You can complete this step online by uploading a copy of your passport or driver’s license and a copy of a recent bank statement or utility bill.

Fund Your Trading Account

You can usually deposit funds to your trading account by debit or credit card, using an e-wallet like Neteller or Skrill, or through a bank or wire transfer.

Place Your First Price Action Trade

Now you’re ready to start price action trading. To find a potential setup to trade, search for an asset in your dashboard, then click ‘Trade’ to open a new order form. Enter how much money you want to trade, and set a stop loss level to protect your downside risk. When you’re ready, click confirm the transaction to open your first UK price action trade.

Conclusion

UK price action trading is a popular trading strategy that relies on price movements to determine where an asset is headed next. Price action trading systems can be used to trade almost any type of asset. It’s important to remember that most price action trading strategies are subjective, so you’ll want to be cautious when committing to trading decisions.

If you’re looking to begin trading, you can do so with an FCA-regulated broker that offers the assets that you are interested in.