How to Buy Synairgen Shares UK

Synairgen deals is a biotech company based in the UK . For users looking to invest in the biotech sector, we have conducted a review on the historical price and the financials of Synairgen. This guide shows you How to Purchase Synairgen Shares UK from popular brokerages as well.

How to Purchase Synairgen Shares UK

If you are interested in purchasing Synairgen UK, you can get started with a suitable platform that meets your trading needs. Most platforms will let you do so in 4 simple steps.

Step 1: Open an account – Head to the official website of your platform and begin the account creation process. Fill in a valid email address, username, and password.

Step 2: Upload ID – Upload a copy of your ID (driver’s license or official passport) and proof of address (bank statement or utility bill) as proof of identity.

Step 3: Deposit Funds – Users can make a minimum deposit of $50 via bank wire transfer, PayPal, credit card, debit card, and several other options.

Step 4: Purchase Synairgen Shares UK – Type the ticker symbol into the search bar and click the ‘Trade’ button. Enter the amount you want to invest and click ‘Open Trade’ to get started.

Step 1: Choose A Broker

Users need to select a broker before purchasing Synairgen shares. This is an important step as stock brokers generally serve as intermediaries to the financial markets, enabling buyers and sellers to interact.

However, you need to select a broker with guaranteed security, regulatory coverage and low fees. This section covers two reviews of popular brokers available to invest within the UK.

Fineco Bank

Finco Bank is another platform that lets users purchase Synairgen and other shares. Operating traditionally as a conventional bank, Fineco offers financial trading services. Founded in 1997, Fineco is a leading broker with more than a decade of facilitating financial transactions in the stock market.

Finco Bank is another platform that lets users purchase Synairgen and other shares. Operating traditionally as a conventional bank, Fineco offers financial trading services. Founded in 1997, Fineco is a leading broker with more than a decade of facilitating financial transactions in the stock market.

It’s regulated by the UK’s FCA and the Italian Market Authority (CONSOB). This makes it a safe platform to trade securely. Meanwhile, Fineco offers contracts for differences (CFDs) trades, and you may trade Synairgen shares without necessarily holding the asset.

Leveraged trades are also offered on Fineco up to 1:30 for FX currency pairs, 1:20 for commodities like gold, indices, and several minor FX pairs. Leverage is set at 1:5 for stocks, and allows users to short-sell their assets anytime you need. Fineco offers investors a large exposure for stock trading, ETFs, and other investment assets.

It does not charge for deposits and monthly fees and offers low-cost trades with no extra hidden fees. You also pay no inactive or withdrawal fees.

Like eToro, Fineco offers a web trading platform and mobile app.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Research Synairgen Shares

Synairgen’s Interferon-beta treatment for Covid-19 patients is a major update for the company. However, for users looking to invest in the stock, you may want to get a better understanding of the company’s financials and past performance.

Given the important role research plays in determining a company’s future potential performance, we have highlighted some key details, including its stock market performance.

What is Synairgen?

Since the outbreak of the Wuhan-generated illness in early 2020, Synairgen has focused on finding a cure or stop-gap measures in addressing the viral spread of the respiratory infection. This led the biotech company down the path to SNG001 or inhaled interferon beta, currently undergoing clinical trial.

According to the Southern England biotech giant, its interferon-beta treatment was conducted in a double-blind, placebo-controlled trial that saw 101 Covid patients from nine specialist hospitals taking the drug. The company said that patients who were administered SNG001 had a 79% lower risk of developing severe diseases than those who received a placebo. Those who got the interferon drug were twice more likely to recover from Covid-19 complications than those who were fed dummy drugs.

Also, the average time patients spent in hospitals were significantly reduced by a third – down from an average of nine days to six days. Interferon beta is one of the first defenses against viral diseases as it warns the body against an attack. According to the Synairgen team, its treatment is inspired by the body’s immune structure. SARS-CoV-2 penetrates the body by suppressing its production, thereby reducing the victim’s response to infection.

SNG001 seeks to boost this primary line of defense by delivering interferon-beta directly to the patient’s airways through a nebulizer which turns the protein into an aerosol. This is meant to trigger a stronger anti-viral response, even in patients whose immune systems have been severely hampered by respiratory disease. So far, SNG001 has undergone various clinical trials and is peer-reviewed on The Lancet Respiratory Medicine Journey. It has also been effective against Covid variants, particularly the UK and South Africa morphs. But its patient base is still minimal, and this has seen its approval delayed.

However, the Chief Scientist in charge of the trial, Tom Wilkinson, believes in the efficacy of the treatment for patients with severe respiratory issues. According to him, if the results are confirmed in larger studies, then the treatment will be a “game-changer” for the fight against the Wuhan-like respiratory illness. Explaining further the intricacies behind the SNG001 project, Wilkinson said,

“This pH neutral, inhaled interferon beta-1a formulation (SNG001) provides high, local concentrations of immune protein which boosts lung defenses rather than targeting specific viral mechanisms.

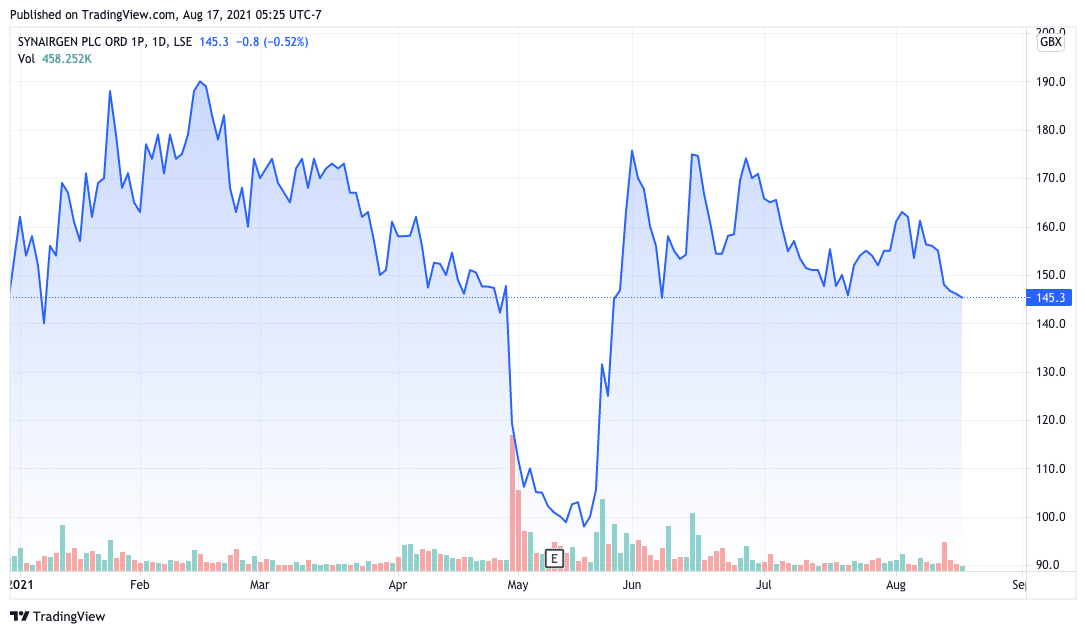

Synairgen Share Price

Synairgen’s share price has been wildly impacted by the announcement of its game-changing Covid treatment. At press time, Synairgen share price is currently trading at £145.20. This shows a 37.58% drop by £87.41 in the last year. However, the SNG stock has not been performing badly since it launched on the London Stock Exchange trading floor (LSE).

It had a somewhat lackluster performance from 2017 to 2019, trading below the £50 price target.

2020 presented a pivotal year for the company, with the UK-based biotech company catching the eye of investors when it announced the results of its SNG001 tests on over 100 severely affected patients. This saw it shoot up 500% from its December 2019 low of £7.58 to £61.63 in early April 2020. After losing steam, Synairgen became an overnight success when it surged to 246.53 on August 21, 2020. It subsequently dipped, moving below the £200 mark but has mainly retained its price average above £130.

Despite its intra-day dip of 37.58%, Synairgen has posted massive returns for investors averaging an astounding 305.70% growth in stock value in the last five years.

Synairgen Shares Dividends

Some investors invest into a company’s stock due to the passive revenue in dividend payments they can earn from holding its stock. However, Synairgen does not offer share dividends for investors at the moment. Much like many unprofitable companies, Synairgen is going through its cash burn phase.

Synairgen ESG Breakdown

Environmental, social, and governance (ESG) factors are becoming increasingly important in investors’ decisions in the last few years. Now, companies are scrutinized for their environmental impact to know if they have been meticulous in running their operations. To help us understand how Syanirgen performs in this vital asset score, we need to carry out an ESG rating with CSR Hub.

Data below shows the biotech company’s ESG awareness:

- Environmental – 63/100

- Social – 51

- Governance – 49

Are Synairgen Shares A Valuable Investment?

Before taking an investment decision, be aware that a company’s growth is mainly based on several circumstances and is not set in stone. This means it may go up or down. Another thing you should also keep at the back of your mind is if the company’s services make it a sustainable business for the long term.

However, two things work in Synairgen’s favor. First is its share price, which has shown remarkable growth in the last two years. It has grown more than 1,000% since dipping to £7.58 in late 2019.

Synairgen continued to post strong returns reaching its all-time high during the toughest period of the human fight against viral infections. Another is its phenomenal breakthrough in the treatment of the global pandemic. Biotech companies are becoming increasingly popular, especially if they are involved in the Covid-19 fight. Synairgen’s SNG001 is one such solution.

However, the result of Synairgen’s treatment will not be known for at least a few years. Users should make sure to conduct their own research and analysis as well, before investing any money into the company.

Step 3: Open an Account and Purchase Shares

The first step is to create an account with a popular broker. After you pick a suitable broker that can provide you with competitive rates, low fees and multiple tools & features, follow this step-by-step guide to investing in shares.

Step 1: Create an account

To do this, visit the official homepage of your chosen broker and begin the sign-up process. Most brokers will require users to provide their personal information, along with a username and password.

Step 2: Verify your Identity

Most brokers will require you to complete a quick verification process before investing in shares. Upload a copy of your driver’s license or official passport and a copy of your proof of address (a recent copy of your bank statement or utility bill is enough). Your documents will be verified within minutes, and users can head down to the next stage.

Step 3: Make a Deposit

To purchase Synairgen shares UK, the popular brokers may require a minimum deposit beginning at $10. Depending on the chosen broker, you may expect to make your transaction with credit/debit cards, online bank transfers and e-wallets like PayPal.

Choose your preferred deposit method and add cash into your trading account.

Step 4: Purchase Shares

Once the deposit is complete, users will be able to invest in any shares you want. To do this, type in the ticker symbol of the asset into the search tool on the dashboard. Assign the amount of money you wish to enter into the trade, and confirm your transaction.

Conclusions

Synairgen is a leading biotechnology company based in the UK. As with other companies in the sector, Synairgen’s share price had been positively impacted by the coronavirus. Over the last 12 months, the company’s share has grown from 76.5 p to about 250.45 pence. The company’s inhaled drug SNG001 has proved a major success so far, despite not being a vaccine.

However, investors who want to enter the share at the current price should make sure to do some research and analysis and make a well-informed decision.