How to Buy Rolls-Royce Shares UK – Beginner’s Guide

Rolls-Royce Holdings PLC is a UK-based engineering company that designs, manufactures, and sells power systems for aviation and several other industries. It is the world’s second-largest manufacturer of aircraft engines and is one of the three major manufacturers dominating the power systems industry. Further, Rolls Royce is an FTSE 100 composite with a market capitalization of £8.73B as of May 2021.

In this guide, we show you how to buy Rolls-Royce shares online in the UK. We also highlight popular brokers you can use to buy shares online and analyse Rolls-Royce Holdings PLC’s share price history.

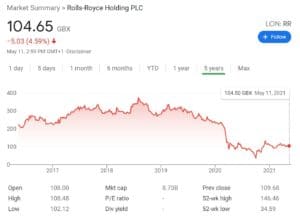

To make things easier for you, let’s take a closer look at two of the most popular UK brokers that allows you to trade shares of Rolls Royce Holding plc. If you are interested in shorter-term trading, you might be more suited for a CFD platform like Plus500. The online trading platform not only gives you access to thousands of financial instruments but also allows you to leverage your capital with a 5:1 ratio on shares. The reason why Plus500 has become one of the most popular CFD brokerage firms in the United Kingdom and worldwide is its convenient platform, and low-cost pricing structure. The broker gives you the option of managing your account via its web-based platform or mobile trading app. It is also worth mentioning that you will get access to built-in price alerts, and a range of risk management tools. If you wish to get started with Plus500, you will need to meet a £100 minimum deposit. You can add funds via debit/credit cards, bank account transfers, and Paypal. Finally, Plus500 is a safe platform as it is authorized by the FCA in the UK and its parent company is publicly listed on the London Stock Exchange under the ticker symbol PLUS. Sponsored ad. 72% of retail investors lose money trading CFDs at this site. Whether you’re investing in Rolls Royce or other companies like easyJet or AstraZeneca, it’s always important to do your research. It is impossible to ignore the fact that the coronavirus crisis has severely impacted the Rolls-Royce share price. Hence, you need to perform some homework to determine whether it’s worth investing in Rolls Royce right now. Before you invest in stocks of this company, you should make a background research about Rolls Royce’s share price performance before and during the Covid-19 pandemic and its outlook for the future. Rolls Royce was founded 116 years ago in Manchester, Lancashire, England as a result of a partnership between Henry Royce and Charles Rolls. This partnership has created a new company: Rolls-Royce. While the company focused on manufacturing car engines in the first years of operation, it had an early foray into airplane engine production. Eventually, Rolls-Royce Holdings plc was incorporated in February 2011, and nowadays, it is the world’s second-largest maker of aircraft engines and the world’s 16th largest defense contractor. The share price has been on an upward trend ever since the company went public. However, the last two years have not been good ones for the Rolls Royce share price. Since 2018, the share price lost around 80% due to problems with the Trent 1,000 engine, Airbus A380 cancellation, Brexit, and the current Covid-19 pandemic. Rolls Royce reached its all-time high of £1271 back in January 2014 but at the time of writing the share price is trading at £104.7, near its lowest level for more than a decade. On top of that, since so much of Rolls Royce’s business relies on the airline industry, it comes as no surprise that the share dropped almost 500p since the beginning of 2020. Rolls Royce typically pays two dividends per year (excluding specials), and the dividend cover is approximately 1.9. Overall, this company has a payment history of over ten years with an average annual yield of 3.2%. This, obviously, makes it an attractive share for some investors. It is also worth mentioning that in spite of the negative impact of the COV-19 pandemic on Rolls Royce, the company continues paying dividends to its shareholders. Rolls Royce share price has been hit hard since it has adopted a new strategy in 2018. Additionally, the company was hit particularly hard due to problems with the Trent 1,000 engine, Brexit, and the global economic recession caused by the coronavirus pandemic. This adds further weight to the share, especially when you consider the shutoff of the airline industry. Nevertheless, it’s not all dark for one of the largest companies traded on the London Stock Exchange. As such, below we list some of the reasons why people opt to invest in RR shares: Rolls Royce Holdings plc makes most of its revenues from civil airline carriers paying it for engine flying hours. But while the civil aerospace division is in a very uncertain condition, the defense business, which manufactures engines for military aircraft, helicopters, and nuclear submarines, has remained resilient. According to some analysts, the value of Rolls Royce’s defense business should cover the company’s current market valuation. It is also worth mentioning that the company is under several military contracts that enable Rolls Royce’s defense division to perform well. Then you have Rolls Royce nuclear division which is an integral part of the company’s future prospects. Rolls Royce has recently submitted a proposal to the British government to accelerate the building of a new fleet of mini nuclear reactors in the North of England. Rolls Royce has a significant market share in the aviation sector. As of 2020, it is the world’s second-largest maker of commercial aircraft engines after General Electric. However, the company’s domination in the aviation sector is not the only reason why investors find Rolls Royce an appealing investment. The company operates a business model that guarantees constant cash flow. Basically, it develops engines, sells them to airlines, and signs up on long-term contracts to maintain, repair, and overhaul (MRO). Hence, when the economy is in growth mode, Rolls Royce is a highly profitable company. While the majority of companies in the world saw valuations declines of between 30-50% since March 2020, Rolls Royce lost 66% in the year to date. The Covid-19 pandemic caused a huge problem for Rolls-Royce, and especially its civil aerospace division. As such, analysts have a mixed view on Rolls Royce. Yet, its defense division makes Rolls Royce a functioning business and as soon as the airline industry gets back, Rolls Royce could benefit from renewed demand. It is also worth mentioning that Rolls Royce plans a £1.5B share issue to bolster finances and strengthen its balance sheet amid the crisis in the aviation industry. In order to start the process of buying shares of Rolls Royce Holdings plc, you’ll have to open an online stock trading account with a brokerage firm operating in the UK. We’ll walk you through the process, which can be completed fully online. To get started, navigate to your chosen broker’s homepage and choose to sign up. You will then be prompted to complete a registration form where you need to provide your personal details such as username, email address, and then create a password. If your chosen broker is regulated in the United Kingdom by the FCA, it requires you to verify your identity before you can start trading. This means you’ll have to provide the following documentation: Once verified, it’s time to deposit funds into your trading account. Your broker may require that you deposit a minimum amount, which you can do through one of these popular payment methods: Now you are ready to buy Rolls Royce shares. On your trading dashboard, enter Rolls Royce or RR.L in the search bar at the top of the screen in order to locate the share page. This will bring you to an order box. Enter the amount of money that you wish to invest in Rolls Royce. The position size must meet your broker’s minimum investment amount. Once you are ready to place an order in the market, click on the ‘Open Trade’ button, and your Rolls Royce share purchase will be completed. Note: If you are buying Rolls Royce Holding plc shares outside of standard market hours (9.30 am to 5 pm, Eastern Standard Time), you will need to set an order for later Your Rolls Royce shares purchase will then be completed when the markets open. Rolls Royce was hit extremely hard by the COVID-19 pandemic. When the airline industry shut down, orders for the company’s planes, parts, and designs were cancelled en masse. However, the pandemic did little to disrupt Rolls Royce’s core business model. The company still has a highly profitable defense division and demand for its aircraft parts should bounce back once global travel resumes. Thanks to the rollout of vaccines from Pfizer and Moderna, it looks like a recovery within the airline industry will happen sooner than many experts initially predicted. Moreover, Rolls Royce has done a nice job of looking to the future to ensure its business is healthy for decades to come. The move into nuclear power positions the company to ride the wave of demand for renewable energy, for example. Rolls Royce shares remain 60% below the level at which they were trading prior to the pandemic. All in all, it’s important to do your own research and make sure you are following your own trading strategy. Although many analysts were bearish about Rolls Royce over the past year, the COVID-19 pandemic has come to a close more quickly than many predicted. At the same time, Rolls Royce managed to get through the pandemic with relatively few disruptions to its core business model. Shares are still down around 60% from their pre-pandemic price. According to Citigroup, Rolls Royce shares could have further upside potential, whilst Goldman Sachs analysts have set a price target of £573. If you’d like to buy Rolls-Royce shares, you can do so using an FCA-regulated broker that provides these shares. It’s also a good idea to partner with a broker that offers FSCS protection. Rolls Royce has a primary listing on the London Stock Exchange under the ticker symbol LSE: RR.L and a secondary listing on Frankfurt Stock Exchange under the same ticker symbol RRU.F. The cost of buying shares will vary depending on your choice of broker. Some brokers may charge commissions, whilst others will have a zero-commission approach. Yes, shareholders of Rolls Royce typically receive 2 dividends per year (excluding specials). This depends on the stockbroker that you choose. While investment banks only allow you to buy a single share in Rolls Royce, CFD brokers tend to permit fractional share trading. This essentially means you can buy a portion of Rolls Royce share. At the time of writing Rolls Royce shares are trading at £216. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Find a UK Stock Broker That Offers Rolls-Royce Shares

The first step you’ll need to take is to find a trusted UK share dealing broker that offers share trading on the London Stock Exchange (LSE). There are plenty of online stock brokers in the UK, but you do need to ensure that your chosen broker offers competitive fees, a range of platforms and tools, and is regulated by the FCA.

The first step you’ll need to take is to find a trusted UK share dealing broker that offers share trading on the London Stock Exchange (LSE). There are plenty of online stock brokers in the UK, but you do need to ensure that your chosen broker offers competitive fees, a range of platforms and tools, and is regulated by the FCA. 1. Plus500

Stock Trading Fees

0% commission + spread

Deposit Fees

No

Withdrawal Fees

No

Inactivity Fees

$10 (£7.60) per month after three months

Monthly Account Fees

No

Research Rolls Royce Shares

Rolls Royce Share Price History

Rolls Royce Shares Dividends Information

Why do People Buy Rolls-Royce Shares?

Diversification of Products and Services

A Key Player in the Aviation Industry with a Profitable Business Model

Upside Potential is Available

Open an Account and Deposit Funds

How Buy Rolls Royce Shares

Is It a Good Idea to Buy Rolls-Royce Shares?

The Verdict

FAQs

What stock exchange is Rolls Royce listed on?

How much does it cost to buy Rolls Royce shares in the UK?

Does Rolls Royce pay dividends?

What is the minimum number of Rolls Royce shares that I can buy?

How much are Rolls Royce shares?

Tom Chen