How to Buy Safestyle Shares UK

With the home improvement market getting bubbly in recent times, users may be looking to invest in Safestyle shares in the UK. In this guide, we will see how to purchase safestyle shares UK and explore the company’s business model and financials.

How to Purchase Safestyle Shares UK

If you’re looking to purchase Safestyle shares in the UK, you may choose to open an account with a trusted broker. In the example below, users can begin investing in Safestyle Shares in 4 simple steps.

- Step 1: Open an account – Visit your chosen platform’s official website and create your account by entering your personal details and choosing a username and password.

- Step 2: Upload ID – Verify your account by uploading proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of your recent bank statement or utility bill).

- Step 3: Deposit – Fund your account through credit/debit card, bank transfer, or e-wallet with at least $50.

- Step 4: Purchase Safestyle Shares UK – Type the ticker symbol into the search bar and click the ‘Trade’ button. Input the amount you’d like to invest and click ‘Open Trade’.

Popular Stock Brokers Reviewed

To purchase Safestyle Shares UK, you may want to to invest with a regulated stock broker. You may have come across several brokerages, but users will want to pick a suitable broker that provides low fees and multiple features that adds to their trading experience. With that in mind, this section focuses on reviewing some available stock brokers in the UK.

Fineco Bank

Another popular broker is Fineco bank. Like eToro, Fineco Bank is a regulated broker. Traditionally, the Italian bank is heavily regulated by the banking regulatory authority CONSOB in Italy and the UK’s FCA.

Fineco is the total package. The CFD broker holds a banking license, is part of the STOXX Europe 600 index, and is publicly traded on the Italian stock exchange.

In terms of fees, Fineco Bank offers competitive rates. For UK traders, Fineco Bank has a fixed commission of £2.95 per trade when you purchase or sell stocks of UK-based companies. This rate goes as high as £3.95 when you invest in US-listed stocks. However, Fineco does not charge withdrawal or inactivity fees, but its overnight financing rates and forex fees are quite high.

Fineco Bank offers trading in over 10,000 stocks, 1,000 ETFs, and more than 5,500 bonds. The platform’s mobile trading platform is well-designed and available for both Android and iOS, enabling users to trade while on the move.

One major quirk with using Fineco Bank is payments. Funding your account with this broker is limited to bank transfer. Users can fund their accounts with popular options like credit or debit cards. Electronic wallets are also not supported.

65.11% of retail investor accounts lose money due to CFD trading with FinecoBank.

Research Safestyle Shares

After a challenging 2020, Safestyle would be looking to kick-start normal business operations once again following the progress in vaccine dissemination. Its dominance of the UK’s windows replacement and doors is unparalleled, with Safestyle controlling 10% of the total market share. Despite this, researching the company’s performance and tactical operations is vital to making an informed decision. Given the important role research plays in making investment decisions, this section gives a full breakdown of Safestyle and a glimpse into its financials and share price performance in the last fiscal year.

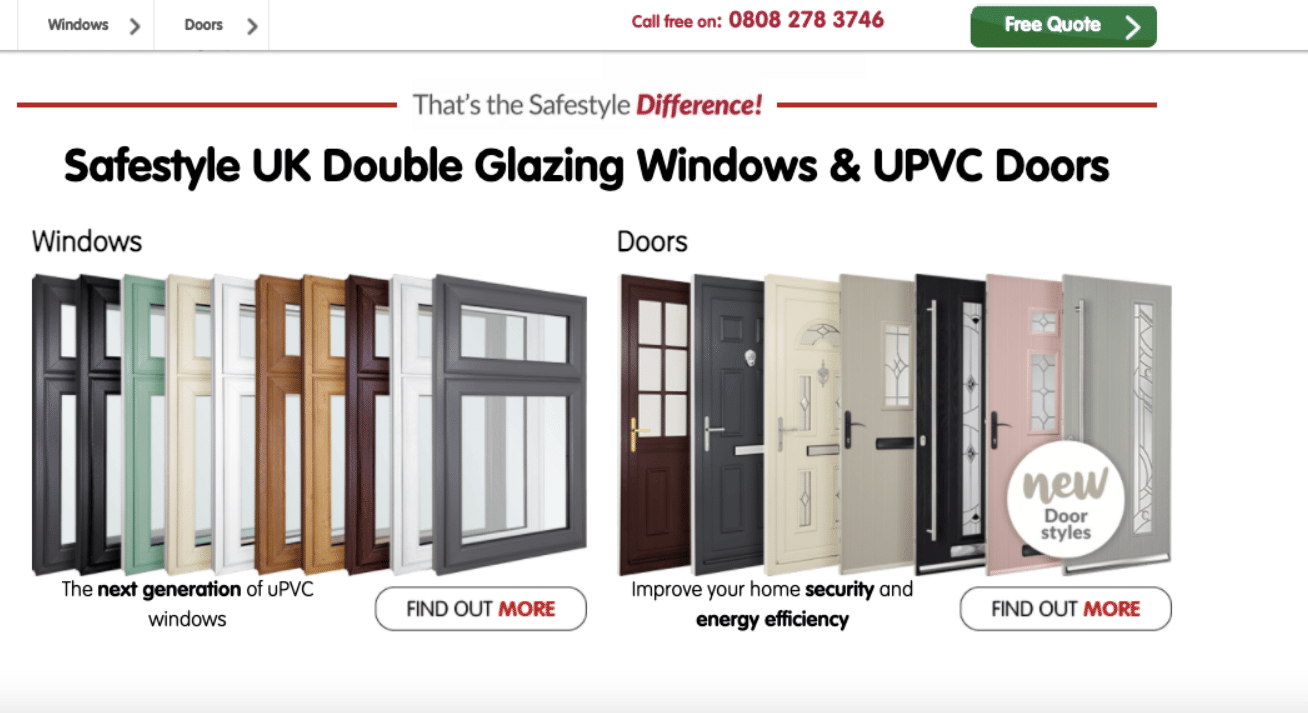

What is Safestyle?

Safestyle was founded on December 22, 1992, with £2000 as the seed capital. The Bradford-based retailer is a leading manufacturer of PVCu windows and doors for the UK homeowner replacement market. The company specializes in manufacturing French doors, patio sliding doors, bi-folding doors, and conservatories in the UK region.

Safestyle has quickly established itself as a manufacturing giant in the UK homeowner window and door replacement market by installations with a 10% market share. In 2005, the company announced that it had completed the installation of £100 million worth of replacement windows and doors. In 2013, Safestyle UK was able to churn out over 250,000 window frames and completed over 55,000 installations for its 1 million customers in the UK market.

Despite growing competition in the replacement market, Safestyle has continued to grow and has more than 40 functioning branches spread across the United Kingdom. So far, Safestyle has completed the installations of over 1 million windows and doors for customers. Like many growing concerns, Safestyle runs separate divisions to meet up market demand. The company set up its Window style division in 1996 to manufacture the double glazed PVCu windows and doors. The operation, set up in Barnsley, South Yorkshire, employs over 600 specialist production staff. It runs 24 hours a day, six days a week, and produces more than 5,500 frames and 13,500 double glazed sealed units per week.

Safestyle is also an award-winning retailer snapping up individual accolades in the G05 Award for Best Promotional Campaign of the Year and repeating its success in the next G-series Award for Best Customer Care. It also won the G07 Installer of the Year Award and the G07 Health and Safety Initiative Award for the same year. Safestyle has also received UK government-backed endorsement in the TrustMark scheme, which enables member companies to make improvements and repairs inside and outside homes while adhering to the highest standards of workmanship and customer care.

Given the nature of its business model, Safestyle has been hard hit by the global pandemic that led to the subsequent halt of business operations. With several backlogs of customer orders and installation cancellations, the company has had to navigate treacherous lockdown restrictions. This has seen its pre-tax losses for the year ended December 2020 surge more than 50% to £6.2 million compared to 2019 losses of just £3.8 million. Revenue was also affected, dipping 10% to £113.2 million against £126.2 million for the previous year.

However, Safestyle has shown resilience despite suffering major losses. With the UK government’s Coronavirus Job Retention fund of £1.8 million, its Q1 losses for 2020 were partly reduced. This has the positive impact of strengthening the company’s order book by 83% from its 2019 operations. 2021 brought a new breath of air for the doors and windows firm, with CEO Mike Gallacher noting in a May annual general meeting (AGM) that the company’s revenue for the opening four months of the year was up 10.4% like the pre-pandemic period. He also noted that the company’s revenue surged 50.9% than the Covid-impacted 2020 fiscal year. This turn in fortune is largely attributed to the company resuming sales and canvassing activities as lockdown restrictions subsided.

Safestyle Share Price

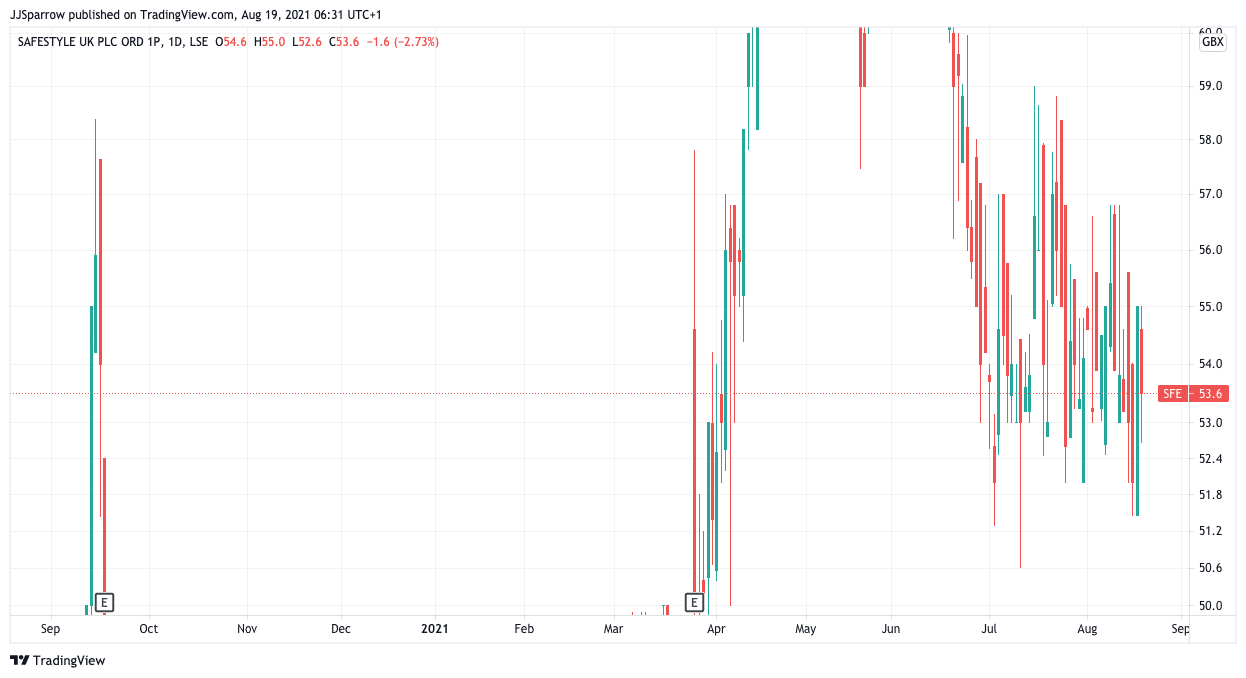

Safestyle is a popular player in the UK windows and doors replacement market, and this has played a huge role in its share price recovery. Given the huge challenges various businesses had to overcome.

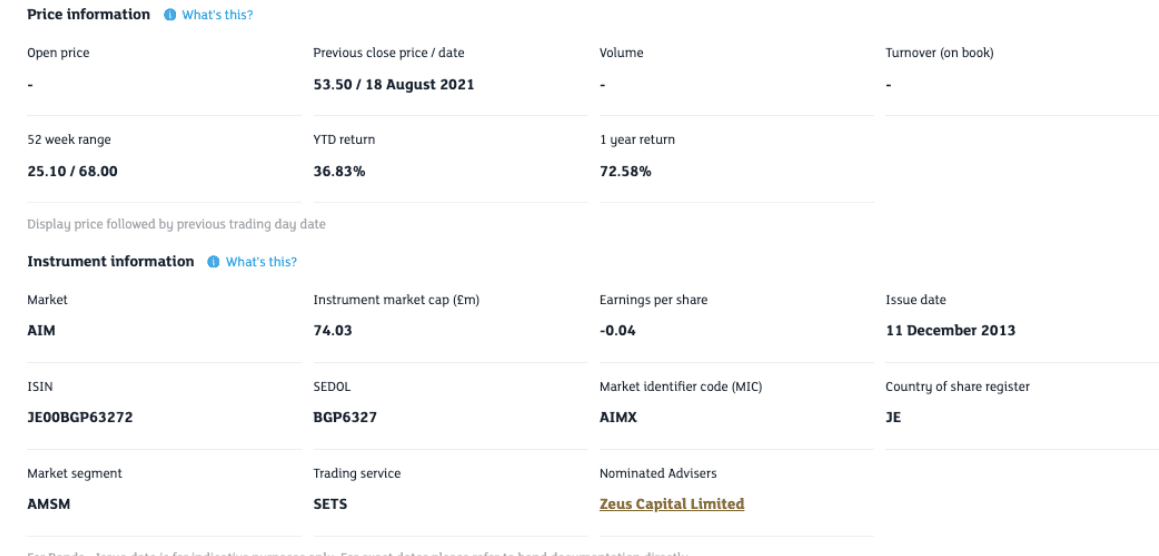

The company’s share price has also improved with the ease of lockdown restrictions in the last eight months. It has surged 66% year-to-date (YTD), with its share price mainly following a bullish trend line. This is obvious when SFE stock surged more than 50% from its December 2020 valuation of £39.70 to £66.80 in early May. At press time, Safestyle’s SFE stock trades at £53.6, down 2.73% in the last 24 hours.

Safestyle Shares Dividends

Safestyle last paid dividends to investors in 2018. The company paid out a total dividend amount of £11.25 per share to investors.

Safestyle ESG Breakdown

Environmental, social, and governance (ESG) factors now drive many investment decisions. As the world battles with global warming and tries to foster equality, several investors are looking for companies with beneficial ESG ratings to invest their capital in. The way to determine this is to look at the company’s asset score to know if they are morally and environmentally responsible in carrying out their operations.

Checking Safestyle’s ESG rating on popular analytics website CSR Hub, we were able to gather the following data:

- Environment – 63/100

- Social – 51/100

- Governance – 49/100

Safestyle scores high in its environmental rating with a 63% rating.

Are Safestyle Shares A Valuable Investment?

Safestyle is reputed as a popular manufacturer in the UK. Also, the company’s strong order book shows that it is slowly regaining some of the losses from the previous year.

Despite the downward spiral that characterized much of last year, SFE stock has retained a positive outlook and traded above the £30 mark. Meanwhile, the decision to invest in Safestyle shares lies with you, and you should conduct independent research before placing a stake in the company.

Open an Account & Purchase Shares

If you want to purchase Safestyle shares in the UK, then you will need to create an account with a suitable broker that meets your needs in the market.

In the steps below, we will show you how to begin the investing process with a suitable broker of your choice.

Create an Account

To get started, simply head to the website’s homepage and head to the sign-up page. On the signup page, simply enter your email address and choose a username and password.

Verify your Identify

Before new users are allowed to trade, they need to verify their identities. This is straightforward and can be completed online in a few minutes. Upload a proof of ID (driver’s license or a copy of your official passport) and proof of address (a copy of a recent bank statement or utility bill).

Make a Deposit

When funding your account, users can access any of the supported payment methods that your brokerage provides. In most instances, users may be able to access credit/debit cards, online transfers and e-wallets.

Choose your preferred payment method and deposit cash into your account.

Purchase Shares

Now that the deposit is made, users can begin investing in shares. Choose the shares you would like to invest in and insert the amount of money you wish to enter in the trade. Once your transaction is confirmed, the investing process has been completed.

Conclusion

Safestyle has been in the replacement market for a long period spanning over 25 years. If users want to invest in the share, they may want do so with the help of a popular brokerage that will provide low fees, multiple tools & features and other asset classes.