Best European Funds UK to Watch

Although the US stock market is where most investors focus their attention, Europe’s economy is in the midst of a transformation that could provide significant opportunities for investors.

In this guide, we’ll review some of the Popular European funds in the UK for 2021.

-

- 1. iShares Core MSCI Europe ETF (IEUR)

- 2. Vanguard FTSE Europe ETF (VGK)

- 3. SPDR Euro STOXX 50 ETF (FEZ)

- 4. iShares MSCI Germany ETF (EWG)

- 5. First Trust Eurozone AlphaDEX ETF (FEUZ)

- 6. iShares UK Property UCITS ETF (IUKP)

- 7. JPMorgan BetaBuilders Europe ETF (BBEU)

- 8. iShares MSCI Eurozone ETF (EZU)

- 9. WisdomTree Europe SmallCap Dividend ETF (DFE)

- 10. Xtrackers STOXX Europe 600 Utilities Swap UCITS ETF (XS6R)

-

- 1. iShares Core MSCI Europe ETF (IEUR)

- 2. Vanguard FTSE Europe ETF (VGK)

- 3. SPDR Euro STOXX 50 ETF (FEZ)

- 4. iShares MSCI Germany ETF (EWG)

- 5. First Trust Eurozone AlphaDEX ETF (FEUZ)

- 6. iShares UK Property UCITS ETF (IUKP)

- 7. JPMorgan BetaBuilders Europe ETF (BBEU)

- 8. iShares MSCI Eurozone ETF (EZU)

- 9. WisdomTree Europe SmallCap Dividend ETF (DFE)

- 10. Xtrackers STOXX Europe 600 Utilities Swap UCITS ETF (XS6R)

Popular European Funds UK List

Below is our list of the popular European funds in the UK for 2022:

- iShares Core MSCI Europe ETF (IEUR)

- Vanguard FTSE Europe ETF (VGK)

- SPDR Euro STOXX 50 ETF (FEZ)

- iShares MSCI Germany ETF (EWG)

- First Trust Eurozone AlphaDEX ETF (FEUZ)

- iShares UK Property UCITS ETF (IUKP)

- JPMorgan BetaBuilders Europe ETF (BBEU)

- iShares MSCI Eurozone ETF (EZU)

- WisdomTree Europe SmallCap Dividend ETF (DFE)

- Xtrackers STOXX Europe 600 Utilities Swap UCITS ETF (XS6R)

Popular European Fund to Watch

Let’s take a closer look at 10 of the popular European Funds to invest in the UK.

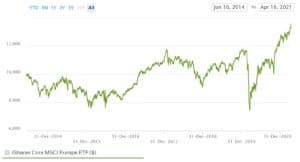

1. iShares Core MSCI Europe ETF (IEUR)

If you’re looking for a single ETF that captures the breadth of the European stock market, the iShares Core MSCI Europe ETF is it. This fund holds over 1,000 shares from across Europe, including the UK. No single company makes up more than 2.7% of the fund’s portfolio, so it’s highly balanced.

That balance means that the fund typically moves quite slowly. It returned just 8.70% over the past 5 years, although the fund saw a jump of 48.4% over the past year alone. The fund has $3.8 billion in assets under management and has a low expense ratio of 0.09%.

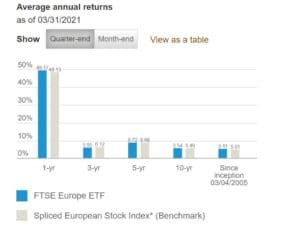

2. Vanguard FTSE Europe ETF (VGK)

The Vanguard FTSE Europe ETF seeks to replicate the FTSE Developed Europe All Cap Index. It shares a lot in common with the iShares Core MSCI Europe fund, but it’s even cheaper – this ETF carries an expense ratio of just 0.08%. The Vanguard fund is also larger, with over $21 billion in assets under management.

The fund invests in over 1,300 European stocks, including mega-cap companies like Nestle, Novartis, Royal Dutch Shell, and AstraZeneca. Of course, the fund also holds hundreds of small-cap companies, so it represents a blend of blue chip stocks and growth stocks.

3. SPDR Euro STOXX 50 ETF (FEZ)

The SPDR Euro STOXX 50 ETF is a simple fund with only 50 holdings. It tracks 50 of the largest companies from across Europe, including LVMH, SAP, and Siemens. While it might not be the most representative of the total European stock market, it actually captures 60% of the market capitalization of the Euro STOXX 600 index.

Despite being simple, the fund carries an expense ratio of 0.29% – not bad, but pricey relative to the Vanguard and iShares Euro ETFs. The fund currently manages $2.1 billion in assets and has generated a return of 9.0% over the past 5 years.

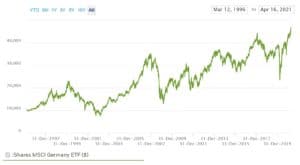

4. iShares MSCI Germany ETF (EWG)

Germany has the largest economy in Europe and is home to a number of global companies such as SAP, Allianz, Daimler, and Bayer. With the iShares MSCI Germany ETF, you may invest directly in these German companies. The fund invests in 63 of the largest stocks in Germany.

Despite the size of the German economy, the fund’s performance over the past 5 years has lagged the broader European stock market. It generated returns of 7.84%, compared to around 9% for the Euro STOXX 50 index fund. It also carries an expense ratio of 0.51%.

5. First Trust Eurozone AlphaDEX ETF (FEUZ)

The First Trust Eurozone AlphaDEX ETF is an actively managed fund that seeks to beat the performance of the Eurozone market. It’s performed relatively well in recent years, producing returns of 9.9% over the past 5 years and 51.1% over the past year. However, note that it carries an expensive 0.80% expense ratio, which is to be expected for an actively managed fund.

The First Trust Eurozone AlphaDEX fund is relatively small, with assets of just $27.3 million. So, you may have some trouble moving into and out of this fund, especially on days when trading volume is low. The fund typically has a spread of around 1%, whereas the spread for larger funds is close to 0%.

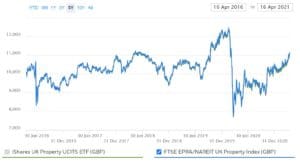

6. iShares UK Property UCITS ETF (IUKP)

Investing in Europe doesn’t mean you have to look to the stock market. The iShares UK Property UCITS ETF enables you to invest in property through a series of holding companies and REITs (real estate investment trusts). The property fund itself only has 40 holdings, but since many of those are REITs, the true number of investments across the UK is much higher.

Unfortunately for investors, the UK property market hasn’t been particularly active in recent years. The iShares UK Property UCITS ETF has a 5-year return of just 1.11%.

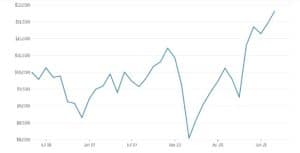

7. JPMorgan BetaBuilders Europe ETF (BBEU)

The JPMorgan BetaBuilders Europe ETF is designed to help investors capitalize on directional moves in the European stock market. It invests heavily in 532 of Europe’s biggest companies so that when the market moves, you’re able to ride the wave. Of course, that also means that you are left with higher risk if the European market drops.

The fund has performed well, producing a cumulative return of 18.2% since its inception in 2018. During last year’s volatility, the fund gained 46.9%. The fund manages $4.7 billion in assets and has a cheap expense ratio of just 0.09%.

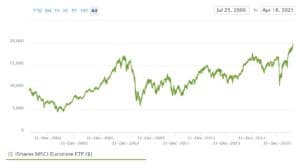

8. iShares MSCI Eurozone ETF (EZU)

The iShares MSCI Eurozone ETF is a lot like our first fund pick, the iShares Core MSCI Europe ETF. The difference is that the Eurozone ETF only invests in countries that use the Euro – so markets like the UK, Norway, and Denmark are left out of the fund. The ETF invests in 240 stocks, the majority of which come from France and Germany.

Despite leaving out several major economies, the fund has performed in line with similar all-of-Europe ETFs. It has grown 8.9% over the past 5 years, and jumped 55.0% last year. However, the fund’s 0.51% expense ratio makes it much more expensive than the iShares Core MSCI Europe ETF.

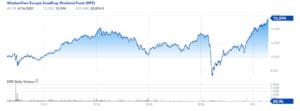

9. WisdomTree Europe SmallCap Dividend ETF (DFE)

The WisdomTree Europe SmallCap Dividend ETF is an alternative fund that invests primarily in small cap stocks. Chances are, you haven’t heard of the popular stocks in this fund – companies like Ferrexpo in the UK, TGS Nopec in Norway, and Anima Holding in Italy. The fund invests in hundreds of shares from across Europe, with around 28% of its total investment in the UK.

Part of what makes this fund special is that all of the companies it holds pay dividends. Some of the dividends are reinvested in the fund, while investors can expect to receive an annual payout of 0.80%. That’s on top of the fund’s 5-year average return of 8.0% per year. The WisdomTree ETF has an expense ratio of 0.58%.

10. Xtrackers STOXX Europe 600 Utilities Swap UCITS ETF (XS6R)

The Xtrackers STOXX Europe 600 Utilities Swap UCITS ETF is a unique fund that invests in utility stocks from across Europe. The fund doesn’t invest in these companies directly but rather uses swap contracts to gain exposure to changes in their share prices. This ETF may be valuable for investors interested in value investing since utility stocks are typically defensive stocks.

The fund has a 5-year annualised return of 12.3%, although it lost 1.2% last year as investors moved money to capture the post-COVID European economic recovery. The fund has $20 million in assets under management and an expense ratio of 0.30%.

Key Developments of Popular European Funds

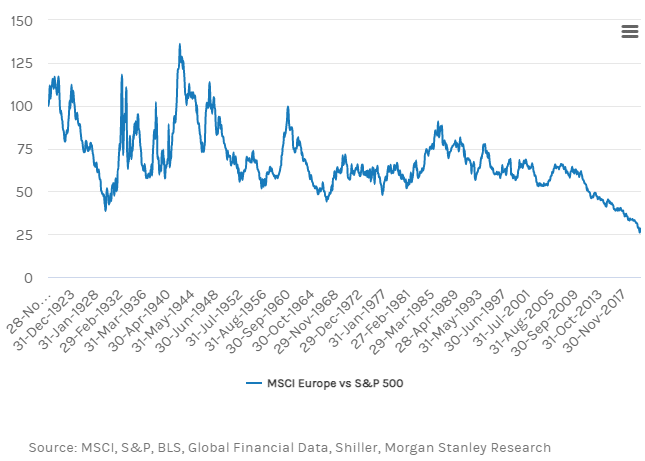

The European stock market has long been overlooked in favor of the US stock market. That’s in large part because the European market has underperformed the S&P 500 for many years – as evidenced by the chart below:

Underneath the surface, several large trends are taking place which could very well offer major tailwinds for the European market going forward.

For one thing, Europe is finally catching up to the US in fostering technology stocks and innovation. The continent is seeing huge investments in new startups, which promises to accelerate the digitisation of Europe’s economy. Today’s startups could be tomorrow’s European equivalents of Apple and Tesla, and investing in European funds now allows you to get in on the ground floor while spreading your bets as widely as possible.

Another important development for European stocks is the separation of the UK from the European Union. Brexit hurt stocks in the Eurozone and the UK for many years, but now that it’s coming to a close, the market can move forward. Even though the UK is no longer part of the EU, it’s still included in most of the popular European funds – so investors can benefit from the UK’s push to become a global hub for commerce and technology.

Europe could also see a booming economy once the continent finishes tackling the COVID-19 pandemic. European governments passed the largest stimulus package ever, which is expected to make it easier for high-growth companies to take off as the economy starts heating up again. The stimulus package will also help Europe invest in renewable energy and build a more resilient long-term economic foundation.

How to Invest in European Funds

Investing in ETFs may be done by choosing the right broker of your choice in the UK. After selecting a suitable broker, you may follow these steps to being your investing journey.

Open a Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Complete the Verification Process

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in European Funds

Once your account has been funded, proceed to search for the European Funds you wish to invest in, on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

European funds are a potential way for investors to diversify their portfolios and get exposure to the European stock market. Europe is in the midst of rapid changes, so there are plenty of opportunities ahead for investors looking to this market.

However, users should make sure to invest after carrying out their own due diligence and carefully analysing the assets they wish to trade in.

FAQs

Can I invest in European stocks through mutual funds?

Yes, there are dozens of mutual funds that invest in the European or Eurozone markets. However, mutual funds typically have higher management fees and investment minimums compared to ETFs.

What is an ETF’s expense ratio?

A fund’s expense ratio is its annual management fee. This is typically charged as a percentage of your total investment rather than as a flat commission.

Do European stocks pay dividends?

Some European stocks pay dividends. If you are interested in dividend investing, you may prefer an ETF like the WisdomTree Europe SmallCap Dividend ETF, which invests only in dividend-paying companies.

What is the STOXX 50?

The STOXX 50 is a stock market index that tracks the performance of the 50 largest companies in Europe.

Can I invest in European funds using GBP?

Whether or not you may invest in European funds using GBP depends on your broker and the specific fund you choose. Many funds are priced in USD, but some are priced in Euros and others are priced in GBP. Most brokers will automatically make the necessary currency conversions for you, although this may incur a fee.

Ilija Rajakovic

Ilija Rajakovic

Ilija Rajakovic is a Serbian-based investor and writer. His main focus areas include finance, trading, and macroeconomy. Ilija holds a Master’s Degree in Investment Banking and is pursuing his Ph.D. with a focus on sustainable finance and development. He is actively managing personal investment portfolios and advising private clients. And has run a website which generated actionable stock market ideas and provided insights into global economic landscape in the past. His economic articles have been publshed in highly respected magazines like NIN and Magazin Biznis.View all posts by Ilija Rajakovic

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up